Last updated: October 15, 2025

Introduction

Novo Nordisk Inc. stands as a global leader in diabetes care and metabolic disease management, leveraging a rich legacy of innovation, strategic positioning, and expanding pipeline offerings. As the pharmaceutical sector evolves amid rising demand for endocrinology therapeutics, Novo Nordisk's market position and strategic initiatives merit meticulous analysis. This report elucidates its competitive stature, core strengths, and strategic outlook within the global pharmaceutical landscape.

Market Position of Novo Nordisk Inc.

Global Dominance in Diabetes Care

Novo Nordisk maintains a commanding global presence with approximately 45% market share in insulin therapy, according to recent industry analyses [1]. Its insulin portfolio, including renowned products like NovoLog, Tresiba, and Victoza, positions it as the top-tier provider for type 1 and type 2 diabetes management.

Revenue and Growth Metrics

In 2022, Novo Nordisk reported revenues exceeding $25 billion, with a CAGR of 8% over the past five years, predominantly driven by diabetes and obesity segments [2]. The company's global footprint extends to over 170 countries, with robust sales in North America, Europe, and emerging markets like China and Latin America.

Strategic Expansion in Obesity and Rare Diseases

Recent shifts emphasize diversification beyond traditional diabetes management, notably in obesity therapeutics with the launch of Wegovy (semaglutide). This pivot capitalizes on the burgeoning obesity epidemic and associated metabolic disorders, establishing Novo Nordisk as a dominant player in the obesity treatment market, estimated to reach $27 billion globally by 2030 [3].

Core Strengths of Novo Nordisk

Innovative Product Pipeline

Novo Nordisk invests approximately 17% of its annual revenue into R&D, fostering a pipeline that includes next-generation insulin analogs, GLP-1 receptor agonists, and potential treatments for NASH and cardiovascular diseases [4]. Its leadership in GLP-1 therapies, especially semaglutide-based products, underscores its pioneering role in metabolic therapeutics.

Robust Manufacturing Capabilities

The company's strategic investments in manufacturing facilities—such as in Denmark, the US, and emerging markets—ensure supply reliability amid rising demand. Its vertical integration enhances control over production quality, enabling rapid scaling during product launches.

Strong Regulatory and Patent Framework

Novo Nordisk's extensive patent portfolio safeguards critical formulations, delaying generic competition and securing market exclusivity. Its proactive regulatory engagement facilitates quick approval pathways in key markets, notably with the FDA and EMA.

Patient-Centric Approach and Digital Innovation

Digital health initiatives, including connected insulin pens and mobile apps, foster patient adherence and real-world data collection. These innovations enhance therapeutic outcomes and strengthen customer engagement, distinguishing Novo Nordisk from competitors.

Strategic Collaborations and Acquisitions

The company's strategic alliances, such as with MannKind for afrezza inhaled insulin and recent acquisitions in the obesity domain, augment its product offerings and technological capabilities, reinforcing its leadership stance [5].

Strategic Insights and Future Outlook

Focus on Personalized Medicine and Digital Health

Novo Nordisk is increasingly integrating digital health solutions and personalized therapeutics into its development strategy. Investments in AI-driven data analytics and bioinformatics aim to refine patient stratification and optimize treatment efficacy.

Expansion in Emerging Markets

Emerging markets present a high-growth avenue, driven by rising diabetes prevalence and healthcare infrastructure development. Novo Nordisk's localized manufacturing and pricing strategies enable market penetration while navigating complex regulatory landscapes.

Pipeline Expansion into NASH and Cardiovascular Disease

Given the substantial global burden of NASH and cardiovascular comorbidities among diabetics, Novo Nordisk’s R&D efforts target these indications, promising diversification beyond traditional endocrinology.

Responding to Competitive Pressures

While Lilly and Sanofi remain primary competitors, Novo Nordisk's early market entries with once-weekly and oral GLP-1 formulations give it a competitive edge. However, patent expirations and biosimilar entrants necessitate continuous innovation and strategic agility.

Sustainability and Corporate Responsibility

Novo Nordisk emphasizes sustainability, aiming for carbon neutrality by 2030. This positioning enhances its brand reputation, aligns with stakeholder expectations, and fosters long-term resilience.

Challenges and Risks

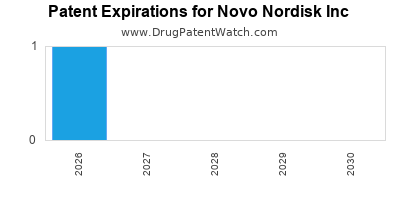

- Patent expirations could invite biosimilar competition, impacting pricing power.

- Pricing and reimbursement pressures in key markets threaten margins.

- Regulatory hurdles in emerging indications may delay pipeline commercialization.

- Manufacturing complexities associated with biologics may impact supply chain robustness.

Investors and stakeholders must monitor these factors while assessing Novo Nordisk’s strategic responses and adaptability.

Conclusion

Novo Nordisk Inc. exemplifies a resilient and innovative pharmaceutical entity focused on diabetes, obesity, and metabolic diseases. Its commanding market share, robust R&D pipeline, strategic geographic expansion, and digital transformation initiatives underpin its competitive advantage. As the company advances into emerging therapeutic territories, its ability to sustain innovation, navigate regulatory landscapes, and effectively engage markets will determine its trajectory amid intensifying competition.

Key Takeaways

- Market Leader: Dominates global insulin and GLP-1 therapeutics, leveraging a broad portfolio and strong brand equity.

- Innovative Pipeline: Continues investing heavily in R&D, expanding into NASH, cardiovascular, and obesity treatments.

- Strategic Expansion: Focuses on emerging markets and digital health solutions for enhanced patient engagement and market share.

- Competitive Edge: Maintains patent protection, manufacturing excellence, and strategic alliances to preempt biosimilar threats.

- Future Potential: Positioned for growth through pipeline diversification, technological innovation, and sustainability commitments.

FAQs

1. How does Novo Nordisk’s market share compare to competitors like Eli Lilly and Sanofi?

Novo Nordisk leads with approximately 45% global insulin market share, ahead of Eli Lilly and Sanofi, who hold significant but smaller portions of the market, especially in insulin therapy segments [1].

2. What are the key growth drivers for Novo Nordisk in the coming years?

Major drivers include expanding obesity therapeutics with Wegovy, pipeline developments in NASH and cardiovascular indications, and growth in emerging markets.

3. How is Novo Nordisk leveraging digital health?

The company integrates connected devices, mobile apps, and data analytics to improve patient adherence, gather real-world evidence, and personalize therapy, strengthening its market positioning.

4. What risks could impede Novo Nordisk’s growth?

Patent expirations, biosimilar entry, pricing pressures, regulatory delays, and manufacturing complexities pose significant risks.

5. What strategic initiatives is Novo Nordisk implementing to sustain competitive advantage?

Investments in R&D, pipeline diversification, digital health, geographic expansion, and sustainability commitments collectively reinforce its market leadership.

References

[1] IMS Health Data, 2022.

[2] Novo Nordisk Annual Report, 2022.

[3] Global Market Insights, 2022.

[4] Novo Nordisk R&D Annual Review, 2022.

[5] Industry News, 2023.