FARXIGA Drug Patent Profile

✉ Email this page to a colleague

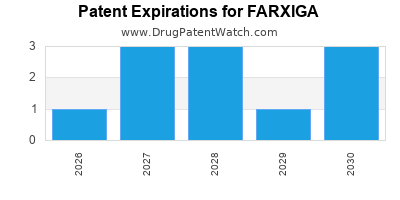

When do Farxiga patents expire, and when can generic versions of Farxiga launch?

Farxiga is a drug marketed by Astrazeneca Ab and is included in one NDA. There are nineteen patents protecting this drug and one Paragraph IV challenge.

This drug has four hundred and fifty-one patent family members in fifty-two countries.

The generic ingredient in FARXIGA is dapagliflozin. There are twenty-six drug master file entries for this compound. Five suppliers are listed for this compound. Additional details are available on the dapagliflozin profile page.

DrugPatentWatch® Generic Entry Outlook for Farxiga

Farxiga was eligible for patent challenges on January 8, 2018.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be June 16, 2030. This may change due to patent challenges or generic licensing.

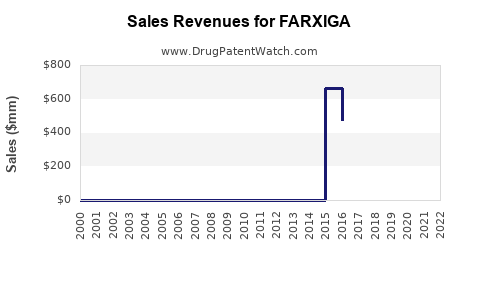

Annual sales in 2022 were $5.3bn, indicating a strong incentive for generic entry.

There have been thirteen patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There are sixteen tentative approvals for the generic drug (dapagliflozin), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for FARXIGA?

- What are the global sales for FARXIGA?

- What is Average Wholesale Price for FARXIGA?

Summary for FARXIGA

| International Patents: | 451 |

| US Patents: | 19 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 5 |

| Raw Ingredient (Bulk) Api Vendors: | 2 |

| Clinical Trials: | 50 |

| Patent Applications: | 1 |

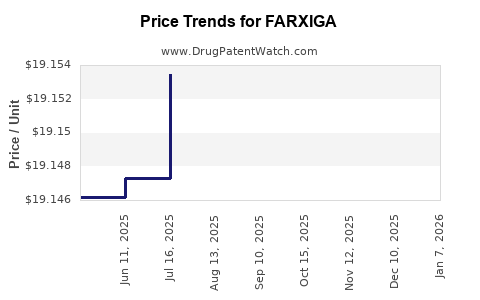

| Drug Prices: | Drug price information for FARXIGA |

| Drug Sales Revenues: | Drug sales revenues for FARXIGA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for FARXIGA |

| What excipients (inactive ingredients) are in FARXIGA? | FARXIGA excipients list |

| DailyMed Link: | FARXIGA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for FARXIGA

Generic Entry Date for FARXIGA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for FARXIGA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Han Xu, M.D., Ph.D., FAPCR, Sponsor-Investigator, IRB Chair | PHASE2 |

| UnitedHealthcare | PHASE2 |

| The University of Hong Kong | Phase 2 |

Pharmacology for FARXIGA

| Drug Class | Sodium-Glucose Cotransporter 2 Inhibitor |

| Mechanism of Action | Sodium-Glucose Transporter 2 Inhibitors |

Paragraph IV (Patent) Challenges for FARXIGA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| FARXIGA | Tablets | dapagliflozin | 5 mg and 10 mg | 202293 | 20 | 2018-01-08 |

US Patents and Regulatory Information for FARXIGA

FARXIGA is protected by nineteen US patents and four FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of FARXIGA is ⤷ Get Started Free.

