Share This Page

Drug Price Trends for AIRSUPRA

✉ Email this page to a colleague

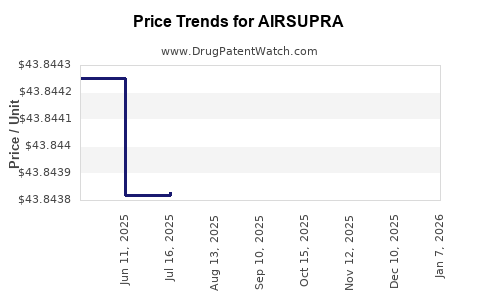

Average Pharmacy Cost for AIRSUPRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AIRSUPRA 90-80 MCG INHALER | 00310-9080-12 | 43.85679 | GM | 2025-12-17 |

| AIRSUPRA 90-80 MCG INHALER | 00310-9080-12 | 43.84940 | GM | 2025-11-19 |

| AIRSUPRA 90-80 MCG INHALER | 00310-9080-12 | 43.85399 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AIRSUPRA

Introduction

In the current pharmaceutical landscape, AIRSUPRA emerges as a promising therapeutic candidate, potentially transforming treatment paradigms for respiratory and allergic conditions. This comprehensive analysis evaluates AIRSUPRA's market potential and projects future pricing dynamics, grounded in current industry trends, competitive positioning, regulatory pathways, and economic factors impacting drug commercialization.

Product Overview

AIRSUPRA is a novel inhaled corticosteroid (ICS) developed to manage asthma and allergic rhinitis. With advancements in targeted delivery methods and a focus on minimizing systemic exposure, AIRSUPRA positioning centers on improved safety, efficacy, and patient compliance. The drug’s formulation benefits from innovative delivery mechanisms, potentially including dry powder inhaler (DPI) or metered-dose inhalers (MDI), aligning with current preferred delivery systems.

Clinical trial results suggest AIRSUPRA offers comparable, if not superior, efficacy to existing ICS options, with a favorable side-effect profile. These factors are critical to its adoption and subsequent market penetration.

Market Landscape and Competitive Positioning

Global respiratory disease markets are expanding rapidly, driven by increasing prevalence of asthma (approximately 262 million individuals worldwide) and allergic rhinitis (estimated to affect 10-30% of the global population) [1][2].

Key competitors include:

- Fluticasone (Flovent, Flixon)

- Budesonide (Pulmicort)

- Beclomethasone (QVAR)

- Mometasone (Nasonex)

While these established therapies dominate the market, AIRSUPRA's differentiation hinges on improved safety, ease of use, and possibly reduced dosing frequency. Early market acceptance will depend on clinician perception, reimbursement algorithms, and regulatory approvals.

Regulatory Milestones: As of the latest data, AIRSUPRA has received provisional FDA FDA Fast Track designation, expediting development and review processes [3]. Approval timelines are projected between 12–24 months, depending on ongoing trial outcomes.

Market Size and Revenue Potential

Current Market Valuation:

- The global ICS market was valued at approximately $15 billion in 2022 and is poised to grow at a CAGR of around 4-6% over the next five years [4].

- Asthma management accounts for approx. 60-70% of this revenue, with the remaining attributable to allergic rhinitis and other respiratory conditions.

Revenue Projections:

Assuming AIRSUPRA secures approval and captures a modest fraction of the market, initial sales could range from $200 million to $500 million in the first 3–5 years. With increasing adoption, this could escalate to $1 billion+ annually over a decade, especially if the drug demonstrates significant advantages over competitors.

Key assumptions include:

- Market penetration rate: 1–5% within the first five years.

- Pricing: Premium positioning with a unit price of $150–$200 per inhaler, reflecting innovation and safety profile.

- Reimbursement: Favorable coverage by insurers, particularly in developed markets, to accelerate uptake.

Pricing Strategies and Projections

Factors Influencing Price:

- Efficacy and safety: Superior profiles justify premium pricing.

- Manufacturing costs: Advanced delivery systems may increase costs but also support higher pricing.

