Last updated: July 29, 2025

Introduction

Aveo Pharmaceuticals stands as a notable player in the competitive oncology landscape, focusing on developing targeted therapies for rare and aggressive cancers. With an emphasis on precision medicine, the company’s pipeline and strategic positioning have significant implications for stakeholders navigating the rapidly evolving pharmaceutical sector. This analysis examines Aveo’s current market standing, competitive strengths, challenges, and strategic pathways to bolster growth.

Market Position of Aveo Pharmaceuticals

Aveo Pharmaceuticals primarily targets renal cell carcinoma (RCC), vascular tumors, and other oncological indications through innovative kinase inhibitors and biologic agents. As of 2023, the firm’s key product candidate, Tivozee™ (tivozanib), gained FDA approval for relapsed or refractory RCC, positioning it as a focused player within a high-growth therapeutic niche.

Market Share and Revenue Dynamics

The approval of tivozanib marked a pivotal shift, elevating Aveo’s visibility in the RCC treatment arena. Despite its specialized focus, Aveo faces stiff competition from established oncology giants like Pfizer, Merck, and Novartis, who possess extensive portfolios in kidney cancer and systemic therapy. Nonetheless, Aveo’s niche positioning allows it to capture a segment of patients seeking alternatives to broad-spectrum treatments, especially within Europe and select Asian markets where regulatory approvals are progressing.

Revenue from tivozanib has shown gradual growth, driven primarily by strategic licensing agreements, regional expansions, and increasing clinical adoption. However, it remains modest relative to larger pharmaceutical counterparts, underscoring Aveo’s role as a specialized biotech with high growth potential rather than a dominant market powerhouse.

Strengths of Aveo Pharmaceuticals

1. Focused Therapeutic Niche

Aveo’s concentration on targeted kinase inhibitors for specific cancer types offers a competitive edge through deep expertise and tailored clinical development. This focus minimizes diversification risks and allows the company to channel resources into refining its pipeline.

2. Strategic Licensing and Collaborations

Partnerships with entities like EUSA Pharma have expanded geographic reach and facilitated market entry in regions with high unmet needs. These collaborations enable Aveo to leverage local regulatory and commercialization expertise, accelerating access to diverse markets.

3. Robust Clinical Data and Regulatory Approvals

The approval of tivozanib in multiple regions, including the FDA in 2021 for RCC, enhances Aveo’s credibility and validation of its scientific approach. Ongoing trials exploring its efficacy in other indications bolster future growth prospects.

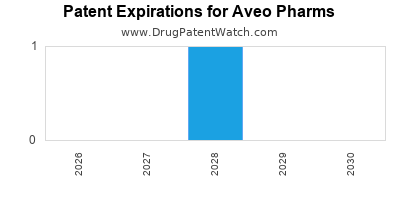

4. Intellectual Property Portfolio

Aveo maintains a strong patent portfolio protecting its core compounds, enabling the company to fend off generic competition and maintain pricing power domestically and regionally.

Challenges and Strategic Risks

1. Limited Product Portfolio

Reliance on a single marketed drug exposes Aveo to significant revenue volatility and market risks. If future pipeline candidates encounter setbacks, the company’s growth trajectory could stall.

2. Competitive Market Environment

The RCC and targeted oncology markets are highly competitive, with major players investing heavily in research and development, making differentiation challenging. Larger firms may quickly develop alternatives or superior agents.

3. Regulatory and Pricing Pressures

Increasing regulatory scrutiny and pricing negotiations worldwide threaten profit margins. The strategic focus on regions with evolving healthcare policies necessitates agile adaptation.

4. Clinical Trial Risks

Pipeline candidates face inherent risks such as failed trials, delays, or safety concerns. Strategic portfolio management and continuous innovation are imperative.

Strategic Insights for Future Growth

1. Pipeline Expansion and Diversification

Aveo should prioritize expanding its pipeline into adjacent indications, such as other solid tumors or biologic approaches, to reduce reliance on a single revenue driver. Investing in early-stage research may yield highly differentiated therapies in emerging niches.

2. Geographical Market Penetration

Deepening presence in Asian markets, especially China and Japan, offers substantial growth opportunities owing to increasing cancer prevalence and favorable regulatory reforms. Tailoring clinical programs and partnerships to local ecosystems will be critical.

3. Strategic Collaborations and M&A

Forming alliances or acquiring complementary assets can accelerate pipeline development, expand market access, and enhance competitiveness. Strategic M&A activity could also facilitate entry into novel therapeutic classes.

4. Digital and Data-driven Approaches

Leveraging real-world evidence and precision medicine analytics can optimize clinical trial success rates, improve patient stratification, and refine commercialization strategies.

5. Focus on Cost-Effective Commercialization

Streamlining operations via partnerships and optimizing supply chains will help maintain competitive pricing and profitability amid mounting industry cost pressures.

Conclusion

Aveo Pharmaceuticals is strategically positioned as a specialized oncology innovator with a promising flagship therapy and an active pipeline. Its focused clinical approach, robust IP, and collaborative strategies provide resilience in a competitive landscape. However, its growth hinges on effective diversification, internationalization, and efficient execution amid stiff competition and regulatory challenges. With continued innovation and strategic agility, Aveo can enhance its market footprint and deliver sustained growth in the rapidly expanding oncology sector.

Key Takeaways

- Focused Positioning: Aveo’s specialization in RCC and targeted therapies forms the foundation for differentiation but requires pipeline diversification to mitigate reliance on a single product.

- Growth Opportunities: Strategic geographic expansion, especially in Asia, combined with pipeline development, offers high growth potential.

- Partnership Leverage: Collaborations and licensing are vital for expanding market reach and sharing development risks.

- Innovation and IP: Maintaining strong patent protections and investing in innovative therapies are essential to retain competitive advantage.

- Market Challenges: Competitive intensity, regulatory pressures, and clinical trial uncertainties demand operational agility and strategic foresight.

FAQs

Q1: How significant is Aveo Pharmaceuticals’ market share in renal cell carcinoma?

A: While Aveo’s tivozanib has secured regulatory approval in several regions, its market share remains modest, primarily due to competition from larger pharmaceutical companies with broader treatment portfolios and established market presence. The company’s strategic focus on targeted therapy and regional expansion could increase its share over time.

Q2: *What distinguishes Aveo’s flagship drug, Tivozee™, from competitors?

A:** Tivozee™ (tivozanib) is a potent and selective VEGFR inhibitor demonstrating a favorable safety profile, which differentiates it in terms of tolerability. Its efficacy in relapsed RCC and regulatory approvals substantiate its clinical value, providing a competitive edge in targeted therapy.

Q3: *What are Aveo’s primary growth drivers moving forward?

A:** Pipeline expansion into new indications, strategic international market penetration, forging new collaborations, and advancing clinical trials are the primary drivers for future growth.

Q4: *What are the main risks faced by Aveo Pharmaceuticals?

A:** Key risks include pipeline failures, intense competition, regulatory hurdles, pricing pressures, and reliance on a limited product portfolio, which could impact revenue stability.

Q5: *How can Aveo Pharmaceuticals sustain its competitive advantage?

A:** By continuously innovating its pipeline, expanding into emerging markets, strengthening strategic alliances, and investing in data-driven personalized medicine approaches, Aveo can maintain and enhance its market position.

Sources:

- [1] Aveo Pharmaceuticals Clinical Pipeline and Regulatory Updates, 2023.

- [2] Market Reports on Renal Cell Carcinoma therapeutics, 2023.

- [3] Regulatory filings and FDA/EMA approvals, 2021-2023.

- [4] Industry analysis on targeted oncology market dynamics.