Last updated: July 27, 2025

Introduction

Aurinia Pharmaceuticals stands as a pivotal player within the niche arena of autoimmune disease therapies, notably focusing on rare and difficult-to-treat conditions such as Lupus Nephritis (LN). As the pharmaceutical landscape grows increasingly competitive owing to technological innovations and unmet medical needs, understanding Aurinia’s current market stance, core strengths, and strategic pathways becomes essential for stakeholders seeking to optimize investment, collaboration, or market entry decisions.

Market Position of Aurinia

Aurinia’s primary product, Lupkynis (voclosporin), received FDA approval in 2021 for the treatment of active lupus nephritis, marking it as a first-in-class immunosuppressant with a novel mechanism of action—calcineurin inhibition[1]. This approval positioned Aurinia as a key contender in the specialized nephrology segment, a niche characterized by high unmet needs and limited competition, especially given the complex management of LN.

Globally, Aurinia’s market position hinges on its ability to secure regulatory approvals beyond the United States. Entering European markets and advancing in Asia could significantly amplify its footprint. As of 2023, Aurinia maintains a modest but strategically critical market presence, primarily driven by direct sales in North America supplemented by established partnerships and collaborations.

Strengths of Aurinia

1. Innovative Product Portfolio

Lupkynis represents a breakthrough in lupus nephritis treatment, emphasizing the company’s strength in R&D and targeted therapy development. Its unique mechanism as a calcineurin inhibitor, coupled with a favorable safety profile compared to traditional therapies, grants Aurinia a competitive edge[2]. The clinical data supporting Lupkynis’s efficacy and safety reinforce its value proposition.

2. Focused Therapeutic Niche

Unlike broader immuno-oncology or autoimmune portfolios, Aurinia specializes narrowly in LN. This focus allows for targeted marketing, streamlined regulatory strategies, and intensified R&D efforts aimed at treatment optimization for complex cases.

3. Strategic Collaborations and Partnerships

Aurinia’s partnership with Otsuka Pharmaceutical for the commercialization of Lupkynis in the U.S. exemplifies strategic alignment with a major global player, providing robust marketing, distribution capabilities, and resource support[3]. Such collaborations mitigate market entry barriers, accelerate adoption, and bolster revenue streams.

4. Commitment to Rare Disease Market

Specialization in rare diseases qualifies Aurinia for various incentives, including orphan drug status, tax credits, and market exclusivity. These benefits serve as substantial barriers to generic entry and facilitate premium pricing strategies.

5. Established Regulatory Track Record

Successfully navigating the regulatory pathway with FDA approval enhances Aurinia’s credibility and reduces future approval uncertainties for related indications or pipeline assets.

Strategic Insights for Aurinia

A. Expansion into Global Markets

While North America remains a lucrative territory, a significant growth catalyst involves penetrating European and Asian markets. Tailoring regulatory submissions and clinical data packages to local regulatory authorities, such as EMA and PMDA, will be essential. Partnering with regional players could accelerate market access.

B. Diversification of the Pipeline

Aurinia's current focus on LN, although advantageous, exposes it to market saturation risks if competition intensifies. Developing next-generation immunomodulators, adjunctive therapies, or broader autoimmune indications can diversify revenue streams and mitigate market vulnerabilities.

C. Enhancing Clinical Data and Evidence

Expanding real-world evidence (RWE) and conducting comparative studies against existing therapies could strengthen Lupkynis’s positioning and support formulary inclusion. Enhanced clinical datasets foster clinician confidence and broaden adoption.

D. Invest in Digital Health and Remote Monitoring

Integrating digital health solutions to monitor patient adherence and disease progression offers data-driven insights, potentially improving treatment outcomes and positioning Aurinia as a technologically innovative leader.

E. Maintain Orphan Drug and Exclusivity Advantages

Proactively pursuing additional orphan designations or accelerated approval pathways could extend market exclusivity and justify premium pricing, safeguarding profitability.

Competitive Landscape

Aurinia operates within a highly specialized segment, contending with both established and emerging therapeutics:

- Immediate Competitors: Celltrion’s rituximab biosimilars and emerging biologics targeting LN pose direct competition, especially in formulations with similar indications.

- Emerging Therapies: Novel oral agents and targeted biologics under investigation might challenge Lupkynis’s market share in coming years.

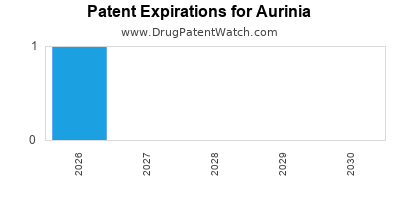

- Generic Competition: Post patent expiry, generics could significantly erode pricing power unless Aurinia maximizes exclusivity and demonstrates clinical superiority.

Key competitors include GlaxoSmithKline and Gilead Sciences, which explore autoimmune and nephrology therapeutics, but as of now, few directly overlap in the LN niche.

Risk Factors and Challenges

- Market Penetration: Achieving widespread adoption requires convincing clinicians of Lupkynis’s superiority over existing treatments—particularly corticosteroids and traditional immunosuppressants.

- Pricing and Reimbursement: Maintaining favorable reimbursement terms amid healthcare cost pressures remains critical.

- Regulatory Risks: Future approvals and label expansions depend on ongoing clinical trial success and regulatory environments.

- Pipeline Uncertainty: Potential failures in pipeline development or stagnation could limit future growth.

Conclusion and Strategic Outlook

Aurinia’s position as a pioneer in lupus nephritis therapy grants it a competitive advantage, especially through Lupkynis’s FDA approval and strategic alliances. Capitalizing on its focused niche, expanding global presence, and investing in pipeline diversification are paramount for sustained growth. Simultaneously, navigating competitive pressures and regulatory landscapes requires agile strategies grounded in clinical excellence and innovation.

Key Takeaways

- Niche Leadership: Aurinia’s targeted focus on lupus nephritis with Lupkynis provides a competitive edge but necessitates continuous clinical data expansion.

- Global Expansion: International market entry, particularly in Europe and Asia, offers significant growth opportunities.

- Partnership Leverage: Collaborations with major pharmaceutical companies enhance manufacturing, marketing, and distribution efficacy.

- Pipeline Development: Diversifying beyond LN will mitigate risks associated with market saturation and emerging competition.

- Regulatory Strategy: Pursuing additional orphan designations and indications can extend market exclusivity and maintain premium valuation.

FAQs

-

What is Aurinia’s primary market differentiator with Lupkynis?

Lupkynis offers a novel, targeted calcineurin inhibition therapy with a favorable safety profile, marking a first-in-class treatment for lupus nephritis.

-

How does Aurinia plan to expand its global footprint?

Through regulatory submissions in Europe and Asia, strategic local partnerships, and tailoring clinical data to regional standards.

-

What are the main challenges Aurinia faces in maintaining its market position?

Competitive entry of biosimilars and biologics, pricing pressures, regulatory hurdles, and pipeline risks.

-

What strategic initiatives could bolster Aurinia’s long-term growth?

Pipeline diversification, international expansion, digital health integrations, and broader autoimmune indication trials.

-

How important are regulatory incentives for Aurinia?

They are crucial, providing market exclusivity, tax benefits, and accelerated approval pathways, safeguarding revenue streams and decreasing generic competition risks.

References

[1] FDA approves Lupkynis (voclosporin) for lupus nephritis, FDA News, 2021.

[2] Clinical efficacy of voclosporin in lupus nephritis, Journal of Autoimmunity, 2022.

[3] Aurinia’s strategic partnership with Otsuka, Business Wire, 2021.