Expiring Drug Patents Cheat Sheet

We analyse the patents covering drugs in 134 countries and quickly give you the likely loss-of-exclusivity/generic entry date

Argentina: These 27 Drugs Face Patent Expirations and Generic Entry From 2025 - 2026

The content of this page is licensed under a Creative Commons Attribution 4.0 International License.

Generic Entry Dates in Other Countries

Friedman, Yali, "Argentina: These 27 Drugs Face Patent Expirations and Generic Entry From 2025 - 2026" DrugPatentWatch.com thinkBiotech, 2025 www.drugpatentwatch.com/p/expiring-drug-patents-generic-entry/.

Media collateral

These estimated drug patent expiration dates and generic entry opportunity dates are calculated from analysis of known patents covering drugs. Many factors can influence early or late generic entry. This information is provided as a rough estimate of generic entry potential and should not be used as an independent source. The methodology is described in this blog post.

When can BELRAPZO (bendamustine hydrochloride) generic drug versions launch?

Generic name: bendamustine hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: January 13, 2026

Generic Entry Controlled by: Argentina Patent 52,877

Patent Title: COMPOSICIONES FARMACEUTICAS DE BENDAMUSTINA

BELRAPZO is a drug marketed by Eagle Pharms. There are eleven patents protecting this drug. Six tentatively approved generics are ready to enter the market.

This drug has sixty-five patent family members in thirty countries. There has been litigation on patents covering BELRAPZO

See drug price trends for BELRAPZO.

The generic ingredient in BELRAPZO is bendamustine hydrochloride. There are twenty-three drug master file entries for this API. Eleven suppliers are listed for this generic product. Additional details are available on the bendamustine hydrochloride profile page.

When can BENDEKA (bendamustine hydrochloride) generic drug versions launch?

Generic name: bendamustine hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: January 13, 2026

Generic Entry Controlled by: Argentina Patent 52,877

Patent Title: COMPOSICIONES FARMACEUTICAS DE BENDAMUSTINA

BENDEKA is a drug marketed by Eagle Pharms. There are twenty patents protecting this drug and one Paragraph IV challenge. Six tentatively approved generics are ready to enter the market.

This drug has one hundred and twenty-five patent family members in thirty-one countries. There has been litigation on patents covering BENDEKA

See drug price trends for BENDEKA.

The generic ingredient in BENDEKA is bendamustine hydrochloride. There are twenty-three drug master file entries for this API. Eleven suppliers are listed for this generic product. Additional details are available on the bendamustine hydrochloride profile page.

When can WAKIX (pitolisant hydrochloride) generic drug versions launch?

Generic name: pitolisant hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: February 08, 2026

Generic Entry Controlled by: Argentina Patent 54,734

Patent Title: COMPUESTO QUE COMPRENDE MONOCLORHIDRATO DE 1-[3-[3(4-CLOROFENIL) PROPOXI] PROPIL] - PIPERIDINA CRISTALINO, PROCEDIMIENTO PARA SU FABRICACION Y COMPOSICIONES FARMACEUTICAS.

WAKIX is a drug marketed by Harmony. There are three patents protecting this drug.

This drug has sixty-one patent family members in thirty-one countries. There has been litigation on patents covering WAKIX

See drug price trends for WAKIX.

The generic ingredient in WAKIX is pitolisant hydrochloride. One supplier is listed for this generic product. Additional details are available on the pitolisant hydrochloride profile page.

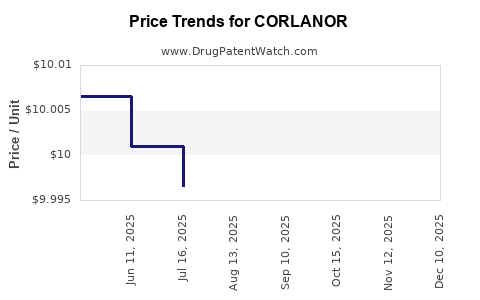

When can CORLANOR (ivabradine) generic drug versions launch?

