Expiring Drug Patents Cheat Sheet

We analyse the patents covering drugs in 134 countries and quickly give you the likely loss-of-exclusivity/generic entry date

Mexico: These 28 Drugs Face Patent Expirations and Generic Entry From 2025 - 2026

The content of this page is licensed under a Creative Commons Attribution 4.0 International License.

Generic Entry Dates in Other Countries

Friedman, Yali, "Mexico: These 28 Drugs Face Patent Expirations and Generic Entry From 2025 - 2026" DrugPatentWatch.com thinkBiotech, 2025 www.drugpatentwatch.com/p/expiring-drug-patents-generic-entry/.

Media collateral

These estimated drug patent expiration dates and generic entry opportunity dates are calculated from analysis of known patents covering drugs. Many factors can influence early or late generic entry. This information is provided as a rough estimate of generic entry potential and should not be used as an independent source. The methodology is described in this blog post.

When can RAPIVAB (peramivir) generic drug versions launch?

Generic name: peramivir

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: February 13, 2026

Generic Entry Controlled by: Mexico Patent 2,008,010,394

Patent Title: TRATAMIENTOS ANTIVIRALES INTRAVENOSOS. (INTRAVENOUS ANTIVIRAL TREATMENTS.)

RAPIVAB is a drug marketed by Biocryst. There are two patents protecting this drug.

This drug has forty-three patent family members in fourteen countries.

See drug price trends for RAPIVAB.

The generic ingredient in RAPIVAB is peramivir. There is one drug master file entry for this API. One supplier is listed for this generic product. Additional details are available on the peramivir profile page.

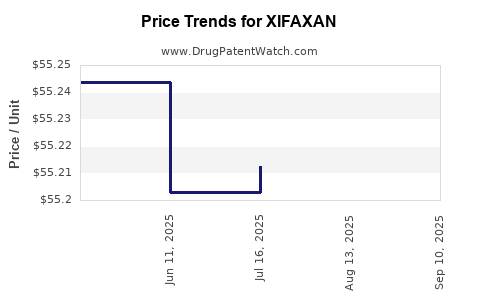

When can XIFAXAN (rifaximin) generic drug versions launch?

Generic name: rifaximin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: February 27, 2026

Generic Entry Controlled by: Mexico Patent 2,007,010,742

Patent Title: NUEVAS FORMAS POLIMORFAS DE RIFAXIMINA, PROCEDIMIENTOS PARA SU PRODUCCION Y USO DE LA MISMA EN PREPARACIONES MEDICINALES. (NEW POLYMORPHOUS FORMS OF RIFAXIMIN, PROCESSES FOR THEIR PRODUCTION AND USE THEREOF IN THE MEDICINAL.)

This drug has two hundred and nineteen patent family members in forty-one countries. There has been litigation on patents covering XIFAXAN

See drug price trends for XIFAXAN.

The generic ingredient in XIFAXAN is rifaximin. There are fourteen drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the rifaximin profile page.

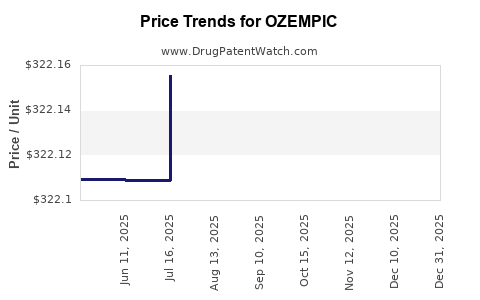

When can OZEMPIC (semaglutide) generic drug versions launch?

Generic name: semaglutide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 20, 2026

Generic Entry Controlled by: Mexico Patent 2,007,011,220

Patent Title: COMPUESTOS DE PEPTIDO 1 TIPO GLUCAGON ACILADOS. (ACYLATED GLP-1 COMPOUNDS.)

This drug has two hundred and thirty-eight patent family members in thirty-three countries. There has been litigation on patents covering OZEMPIC

See drug price trends for OZEMPIC.

The generic ingredient in OZEMPIC is semaglutide. Two suppliers are listed for this generic product. Additional details are available on the semaglutide profile page.

