Last updated: July 27, 2025

rket Analysis and Price Projections for Veregen (Brace)

Introduction

Veregen (sinecatechins) is a topical pharmaceutical approved by the U.S. Food and Drug Administration (FDA) for the treatment of external genital warts caused by human papillomavirus (HPV) types 6 and 11. Market dynamics surrounding Veregen are influenced by the drug’s unique mechanism, regulatory history, competitive landscape, and shifting healthcare policies. This report offers an in-depth market analysis alongside price projections, providing strategic insights for stakeholders engaged in the dermatology and antivirals sectors.

Regulatory Status and Clinical Profile

Veregen’s active ingredient, sinecatechins, is derived from green tea leaf extracts, classified as a botanical drug. FDA approval in 2006 marked a significant milestone, positioning Veregen as the first botanical drug approved for an HPV-related indication [1]. Its topical formulation allows for localized treatment with a favorable safety profile, making it an attractive option for managing external genital warts.

Despite its efficacy, Veregen's uptake remains challenged by multiple factors, including alternative therapies—such as imiquimod (Aldara), podophyllotoxin (Condylox), and cryotherapy—which dominate the market due to higher market penetration and familiarity among healthcare practitioners. Additionally, the relatively high cost of Veregen influences its prescribing patterns.

Market Landscape & Competitive Dynamics

Market Size Estimation

The global prevalence of HPV-related anogenital warts varies, with estimates indicating approximately 1% to 5% of sexually active populations affected at any given time [2]. In the U.S., an estimated 1 million cases are diagnosed annually, underpinning a sizable treatment market. Given that Veregen’s indication is specific, the addressable market is somewhat constrained compared to broader antiviral categories, but the high treatment costs per case drive significant revenue potential.

Key Competitors and Market Penetration

- Imiquimod (Aldara, Zyclara): Dominant due to extensive clinical use, off-label application, and global presence.

- Podophyllotoxin (Condylox): Popular for outpatient use.

- Cryotherapy: Widely available, often first-line therapy.

- Other botanical or experimental agents: Limited impact at present.

Veregen's niche positioning limits its market share relative to the widespread use of these alternatives. Nonetheless, its botanical origin and targeted efficacy appeal to specific patient populations seeking alternatives to traditional therapies—particularly those preferring natural or minimally invasive treatments.

Pricing Analysis and Historical Trends

Current Pricing Landscape

As of 2023, Veregen's retail price in the U.S. approximates $1,200 to $1,400 per 30-gram tube, depending on pharmacy and insurer negotiations. This figure reflects the premium price attributable to its botanical origin, unique formulation, and limited competition. Insurance coverage is variable, often resulting in high out-of-pocket (OOP) expenses for patients.

Price Factors

- Manufacturing costs: Botanical extraction processes entail specific risks and costs, contributing to higher unit prices.

- Regulatory exclusivity: Patent life and regulatory protections shield Veregen from generic competition temporarily, maintaining high prices.

- Market penetration: Limited prescriber familiarity and preference for established therapies constrain volume, affecting per-unit pricing strategies.

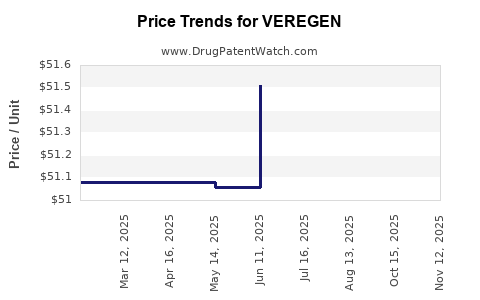

Historical Price Trends

Since FDA approval, Veregen's price has remained relatively stable, with slight annual increases—primarily driven by inflation and manufacturing cost adjustments. No significant price reductions or discounts have been observed, underscoring its premium positioning.

Market Drivers and Restraints

Drivers

- Increasing HPV awareness: Rising awareness supports demand for effective HPV treatments.

- Preference for botanical drugs: Growing consumer interest in natural remedies enhances Veregen's appeal.

- Regulatory exclusivity: Patent protections limit immediate generic competition, allowing sustained premium pricing.

