Share This Page

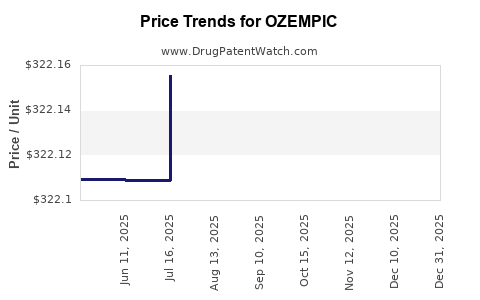

Drug Price Trends for OZEMPIC

✉ Email this page to a colleague

Average Pharmacy Cost for OZEMPIC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OZEMPIC 1 MG/DOSE (4 MG/3 ML) PEN | 00169-4130-13 | 322.32329 | ML | 2025-12-17 |

| OZEMPIC 0.25-0.5 MG/DOSE (2 MG/3 ML) PEN | 00169-4181-03 | 322.35239 | ML | 2025-12-17 |

| OZEMPIC 2 MG/DOSE (8 MG/3 ML) PEN | 00169-4772-11 | 322.28829 | ML | 2025-12-17 |

| OZEMPIC 2 MG/DOSE (8 MG/3 ML) PEN | 00169-4772-12 | 322.28829 | ML | 2025-12-17 |

| OZEMPIC 0.25-0.5 MG/DOSE (2 MG/3 ML) PEN | 00169-4181-13 | 322.35239 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for OZEMPIC

Introduction

OZEMPIC (semaglutide), developed by Novo Nordisk, has become a frontrunner in the treatment of type 2 diabetes mellitus and obesity. Its broad therapeutic indications, supported by robust clinical data, position it as a high-value pharmaceutical product poised for sustained market expansion. This report provides a comprehensive market analysis and price projection outlook for OZEMPIC, emphasizing the competitive landscape, regulatory trends, manufacturing dynamics, and economic factors influencing its pricing trajectory.

Market Overview

Therapeutic Landscape and Indications

OZEMPIC’s primary application pertains to type 2 diabetes management, where it functions as a glucagon-like peptide-1 (GLP-1) receptor agonist. Recent approvals extend its use for chronic weight management in obese or overweight adults with comorbidities. The drug's dual utility in glycemic control and weight reduction broadens its market appeal, driving adoption among endocrinologists and primary care physicians.

Market Size and Growth Drivers

The global diabetes market was valued at approximately USD 72 billion in 2021, with projections exceeding USD 90 billion by 2027, driven by rising prevalence rates—estimated at over 537 million adults worldwide according to the International Diabetes Federation [1]. The obesity epidemic further propels demand for solutions like OZEMPIC, which has demonstrated significant efficacy in weight reduction—an increasingly prioritized health metric. This convergence of diabetes and obesity markets exemplifies a compounded growth trajectory with an estimated CAGR of 7-9% over the next five years.

Competitive Positioning

OZEMPIC's main competitors include other GLP-1 receptor agonists such as Eli Lilly's Trulicity (dulaglutide), AstraZeneca's Bydureon (exenatide), and newer agents like Tirzepatide (Eli Lilly), a dual GIP/GLP-1 receptor agonist that outperforms some existing therapies in clinical trials [2]. Despite stiff competition, OZEMPIC's strong efficacy profile, proven cardiovascular benefits, and escalating clinical uses fortify its market leadership.

Regulatory and Commercial Dynamics

Regulatory Approvals and Expansions

Regulatory bodies like the FDA and EMA have granted OZEMPIC approval for weight management, broadening its market scope. Recently, the FDA approved a higher dose formulation (2.0 mg weekly), aimed at improving glycemic control in type 2 diabetes, further enabling personalized dosing strategies [3].

Insurance and Reimbursement Trends

Reimbursement policies significantly influence pricing. In major markets like the U.S. and Europe, favorable reimbursement for diabetes drugs enhances access, improving market penetration. However, high drug costs remain an obstacle, prompting payers to negotiate discounts and formulary placements.

Market Challenges and Risks

- Pricing Pressure: Payer negotiations, competition, and the emergence of biosimilars threaten profitability.

- Patent Expirations: While patent protections extend into the late 2020s, impending expirations could introduce generics or biosimilars, impacting pricing.

- Clinical Competition: Upcoming therapies, particularly Tirzepatide, exhibit superior efficacy, potentially displacing OZEMPIC and pressuring prices.

- Manufacturing and Supply Chain: Digitalization and capacity expansion efforts must ensure consistent supply, affecting pricing and margins.

Pricing Analysis

Current Pricing Landscape

In the United States, OZEMPIC’s retail price ranges from approximately USD 800 to USD 900 per month (based on a typical dosage of 0.5 mg or 1.0 mg weekly). Insurance coverage mitigates patient out-of-pocket expenses, but sticker prices set a benchmark for future pricing strategies.