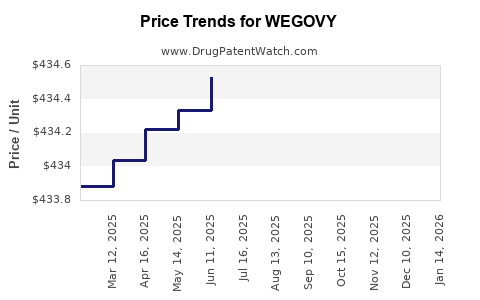

When can WEGOVY (semaglutide) generic drug versions launch?

Generic name: semaglutide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 20, 2026

Generic Entry Controlled by: Mexico Patent 2,007,011,220

Patent Title: COMPUESTOS DE PEPTIDO 1 TIPO GLUCAGON ACILADOS. (ACYLATED GLP-1 COMPOUNDS.)

This drug has one hundred and eighty-two patent family members in thirty-three countries. There has been litigation on patents covering WEGOVY

See drug price trends for WEGOVY.

The generic ingredient in WEGOVY is semaglutide. Two suppliers are listed for this generic product. Additional details are available on the semaglutide profile page.

When can AMYVID (florbetapir f-18) generic drug versions launch?

Generic name: florbetapir f-18

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 30, 2026

Generic Entry Controlled by: Mexico Patent 2,008,012,527

Patent Title: DERIVADOS DE ESTIRILPIRIDINA Y SUS USOS PARA UNION A PLACAS AMILOIDES Y OBTENCION DE IMAGENES DE LAS MISMAS. (STYRYLPYRIDINE DERIVATIVES AND THEIR USE FOR BINDING AND IMAGING AMYLOID PLAQUES.)

AMYVID is a drug marketed by Avid Radiopharms Inc. There are two patents protecting this drug.

This drug has fifty-one patent family members in thirty-three countries. There has been litigation on patents covering AMYVID

The generic ingredient in AMYVID is florbetapir f-18. One supplier is listed for this generic product. Additional details are available on the florbetapir f-18 profile page.

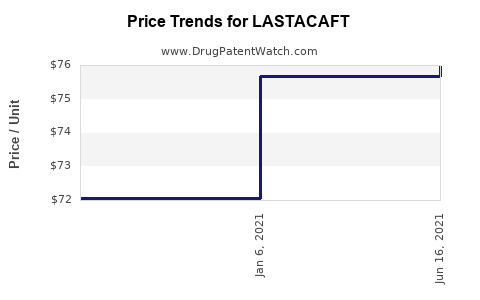

When can LASTACAFT (alcaftadine) generic drug versions launch?

Generic name: alcaftadine

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 31, 2026

Generic Entry Controlled by: Mexico Patent 2,008,012,657

Patent Title: TRATAMIENTOS DE LAS ALERGIAS OCULARES. (OCULAR ALLERGY TREATMENTS.)

This drug has forty-six patent family members in thirty countries. There has been litigation on patents covering LASTACAFT

See drug price trends for LASTACAFT.

The generic ingredient in LASTACAFT is alcaftadine. There are six drug master file entries for this API. Four suppliers are listed for this generic product. Additional details are available on the alcaftadine profile page.

When can RAPIVAB (peramivir) generic drug versions launch?

Generic name: peramivir

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: April 12, 2026

Generic Entry Controlled by: Mexico Patent 2,008,013,140

Patent Title: TRATAMIENTOS ANTIVIRALES INTRAMUSCULARES. (INTRAMUSCULAR ANTIVIRAL TREATMENTS.)

RAPIVAB is a drug marketed by Biocryst. There are two patents protecting this drug.

This drug has forty-three patent family members in fourteen countries.

See drug price trends for RAPIVAB.

The generic ingredient in RAPIVAB is peramivir. There is one drug master file entry for this API. One supplier is listed for this generic product. Additional details are available on the peramivir profile page.

When can TYKERB (lapatinib ditosylate) generic drug versions launch?

