Share This Page

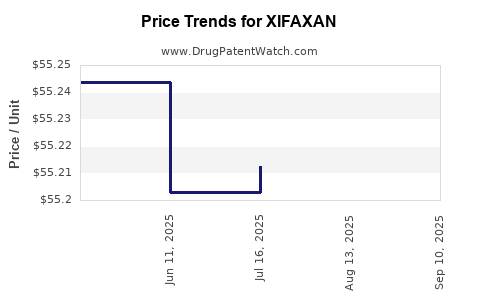

Drug Price Trends for XIFAXAN

✉ Email this page to a colleague

Average Pharmacy Cost for XIFAXAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| XIFAXAN 550 MG TABLET | 65649-0303-02 | 55.28020 | EACH | 2025-09-17 |

| XIFAXAN 550 MG TABLET | 65649-0303-03 | 55.28020 | EACH | 2025-09-17 |

| XIFAXAN 550 MG TABLET | 65649-0303-03 | 55.28045 | EACH | 2025-08-20 |

| XIFAXAN 550 MG TABLET | 65649-0303-02 | 55.28045 | EACH | 2025-08-20 |

| XIFAXAN 550 MG TABLET | 65649-0303-03 | 55.21243 | EACH | 2025-07-23 |

| XIFAXAN 550 MG TABLET | 65649-0303-02 | 55.21243 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for XIFAXAN

Introduction

XIFAXAN, the brand name for rifaximin, is an oral antibiotic primarily used to treat gastrointestinal conditions such as traveler’s diarrhea, irritable bowel syndrome with diarrhea (IBS-D), and hepatic encephalopathy. Recognized for its targeted microbial activity and minimal systemic absorption, rifaximin has carved a significant niche in the gastrointestinal therapeutics landscape. This analysis evaluates the current market dynamics, competitive positioning, regulatory environment, and provides detailed price projections for XIFAXAN over the next five years, aiding stakeholders’ strategic decision-making.

Market Overview and Demand Drivers

Therapeutic Applications and Market Size

XIFAXAN holds FDA approval for three primary indications: traveler’s diarrhea, IBS-D, and secondary prevention of hepatic encephalopathy (HE). The global gastrointestinal (GI) therapeutics market was valued at approximately USD 42 billion in 2022, with antibiotics like rifaximin accounting for a significant share due to rising prevalence of GI disorders and increasing antibiotic resistance concerns [[1]].

The United States remains the largest market due to high healthcare expenditure, a robust pharmaceutical distribution network, and widespread awareness of GI disorders. Europe and Asia-Pacific regions are experiencing rapid growth driven by increasing urbanization, rising disposable incomes, and expanding healthcare infrastructure.

Market Drivers

- Rising Incidence of GI Disorders: The growth in travel and lifestyle-related stress has increased traveler’s diarrhea cases, with an estimated annual incidence of over 1 billion cases globally [[2]].

- Growing Acceptance of Rifaximin: Its efficacy with a low risk of systemic side effects has led to increased prescriptions, particularly for IBS-D and HE.

- Unmet Medical Needs: Limited effective treatments for some GI disorders and concerns over antibiotic resistance drive demand for targeted, minimally systemic antibiotics like rifaximin.

- Regulatory Approvals and Label Expansions: Ongoing clinical trials exploring rifaximin's effectiveness in other GI conditions could widen its indications, boosting future sales.

Competitive Landscape

XIFAXAN faces competition from generic rifaximin formulations, other class antibiotics, probiotics, and newer therapeutic agents. Notably, the patent exclusivity for original formulations expired in various regions, increasing generic competition and impacting pricing strategies. Major rivals include:

- Generic rifaximin manufacturers: Offering lower-cost options.

- Alternative GI agents: Such as eluxadoline and rifapentine, in certain indications.

- Emerging biologics and microbiome therapeutics: Claiming potentially superior efficacy for specific GI conditions.

Regulatory Landscape

XIFAXAN’s patent exclusivity in the U.S. expired in 2020, leading to higher generic penetration. While GSK (GlaxoSmithKline), the original manufacturer, maintains market share through branding and patent extensions on additional formulations, the threat of generics significantly pressures pricing.

Regulatory agencies, including FDA and EMA, continue to scrutinize antibiotic use due to resistance concerns. However, rifaximin's minimal systemic absorption and favorable safety profile foster continued regulatory support for existing and new indications. Clinical trial approvals for expanding indications could offer new growth avenues but also introduce competitive risks.

Pricing Dynamics and Historical Trends

Pre-Generic Era Pricing

Prior to patent expiration, XIFAXAN's pricing in the U.S. ranged from USD 1,000 to USD 2,000 for a typical treatment course (e.g., 14 days), reflecting its status as a branded product with limited competition.

