Last updated: July 28, 2025

Introduction

Vifor Pharma (Vifor Intl) stands as a notable entity within the global pharmaceutical industry, specializing in iron deficiency, nephrology, and rare diseases. With a strategic focus on specialized treatments, the company operates in a competitive landscape shaped by innovation, regulatory shifts, and evolving healthcare demands. Analyzing Vifor’s market positioning, core competencies, and strategic directions reveals critical insights essential for stakeholders aiming to navigate this high-stakes environment effectively.

Market Positioning

Vifor Pharma holds a distinctive niche within the global pharmaceutical industry, emphasizing therapies for iron deficiency anemia, kidney diseases, and rare conditions. Its strategic emphasis on specialty pharmaceuticals has allowed it to carve out a resilient market share, especially in areas less susceptible to generic erosion. As of 2023, Vifor’s revenue exceeded CHF 1.5 billion, reflecting sustained growth driven by key products such as Ferinject (ferric carboxymaltose) and Venofer (iron sucrose), which are central to iron deficiency treatment protocols worldwide.

The company's global footprint spans Europe, North America, and emerging markets, leveraging partnerships and acquisitions to expand reach. Recent strategic moves, including the acquisition of Galencia in China and expansion efforts in North America, underpin Vifor’s ambition to penetrate high-growth markets and diversify revenue streams.

Core Strengths

Specialized Product Portfolio

Vifor’s focus on niche therapeutic areas affords it high investor and payer confidence. Its flagship products, Ferinject and Venofer, enjoy strong brand recognition, backed by extensive clinical data demonstrating efficacy and safety. This specialization fosters higher pricing power and robust reimbursement pathways, critical in the current environment of evolving healthcare economics.

Pipeline and Innovation

Investments in clinical development underpin Vifor’s growth strategy. The pipeline includes novel formulations of iron therapies, anemia treatments, and rare disease compounds, often in collaboration with research institutions. Their focus on improving administration routes (e.g., oral and intravenous variants) aims to enhance patient compliance and broaden market access.

Strategic Partnerships and Alliances

Vifor’s collaborations with global pharmaceutical giants like CSL Behring and Fresenius Medical Care enhance its R&D capabilities and distribution reach. These alliances facilitate access to new markets and enable co-development of innovative therapies, strengthening its competitive edge.

Regulatory and Quality Compliance

Vifor’s adherence to rigorous regulatory standards across multiple jurisdictions fosters trust and supports international expansion. Its reputation for quality assurance contributes to sustainable market access and brand loyalty.

Operational Agility

The company maintains lean operational structures, allowing rapid response to market changes, regulatory updates, and competitive threats. Its strategic acquisitions and divestitures reflect a proactive approach to optimize its portfolio and geographic footprint.

Strategic Challenges and Weaknesses

Dependence on Core Products

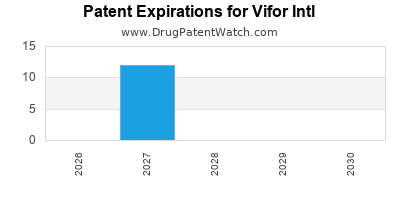

While Ferinject and Venofer have driven growth, heavy reliance on these therapies raises concerns of revenue concentration risk. Patent expirations and competition from biosimilars could erode market share if not proactively addressed.

Competitive Intensity

Major pharmaceutical players like Amgen, Moderna, and Fresenius are developing alternative anemia treatments and expanding their specialty portfolios. Additionally, biosimilar entrants pose a threat to Vifor’s branded products, emphasizing the need for continuous innovation.

Pricing and Reimbursement Pressures

Increasing healthcare cost containment measures exert downward pressure on drug prices globally. Reimbursement policies in key markets such as the US and Europe could impact profit margins unless offset by value-based pricing and differentiated offerings.

Limited Diversification of Indications

While focusing on iron deficiency and nephrology provides strategic benefits, the narrow therapeutic focus risks stagnation if these markets mature or face disruption. Broader diversification could mitigate this vulnerability.

Market Dynamics and Competitive Landscape

Industry Trends

-

Growing Burden of Chronic Diseases: The rise in chronic kidney disease (CKD) and anemia, especially among aging populations, sustains demand for Vifor’s core therapies.