Generic name: lapatinib ditosylate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: April 18, 2026

Generic Entry Controlled by: Mexico Patent 2,007,013,089

Patent Title: COMPOSICION FARMACEUTICA. (PHARMACEUTICAL COMPOSITION.)

TYKERB is a drug marketed by Novartis. There is one patent protecting this drug and one Paragraph IV challenge.

This drug has twenty-eight patent family members in twenty-six countries.

See drug price trends for TYKERB.

The generic ingredient in TYKERB is lapatinib ditosylate. There are seven drug master file entries for this API. Four suppliers are listed for this generic product. Additional details are available on the lapatinib ditosylate profile page.

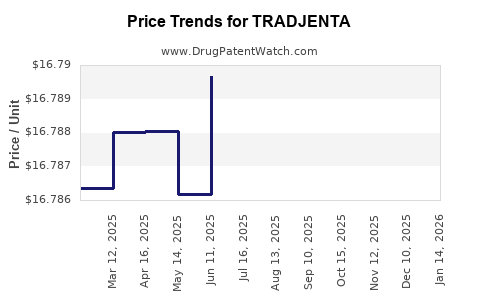

When can TRADJENTA (linagliptin) generic drug versions launch?

Generic name: linagliptin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 04, 2026

Generic Entry Controlled by: Mexico Patent 2,008,013,958

This drug has four hundred and eighty-six patent family members in forty-five countries. There has been litigation on patents covering TRADJENTA

See drug price trends for TRADJENTA.

The generic ingredient in TRADJENTA is linagliptin. There are nineteen drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the linagliptin profile page.

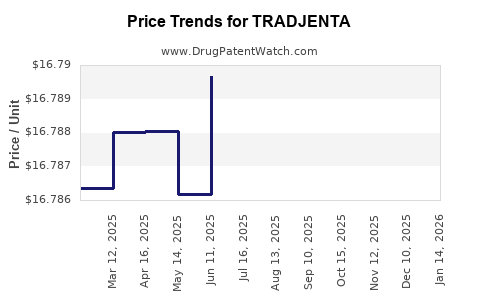

When can TRADJENTA (linagliptin) generic drug versions launch?

Generic name: linagliptin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 04, 2026

Generic Entry Controlled by: Mexico Patent 358,617

This drug has four hundred and eighty-six patent family members in forty-five countries. There has been litigation on patents covering TRADJENTA

See drug price trends for TRADJENTA.

The generic ingredient in TRADJENTA is linagliptin. There are nineteen drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the linagliptin profile page.

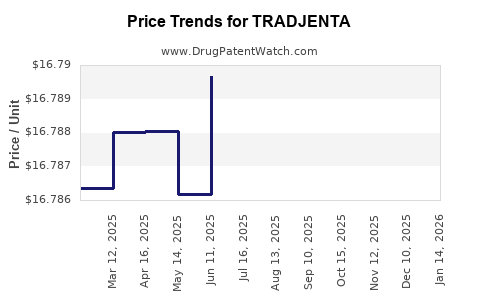

When can TRADJENTA (linagliptin) generic drug versions launch?

Generic name: linagliptin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 04, 2026

Generic Entry Controlled by: Mexico Patent 384,206

This drug has four hundred and eighty-six patent family members in forty-five countries. There has been litigation on patents covering TRADJENTA

See drug price trends for TRADJENTA.

The generic ingredient in TRADJENTA is linagliptin. There are nineteen drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the linagliptin profile page.

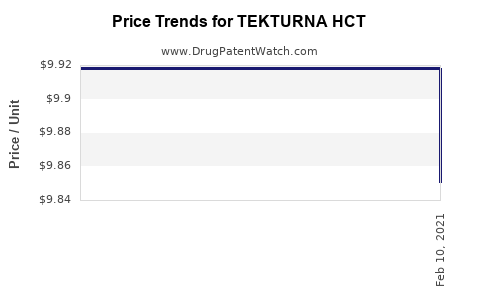

When can TEKTURNA HCT (aliskiren hemifumarate; hydrochlorothiazide) generic drug versions launch?

