Last updated: January 3, 2026

Summary

Endo International plc is a prominent player in the global pharmaceutical landscape, primarily operating within specialty branded pharmaceuticals and generics markets. This analysis provides a comprehensive overview of Endo’s market position, operational strengths, competitive strategies, product portfolio, and future growth prospects. It emphasizes how Endo navigates challenges within a highly competitive, regulated environment and identifies strategic avenues for sustained expansion amid evolving industry dynamics.

Introduction

Endo operates across multiple therapeutic areas, including pain management, urology, and dermatology. With a focus on specialty pharmaceuticals, Endo's operations are characterized by a mix of innovation, strategic acquisitions, and a diversified product pipeline. As of 2022, Endo’s revenue primarily stems from North America, with international markets contributing progressively.

Market Overview

The pharmaceutical industry is marked by rapid innovation, patent expiries, and intense competition. Key drivers include evolving drug approval landscapes, pricing pressures, and digital transformation. Endo faces competition from both large pharmaceutical firms and niche players, emphasizing the need for strong operational execution and strategic agility.

What Is Endo’s Current Market Position?

Market Share & Revenue Breakdown

| Metric |

2022 Figures |

Notes |

| Global Revenue |

~$2.63 billion |

Revenue decline of ~5% YoY attributed to patent cliffs and restructuring |

| North America Revenue |

~$2.0 billion (~76%) |

Largest contributor, driven by pain management and urology products |

| International Revenue |

~$630 million (~24%) |

Growth driven by emerging markets and portfolio expansion |

Core Therapeutic Areas & Product Segments

| Segment |

Major Products |

Market Position |

Key Competitors |

| Pain Management |

Lidoderm, Voltaren |

Leading in transdermal patches |

Pfizer (Negotiate), Novartis |

| Urology & Women's Health |

Androgel, Fortesta |

Top-tier US market share |

Abbott, Teva, Pfizer |

| Dermatology |

Benzaclin, Tactupump |

Niche but competitive |

Galderma, Valeant |

Distribution & Market Penetration

Endo’s distribution channels include specialty pharmacies, hospitals, and retail pharmacies. Its robust footprint, especially in the US, solidifies its position, although regulatory hurdles and patent expiries threaten future dominance.

What Are Endo’s Strengths and Competitive Advantages?

Operational and Strategic Strengths

| Strength |

Description |

Impact |

| Diversified Product Portfolio |

Combines branded, generic, and OTC assets |

Minimizes risk; buffers against patent losses |

| Strong Presence in Pain Management |

Portfolio of established brands |

Ensures steady revenue streams |

| Strategic Acquisitions |

Acquired Par Pharmaceuticals and other assets |

Expands market share, enhances R&D pipeline |

| Regulatory & Quality Compliance |

Maintenance of high standards |

Trust among physicians and pharmacies |

| Focus on Specialty Pharmaceuticals |

High-margin niche markets |

Improved profitability compared to generics |

Market-driven Operational Strengths

- Effective commercialization of complex formulations.

- Focused R&D on high-value, specialty drugs.

- Strategic geographic expansion, notably into China, Latin America, and Southeast Asia.

Financial Strengths

| Metric |

2022 Data |

Insights |

| EBITDA Margin |

~23% |

Healthy profitability amid market challenges |

| R&D Investment |

~$100 million |

Emphasizes innovation pipeline |

| Debt Levels |

Moderate, with strategic deleveraging |

Enables acquisition and operational agility |

What Are Key Challenges Facing Endo?

| Challenge |

Details |

Strategic Implications |

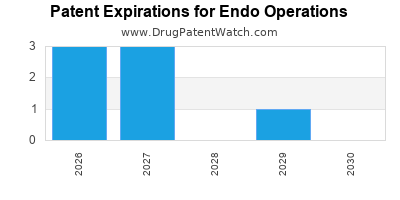

| Patent Expiries & Generics Competition |

Loss of exclusivity on flagship products |

Need for pipeline diversification |

| Regulatory & Litigation Risks |

Ongoing litigations on opioid-related lawsuits (notably in the US) |

Impact on financial stability |

| Pricing Pressures & Reimbursements |

Increasing governmental and payer scrutiny |

Necessitate value-based strategies |

| Market Saturation & Innovation Gap |

Slower pipeline development compared to large peers |

Critical focus area for R&D investments |

How Does Endo’s Strategic Approach Position It for Future Growth?