This potential generic entry date is based on patent 7,919,598.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Astrazeneca Ab | FARXIGA | dapagliflozin | TABLET;ORAL | 202293-002 | Jan 8, 2014 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Astrazeneca Ab | FARXIGA | dapagliflozin | TABLET;ORAL | 202293-002 | Jan 8, 2014 | RX | Yes | Yes | 8,461,105*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Astrazeneca Ab | FARXIGA | dapagliflozin | TABLET;ORAL | 202293-002 | Jan 8, 2014 | RX | Yes | Yes | 8,685,934*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for FARXIGA

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Astrazeneca Ab | FARXIGA | dapagliflozin | TABLET;ORAL | 202293-001 | Jan 8, 2014 | 6,956,026 | ⤷ Get Started Free |

| Astrazeneca Ab | FARXIGA | dapagliflozin | TABLET;ORAL | 202293-001 | Jan 8, 2014 | 7,741,269 | ⤷ Get Started Free |

| Astrazeneca Ab | FARXIGA | dapagliflozin | TABLET;ORAL | 202293-001 | Jan 8, 2014 | 7,563,871 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for FARXIGA

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| AstraZeneca AB | Forxiga | dapagliflozin | EMEA/H/C/002322Type 2 diabetes mellitusForxiga is indicated in adults and children aged 10 years and above for the treatment of insufficiently controlled type 2 diabetes mellitus as an adjunct to diet and exerciseas monotherapy when metformin is considered inappropriate due to intolerance.in addition to other medicinal products for the treatment of type 2 diabetes.For study results with respect to combination of therapies, effects on glycaemic control, cardiovascular and renal events, and the populations studied, see sections 4.4, 4.5 and 5.1.Heart failureForxiga is indicated in adults for the treatment of symptomatic chronic heart failure.Chronic kidney diseaseForxiga is indicated in adults for the treatment of chronic kidney disease. | Authorised | no | no | no | 2012-11-11 | |

| AstraZeneca AB | Edistride | dapagliflozin | EMEA/H/C/004161Type 2 diabetes mellitusEdistride is indicated in adults and children aged 10 years and above for the treatment of insufficiently controlled type 2 diabetes mellitus as an adjunct to diet and exerciseas monotherapy when metformin is considered inappropriate due to intolerance.in addition to other medicinal products for the treatment of type 2 diabetes.For study results with respect to combination of therapies, effects on glycaemic control, cardiovascular and renal events, and the populations studied, see sections 4.4, 4.5 and 5.1.Heart failureEdistride is indicated in adults for the treatment of symptomatic chronic heart failure.Chronic kidney diseaseEdistride is indicated in adults for the treatment of chronic kidney disease. | Authorised | no | no | no | 2015-11-09 | |

| Viatris Limited | Dapagliflozin Viatris | dapagliflozin | EMEA/H/C/006006Type 2 diabetes mellitusDapagliflozin Viatris is indicated in adults and children aged 10 years and above for the treatment of insufficiently controlled type 2 diabetes mellitus as an adjunct to diet and exercise- as monotherapy when metformin is considered inappropriate due to intolerance.- in addition to other medicinal products for the treatment of type 2 diabetes.For study results with respect to combination of therapies, effects on glycaemic control, cardiovascular and renal events, and the populations studied, see sections 4.4, 4.5 and 5.1.Heart failureDapagliflozin Viatris is indicated in adults for the treatment of symptomatic chronic heart failure with reduced ejection fraction.Chronic kidney diseaseDapagliflozin Viatris is indicated in adults for the treatment of chronic kidney disease. | Authorised | yes | no | no | 2023-03-24 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for FARXIGA

When does loss-of-exclusivity occur for FARXIGA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 1730