Generic name: aliskiren hemifumarate; hydrochlorothiazide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 23, 2026

Generic Entry Controlled by: Mexico Patent 2,008,016,533

This drug has thirty-two patent family members in twenty-five countries. There has been litigation on patents covering TEKTURNA HCT

See drug price trends for TEKTURNA HCT.

The generic ingredient in TEKTURNA HCT is aliskiren hemifumarate; hydrochlorothiazide. There are four drug master file entries for this API. Additional details are available on the aliskiren hemifumarate; hydrochlorothiazide profile page.

When can VAFSEO (vadadustat) generic drug versions launch?

Generic name: vadadustat

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 26, 2026

Generic Entry Controlled by: Mexico Patent 2,009,000,286

Patent Title: INHIBIDORES DE PROLIL HIDROXILASA Y METODOS DE USO. (PROLYL HYDROXYLASE INHIBITORS AND METHODS OF USE.)

VAFSEO is a drug marketed by Akebia. There are thirteen patents protecting this drug.

This drug has two hundred and sixty patent family members in forty-eight countries. There has been litigation on patents covering VAFSEO

The generic ingredient in VAFSEO is vadadustat. One supplier is listed for this generic product. Additional details are available on the vadadustat profile page.

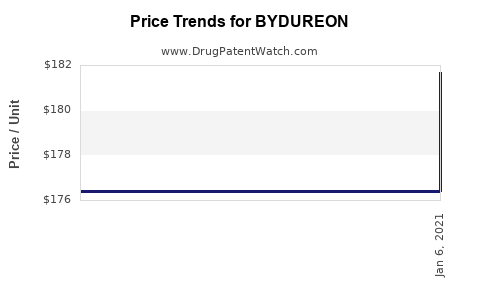

When can BYDUREON (exenatide synthetic) generic drug versions launch?

Generic name: exenatide synthetic

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 28, 2026

Generic Entry Controlled by: Mexico Patent 367,155

This drug has three hundred and forty-six patent family members in forty-eight countries. There has been litigation on patents covering BYDUREON

See drug price trends for BYDUREON.

The generic ingredient in BYDUREON is exenatide synthetic. There are seven drug master file entries for this API. Two suppliers are listed for this generic product. Additional details are available on the exenatide synthetic profile page.

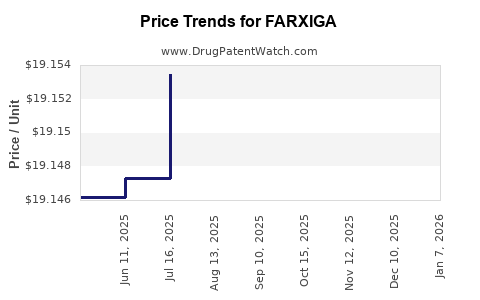

When can FARXIGA (dapagliflozin) generic drug versions launch?

Generic name: dapagliflozin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 28, 2026

Generic Entry Controlled by: Mexico Patent 367,155

This drug has four hundred and fifty-one patent family members in fifty-two countries. There has been litigation on patents covering FARXIGA

See drug price trends for FARXIGA.

The generic ingredient in FARXIGA is dapagliflozin. There are twenty-six drug master file entries for this API. Five suppliers are listed for this generic product. Additional details are available on the dapagliflozin profile page.

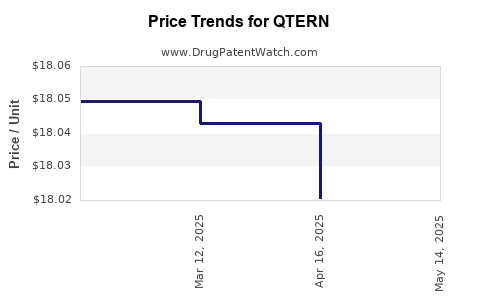

When can QTERN (dapagliflozin; saxagliptin hydrochloride) generic drug versions launch?

Generic name: dapagliflozin; saxagliptin hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 28, 2026

Generic Entry Controlled by: Mexico Patent 367,155

This drug has three hundred and thirteen patent family members in forty-eight countries. There has been litigation on patents covering QTERN

See drug price trends for QTERN.

