FARYDAK Drug Patent Profile

✉ Email this page to a colleague

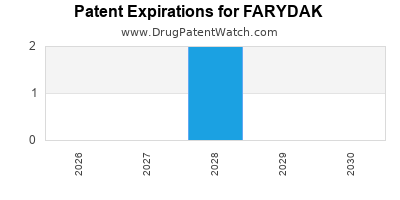

When do Farydak patents expire, and when can generic versions of Farydak launch?

Farydak is a drug marketed by Secura and is included in one NDA. There are two patents protecting this drug.

This drug has sixty-eight patent family members in forty countries.

The generic ingredient in FARYDAK is panobinostat lactate. There is one drug master file entry for this compound. Additional details are available on the panobinostat lactate profile page.

DrugPatentWatch® Generic Entry Outlook for Farydak

Farydak was eligible for patent challenges on February 23, 2019.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be January 17, 2028. This may change due to patent challenges or generic licensing.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for FARYDAK?

- What are the global sales for FARYDAK?

- What is Average Wholesale Price for FARYDAK?

Summary for FARYDAK

| International Patents: | 68 |

| US Patents: | 2 |

| Applicants: | 1 |

| NDAs: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 73 |

| Clinical Trials: | 12 |

| Patent Applications: | 5,111 |

| Drug Prices: | Drug price information for FARYDAK |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for FARYDAK |

| What excipients (inactive ingredients) are in FARYDAK? | FARYDAK excipients list |

| DailyMed Link: | FARYDAK at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for FARYDAK

Generic Entry Date for FARYDAK*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for FARYDAK

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Abdullah Khan | Phase 1 |

| Secura Bio, Inc. | Phase 1 |

| Secura Bio | Phase 1 |

US Patents and Regulatory Information for FARYDAK

FARYDAK is protected by two US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of FARYDAK is ⤷ Get Started Free.

This potential generic entry date is based on patent 7,989,494.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-001 | Feb 23, 2015 | DISCN | Yes | No | 8,883,842 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-002 | Feb 23, 2015 | DISCN | Yes | No | 7,989,494 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-001 | Feb 23, 2015 | DISCN | Yes | No | 7,989,494 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-002 | Feb 23, 2015 | DISCN | Yes | No | 8,883,842 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-003 | Feb 23, 2015 | DISCN | Yes | No | 7,989,494 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-003 | Feb 23, 2015 | DISCN | Yes | No | 8,883,842 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for FARYDAK

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-002 | Feb 23, 2015 | 6,833,384 | ⤷ Get Started Free |

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-003 | Feb 23, 2015 | 7,067,551 | ⤷ Get Started Free |

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-001 | Feb 23, 2015 | 6,552,065 | ⤷ Get Started Free |

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-003 | Feb 23, 2015 | 6,552,065 | ⤷ Get Started Free |

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-001 | Feb 23, 2015 | 6,833,384 | ⤷ Get Started Free |

| Secura | FARYDAK | panobinostat lactate | CAPSULE;ORAL | 205353-002 | Feb 23, 2015 | 7,067,551 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for FARYDAK

When does loss-of-exclusivity occur for FARYDAK?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 1297

