Expiring Drug Patents Cheat Sheet

We analyse the patents covering drugs in 134 countries and quickly give you the likely loss-of-exclusivity/generic entry date

United States: These 42 Drugs Face Patent Expirations and Generic Entry From 2025 - 2026

The content of this page is licensed under a Creative Commons Attribution 4.0 International License.

Generic Entry Dates in Other Countries

Friedman, Yali, "United States: These 42 Drugs Face Patent Expirations and Generic Entry From 2025 - 2026" DrugPatentWatch.com thinkBiotech, 2025 www.drugpatentwatch.com/p/expiring-drug-patents-generic-entry/.

Media collateral

These estimated drug patent expiration dates and generic entry opportunity dates are calculated from analysis of known patents covering drugs. Many factors can influence early or late generic entry. This information is provided as a rough estimate of generic entry potential and should not be used as an independent source. The methodology is described in this blog post.

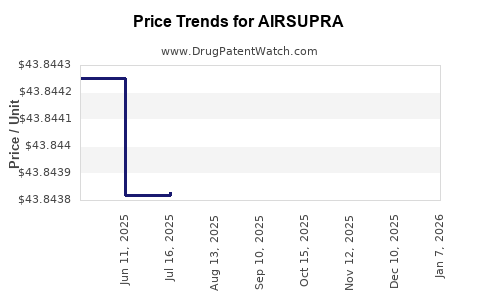

When can AIRSUPRA (albuterol sulfate; budesonide) generic drug versions launch?

Generic name: albuterol sulfate; budesonide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: January 10, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

This drug has one hundred and ninety-two patent family members in thirty-two countries. There has been litigation on patents covering AIRSUPRA

See drug price trends for AIRSUPRA.

The generic ingredient in AIRSUPRA is albuterol sulfate; budesonide. There are thirty-eight drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the albuterol sulfate; budesonide profile page.

When can SOLUPREP (chlorhexidine gluconate; isopropyl alcohol) generic drug versions launch?

Generic name: chlorhexidine gluconate; isopropyl alcohol

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: January 20, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

SOLUPREP is a drug marketed by 3m Health Care.

This drug has one hundred and ninety-two patent family members in thirty-two countries.

The generic ingredient in SOLUPREP is chlorhexidine gluconate; isopropyl alcohol. There are fifty-eight drug master file entries for this API. Five suppliers are listed for this generic product. Additional details are available on the chlorhexidine gluconate; isopropyl alcohol profile page.

When can LUPKYNIS (voclosporin) generic drug versions launch?

Generic name: voclosporin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: January 22, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

LUPKYNIS is a drug marketed by Aurinia. There are three patents protecting this drug.

This drug has one hundred and ninety-eight patent family members in forty countries. There has been litigation on patents covering LUPKYNIS

See drug price trends for LUPKYNIS.

The generic ingredient in LUPKYNIS is voclosporin. There is one drug master file entry for this API. One supplier is listed for this generic product. Additional details are available on the voclosporin profile page.

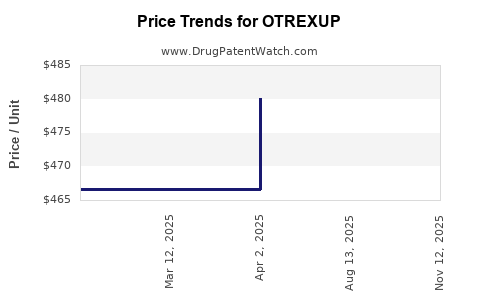

When can OTREXUP (methotrexate) generic drug versions launch?

Generic name: methotrexate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: January 24, 2026

Generic Entry Controlled by: United States Patent Patent 9,629,959

This drug has thirty-nine patent family members in fourteen countries. There has been litigation on patents covering OTREXUP

See drug price trends for OTREXUP.

The generic ingredient in OTREXUP is methotrexate. There are twenty drug master file entries for this API. Four suppliers are listed for this generic product. Additional details are available on the methotrexate profile page.

