ACTOPLUS MET XR Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Actoplus Met Xr, and when can generic versions of Actoplus Met Xr launch?

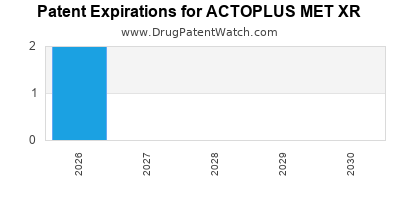

Actoplus Met Xr is a drug marketed by Takeda Pharms Usa and is included in one NDA. There are two patents protecting this drug and one Paragraph IV challenge.

This drug has seventy-two patent family members in twenty-five countries.

The generic ingredient in ACTOPLUS MET XR is metformin hydrochloride; pioglitazone hydrochloride. There are forty-nine drug master file entries for this compound. Seven suppliers are listed for this compound. Additional details are available on the metformin hydrochloride; pioglitazone hydrochloride profile page.

DrugPatentWatch® Generic Entry Outlook for Actoplus Met Xr

There have been five patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ACTOPLUS MET XR?

- What are the global sales for ACTOPLUS MET XR?

- What is Average Wholesale Price for ACTOPLUS MET XR?

Summary for ACTOPLUS MET XR

| International Patents: | 72 |

| US Patents: | 2 |

| Applicants: | 1 |

| NDAs: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 2 |

| Clinical Trials: | 3 |

| Patent Applications: | 87 |

| Drug Prices: | Drug price information for ACTOPLUS MET XR |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for ACTOPLUS MET XR |

| DailyMed Link: | ACTOPLUS MET XR at DailyMed |

Recent Clinical Trials for ACTOPLUS MET XR

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| National Cancer Institute (NCI) | Phase 2 |

| Torrent Pharmaceuticals Limited | Phase 1 |

Paragraph IV (Patent) Challenges for ACTOPLUS MET XR

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| ACTOPLUS MET XR | Extended-release Tablets | metformin hydrochloride; pioglitazone hydrochloride | 15 mg/1000 mg and 30 mg/1000 mg | 022024 | 1 | 2011-09-23 |

US Patents and Regulatory Information for ACTOPLUS MET XR

ACTOPLUS MET XR is protected by two US patents.

Expired US Patents for ACTOPLUS MET XR

International Patents for ACTOPLUS MET XR

When does loss-of-exclusivity occur for ACTOPLUS MET XR?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 4238

Patent: COMPOSICION FARMACEUTICA QUE CONTIENE UNA BIGUANIDA Y UN DERIVADO DE TIAZOLIDINDIONA

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 01501

Patent: NOUVELLE FORMULATION PHARMACEUTIQUE CONTENANT UN BIGUANIDE ET UN DERIVE DE THIAZOLIDINEDIONE (NOVEL PHARMACEUTICAL FORMULATION CONTAINING A BIGUANIDE AND A THIAZOLIDINEDIONE DERIVATIVE)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ACTOPLUS MET XR around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Canada | 1277323 | DERIVES DE THIAZOLIDINEDIONE, LEUR PRODUCTION ET LEUR EMPLOI (THIAZOLIDINEDIONE DERIVATIVES, THEIR PRODUCTION AND USE) | ⤷ Get Started Free |

| Canada | 2533845 | COMPOSITIONS PHARMACEUTIQUES COMPRENANT UN ACTIVATEUR DE LA SENSIBILITE A L'INSULINE ET UN AUTRE ANTIDIABETIQUE (PHARMACEUTICAL COMPOSITIONS COMPRISING INSULIN SENSITIVITY ENHANCER AND ANOTHER ANTIDIABETIC) | ⤷ Get Started Free |

| South Korea | 20120034211 | PHARMACEUTICAL TABLET | ⤷ Get Started Free |

| Japan | 3973280 | ⤷ Get Started Free | |

| Russian Federation | 2003130978 | ⤷ Get Started Free | |

| South Africa | 8600203 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for ACTOPLUS MET XR

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 0861666 | SPC/GB07/009 | United Kingdom | ⤷ Get Started Free | SPC/GB07/009: 20070126 |

| 1506211 | 179 5017-2014 | Slovakia | ⤷ Get Started Free | PRODUCT NAME: KOMBINACIA DAPAGLIFLOZINU ALEBO JEHO FARMACEUTICKY PRIJATELNYCH SOLI A METFORMINU ALEBO JEHO FARMACEUTICKY PRIJATELNYCH SOLI; REGISTRATION NO/DATE: EU/1/13/900/001 - EU/1/13/900/012 20140116 |

| 2498758 | 301040 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: METFORMINE OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN; SAXAGLIPTINE OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN; DAPAGLIFLOZINE OF EEN FARMACEUTISCH AANVAARDBAAR SOLVAAT DAARVAN; REGISTRATION NO/DATE: EU/1/19/1401 20191113 |

| 1506211 | CR 2014 00037 | Denmark | ⤷ Get Started Free | PRODUCT NAME: ET KOMBINATIONSPRODUKT AF DAPAGLIFLOZIN ELLER ET FARMACEUTISK ACCEPTABELT SALT DERAF, HERUNDER DAPAGLIFLOZINPROPANDIOLMONOHYDRAT OG METFORMIN ELLER SALTE DERAF, HERUNDER METFORMINHYDROCHLORID; REG. NO/DATE: EU/1/13/900 20140116 |

| 0193256 | C300038 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: PIOGLITAZON, DESGEWENST IN DE VORM VAN EEN FARMACOLOGISCH AANVAARDBAAR ZOUT, IN HET BIJZONDER HET HYDROCHLORIDE; REGISTRATION NO/DATE: EU/1/00/151/001 - EU/1/00/151/006 20001011 |

| 2498758 | 132020000000034 | Italy | ⤷ Get Started Free | PRODUCT NAME: METFORMINA O UN SUO SALE FARMACEUTICAMENTE ACCETTABILE; SAXAGLIPTIN O UN SUO SALE FARMACEUTICAMENTE ACCETTABILE; DAPAGLIFLOZIN O UN SUO SOLVATO FARMACEUTICAMENTE ACCETTABILE.(QTRILMET); AUTHORISATION NUMBER(S) AND DATE(S): EU/1/19/1401, 20191113 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for ACTOPLUS MET XR

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.