Generic name: ivabradine

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: February 28, 2026

Generic Entry Controlled by: Argentina Patent 52,926

Patent Title: FORMA CRISTALINA GAMA DEL CLORHIDRATO DE IVABRADINA, UN PROCEDIMIENTO PARA SU PREPARACION Y COMPOSICIONES QUE LA CONTIENEN

This drug has ninety-seven patent family members in forty-two countries. There has been litigation on patents covering CORLANOR

See drug price trends for CORLANOR.

The generic ingredient in CORLANOR is ivabradine. There are nine drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the ivabradine profile page.

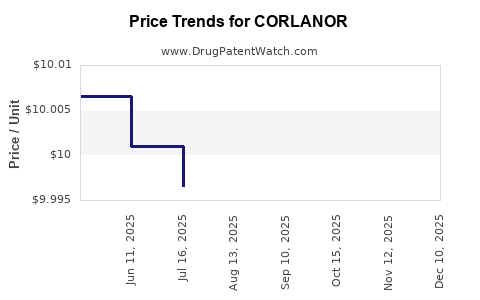

When can CORLANOR (ivabradine hydrochloride) generic drug versions launch?

Generic name: ivabradine hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: February 28, 2026

Generic Entry Controlled by: Argentina Patent 53,147

Patent Title: FORMA CRISTALINA DEL CLORHIDRATO DE IVABRADINA, UN PROCEDIMIENTO PARA SU PREPARACION Y COMPOSICIONES FARMACEUTICAS QUE LA CONTIENEN

This drug has ninety-seven patent family members in forty-two countries. There has been litigation on patents covering CORLANOR

See drug price trends for CORLANOR.

The generic ingredient in CORLANOR is ivabradine hydrochloride. There are nine drug master file entries for this API. Eleven suppliers are listed for this generic product. Additional details are available on the ivabradine hydrochloride profile page.

When can NEXAVAR (sorafenib tosylate) generic drug versions launch?

Generic name: sorafenib tosylate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 03, 2026

Generic Entry Controlled by: Argentina Patent 54,234

Patent Title: COMPOSICION FARMACEUTICA PARA EL TRATAMIENTO DEL CANCER

NEXAVAR is a drug marketed by Bayer Hlthcare. There are two patents protecting this drug and one Paragraph IV challenge.

This drug has eighty-nine patent family members in thirty-nine countries. There has been litigation on patents covering NEXAVAR

See drug price trends for NEXAVAR.

The generic ingredient in NEXAVAR is sorafenib tosylate. There are thirteen drug master file entries for this API. Eight suppliers are listed for this generic product. Additional details are available on the sorafenib tosylate profile page.

When can ACTOPLUS MET XR (metformin hydrochloride; pioglitazone hydrochloride) generic drug versions launch?

Generic name: metformin hydrochloride; pioglitazone hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 15, 2026

Generic Entry Controlled by: Argentina Patent 54,238

Patent Title: COMPOSICION FARMACEUTICA QUE CONTIENE UNA BIGUANIDA Y UN DERIVADO DE TIAZOLIDINDIONA

This drug has seventy-two patent family members in twenty-five countries. There has been litigation on patents covering ACTOPLUS MET XR

See drug price trends for ACTOPLUS MET XR.

The generic ingredient in ACTOPLUS MET XR is metformin hydrochloride; pioglitazone hydrochloride. There are forty-nine drug master file entries for this API. Seven suppliers are listed for this generic product. Additional details are available on the metformin hydrochloride; pioglitazone hydrochloride profile page.