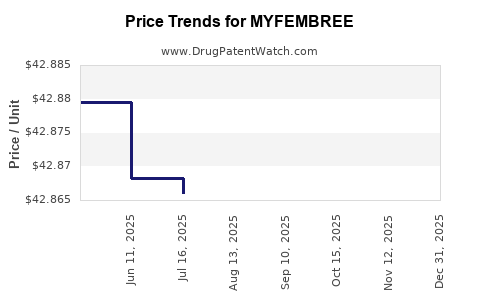

When can MYFEMBREE (estradiol; norethindrone acetate; relugolix) generic drug versions launch?

Generic name: estradiol; norethindrone acetate; relugolix

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: January 28, 2026

Generic Entry Controlled by: United States Patent Patent 7,300,935

This drug has one hundred and fifty-six patent family members in thirty-six countries. There has been litigation on patents covering MYFEMBREE

See drug price trends for MYFEMBREE.

The generic ingredient in MYFEMBREE is estradiol; norethindrone acetate; relugolix. There are seventy-five drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the estradiol; norethindrone acetate; relugolix profile page.

When can EGATEN (triclabendazole) generic drug versions launch?

Generic name: triclabendazole

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: February 13, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

EGATEN is a drug marketed by Novartis.

This drug has one hundred and fifty-six patent family members in thirty-six countries.

The generic ingredient in EGATEN is triclabendazole. There is one drug master file entry for this API. One supplier is listed for this generic product. Additional details are available on the triclabendazole profile page.

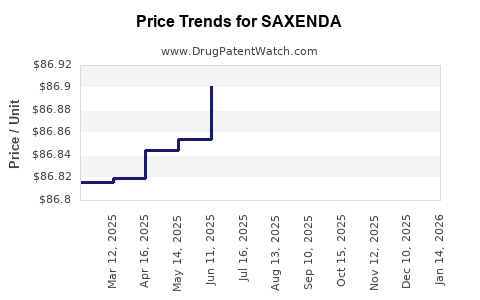

When can SAXENDA (liraglutide recombinant) generic drug versions launch?

Generic name: liraglutide recombinant

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: February 13, 2026

Generic Entry Controlled by: United States Patent Patent 8,114,833

This drug has sixty-three patent family members in twenty-seven countries. There has been litigation on patents covering SAXENDA

See drug price trends for SAXENDA.

The generic ingredient in SAXENDA is liraglutide recombinant. There are seven drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the liraglutide recombinant profile page.

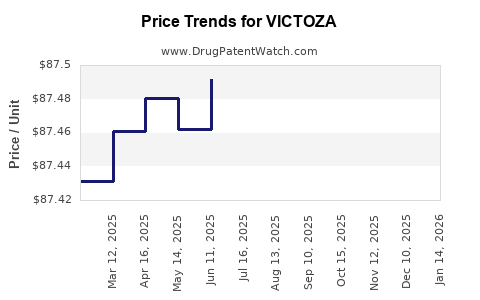

When can VICTOZA (liraglutide recombinant) generic drug versions launch?

Generic name: liraglutide recombinant

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: February 13, 2026

Generic Entry Controlled by: United States Patent Patent 8,114,833

This drug has sixty-three patent family members in twenty-seven countries. There has been litigation on patents covering VICTOZA

See drug price trends for VICTOZA.

The generic ingredient in VICTOZA is liraglutide recombinant. There are seven drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the liraglutide recombinant profile page.

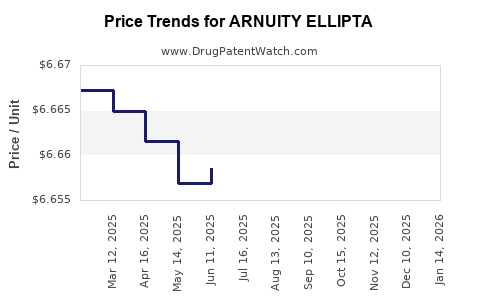

When can ARNUITY ELLIPTA (fluticasone furoate) generic drug versions launch?

Generic name: fluticasone furoate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 01, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

This drug has sixty-three patent family members in twenty-seven countries. There has been litigation on patents covering ARNUITY ELLIPTA

See drug price trends for ARNUITY ELLIPTA.

The generic ingredient in ARNUITY ELLIPTA is fluticasone furoate. There are twenty-nine drug master file entries for this API. Four suppliers are listed for this generic product. Additional details are available on the fluticasone furoate profile page.

