OLYSIO Drug Patent Profile

✉ Email this page to a colleague

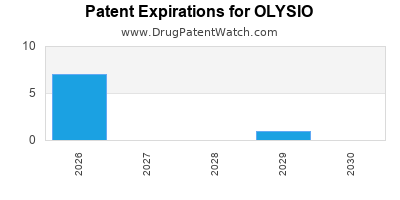

When do Olysio patents expire, and when can generic versions of Olysio launch?

Olysio is a drug marketed by Janssen Prods and is included in one NDA. There are nine patents protecting this drug.

This drug has one hundred and forty patent family members in forty-three countries.

The generic ingredient in OLYSIO is simeprevir sodium. There is one drug master file entry for this compound. Additional details are available on the simeprevir sodium profile page.

DrugPatentWatch® Generic Entry Outlook for Olysio

Olysio was eligible for patent challenges on November 22, 2017.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be September 5, 2029. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for OLYSIO?

- What are the global sales for OLYSIO?

- What is Average Wholesale Price for OLYSIO?

Summary for OLYSIO

| International Patents: | 140 |

| US Patents: | 9 |

| Applicants: | 1 |

| NDAs: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 7 |

| Patent Applications: | 1,537 |

| Drug Prices: | Drug price information for OLYSIO |

| DailyMed Link: | OLYSIO at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for OLYSIO

Generic Entry Date for OLYSIO*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for OLYSIO

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Stanford University | Phase 4 |

| Yale University | Phase 4 |

| Alexion Pharmaceuticals | Phase 1 |

US Patents and Regulatory Information for OLYSIO

OLYSIO is protected by nine US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of OLYSIO is ⤷ Get Started Free.

This potential generic entry date is based on patent 8,148,399.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Janssen Prods | OLYSIO | simeprevir sodium | CAPSULE;ORAL | 205123-001 | Nov 22, 2013 | DISCN | Yes | No | 8,349,869 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Janssen Prods | OLYSIO | simeprevir sodium | CAPSULE;ORAL | 205123-001 | Nov 22, 2013 | DISCN | Yes | No | 9,353,103 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Janssen Prods | OLYSIO | simeprevir sodium | CAPSULE;ORAL | 205123-001 | Nov 22, 2013 | DISCN | Yes | No | 9,040,562 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Janssen Prods | OLYSIO | simeprevir sodium | CAPSULE;ORAL | 205123-001 | Nov 22, 2013 | DISCN | Yes | No | 9,623,022 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Janssen Prods | OLYSIO | simeprevir sodium | CAPSULE;ORAL | 205123-001 | Nov 22, 2013 | DISCN | Yes | No | 8,754,106 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for OLYSIO

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Janssen Prods | OLYSIO | simeprevir sodium | CAPSULE;ORAL | 205123-001 | Nov 22, 2013 | 7,671,032 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for OLYSIO

When does loss-of-exclusivity occur for OLYSIO?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

African Regional IP Organization (ARIPO)

Patent: 06

Patent: Macrocydic inhibitors of hepatitis C virus.

Estimated Expiration: ⤷ Get Started Free

Argentina

Patent: 5359

Patent: INHIBIDORES MACROCICLICOS DEL VIRUS DE LA HEPATITIS C

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0614654

Patent: inibidores macrocìclicos de vìrus de hepatite c

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 16580

Patent: INHIBITEURS MACROCYCLIQUES DU VIRUS DE L'HEPATITE C (MACROCYCLIC INHIBITORS OF HEPATITIS C VIRUS)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2627639

Patent: Macrocydic inhibitors of hepatitis c virus.

