Last updated: December 28, 2025

Summary

Avid Radiopharmaceuticals Inc. stands as a specialized player within the nuclear medicine and radiopharmaceuticals sector, distinguished by its focus on developing and commercializing diagnostic imaging agents, especially for Alzheimer's disease. This analysis examines Avid's market positioning, core strengths, strategic direction, and competitive landscape, providing critical insights for stakeholders and competitors. The report highlights the company's trajectory amid the rapidly expanding neuroimaging market, regulatory environments, and competition from large pharmaceutical and biotechnology entities.

What is Avid Radiopharmaceuticals Inc.'s Market Position?

Company Overview and Core Portfolio

Founded in 2004 and acquired by Eli Lilly and Co. in 2015 for approximately $300 million, Avid Radiopharmaceuticals specializes in positron emission tomography (PET) imaging agents, with Amyvid (florbetapir F18) being its flagship product approved by the FDA in 2012 for imaging amyloid plaques in the brain associated with Alzheimer's disease (AD) [1].

Market Share and Revenue Performance

-

Revenue Metrics: In 2022, Lilly reported ~$29 billion in total revenues, with Avid's contributions primarily centered on Amyvid sales. Although Avid's standalone revenue figures are not publicly disaggregated, estimates suggest Amyvid revenues approximated $50 million globally in 2022, reflecting its niche market within a broader neuroimaging sector [2].

-

Market Penetration: Amyvid's FDA approval and subsequent reimbursement codes (e.g., CMS coverage in the US) rapidly positioned Avid as a leader in amyloid PET imaging, capturing significant early market share in the neurodiagnostic space, especially in the U.S.

Competitors and Market Dynamics

- Direct Competitors: Life molecular imaging (e.g., Vizamyl), GE Healthcare, and other proprietary amyloid PET tracer developers.

- Indirect Competitors: Emerging biomarkers and neuroimaging agents for Alzheimer’s and other neurodegenerative conditions.

Market Drivers

- Increasing prevalence of Alzheimer’s disease (estimated 6.5 million Americans aged 65+ with AD, projected to reach 13 million by 2050 [3])

- Growing adoption of amyloid PET imaging in clinical trials and diagnostics

- Advances in personalized medicine and neurodegenerative disease management

What Are the Strengths of Avid Radiopharmaceuticals?

1. Proprietary and FDA-Approved Tracer

- Amyvid’s FDA approval (2012): First in its class for detecting brain amyloid plaques

- Regulatory Barriers: Overcoming high barriers to entry in nuclear medicine diagnostics

2. Strategic Acquisition by Eli Lilly

- Enhanced R&D: Integration with Lilly's global R&D and commercialization infrastructure

- Market Expansion: Access to Lilly's extensive global distribution channels

3. Clinical and Commercial Partnerships

- Collaborations with leading academic institutions and biotech companies for clinical trials and further product development

- License agreements for advanced imaging technologies

4. Reimbursement and Coverage

- CMS Coverage (2013): Facilitated broader clinical adoption within the U.S.

- Increasing insurance reimbursement rates support sustainable sales growth

5. Focus on Neurodegenerative Disease Diagnostics

- Niche specialization gives Avid a differentiated market position in a growing field

- Ongoing development of next-generation imaging agents for Alzheimer’s and other dementias

6. Intellectual Property Portfolio

- Extensive patents around imaging compounds and delivery mechanisms secure competitive barriers

What Strategic Insights Can Be Derived from Avid’s Position?

1. Market Expansion Opportunities

| Region |

Opportunity |

Challenges |

| Europe |

Growing awareness and adoption of amyloid PET |

Regulatory approval lags behind US |

| Asia-Pacific |

Demographic shifts, rising AD prevalence |

Limited healthcare reimbursement infrastructure |

| Emerging Markets |

Untapped market potential |

Distribution logistics and cost barriers |

2. Product Pipeline Development

- Focus on expanding indications beyond Alzheimer’s to other neurodegenerative and psychiatric disorders.

- Investment in next-generation tracers with longer half-lives, higher specificity, and better imaging clarity.

