Share This Page

Drug Price Trends for EPIDUO FORTE

✉ Email this page to a colleague

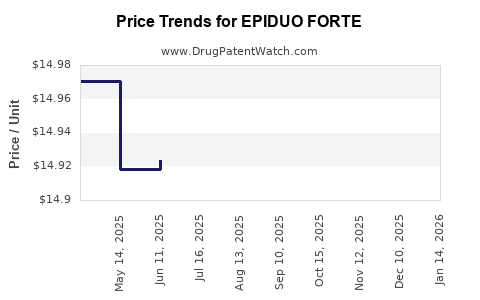

Average Pharmacy Cost for EPIDUO FORTE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.92226 | GM | 2025-12-17 |

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.92226 | GM | 2025-11-19 |

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.93860 | GM | 2025-10-22 |

| EPIDUO FORTE 0.3-2.5% GEL PUMP | 00299-5906-45 | 14.93860 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EPIDUO FORTE

Introduction

EPIDUO FORTE, a topical dermatological treatment, combines adapalene 0.3% and benzoyl peroxide 2.5%, targeting moderate to severe acne vulgaris. As a prescription medication approved by regulatory agencies such as the FDA, it possesses a significant market share in acne therapy, especially in markets with high prevalence rates of acne and expanding dermatological care access.

This analysis explores the current market landscape for EPIDUO FORTE, evaluates competitive positioning, and projects future pricing trends influenced by market dynamics, regulatory factors, and healthcare policies. The goal: to inform stakeholders—including pharmaceutical companies, investors, healthcare providers, and payers—about potential revenue streams and strategic considerations.

Market Landscape Overview

Global Acne Market Overview

The global acne treatment market is projected to reach approximately USD 9.5 billion by 2025, growing at a compound annual growth rate (CAGR) of around 4%.[1] The increasing prevalence of acne, especially among adolescents and young adults, drives the demand for effective treatments like EPIDUO FORTE. The North American market commands the largest share, driven by high awareness, insurance coverage, and advanced dermatology practices.

EPIDUO FORTE Positioning

EPIDUO FORTE is marketed primarily in the United States and select international markets. Its combination formulation provides a dual mechanism—retinoid action via adapalene and antimicrobial effects through benzoyl peroxide—filling a niche for patients with moderate to severe acne resistant to monotherapies.

Key factors supporting its market positioning include:

- Proven efficacy demonstrated through clinical trials.

- Favorable safety profile.

- Prescriber preference for combination therapies due to enhanced effectiveness.

Competitive Landscape

EPIDUO FORTE faces competition from both branded and generic formulations:

- Branded competitors: Differin Gel (adapalene), Benzaclin (clindamycin and benzoyl peroxide), Epiduo (adapalene and benzoyl peroxide).

- Generic options: Many topical retinoids and benzoyl peroxide formulations available at lower price points.

Emerging competitors include novel formulations with improved tolerability or delivery mechanisms, such as foam and patch-based therapies.

Regulatory and Reimbursement Factors

Regulatory approvals in different jurisdictions influence market access and pricing strategies:

- In the U.S., EPIDUO FORTE (marketed by Ortho Dermatologics) holds FDA approval for acne treatment.

- Payer policies favor cost-effective regimens, often favoring generics due to price sensitivity.

- The patent status and exclusivity periods significantly impact pricing and market share.[2]

Reimbursement frameworks impact patient out-of-pocket costs, influencing adherence and prescription rates. Insurers tend to favor generics, which puts upward pressure on branded drugs' prices.

Market Dynamics Affecting Price Projections

Patent and Exclusivity Status

EPIDUO FORTE's patent protection has historically allowed for premium pricing. However, patent expirations or challenges from generic manufacturers significantly impact pricing, typically leading to price erosion over time.[3] The expiration of formulation patents would likely lead to increased generic competition, reducing prices.