The generic ingredient in QTERN is dapagliflozin; saxagliptin hydrochloride. There are twenty-six drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the dapagliflozin; saxagliptin hydrochloride profile page.

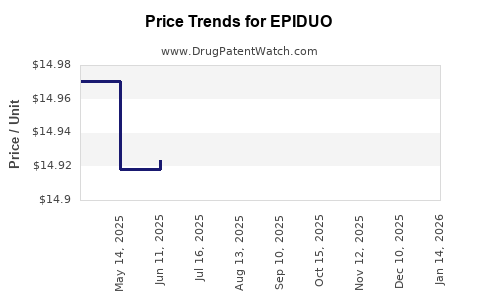

When can EPIDUO (adapalene; benzoyl peroxide) generic drug versions launch?

Generic name: adapalene; benzoyl peroxide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: July 13, 2026

Generic Entry Controlled by: Mexico Patent 2,009,000,319

Patent Title: COMBINACION DE ADAPALENO Y PEROXIDO DE BENZOILO PARA TRATAMIENTO DE LESIONES DEL ACNE. (COMBINATION OF ADAPALENE AND BENZOYL PEROXIDE FOR TREATING ACNE LESIONS.)

This drug has sixty-eight patent family members in twenty-five countries. There has been litigation on patents covering EPIDUO

See drug price trends for EPIDUO.

The generic ingredient in EPIDUO is adapalene; benzoyl peroxide. There are twelve drug master file entries for this API. Thirteen suppliers are listed for this generic product. Additional details are available on the adapalene; benzoyl peroxide profile page.

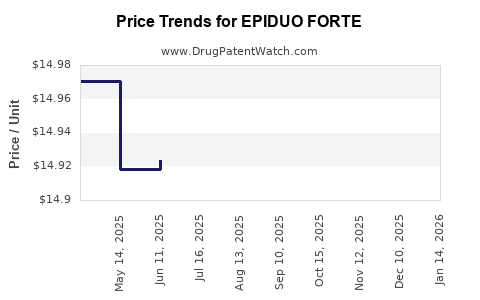

When can EPIDUO FORTE (adapalene; benzoyl peroxide) generic drug versions launch?

Generic name: adapalene; benzoyl peroxide

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: July 13, 2026

Generic Entry Controlled by: Mexico Patent 2,009,000,319

Patent Title: COMBINACION DE ADAPALENO Y PEROXIDO DE BENZOILO PARA TRATAMIENTO DE LESIONES DEL ACNE. (COMBINATION OF ADAPALENE AND BENZOYL PEROXIDE FOR TREATING ACNE LESIONS.)

This drug has sixty-eight patent family members in twenty-five countries. There has been litigation on patents covering EPIDUO FORTE

See drug price trends for EPIDUO FORTE.

The generic ingredient in EPIDUO FORTE is adapalene; benzoyl peroxide. There are twelve drug master file entries for this API. Thirteen suppliers are listed for this generic product. Additional details are available on the adapalene; benzoyl peroxide profile page.

When can CREON (pancrelipase (amylase;lipase;protease)) generic drug versions launch?

Generic name: pancrelipase (amylase;lipase;protease)

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: August 15, 2026

Generic Entry Controlled by: Mexico Patent 2,008,001,557

Patent Title: NUCLEOS DE MICROGLOBULOS DE PANCREATIVA ADECUADOS PARA REVESTIMIENTO ENTERICO. (PANCREATIN MICROPELLET CORES SUITABLE FOR ENTERIC COATING.)

CREON is a drug marketed by

This drug has sixty-eight patent family members in twenty-five countries.

See drug price trends for CREON.

The generic ingredient in CREON is pancrelipase (amylase;lipase;protease). There are six drug master file entries for this API. Thirteen suppliers are listed for this generic product. Additional details are available on the pancrelipase (amylase;lipase;protease) profile page.

When can CREON (pancrelipase (amylase;lipase;protease)) generic drug versions launch?

