Last updated: October 4, 2025

Introduction

Assertio Therapeutics, Inc., a specialty pharmaceutical company, has carved a distinctive role within the complex landscape of pain management and inflammation treatment. Operating in a competitive environment marked by rapid innovation, extensive patent portfolios, and shifting healthcare policies, Assertio’s strategic positioning offers key insights into its growth trajectory, strengths, and potential vulnerabilities. This analysis dissects Assertio’s market stance, competitive advantages, and strategic considerations that shape its future in the pharmaceutical industry.

Market Position and Business Overview

Assertio’s portfolio predominantly targets the chronic pain, dermatology, and inflammation segments, with a primary focus on products for specialty markets. Its leading product, 5% AMRIX (Cyclobenzaprine Hydrochloride Extended-Release Capsules), addresses spasticity, and its commercial strategy is anchored on niche therapeutic areas with high unmet need.

Within the broader pain management ecosystem, Assertio positions itself as a differentiated player, emphasizing proprietary formulations, targeted indications, and a focus on complex delivery mechanisms. The company's strategic initiatives include achieving premium pricing, leveraging its limited competition products, and pursuing strategic acquisitions to expand its portfolio.

Market share analysis indicates Assertio maintains a modest but increasing foothold in its core segments, confronting formidable competitors like Teva, Mylan (now part of Viatris), and emerging biotech entrants pioneering novel therapies. The company's agility is partly supported by a lean operational structure and a focus on specialty markets less exposed to generic erosion.

Strengths of Assertio in the Competitive Landscape

1. Focused Portfolio with Niche Indications

Assertio’s emphasis on specialty-oriented products minimizes direct competition, allowing for more predictable revenue streams. For example, its flagship, AMRIX, faces limited competitors due to its unique once-daily extended-release formulation approved for muscle spasm associated with multiple spinal cord diseases.

2. Proprietary Formulations and Technology Innovation

Assertio leverages proprietary delivery technologies, which often translate into higher barriers for generic competitors. Its strategic R&D investments aim at proprietary solutions catering to unmet clinical needs, bolstering its intellectual property portfolio.

3. Strategic Acquisitions and Licensing

Historically, Assertio has employed targeted acquisitions—such as the 2017 acquisition of restricted products from Grunenthal—that sharpen its therapeutic focus and expand its market reach. These moves strengthen its pipeline and diversify revenue sources.

4. Commercial Expertise in Specialty Markets

Having developed a team experienced in specialty pharmaceuticals, Assertio’s sales and marketing efforts are tailored to healthcare providers managing complex cases, enabling high-touch engagement that sustains product demand.

5. Financial Flexibility and Growth Initiatives

While operating with modest revenues, Assertio’s recent strategic financings, including debt and equity offerings, provide capital buffers to fund pipeline expansion and strategic transactions.

Strategic Challenges and Vulnerabilities

1. Heavy Dependence on Select Products

The majority of Assertio’s revenue hinges on a few key products. This concentration exposes the company to risks pertaining to patent expirations, evolving regulatory requirements, and generic competition.

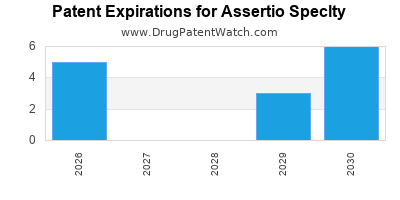

2. Patent Expirations and Market Erosion

Upcoming patent cliffs threaten its core products, especially in an industry where patent expiry often leads to price erosion and market share loss.

3. Competitive Innovation and Market Entry Threats

Emerging biotech therapies and alternative pain management modalities challenge Assertio’s products. Additionally, large pharmaceutical firms with greater R&D capabilities could develop competing formulations or novel mechanisms of action.

4. Regulatory and Reimbursement Dynamics

Changes in clinical guidelines, reimbursement policies, or regulatory standards, particularly in pain management, can adversely impact sales and market access.

