Share This Page

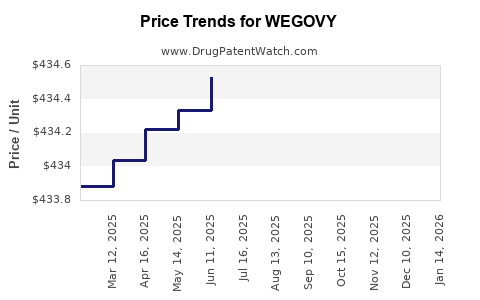

Drug Price Trends for WEGOVY

✉ Email this page to a colleague

Average Pharmacy Cost for WEGOVY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| WEGOVY 0.5 MG/0.5 ML PEN | 00169-4505-14 | 653.27739 | ML | 2025-12-17 |

| WEGOVY 1.7 MG/0.75 ML PEN | 00169-4517-14 | 435.52893 | ML | 2025-12-17 |

| WEGOVY 2.4 MG/0.75 ML PEN | 00169-4524-14 | 435.47470 | ML | 2025-12-17 |

| WEGOVY 1 MG/0.5 ML PEN | 00169-4501-14 | 653.23363 | ML | 2025-12-17 |

| WEGOVY 0.25 MG/0.5 ML PEN | 00169-4525-14 | 653.29259 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Wegovy (semaglutide)

Summary

Wegovy (semaglutide) is a prescription medication developed by Novo Nordisk, approved by the FDA in June 2021 for chronic weight management in adults with obesity or overweight with comorbidities. Its success in addressing the global obesity epidemic, coupled with high demand, has positioned Wegovy as a significant player in the obesity pharmacotherapy market. This analysis evaluates current market dynamics, competitive landscape, manufacturing considerations, pricing strategies, regulatory influences, and future price projections.

Introduction

Obesity remains a predominant public health challenge worldwide, with over 650 million adults classified as obese (BMI ≥30 kg/m²) according to WHO[1]. The increasing prevalence has driven a surge in medical interventions, including pharmacological treatments like Wegovy, which harness the therapeutic potential of semaglutide — a GLP-1 receptor agonist initially approved for type 2 diabetes management (marketed as Ozempic). The repositioning of semaglutide for weight management significantly impacts market trajectories and pricing strategies.

Market Landscape Overview

Global Obesity Market Size and Growth

| Parameter | Data | Source |

|---|---|---|

| Global obesity drug market (2022) | $3.7 billion | MarketsandMarkets[2] |

| CAGR (2023-2030) | 15.2% | ResearchAndMarkets[3] |

| Estimated market value (2030) | ~$11.3 billion | Projected |

Key Players & Competition

| Company | Product | Indication | Market Penetration | Notes |

|---|---|---|---|---|

| Novo Nordisk | Wegovy (semaglutide) | Obesity | Leading | First FDA-approved GLP-1 for weight management |

| Eli Lilly | Mounjaro (tirzepatide) | T2DM/weight | Emerging | Promising efficacy; potential competitor |

| Novo Nordisk | Ozempic (semaglutide) | T2DM | Significant | Off-label use for weight reduction |

| Others | Contrave, Saxenda | Obesity | Moderate | Smaller market share |

Market Drivers

- Rising obesity prevalence

- Increasing awareness of pharmacotherapy options

- Favorable reimbursement trends

- U.S. FDA approval and expanding access

- Growth in telemedicine for weight management

Market Barriers

- High treatment costs

- Limited insurance coverage

- Regulatory scrutiny over side effects

- Competition from generics and biosimilars

Pricing Overview and Strategy of Wegovy

Current Pricing Framework

| Region | Approximate List Price (USD) | Notes |

|---|---|---|

| United States | $1,349/month | Based on CMS and pharmacy data[4] |

| European Union | Varies (~€300-€400/week) | Conversion-dependent |

| Canada | CAD 1,700/month | Approximately |

Pricing Components

- Per-Unit Cost: Retail pharmacies typically set price based on acquisition costs plus markups.

- Reimbursement & Insurance: Negotiated discounts and formularies influence net prices.

- Patient Out-of-Pocket: Often reduced by insurance, but may include deductibles and copayments.

- Manufacturer Strategies:

- Price premium for exclusivity

- Tiered discount models

- Patient assistance programs

Key Price Drivers

- Efficacy and Tolerability: Superior efficacy justifies premium pricing.

- Regulatory & Reimbursement Policies: Favorable policies enhance market access.

- Market Competition: Entry of biosimilars or competing drugs could pressure prices.

- Cost of Goods Sold (COGS): Manufacturing expenses, especially for biologics.

Regulatory & Policy Impact on Pricing

- FDA & EMA Approvals: Accelerated approval paths for obesity drugs increase market potential.

- Reimbursement Policies:

- The U.S. Centers for Medicare & Medicaid Services (CMS) evaluating coverage policies[5].

- European health authorities assessing cost-effectiveness.

- Health Technology Assessments (HTAs):

- Bodies like NICE (UK) determine value-based pricing.