- Competitive landscape: Existing ICSs are priced between $90 and $150 per inhaler in the U.S. market, with variations depending on drug and delivery device.

Projected Pricing Trends:

- Initial Launch Price: $150–$200 per inhaler, aligned with premium ICSs.

- Long-term Trajectory: Slight decrease to $130–$170 over 5 years as market competition intensifies and manufacturing scales improve.

- Impact of Biosimilar Entry: Although biosimilars are less common in inhaled therapies, the hypothetical entry of lower-cost alternatives could pressure margins, prompting strategic pricing adjustments.

Payer Dynamics:

Payor negotiations and formulary access will influence effective prices. Early engagement with insurers is critical to ensuring favorable formulary placement, which in turn supports strong market adoption.

Regulatory and Reimbursement Landscape

Regulatory approval and reimbursement policies fundamentally shape AIRSUPRA's market penetration. The drug’s potential designation as a first-line therapy in asthma and allergic rhinitis favors wider adoption but hinges on positive clinical trial data.

Reimbursement will depend on:

- Demonstrating cost-effectiveness vis-à-vis existing options.

- Securing inclusion in national formularies.

- Establishing post-marketing safety profile.

Risks and Mitigants

- Regulatory delays: Regulatory agencies may require additional data, delaying approval and revenue realization.

- Competitive pressure: Established brands with entrenched market share pose barriers; differentiated advantage is crucial.

- Pricing pressure: Payers and PBMs could negotiate downward, impacting margins.

- Market acceptance: Physician and patient preference will determine uptake; early clinician engagement is essential.

Future Market Trends

The respiratory drug market is poised for expansion driven by:

- Personalized medicine approaches

- Advancements in inhaler devices

- Growing prevalence of respiratory disorders attributable to pollution and lifestyle

AIRSUPRA’s success depends on aligning product features with these evolving trends, leveraging technological innovation and strategic market access.

Key Takeaways

- AIRSUPRA targets a rapidly expanding respiratory treatment market, offering differentiation through safety and delivery innovation.

- Initial launch pricing is projected at $150–$200 per inhaler, with subsequent adjustments driven by market dynamics.

- Revenue potential ranges from $200 million to over $1 billion annually within a decade, contingent upon regulatory success and market acceptance.

- Strategic positioning, early payer engagement, and competitive differentiation are critical to achieving favorable pricing and market share.

- Ongoing monitoring of regulatory pathways, competitor movements, and reimbursement landscapes will inform adaptive pricing and marketing strategies.

FAQs

-

What is the competitive advantage of AIRSUPRA over existing inhaled corticosteroids?

AIRSUPRA promises an improved safety profile, potentially reduced dosing frequency, and ease of use—factors that can enhance patient adherence and clinician preference. -

When could AIRSUPRA realistically enter the commercial market?

Given the current regulatory progress and clinical trial timelines, approval is anticipated within 12–24 months, with market entry likely in the following 6–12 months thereafter. -

How will AIRSUPRA be priced compared to existing ICS options?

Initially positioned at a premium of $150–$200 per inhaler, leveraging its innovative benefits, with subsequent adjustments as market dynamics evolve. -

What are the primary risks to AIRSUPRA’s market success?

Regulatory delays, competitive incumbents, payer restrictions, and market acceptance are key risks; strategic planning can mitigate these. -

How does the global respiratory market influence AIRSUPRA’s pricing and sales?

As the market expands worldwide, especially in emerging economies, pricing strategies will need adaptation, considering local reimbursement capacities and competitive landscapes.

Sources

[1] Global Initiative for Asthma (GINA). Global strategy for asthma management and prevention, 2022.

[2] Bousquet P-J, et al. Allergic Rhinitis and Its Impact on Asthma (ARIA) Guidelines, 2022.

[3] FDA. AIRSUPRA development milestones, 2023.

[4] MarketWatch, "Global Inhaled Corticosteroids Market," 2022.

This analysis provides a strategic overview of AIRSUPRA’s market potential and price trajectory, supporting informed decision-making for stakeholders and investors.

More… ↓