Generic name: pancrelipase (amylase;lipase;protease)

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: August 15, 2026

Generic Entry Controlled by: Mexico Patent 2,008,001,558

Patent Title: COMPOSICIONES FARMACEUTICAS DE DESPRENDIMIENTO CONTROLADO PARA FARMACOS LABILES EN MEDIO ACIDO. (CONTROLLED RELEASE PHARMACEUTICAL COMPOSITIONS FOR ACID LABILE DRUGS.)

CREON is a drug marketed by

This drug has sixty-eight patent family members in twenty-five countries.

See drug price trends for CREON.

The generic ingredient in CREON is pancrelipase (amylase;lipase;protease). There are six drug master file entries for this API. Thirteen suppliers are listed for this generic product. Additional details are available on the pancrelipase (amylase;lipase;protease) profile page.

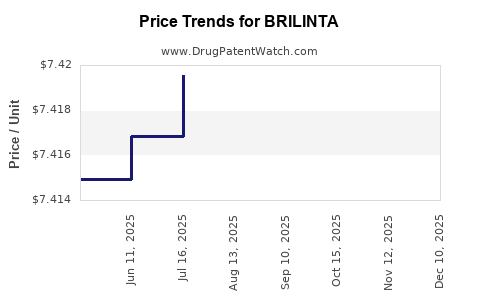

When can BRILINTA (ticagrelor) generic drug versions launch?

Generic name: ticagrelor

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: August 21, 2026

Generic Entry Controlled by: Mexico Patent 2,009,001,853

This drug has one hundred and forty-seven patent family members in forty-four countries. There has been litigation on patents covering BRILINTA

See drug price trends for BRILINTA.

The generic ingredient in BRILINTA is ticagrelor. There are twenty-one drug master file entries for this API. Twenty-five suppliers are listed for this generic product. Additional details are available on the ticagrelor profile page.

When can ESBRIET (pirfenidone) generic drug versions launch?

Generic name: pirfenidone

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: September 22, 2026

Generic Entry Controlled by: Mexico Patent 2,008,003,882

Patent Title: FORMULACION DE CAPSULA DE PIRFENIDONA Y EXCIPIENTES FARMACEUTICAMENTE ACEPTABLES. (CAPSULE FORMULATION OF PIRFENIDONE AND PHARMACEUTICALLY ACCEPTABLE EXCIPIENTS.)

ESBRIET is a drug marketed by Genentech Inc. There are twenty patents protecting this drug and two Paragraph IV challenges. One tentatively approved generic is ready to enter the market.

This drug has two hundred and sixty-six patent family members in forty-six countries. There has been litigation on patents covering ESBRIET

See drug price trends for ESBRIET.

The generic ingredient in ESBRIET is pirfenidone. There are twenty-three drug master file entries for this API. Twenty-four suppliers are listed for this generic product. Additional details are available on the pirfenidone profile page.

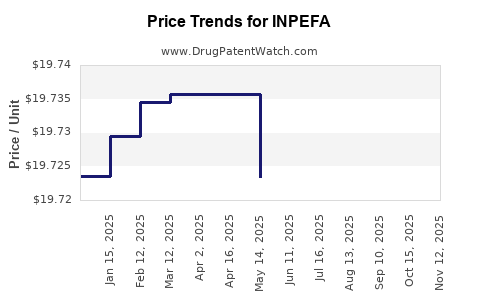

When can INPEFA (sotagliflozin) generic drug versions launch?

Generic name: sotagliflozin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: September 29, 2026

Generic Entry Controlled by: Mexico Patent 2,009,003,305

Patent Title: INHIBIDORES DE CO-TRANSPORTADOR DE GLUCOSA DE SODIO 2 Y METODO PARA SU USO. (PHLORIZIN ANALOGS AS INHIBITORS OF SODIUM GLUCOSE CO-TRANSPORTER 2.)

This drug has eighty-one patent family members in thirty-three countries.

See drug price trends for INPEFA.

The generic ingredient in INPEFA is sotagliflozin. One supplier is listed for this generic product. Additional details are available on the sotagliflozin profile page.