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 83

Patent: INHIBIDORES MACROCICLICOS DEL VIRUS DE LA HEPATITIS C

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0151326

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 12006

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 12999

Estimated Expiration: ⤷ Get Started Free

El Salvador

Patent: 08002642

Patent: INHIBIDORES MACROCICLICOS DEL VIRUS DE HEPATITIS C REF. PIT 111 SLV

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 5131

Patent: МАКРОЦИКЛИЧЕСКИЕ ИНГИБИТОРЫ ВИРУСА ГЕПАТИТА С (MACROCYCLIC INHIBITORS OF HEPATITIS C VIRUS)

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 22516

Patent: Composés intermédiaires pour la préparation d'inhibiteurs macrocycliques du virus de l'hépatite C (Intermediates for the preparation of Macrocyclic inhibitors of hepatitis c virus)

Estimated Expiration: ⤷ Get Started Free

Patent: 37339

Patent: Inhibiteurs macrocycliques du virus de l'hépatite C (Macrocylic inhibitors of hepatitis c virus)

Estimated Expiration: ⤷ Get Started Free

Honduras

Patent: 08000134

Patent: INHIBIDORES MACROCICLICOS DEL VIRUS HEPATITIS C

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 83872

Patent: 丙型肝炎病毒的大環抑制劑 (MACROCYLIC INHIBITORS OF HEPATITIS C VIRUS)

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 27156

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 8227

Patent: תרכובות מקרוציקליות, שילובים ותכשירים רוקחיים המכילים אותן, שימושים בהן כמעכבי וירוס הפטיטיס c ותהליכים להכנתן (Macrocyclic compounds, combinations and pharmaceutical compositions comprising them, uses thereof as inhibitors of hepatitis c virus and processes for their preparation)

Estimated Expiration: ⤷ Get Started Free

Luxembourg

Patent: 568

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 231

Patent: Makrociklički inhibitori virusa hepatitisa C (MACROCYCLIC INHIBITORS OF HEPATITIS C VIRUS)

Estimated Expiration: ⤷ Get Started Free

Patent: 415

Patent: Intermedijari za pripremu makrocikličkih inhibitora virusa hepatitisa C (Intermediates for the preparation of Macrocyclic inhibitors of hepatitis c virus)

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 12999

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 743

Patent: MAKROCIKLIČKI INHIBITORI VIRUSA HEPATITISA C (MACROCYCLIC INHIBITORS OF HEPATITIS C VIRUS)

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 22516

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 080042084

Patent: MACROCYLIC INHIBITORS OF HEPATITIS C VIRUS

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 245

Patent: МАКРОЦИКЛИЧЕСКИЕ ИНГИБИТОРЫ ВИРУСА ГЕПАТИТА С;МАКРОЦИКЛІЧНІ ІНГІБІТОРИ ВІРУСУ ГЕПАТИТУ С (MACROCYCLIC INHIBITORS OF HEPATITIS C VIRUS)

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 703

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering OLYSIO around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Portugal | 1713823 | ⤷ Get Started Free | |

| Spain | 2342944 | ⤷ Get Started Free | |

| Eurasian Patent Organization | 200601400 | ИНГИБИТОРЫ NS-3 СЕРИНОВОЙ ПРОТЕАЗЫ HCV | ⤷ Get Started Free |

| Taiwan | I358411 | ⤷ Get Started Free | |

| World Intellectual Property Organization (WIPO) | 2005073216 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for OLYSIO

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1713823 | C300703 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: SIMEPREVIR, OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN, WAARONDER SIMEPREVIRNATRIUM; REGISTRATION NO/DATE: EU/1/14/924/001-002 20140514 |

| 1912999 | 122014000098 | Germany | ⤷ Get Started Free | PRODUCT NAME: SIMEPREVIR ODER EIN SALZ DAVON; REGISTRATION NO/DATE: EU/1/14/924 20140514 |

| 1912999 | 1490062-5 | Sweden | ⤷ Get Started Free | PRODUCT NAME: SIMEPREVIR, OR A SALT THEREOF, INCLUDING SIMEPREVIR SODIUM; REG. NO/DATE: EU/1/14/924 20140516 |

| 1912999 | CA 2014 00053 | Denmark | ⤷ Get Started Free | PRODUCT NAME: SIMEPREVIR ELLER ET SALT DERAF, HERUNDER SIMEPREVIRNATRIUM; REG. NO/DATE: EU/1/14/924 20140514 |

| 1912999 | PA2014036,C1912999 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: SIMEPREVIRAS; REGISTRATION NO/DATE: EU/1/14/924 20140514 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for OLYSIO (Simeprevir)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.