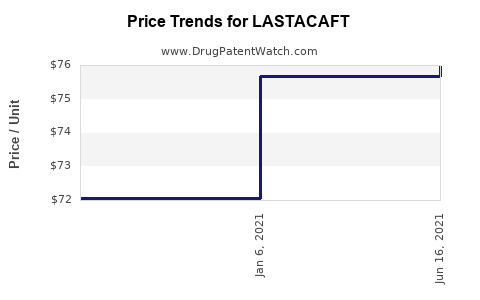

When can LASTACAFT (alcaftadine) generic drug versions launch?

Generic name: alcaftadine

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 31, 2026

Generic Entry Controlled by: Argentina Patent 60,278

Patent Title: TRATAMIENTOS DE LAS ALERGIAS OCULARES

This drug has forty-six patent family members in thirty countries. There has been litigation on patents covering LASTACAFT

See drug price trends for LASTACAFT.

The generic ingredient in LASTACAFT is alcaftadine. There are six drug master file entries for this API. Four suppliers are listed for this generic product. Additional details are available on the alcaftadine profile page.

When can TYKERB (lapatinib ditosylate) generic drug versions launch?

Generic name: lapatinib ditosylate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: April 18, 2026

Generic Entry Controlled by: Argentina Patent 54,252

Patent Title: COMPOSICION FARMACEUTICA ORAL QUE CONTIENE SALES DE DITOSILATO DE 4-QUINAZOLINAMINA

TYKERB is a drug marketed by Novartis. There is one patent protecting this drug and one Paragraph IV challenge.

This drug has twenty-eight patent family members in twenty-six countries.

See drug price trends for TYKERB.

The generic ingredient in TYKERB is lapatinib ditosylate. There are seven drug master file entries for this API. Four suppliers are listed for this generic product. Additional details are available on the lapatinib ditosylate profile page.

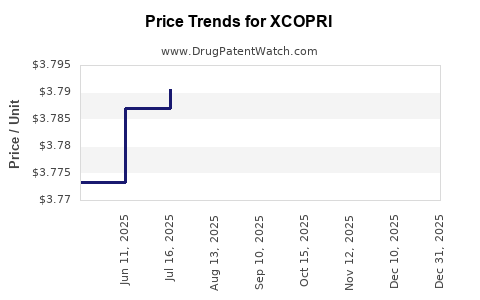

When can XCOPRI (cenobamate) generic drug versions launch?

Generic name: cenobamate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: April 21, 2026

Generic Entry Controlled by: Argentina Patent 53,065

Patent Title: COMPUESTOS AZOLICOS NEUROTERAPEUTICOS Y COMPOSICIONES FARMACEUTICAS QUE LOS CONTIENEN

This drug has twenty-six patent family members in twenty countries. There has been litigation on patents covering XCOPRI

See drug price trends for XCOPRI.

The generic ingredient in XCOPRI is cenobamate. One supplier is listed for this generic product. Additional details are available on the cenobamate profile page.

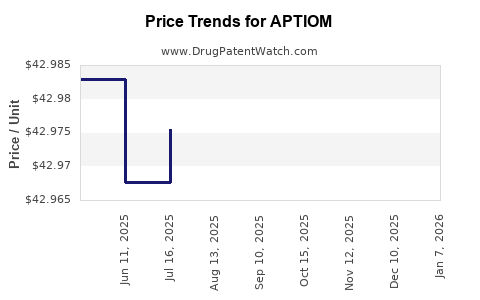

When can APTIOM (eslicarbazepine acetate) generic drug versions launch?

Generic name: eslicarbazepine acetate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: April 24, 2026

Generic Entry Controlled by: Argentina Patent 55,917

Patent Title: PROCESO DE REDUCCION CATALITICA ASIMETRICA PARA PREPARAR LOS ISOMEROS (S)-(+) Y (R)-(-) DEL COMPUESTO (10,11-DIHIDRO-10-HIDROXI-5-H DIBENZ [B.F] AZEPIN-5-CARBOXAMIDA]

This drug has one hundred patent family members in twenty-six countries. There has been litigation on patents covering APTIOM

See drug price trends for APTIOM.

