Last updated: July 27, 2025

Introduction

Corlanor (ivabradine) is a selective sinus node inhibitor marketed primarily for the treatment of chronic heart failure with reduced ejection fraction (HFrEF) and certain anginal conditions. Since its initial approval in 2010 in Europe and later in the US in 2015, Corlanor has carved out a niche within the cardiovascular therapeutics market. This analysis explores its current market landscape, competitive positioning, pricing strategies, and future price projections amid evolving clinical, regulatory, and market dynamics.

Market Overview and Therapeutic Landscape

1. Indications and Clinical Utility

Corlanor is indicated to improve survival in adults with chronic HFrEF who are in sinus rhythm with a heart rate of ≥70 bpm, on guideline-directed medical therapy. Its mechanism focuses on reducing heart rate without impacting myocardial contractility—offering an alternative for patients intolerant of beta-blockers or combination therapies.

It also holds indications for the management of stable angina, particularly in patients with contraindications or intolerance to other standard treatments. The expansion of these indications and continued clinical trials could influence market penetration.

2. Market Size and Growth Drivers

The global heart failure market is projected to reach approximately $9 billion by 2027, with ivabradine’s share expected to grow owing to several factors:

-

Rising prevalence: The World Heart Federation reports over 60 million people worldwide living with heart failure, emphasizing the need for novel therapies.

-

Unmet medical needs: Patients intolerant to beta-blockers benefit significantly from ivabradine's distinct mechanism, expanding accessible patient pools.

-

Guideline endorsements: The 2016 ESC Guidelines recommend ivabradine for specific HFrEF patient profiles, bolstering prescribing rates.

-

Aging populations: Increasing elderly demographics are more susceptible to heart failure, driving demand.

3. Competitive Landscape

Corlanor competes with multiple classes:

-

Beta-blockers (e.g., carvedilol, metoprolol): First-line, well-established, but not suitable for all.

-

Other HR-reducing agents and device therapies: Limited direct pharmacologic comparators but important in comprehensive management.

-

Emerging therapies and variants: Could impact market share depending on efficacy, safety, and approval trajectory.

The competition is intensified in health systems favoring cost-effectiveness, and payers’ formulary decisions greatly influence accessibility.

Pricing Strategy and Analysis

1. Current Pricing Structure

Corlanor's pricing varies by region:

-

United States: Approximate list price around $300 per month (per 5 mg tablets). Actual net prices are often lower owing to negotiations, discounts, and formularies.

-

Europe: Pricing is generally lower, with specific national adjustments.

The cost is justified by its clinical benefit in certain patient populations, but price sensitivity remains relevant, given healthcare budget constraints.

2. Reimbursement Environment

Reimbursement policies significantly influence drug affordability:

-

US: Heavily dependent on insurance coverage and Medicare Part D. Incentives for formulary placement can impact net prices.

-

Europe: National health authorities and payers negotiate prices, often leading to lower publicly funded prices.

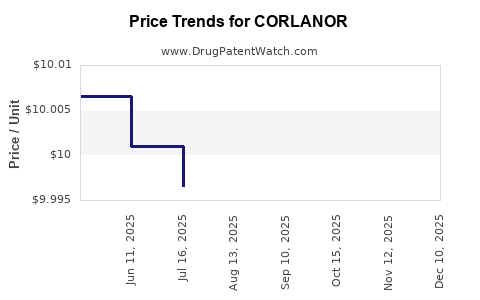

3. Price Trends and Drivers

Factors influencing the pricing trajectory:

-

Patent exclusivity: Patents protecting Corlanor extend until approximately 2027, limiting generic competition currently.

-

Market penetration: Higher penetration in developed markets supports stable pricing.

-

Potential biosimilars/generics: Patent expiration could enable cost reductions, though no biosimilar development is anticipated for ivabradine specifically.

-

Pricing negotiations: Ongoing health technology assessments (HTAs) might lead to price adjustments.

