KORSUVA Drug Patent Profile

✉ Email this page to a colleague

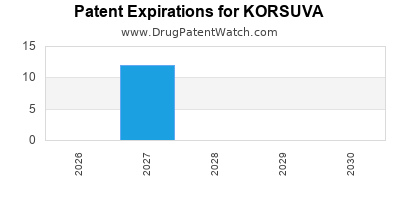

When do Korsuva patents expire, and what generic alternatives are available?

Korsuva is a drug marketed by Vifor Intl and is included in one NDA. There are twelve patents protecting this drug and one Paragraph IV challenge.

This drug has fifty-three patent family members in twenty-seven countries.

The generic ingredient in KORSUVA is difelikefalin acetate. One supplier is listed for this compound. Additional details are available on the difelikefalin acetate profile page.

DrugPatentWatch® Generic Entry Outlook for Korsuva

Korsuva was eligible for patent challenges on August 23, 2025.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be November 12, 2027. This may change due to patent challenges or generic licensing.

There have been four patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for KORSUVA?

- What are the global sales for KORSUVA?

- What is Average Wholesale Price for KORSUVA?

Summary for KORSUVA

| International Patents: | 53 |

| US Patents: | 12 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 21 |

| Drug Prices: | Drug price information for KORSUVA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for KORSUVA |

| What excipients (inactive ingredients) are in KORSUVA? | KORSUVA excipients list |

| DailyMed Link: | KORSUVA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for KORSUVA

Generic Entry Date for KORSUVA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

SOLUTION;INTRAVENOUS |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Pharmacology for KORSUVA

| Drug Class | Kappa Opioid Receptor Agonist |

| Mechanism of Action | Opioid kappa Receptor Agonists |

Paragraph IV (Patent) Challenges for KORSUVA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| KORSUVA | Intravenous Solution | difelikefalin acetate | 0.065 mg/1.3 mL | 214916 | 5 | 2025-08-25 |

US Patents and Regulatory Information for KORSUVA

KORSUVA is protected by twelve US patents and one FDA Regulatory Exclusivity.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of KORSUVA is ⤷ Get Started Free.

This potential generic entry date is based on patent 10,017,536.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Vifor Intl | KORSUVA | difelikefalin acetate | SOLUTION;INTRAVENOUS | 214916-001 | Aug 23, 2021 | RX | Yes | Yes | 10,793,596 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Vifor Intl | KORSUVA | difelikefalin acetate | SOLUTION;INTRAVENOUS | 214916-001 | Aug 23, 2021 | RX | Yes | Yes | 8,486,894 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Vifor Intl | KORSUVA | difelikefalin acetate | SOLUTION;INTRAVENOUS | 214916-001 | Aug 23, 2021 | RX | Yes | Yes | 9,359,399 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Vifor Intl | KORSUVA | difelikefalin acetate | SOLUTION;INTRAVENOUS | 214916-001 | Aug 23, 2021 | RX | Yes | Yes | 7,402,564 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Vifor Intl | KORSUVA | difelikefalin acetate | SOLUTION;INTRAVENOUS | 214916-001 | Aug 23, 2021 | RX | Yes | Yes | 8,236,766 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Vifor Intl | KORSUVA | difelikefalin acetate | SOLUTION;INTRAVENOUS | 214916-001 | Aug 23, 2021 | RX | Yes | Yes | 10,138,270 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for KORSUVA

When does loss-of-exclusivity occur for KORSUVA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 07317817

Estimated Expiration: ⤷ Get Started Free

Patent: 07319831

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0718651

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 67155

Estimated Expiration: ⤷ Get Started Free

Patent: 67460

Estimated Expiration: ⤷ Get Started Free

Patent: 98514

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1535336

Estimated Expiration: ⤷ Get Started Free

Patent: 1627049

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 16760

Estimated Expiration: ⤷ Get Started Free

Patent: 22032

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 64228

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 64228

Estimated Expiration: ⤷ Get Started Free

Patent: 79756

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 0220043

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1054

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 30814

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 200045

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 7923

Estimated Expiration: ⤷ Get Started Free

Patent: 7924

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 44810

Estimated Expiration: ⤷ Get Started Free

Patent: 64583

Estimated Expiration: ⤷ Get Started Free

Patent: 20180

Estimated Expiration: ⤷ Get Started Free

Patent: 10509343

Estimated Expiration: ⤷ Get Started Free

Patent: 10510966

Estimated Expiration: ⤷ Get Started Free

Patent: 13241447

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 064228

Estimated Expiration: ⤷ Get Started Free

Patent: 2022522

Estimated Expiration: ⤷ Get Started Free

Luxembourg

Patent: 0282

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 8144

Patent: SYNTHETIC PEPTIDE AMIDES

Estimated Expiration: ⤷ Get Started Free

Patent: 3678

Patent: SYNTHETIC PEPTIDE AMIDES AND DIMERS THEREOF

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 09004999

Patent: AMIDAS DE PEPTIDOS SINTETICOS Y DIMEROS DE LAS MISMAS. (SYNTHETIC PEPTIDE AMIDES AND DIMERS THEREOF.)

