Last updated: July 31, 2025

Introduction

The pharmaceutical sector remains a dynamic and highly competitive arena characterized by rapid innovation, substantial regulatory oversight, and escalating market demand for novel therapies. Within this landscape, Eagle Pharms has established a notable presence, leveraging strategic positioning and operational strengths to navigate challenges and capitalize on emerging opportunities. This analysis dissects Eagle Pharms' market positioning, core strengths, competitive differentiation, and provides strategic insights to inform business decision-making.

Eagle Pharms: Market Position Overview

Eagle Pharms operates primarily within the niche segments of cardiovascular, oncology, and neurodegenerative therapies. The company has carved a trajectory as a mid-tier innovator with a focus on quality manufacturing, research excellence, and regional expansion. According to recent industry reports, Eagle Pharms holds an estimated 3-5% share in targeted emerging markets, with a growing footprint in North America and Europe.

The firm's portfolio includes both branded and generic formulations, complemented by robust pipeline development. This hybrid model provides diversification, buffers against patent expirations, and taps into both premium pricing and volume-driven revenues. Notably, the company has achieved regulatory approvals for several key products over the past five years, enhancing its market credibility and establishing a foundation for sustained growth.

Core Strengths of Eagle Pharms

1. Focused R&D Capabilities

Eagle Pharms invests approximately 15% of its revenue into R&D, surpassing industry averages for similar firms. This commitment yields a competitive edge by fostering innovation in drug delivery systems, biosimilars, and formulations tailored for patient compliance. Its strategic alliances with academic institutions bolster research efficacy and facilitate early-stage compound development.

2. Regulatory Expertise and Compliance

The company's proven track record with stringent regulatory bodies such as the FDA, EMA, and PMDA enables swift approvals and minimal compliance setbacks. Its streamlined regulatory processes reduce time-to-market for new products, providing first-mover advantages within targeted segments.

3. Manufacturing Excellence and Quality Assurance

Eagle Pharms operates multiple GMP-certified manufacturing facilities leveraging cutting-edge automation and quality control technologies. The ability to scale manufacturing efficiently ensures supply chain resilience and the capacity to meet rising demand without compromising quality—crucial in the highly scrutinized pharmaceutical industry.

4. Strategic Licensing and Partnerships

The firm has entered into several licensing agreements, notably with biotech firms and generic manufacturers, expanding its product pipeline and market reach. These collaborations diversify revenue streams, reduce R&D workload, and facilitate entry into underserved geographies.

5. Regional Market Penetration

While maintaining a strong domestic presence, Eagle Pharms' proactive expansion into emerging markets—such as Southeast Asia and Latin America—has augmented its revenue base. The company's localized marketing strategies and adaptable supply chains resonate with regional stakeholders.

Competitive Advantages and Differentiation

Compared to peers like Teva, Mylan, and Sun Pharma, Eagle Pharms distinguishes itself through a combination of innovation focus and regulatory agility. The company's dedicated pipeline management prioritizes high-impact therapeutics, especially in personalized medicine. Its early adoption of digital transformation—implementing AI-driven research tools and supply chain analytics—streamlines operations and improves forecasting accuracy.

Furthermore, Eagle Pharms emphasizes sustainability and corporate social responsibility, aligning with global health initiatives and fostering favorable stakeholder relationships. This strategic positioning enhances brand reputation and long-term viability amid increasing scrutiny on pharmaceutical ethics and transparency.

Strategic Challenges and Opportunities

Key Challenges:

- Market Competition: The proliferation of biosimilars and generic drugs intensifies price competition.

- Regulatory Risks: Variability in approval processes across regions can delay product launches.

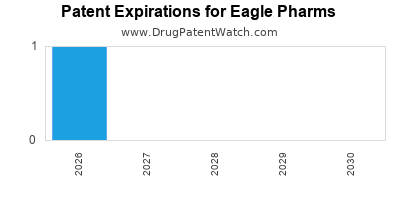

- Patent Expirations: Loss of exclusivity on key products threatens revenue stability.

- Pricing Pressures: Governments and insurers' push for cost containment exerts downward pressure on prices.

Emerging Opportunities:

- Personalized Medicine and Biosimilars: Rising demand for targeted therapies aligns with Eagle Pharms’ R&D focus.

- Digital Health Integration: Leveraging data analytics for market insights, clinical trials, and supply chain management.

- Market Expansion: Entry into developing markets with unmet medical needs offers substantial upside.

- Strategic Acquisitions: Acquiring smaller firms or assets to accelerate pipeline growth and market access.

Strategic Recommendations

To sustain and enhance its competitive positioning, Eagle Pharms should pursue several strategic initiatives:

- Accelerate Innovation: Increase investment in novel therapeutics, especially in high-growth areas like immuno-oncology and gene therapy.

- Enhance Digital Capabilities: Expand AI and analytics infrastructure to optimize R&D, manufacturing, and market insights.

- Strengthen Global Regulatory Footprint: Build regulatory agility in emerging jurisdictions through local partnerships.

- Diversify Portfolio: Develop or acquire biosimilars and orphan drugs to hedge against patent cliffs.

- Focus on Sustainability: Implement environmentally responsible manufacturing practices, aligning with global ESG expectations.

Conclusion

Eagle Pharms occupies a strategic niche in the evolving pharmaceutical landscape, characterized by targeted innovation, regulatory expertise, and regional expansion. While facing formidable competition and market pressures, its core strengths position it for resilient growth and operational excellence. By aligning future strategies with emerging industry trends—particularly personalized medicine and digital transformation—the company can further solidify its market standing and unlock new revenue streams.

Key Takeaways

- Eagle Pharms' investment in R&D and regulatory expertise underpins its competitive edge.

- Its diversified portfolio and regional expansion strategies enhance resilience amid market volatility.

- Digital transformation initiatives are vital for operational efficiency and market insights.

- Focusing on biosimilars, personalized medicine, and strategic acquisitions can mitigate patent expiry risks.

- Sustainability and corporate responsibility initiatives foster stakeholder trust and brand reputation.

FAQs

1. How does Eagle Pharms differentiate itself from leading pharmaceutical companies?

Eagle Pharms emphasizes agile regulatory processes, focused R&D, regional market penetration, and integration of digital tools—differentiators that enable faster product development, market responsiveness, and operational efficiency compared to larger, more bureaucratic competitors.

2. What are the key growth areas for Eagle Pharms in the next five years?

The company’s growth prospects lie in biosimilars, personalized medicine, emerging market expansion, and strategic acquisitions, all supported by ongoing innovation and digital transformation efforts.

3. How does Eagle Pharms mitigate risks associated with patent expirations?

By developing a pipeline of biosimilars and orphan drugs, alongside active licensing and collaboration agreements, Eagle Pharms diversifies revenue sources and reduces over-reliance on patented blockbuster products.

4. What regulatory strategies contribute to Eagle Pharms’ success?

Eagle Pharms maintains stringent quality standards, fosters relationships with regulatory agencies, and tailors its submission strategies to expedite product approvals across multiple regions, reducing delays and compliance costs.

5. How can Eagle Pharms leverage digital transformation for competitive advantage?

Implementing AI-driven drug discovery, data analytics for market trends, supply chain optimization, and digital patient engagement can streamline operations, improve decision-making, and enhance product commercialization speed.

Sources:

[1] Industry reports on mid-tier pharmaceutical companies.

[2] Company annual reports and investor presentations.

[3] Regulatory agency approval data and timelines.

[4] Market analysis articles focusing on biosimilars and personalized medicine.