Last updated: October 15, 2025

Introduction

Janssen Pharmaceuticals, a subsidiary of Johnson & Johnson, stands as a formidable contender within the global pharmaceutical industry. With a diverse portfolio spanning immunology, oncology, neuroscience, infectious diseases, and cardiovascular health, Janssen’s strategic positioning leverages both innovative R&D capabilities and robust commercialization channels. This analysis explores Janssen's market stature, core strength areas, competitive advantages, and strategic avenues to sustain growth amid evolving industry dynamics.

Market Position and Revenue Footprint

Janssen Pharmaceuticals consistently ranks among the top pharmaceutical companies globally, driven by a broad, diversified product portfolio and a significant pipeline of investigational compounds. In 2022, Johnson & Johnson’s Pharmaceutical segment, dominated by Janssen, reported approximately $54 billion in sales, illustrating its substantial contribution (source: Johnson & Johnson Annual Report 2022).

Janssen's portfolio is anchored by blockbuster drugs such as Stelara (ustekinumab) in immunology, Darzalex (daratumumab) in multiple myeloma, and Imbruvica (ibrutinib) in oncology, reinforcing its market leadership. The firm maintains a competitive edge through strategic acquisitions and licensing deals, notably acquiring biotech entities to expand its pipeline and diversify revenue streams.

Core Strengths and Competitive Advantages

1. Robust R&D Pipeline and Innovation Capabilities

Janssen invests heavily in research and development, allocating approximately $3.5 billion annually to innovation efforts. Its R&D centers across the globe foster a culture of scientific excellence, with over 60 new molecular entities (NMEs) in various phases of clinical development as of 2022. This pipeline robustness enhances its ability to address evolving therapeutic needs and maintain a competitive advantage.

2. Diverse Therapeutic Portfolio

Strategic diversification across therapeutic areas mitigates risks associated with biopharmaceutical market fluctuations. Janssen’s leadership in immunology, oncology, and infectious diseases—particularly its pioneering COVID-19 vaccine (Janssen COVID-19 Vaccine) — exemplifies its versatile product strategy.

3. Regulatory and Market Access Expertise

Janssen’s in-depth understanding of regulatory landscapes across multiple markets streamlines the drug approval process. Its impressive record of securing approvals in key jurisdictions accelerates product launches, while established relationships with health authorities facilitate market access strategies.

4. Global Commercial Footprint

With operations spanning over 100 countries, Janssen benefits from an extensive commercial network capable of rapid product dissemination. Its strategic partnerships with healthcare providers and payers further strengthen its market presence.

5. Commitment to Precision Medicine

Janssen’s focus on personalized therapies, including biologics and gene therapies, positions it at the forefront of precision medicine. Developing targeted treatments enhances efficacy and reduces side effects, meeting the demands of modern healthcare delivery.

Strategic Insights and Future Outlook

1. Focused Innovation and Pipeline Expansion

Janssen’s commitment to innovation remains paramount. Intensifying efforts in gene editing, cell therapies, and digital health integration can accelerate the development of breakthrough therapies. Prioritizing rare diseases and personalized medicine aligns with global healthcare trends and unmet medical needs.

2. Strategic Partnerships and Mergers & Acquisitions

Continuing to acquire promising biotech startups and forming alliances with academia capitalizes on innovative discoveries. For example, Janssen’s recent partnership with Genoa Biosciences aims to develop novel immunotherapies, illustrating an ongoing strategy to stay ahead.

3. Digital Transformation and Data-Driven Decision Making

Investing in digital health technologies, real-world evidence, and AI-enabled drug discovery can reduce R&D costs, enhance clinical trial efficiency, and improve patient outcomes. Digital platforms also facilitate patient engagement, fostering loyalty and adherence.

4. Navigating Pricing & Regulatory Challenges

Global pricing pressures and evolving regulatory standards necessitate adaptive strategies. Emphasizing value-based pricing and demonstrating cost-effectiveness can mitigate reimbursement risks and sustain profitability.