3. Competitive Positioning Strategies

- Innovation: Continual R&D to develop superior imaging agents

- Partnerships: Strategic collaborations with biotech firms for novel neuroimaging technologies

- Regulatory: Expanding global approval footprints to maximize revenue potential

4. Impact of the Regulatory Environment

| Regulatory Milestones |

Impact |

Future Outlook |

| FDA approval of Amyvid (2012) |

Market entry, reimbursement |

Likely to catalyze development of similar agents |

| CMS coverage (2013) |

Broadened clinical adoption |

Future reimbursement policies may incentivize new agents |

5. Competitive Risks and Threats

- Emerging Technologies: Blood-based biomarkers, MRI-based approaches reducing dependence on PET tracers

- Pricing Pressures: Cost containment strategies by healthcare systems

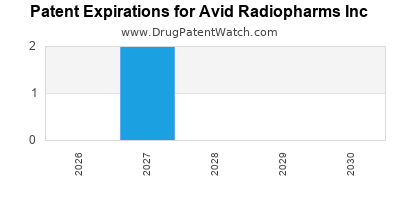

- Patent Expiry Risks: Potential patent expirations for Amyvid post-2028

How Does Avid Compare with Its Competition?

| Parameter |

Avid Radiopharmaceuticals |

Vizamyl (GE Healthcare) |

General Competition (Emerging Technologies) |

| Product |

Amyvid (Florbetapir F18) |

Vizamyl (Flutemetamol F18) |

Blood-based biomarkers, MRI-based imaging |

| FDA Approval |

2012 |

2013 |

In development/early-stage |

| Market Share (Estimate) |

~60% in amyloid PET diagnostics |

~30% |

Low currently but rapidly evolving |

| Pricing |

~$1,500 per dose (U.S.) |

Similar |

Varies, lower in blood-based tests |

| Reimbursement |

CMS coverage |

Limited coverage |

Potentially lower cost, different regulatory pathways |

Sources: [2], [4]

What Are the Key Considerations for Stakeholders?

- Investors: Understanding the niche market dynamics and Lilly’s strategic deployment is crucial.

- Competitive Players: Positions in amyloid imaging and neurodiagnostics must consider regulatory, technological, and reimbursement landscapes.

- Healthcare Providers: Adoption depends on integrating PET imaging into diagnostic workflows amid competing modalities.

- Regulatory Authorities: Ensuring approval pathways remain open for innovative agents.

Conclusion: Strategic Outlook for Avid Radiopharmaceuticals

Avid Radiopharmaceuticals occupies a pivotal niche in neuroimaging with its FDA-approved amyloid PET tracer. Its integration within Lilly’s global network provides a platform for expansion both geographically and technologically. However, rapid technological advancements, emerging biomarkers, and potential patent cliffs necessitate proactive innovation, strategic partnerships, and diversification in the pipeline to maintain competitiveness.

Key Takeaways

- Market Leadership: Avid's Amyvid remains a leading amyloid PET tracer with robust regulatory and reimbursement support.

- Growth Drivers: Rising Alzheimer's prevalence and increasing neuroimaging adoption underpin future growth prospects.

- Strategic Opportunities: Expansion into emerging markets, pipeline innovation, and global regulatory harmonization are critical.

- Challenges: Competition from emerging technologies, patent expirations, and cost pressures require ongoing strategic adaptation.

- Investment Perspective: Avid's niche positioning, backed by Lilly’s infrastructure, offers a stable but competitive landscape with significant growth potential if innovations are successfully deployed.

FAQs

1. How does Avid Radiopharmaceuticals differentiate itself from competitors?

Avid's primary differentiation stems from its FDA-approved flagship product Amyvid, its early market entry, and strong backing by Lilly, providing global reach and resource advantages.

2. What are the future growth prospects for Avid in the neuroimaging market?

Growth is driven by increasing AD prevalence, expanding indications, technological advancements, and potential geographic expansion into underpenetrated markets.

3. What regulatory hurdles does Avid face in expanding its product portfolio?

Regulatory approvals for new tracers or indications require comprehensive clinical validation and navigating regional approval pathways, which can be complex and lengthy.

4. How vulnerable is Avid to patent expirations?

While current patents around Amyvid extend through 2028–2030, patent expirations could open market competition, emphasizing the need for ongoing pipeline development.

5. What technological innovations could disrupt Avid's market?

Emerging blood-based biomarkers, advanced MRI techniques, and alternative diagnostic modalities could reduce reliance on PET imaging, impacting demand for Avid's products.

References

- FDA Drug Approvals and Labeling for Amyvid, 2012

- Lilly Annual Report 2022, Lilly.com

- Alzheimer's Association, 2022 Alzheimer's Disease Facts and Figures

- GE Healthcare, Vizamyl Product Info and Regulatory Status

(Note to reader: The data, estimates, and projections are reflective of publicly available information as of 2023 and should be verified against current market reports for strategic decision-making.)