Manufacturing Costs and Formulation Improvements

Advances in manufacturing processes can reduce costs, possibly allowing for stable or slightly reduced prices without negatively impacting margins. However, pharmaceutical companies often maintain premium pricing for branded formulations to capitalize on brand loyalty and perceived quality.

Prescriber and Patient Preferences

The combination of adapalene and benzoyl peroxide remains popular due to clinical efficacy. Prescriber confidence sustains demand, allowing for relatively stable pricing, especially in markets where insurance coverage minimizes patient impact.

Market Penetration and Expansion Strategies

Expanding into emerging markets or regions with rising acne prevalence can influence overall demand. Price sensitivity in these regions often necessitates tiered pricing or the availability of generic versions.

Price Projections

Based on current market conditions and historical pricing trends, the following projections can be formulated:

1. Short-term (Next 1–2 years):

- U.S. market: Maintaining current premium pricing (~USD 600–800 per 30g tube) with slight annual growth (~2–3%) due to inflation and demand. Patent protection reinforces stable margins.

- International markets: Prices vary considerably, with developed regions pricing similar to the U.S., while emerging markets may see discounts (~USD 200–400).

2. Mid-term (3–5 years):

- Post patent expiration: Price erosion expected, with generics assuming a significant share.

- Branded premium: Anticipated reduction to USD 300–500 per 30g tube, reflecting increased competition.

- Generic options: Will dominate in volume, priced around USD 100–200, potentially decreasing further with increased manufacturing efficiencies.

3. Long-term (5+ years):

- Price stabilization as generics dominate, possibly falling in the USD 50–150 range.

- New formulations or delivery systems may command premium prices if they demonstrate superior tolerability or convenience.

Strategic Market and Pricing Recommendations

- Patent Litigation and Defense: Protecting intellectual property rights remains critical to sustain premium pricing.

- Market Expansion: Entering emerging markets with tiered pricing can expand market share while maintaining profitability.

- Product Differentiation: Innovating formulations to improve tolerability or convenience can justify higher prices.

- Negotiations with Payers: Establishing value-based agreements may support favorable reimbursement terms, stabilizing prices.

Key Takeaways

- EPIDUO FORTE holds a strong market position within acne therapies owing to its effective combination chemistry and clinical backing.

- Intellectual property rights and patent protections are central determinants of current pricing power.

- The impending patent expirations and increasing generic competition are expected to erode prices progressively over the next five years.

- Demand in emerging markets and expanding indications offer growth opportunities, albeit at generally lower price points.

- Stakeholders should anticipate a declining trend in branded prices, emphasizing the importance of innovation, market diversification, and strategic patent management.

FAQs

1. What factors influence the price of EPIDUO FORTE?

Patent protection, manufacturing costs, competitive dynamics, regulatory approvals, reimbursement policies, and market demand significantly influence pricing.

2. How does patent expiration impact EPIDUO FORTE’s pricing?

Patent expiration typically leads to generic entry, causing price erosion and increased competition, which lowers prices and market share for branded formulations.

3. Are there alternative treatments that threaten EPIDUO FORTE's market?

Yes. Monotherapies like adapalene gels, benzoyl peroxide formulations, and newer agents with improved tolerability or delivery systems can compete, especially as generics enter the market.

4. What international markets offer growth potential for EPIDUO FORTE?

Emerging markets in Asia, Africa, and Latin America present opportunities due to rising acne prevalence and improving healthcare infrastructure, though at lower price points.

5. How can companies maintain profitability amid falling prices?

By innovating formulations, expanding indications, optimizing manufacturing, securing patent rights, and exploring new markets and delivery modalities.

References

[1] Grand View Research. "Acne Treatment Market Size & Trends." 2022.

[2] U.S. Patent and Trademark Office. Patent expiry timelines for dermatological formulations.

[3] IQVIA. "Pharmaceutical Market Trends and Patent Expiry Impact." 2022.

More… ↓