Last updated: October 15, 2025

Introduction

Bristol Myers Squibb (BMS) stands as a prominent figure in the global pharmaceutical industry, renowned for its robust portfolio spanning oncology, immunology, cardiovascular, and hematology segments. With an emphasis on innovative therapies and strategic acquisitions, BMS continues to carve a significant niche within competitive landscapes dominated by giants like Pfizer, Roche, and AbbVie. This analysis evaluates BMS’s market position, core strengths, and strategic approaches, providing actionable insights for stakeholders seeking to comprehend its standing amid evolving industry dynamics.

Market Position of Bristol Myers Squibb

Global Footprint and Revenue Streams

Bristol Myers Squibb generated approximately $46.4 billion in revenue in 2022, with a significant portion derived from oncology and hematology, notably through drugs like Opdivo (nivolumab) and Eliquis (apixaban). Its global presence spans North America, Europe, Asia, and emerging markets, with strategic investments in expanding access and pipeline development. The company's diversified revenue base cushions against regional risks, ensuring steady growth amid market fluctuations.

Competitive Advantages

BMS's competitive positioning hinges on its leadership in immuno-oncology, backed by the success of Opdivo, one of the world's top-selling cancer immunotherapies. Coupled with a growing portfolio of innovative treatments, BMS maintains a upper-tier position driven by sustained R&D investments and strategic mergers, such as the 2019 acquisition of Celgene, which added promising hematologic and autoimmune agents.

Market Share and Industry Rankings

In oncology, BMS holds an estimated 15% market share globally, second only to Roche in the immunotherapy segment [1]. Its hematology portfolio, particularly Eliquis, significantly contributes to its revenue, making BMS a dominant player in anticoagulant therapies. Moreover, the company's focus on specialty drugs allows it to maintain a competitive edge in high-margin sectors.

Strengths of Bristol Myers Squibb

Robust and Diversified Portfolio

BMS's portfolio encompasses over 50 marketed drugs, with a strategic emphasis on high-growth areas such as cancer, cardiovascular diseases, and autoimmune conditions. Its flagship drugs—Opdivo, Eliquis, Revlimid (lenalidomide), and Sprycel (dasatinib)—are recognized for their substantial market shares and therapeutic efficacy.

Innovative Pipeline and R&D Capabilities

Investing approximately $4 billion annually into R&D, BMS maintains a vigorous pipeline of over 50 clinical candidates, many targeting oncology and immunology. Notably, its focus on personalized medicine and immune-oncology positions BMS at the forefront of therapeutic innovation.

Strategic Acquisitions and Collaborations

The acquisition of Celgene bolstered BMS's portfolio, adding blockbuster drugs and promising candidates like luspatercept and bb2121 (idecabtagene vicleucel). Collaborative ventures with biotech firms further enhance its pipeline, enabling rapid development and market entry for novel therapies.

Global Distribution and Market Penetration

BMS leverages a vast distribution network and strategic regional offices to facilitate global reach, especially in emerging economies where healthcare expansion offers new growth prospects. Its market access strategies and localized partnerships improve patient access and compliance.

Financial Strength and Investment Capacity

A strong balance sheet—with over $28 billion in cash and equivalents—facilitates ongoing R&D investment, acquisitions, and strategic initiatives, ensuring competitive resilience.

Strategic Insights

Focus on Personalized and Immuno-Oncology Therapies

BMS's dedication to personalized medicine, exemplified by R&D efforts in cell and gene therapies, positions it as a leader in innovative treatment modalities. The continued development of CAR-T therapies and bispecific antibodies exemplifies this strategy, capturing high unmet medical needs.

Enhancing Market Access and Pricing Strategies

Navigating complex global pricing landscapes necessitates an emphasis on value-based pricing and partnerships to improve market access. BMS's engagement with healthcare providers and policymakers supports sustainable pricing models adapted to regional economic realities.

Expanding Digital and Data-Driven Approaches

Investments in digital health and data analytics enable BMS to optimize clinical trials, improve patient outcomes, and personalize treatment pathways. These technological advancements foster innovation and reduce time-to-market.

Emphasizing Sustainability and Patient-Centric Policies

In response to increasing pressure for corporate sustainability, BMS aligns its corporate social responsibility initiatives with patient-centric approaches—enhancing brand reputation and stakeholder trust.

Competitive Differentiation through Strategic Collaborations

Formulating alliances with biotech firms, academic institutions, and healthcare providers accelerates innovation and broadens the therapeutic horizon, creating a formidable barrier to competition.

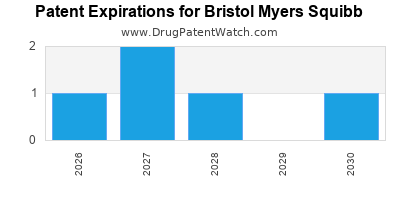

Challenges and Risks

Despite its strengths, BMS faces notable challenges. Patent expirations threaten revenue streams, exemplified by the decline of Revlimid's exclusivity. Competition from Chinese biotechs and biologics manufacturers also intensifies, potentially eroding market share. Regulatory hurdles and pricing pressures across markets could hinder profit margins, requiring adaptive strategies.

Conclusion

Bristol Myers Squibb embodies a resilient and innovative leader in the pharmaceutical industry, driven by strategic acquisitions, a diversified portfolio, and robust R&D. Its commitment to immuno-oncology and personalized medicine positions it favorably in high-growth sectors. However, maintaining a competitive edge necessitates continuous innovation, adaptive market strategies, and proactive risk management.

Key Takeaways

- Strategic acquisitions, notably Celgene, have expanded BMS’s pipeline and market share, reinforcing its leadership in oncology and hematology.

- Innovation focus, especially in immuno-oncology and cell therapies, aligns with industry trends and unmet medical needs, fostering sustained growth.

- Global expansion and market access strategies are essential for capturing emerging market opportunities and managing regional pricing pressures.

- Investment in digital health and data analytics enhances BMS’s capability to personalize therapies and streamline development processes.

- Adaptive responses to patent cliffs and competitive threats remain critical; diversification and innovation are vital for long-term sustainability.

FAQs

-

What are Bristol Myers Squibb's primary revenue-generating products?

Opdivo (nivolumab), Eliquis (apixaban), Revlimid (lenalidomide), and Sprycel (dasatinib) comprise the core revenue drivers.

-

How does BMS differentiate itself in the competitive oncology market?

Through its leadership in immuno-oncology, particularly with Opdivo, and investments in cell and gene therapies like CAR-T.

-

What strategic moves has BMS made to strengthen its pipeline?

Notable acquisitions such as Celgene and collaborations with biotech firms have expanded its drug portfolio and innovative capabilities.

-

What are the main challenges facing Bristol Myers Squibb?

Patent expirations, increased competition from generic and biosimilar biologics, pricing pressures, and regulatory hurdles.

-

How is BMS addressing global market expansion?

By localizing market access strategies, investing in emerging markets, and forming regional partnerships to enhance distribution and patient access.

References

[1] IQVIA. (2022). Global Oncology Market Share Analysis.

[2] Bristol Myers Squibb Annual Report 2022.

[3] EvaluatePharma. (2022). Top-Performing Oncology Drugs.

[4] MarketWatch. (2022). Bristol Myers Squibb Revenue Highlights.