Expiring Drug Patents Cheat Sheet

We analyse the patents covering drugs in 134 countries and quickly give you the likely loss-of-exclusivity/generic entry date

Poland: These 18 Drugs Face Patent Expirations and Generic Entry From 2025 - 2026

The content of this page is licensed under a Creative Commons Attribution 4.0 International License.

Generic Entry Dates in Other Countries

Friedman, Yali, "Poland: These 18 Drugs Face Patent Expirations and Generic Entry From 2025 - 2026" DrugPatentWatch.com thinkBiotech, 2025 www.drugpatentwatch.com/p/expiring-drug-patents-generic-entry/.

Media collateral

These estimated drug patent expiration dates and generic entry opportunity dates are calculated from analysis of known patents covering drugs. Many factors can influence early or late generic entry. This information is provided as a rough estimate of generic entry potential and should not be used as an independent source. The methodology is described in this blog post.

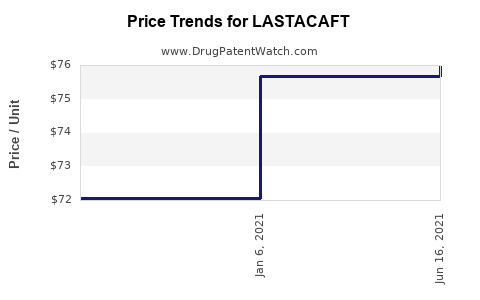

When can LASTACAFT (alcaftadine) generic drug versions launch?

Generic name: alcaftadine

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 31, 2026

Generic Entry Controlled by: Poland Patent 2,004,196

This drug has forty-six patent family members in thirty countries. There has been litigation on patents covering LASTACAFT

See drug price trends for LASTACAFT.

The generic ingredient in LASTACAFT is alcaftadine. There are six drug master file entries for this API. Four suppliers are listed for this generic product. Additional details are available on the alcaftadine profile page.

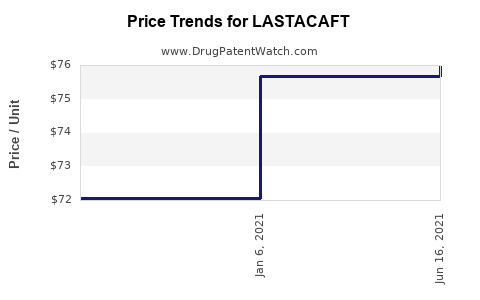

When can LASTACAFT (alcaftadine) generic drug versions launch?

Generic name: alcaftadine

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: March 31, 2026

Generic Entry Controlled by: Poland Patent 3,150,209

This drug has forty-six patent family members in thirty countries. There has been litigation on patents covering LASTACAFT

See drug price trends for LASTACAFT.

The generic ingredient in LASTACAFT is alcaftadine. There are six drug master file entries for this API. Four suppliers are listed for this generic product. Additional details are available on the alcaftadine profile page.

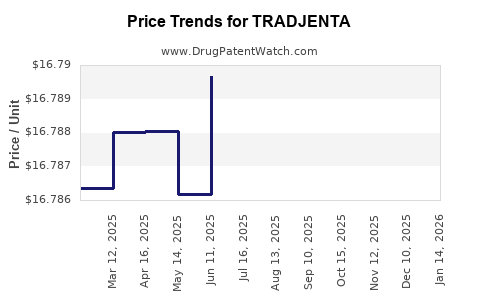

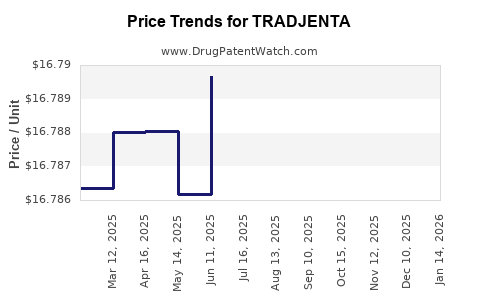

When can TRADJENTA (linagliptin) generic drug versions launch?