When can VALCHLOR (mechlorethamine hydrochloride) generic drug versions launch?

Generic name: mechlorethamine hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 07, 2026

Generic Entry Controlled by: United States Patent Patent 7,838,564

VALCHLOR is a drug marketed by Helsinn. There are six patents protecting this drug.

This drug has fifty patent family members in twenty countries.

See drug price trends for VALCHLOR.

The generic ingredient in VALCHLOR is mechlorethamine hydrochloride. There is one drug master file entry for this API. One supplier is listed for this generic product. Additional details are available on the mechlorethamine hydrochloride profile page.

When can FOTIVDA (tivozanib hydrochloride) generic drug versions launch?

Generic name: tivozanib hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 10, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

FOTIVDA is a drug marketed by Aveo Pharms. There are three patents protecting this drug.

This drug has fifty-five patent family members in twenty-six countries. There has been litigation on patents covering FOTIVDA

See drug price trends for FOTIVDA.

The generic ingredient in FOTIVDA is tivozanib hydrochloride. One supplier is listed for this generic product. Additional details are available on the tivozanib hydrochloride profile page.

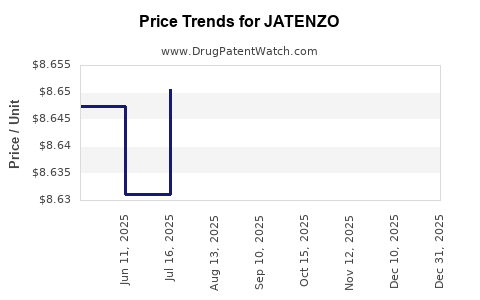

When can JATENZO (testosterone undecanoate) generic drug versions launch?

Generic name: testosterone undecanoate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: April 14, 2026

Generic Entry Controlled by: United States Patent Patent 11,179,402

This drug has twenty-nine patent family members in fourteen countries. There has been litigation on patents covering JATENZO

See drug price trends for JATENZO.

The generic ingredient in JATENZO is testosterone undecanoate. There are sixty-nine drug master file entries for this API. Five suppliers are listed for this generic product. Additional details are available on the testosterone undecanoate profile page.

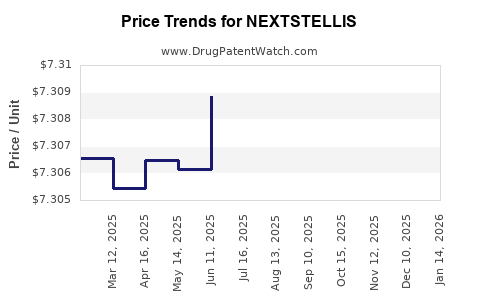

When can NEXTSTELLIS (drospirenone; estetrol) generic drug versions launch?

Generic name: drospirenone; estetrol

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: April 15, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

This drug has two hundred and twenty-nine patent family members in fifty-one countries.

See drug price trends for NEXTSTELLIS.

The generic ingredient in NEXTSTELLIS is drospirenone; estetrol. There are eleven drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the drospirenone; estetrol profile page.

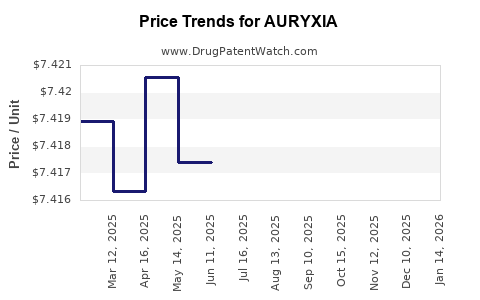

When can AURYXIA (ferric citrate) generic drug versions launch?

Generic name: ferric citrate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: April 21, 2026

Generic Entry Controlled by: United States Patent Patent 8,093,423

This drug has one hundred and twenty-two patent family members in twenty-three countries. There has been litigation on patents covering AURYXIA

See drug price trends for AURYXIA.

The generic ingredient in AURYXIA is ferric citrate. There are twenty drug master file entries for this API. Two suppliers are listed for this generic product. Additional details are available on the ferric citrate profile page.