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 07257881

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0712993

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 50263

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 07001689

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1641328

Estimated Expiration: ⤷ Get Started Free

Patent: 2584673

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 440

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 088976

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 7984

Estimated Expiration: ⤷ Get Started Free

Patent: 0802383

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 86930

Estimated Expiration: ⤷ Get Started Free

Patent: 09967

Estimated Expiration: ⤷ Get Started Free

Georgia, Republic of

Patent: 0115175

Estimated Expiration: ⤷ Get Started Free

Guatemala

Patent: 0800280

Estimated Expiration: ⤷ Get Started Free

Honduras

Patent: 08001862

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 5015

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 09540006

Estimated Expiration: ⤷ Get Started Free

Patent: 13139476

Estimated Expiration: ⤷ Get Started Free

Patent: 15164968

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 9337

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 08015900

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 529

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 511

Estimated Expiration: ⤷ Get Started Free

Nicaragua

Patent: 0800306

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 090135

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 080852

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 012501724

Estimated Expiration: ⤷ Get Started Free

Patent: 012501725

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 200900001

Estimated Expiration: ⤷ Get Started Free

Patent: 00900001

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0809094

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 090015968

Estimated Expiration: ⤷ Get Started Free

Patent: 140142335

Estimated Expiration: ⤷ Get Started Free

Patent: 150082690

Estimated Expiration: ⤷ Get Started Free

Patent: 160032264

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 53196

Estimated Expiration: ⤷ Get Started Free

Patent: 15179

Estimated Expiration: ⤷ Get Started Free

Patent: 0815344

Estimated Expiration: ⤷ Get Started Free

Patent: 1441190

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 08495

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 243

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 406

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering FARYDAK around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Spain | 2292610 | ⤷ Get Started Free | |

| China | 101641328 | ⤷ Get Started Free | |

| European Patent Office | 1870399 | ⤷ Get Started Free | |

| Poland | 221738 | ⤷ Get Started Free | |

| China | 101232880 | Use of HDAC inhibitors for the treatment of myeloma | ⤷ Get Started Free |

| Norway | 2015026 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for FARYDAK

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1318980 | CR 2015 00068 | Denmark | ⤷ Get Started Free | PRODUCT NAME: PANOBINOSTAT ELLER ET FARMACEUTISK ACCEPTABELT SALT DERAF, HERUNDER PANOBINOSTATLAKTAT; REG. NO/DATE: EU/1/15/1023 20150901 |

| 1912640 | PA2016003,C1912640 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: PANOBINOSTATAS ARBA JO FARMACINIU POZIURIU PRIIMTINA DRUSKA; REGISTRATION NO/DATE: EU/1/15/1023 20120828 |

| 1318980 | 15C0086 | France | ⤷ Get Started Free | PRODUCT NAME: PANOBINOSTAT OU UN DE SES SELS PHARMACEUTIQUEMENT ACCEPTABLES; REGISTRATION NO/DATE: EU/1/15/1023 20150901 |

| 1318980 | 72/2015 | Austria | ⤷ Get Started Free | PRODUCT NAME: PANOBINOSTAT ODER EIN PHARMAZEUTISCH AKZEPTABLES SALZ DAVON; REGISTRATION NO/DATE: EU/1/15/1023 (MITTEILUNG) 20150901 |

| 1318980 | CA 2015 00068 | Denmark | ⤷ Get Started Free | PRODUCT NAME: PANOBINOSTAT ELLER ET FARMACEUTISK SALT ELLER DERIVAT DERAF; REG. NO/DATE: EU/1/15/1023 20150901 |

| 1318980 | C 2015 053 | Romania | ⤷ Get Started Free | PRODUCT NAME: PANOBINOSTAT SAU O SARE ACCEPTABILA FARMACEUTIC SAU UNDERIVAT AL ACESTUIAN-HIDROXI-3-[-[4-({[2-(2-METIL-1H-INDOL-3-IL)ETIL}AMINO}METIL)FENIL]]-2E-2-PROPENAMIDA; NATIONAL AUTHORISATION NUMBER: EU/1/15/1023/001, EU/1/15/1023/002, EU/1/15/1023/003, EU/1/15/1023/004, EU/1/15/1023/005, EU/1/15/1023/006, EU/1/15/1023/007, EU/1/15/1023/008, EU/1/15/1023/009; DATE OF NATIONAL AUTHORISATION: 20150828; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/15/1023/001, EU/1/15/1023/002, EU/1/15/1023/003, EU/1/15/1023/004, EU/1/15/1023/005, EU/1/15/1023/006, EU/1/15/1023/007, EU/1/15/1023/008, EU/1/15/1023/009; DATE OF FIRST AUTHORISATION IN EEA: 20150828 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for FARYDAK (Fungal Infections Treatment)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.