Last updated: July 29, 2025

Introduction

In the rapidly evolving pharmaceutical and biotechnological sectors, precision instrumentation and analytical services have become pivotal for advancing drug discovery, development, and manufacturing processes. Leo Labs, a pioneer in high-precision nanoparticle analysis, is increasingly influential within this landscape. This report explores Leo Labs’ market position, core strengths, and strategic outlook, providing critical insights for stakeholders aiming to navigate the competitive environment effectively.

Leo Labs’ Market Position

Emerging Leader in Nano-Particle Characterization

Leo Labs specializes in advanced nanoparticle size and concentration measurement technologies, primarily serving the pharmaceutical, biotech, and nanoparticle manufacturing industries. Its core offerings—such as the NanoCam system—deliver real-time, high-resolution analytics essential for ensuring compliance with stringent regulatory standards like those of the FDA and EMA.

Market Penetration and Client Base

The company’s rapid adoption by leading pharmaceutical firms underscores its rising prominence. Notably, Leo Labs actively collaborates with biotech startups, large pharmaceutical firms, and contract manufacturing organizations (CMOs). Its strategic positioning as a provider of both analytical tools and insights enables it to penetrate new segments swiftly.

Competitive Positioning vis-à-vis Peers

Compared to conventional particle analysis providers—such as Malvern Panalytical or Wyatt Technology—Leo Labs differentiates itself through its non-invasive, real-time measurement capability and the ability to analyze particles at nanometer scales with high throughput. This technological edge enhances its position amidst a landscape marked by traditional, often slower, bulk analysis techniques.

Core Strengths

1. Cutting-Edge Technology and Innovation

Leo Labs’ proprietary nano-imaging technology allows for precise, rapid characterization of nanoparticles at a scale unmatched by traditional methods. Its systems facilitate on-the-fly analysis, crucial for real-time decision-making during manufacturing and formulation stages.

2. Customizable and Scalable Solutions

Its modular platform design enables clients to tailor analytical workflows, integrating seamlessly into existing manufacturing lines. This scalability appeals to both early-stage R&D entities and large-scale production facilities, broadening the company’s market reach.

3. Strategic Collaborations and Industry Partnerships

Leo Labs’ collaborations with pharma giants and biotech startups generate valuable validation and foster trust. Such alliances often lead to co-development opportunities, further embedding its technology within industry standards.

4. Regulatory Compliance and Data Integrity

The company’s analytical systems meet key regulatory standards, which accelerates adoption by firms aiming for compliant manufacturing processes. The integration of audit trails and validated software enhances data integrity, a critical factor in pharmaceutical quality systems.

5. Thought Leadership and Market Education

Leo Labs actively participates in industry forums, publishes peer-reviewed studies, and shares technological advancements—positioning itself as a thought leader. This reputation enhances brand trust and influences market standards.

Strategic Insights

A. Expansion into New Therapeutic Areas

The rising importance of nanomedicine and targeted drug delivery offers new avenues. Leo Labs’ tools are increasingly relevant for characterizing drug delivery vehicles such as liposomes or polymeric nanoparticles, promising broader application territories.

B. Geographic Growth Strategies

While North America and Europe remain primary markets, emerging regions like Asia-Pacific show high growth potential. Targeted investments and local partnerships could accelerate market penetration, especially considering region-specific regulatory nuances.

C. Investment in Software Ecosystems

Developing integrated software platforms that facilitate data analytics, compliance reporting, and process monitoring enhances value propositions. Advanced AI-driven data interpretation could unlock further efficiencies and predictive insights.

D. Focus on Personalized Medicine

As personalized therapies gain prominence, the need for precise nanoparticle characterization grows. Leo Labs’ ability to provide robust, real-time data aligns with industry moves toward bespoke therapeutics, highlighting its strategic relevance.

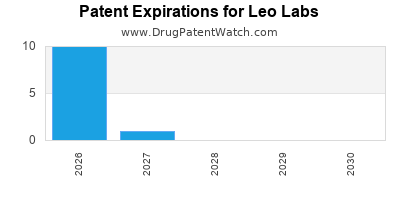

E. Intellectual Property and R&D Investment

Continued investment in R&D and patent development ensures technological differentiation. Protecting core innovations maintains competitive barriers and allows for premium positioning.

Competitive Challenges and Risks

- Technological Competition: Established analytical firms expanding into nanoparticle characterization pose a direct threat.

- Regulatory Hurdles: Diverse global standards may complicate product compliance and deployment.

- Market Education: Convincing conservative industries to adopt high-tech, real-time analysis systems involves educational challenges.

- Pricing Pressures: As competition intensifies, pricing strategies may need optimization to maintain margins while expanding market share.

Conclusion

Leo Labs occupies a strategically advantageous position within the pharmaceutical analytical ecosystem, emphasizing technological innovation, regulatory compliance, and customer-centric solutions. Its focus on nanoparticle analysis caters directly to the burgeoning needs of nanomedicine and advanced drug delivery, positioning it for sustained growth. Key to its future success will be leveraging strategic collaborations, expanding geographically, and deepening technological capabilities to remain ahead of emerging competitors.

Key Takeaways

- Leo Labs’ high-precision nanoparticle analysis technology differentiates it within a crowded market, enabling real-time, non-invasive measurements vital for pharmaceutical manufacturing.

- Its strategic partnerships and focus on regulatory standards provide a competitive edge, fostering industry trust and expanding its client base.

- Growth opportunities lie in diversification across therapeutic areas, regional expansion, and software integration for enhanced data analytics.

- Protecting intellectual property and investing in R&D are critical to maintaining technological leadership amid evolving competition.

- The industry shift towards personalized medicine and nanotechnology presents significant expansion potential for Leo Labs’ offerings.

FAQs

1. How does Leo Labs’ technology improve upon traditional nanoparticle analysis methods?

Leo Labs utilizes proprietary nano-imaging systems capable of real-time, high-resolution particle size and concentration analysis, offering faster, more accurate insights than traditional techniques like dynamic light scattering (DLS) or electron microscopy.

2. What industries benefit most from Leo Labs’ nanoparticle analysis solutions?

Primarily the pharmaceutical and biotech sectors, especially those involved in drug formulation, nanomedicine, vaccine development, and advanced delivery systems.

3. How does Leo Labs ensure regulatory compliance of its systems?

Its analytical platforms are designed with validated software, audit trails, and data security features aligned with international standards such as 21 CFR Part 11, facilitating regulatory approval and manufacturing compliance.

4. What are the main growth strategies for Leo Labs?

Expanding into new therapeutic areas like nanomedicine, increasing geographic footprint particularly in Asia-Pacific, and developing integrated data analytics platforms to enhance value delivery.

5. Who are Leo Labs’ main competitors, and how does it differentiate?

Competitors include Malvern Panalytical and Wyatt Technology. Leo Labs differentiates through its non-invasive, real-time nano-imaging technology and its focus on high throughput, which traditional methods often lack.

References

[1] Industry reports on nanoparticle analysis companies and market trends.

[2] Leo Labs official website and product literature.

[3] Regulatory standards applicable to pharmaceutical analytical systems.

[4] Market analyses on nanomedicine and personalized therapy growth projections.