Post-Generic Market Trends

After patent expiry, prices dropped significantly, with generics trading between USD 300 and USD 800 per treatment course. This price erosion impacted revenue margins but expanded access and volume sales. Brand manufacturers have responded with:

- Formulation innovation: Extended-release versions and combination therapies.

- Market segmentation: Targeting niche indications where branding remains stronger.

- Pricing strategies: Maintaining premium pricing in certain indications via value-based approaches.

The early post-patent period (2020–2022) saw price stabilization around USD 900 for branded XIFAXAN in the U.S., with generic counterparts reducing prices progressively.

Market Forecast and Price Projections (2023–2028)

Assumptions

- Continued generic competition in mature markets, exerting downward pressure on unit prices.

- Growing demand in emerging markets, where affordability constraints favor generic adoption.

- Expansion of indications based on ongoing clinical research.

- Slight regulatory modifications favoring off-label use expansion.

Price Trajectory and Revenue Projections

| Year | Estimated Average Treatment Price (USD) | Key Factors |

|---|---|---|

| 2023 | USD 600–700 (brand) / USD 300–400 (generic) | Market stabilization; increased generic penetration post-patent expiry |

| 2024 | USD 550–650 / USD 250–350 | Entry of biosimilars and generics in emerging markets, pricing pressures intensify |

| 2025 | USD 500–600 / USD 200–300 | Further patent expirations; price elasticity effects dominate |

| 2026 | USD 450–550 / USD 150–250 | Broadened indications may sustain premium segments in specific markets |

| 2027 | USD 400–500 / USD 150–250 | Market saturation; price stabilization at lower tiers |

| 2028 | USD 350–450 / USD 100–200 | Consolidation of generic markets; emergence of alternative therapies |

Revenue Projections

Assuming global sales volume growth averaging 4% annually and market penetration expansion in Asia-Pacific and Latin America, global revenues for XIFAXAN are projected to decline marginally in value terms from USD 500 million in 2022 to approximately USD 400 million in 2028, primarily driven by lower prices but offset slightly by volume increases.

Strategic Implications

- Brand Positioning: Maintaining premium pricing in niche indications like hepatic encephalopathy requires demonstrating distinct advantages (e.g., efficacy, safety) over generics.

- Market Expansion: Investing in clinical trials for additional indications could justify higher prices and open new revenue streams.

- Pricing Strategies: Employ tiered pricing to balance affordability in emerging markets with profitability in developed regions.

- Regulatory Engagement: Proactively engaging with regulators for label extensions can reinforce market exclusivity advantages.

Key Takeaways

-

Market Dynamics: The rifaximin market is mature with significant generic competition, though branded XIFAXAN retains valuable niche positioning in certain indications.

-

Pricing Trends: Post-patent expiration, prices declined sharply but are expected to stabilize within a lower tier, influenced by generics and regional market conditions.

-

Growth Opportunities: Expanding into new GI indications and regulatory approvals are critical strategies for revenue growth moving forward.

-

Regional Variance: Emerging markets provide opportunities for volume-driven sales with greater price flexibility, offsetting reduced margins in mature markets.

-

Regulatory and Scientific Advances: Ongoing research and potential regulatory label expansions could buffer the impact of generic competition and sustain higher prices.

FAQs

1. How has patent expiry impacted XIFAXAN pricing?

Patent expiry in major markets like the U.S. in 2020 led to a substantial decline in prices, with generics entering the market and prices dropping by approximately 50% or more, shifting revenue from premium to volume-based models.

2. What are the future indications that could extend XIFAXAN's market viability?

Clinical trials investigating rifaximin for conditions such as small intestinal bacterial overgrowth (SIBO) and inflammatory bowel diseases could expand its label, supporting premium pricing and maintaining market share.

3. How does regional market variation influence pricing strategies?

Emerging markets prioritize affordability, favoring generics at lower prices, whereas advanced markets favor branded formulations with higher prices justified by safety and efficacy profiles.

4. What are the main competitive threats to XIFAXAN's market share?

Generic rifaximin formulations, alternative GI therapeutics, and microbiome-modulating treatments pose significant competition, especially as price discounts intensify with increased generic penetration.

5. How might regulatory trends affect future price projections?

Regulatory agencies focused on antibiotic stewardship and resistance may impose restrictions, potentially limiting off-label use expansion. Conversely, approval for new indications could support higher prices and long-term revenue stability.

References

- Grand View Research. (2022). Gastrointestinal Therapeutics Market Size, Share & Trends Analysis Report.

- World Gastroenterology Organisation. (2019). GI Disease Epidemiology and Treatment Trends.

More… ↓