When can MYDCOMBI (phenylephrine hydrochloride; tropicamide) generic drug versions launch?

Generic name: phenylephrine hydrochloride; tropicamide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 05, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

MYDCOMBI is a drug marketed by Eyenovia. There are three patents protecting this drug.

This drug has forty-four patent family members in fourteen countries.

The generic ingredient in MYDCOMBI is phenylephrine hydrochloride; tropicamide. There are twenty-one drug master file entries for this API. Additional details are available on the phenylephrine hydrochloride; tropicamide profile page.

When can RUZURGI (amifampridine) generic drug versions launch?

Generic name: amifampridine

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 06, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

RUZURGI is a drug marketed by One tentatively approved generic is ready to enter the market.

This drug has forty-four patent family members in fourteen countries.

See drug price trends for RUZURGI.

The generic ingredient in RUZURGI is amifampridine. Additional details are available on the amifampridine profile page.

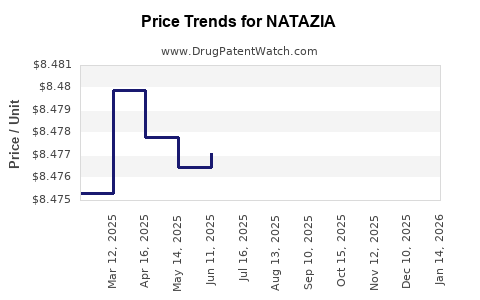

When can NATAZIA (dienogest; estradiol valerate) generic drug versions launch?

Generic name: dienogest; estradiol valerate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 13, 2026

Generic Entry Controlled by: United States Patent Patent 8,071,577

This drug has ninety patent family members in thirty-nine countries. There has been litigation on patents covering NATAZIA

See drug price trends for NATAZIA.

The generic ingredient in NATAZIA is dienogest; estradiol valerate. There are seven drug master file entries for this API. Two suppliers are listed for this generic product. Additional details are available on the dienogest; estradiol valerate profile page.

When can GATTEX KIT (teduglutide recombinant) generic drug versions launch?

Generic name: teduglutide recombinant

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 16, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

GATTEX KIT is a drug marketed by Takeda Pharms Usa. There are two patents protecting this drug and one Paragraph IV challenge.

This drug has eight patent family members in seven countries. There has been litigation on patents covering GATTEX KIT

The generic ingredient in GATTEX KIT is teduglutide recombinant. There is one drug master file entry for this API. Two suppliers are listed for this generic product. Additional details are available on the teduglutide recombinant profile page.

When can INJECTAFER (ferric carboxymaltose) generic drug versions launch?

Generic name: ferric carboxymaltose

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 31, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

INJECTAFER is a drug marketed by Am Regent. There are six patents protecting this drug.

This drug has seventy-one patent family members in thirty-two countries. There has been litigation on patents covering INJECTAFER

See drug price trends for INJECTAFER.

The generic ingredient in INJECTAFER is ferric carboxymaltose. There are twenty drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the ferric carboxymaltose profile page.

When can OMONTYS (peginesatide acetate) generic drug versions launch?

Generic name: peginesatide acetate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 02, 2026

Generic Entry Controlled by: United States Patent Patent 7,550,433

OMONTYS is a drug marketed by Takeda Pharms Usa. There are two patents protecting this drug.

This drug has twenty-seven patent family members in eighteen countries.

The generic ingredient in OMONTYS is peginesatide acetate. Additional details are available on the peginesatide acetate profile page.

When can SUFLAVE (magnesium sulfate; polyethylene glycol 3350; potassium chloride; sodium chloride; sodium sulfate) generic drug versions launch?

Generic name: magnesium sulfate; polyethylene glycol 3350; potassium chloride; sodium chloride; sodium sulfate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 15, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

SUFLAVE is a drug marketed by Braintree Labs. There are three patents protecting this drug.

This drug has one patent family member in one country.

See drug price trends for SUFLAVE.

The generic ingredient in SUFLAVE is magnesium sulfate; polyethylene glycol 3350; potassium chloride; sodium chloride; sodium sulfate. There are one hundred and forty-six drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the magnesium sulfate; polyethylene glycol 3350; potassium chloride; sodium chloride; sodium sulfate profile page.

