Last updated: October 15, 2025

Overview of Janssen Therapeutics

Janssen Therapeutics, a subsidiary of Johnson & Johnson, is a prominent player within the global pharmaceutical landscape, focusing on innovative therapies across immunology, oncology, neuroscience, infectious diseases, and cardiovascular health. Established as a leader in biologics and targeted therapies, Janssen leverages extensive R&D capabilities, robust global distribution channels, and strategic alliances to maintain competitive advantage.

Market Position

Janssen Therapeutics holds a significant share in multiple therapeutic segments, notably immunology and oncology. Its portfolio includes blockbuster products such as Stelara (ustekinumab), Remicade (infliximab), and Darzalex (daratumumab), which are deemed essential within their respective indications. According to recent industry reports, Janssen ranks among the top five pharmaceutical companies globally based on revenue [1].

In the immunology sector, Janssen’s early entry and continuous innovation have solidified its dominance, with Stelara generating over $8 billion annually. Its oncology portfolio, particularly Darzalex, has aggressively gained market share since approval, now representing a substantial revenue contributor. In infectious diseases, Janssen's COVID-19 vaccine, Janssen COVID-19 Vaccine (Johnson & Johnson), further elevated its market presence during the pandemic [2].

Strengths

1. Robust R&D Pipeline and Innovation Capabilities

Janssen invests heavily in research, allocating approximately 20% of its revenue to R&D annually [3]. Its pipeline includes promising candidates in immunology, immuno-oncology, and neurodegenerative diseases, reflecting a sustained commitment to innovation. The company’s focus on biologics and personalized medicine has resulted in numerous FDA and EMA approvals, reinforcing its reputation as an innovator.

2. Diversified Therapeutic Portfolio

The company’s broad portfolio mitigates risks associated with dependency on a single line of therapy. Its presence spans chronic diseases, autoimmune conditions, and infectious diseases, allowing flexibility amid shifting market demands and regulatory environments.

3. Strategic Collaborations and Acquisitions

Janssen has fortified its market position through strategic partnerships with biotech firms and academic institutions, fostering access to cutting-edge technologies. For instance, collaborations with BeiGene and Genmab have expedited oncology drug development and commercialization. Its recent acquisition of Momenta Pharmaceuticals expanded its capabilities in autoimmune diseases [4].

4. Global Reach and Distribution Network

As a subsidiary of Johnson & Johnson, Janssen benefits from a vast global supply chain and distribution infrastructure, facilitating rapid market access and penetration. It maintains a presence in over 150 countries, ensuring widespread availability of its therapeutics.

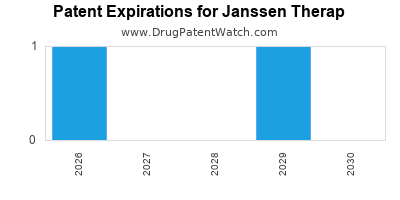

5. Strong Intellectual Property Portfolio

Janssen’s extensive patent estate provides competitive barriers against generic entrants and biosimilars. Its strategic patent filings extend exclusivity periods, maximizing revenue streams.

Strategic Insights

1. Emphasis on Precision Medicine and Biologics

Janssen’s focus on biologics aligns with industry-wide trends toward personalized therapies. The development of targeted monoclonal antibodies and cell therapies supports premium pricing and extended market exclusivity. Continued investment in biomarkers and companion diagnostics fuels this strategy, differentiating Janssen's offerings.

2. Digital Transformation and Data Analytics

The company leverages digital health innovations—such as real-world data collection, artificial intelligence, and telemedicine—to optimize R&D, streamline clinical trials, and enhance patient engagement. These initiatives could accelerate drug development cycles and improve market responsiveness.

3. Navigating Biosimilar Competition

With the impending expiration of patents for several biologics, Janssen actively strategizes around biosimilar competition by developing next-generation biologics and irreversible patent protections. Its focus on innovative formulations and delivery methods aims to sustain market share.