Future Price Projections

1. Patent Expiry and Generic Entry

Expected patent expiry around 2027 could introduce generics, exerting downward pressure on prices. The extent of price erosion will depend on:

-

Market competition: Number of entrants and pricing strategies.

-

Regulatory hurdles: Challenges in gaining approval for generic versions.

-

Market absorption: Physicians’ and payers’ acceptance of generics for cardiovascular indications.

2. Regulatory and Clinical Developments

-

New indications: Approval for additional uses (e.g., rare arrhythmias) could sustain or increase demand, stabilizing prices.

-

Clinical trial outcomes: Positive results may bolster credit to Corlanor’s unique value proposition, potentially supporting premium pricing.

-

Pricing negotiations with payers: As real-world data accumulates, price revisions may reflect perceived value.

3. Market Penetration and Adoption Trends

-

Differentiation effects: As more therapies enter the market, Corlanor's positioning could shift, influencing pricing.

-

Health system dynamics: Value-based care models favor medications with demonstrated cost-effectiveness, which could support tiered or value-based pricing.

4. Impact of Cost-Containment Measures

Global trends toward drug cost containment and value-based pricing models may pressure Corlanor’s price points downward across regions, especially in countries with strict tariffs.

Conclusion

Corlanor remains a specialized cardiovascular therapy with a stable market in developed regions, supported by clinical efficacy in targeted patient groups. Its current pricing reflects its positioning, patent exclusivity, and significant clinical benefit. Future price projections anticipate a decline post-patent expiry, contingent upon generic entry and competitive pressures. Market expansion driven by new indications and positive clinical data may maintain or elevate its value proposition, mitigating some downward price pressures.

Key Takeaways

-

Market Stability: Corlanor commands a premium price within cardiovascular therapeutics due to its unique mechanism and targeted patient benefits.

-

Patent Dependency: Patent expiration around 2027 is a critical inflection point, likely heralding significant price reductions due to generic competition.

-

Pricing Influencers: Reimbursement negotiations, health technology assessments, and clinical trial outcomes will continue to shape its price trajectory.

-

Market Expansion Opportunities: Broader indications and real-world evidence could sustain demand and justify premium pricing for longer.

-

Strategic Positioning: Companies should monitor upcoming clinical data, patent landscapes, and evolving payer policies to optimize market access and revenue.

FAQs

1. How does ivabradine compare to beta-blockers in treating HFrEF?

Ivabradine offers selective heart rate reduction without impacting myocardial contractility, making it suitable for patients intolerant to beta-blockers or as an adjunct. While beta-blockers remain first-line, ivabradine provides an alternative in specific cases, especially when heart rate control is inadequate or beta-blockers are contraindicated.

2. What are the main factors influencing Corlanor's future pricing?

Patent expiration, generic competition, clinical development outcomes, regulatory approvals, payer negotiations, and broader healthcare cost containment policies significantly influence future prices.

3. Will the entry of generics drastically reduce Corlanor’s price?

Typically, generic entry precipitates substantial price reductions. The extent depends on the number of competitors, regulatory hurdles, and market demand. In similar cardiovascular drugs, prices usually decline by 50% or more post-patent expiry.

4. Are there prospects for new indications to sustain Corlanor pricing?

Yes. Positive clinical trial outcomes for additional indications can extend the drug’s lifecycle and justify sustained or increased pricing levels through expanded market need.

5. How does healthcare policy impact Corlinor’s pricing globally?

Policy trends favoring cost-effective therapies, value-based pricing, and reimbursement optimization influence retail prices. Countries with strict price controls often see lower prices, whereas regions prioritizing innovation may sustain higher pricing levels.

References

[1] European Society of Cardiology. 2016 ESC Guidelines for the diagnosis and treatment of acute and chronic heart failure.

[2] Novartis Pharma AG. Corlanor (ivabradine) prescribing information.

[3] MarketWatch. Heart failure therapeutics market analysis, 2022.

[4] IQVIA. Global prescribing trends and pricing analysis, 2022.

[5] U.S. Food and Drug Administration. Patent and exclusivity period for Corlanor.