Last updated: October 15, 2025

Introduction

Teva Pharmaceuticals International (Teva) stands as a dominant player within the global generic and specialty pharmaceuticals market. With a legacy rooted in generic drug manufacturing, Teva has evolved into a multifaceted pharmaceutical company, challenging patent protections and pioneering innovative treatment options. This analysis delineates Teva’s current market position, operational strengths, competitive advantages, and strategic initiatives essential for maintaining growth amid dynamic global market forces.

Market Position of Teva Pharmaceuticals International

Global Footprint and Revenue Streams

Teva maintains a robust global presence, operating in over 60 countries with a predominant focus on the United States, Europe, and emerging markets in Asia and Latin America. The company's revenue primarily stems from generic medicines, which account for approximately 60-70% of total sales, and innovative specialty drugs, including branded products and biosimilars.

In FY 2022, Teva reported revenues of approximately $14.6 billion, with the North American region contributing nearly 50%. This indicates a strategic reliance on the U.S. market, which faces intense generic drug competition but also presents substantial revenue opportunities.

Market Share and Competitive Standing

Teva is one of the top five global generic pharmaceutical companies, holding approximately 4-5% of the global generics market share[1]. Its competitive edge lies in a catalog exceeding 3,500 product dossiers, strengthening its ability to quickly respond to patent expirations globally. In specific therapeutic segments such as CNS, respiratory, and analgesics, Teva maintains strong market positions.

However, Teva faces rising competition from other generics giants like Novartis (Sandoz), Mylan (now part of Viatris), and Devgen, as well as from innovative biotech firms. The company’s market share has been impacted by patent litigations and pricing pressures, primarily in mature markets like the U.S. and Europe.

Strengths of Teva Pharmaceuticals International

1. Extensive Product Portfolio and R&D Capabilities

Teva boasts one of the most extensive product portfolios in the industry, including over 400 generic molecules and 150 branded medicines. Its substantial investment in R&D — approximately $700 million annually — facilitates the development of complex generics and biosimilars, positioning the company as a pioneer in niche therapeutic areas like peptide-based therapies and inhalation products.

2. Manufacturing Scale and Geographic Diversification

The company operates globally with a network of approximately 60 manufacturing facilities. Its manufacturing footprint reduces supply chain risks and lowers costs through economies of scale. Additionally, Teva's diversified geographic footprint mitigates risks associated with regional regulatory changes and economic fluctuations.

3. Strategic Acquisitions and Partnerships

Teva’s strategic acquisitions, such as the purchase of Rimsa in Mexico and the acquisition of Hikma’s branded business in the Middle East, bolster local market penetration. Collaboration with biotech firms, including licensing deals for biosimilars, accelerates its entry into high-growth segments.

4. Focus on Specialty and Biosimilar Segments

Teva’s growth pivot toward specialty and biosimilar medicines aligns with macro market trends favoring high-margin, innovative therapies. Its biosimilar pipeline encompasses leading medicines in oncology and inflammatory diseases, granting it early-mover advantages and patent exclusivities.

Strategic Insights and Challenges

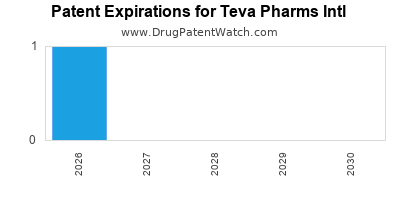

1. Patent Expirations and Pricing Pressures

The expiration of blockbuster patents, notably for drugs like Copaxone (multiple sclerosis) and generic competition for core products, erodes revenue. Simultaneously, pricing pressures driven by payers and policymakers in the U.S. and Europe force Teva to innovate cost-efficiency measures while maintaining margins.

2. Investment in Biosimilars and Innovation

Teva’s strategic focus on biosimilars could unlock new revenue streams, especially in the U.S., Europe, and Japan, where biosimilar adoption accelerates driven by healthcare cost containment policies. However, biosimilar development incurs high costs and regulatory hurdles, requiring sustained investment and strategic partnerships.

3. Regulatory and Legal Risks

The highly regulated nature of the pharmaceutical industry presents compliance and litigation risks. Teva faced numerous legal challenges related to patent disputes and pricing allegations, which can strain financial resources and distract management.

4. Market Diversification and Emerging Markets Expansion

Growing markets in Asia, Latin America, and Africa offer opportunities but entail regulatory variability and supply chain complexities. Teva’s strategic push into these regions balances revenue growth with risk management.

5. Digital Transformation and Supply Chain Optimization

Investments in digital technologies, such as blockchain for supply chain transparency and AI-driven R&D, are critical to increasing operational efficiencies. Streamlined supply chains will be vital in post-pandemic recovery and meeting global demand.

Key Strategic Recommendations

- Accelerate biosimilar pipeline development to capitalize on high-growth markets with high barriers to entry for competitors.

- Enhance cost-efficiency through supply chain digitization and manufacturing automation.

- Expand presence in emerging markets via local partnerships and tailored regulatory strategies.

- Invest in intellectual property management to defend critical patents and mitigate litigation risks.

- Foster innovation collaborations with biotech firms and academic institutions to diversify R&D efforts.

Conclusion

Teva Pharmaceuticals International has cemented its stature as a global leader in generics and burgeoning biosimilars sectors. Its expansive product portfolio, strategic acquisitions, and focus on innovative therapies position it favorably within the evolving pharmaceutical landscape. However, significant challenges—such as patent cliffs, pricing pressures, and regulatory complexities—necessitate agile strategic adaptations. Continued investment in biosimilars, operational efficiency, and emerging markets will be pivotal for Teva’s sustained growth and competitive advantage.

Key Takeaways

- Market leadership, primarily in generics, remains robust but increasingly contested.

- Diversification into biosimilars and specialty drugs is crucial for future revenue stability.

- Operational resilience and cost optimization will determine profitability amidst pricing pressures.

- Strategic geographic expansion into emerging markets offers growth opportunities but requires careful regulatory navigation.

- Innovation collaboration and patent strategy remain essential in safeguarding market share.

FAQs

1. How does Teva differentiate itself from other generics companies?

Teva’s extensive patent portfolio, investment in biosimilars, and focus on complex generics—such as inhaled and peptide-based therapies—set it apart. Its global manufacturing scale and broad therapeutic presence enable rapid market response and innovation.

2. What are the primary growth drivers for Teva in the coming years?

Growth will hinge on biosimilar development, expansion into emerging markets, strategic acquisitions, and innovations in specialty medicines, particularly in high-margin therapeutic areas like oncology and inflammatory diseases.

3. How does Teva mitigate risks related to patent cliffs?

Teva actively invests in R&D for complex generics and biosimilars, diversifies product portfolios, files for regulatory exclusivities, and explores patent litigation strategies to extend market protections.

4. What challenges does Teva face concerning regulatory compliance?

Rigorous anti-bribery, patent, and safety regulations expose Teva to legal risks. Ongoing improvements in compliance programs and proactive patent management are essential to minimize legal disputes’ financial and reputational impact.

5. What strategic moves could enhance Teva’s competitive position?

Accelerating biosimilar pipelines, leveraging digital supply chain tools, expanding collaborations with biotech firms, and deepening market penetration in Africa and Asia will strengthen its competitive edge.

Sources:

- Teva Pharmaceuticals Annual Report, 2022.