When can SUPPRELIN LA (histrelin acetate) generic drug versions launch?

Generic name: histrelin acetate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 16, 2026

Generic Entry Controlled by: United States Patent Patent 8,062,652

SUPPRELIN LA is a drug marketed by Endo Operations. There is one patent protecting this drug.

This drug has three patent family members in three countries.

See drug price trends for SUPPRELIN LA.

The generic ingredient in SUPPRELIN LA is histrelin acetate. There are two drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the histrelin acetate profile page.

When can APLENZIN (bupropion hydrobromide) generic drug versions launch?

Generic name: bupropion hydrobromide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 27, 2026

Generic Entry Controlled by: United States Patent Patent 7,241,805

APLENZIN is a drug marketed by Bausch. There are eight patents protecting this drug and three Paragraph IV challenges. One tentatively approved generic is ready to enter the market.

This drug has fifty-two patent family members in eighteen countries. There has been litigation on patents covering APLENZIN

See drug price trends for APLENZIN.

The generic ingredient in APLENZIN is bupropion hydrobromide. There are thirty-eight drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the bupropion hydrobromide profile page.

When can NUCYNTA (tapentadol hydrochloride) generic drug versions launch?

Generic name: tapentadol hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: July 03, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

This drug has forty-five patent family members in twenty-six countries. There has been litigation on patents covering NUCYNTA

See drug price trends for NUCYNTA.

The generic ingredient in NUCYNTA is tapentadol hydrochloride. There are five drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the tapentadol hydrochloride profile page.

When can VALTURNA (aliskiren hemifumarate; valsartan) generic drug versions launch?

Generic name: aliskiren hemifumarate; valsartan

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: July 03, 2026

Generic Entry Controlled by: United States Patent Patent 8,168,616

VALTURNA is a drug marketed by Novartis. There is one patent protecting this drug.

This drug has ninety-three patent family members in thirty-one countries.

The generic ingredient in VALTURNA is aliskiren hemifumarate; valsartan. There are four drug master file entries for this API. Additional details are available on the aliskiren hemifumarate; valsartan profile page.

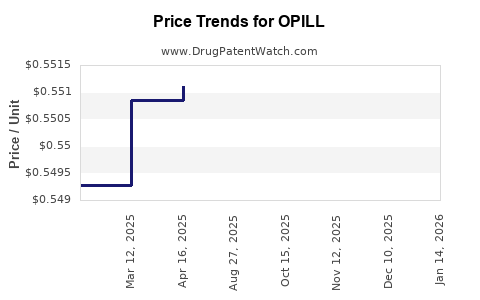

When can OPILL (norgestrel) generic drug versions launch?

Generic name: norgestrel

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: July 13, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

This drug has ninety-three patent family members in thirty-one countries.

See drug price trends for OPILL.

The generic ingredient in OPILL is norgestrel. There are twenty-five drug master file entries for this API. Two suppliers are listed for this generic product. Additional details are available on the norgestrel profile page.

When can GALLIUM DOTATOC GA 68 (gallium dotatoc ga-68) generic drug versions launch?

Generic name: gallium dotatoc ga-68

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: August 21, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

GALLIUM DOTATOC GA 68 is a drug marketed by

This drug has ninety-three patent family members in thirty-one countries.

The generic ingredient in GALLIUM DOTATOC GA 68 is gallium dotatoc ga-68. There are sixteen drug master file entries for this API. Two suppliers are listed for this generic product. Additional details are available on the gallium dotatoc ga-68 profile page.

When can TECHNEGAS KIT (technetium tc-99m labeled carbon) generic drug versions launch?

Generic name: technetium tc-99m labeled carbon

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: September 29, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

TECHNEGAS KIT is a drug marketed by Cyclomedica.

This drug has ninety-three patent family members in thirty-one countries.

The generic ingredient in TECHNEGAS KIT is technetium tc-99m labeled carbon. There are four drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the technetium tc-99m labeled carbon profile page.

