Last updated: July 31, 2025

Introduction

Biofrontera AG, a German biotechnology firm specializing in dermatological products, has carved a niche within the competitive landscape of niche pharmaceutical markets. Its primary focus on photodynamic therapy (PDT) and proprietary formulations positions it uniquely amidst global dermatology and oncological treatment sectors. This analysis explores Biofrontera's market standing, core strengths, and strategic outlook to empower stakeholders with actionable insights for competitive advantage.

Market Position Overview

Biofrontera operates predominantly within dermatology, oncology, and aesthetic medicine. Its flagship product, Ameluz®, a photosensitizing agent for treating actinic keratosis (AK), and FecoVire for photodynamic therapy (PDT), are central to its portfolio.

The company has experienced significant market expansion, driven by increasing prevalence of skin cancers and rising demand for minimally invasive dermatological treatments. According to industry reports, the global actinic keratosis treatment market is projected to grow at a compound annual growth rate (CAGR) of 7% through 2028, providing robust demand channels for Biofrontera's solutions[1].

Biofrontera’s strategic penetration into North American markets, especially after obtaining FDA approval for Ameluz in 2017, bolstered its presence significantly. Despite facing stiff competition from multi-national giants like Galderma and DUSA Pharmaceuticals, Biofrontera's focus on niche PDT markets and its innovative product pipeline bolster its competitive resilience.

Core Strengths

1. Proprietary Photodynamic Therapy Platform

Biofrontera's competitive edge lies in its proprietary PDT technology, which leverages photoactivatable compounds for precise, minimally invasive dermatological treatments. Its key products, Ameluz® and BF-RhodoLED® (a device for activating the photosensitizer), establish a closed-loop ecosystem that enhances treatment efficacy and patient compliance.

2. Robust R&D and Innovation Pipeline

The company's commitment to innovation has yielded a promising pipeline, including novel formulations for actinic keratosis, basal cell carcinoma, and cosmetic applications such as acne and skin rejuvenation. Its ongoing clinical trials and collaborations with dermatology research centers underpin future growth prospects.

3. Strategic Regulatory Approvals

Securing approvals across key markets such as the US, EU, and Asia has increased Biofrontera's credibility and market access. These regulatory achievements serve as barriers to entry for new entrants and demonstrate the company's compliance with international standards.

4. Niche Market Focus

Unlike competitors targeting broad dermatological or oncological niches, Biofrontera's specialization in PDT provides a competitive moat. This focus reduces competitive pressure while positioning the company as an expert in phototherapy.

5. Geographic Expansion Strategy

Biofrontera’s aggressive expansion into North America, China, and other emerging markets signals a proactive approach to diversification and revenue growth. Local partnerships and distribution agreements accelerate market penetration.

Strategic Insights and Challenges

A. Competitive Landscape Dynamics

Major players, notably Galderma, DUSA Pharmaceuticals, and Roche, dominate dermatological treatments with broader portfolios. Biofrontera’s challenge lies in differentiating through technological innovation and targeted marketing. To sustain its position, the company must continue investing in R&D, fostering clinical evidence, and expanding its evidence basis for PDT's efficacy.

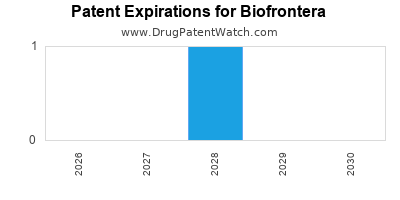

B. Intellectual Property and Patent Portfolio

Securing and extending patent protections remains critical. Biofrontera’s patents cover key formulations and devices, providing a period of exclusivity. Vigilant IP management will prevent infringement issues and preserve market share against potential generics.

C. Regulatory and Reimbursement Hurdles

Differing regulatory landscapes and reimbursement policies governing PDT treatments could influence adoption rates. While FDA approvals bolster US market access, reimbursement negotiations with payers are crucial for widespread clinical adoption.

D. Market Education and Physician Adoption

Awareness campaigns underscoring PDT's benefits need bolstering. Physicians often prefer established treatments, so targeted education about efficacy, safety, and cosmetic benefits is vital. Success hinges on demonstrating superior outcomes and cost-effectiveness.