Generic name: linagliptin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 04, 2026

Generic Entry Controlled by: Poland Patent 2,023,902

This drug has four hundred and eighty-six patent family members in forty-five countries. There has been litigation on patents covering TRADJENTA

See drug price trends for TRADJENTA.

The generic ingredient in TRADJENTA is linagliptin. There are nineteen drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the linagliptin profile page.

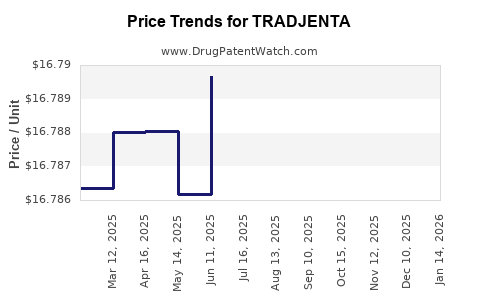

When can TRADJENTA (linagliptin) generic drug versions launch?

Generic name: linagliptin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 04, 2026

Generic Entry Controlled by: Poland Patent 2,277,509

This drug has four hundred and eighty-six patent family members in forty-five countries. There has been litigation on patents covering TRADJENTA

See drug price trends for TRADJENTA.

The generic ingredient in TRADJENTA is linagliptin. There are nineteen drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the linagliptin profile page.

When can TRADJENTA (linagliptin) generic drug versions launch?

Generic name: linagliptin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: May 04, 2026

Generic Entry Controlled by: Poland Patent 2,283,819

This drug has four hundred and eighty-six patent family members in forty-five countries. There has been litigation on patents covering TRADJENTA

See drug price trends for TRADJENTA.

The generic ingredient in TRADJENTA is linagliptin. There are nineteen drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the linagliptin profile page.

When can EMBEDA (morphine sulfate; naltrexone hydrochloride) generic drug versions launch?

Generic name: morphine sulfate; naltrexone hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 19, 2026

Generic Entry Controlled by: Poland Patent 2,034,975

EMBEDA is a drug marketed by Alpharma Pharms. There are nine patents protecting this drug and four Paragraph IV challenges.

This drug has seventy-four patent family members in twenty-three countries.

See drug price trends for EMBEDA.

The generic ingredient in EMBEDA is morphine sulfate; naltrexone hydrochloride. There are twenty-three drug master file entries for this API. Additional details are available on the morphine sulfate; naltrexone hydrochloride profile page.

When can EMBEDA (morphine sulfate; naltrexone hydrochloride) generic drug versions launch?

Generic name: morphine sulfate; naltrexone hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 19, 2026

Generic Entry Controlled by: Poland Patent 2,484,346

EMBEDA is a drug marketed by Alpharma Pharms. There are nine patents protecting this drug and four Paragraph IV challenges.

This drug has seventy-four patent family members in twenty-three countries.

See drug price trends for EMBEDA.

The generic ingredient in EMBEDA is morphine sulfate; naltrexone hydrochloride. There are twenty-three drug master file entries for this API. Additional details are available on the morphine sulfate; naltrexone hydrochloride profile page.

When can EMBEDA (morphine sulfate; naltrexone hydrochloride) generic drug versions launch?

Generic name: morphine sulfate; naltrexone hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 19, 2026

Generic Entry Controlled by: Poland Patent 2,719,378

EMBEDA is a drug marketed by Alpharma Pharms. There are nine patents protecting this drug and four Paragraph IV challenges.

This drug has seventy-four patent family members in twenty-three countries.

See drug price trends for EMBEDA.

The generic ingredient in EMBEDA is morphine sulfate; naltrexone hydrochloride. There are twenty-three drug master file entries for this API. Additional details are available on the morphine sulfate; naltrexone hydrochloride profile page.

When can VAFSEO (vadadustat) generic drug versions launch?