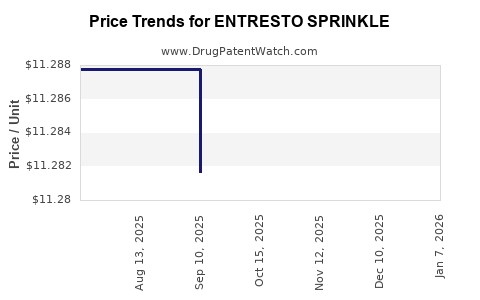

When can ENTRESTO SPRINKLE (sacubitril; valsartan) generic drug versions launch?

Generic name: sacubitril; valsartan

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: November 08, 2026

Generic Entry Controlled by: Mexico Patent 2,007,008,075

Patent Title: COMBINACIONES FARMACEUTICAS DE UN ANTAGONISTA DEL RECEPTOR DE ANGIOTENSINA Y UN INHIBIDOR DE ENDOPEPTIDASA NEUTRAL (NEP). (PHARMACEUTICAL COMBINATIONS OF AN ANGIOTENSIN RECEPTOR ANTAGONIST AND AN NEP INHIBITOR.)

This drug has one hundred and forty-five patent family members in forty-three countries. There has been litigation on patents covering ENTRESTO SPRINKLE

See drug price trends for ENTRESTO SPRINKLE.

The generic ingredient in ENTRESTO SPRINKLE is sacubitril; valsartan. There are eleven drug master file entries for this API. Twenty-two suppliers are listed for this generic product. Additional details are available on the sacubitril; valsartan profile page.

When can KORSUVA (difelikefalin acetate) generic drug versions launch?

Generic name: difelikefalin acetate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: November 10, 2026

Generic Entry Controlled by: Mexico Patent 2,009,004,999

Patent Title: AMIDAS DE PEPTIDOS SINTETICOS Y DIMEROS DE LAS MISMAS. (SYNTHETIC PEPTIDE AMIDES AND DIMERS THEREOF.)

KORSUVA is a drug marketed by Vifor Intl. There are twelve patents protecting this drug.

This drug has fifty-three patent family members in twenty-seven countries. There has been litigation on patents covering KORSUVA

See drug price trends for KORSUVA.

The generic ingredient in KORSUVA is difelikefalin acetate. One supplier is listed for this generic product. Additional details are available on the difelikefalin acetate profile page.

When can KORSUVA (difelikefalin acetate) generic drug versions launch?

Generic name: difelikefalin acetate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: November 10, 2026

Generic Entry Controlled by: Mexico Patent 2,009,005,000

Patent Title: AMIDAS DE PEPTIDOS SINTETICOS. (SYNTHETIC PEPTIDE AMIDES.)

KORSUVA is a drug marketed by Vifor Intl. There are twelve patents protecting this drug.

This drug has fifty-three patent family members in twenty-seven countries. There has been litigation on patents covering KORSUVA

See drug price trends for KORSUVA.

The generic ingredient in KORSUVA is difelikefalin acetate. One supplier is listed for this generic product. Additional details are available on the difelikefalin acetate profile page.

When can ZTALMY (ganaxolone) generic drug versions launch?

Generic name: ganaxolone

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: November 28, 2026

Generic Entry Controlled by: Mexico Patent 2,008,006,888

Patent Title: FORMULAS Y METODOS PARA LA MANUFACTURA Y USO DE LA GANAXOLONA. (GANAXOLONE FORMULATIONS AND METHODS FOR THE MAKING AND USE THEREOF.)

ZTALMY is a drug marketed by Marinus. There are eleven patents protecting this drug.

This drug has forty-eight patent family members in sixteen countries. There has been litigation on patents covering ZTALMY

See drug price trends for ZTALMY.

The generic ingredient in ZTALMY is ganaxolone. One supplier is listed for this generic product. Additional details are available on the ganaxolone profile page.

When can SIRTURO (bedaquiline fumarate) generic drug versions launch?