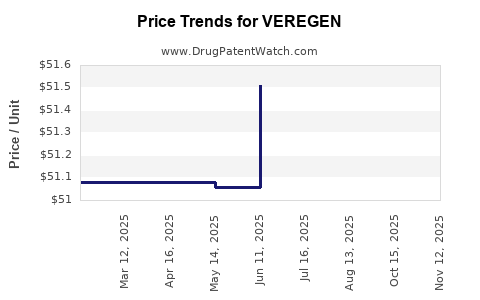

When can VEREGEN (sinecatechins) generic drug versions launch?

Generic name: sinecatechins

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: October 02, 2026

Generic Entry Controlled by: United States Patent Patent 5,795,911

This drug has thirty-one patent family members in twenty countries. There has been litigation on patents covering VEREGEN

See drug price trends for VEREGEN.

The generic ingredient in VEREGEN is sinecatechins. There is one drug master file entry for this API. One supplier is listed for this generic product. Additional details are available on the sinecatechins profile page.

When can SCENESSE (afamelanotide) generic drug versions launch?

Generic name: afamelanotide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: October 08, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

SCENESSE is a drug marketed by Clivunel Inc. There are two patents protecting this drug.

This drug has thirty-four patent family members in eighteen countries.

See drug price trends for SCENESSE.

The generic ingredient in SCENESSE is afamelanotide. There is one drug master file entry for this API. One supplier is listed for this generic product. Additional details are available on the afamelanotide profile page.

When can JUVISYNC (simvastatin; sitagliptin phosphate) generic drug versions launch?

Generic name: simvastatin; sitagliptin phosphate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: October 11, 2026

Generic Entry Controlled by: United States Patent Patent 7,326,708

JUVISYNC is a drug marketed by Merck Sharp Dohme. There is one patent protecting this drug and three Paragraph IV challenges.

This drug has fifty-two patent family members in forty countries. There has been litigation on patents covering JUVISYNC

The generic ingredient in JUVISYNC is simvastatin; sitagliptin phosphate. There are forty drug master file entries for this API. Additional details are available on the simvastatin; sitagliptin phosphate profile page.

When can COMBOGESIC IV (acetaminophen; ibuprofen sodium) generic drug versions launch?

Generic name: acetaminophen; ibuprofen sodium

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: October 17, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

COMBOGESIC IV is a drug marketed by Hikma. There are six patents protecting this drug.

This drug has seventy patent family members in thirty-one countries.

The generic ingredient in COMBOGESIC IV is acetaminophen; ibuprofen sodium. There are sixty-six drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the acetaminophen; ibuprofen sodium profile page.

When can ADASUVE (loxapine) generic drug versions launch?

Generic name: loxapine

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: October 23, 2026

Generic Entry Controlled by: United States Patent Patent 8,387,612

ADASUVE is a drug marketed by Alexza Pharms. There is one patent protecting this drug.

This drug has twenty-one patent family members in six countries. There has been litigation on patents covering ADASUVE

See drug price trends for ADASUVE.

The generic ingredient in ADASUVE is loxapine. There are eight drug master file entries for this API. Additional details are available on the loxapine profile page.

When can SYNRIBO (omacetaxine mepesuccinate) generic drug versions launch?

Generic name: omacetaxine mepesuccinate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: October 26, 2026

Generic Entry Controlled by: United States Patent Patent 6,987,103

SYNRIBO is a drug marketed by Teva Pharms Intl. There is one patent protecting this drug and one Paragraph IV challenge.

This drug has twenty-one patent family members in twelve countries.

See drug price trends for SYNRIBO.

The generic ingredient in SYNRIBO is omacetaxine mepesuccinate. There are two drug master file entries for this API. Additional details are available on the omacetaxine mepesuccinate profile page.

When can AXUMIN (fluciclovine f-18) generic drug versions launch?

Generic name: fluciclovine f-18

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: November 28, 2026

Generic Entry Controlled by: United States Patent Patent 10,010,632

AXUMIN is a drug marketed by Blue Earth. There are eight patents protecting this drug.

This drug has thirty patent family members in sixteen countries. There has been litigation on patents covering AXUMIN

The generic ingredient in AXUMIN is fluciclovine f-18. One supplier is listed for this generic product. Additional details are available on the fluciclovine f-18 profile page.

When can ZUNVEYL (benzgalantamine gluconate) generic drug versions launch?