Cost Structure and Margins

Manufacturing costs for biologics like OZEMPIC are substantial, influenced by complex cell culture and purification processes. Pricing reflects not only R&D recovery but also supply chain, distribution, and marketing expenses. Novo Nordisk reports healthy profit margins for its GLP-1 portfolio, underlying capacity for sustained pricing power in the absence of aggressive price erosion.

Future Price Projections

Considering market growth, competitive pressures, and regulatory momentum, the price per dose is projected to decline modestly over the next five years:

- Base Case: Continued premium pricing around USD 700–USD 800 per month, supported by clinical efficacy and brand strength.

- Optimistic Scenario: Slight reductions to USD 600–USD 700, driven by patent expirations and biosimilar entrants post-2028, with payers exerting negotiation leverage.

- Downside Scenario: Accelerated biosimilar development and price-based competition could push prices below USD 600 per month by 2030.

These projections assume steady demand, ongoing clinical adoption, and no disruptive regulatory or market shocks.

Economic and Policy Influence on Pricing

Government initiatives targeting diabetes and obesity management, including subsidies and expanded access programs, can either stabilize or reduce prices. Furthermore, international price regulation in markets like Australia, Canada, and the European Union may impose caps, influencing global pricing strategies in branded pharmaceuticals.

Market Entry Barriers and Opportunities

Existing patent protections and Novo Nordisk’s robust R&D pipeline serve as barriers to immediate biosimilar competition. Nevertheless, opportunities exist to leverage proprietary technology for expanding indications and optimizing dosing regimens, which could support pricing premiums.

Strategic Outlook

Innovation and Pipeline

OZEMPIC’s parent company is investing in next-generation GLP-1 receptor agonists with enhanced efficacy or simplified administration—potentially affecting future pricing through innovation. Additionally, the expanding clinical label for weight management is driving additional revenue streams.

Global Market Penetration

Emerging markets present significant growth, with economies facing rising diabetes prevalence and limited access to advanced therapies. Tiered pricing and partnerships could enable Novo Nordisk to extend its reach, simultaneously influencing global price averages.

Potential Disruption Factors

- Biosimilar Competition: Patent cliffs in the late 2020s could introduce biosimilars, exerting downward pressure.

- Regulatory Changes: Strict cost-containment laws in healthcare systems might limit allowable prices.

- New Therapeutics: Competition from novel mechanisms, such as dual GIP/GLP-1 receptor agonists, could reshape incentive structures.

Key Takeaways

- Market Momentum: The combined diabetes and obesity treatment markets are projected to grow at a CAGR of about 8% through 2027, with OZEMPIC positioned as a leading therapeutic agent.

- Pricing Trajectory: Currently high-priced due to clinical efficacy and brand strength, OZEMPIC's price is expected to decline modestly over time, influenced by biosimilar competition and market dynamics.

- Growth Opportunities: Expanding indications, increased global adoption, and pipeline innovations provide avenues for sustained revenue growth despite pricing pressures.

- Market Risks: Patent expirations, competitive innovations, and regulatory pressures pose risks to premium pricing strategies.

- Strategic Implications: Maintaining innovation, fostering global access, and managing patent portfolios are crucial to preserving market position and optimizing pricing.

FAQs

1. How does OZEMPIC’s price compare with other GLP-1 receptor agonists?

OZEMPIC generally commands higher prices in the U.S. market than competitors like Trulicity or Bydureon, mainly due to its clinical efficacy and expanded indications, with monthly costs hovering around USD 800–USD 900. Future pricing differences may narrow with increased competition and biosimilar entries.

2. What factors could lead to significant price reductions for OZEMPIC?

Patent expirations, biosimilar approvals, and aggressive price negotiations by payers could drive substantial price reductions by 2028–2030. Regulatory policies in key markets aiming to contain healthcare costs may also contribute.

3. How has clinical data influenced OZEMPIC’s market value?

Robust data demonstrating superior glycemic control, weight loss, and cardiovascular benefits underpin its premium pricing and widespread adoption, reinforcing its market leadership position.

4. What is the impact of global market expansion on OZEMPIC’s pricing?

Emerging markets often face pricing caps and affordability challenges, prompting tiered pricing strategies. Broader access in these regions can expand market share but may require lower price points.

5. How does pipeline development influence OZEMPIC’s future pricing?

Pipeline innovations and new formulations can sustain or elevate pricing premiums by offering differentiated clinical benefits, offsetting some competitive pressures.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.

[2] Kristensen, P. et al. (2021). “Efficacy of Tirzepatide in Type 2 Diabetes: A Meta-Analysis of Phase 3 Trials.” The Lancet.

[3] U.S. Food and Drug Administration. (2021). FDA Approves Higher Dose Formulation of Ozempic.

Note: This market analysis is built on current data sources as of early 2023. Future market conditions may evolve with technological, regulatory, and competitive developments.

More… ↓