5. Limited Revenue Base and Scale

Compared to industry giants, Assertio’s relatively small scale amplifies challenges related to market penetration, negotiating power with payers, and investment capacity for large clinical trials.

Strategic Insights and Recommendations

Diversify Through Product Development and Licensing

To sustain growth, Assertio should prioritize expanding its pipeline through in-house R&D, licensing agreements, and acquisitions targeting adjacent therapeutic areas with unmet needs. Diversification reduces reliance on a handful of products and mitigates patent expiry risks.

Invest in Proprietary Technologies and Differentiation

Enhancing proprietary formulations and drug delivery mechanisms can create sustainable barriers against generics and improve patient adherence. Intellectual property fortification should remain a key strategic focus.

Expand Market Access and Reimbursement Strategies

Proactive engagement with payers and policymakers can secure favorable reimbursement pathways. Offering evidence of cost-effectiveness and clinical benefit can position Assertio favorably in negotiations.

Leverage Strategic Partnerships

Forming alliances with biotech firms or healthcare providers can facilitate access to innovative therapies and expedite market entry for new products.

Optimize Commercial Operations

Investments in digital marketing, physician engagement, and patient support programs tailored to specialty markets can enhance brand loyalty and expand prescriber base.

Future Outlook and Strategic Opportunities

The evolving landscape of pain and inflammation therapies presents both challenges and opportunities for Assertio. Its strength lies in a focused, niche strategy complemented by proprietary innovations. To capitalize on the expanding demand for specialized treatments, Assertio must mitigate patent risks, broaden its portfolio, and foster strategic collaborations.

Emerging trends such as personalized medicine and biologic therapies could open new avenues for growth, provided Assertio invests strategically in relevant areas. Additionally, expanding into adjacent therapeutic segments like dermatology or neurology may diversify revenue streams and reduce market cyclicality.

Key Takeaways

- Assertio’s niche positioning and proprietary formulations afford a competitive moat, though reliance on limited products and upcoming patent expirations pose risks.

- Strategic acquisitions, focused R&D, and proprietary technology are instrumental in reinforcing its market stance.

- To secure sustained growth, Assertio should diversify its portfolio, enhance market access strategies, and pursue strategic alliances.

- The company's agility and operational expertise in specialty markets constitute core strengths to navigate industry complexities.

- Future success hinges on proactive innovation, patent strategy, and expanding into adjacent therapeutic areas.

FAQs

1. How does Assertio differentiate itself from larger pharmaceutical competitors?

Assertio focuses on niche, high-unmet-need indications within the specialty pharmaceutical space, leveraging proprietary formulations and targeted marketing, which larger competitors may overlook due to broader portfolio strategies.

2. What are the primary threats facing Assertio in the current market?

Key threats include patent expirations leading to generic competition, rapid innovation by biotech entrants, regulatory changes, and potential market shrinkage in core therapeutic areas.

3. How can Assertio mitigate risks associated with patent cliffs?

By investing in R&D for new formulations, expanding patent protections, licensing innovative technologies, and diversifying into new therapeutic areas, Assertio can offset patent expiration impacts.

4. What strategic acquisitions could benefit Assertio’s growth?

Acquiring early-stage biotech firms with promising therapies, or complementary products for pain, dermatology, or neurology, could diversify revenue and accelerate pipeline development.

5. How important is market access for Assertio’s success?

Vital. Strong relationships with payers, demonstrating cost-effectiveness, and navigating reimbursement landscapes are crucial to maintain pricing power and accessibility for its products.

Sources:

[1] Assertio Therapeutics, Inc. Official Website. Federal Securities & Exchange Commission Filings.

[2] Market research reports on specialty pharmaceuticals and pain management industry trends.

[3] Industry analyst assessments of pharmaceutical patent landscapes and competitive dynamics.

[4] Clinical and regulatory updates from the FDA and EMA relevant to Assertio’s segments.