5. Dedicated Focus on Emerging Markets

Expanding access and tailoring offerings for high-growth regions such as Southeast Asia, Africa, and Latin America is crucial for long-term growth. Local collaborations and manufacturing investments will enable Janssen to capitalize on regional health expansions.

Competitive Landscape Overview

Janssen operates within a highly competitive environment, contending with industry giants such as Pfizer, Roche, Novartis, and Merck. Its key differentiators include a strong early-stage pipeline, proprietary biologics, and a comprehensive global footprint. However, the landscape faces constant disruption due to biosimilar entrants, pricing pressures, and rapid technological advancements.

Notably, biosimilar competition in therapeutic segments like oncology and immunology presents risks to Janssen’s blockbuster drugs. Proactive lifecycle management, such as patent extensions and line extensions, becomes critical in safeguarding revenue streams.

Risks and Challenges

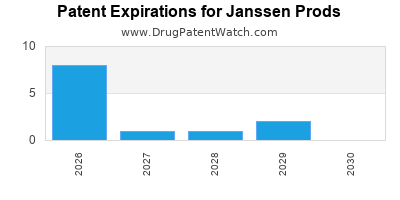

- Patent Expirations: The impending patent lapses for several high-revenue products threaten revenue erosion.

- Pricing Regulations: Governments worldwide adopt measures to curb drug prices, impacting margins.

- Regulatory Hurdles: Faster approval pathways often entail higher compliance and post-marketing obligations.

- Pipeline Uncertainties: Despite a strong pipeline, clinical failures remain a risk factor.

- Competitive Biosimilars: The rise of biosimilars poses significant competition, especially in immunology and oncology.

Conclusion

Janssen Pharmaceuticals maintains its competitive edge through diversified therapeutic offerings, relentless innovation, and an entrenched global presence. Strategic investments in cutting-edge technologies, pipeline expansion, and market diversification will be instrumental in sustaining growth. Managing regulatory, pricing, and biosimilar challenges remains vital to safeguarding its market position.

Key Takeaways

- Janssen's diversified portfolio and R&D excellence underpin its leadership in immunology, oncology, and infectious diseases.

- Continued pipeline innovation and strategic alliances are essential for maintaining a competitive edge amid rapid industry evolution.

- Digital transformation and real-world evidence integration will redefine drug development and commercialization strategies.

- Navigating regulatory landscapes and pricing pressures demands adaptive, value-based approaches.

- Expansion in emerging markets offers substantial growth opportunities, contingent upon local partnerships and tailored access strategies.

FAQs

1. How does Janssen differentiate itself from competitors in the pharmaceutical industry?

Janssen’s differentiation stems from its strong focus on innovative biologics, a diverse pipeline across multiple therapeutic areas, and extensive global reach, enabling rapid deployment and adoption of new therapies.

2. What are the main risks facing Janssen’s market position?

Key risks include patent expirations, biosimilar competition, regulatory challenges, pricing pressures, and clinical trial failures. Strategic lifecycle management and pipeline diversification are essential mitigation strategies.

3. How is Janssen leveraging digital health to boost its competitiveness?

Janssen invests in digital health platforms, AI-enhanced drug discovery, and real-world evidence collection to increase R&D efficiency, improve patient engagement, and support data-driven decision-making.

4. What strategic moves are planned to expand Janssen’s footprint in emerging markets?

Janssen focuses on local manufacturing, strategic alliances, and tailored access programs to penetrate high-growth regions, leveraging government collaborations and adapting offerings to regional healthcare needs.

5. How does Janssen address biosimilar threats?

Janssen invests in lifecycle extension strategies like line extensions, value-based pricing, and developing next-generation biologics to maintain market share amidst biosimilar entries.

References

- Johnson & Johnson Annual Report 2022.

- GlobalData Pharmaceutical Industry Report 2022.

- BioPharma Dive: Janssen’s R&D and pipeline updates.

- Fierce Pharma: Industry insights on biosimilars and regulatory trends.