Generic name: vadadustat

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: June 26, 2026

Generic Entry Controlled by: Poland Patent 3,026,044

VAFSEO is a drug marketed by Akebia. There are thirteen patents protecting this drug.

This drug has two hundred and sixty patent family members in forty-eight countries. There has been litigation on patents covering VAFSEO

The generic ingredient in VAFSEO is vadadustat. One supplier is listed for this generic product. Additional details are available on the vadadustat profile page.

When can CREON (pancrelipase (amylase;lipase;protease)) generic drug versions launch?

Generic name: pancrelipase (amylase;lipase;protease)

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: August 15, 2026

Generic Entry Controlled by: Poland Patent 1,931,316

CREON is a drug marketed by

This drug has two hundred and sixty patent family members in forty-eight countries.

See drug price trends for CREON.

The generic ingredient in CREON is pancrelipase (amylase;lipase;protease). There are six drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the pancrelipase (amylase;lipase;protease) profile page.

When can CREON (pancrelipase (amylase;lipase;protease)) generic drug versions launch?

Generic name: pancrelipase (amylase;lipase;protease)

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: August 15, 2026

Generic Entry Controlled by: Poland Patent 1,931,317

CREON is a drug marketed by

This drug has two hundred and sixty patent family members in forty-eight countries.

See drug price trends for CREON.

The generic ingredient in CREON is pancrelipase (amylase;lipase;protease). There are six drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the pancrelipase (amylase;lipase;protease) profile page.

When can JYNARQUE (tolvaptan) generic drug versions launch?

Generic name: tolvaptan

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: September 01, 2026

Generic Entry Controlled by: Poland Patent 2,261,215

JYNARQUE is a drug marketed by Otsuka. There are two patents protecting this drug.

This drug has eighty-six patent family members in twenty-four countries. There has been litigation on patents covering JYNARQUE

See drug price trends for JYNARQUE.

The generic ingredient in JYNARQUE is tolvaptan. There are eight drug master file entries for this API. Seven suppliers are listed for this generic product. Additional details are available on the tolvaptan profile page.

When can SAMSCA (tolvaptan) generic drug versions launch?

Generic name: tolvaptan

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: September 01, 2026

Generic Entry Controlled by: Poland Patent 2,261,215

SAMSCA is a drug marketed by Otsuka. There are two patents protecting this drug and two Paragraph IV challenges.

This drug has eighty-six patent family members in twenty-four countries. There has been litigation on patents covering SAMSCA

See drug price trends for SAMSCA.

The generic ingredient in SAMSCA is tolvaptan. There are eight drug master file entries for this API. Seven suppliers are listed for this generic product. Additional details are available on the tolvaptan profile page.

When can ESBRIET (pirfenidone) generic drug versions launch?

Generic name: pirfenidone

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: September 22, 2026

Generic Entry Controlled by: Poland Patent 1,940,364

ESBRIET is a drug marketed by Genentech Inc. There are twenty patents protecting this drug and two Paragraph IV challenges. One tentatively approved generic is ready to enter the market.

This drug has two hundred and sixty-six patent family members in forty-six countries. There has been litigation on patents covering ESBRIET

See drug price trends for ESBRIET.

The generic ingredient in ESBRIET is pirfenidone. There are twenty-three drug master file entries for this API. Twenty-four suppliers are listed for this generic product. Additional details are available on the pirfenidone profile page.

When can ZUNVEYL (benzgalantamine gluconate) generic drug versions launch?

Generic name: benzgalantamine gluconate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: September 22, 2026

Generic Entry Controlled by: Poland Patent 1,940,817

ZUNVEYL is a drug marketed by Alpha Cognition. There are three patents protecting this drug.

This drug has twenty-six patent family members in seventeen countries. There has been litigation on patents covering ZUNVEYL

The generic ingredient in ZUNVEYL is benzgalantamine gluconate. One supplier is listed for this generic product. Additional details are available on the benzgalantamine gluconate profile page.