Innovation & Pipeline Development

Endo prioritizes advancing its pipeline in pain management, urology, and dermatology. Highlights include:

- New Chemical Entities (NCEs): Focused on niche formulations.

- Biosimilars & Generics: Leveraging cost advantages.

- Digital & Companion Diagnostics: Implementing tech for personalized therapy.

Market Expansion Strategies

- Strengthening presence in emerging markets.

- Expanding specialty distribution channels.

- Forming strategic alliances to enhance R&D capabilities.

Operational Efficiency & Restructuring

- Cost-cutting initiatives, including headcount reduction and process automation.

- Divestment of non-core assets to optimize capital allocation.

- Reorganisation of R&D to accelerate bringing innovative products to market.

How Does Endo Compare to Peers?

| Company |

Key Strengths |

Market Cap (USD) |

Focus Areas |

Key Challenges |

| Endo |

Specialized niche, strong US presence |

~$1.5 billion |

Pain, urology, dermatology |

Patent cliffs, litigations |

| Pfizer |

Diversified global portfolio, R&D prowess |

~$220 billion |

Broad medicine spectrum |

Patent expiries, pricing pressures |

| Teva |

Generics pioneer, cost leadership |

~$12 billion |

Generics, biosimilars |

Debt, patent cliff recovery |

| Novartis |

Innovation-driven, pipeline strength |

~$210 billion |

Specialty, ophthalmology |

Pricing policies, patent cliffs |

Note: Endo’s smaller scale affords agility but imposes limitations on large-scale R&D investments relative to giants like Pfizer or Novartis.

Future Outlook & Strategic Recommendations

Emerging Opportunities

- Innovative Pain Therapies: Developing therapies targeting neuropathic pain and other high unmet needs.

- Biosimilars & Generic Expansion: Capitalizing on patent expirations of major brands.

- Digital Health Integration: Using digital platforms for outcomes monitoring.

Risks to Monitor

- Growing regulatory and legal scrutiny, especially opioid-related cases.

- Competitive moves from large pharmaceutical players.

- Pricing reforms impacting profitability.

Recommended Strategic Focus

| Focus Area |

Actions |

Expected Outcomes |

| Pipeline Acceleration |

Invest in novel formulations & delivery systems |

New revenue streams |

| Market Diversification |

Enter or expand in emerging markets |

Growth in high-growth regions |

| Operational Optimization |

Enhance manufacturing efficiency |

Cost savings |

| Legal & Regulatory Preparedness |

Robust compliance & litigation strategies |

Minimize legal risks |

Key Takeaways

- Endo maintains a strong foothold in niche, high-margin markets within the US, especially pain management and urology.

- The company's diversified portfolio and strategic acquisitions provide resilience but face headwinds from patent expiries and legal challenges.

- Emphasizing innovation, market expansion, and operational efficiency is vital for future growth.

- Competitively, Endo benefits from agility and specialization but must navigate increased regulatory scrutiny and intensifying competition.

- To sustain its positioning, Endo should focus on pipeline diversification, enter high-growth emerging markets, and leverage digital health.

FAQs

1. How vulnerable is Endo to patent expiries?

Endo’s revenue heavily relies on a few core products nearing patent cliffs, which pose significant risks. Diversification and pipeline development are critical to mitigate this vulnerability.

2. What are Endo’s most promising areas for future growth?

Pain management, biosimilars, and dermatological innovations offer substantial growth potential, especially as the company expands in emerging markets and invests in digital therapeutics.

3. How does Endo’s competitor landscape impact its strategy?

Large players like Pfizer and Novartis emphasize innovation and R&D, pressuring Endo to accelerate its pipeline and expand market share through strategic alliances and geographic expansion.

4. What legal challenges does Endo face?

Endo has faced opioid-related litigation in the US, which could result in significant financial liabilities and reputation impact, necessitating strong compliance and legal risk management.

5. What steps should Endo take to enhance its competitive edge?

Focusing on R&D acceleration, diversifying its product pipeline, expanding internationally, and adopting digital health tools will be crucial for preserving and enhancing its market position.

References

[1] Endo International Annual Report 2022.

[2] MarketWatch, Endo Pharmaceuticals Profile.

[3] IQVIA, Pharmaceutical Market Trends 2022.

[4] Reuters, Endo Litigation Updates.

[5] Bloomberg, Industry Competitive Analysis 2023.