Last updated: October 14, 2025

Introduction

AbbVie Inc., a leading global biopharmaceutical company, has cemented its position through a strategic focus on innovative therapies across immunology, oncology, neuroscience, and virology. Since its spinoff from Abbott Laboratories in 2013, AbbVie has rapidly built a robust portfolio, leveraging a combination of groundbreaking drug development, strategic acquisitions, and a keen pursuit of pipeline diversification. This analysis explores AbbVie's current market positioning, core strengths, and strategic initiatives that shape its competitive landscape within the dynamic pharmaceutical industry.

Market Position and Financial Overview

As of 2023, AbbVie ranks among the top-tier pharmaceutical companies worldwide, with a market capitalization exceeding $200 billion. Its revenue models are primarily driven by high-margin franchises, notably Humira (adalimumab), Skyrizi (risankizumab), and Imbruvica (ibrutinib). Despite Humira’s patent expiration in key markets like the US in 2023, which historically contributed about 60% of its revenue, AbbVie’s strategic diversification efforts aim to mitigate revenue erosion.

In 2022, the company's net revenues reached approximately $58 billion, with immunology accounting for nearly 55%, oncology around 25%, and neuroscience and other sectors constituting the remainder. The company's consistent R&D investment, approximately 20% of annual revenues, underscores its focus on innovation as a pillar of sustained growth.

Core Strengths

1. Dominance in Immunology with Humira

Humira's blockbuster success established AbbVie’s dominance in immunology. Its broad application across rheumatoid arthritis, psoriatic arthritis, and inflammatory bowel diseases created a resilient revenue stream. Despite impending biosimilar competition, AbbVie's proactive pipeline and manufacturing capacity position it for continued leadership.

2. Robust R&D Pipeline and Innovation

AbbVie's R&D strategy emphasizes personalized medicine, biologics, and emerging modalities like antibody-drug conjugates (ADCs) and gene therapies. The company invests heavily in clinical trials, focusing on unmet medical needs, with over 50 molecules in late-stage development. Notably, the acquisition of Allergan in 2020 expanded its pipeline and diversified its therapeutic areas beyond immunology.

3. Strategic Acquisitions and Partnerships

Targeted acquisitions, including Allergan’s portfolio and innovative biotech firms, have expanded AbbVie's therapeutic offerings and pipeline. Strategic collaborations with biotech startups, academia, and contract research organizations (CROs) enhance innovation, speed to market, and access to novel technologies.

4. Global Commercial Footprint

With operations spanning North America, Europe, Asia-Pacific, and emerging markets, AbbVie's expansive commercial infrastructure enables rapid product launches and market penetration. Its strong presence in both established and emerging markets offers resilience against regional regulatory and patent challenges.

5. Focused Portfolio Management

AbbVie maintains a disciplined approach to portfolio management by divesting non-core assets, such as the sale of its women's health portfolio to assertion of core franchise dominance. This focus enhances resource allocation toward high-growth and high-margin therapeutic areas.

Strategic Insights and Future Outlook

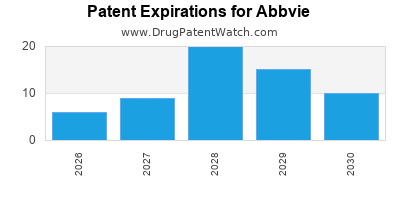

1. Navigating Patent Expirations

The imminent biosimilar entry for Humira challenges AbbVie's revenue streams. The company's response involves accelerating pipeline development in biologics, small-molecule drugs, and novel modalities. For example, Skyrizi and Rinvoq (upadacitinib) have shown promising growth in immune-mediated diseases, offsetting Humira's decline.

2. Investment in Digital and Precision Medicine

AbbVie's integration of digital tools enhances clinical trial efficiency, patient engagement, and health outcomes. Collaborations with tech firms aim to develop AI-enabled drug discovery platforms, predictive analytics, and personalized therapies, fostering a competitive edge.

3. Expanding Oncology Portfolio

The oncology segment is a growth priority, with AbbVie's strategic acquisitions, such as the purchase of Syndax Pharmaceuticals' late-stage assets, bolstering its pipeline in cancer immunotherapies. Its focus on innovative treatments like bispecific antibodies aims to differentiate in an intensive competitive landscape.

4. Embracing Global Market Expansion

AbbVie's focus on emerging markets, such as China and India, taps into high-growth which compensates for mature market declines. Tailored pricing strategies, partnership models, and local manufacturing capabilities enhance market access.

5. Sustainability and Corporate Social Responsibility

As healthcare regulators increasingly scrutinize pharmaceutical pricing and access, AbbVir's investments in affordability programs and sustainable practices are vital to navigate reputational and regulatory risks.