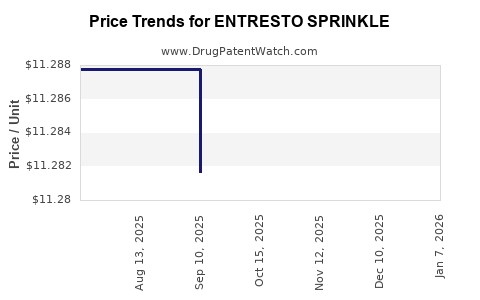

When can ENTRESTO SPRINKLE (sacubitril; valsartan) generic drug versions launch?

Generic name: sacubitril; valsartan

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: November 08, 2026

Generic Entry Controlled by: Poland Patent 1,948,158

This drug has one hundred and forty-five patent family members in forty-three countries. There has been litigation on patents covering ENTRESTO SPRINKLE

See drug price trends for ENTRESTO SPRINKLE.

The generic ingredient in ENTRESTO SPRINKLE is sacubitril; valsartan. There are eleven drug master file entries for this API. Twenty-two suppliers are listed for this generic product. Additional details are available on the sacubitril; valsartan profile page.

When can ENTRESTO SPRINKLE (sacubitril; valsartan) generic drug versions launch?

Generic name: sacubitril; valsartan

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: November 08, 2026

Generic Entry Controlled by: Poland Patent 2,340,828

This drug has one hundred and forty-five patent family members in forty-three countries. There has been litigation on patents covering ENTRESTO SPRINKLE

See drug price trends for ENTRESTO SPRINKLE.

The generic ingredient in ENTRESTO SPRINKLE is sacubitril; valsartan. There are eleven drug master file entries for this API. Twenty-two suppliers are listed for this generic product. Additional details are available on the sacubitril; valsartan profile page.

When can XALKORI (crizotinib) generic drug versions launch?

Generic name: crizotinib

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: November 23, 2026

Generic Entry Controlled by: Poland Patent 1,963,302

XALKORI is a drug marketed by Pf Prism Cv. There are five patents protecting this drug.

This drug has one hundred and fifty-two patent family members in forty-eight countries.

See drug price trends for XALKORI.

The generic ingredient in XALKORI is crizotinib. One supplier is listed for this generic product. Additional details are available on the crizotinib profile page.

When can AXUMIN (fluciclovine f-18) generic drug versions launch?

Generic name: fluciclovine f-18

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: November 28, 2026

Generic Entry Controlled by: Poland Patent 1,978,015

AXUMIN is a drug marketed by Blue Earth. There are eight patents protecting this drug.

This drug has thirty patent family members in sixteen countries. There has been litigation on patents covering AXUMIN

The generic ingredient in AXUMIN is fluciclovine f-18. One supplier is listed for this generic product. Additional details are available on the fluciclovine f-18 profile page.

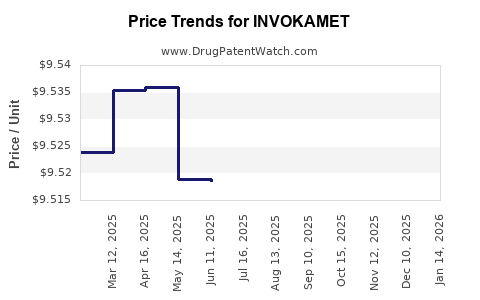

When can INVOKAMET (canagliflozin; metformin hydrochloride) generic drug versions launch?

Generic name: canagliflozin; metformin hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 04, 2026

Generic Entry Controlled by: Poland Patent 2,102,224

This drug has two hundred and seventy-one patent family members in forty-eight countries. There has been litigation on patents covering INVOKAMET

See drug price trends for INVOKAMET.

The generic ingredient in INVOKAMET is canagliflozin; metformin hydrochloride. There are twenty-one drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the canagliflozin; metformin hydrochloride profile page.

