Share This Page

Drug Price Trends for EPIDUO

✉ Email this page to a colleague

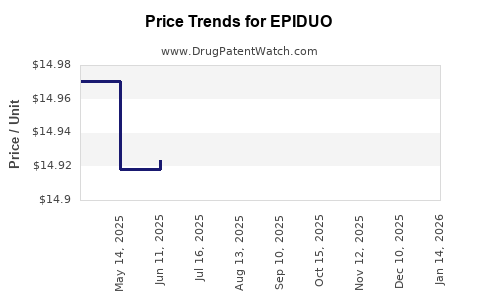

Average Pharmacy Cost for EPIDUO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.92226 | GM | 2025-12-17 |

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.92226 | GM | 2025-11-19 |

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.93860 | GM | 2025-10-22 |

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.93860 | GM | 2025-09-17 |

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.94127 | GM | 2025-08-20 |

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.94127 | GM | 2025-07-23 |

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.92346 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Epiduo

Introduction

Epiduo, a topical medication combining adapalene 0.1% and benzoyl peroxide 2.5%, is widely prescribed for the treatment of acne vulgaris in both adolescent and adult populations. Its unique formulation addresses multiple pathogenic factors of acne, establishing it as a staple in dermatological therapeutics. As the dermatology market evolves, understanding Epiduo’s current market positioning, competitive landscape, and future pricing trajectories is critical for stakeholders ranging from manufacturers to healthcare providers.

Market Overview

The global acne treatment market is projected to reach USD 4.4 billion by 2027, expanding at a compound annual growth rate (CAGR) of approximately 4.5% from 2020 onwards [1]. Epiduo accounts for a significant share, bolstered by its innovative combination therapy, high efficacy, and favorable safety profile. The drug’s market penetration spans North America, Europe, and Asia-Pacific, with emerging markets witnessing rapid adoption due to rising acne prevalence and increasing awareness about dermatological conditions.

Competitive Landscape

Epiduo faces competition primarily from other topical therapies and combination medications, including:

- Differin (adapalene 0.1%) monotherapy

- BenzaClin (clindamycin 1% + benzoyl peroxide 5%)

- Aczone (dapsone gel)

- Emerging generics and biosimilars

Despite the competition, Epiduo retains strong positioning owing to its dual-action mechanism, clinical efficacy, and established brand recognition.

Key Market Drivers

- Increasing acne prevalence: Especially among adolescents and young adults, fueling demand for effective treatments.

- Rising demand for combination therapies: Driven by the need for improved efficacy and reduced resistance.

- Growing awareness of dermatological health: Enhanced patient and clinician awareness increases prescription rates.

- Regulatory approvals and expansions: Epiduo’s approval in multiple geographies, including pediatric populations, broadens its market base.

Regulatory Landscape

Regulatory agencies like the FDA and EMA have approved Epiduo, with ongoing evaluations for expanded indications. Market access and reimbursement policies continue to influence overall sales potential, especially pending potential formulary placements.

Pricing Analysis and Projections

Epiduo’s current price structure varies globally, influenced by factors such as regulatory status, market competition, and local healthcare policies. In the United States, the average wholesale price (AWP) for a 45-gram tube of Epiduo ranges from USD 400-500, translating to a retail price of approximately USD 450-550 after markups and insurance adjustments.

Current Pricing Factors:

- Brand Premium: As a branded product, Epiduo commands a premium over generics, which impacts patient affordability.

- Reimbursement Policies: Insurance coverage significantly influences out-of-pocket costs, affecting patient uptake.

- Market Penetration Strategies: Pricing strategies aimed at physicians and pharmacies influence dispensation rates.

Future Price Trajectory:

Anticipated trends suggest a moderate decrease in standalone Epiduo pricing over the next 3-5 years, driven by:

-

Entry of Generics: Patent expirations anticipated between 2025-2027 could catalyze generic manufacturing, leading to price erosion by 20-30%, similar to trends observed with other dermatology drugs [2].

-

Market Competition Intensification: New combination therapies and evolving formulations will exert pricing pressures, encouraging manufacturers to adopt tiered or value-based pricing models.

-

Reimbursement Policies: Payer strategies focusing on cost containment are likely to negotiate better pricing, increasing access but decreasing margins for the originator.

-

Regulatory and Patent Considerations: Additional indications or formulations may sustain higher prices temporarily but are unlikely to prevent long-term price declines.

Projections:

- Short-term (1-2 years): Stable pricing with slight fluctuations due to supply chain dynamics and inflation.

- Mid-term (3-5 years): Prices could decrease by approximately 15-25% post-patent expiry, especially if biosimilar or generic versions are introduced.

- Long-term (6+ years): Potential stabilization at a lower price point, contingent upon market acceptance and competitive pressures.

Market Opportunities and Challenges

Opportunities:

- Expansion into emerging markets where acne prevalence is rising.

- Formulation innovations, such as once-daily or combination products with added anti-inflammatory agents.

- Increasing use in adult populations with persistent acne.

Challenges:

- Patent expirations leading to generic competition.

- Price sensitivity among patients in cost-focused healthcare systems.

- Variability in regulatory approvals for new indications.

Conclusion

Epiduo maintains a robust position within the dermatology landscape, driven by its efficacy and brand loyalty. However, impending patent expirations and escalating competition are poised to influence its pricing landscape, generally trending toward more affordable options. Stakeholders should anticipate moderate price reductions over the coming years, with strategic focus on market expansion and formulation development to sustain profitability.

Key Takeaways

- The global acne market is expanding, with Epiduo occupying a significant market share due to its dual-action formulation.

- Current retail prices for Epiduo in the US average USD 450-550 per tube, influenced by brand premiums and reimbursement frameworks.

- Price projections indicate potential decreases of 15-30% within five years driven by generic entry and competitive innovations.

- Emerging markets present growth opportunities, fueled by rising dermatological needs and increasing healthcare investments.

- Strategic adaptation, including formulation diversification and market expansion, will be paramount for maintaining competitiveness amid declining prices.

FAQs

1. When are generic versions of Epiduo expected to enter the market?

Patent protections are anticipated to lapse around 2025-2027, paving the way for generic competitors, which historically leads to significant price reductions.

2. How will pricing changes affect patient access in different regions?

Lower prices post-generic entry will improve accessibility, especially in cost-sensitive markets, potentially increasing prescription volumes but reducing profit margins for original manufacturers.

3. Are there alternative treatments projected to replace Epiduo in the future?

Emerging combination therapies and novel agents targeting different acne pathophysiology are under development, but Epiduo’s well-established efficacy sustains its significant market presence.

4. What strategies can manufacturers employ to prolong Epiduo’s market relevance?

Investing in new formulations, expanding indications, and developing complementary products can mitigate revenue declines associated with pricing erosion.

5. How do reimbursement policies influence Epiduo’s market penetration?

Coverage restrictions and formulary placements significantly impact patient access and prescription frequency, emphasizing the need for favorable reimbursement negotiations.

Sources

[1] Grand View Research, "Acne Treatment Market Size, Share & Trends Analysis," 2021.

[2] U.S. Food and Drug Administration, "Patent Expirations and Generic Launches," 2022.

More… ↓