Competitive Landscape Analysis

Major Competitors

- Pfizer: Leading immunology portfolio with Enbrel and subsequent biosimilars post-Humira patent expiry; heavy investment in oncology, vaccines, and COVID-19 therapeutics.

- Roche: Dominates biologics and personalized medicine; robust oncology pipeline with targeted therapies like Tecentriq.

- Johnson & Johnson: Diversified with pharmaceuticals, medical devices, and consumer health; notable strengths in immunology and oncology.

- Novartis: Strong pipeline in gene therapies and biosimilars; expanding digital medicine initiatives.

- Bristol-Myers Squibb: Focused on oncology and immunology, with recent acquisitions like Celgene strengthening its portfolio.

Competitive Advantage Factors

While AbbVie's entrenched immunology franchise provides a significant advantage, biosimilar competition and patent cliffs pose ongoing challenges. The company's aggressive pipeline development, strategic acquisitions, and market expansion initiatives are critical to maintain its competitive edge. Its investments in innovative modalities like cell therapies and personalized medicine further differentiate its offerings.

Emerging Trends Impacting Competition

- Biosimilar Market Dynamics: Increasing biosimilar penetration pressures traditional biologics revenues, emphasizing the need for innovative and diversified portfolios.

- Precision Oncology: Rapid advancements in genomics and biomarker research necessitate agile R&D capabilities.

- Digital Health Integration: Companies embracing digital transformation are poised to enhance clinical efficacy, patient adherence, and cost efficiencies.

- Regulatory Policies: Evolving global regulatory landscapes demand adaptive strategies for drug approvals, pricing, and market access.

Key Strategic Recommendations for Stakeholders

- Diversify Revenue Streams: Accelerate pipeline progression in oncology and neuroscience to offset potential humira biosimilar declines.

- Leverage Digital Transformation: Invest in AI, machine learning, and data analytics for faster, cost-effective drug discovery and personalized therapies.

- Strengthen Global Footprint: Deepen presence in emerging markets through localized manufacturing and tailored market strategies.

- Engage in Strategic Alliances: Partner with biotech firms and academic institutions to foster innovation and access novel therapeutic platforms.

- Prioritize Patient-Centric Innovations: Focus on improving patient outcomes, adherence, and affordability to build brand loyalty and long-term market share.

Conclusion

AbbVie’s strategic positioning within the pharmaceutical industry relies on its pioneering immunology portfolio, robust pipeline development, targeted acquisitions, and global expansion efforts. While patent expirations and biosimilar competition pose challenges, its investment in innovative therapies, digital health, and emerging markets position it favorably for sustained growth. To maintain its leadership, AbbVie must continue balancing innovation with strategic portfolio management, adapt to regulatory and market shifts, and prioritize patient-centric solutions.

Key Takeaways

- AbbVie maintains a dominant position in immunology but faces biosimilar competition post-Humira patent expiry.

- Its diversified pipeline and strategic acquisitions underpin growth in oncology and neuroscience.

- Investing in digital health and personalized medicine enhances discovery and patient engagement.

- Expanding into emerging markets generates growth amid saturation in mature regions.

- Navigating biosimilar threats requires continuous innovation, strategic alliances, and portfolio diversification.

FAQs

1. How is AbbVie planning to offset revenue losses from Humira biosimilars?

AbbVie is accelerating development of new biologics like Skyrizi and Rinvoq, expanding into oncology and neuroscience, and investing in innovative modalities such as cell and gene therapies to diversify revenue sources and offset Humira’s decline.

2. What are AbbVie's key growth areas beyond immunology?

Oncology, neuroscience, and virology represent primary growth sectors, supported by strategic acquisitions, pipeline expansion, and investments in precision medicine and digital health technologies.

3. How does AbbVie's R&D investment impact its competitive positioning?

Heavy R&D investment enables rapid pipeline growth, supports breakthrough therapies, and sustains innovation-led differentiation in a highly competitive industry landscape.

4. What role does digital transformation play in AbbVie's strategy?

Digital tools streamline drug discovery, improve clinical trial efficiency, enhance patient engagement, and facilitate personalized therapies, giving AbbVie a competitive advantage.

5. How significant are emerging markets to AbbVie's long-term strategy?

Emerging markets offer high-growth opportunities, with targeted initiatives in China, India, and Southeast Asia vital for revenue diversification and global footprint expansion.

References

- AbbVie Annual Report 2022.

- IBISWorld Pharmaceutical Industry Report, 2023.

- STAT News. “Humira biosimilars: the impact and market implications,” 2023.

- EvaluatePharma. “Top Global Pharma Companies by Revenue,” 2022.

- Deloitte. “Global Life Sciences Outlook,” 2023.