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 07265246

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0713544

Estimated Expiration: ⤷ Get Started Free

Patent: 2017015106

Estimated Expiration: ⤷ Get Started Free

Patent: 2017021516

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 53344

Estimated Expiration: ⤷ Get Started Free

Patent: 24318

Estimated Expiration: ⤷ Get Started Free

Patent: 85797

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 07001915

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1479287

Estimated Expiration: ⤷ Get Started Free

Patent: 3145773

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 60299

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0141007

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 15738

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 69374

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 8229

Estimated Expiration: ⤷ Get Started Free

Patent: 0428

Estimated Expiration: ⤷ Get Started Free

Patent: 8259

Estimated Expiration: ⤷ Get Started Free

Patent: 5999

Estimated Expiration: ⤷ Get Started Free

Patent: 0900066

Estimated Expiration: ⤷ Get Started Free

Patent: 1171333

Estimated Expiration: ⤷ Get Started Free

Patent: 1490902

Estimated Expiration: ⤷ Get Started Free

Patent: 1791254

Estimated Expiration: ⤷ Get Started Free

Patent: 2091391

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 69374

Estimated Expiration: ⤷ Get Started Free

Patent: 57918

Estimated Expiration: ⤷ Get Started Free

Patent: 45466

Estimated Expiration: ⤷ Get Started Free

Patent: 63807

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 27359

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 5882

Estimated Expiration: ⤷ Get Started Free

Patent: 4180

Estimated Expiration: ⤷ Get Started Free

Patent: 4181

Estimated Expiration: ⤷ Get Started Free

Patent: 4182

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 13889

Estimated Expiration: ⤷ Get Started Free

Patent: 66651

Estimated Expiration: ⤷ Get Started Free

Patent: 37187

Estimated Expiration: ⤷ Get Started Free

Patent: 09545525

Estimated Expiration: ⤷ Get Started Free

Patent: 13209394

Estimated Expiration: ⤷ Get Started Free

Patent: 15071636

Estimated Expiration: ⤷ Get Started Free

Patent: 16172758

Estimated Expiration: ⤷ Get Started Free

Patent: 17222681

Estimated Expiration: ⤷ Get Started Free

Patent: 19059779

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 8566

Estimated Expiration: ⤷ Get Started Free

Patent: 3930

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 9143

Estimated Expiration: ⤷ Get Started Free

Patent: 7155

Estimated Expiration: ⤷ Get Started Free

Patent: 08015377

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 4346

Estimated Expiration: ⤷ Get Started Free

Patent: 9190

Estimated Expiration: ⤷ Get Started Free

Patent: 9195

Estimated Expiration: ⤷ Get Started Free

Patent: 9202

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 6828

Estimated Expiration: ⤷ Get Started Free

Patent: 7770

Estimated Expiration: ⤷ Get Started Free

Patent: 085169

Estimated Expiration: ⤷ Get Started Free

Patent: 221233

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 080349

Estimated Expiration: ⤷ Get Started Free

Patent: 120776

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 012500168

Patent: CRYSTALLINE SOLVATES AND COMPLEXES OF (IS)-1,5-ANHYDRO-L-C-(3-((PHENYL)METHYL)PHENYL)-D-GLUCITOL DERIVATIVES WITH AMINO ACIDS AS SGLT2 INHIBITORS FOR THE TREATMENT OF DIABETES

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 69374

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 69374

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 638

Patent: KRISTALNI SOLVATI DERIVATA (1S)-1,5-ANHIDRO-1-C-(3-((FENIL) METIL) FENIL)-D-GLUCITOLA SA ALKOHOLIMA KAO INHIBITORI SGLT2 ZA TRETMAN DIJABETESA (CRYSTALLINE SOLVATES OF (1S)-1,5-ANHYDRO-1-C-(3-((PHENYL) METHYL) PHENYL)-D-GLUCITOL DERIVATIVES WITH ALCOHOLS AS SGLT2 INHIBITORS FOR THE TREATMENT OF DIABETES)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 2741

Patent: CRYSTALLINE SOLVATES AND COMPLEXES OF (1S) -1, 5-ANHYDRO-1-C- (3- ( (PHENYL) METHYL) PHENYL) -D-GLUCITOL DERIVATIVES WITH AMINO ACIDS AS SGLT2 INHIBITORS FOR THE TREATMENT OF DIABETES