-

Innovation in Delivery Systems: Advances in oral iron formulations and biologics for anemia management are reshaping treatment paradigms, necessitating ongoing R&D investment.

-

Regulatory Environment: Recent regulatory accelerations, such as conditional approvals in Europe and China, could facilitate faster market access but require compliance vigilance.

Competitors Overview

- Amgen & Roche: Offer biosimilars and novel biologics targeting anemia.

- AbbVie & Johnson & Johnson: Pursuing nephrology and rare disease territories.

- Emerging Biotech Firms: Focusing on oral therapies and gene editing technologies, potentially disrupting current treatment approaches.

Vifor competes primarily on its reputation for specialized, well-validated therapies, leveraging its expertise in iron management and nephrology.

Strategic Insights

Innovation and Portfolio Expansion

Vifor should prioritize expanding its pipeline with next-generation therapies that offer improved safety, ease of administration, and efficacy. Focused efforts on oral iron formulations could capture unmet needs, especially in non-hospital settings.

Geographic Diversification

Expanding presence in high-growth emerging markets — notably China and India — offers scalability. Strategic partnerships with local distributors and regulatory agencies are vital to capitalize on market potential.

Enhanced R&D Collaboration

Deepening alliances with biotech firms and academic institutions can accelerate innovation, especially in personalized medicine and biologics, securing a pipeline resilient against biosimilar threats.

Pricing & Market Access Strategies

Adopting flexible pricing strategies aligned with value-based care models will be critical to navigate reimbursement landscapes. Demonstrating cost-effectiveness through real-world evidence can bolster market access.

M&A and Portfolio Optimization

Targeted acquisitions to diversify indications and capably counter biosimilar threats will enhance Vifor’s competitive moat. Divestment of non-core assets can streamline operations and reinvest in high-impact R&D.

Key Takeaways

- Vifor Intl occupies a strategic niche in specialized pharmaceuticals, with a strong focus on iron deficiency and nephrology markets.

- Its core strengths include a proven product portfolio, strategic partnerships, innovation potential, and operational agility.

- The company faces headwinds from patent expirations, biosimilar competition, and pricing pressures; proactive innovation and diversification are paramount.

- Geographic expansion, especially into emerging markets, can enhance growth prospects but requires careful regulatory navigation.

- Strategic initiatives should include pipeline acceleration, market access optimization, and M&A activity to sustain leadership.

FAQs

1. How does Vifor Pharma differentiate itself from competitors?

Vifor specializes in high-value niche therapies for iron deficiency and nephrology, backed by extensive clinical data, strong brands, and strategic partnerships, enabling it to sustain higher pricing and market loyalty.

2. What are Vifor’s primary growth drivers at present?

The main drivers include expanding indications for its existing products, entering new markets (especially China and North America), pipeline innovation with oral formulations, and strategic acquisitions.

3. How vulnerable is Vifor to biosimilar and generic competition?

While patent protections and brand loyalty provide some shield, biosimilars pose a significant threat as patents expire. Continuous innovation and pipeline diversification are essential to mitigate this risk.

4. What strategic moves could Vifor make to increase its market share?

Vifor should enhance investments in R&D, explore oral and biologic therapies, expand geographically in high-growth regions, and pursue targeted acquisitions to expand its indication portfolio.

5. How is regulatory development impacting Vifor’s strategy?

Regulatory accelerations facilitate faster product approvals in key markets but require rigorous compliance. Staying ahead through proactive engagement and quality assurance is vital to capitalize on these opportunities.

Conclusion

Vifor Intl’s strategic positioning as a provider of specialized, high-value therapies has cultivated a resilient market presence amid a highly competitive environment. To maintain and enhance its leadership, Vifor must continue innovating, diversify geographically and scientifically, and navigate evolving regulatory and market access landscapes. Through targeted strategic initiatives, Vifor can capitalize on industry trends and reinforce its role as a key player in the specialty pharmaceutical sector.

Sources:

- Vifor Pharma Annual Report 2022

- EvaluatePharma, "Iron Deficiency Anemia Market Trends 2023"

- IQVIA Reports, "Global Specialty Pharmaceuticals 2023"

- Company Press Releases and Investor Presentations

- Regulatory Agency Publications (European Medicines Agency, FDA)