Last updated: October 15, 2025

Introduction

Merck Sharp & Dohme (MSD), operating under Merck & Co. in the United States and Canada, remains a formidable player in the global pharmaceutical landscape. With a history spanning over a century, MSD’s strategic positioning is built upon innovative R&D, robust portfolio diversification, and expansive global footprint. This report critically evaluates MSD’s market position, core strengths, competitive advantages, and strategic outlook within the evolving pharmaceutical industry.

Market Position of MSD

MSD holds a prominent stature in the pharmaceutical sector, consistently ranked among the top-tier global drug developers by revenue and R&D investment. As of 2022, MSD ranked as the second-largest pharmaceutical company globally in terms of revenue, trailing only behind Pfizer, and within the top five alongside Roche, Novartis, and Johnson & Johnson [1].

The company’s core focus areas include oncology, vaccines, infectious diseases, and cardiovascular health, with a strategic emphasis on specialty medicines. The recent success of blockbuster drugs such as Keytruda (pembrolizumab), Gardasil (HPV vaccine), and its expanding pipeline solidify MSD’s top-tier market status. These products position MSD strongly in high-growth areas, particularly oncology and immunotherapy, which are integral to the contemporary pharmaceutical landscape.

Core Strengths of MSD

1. Innovation and R&D Leadership

MSD’s commitment to R&D remains a cornerstone of its competitive advantage. The company invested over $11 billion in R&D in 2022, emphasizing vaccine technology, immuno-oncology, and personalized medicine [2]. Its strong pipeline includes numerous candidates in late-stage development, underscoring its forward-looking innovation strategy.

2. Blockbuster Portfolio and Market-Led Products

Keytruda, launched in 2014, revolutionized cancer treatment and generated over $17 billion in global sales in 2022, representing a flagship asset that secures long-term revenue streams. The company’s vaccine portfolio, particularly Gardasil, continues to dominate in HPV vaccination markets, bolstered by expanding indication approvals [3].

3. Strategic Collaborations and Licensing Agreements

MSD’s strategic alliances with biotech firms, academic institutions, and technology players enhance its innovation capacity. Recent collaborations focus on novel immunotherapies and digital health integration, positioning MSD at the intersection of pharma and tech.

4. Robust Global Footprint and Market Penetration

With a presence in over 140 countries, MSD leverages extensive distribution channels, local manufacturing, and tailored market strategies to maximize reach. Its early adoption of emerging markets and tailored healthcare initiatives strengthen its global competitive edge [4].

5. Commitment to Vaccination and Public Health

MSD's leadership in vaccine development, exemplified by Gardasil’s widespread adoption, underscores its strategic emphasis on disease prevention, aligning with global health initiatives. This commitment enhances its reputation and drives steady revenue from vaccines.

Strategic Insights and Competitive Dynamics

1. Differentiation through Immunotherapy and Precision Medicine

MSD’s significant investment in immuno-oncology, notably HER2-targeted therapies and checkpoint inhibitors, positions it ahead of many competitors in personalized cancer treatments. The continued success of Keytruda and pipeline expansion into combination therapies exemplify its commitment to differentiation.

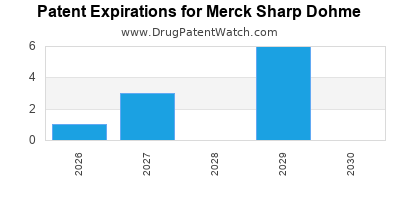

2. Navigating Patent Expirations and Biosimilar Competition

While MSD’s blockbuster drugs secure significant revenue, looming patent expirations pose risks. The company actively invests in biosimilars and next-generation therapies to mitigate revenue erosion, exemplified by its pipeline of biosimilar drugs for biologics like Humira.

3. Digital Transformation and Data-Driven Approaches

MSD capitalizes on data analytics, AI, and digital engagement to accelerate drug discovery, optimize clinical trials, and enhance patient adherence programs. This technological integration aims to sustain innovation velocity and operational efficiency.

4. Regulatory and Market Access Strategies

MSD’s proactive engagement with regulatory agencies and investment in market access strategies bolster its product approvals and reimbursement coverages. Its deep understanding of diverse healthcare systems gives it an advantage amidst evolving regulatory landscapes.

5. Emerging Market Expansion

Targeting high-growth markets such as China, India, and Southeast Asia is central to MSD’s growth strategy. Tailored products, local partnerships, and compliance with regional regulations are pivotal for capturing new revenue streams.

Challenges and Strategic Risks

- Patents and Biosimilar Threats: Patent expiries threaten existing revenue streams, necessitating ongoing innovation and diversification.

- Pricing Pressures: Increasing scrutiny on drug pricing, especially in the U.S., impacts profitability.

- Regulatory Hurdles: Navigating diverse regulatory environments worldwide demands agility and compliance.

- Competitive Innovation Pace: Rivals such as Pfizer, Roche, and Novartis intensify competition in immunotherapies and biologics.

Future Outlook and Strategic Recommendations

To sustain its competitive edge, MSD should prioritize:

- Accelerating pipeline development with innovative, high-value assets,

- Expanding digital health initiatives to improve personalized medicine delivery,

- Enhancing early-stage collaborations with biotech startups,

- Diversifying beyond blockbuster dependence and into niche therapeutic areas,

- Strengthening focus on emerging markets for long-term growth.

Key Takeaways

- Market Leadership: MSD’s robust revenue streams from blockbuster drugs like Keytruda and Gardasil underscore its dominant market position.

- Innovation Engine: Heavy investments in R&D and strategic collaborations sustain its pipeline and technological advancements.

- Growth Levers: Focused expansion in immunotherapy, vaccines, personalized medicine, and emerging markets present key growth avenues.

- Risk Management: Addressing patent expiries, biosimilar competition, and global regulatory challenges is critical.

- Strategic agility in digital transformation and market adaptation will determine future success.

FAQs

Q1: How does MSD maintain its leadership in oncology?

MSD leverages its pioneering immuno-oncology drug Keytruda, continuous pipeline innovation, strategic collaborations, and expansion into combination therapies to retain dominance in the oncology segment.

Q2: What are the primary growth drivers for MSD beyond existing blockbuster drugs?

Emerging areas such as personalized medicines, biosimilars, next-generation immunotherapies, vaccines in underserved regions, and digital health solutions are pivotal for growth.

Q3: How does MSD contend with patent expirations?

MSD invests heavily in R&D, develops next-generation biologics, and actively pursues biosimilar development and diversification into new therapeutic areas.

Q4: What role do emerging markets play in MSD’s strategic plans?

Emerging markets present high-growth opportunities; MSD tailors products, invests in local manufacturing, and forms regional partnerships to capitalize on market expansion.

Q5: How is digital health influencing MSD’s innovation strategy?

MSD integrates AI, data analytics, and digital engagement tools to accelerate drug discovery, optimize clinical trials, and improve patient outcomes, reinforcing its competitive edge.

Sources

[1] IQVIA, "Top 20 Global Pharma Companies," 2022.

[2] Merck & Co., Annual Report 2022.

[3] MarketsandMarkets, “Vaccine Market Trends,” 2022.

[4] Company reports and industry analysis, 2022.

In an industry defined by rapid innovation, strategic agility and robust R&D investments underpin MSD’s sustained market position. Navigating patent cliffs, competitive pressures, and evolving healthcare landscapes demands continuous focus on innovation, market expansion, and operational excellence.