The generic ingredient in APTIOM is eslicarbazepine acetate. There are twelve drug master file entries for this API. Eight suppliers are listed for this generic product. Additional details are available on the eslicarbazepine acetate profile page.

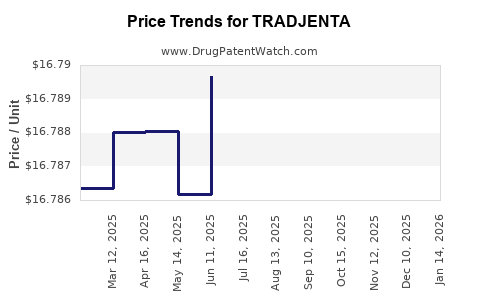

When can TRADJENTA (linagliptin) generic drug versions launch?

Generic name: linagliptin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 04, 2026

Generic Entry Controlled by: Argentina Patent 60,755

This drug has four hundred and eighty-six patent family members in forty-five countries. There has been litigation on patents covering TRADJENTA

See drug price trends for TRADJENTA.

The generic ingredient in TRADJENTA is linagliptin. There are nineteen drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the linagliptin profile page.

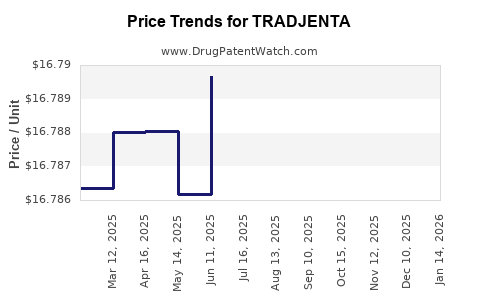

When can TRADJENTA (linagliptin) generic drug versions launch?

Generic name: linagliptin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 04, 2026

Generic Entry Controlled by: Argentina Patent 79,930

This drug has four hundred and eighty-six patent family members in forty-five countries. There has been litigation on patents covering TRADJENTA

See drug price trends for TRADJENTA.

The generic ingredient in TRADJENTA is linagliptin. There are nineteen drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the linagliptin profile page.

When can VICTRELIS (boceprevir) generic drug versions launch?

Generic name: boceprevir

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 31, 2026

Generic Entry Controlled by: Argentina Patent 55,198

Patent Title: FORMULACIONES FARMACEUTICAS Y METODOS DE TRATAMIENTO QUE LAS UTILIZAN

VICTRELIS is a drug marketed by Merck Sharp Dohme. There are two patents protecting this drug.

This drug has twenty-seven patent family members in seventeen countries.

The generic ingredient in VICTRELIS is boceprevir. Additional details are available on the boceprevir profile page.

When can FARYDAK (panobinostat lactate) generic drug versions launch?

Generic name: panobinostat lactate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 12, 2026

Generic Entry Controlled by: Argentina Patent 61,297

FARYDAK is a drug marketed by Secura. There are two patents protecting this drug.

This drug has sixty-eight patent family members in forty countries. There has been litigation on patents covering FARYDAK

See drug price trends for FARYDAK.

The generic ingredient in FARYDAK is panobinostat lactate. There is one drug master file entry for this API. Additional details are available on the panobinostat lactate profile page.

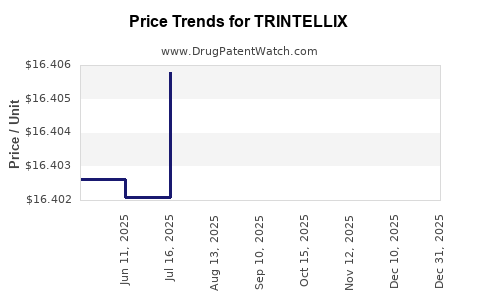

When can TRINTELLIX (vortioxetine hydrobromide) generic drug versions launch?