4. Market Expansion in Emerging Economies

Janssen plans to deepen its footprint within emerging markets such as China, India, and Brazil, where healthcare expenditure growth presents significant opportunities. Tailored pricing strategies and localized manufacturing will be key to capturing these markets.

5. Navigating Regulatory and Pricing Pressures

Increasing global scrutiny over drug pricing and drug accessibility pressures Janssen to adopt value-based pricing models and patient-centric approaches. Demonstrating clear clinical benefits and cost-effectiveness is critical to maintaining market stature.

Competitive Landscape

Janssen faces intense competition from both traditional pharma giants like Pfizer, Roche, and Novartis, and innovative biotech firms such as Amgen and Regeneron. Its strategic differentiation hinges on its robust R&D, diversified portfolio, and global reach. The rise of biosimilars and the accelerated adoption of digital health solutions further shape the competitive environment, necessitating continuous innovation and strategic agility.

Challenges and Risks

- Patent Expirations and Biosimilar Competition: The loss of exclusivity for key biologics could precipitate revenue declines unless offset by pipeline successes or next-generation biologics.

- Regulatory Hurdles: Stringent approval processes and evolving safety standards could delay or restrict market access.

- Pricing and Reimbursement Pressures: Governments and insurers globally seek to control drug costs, potentially impacting profitability.

- Market Saturation and Competitive Innovation: Rapid advancements by competitors could erode Janssen's market share if it fails to innovate swiftly.

Strategic Recommendations

- Prioritize the advancement of personalized therapies and biomarker-driven drugs.

- Strengthen digital health integration to facilitate clinical development and patient engagement.

- Expand strategic alliances in emerging markets to capitalize on local growth opportunities.

- Invest in next-generation biologics and biosimilar development to sustain competitive advantage.

- Implement value-based pricing models aligning with healthcare system needs.

Key Takeaways

- Leadership in innovation and diversified portfolio are critical assets for Janssen's sustained market success.

- Strategic collaborations and technological investments enhance R&D efficiency and global expansion potential.

- Proactive responses to biosimilar entries and regulatory changes are vital to preserving revenue streams.

- Emerging markets represent significant growth avenues requiring tailored strategies.

- A focus on digital transformation can accelerate drug development and improve patient outcomes, reinforcing Janssen’s competitive edge.

FAQs

1. How does Janssen maintain its competitive edge in biologics?

Janssen invests heavily in R&D, focusing on innovative biologic therapies, protecting IP rights, and expanding its pipeline with next-generation biologics. Strategic acquisitions and partnerships also enhance its technological capabilities.

2. What are the primary growth areas for Janssen in the next five years?

Key growth sectors include immunology, oncology, and infectious diseases, with an emphasis on personalized medicine and biosimilars. Expansion into emerging markets and digital health adoption are also prioritized.

3. How does Janssen address biosimilar threats?

Janssen develops next-generation biologics, extends patent protections, and invests in innovative delivery platforms to sustain exclusivity. Its pipeline emphasizes differentiation through efficacy and safety enhancements.

4. What role does digital health play in Janssen’s strategic planning?

Digital health tools improve clinical trial efficiency, enable real-world evidence collection, and foster patient-centric care models, supporting faster, more precise drug development.

5. How is Janssen adapting to global regulatory and pricing challenges?

Janssen adopts value-based pricing strategies, collaborates with healthcare stakeholders to demonstrate treatment value, and advocates for policies that balance affordability with innovation incentives.

References

[1] Statista. “Top Pharmaceutical Companies by Revenue,” 2022.

[2] Johnson & Johnson Official Website. “Janssen COVID-19 Vaccine,” 2023.

[3] Johnson & Johnson Annual Report. “Research & Development Spending,” 2022.

[4] BioCentury. “Janssen's Strategic Acquisitions and Collaborations,” 2022.