Estimated Expiration: ⤷ Get Started Free

Patent: 09005000

Patent: AMIDAS DE PEPTIDOS SINTETICOS. (SYNTHETIC PEPTIDE AMIDES.)

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 1199

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 7107

Patent: Synthetic peptide amide ligands of the kappa opiod receptor

Estimated Expiration: ⤷ Get Started Free

Patent: 7108

Patent: Synthetic peptide amides and dimers thereof of the kappa opioid receptor

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 64228

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 64228

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 00685

Patent: СИНТЕТИЧЕСКИЕ ПЕПТИДНЫЕ АМИДЫ (SYNTHETIC PEPTIDE AMIDES)

Estimated Expiration: ⤷ Get Started Free

Patent: 10399

Patent: СИНТЕТИЧЕСКИЕ ПЕПТИДНЫЕ АМИДЫ И ИХ ДИМЕРЫ (SYNTHETIC PEPTIDE AMIDES AND THEIR DIMERS)

Estimated Expiration: ⤷ Get Started Free

Patent: 09121297

Patent: СИНТЕТИЧЕСКИЕ ПЕПТИДНЫЕ АМИДЫ

Estimated Expiration: ⤷ Get Started Free

Patent: 09121298

Patent: СИНТЕТИЧЕСКИЕ ПЕПТИДНЫЕ АМИДЫ И ИХ ДИМЕРЫ

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 64228

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0903053

Patent: SYNTHETIC PEPTIDE AMIDES AND DIMERS THEREOF

Estimated Expiration: ⤷ Get Started Free

Patent: 0903054

Patent: SYNTHETIC PEPTIDE AMIDES

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1513736

Estimated Expiration: ⤷ Get Started Free

Patent: 1513737

Estimated Expiration: ⤷ Get Started Free

Patent: 1513842

Estimated Expiration: ⤷ Get Started Free

Patent: 090085096

Estimated Expiration: ⤷ Get Started Free

Patent: 090085097

Estimated Expiration: ⤷ Get Started Free

Patent: 140056396

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 94377

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering KORSUVA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| South Korea | 101513737 | ⤷ Get Started Free | |

| Israel | 197923 | אמידים פפטידים סינתטיים, תכשירים רוקחיים המכילים אותם ושימושים שלהם (Synthetic peptide amides, pharmaceutical compositions comprising the same and uses thereof) | ⤷ Get Started Free |

| Australia | 2007317817 | ⤷ Get Started Free | |

| Mexico | 2009004999 | AMIDAS DE PEPTIDOS SINTETICOS Y DIMEROS DE LAS MISMAS. (SYNTHETIC PEPTIDE AMIDES AND DIMERS THEREOF.) | ⤷ Get Started Free |

| Russian Federation | 2009121298 | СИНТЕТИЧЕСКИЕ ПЕПТИДНЫЕ АМИДЫ И ИХ ДИМЕРЫ | ⤷ Get Started Free |

| Japan | 2013241447 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for KORSUVA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2064228 | 301199 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: DIFELIKEFALIN, DESGEWENST IN DE VORM VAN EEN FARMACEUTISCH AANVAARDBAAR ZOUT, HYDRAAT, SOLVAAT, ZUURZOUT-HYDRAAT OF N-OXIDE; REGISTRATION NO/DATE: EU/1/22/1643 20220427 |

| 2064228 | 122022000071 | Germany | ⤷ Get Started Free | PRODUCT NAME: DIFELIKEFALIN IN ALLEN DURCH DAS GRUNDPATENT GESCHUETZTEN FORMEN; REGISTRATION NO/DATE: EU/1/22/1643 20220425 |

| 2064228 | LUC00282 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: DIFELIKEFALIN IN ALL FORMS COVERED BY THE BASIC PATENT; AUTHORISATION NUMBER AND DATE: EU/1/22/1643 20220427 |

| 2064228 | C202230052 | Spain | ⤷ Get Started Free | PRODUCT NAME: DIFELICEFALINA, OPCIONALMENTE EN FORMA DE UNA SAL FARMACEUTICAMENTE ACEPTABLE,HIDRATO, SOLVATO, HIDRATO DE SAL DE ACIDO O N-OXIDO; NATIONAL AUTHORISATION NUMBER: EU/1/22/1643; DATE OF AUTHORISATION: 20220425; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/22/1643; DATE OF FIRST AUTHORISATION IN EEA: 20220425 |

| 2064228 | C02064228/01 | Switzerland | ⤷ Get Started Free | FORMER OWNER: CARA THERAPEUTICS, INC., US |

| 2064228 | 2290040-1 | Sweden | ⤷ Get Started Free | PRODUCT NAME: DIFELIKEFALIN, OPTIONALLY IN THE FORM OF A PHARMACEUTICALLY ACCEPTABLE SALT, HYDRATE, SOLVATE, OR ACID-SALT-HYDRATE; REG. NO/DATE: EU/1/11/1643 20220427 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for KORSUVA

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.