Generic name: bedaquiline fumarate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 05, 2026

Generic Entry Controlled by: Mexico Patent 2,009,005,909

Patent Title: SAL FUMARATO DE (ALFA S, BETA R)-6-BROMO-ALFA-[2-(DIMETILAMINO)ETI L]-2-METOXI-ALFA-1-NAFTALENIL-BETA-FENIL-3-QUINOLINAETANOL. (FUMARATE SALT OF (ALPHA S, BETA R)-6-BROMO-ALPHA-[2-(DIMETHYLAMIN O)ETHYL]-2-METHOXY-ALPHA-1-NAPHTHALENYL-BETA-PHENYL-3-QUINOLINEE THANOL.)

SIRTURO is a drug marketed by Janssen Therap. There are two patents protecting this drug.

This drug has ninety-seven patent family members in thirty-nine countries.

See drug price trends for SIRTURO.

The generic ingredient in SIRTURO is bedaquiline fumarate. There is one drug master file entry for this API. One supplier is listed for this generic product. Additional details are available on the bedaquiline fumarate profile page.

When can KOSELUGO (selumetinib sulfate) generic drug versions launch?

Generic name: selumetinib sulfate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 12, 2026

Generic Entry Controlled by: Mexico Patent 2,008,008,298

Patent Title: SAL DE SULFATO DE HIDROGENO NOVEDOSA. (NOVEL HYDROGEN SULFATE SALT.)

KOSELUGO is a drug marketed by Astrazeneca. There are eight patents protecting this drug.

This drug has two hundred and one patent family members in forty-five countries. There has been litigation on patents covering KOSELUGO

See drug price trends for KOSELUGO.

The generic ingredient in KOSELUGO is selumetinib sulfate. One supplier is listed for this generic product. Additional details are available on the selumetinib sulfate profile page.

When can XERMELO (telotristat etiprate) generic drug versions launch?

Generic name: telotristat etiprate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 12, 2026

Generic Entry Controlled by: Mexico Patent 2,009,006,195

Patent Title: COMPUESTOS BASADOS EN 4-FENIL-6-(2,2,2-TRIFLUORO-1-FENILETOXI)PIRI MIDINA Y METODOS DE SU USO. (4-PHENYL-6-(2,2,2-TRIFLUORO-1-PHENYLETHOXY)PYRIMIDINE-BASED COMPOUNDS AND METHODS OF THEIR USE.)

XERMELO is a drug marketed by Tersera. There are five patents protecting this drug.

This drug has seventy patent family members in twenty-nine countries.

See drug price trends for XERMELO.

The generic ingredient in XERMELO is telotristat etiprate. One supplier is listed for this generic product. Additional details are available on the telotristat etiprate profile page.

When can PICATO (ingenol mebutate) generic drug versions launch?

Generic name: ingenol mebutate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 18, 2026

Generic Entry Controlled by: Mexico Patent 2,008,007,685

Patent Title: COMPOSICIONES TERAPEUTICAS. (THERAPEUTIC COMPOSITIONS COMPRISING INGENOL-3-ANGELATE.)

This drug has thirty-five patent family members in twenty-one countries. There has been litigation on patents covering PICATO

See drug price trends for PICATO.

The generic ingredient in PICATO is ingenol mebutate. There are three drug master file entries for this API. Additional details are available on the ingenol mebutate profile page.

When can AMELUZ (aminolevulinic acid hydrochloride) generic drug versions launch?

Generic name: aminolevulinic acid hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 22, 2026

Generic Entry Controlled by: Mexico Patent 2,009,006,088

Patent Title: NANOEMULSION. (NANOEMULSION.)

AMELUZ is a drug marketed by Biofrontera. There are three patents protecting this drug.

This drug has twenty-nine patent family members in eighteen countries.

See drug price trends for AMELUZ.

The generic ingredient in AMELUZ is aminolevulinic acid hydrochloride. There are six drug master file entries for this API. Four suppliers are listed for this generic product. Additional details are available on the aminolevulinic acid hydrochloride profile page.

More… ↓

DrugPatentWatch cited by CNN, NEJM, Nature Journals, and more …

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.