E. New Product Development and Licensing

Expanding the product pipeline through in-house R&D or licensing deals will diversify Biofrontera’s revenue streams. Collaborating with global dermatology innovators and leveraging technological advancements in photosensitizer formulations offers pathways to sustain growth.

Competitive SWOT Analysis

| Strengths |

Weaknesses |

| Proprietary PDT platform |

Limited brand recognition compared to industry giants |

| Strong regulatory approvals |

Smaller product portfolio |

| Focused niche specialization |

Dependence on select markets (e.g., US, EU) |

| Geographic expansion initiatives |

Limited manufacturing capacity compared to larger firms |

| Opportunities |

Threats |

| Growing prevalence of skin cancers |

Intense competition from large pharmaceutical companies |

| Expanding into emerging markets |

Patent expiry and generics threat |

| Product development in cosmetic dermatology |

Regulatory delays or rejections |

| Strategic acquisitions or partnerships |

Market hesitation due to reimbursement uncertainties |

Strategic Recommendations

1. Enhance Clinical Evidence Base

Further clinical trials demonstrating PDT's efficacy relative to competitors can strengthen physician confidence and accelerate adoption. Publication in high-impact dermatology journals and presentation at industry conferences will elevate credibility.

2. Expand Global Regulatory Footprint

Accelerating registrations in emerging markets like China, India, and Southeast Asia will diversify revenue streams. Establishing local partnerships can facilitate market entry and compliance.

3. Focus on Service and Education

Investing in professional education programs about PDT advantages and patient management can increase acceptance among dermatologists and oncologists, thereby expanding the customer base.

4. Leverage Digital and Telemedicine Platforms

Integrating digital health solutions, including remote consultations and treatment monitoring, aligns with current healthcare delivery trends and broadens reach.

5. Pursue Strategic Collaborations

Partnering with academic institutions or other biotech firms can unlock new therapeutics and accelerate innovation. Licensing agreements can also provide access to cutting-edge formulations and devices.

Key Takeaways

-

Niche Focus as a Differentiator: Biofrontera’s specialization in PDT offers a distinct competitive position amidst broader dermatological treatment providers.

-

Regulatory and Geographic Expansion: Continued success depends on robust regulatory strategies and entry into emerging markets, which can significantly elevate revenue streams.

-

Innovation and Evidence-Based Practice: Sustained R&D and clinical validation are critical to demonstrating efficacy and maintaining leadership in photodynamic therapy.

-

Market Education and Physician Engagement: Increasing provider awareness of PDT benefits is essential to accelerate adoption rates.

-

Strategic Partnerships and IP Management: Protecting intellectual property and fostering collaborations are key to defending market share and expanding product offerings.

FAQs

1. How does Biofrontera differentiate itself from its competitors?

Biofrontera's core differentiation stems from its proprietary PDT technology, focus on dermatology niche markets, and strategic regulatory approvals, enabling targeted treatment options with demonstrated efficacy, which larger competitors may not emphasize as strongly.

2. What are the main challenges facing Biofrontera?

Challenges include intense competition, patent expirations, regulatory hurdles across different markets, reimbursement policies, and the need to expand clinical evidence to support wider adoption.

3. What growth opportunities exist for Biofrontera?

Key growth avenues include geographical expansion into emerging markets, pipeline development in cosmetic dermatology, strategic licensing, and innovations in phototherapy devices and formulations.

4. How significant is the role of regulatory approvals in Biofrontera’s success?

Regulatory approvals serve as critical barriers to entry for competitors, establish credibility, enable market access, and influence reimbursement decisions, making them fundamental to the company's growth strategy.

5. What steps should Biofrontera take to strengthen its competitive position?

The company should increase investment in clinical trials, expand into new markets, enhance physician education efforts, pursue partnerships for innovation, and fortify its IP portfolio to sustain long-term leadership.

References

[1] Market Research Future. “Actinic Keratosis Market, 2028.” Published 2022.