Generic name: vortioxetine hydrobromide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 16, 2026

Generic Entry Controlled by: Argentina Patent 61,481

Patent Title: COMPUESTOS CON ACTIVIDAD COMBINADA SOBRE SERT, 5-HT3 Y 5-HT1A

This drug has two hundred and seventeen patent family members in forty-two countries. There has been litigation on patents covering TRINTELLIX

See drug price trends for TRINTELLIX.

The generic ingredient in TRINTELLIX is vortioxetine hydrobromide. There are sixteen drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the vortioxetine hydrobromide profile page.

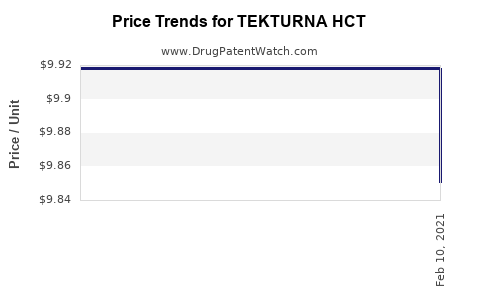

When can TEKTURNA HCT (aliskiren hemifumarate; hydrochlorothiazide) generic drug versions launch?

Generic name: aliskiren hemifumarate; hydrochlorothiazide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 23, 2026

Generic Entry Controlled by: Argentina Patent 61,565

This drug has thirty-two patent family members in twenty-five countries. There has been litigation on patents covering TEKTURNA HCT

See drug price trends for TEKTURNA HCT.

The generic ingredient in TEKTURNA HCT is aliskiren hemifumarate; hydrochlorothiazide. There are four drug master file entries for this API. Additional details are available on the aliskiren hemifumarate; hydrochlorothiazide profile page.

When can EXFORGE HCT (amlodipine besylate; hydrochlorothiazide; valsartan) generic drug versions launch?

Generic name: amlodipine besylate; hydrochlorothiazide; valsartan

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 27, 2026

Generic Entry Controlled by: Argentina Patent 61,627

This drug has thirty-two patent family members in twenty-five countries. There has been litigation on patents covering EXFORGE HCT

See drug price trends for EXFORGE HCT.

The generic ingredient in EXFORGE HCT is amlodipine besylate; hydrochlorothiazide; valsartan. There are fifty drug master file entries for this API. Five suppliers are listed for this generic product. Additional details are available on the amlodipine besylate; hydrochlorothiazide; valsartan profile page.

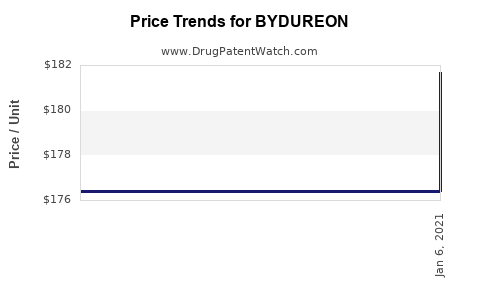

When can BYDUREON (exenatide synthetic) generic drug versions launch?

Generic name: exenatide synthetic

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 28, 2026

Generic Entry Controlled by: Argentina Patent 61,730

This drug has three hundred and forty-six patent family members in forty-eight countries. There has been litigation on patents covering BYDUREON

See drug price trends for BYDUREON.

The generic ingredient in BYDUREON is exenatide synthetic. There are seven drug master file entries for this API. Two suppliers are listed for this generic product. Additional details are available on the exenatide synthetic profile page.

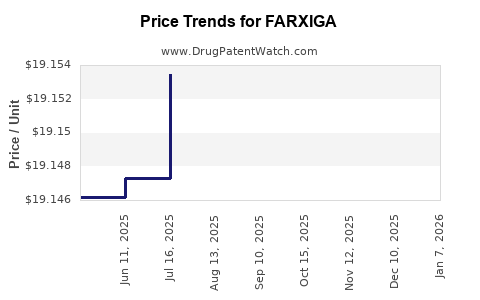

When can FARXIGA (dapagliflozin) generic drug versions launch?