Generic name: benzgalantamine gluconate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 01, 2026

Generic Entry Controlled by: United States Patent Patent 9,763,953

ZUNVEYL is a drug marketed by Alpha Cognition. There are three patents protecting this drug.

This drug has twenty-six patent family members in seventeen countries. There has been litigation on patents covering ZUNVEYL

The generic ingredient in ZUNVEYL is benzgalantamine gluconate. One supplier is listed for this generic product. Additional details are available on the benzgalantamine gluconate profile page.

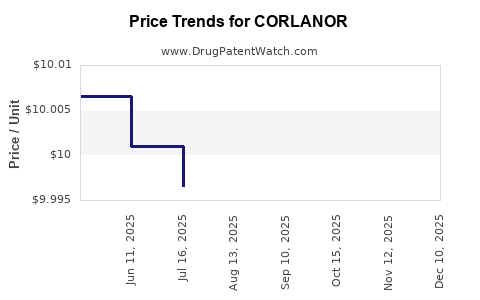

When can CORLANOR (ivabradine) generic drug versions launch?

Generic name: ivabradine

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 12, 2026

Generic Entry Controlled by: United States Patent Patent 7,867,996

This drug has ninety-seven patent family members in forty-two countries. There has been litigation on patents covering CORLANOR

See drug price trends for CORLANOR.

The generic ingredient in CORLANOR is ivabradine. There are nine drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the ivabradine profile page.

When can VYONDYS 53 (golodirsen) generic drug versions launch?

Generic name: golodirsen

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 12, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

VYONDYS 53 is a drug marketed by Sarepta Theraps Inc. There are eight patents protecting this drug.

This drug has thirty patent family members in thirteen countries. There has been litigation on patents covering VYONDYS 53

The generic ingredient in VYONDYS 53 is golodirsen. One supplier is listed for this generic product. Additional details are available on the golodirsen profile page.

When can SIGNIFOR (pasireotide diaspartate) generic drug versions launch?

Generic name: pasireotide diaspartate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 14, 2026

Generic Entry Controlled by: United States Patent Patent 7,473,761

SIGNIFOR is a drug marketed by Recordati Rare. There are four patents protecting this drug.

This drug has eighty-seven patent family members in thirty-nine countries.

See drug price trends for SIGNIFOR.

The generic ingredient in SIGNIFOR is pasireotide diaspartate. One supplier is listed for this generic product. Additional details are available on the pasireotide diaspartate profile page.

When can VYNDAQEL (tafamidis meglumine) generic drug versions launch?

Generic name: tafamidis meglumine

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 19, 2026

Generic Entry Controlled by: United States Patent Patent 7,214,695

VYNDAQEL is a drug marketed by Foldrx Pharms. There are two patents protecting this drug.

This drug has thirty-five patent family members in seventeen countries. There has been litigation on patents covering VYNDAQEL

See drug price trends for VYNDAQEL.

The generic ingredient in VYNDAQEL is tafamidis meglumine. One supplier is listed for this generic product. Additional details are available on the tafamidis meglumine profile page.

When can EPANOVA (omega-3-carboxylic acids) generic drug versions launch?

Generic name: omega-3-carboxylic acids

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 20, 2026

Generic Entry Controlled by: United States Patent Patent 7,960,370

EPANOVA is a drug marketed by Astrazeneca. There are seven patents protecting this drug.

This drug has eighty-five patent family members in forty-one countries.

The generic ingredient in EPANOVA is omega-3-carboxylic acids. There is one drug master file entry for this API. Additional details are available on the omega-3-carboxylic acids profile page.

When can TISSUEBLUE (brilliant blue g) generic drug versions launch?

Generic name: brilliant blue g

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 20, 2026

Generic Entry Controlled by: United States FDA Regulatory Exclusivity

TISSUEBLUE is a drug marketed by Dutch Ophthalmic.

This drug has eighty-five patent family members in forty-one countries.

The generic ingredient in TISSUEBLUE is brilliant blue g. One supplier is listed for this generic product. Additional details are available on the brilliant blue g profile page.

United States Branded and Generic Drug Markets Assessment and Regulatory Opportunities and Challenges

More… ↓

DrugPatentWatch cited by CNN, NEJM, Nature Journals, and more …

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.