Share This Page

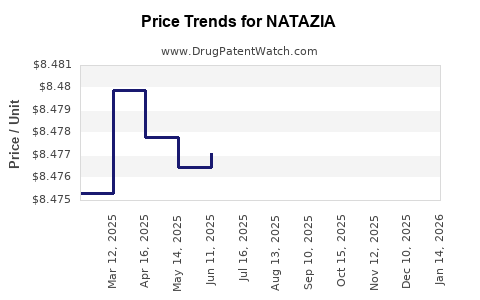

Drug Price Trends for NATAZIA

✉ Email this page to a colleague

Average Pharmacy Cost for NATAZIA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NATAZIA 28 TABLET | 50419-0409-01 | 8.47393 | EACH | 2025-12-17 |

| NATAZIA 28 TABLET | 50419-0409-03 | 8.47393 | EACH | 2025-12-17 |

| NATAZIA 28 TABLET | 50419-0409-01 | 8.46564 | EACH | 2025-11-19 |

| NATAZIA 28 TABLET | 50419-0409-03 | 8.46564 | EACH | 2025-11-19 |

| NATAZIA 28 TABLET | 50419-0409-01 | 8.47099 | EACH | 2025-10-22 |

| NATAZIA 28 TABLET | 50419-0409-03 | 8.47099 | EACH | 2025-10-22 |

| NATAZIA 28 TABLET | 50419-0409-01 | 8.47397 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Natazia (Estradiol Valerate and Dienogest)

Introduction

Natazia (estradiol valerate and dienogest) is a combination oral contraceptive approved by the U.S. Food and Drug Administration (FDA) in 2010 for birth control and the treatment of heavy menstrual bleeding associated with fibroids. As a lower-dose hormonal contraceptive with a unique dosing regimen, Natazia holds a distinctive position in the contraceptive market. Analyzing its market landscape and projecting future pricing dynamics requires an understanding of its clinical profile, competitive positioning, regulatory factors, and evolving market trends within the broader hormonal contraceptive sector.

Market Landscape Overview

Market Size and Growth Drivers

The global contraceptive market was valued at approximately USD 21 billion in 2021 and is projected to reach over USD 33 billion by 2028, with a Compound Annual Growth Rate (CAGR) of around 6-7% (1). The U.S. market constitutes a significant portion, driven by high awareness, reimbursement policies, and healthcare infrastructure.

Natazia, with an estimated market share of less than 5% in the U.S. contraceptive space, faces competition from a range of intrauterine devices (IUDs), implants, patches, and other oral contraceptives. Its niche application in heavy menstrual bleeding enhances its clinical appeal but limits its consumer base relative to broad-spectrum contraceptives.

Competitive Landscape

The contraceptive market includes major players such as Pfizer, Bayer, Teva, and abstracted brands like Yaz, Ortho-Novum, and Jaydess. Natazia's differentiation arises from its unique dosing regimen—four cycles with placebo days—offering both contraceptive efficacy and management of menstrual symptoms.

However, emerging oral contraceptives with novel delivery systems, reduced side effects, or lower costs threaten Natazia's market position. Notably, the availability of less expensive generic formulations of combinational oral contraceptives further constrains market share growth.

Regulatory and Prescriber Trends

Natazia has received approvals in multiple regions, but its clinical indications are relatively narrow. Regulatory bodies emphasize safety profiles, notably the risk of venous thromboembolism (VTE), which may influence prescriber choice. Recent guidelines favor intrauterine devices or implants for long-acting reversible contraception (LARC) over oral pills, impacting Natazia's penetration in certain markets.

Additionally, the rise in prescription drug digital marketing and increasing patient preference for personalized contraceptive options influence prescription patterns for Natazia.

Pricing and Reimbursement Dynamics

Current Pricing Benchmarks

In the U.S., brand-name Natazia wholesaler acquisition prices range approximately from USD 600–800 per 28-day pack, with retail prices often exceeding USD 800–1,000 after markup, insurance co-pays, and pharmacy margins. Generic versions, where available, typically trade at 40–60% lower prices.

Reimbursement policies from insurers influence patient out-of-pocket costs significantly, with certain plans favoring generics or LARC options, thereby limiting direct consumption of Natazia’s branded product.