Generic name: dapagliflozin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 28, 2026

Generic Entry Controlled by: Argentina Patent 61,730

This drug has four hundred and fifty-one patent family members in fifty-two countries. There has been litigation on patents covering FARXIGA

See drug price trends for FARXIGA.

The generic ingredient in FARXIGA is dapagliflozin. There are twenty-six drug master file entries for this API. Five suppliers are listed for this generic product. Additional details are available on the dapagliflozin profile page.

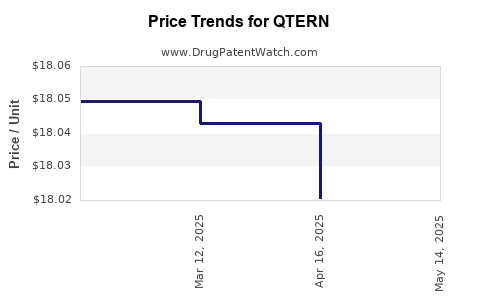

When can QTERN (dapagliflozin; saxagliptin hydrochloride) generic drug versions launch?

Generic name: dapagliflozin; saxagliptin hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 28, 2026

Generic Entry Controlled by: Argentina Patent 61,730

This drug has three hundred and thirteen patent family members in forty-eight countries. There has been litigation on patents covering QTERN

See drug price trends for QTERN.

The generic ingredient in QTERN is dapagliflozin; saxagliptin hydrochloride. There are twenty-six drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the dapagliflozin; saxagliptin hydrochloride profile page.

When can BOSULIF (bosutinib monohydrate) generic drug versions launch?

Generic name: bosutinib monohydrate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 29, 2026

Generic Entry Controlled by: Argentina Patent 54,505

Patent Title: FORMAS CRISTALINAS DE 4- ((2,4-DICLORO-5-METOXIFENIL) AMINO ) -6-METOXI-7-(3-(4-METIL-1-PIPERAZINIL) PROPOXI) -3- QUINOLINCARBONITRILO Y METODOS DE PREPARACION DE LAS MISMAS

BOSULIF is a drug marketed by Pf Prism Cv. There are four patents protecting this drug and two Paragraph IV challenges. Two tentatively approved generics are ready to enter the market.

This drug has eighty-one patent family members in thirty countries. There has been litigation on patents covering BOSULIF

See drug price trends for BOSULIF.

The generic ingredient in BOSULIF is bosutinib monohydrate. There are five drug master file entries for this API. Two suppliers are listed for this generic product. Additional details are available on the bosutinib monohydrate profile page.

When can OLYSIO (simeprevir sodium) generic drug versions launch?

Generic name: simeprevir sodium

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: July 28, 2026

Generic Entry Controlled by: Argentina Patent 55,359

Patent Title: INHIBIDORES MACROCICLICOS DEL VIRUS DE LA HEPATITIS C

OLYSIO is a drug marketed by Janssen Prods. There are nine patents protecting this drug.

This drug has one hundred and forty patent family members in forty-three countries.

See drug price trends for OLYSIO.

The generic ingredient in OLYSIO is simeprevir sodium. There is one drug master file entry for this API. Additional details are available on the simeprevir sodium profile page.

When can REVLIMID (lenalidomide) generic drug versions launch?

Generic name: lenalidomide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: October 03, 2026

Generic Entry Controlled by: Argentina Patent 57,868

Patent Title: METODOS EN LOS QUE SE USA 3-(4-AMINO-1-OXO-1,3-DIHIDRO-ISOINDOL-2-IL)-PIPERIDIN-2,6-DIONA PARA EL TRATAMIENTO DE CIERTAS LEUCEMIAS

REVLIMID is a drug marketed by Bristol Myers Squibb. There are two patents protecting this drug and three Paragraph IV challenges.

This drug has three hundred and thirty-one patent family members in forty-one countries. There has been litigation on patents covering REVLIMID

See drug price trends for REVLIMID.