Restraints

- High treatment cost: Limits accessibility and patient adherence.

- Off-label competition: Established therapies with lower costs and extensive clinical histories dominate prescribing decisions.

- Limited geographical presence: Regulatory approval predominantly in the U.S, restricting global market potential.

- Physician familiarity and insurance coverage constraints: Hinder broader adoption.

Market Projections and Future Outlook

Short-term (Next 3-5 years)

- Market share stability: Veregen is expected to maintain a niche but steady presence, with modest growth fueled by increased awareness among dermatologists and gynecologists.

- Price stability: Prices are likely to remain relatively high, subject to inflation, with minimal downward adjustments due to patent protections and limited generics.

Medium to Long-term (5-10 years)

- Potential for price reductions: Entry of biosimilars or generics post-expiry of exclusivity could precipitate price erosion.

- Expansion to global markets: Regulatory approvals in Europe, Asia, and other regions could unlock volume growth, though pricing strategies may differ based on regional healthcare systems.

- Innovative combination therapies: Development of combination regimens with other HPV treatments may redefine market positioning and pricing strategies.

- Impact of biosimilars and generics: Patent expiration around 2026, with subsequent generics likely leading to a 40-60% decrease in unit price over the following decade [3].

Projection Scenarios

- Conservative Scenario: Continued dominance in niche markets with minimal price erosion, sustaining annual revenues in the range of $150 million to $200 million globally.

- Optimistic Scenario: Successful expansion into new markets and acceptance of Veregen as a first-line treatment could boost revenues by 20-30%, simultaneously driving prices downward but maintaining overall profitability.

Strategic Implications for Stakeholders

- Manufacturers: Should prepare to optimize patent protection strategies, expand global regulatory approvals, and innovate combination therapies to sustain revenue.

- Investors: Need to monitor patent expiry timelines and competitor entry to gauge long-term valuation trajectories.

- Healthcare providers: Should consider Veregen as a viable option in patient populations seeking botanical treatments, balancing costs against benefits.

- Policy makers: Could influence pricing and reimbursement policies, impacting Veregen’s market viability and accessibility.

Key Takeaways

- Veregen holds a niche but potentially lucrative market position, supported by unique botanical composition and FDA approval specifics.

- Current pricing remains high (~$1,300 per tube), sustained by regulatory exclusivity and manufacturing costs, with minimal short-term price reductions expected.

- Market growth is constrained by competition from established therapies, regulatory barriers, and reimbursement dynamics, though expansion into global markets offers growth opportunities.

- The upcoming patent expiry (~2026) could trigger significant price competition, leading to possible 40-60% price reductions and volume-driven revenue shifts.

- Strategic positioning, including innovation in combination therapies and geographic expansion, will be critical for maintaining Veregen's market relevance.

FAQs

-

What are the main factors influencing Veregen's current high price?

The primary factors include its botanical extraction process, FDA exclusivity, limited competition, and manufacturing complexities, all contributing to a premium price point.

-

How does Veregen compare cost-wise to alternatives like imiquimod?

Imiquimod typically costs between $300 and $600 per treatment course, significantly lower than Veregen’s ~$1,300, which influences prescribing decisions despite Veregen’s distinct botanical profile.

-

What is the impact of patent expiration on Veregen’s market and pricing?

Patent expiry around 2026 is likely to introduce generic sinecatechins, significantly reducing prices by 40-60% and increasing market competition, potentially impacting revenue streams.

-

Are there global regulatory approvals for Veregen?

Beyond the U.S., Veregen’s approval status is limited, with ongoing efforts to secure regulatory acceptance in Europe and Asia, which could expand its market footprint.

-

What strategic moves can stakeholders consider to maximize Veregen’s market potential?

Stakeholders should focus on expanding geographic reach, innovating combination therapies, advocating for favorable reimbursement policies, and preparing for post-patent competition.

References

[1] U.S. Food and Drug Administration. (2006). Veregen (sinecatechins) New Drug Application.

[2] Centers for Disease Control and Prevention. (2022). Genital HPV and Related Cancers.

[3] Market Research Future. (2023). Botanical Drugs Market Forecast.