Influencing Factors

-

Patent and Exclusivity: Natazia's patent protections, including secondary patents, historically extended until around 2025. The expiration of these patents could pave the way for generics, pressuring prices downward.

-

Market Competition: The entrance of generics in the coming years likely will reduce average transaction prices, aligning Natazia’s market share with more affordable options.

-

Manufacturers’ Pricing Strategies: Brands often employ rebate and copay assistance programs to sustain market share despite price erosion.

Future Price Projections (2023–2030)

Considering patent expiries, market shifts, and healthcare trends, the following price trajectory is projected:

| Year | Estimated Average Wholesale Price (USD) | Comments |

|---|---|---|

| 2023 | 600–800 | Peak patent protection, limited generic competition |

| 2024–2025 | 500–700 | Approaching patent expiration, potential generic entry |

| 2026–2028 | 350–500 | Increased generic competition, price pressure |

| 2029–2030 | 300–400 | Market stabilization, brand discontinuation possible |

The decline in price reflects generic entry, increased competition from alternative contraceptives, and shifting prescriber preferences.

Market and Price Outlook: Opportunities and Risks

Opportunities

- Niche Segment Expansion: Emphasizing Natazia’s advantages in managing heavy menstrual bleeding could expand its clinical and consumer appeal.

- Emerging Markets: Developing countries with expanding contraceptive access may present growth opportunities; pricing strategies here will differ based on economic contexts.

Risks

- Patent Litigation and Expirations: Delays or challenges to patent protections could accelerate generic entry, intensifying price competition.

- Market Cannibalization: The rising popularity of LARCs, such as IUDs and implants, often displaces oral contraceptives, including Natazia.

- Safety Concerns: Increased regulatory scrutiny over hormonal contraceptives’ thrombotic risks could dampen demand.

Conclusion

Natazia’s market performance hinges on patent longevity, competitive dynamics, and evolving contraceptive preferences. While currently a niche product, its future pricing will be heavily influenced by patent expiration and market penetration of generics. Industry stakeholders should monitor regulatory developments and prescriber shifts to gauge its long-term viability and revenue streams.

Key Takeaways

- Market Position: Natazia is a niche hormonal contraceptive with specialized indications and moderate market penetration.

- Pricing Trajectory: As patent protections expire, prices are expected to decline sharply due to generics, with estimates ranging from current levels (~USD 600–800) down to USD 300–400 by 2030.

- Competitive Challenges: The rise of LARCs and generics will exert downward pressure, challenging Natazia’s profitability.

- Regulatory Influence: Safety concerns and evolving guidelines may influence prescriber habits and market share.

- Strategic Focus: Emphasizing niche benefits, exploring emerging markets, and managing patent portfolios are crucial strategies for sustaining value.

FAQs

Q1. When will Natazia face generic competition?

Patent protections typically expire around 2025, opening the floodgates for generic formulations, which will likely lead to significant price reductions.

Q2. How does Natazia compare to other oral contraceptives in pricing?

Currently, Natazia’s branded prices are higher than generics and other oral contraceptives, though comparable to other branded pills. Price parity will decline as generics enter the market.

Q3. What factors could accelerate Natazia’s market decline?

The entry of affordable generics, preference for LARCs, and regulatory concerns over thrombotic risks could diminish its market share.

Q4. Are there growth opportunities outside the U.S.?

Yes. Developing regions with expanding contraceptive access and less mature markets may display growth potential, contingent upon favorable reimbursement and regulatory environments.

Q5. What strategies can manufacturers pursue post-patent expiration?

Introducing generic versions, engaging in strategic partnerships, emphasizing niche clinical benefits, and exploring line extensions can sustain profitability.

References

- Grand View Research. (2022). Contraceptive Drugs Market Size, Share & Trends Analysis Report.

- U.S. Food and Drug Administration. (2010). Natazia Labeling and Approval Details.

- IQVIA. (2022). National Prescription Data & Market Trends.

- MarketWatch. (2022). Contraceptive Market Outlook and Forecasts.

- FDA Patent and Exclusivity Data. (2023).

More… ↓