The generic ingredient in REVLIMID is lenalidomide. There are fourteen drug master file entries for this API. Fifteen suppliers are listed for this generic product. Additional details are available on the lenalidomide profile page.

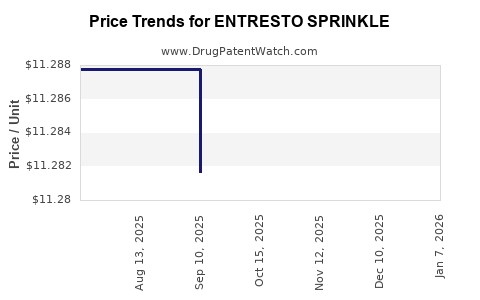

When can ENTRESTO SPRINKLE (sacubitril; valsartan) generic drug versions launch?

Generic name: sacubitril; valsartan

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: November 07, 2026

Generic Entry Controlled by: Argentina Patent 57,882

Patent Title: COMPUESTOS DE ACCION DOBLE DE BLOQUEADORES DEL RECEPTOR DE ANGIOTENSINA E INHIBIDORES DE ENDOPEPTIDASA NEUTRA

This drug has one hundred and forty-five patent family members in forty-three countries. There has been litigation on patents covering ENTRESTO SPRINKLE

See drug price trends for ENTRESTO SPRINKLE.

The generic ingredient in ENTRESTO SPRINKLE is sacubitril; valsartan. There are eleven drug master file entries for this API. Twenty-two suppliers are listed for this generic product. Additional details are available on the sacubitril; valsartan profile page.

When can XALKORI (crizotinib) generic drug versions launch?

Generic name: crizotinib

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 04, 2026

Generic Entry Controlled by: Argentina Patent 57,964

XALKORI is a drug marketed by Pf Prism Cv. There are five patents protecting this drug.

This drug has one hundred and fifty-two patent family members in forty-eight countries.

See drug price trends for XALKORI.

The generic ingredient in XALKORI is crizotinib. One supplier is listed for this generic product. Additional details are available on the crizotinib profile page.

When can AVANDAMET (metformin hydrochloride; rosiglitazone maleate) generic drug versions launch?

Generic name: metformin hydrochloride; rosiglitazone maleate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 05, 2026

Generic Entry Controlled by: Argentina Patent 57,970

Patent Title: COMPOSICIONES FARMACEUTICAS PARA EL TRATAMIENTO DE LA DIABETES MELLITUS Y CONDICIONES ASOCIADAS CON LA DIABETES MELLITUS Y PROCEDIMIENTOS PARA PREPRAR DICHAS COMPOSICIONES

AVANDAMET is a drug marketed by Sb Pharmco.

This drug has one hundred and fifty-two patent family members in forty-eight countries. There has been litigation on patents covering AVANDAMET

The generic ingredient in AVANDAMET is metformin hydrochloride; rosiglitazone maleate. There are forty-nine drug master file entries for this API. Additional details are available on the metformin hydrochloride; rosiglitazone maleate profile page.

When can AMELUZ (aminolevulinic acid hydrochloride) generic drug versions launch?

Generic name: aminolevulinic acid hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 22, 2026

Generic Entry Controlled by: Argentina Patent 64,659

AMELUZ is a drug marketed by Biofrontera. There are three patents protecting this drug.

This drug has twenty-nine patent family members in eighteen countries.

See drug price trends for AMELUZ.

The generic ingredient in AMELUZ is aminolevulinic acid hydrochloride. There are six drug master file entries for this API. Four suppliers are listed for this generic product. Additional details are available on the aminolevulinic acid hydrochloride profile page.

Argentina Branded and Generic Drug Markets: Assessment, Regulatory Opportunities, and Challenges

More… ↓

DrugPatentWatch cited by CNN, NEJM, Nature Journals, and more …

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.