Estimated Expiration: ⤷ Get Started Free

Patent: 201402181S

Patent: CRYSTALLINE SOLVATES AND COMPLEXES OF (1S) -1, 5-ANHYDRO-1-C- (3- ( (PHENYL) METHYL) PHENYL) -D-GLUCITOL DERIVATIVES WITH AMINO ACIDS AS SGLT2 INHIBITORS FOR THE TREATMENT OF DIABETES

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 69374

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0810475

Patent: CRYSTALLINE SOLVATES AND COMPLEXES OF (IS)-1,5-ANHYDRO-L-C-(3-((PHENYL)METHYL)PHENYL)-D-GLUCITOL DERIVATIVES WITH AMINO ACIDS AS SGLT2 INHIBITORS FOR THE TREATMENT OF DIABETES

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1493102

Estimated Expiration: ⤷ Get Started Free

Patent: 090023643

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 21665

Estimated Expiration: ⤷ Get Started Free

Patent: 59862

Estimated Expiration: ⤷ Get Started Free

Patent: 69130

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 21245

Estimated Expiration: ⤷ Get Started Free

Patent: 66876

Estimated Expiration: ⤷ Get Started Free

Patent: 19528

Estimated Expiration: ⤷ Get Started Free

Patent: 0811127

Patent: Crystal structures of SGLT2 inhibitors and processes for preparing same

Estimated Expiration: ⤷ Get Started Free

Patent: 1406743

Patent: Crystal structures of SGLT2 inhibitors and processes for preparing same

Estimated Expiration: ⤷ Get Started Free

Patent: 1509927

Patent: Crystal structures of SGLT2 inhibitors and processes for preparing same

Estimated Expiration: ⤷ Get Started Free

Patent: 1546054

Patent: Crystal structures of SGLT2 inhibitors and processes for preparing same

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 765

Patent: КРИСТАЛЛИЧЕСКИЕ СОЛЬВАТЫ И КОМПЛЕКСЫ ПРОИЗВОДНЫХ (IS)-1,5-АНГИДРО-L-C-(3-((ФЕНИЛ)МЕТИЛ)ФЕНИЛ)-D-ГЛЮЦИТОЛА С АМИНОКИСЛОТАМИ КАК ИНГИБИТОРЫ БЕЛКА SGLT2, ПРИГОДНЫЕ В ЛЕЧЕНИИ ДИАБЕТА;КРИСТАЛІЧНІ СОЛЬВАТИ І КОМПЛЕКСИ ПОХІДНИХ (IS)-1,5-АНГІДРО-L-C-(3-((ФЕНІЛ)МЕТИЛ)ФЕНІЛ)-D-ГЛЮЦИТОЛУ З АМІНОКИСЛОТАМИ ЯК ІНГІБІТОРИ БІЛКА SGLT2, ПРИДАТНІ У ЛІКУВАННІ ДІАБЕТУ (CRYSTALLINE SOLVATES AND COMPLEXES OF (IS) -1, 5-ANHYDRO-L-C- (3- ((PHENYL) METHYL) PHENYL) -D-GLUCITOL DERIVATIVES WITH AMINO ACIDS AS SGLT2 INHIBITORS FOR THE TREATMENT OF DIABETES)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering FARXIGA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| China | 102743340 | ⤷ Get Started Free | |

| South Korea | 101021752 | ⤷ Get Started Free | |

| Australia | 2023202490 | METHODS OF TREATING CHRONIC KIDNEY DISEASE WITH DAPAGLIFLOZIN | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for FARXIGA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2139494 | 132020000000115 | Italy | ⤷ Get Started Free | PRODUCT NAME: SAXAGLIPTIN E DAPAGLIFLOZIN(QTERN); AUTHORISATION NUMBER(S) AND DATE(S): EU/1/16/1108, 20160719 |

| 0996459 | 464 | Finland | ⤷ Get Started Free | |

| 1734971 | CA 2012 00015 | Denmark | ⤷ Get Started Free | PRODUCT NAME: EXENATIDE; REG. NO/DATE: EU/1/11/696/001-002 20110623 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for FARXIGA (Dapagliflozin)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.