Impact on Prices

| Policy Risk/Opportunity | Effect on Wegovy Price | Status/Notes |

|---|---|---|

| Price negotiations | Potential downwards pressure | Pending negotiations |

| Reimbursement expansion | Supports higher prices | Positive outlook |

| Price caps or controls | Limits on pricing | Under consideration in some regions |

Forecasted Price Trends and Projections

| Timeline | Expected Price Direction | Drivers | Commentary |

|---|---|---|---|

| Short-term (1-2 years) | Flat or slight decrease | Competitive pressures, reimbursement negotiations | Focused on market penetration |

| Medium-term (3-5 years) | Moderate decrease (~10-15%) | Market saturation, biosimilar entries, price negotiations | Cost containment initiatives |

| Long-term (>5 years) | Variable | Patent expirations, biosimilar adoption | Potential for significant price declines |

Factors Affecting Price Projections

- Patent Status: Patent expiry window around 2030 may introduce biosimilars, constraining prices.

- Market Penetration: Increased adoption could lead to economies of scale, reducing prices.

- Pricing Strategies: Novo Nordisk may adopt value-based or tiered pricing to sustain revenues.

Comparative Analysis: Wegovy vs. Competitors

| Parameter | Wegovy (semaglutide) | Mounjaro (tirzepatide) | Saxenda (liraglutide) | Contrave (naltrexone/bupropion) |

|---|---|---|---|---|

| Approval Year | 2021 | 2022 | 2014 | 2014 |

| Mode of Action | GLP-1 receptor agonist | GIP and GLP-1 receptor agonist | GLP-1 receptor agonist | Opioid antagonism + antidepressant |

| Weekly Dose | 2.4 mg | 5-15 mg | 3 mg | Oral, daily |

| Efficacy (Average weight loss) | ~15% | Up to 20-22% | ~5-10% | 5-10% |

| Price (USD/month) | ~$1,349 | Not fixed (e.g., $1,000-$2,000) | ~$1,200 | ~$200 |

Note: Mounjaro's pricing is speculative due to current lack of official list prices for weight loss indication.

Future Market and Pricing Scenarios

Optimistic Scenario

- Increased acceptance, expanded insurance coverage, and successful marketing could sustain Wegovy's premium pricing (~$1,300/month).

- Regulatory approvals in additional markets and indication extensions.

- Limited biosimilar competition until ~2030.

Moderate Scenario

- Price erosion (~10-15%) driven by increased competition and reimbursement negotiations.

- Entry of biosimilars leading to downward pressure.

- Adoption plateauing as market matures.

Pessimistic Scenario

- Heightened competition, biosimilar availability, and regulatory constraints reduce pricing dramatically (~50% reduction).

- Market saturation limits pricing power.

- Reimbursement policies favor cost-effective alternatives.

Key Takeaways

- Wegovy dominates the obesity pharmacotherapy space, with high efficacy and positive regulatory status supporting premium pricing.

- Market growth is robust, driven by rising obesity prevalence and expanding indications.

- Pricing remains high (~$1,300/month US), but face pressure from biosimilars, competition, and policy reforms.

- Reimbursement policies and health technology assessments will significantly influence future price trajectories.

- Strategic positioning—including geographic expansion, indications, and patient assistance—will shape Wegovy's long-term market value.

FAQs

1. How does Wegovy compare in efficacy to other obesity drugs?

Wegovy demonstrates approximately 15% weight loss on average, surpassing older agents like Saxenda (~5-10%) and approaching the efficacy of emerging therapies such as Mounjaro (~20%). Its superior performance is a key driver of premium pricing.

2. What factors could lead to Wegovy's price reduction in the future?

Patent expirations, biosimilar development, increased competition, and policy-driven cost containment measures are primary factors that could reduce prices over time.

3. Are there regional differences in Wegovy pricing?

Yes. US prices are around $1,349/month, while European prices vary (~€300-€400/week). Pricing strategies are tailored based on healthcare systems, reimbursement policies, and market demand in each region.

4. What is the expected market impact of new entrants like Mounjaro?

Mounjaro’s promising efficacy and potential approvals for weight management could increase competition, exert pricing pressures on Wegovy, and diversify treatment options, possibly leading to price adjustments.

5. How might regulatory policies influence Wegovy's future pricing?

Regulatory bodies emphasizing cost-effectiveness and reimbursement negotiations could lead to price caps or discounts, especially if new safety or efficacy data emerge that impact its perceived value.

References

[1] WHO. Obesity and Overweight. 2022.

[2] MarketsandMarkets. Obesity Market by Drug Class, Region - Global Forecast to 2027. 2022.

[3] ResearchAndMarkets. Global Obesity Drugs Market. 2022.

[4] CVS Pharmacy, GoodRx, and other public pharmacy pricing sources. 2023.

[5] Centers for Medicare & Medicaid Services (CMS). Coverage and Reimbursement Policies for Obesity Treatments. 2022.

Note: Data and projections are subject to change based on market developments, regulatory decisions, and new clinical data.

More… ↓