AMYVID Drug Patent Profile

✉ Email this page to a colleague

When do Amyvid patents expire, and what generic alternatives are available?

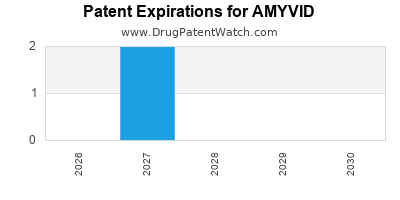

Amyvid is a drug marketed by Avid Radiopharms Inc and is included in one NDA. There are two patents protecting this drug.

This drug has fifty-one patent family members in thirty-three countries.

The generic ingredient in AMYVID is florbetapir f-18. One supplier is listed for this compound. Additional details are available on the florbetapir f-18 profile page.

DrugPatentWatch® Generic Entry Outlook for Amyvid

Amyvid was eligible for patent challenges on April 6, 2016.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be April 30, 2027. This may change due to patent challenges or generic licensing.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for AMYVID?

- What are the global sales for AMYVID?

- What is Average Wholesale Price for AMYVID?

Summary for AMYVID

| International Patents: | 51 |

| US Patents: | 2 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 40 |

| Patent Applications: | 391 |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for AMYVID |

| What excipients (inactive ingredients) are in AMYVID? | AMYVID excipients list |

| DailyMed Link: | AMYVID at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for AMYVID

Generic Entry Date for AMYVID*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

SOLUTION;INTRAVENOUS |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for AMYVID

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Columbia University | PHASE1 |

| Universidad Central del Caribe | Phase 2 |

| University of Puerto Rico | Phase 2 |

Pharmacology for AMYVID

| Drug Class | Radioactive Diagnostic Agent |

| Mechanism of Action | Positron Emitting Activity |

US Patents and Regulatory Information for AMYVID

AMYVID is protected by two US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of AMYVID is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Avid Radiopharms Inc | AMYVID | florbetapir f-18 | SOLUTION;INTRAVENOUS | 202008-001 | Apr 6, 2012 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Avid Radiopharms Inc | AMYVID | florbetapir f-18 | SOLUTION;INTRAVENOUS | 202008-003 | Apr 6, 2012 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Avid Radiopharms Inc | AMYVID | florbetapir f-18 | SOLUTION;INTRAVENOUS | 202008-004 | Oct 13, 2023 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Avid Radiopharms Inc | AMYVID | florbetapir f-18 | SOLUTION;INTRAVENOUS | 202008-003 | Apr 6, 2012 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for AMYVID

When does loss-of-exclusivity occur for AMYVID?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 07243712

Estimated Expiration: ⤷ Get Started Free

Austria

Patent: 39060

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0710225

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 44530

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1522624

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 329

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0120135

Estimated Expiration: ⤷ Get Started Free

Patent: 0170857

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 13048

Estimated Expiration: ⤷ Get Started Free

Patent: 19048

Estimated Expiration: ⤷ Get Started Free

Patent: 13024

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 99109

Estimated Expiration: ⤷ Get Started Free

Patent: 63392

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 088783

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 7898

Estimated Expiration: ⤷ Get Started Free

Patent: 0870389

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 99109

Estimated Expiration: ⤷ Get Started Free

Patent: 63391

Estimated Expiration: ⤷ Get Started Free

Patent: 63392

Estimated Expiration: ⤷ Get Started Free

France

Patent: C0034

Estimated Expiration: ⤷ Get Started Free

Guatemala

Patent: 0800201

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 32660

Estimated Expiration: ⤷ Get Started Free

Patent: 300028

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 3567

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 90954

Estimated Expiration: ⤷ Get Started Free

Patent: 09532349

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 63392

Estimated Expiration: ⤷ Get Started Free

Luxembourg

Patent: 232

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 08012527

Patent: DERIVADOS DE ESTIRILPIRIDINA Y SUS USOS PARA UNION A PLACAS AMILOIDES Y OBTENCION DE IMAGENES DE LAS MISMAS. (STYRYLPYRIDINE DERIVATIVES AND THEIR USE FOR BINDING AND IMAGING AMYLOID PLAQUES.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 0887

Patent: Styrylpyridine derivatives and their use for binding and imaging amyloid plaques

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 2090

Estimated Expiration: ⤷ Get Started Free

Patent: 18030

Estimated Expiration: ⤷ Get Started Free

Patent: 084590

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 99109

Estimated Expiration: ⤷ Get Started Free

Patent: 63392

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 99109

Estimated Expiration: ⤷ Get Started Free

Patent: 63392

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 222

Patent: DERIVATI STIRILPIRIDINA I NJIHOVA UPOTREBA ZA VEZIVANJE I IMIDŽING AMILOIDNIH PLAKOVA (STYRYLPYRIDINE DERIVATIVES AND THEIR USE FOR BINDING AND IMAGING AMYLOID PLAQUES)

Estimated Expiration: ⤷ Get Started Free

Patent: 171

Patent: DERIVATI STIRILPIRIDINA I NJIHOVA UPOTREBA ZA VEZIVANJE I IMIDŽING AMILOIDNIH PLAKOVA (STYRYLPYRIDINE DERIVATIVES AND THEIR USE FOR BINDING AND IMAGING AMYLOID PLAQUES)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 3338

Patent: STYRYLPYRIDINE DERIVATIVES AND THEIR USE FOR BINDING AND IMAGING AMYLOID PLAQUES

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 99109

Estimated Expiration: ⤷ Get Started Free

Patent: 63392

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0807955

Patent: STRYLPYRIDINE DERIVATIVES AND THEIR USE FOR BINDING AND IMAGING AMYLOID PLAQUES

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1376807

Estimated Expiration: ⤷ Get Started Free

Patent: 080106564

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 78785

Estimated Expiration: ⤷ Get Started Free

Patent: 28882

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 99366

Estimated Expiration: ⤷ Get Started Free

Patent: 0838852

Patent: Styrylpyridine derivatives and their use for binding and imaging amyloid plaques

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 802

Patent: СТИРИЛПИРИДИНОВЫЕ ПРОИЗВОДНЫЕ И ИХ ПРИМЕНЕНИЕ ДЛЯ СВЯЗЫВАНИЯ И ВИЗУАЛИЗАЦИИ АМИЛОИДНЫХ БЛЯШЕК;СТИРИЛПІРИДИНОВІ ПОХІДНІ І ЇХ ЗАСТОСУВАННЯ ДЛЯ ЗВ'ЯЗУВАННЯ І ВІЗУАЛІЗАЦІЇ АМІЛОЇДНИХ БЛЯШОК (STYRYLPYRIDINE COMPOUNDS USEFUL AND USE THEREOF IN IMAGING AMYLOID DEPOSITS)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering AMYVID around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Hungary | E032660 | ⤷ Get Started Free | |

| Portugal | 1999109 | ⤷ Get Started Free | |

| Norway | 342090 | ⤷ Get Started Free | |

| Portugal | 2363392 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for AMYVID

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1999109 | C300600 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: FLORBETAPIR ( SUP 18 /SUP F); REGISTRATION NO/DATE: EU/1/12/805 20130114 |

| 1999109 | 139 5017-2013 | Slovakia | ⤷ Get Started Free | PRODUCT NAME: FLORBETAPIR ( 18 F); REGISTRATION NO/DATE: EU/1/12/805 20130114 |

| 1999109 | 92232 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: FLORBETAPIR (18 F) |

| 1999109 | 122013000051 | Germany | ⤷ Get Started Free | PRODUCT NAME: FLORBETAPIR (18F); REGISTRATION NO/DATE: EU/1/12/805 20130114 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for AMYVID

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.