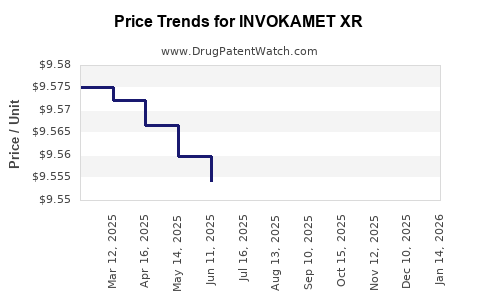

When can INVOKAMET XR (canagliflozin; metformin hydrochloride) generic drug versions launch?

Generic name: canagliflozin; metformin hydrochloride

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 04, 2026

Generic Entry Controlled by: Poland Patent 2,102,224

This drug has two hundred and twenty patent family members in forty-five countries. There has been litigation on patents covering INVOKAMET XR

See drug price trends for INVOKAMET XR.

The generic ingredient in INVOKAMET XR is canagliflozin; metformin hydrochloride. There are twenty-one drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the canagliflozin; metformin hydrochloride profile page.

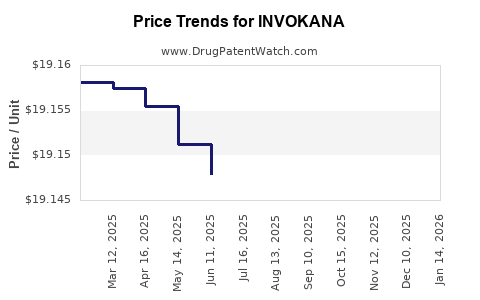

When can INVOKANA (canagliflozin) generic drug versions launch?

Generic name: canagliflozin

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 04, 2026

Generic Entry Controlled by: Poland Patent 2,102,224

This drug has two hundred and twenty patent family members in forty-five countries. There has been litigation on patents covering INVOKANA

See drug price trends for INVOKANA.

The generic ingredient in INVOKANA is canagliflozin. There are twenty-one drug master file entries for this API. Three suppliers are listed for this generic product. Additional details are available on the canagliflozin profile page.

When can KOSELUGO (selumetinib sulfate) generic drug versions launch?

Generic name: selumetinib sulfate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 12, 2026

Generic Entry Controlled by: Poland Patent 1,968,948

KOSELUGO is a drug marketed by Astrazeneca. There are eight patents protecting this drug.

This drug has two hundred and one patent family members in forty-five countries. There has been litigation on patents covering KOSELUGO

See drug price trends for KOSELUGO.

The generic ingredient in KOSELUGO is selumetinib sulfate. One supplier is listed for this generic product. Additional details are available on the selumetinib sulfate profile page.

When can PICATO (ingenol mebutate) generic drug versions launch?

Generic name: ingenol mebutate

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 18, 2026

Generic Entry Controlled by: Poland Patent 1,988,877

This drug has thirty-five patent family members in twenty-one countries. There has been litigation on patents covering PICATO

See drug price trends for PICATO.

The generic ingredient in PICATO is ingenol mebutate. There are three drug master file entries for this API. Additional details are available on the ingenol mebutate profile page.

When can VYKAT XR (diazoxide choline) generic drug versions launch?

Generic name: diazoxide choline

DrugPatentWatch® Estimated Key Patent Expiration / Generic Entry Date: December 20, 2026

Generic Entry Controlled by: Poland Patent 1,968,601

VYKAT XR is a drug marketed by Soleno Therap. There are six patents protecting this drug.

This drug has seventy-eight patent family members in twenty-two countries.

The generic ingredient in VYKAT XR is diazoxide choline. There are five drug master file entries for this API. One supplier is listed for this generic product. Additional details are available on the diazoxide choline profile page.

Poland’s Branded and Generic Drug Markets: An Assessment of Opportunities and Challenges

More… ↓

DrugPatentWatch cited by CNN, NEJM, Nature Journals, and more …

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.