Share This Page

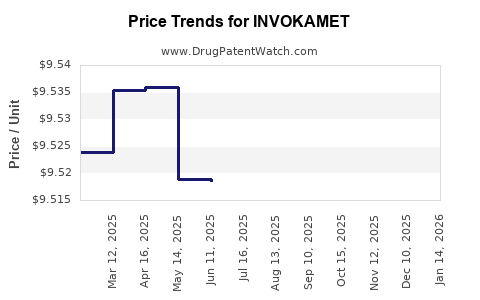

Drug Price Trends for INVOKAMET

✉ Email this page to a colleague

Average Pharmacy Cost for INVOKAMET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INVOKAMET XR 50-1,000 MG TAB | 50458-0941-01 | 9.60603 | EACH | 2025-12-17 |

| INVOKAMET 50-500 MG TABLET | 50458-0540-60 | 9.55869 | EACH | 2025-12-17 |

| INVOKAMET XR 150-500 MG TABLET | 50458-0942-01 | 9.57278 | EACH | 2025-12-17 |

| INVOKAMET 150-1,000 MG TABLET | 50458-0543-60 | 9.56857 | EACH | 2025-12-17 |

| INVOKAMET XR 150-1,000 MG TAB | 50458-0943-01 | 9.51410 | EACH | 2025-12-17 |

| INVOKAMET 150-500 MG TABLET | 50458-0542-60 | 9.59504 | EACH | 2025-12-17 |

| INVOKAMET 50-1,000 MG TABLET | 50458-0541-60 | 9.54732 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INVOKAMET

Introduction

INVOKAMET, developed by Merck & Co., Inc., is a combination pharmaceutical indicated primarily for the management of type 2 diabetes mellitus. Comprising lateinergic and a sodium-glucose co-transporter 2 (SGLT2) inhibitor, INVOKAMET (empagliflozin/metformin extended-release), it addresses the growing global burden of diabetes. This analysis outlines the current market landscape, competitive positioning, regulatory environment, and future price projections for INVOKAMET, spotlighting factors influencing its commercial trajectory.

Market Landscape

Global Diabetes Prevalence and Market Potential

The global prevalence of type 2 diabetes is escalating, with estimates surpassing 537 million adults in 2021 and projected to reach 643 million by 2030 [1]. This expansive patient base fuels demand for effective pharmacotherapies. The diabetes drug market is expanding at an estimated CAGR of 7% (2022-2028), driven by rising awareness, diagnostic rates, and chronic disease management programs [2].

Therapeutic Profile and Positioning

INVOKAMET offers a dual mechanism: empagliflozin reduces glucose reabsorption in the kidneys, promoting glycosuria, while metformin improves insulin sensitivity—widely regarded as first-line therapy [3]. Its fixed-dose formulation simplifies treatment regimens, potentially improving adherence. Clinical trials, notably the EMPA-REG OUTCOME study, demonstrated cardiovascular benefits, increasing its appeal among prescribers [4].

Competitive Landscape

Key competitors include other SGLT2 inhibitors (e.g., Jardiance, Farxiga), DPP-4 inhibitors, GLP-1 receptor agonists, and traditional therapies. Jardiance (empagliflozin monotherapy) and Farxiga (dapagliflozin) are the closest competitors, often preferred for their cardiovascular advantages. Fixed-dose combinations like INVOKAMET bind to market share due to pill burden reduction and enhanced efficacy.

Regulatory Environment

The regulatory framework remains supportive, with approvals in over 60 countries. Notably, the FDA and EMA have approved INVOKAMET for use alongside diet and exercise in adults with type 2 diabetes inadequately controlled on metformin alone [5]. Ongoing post-marketing surveillance ensures safety assessments, with risks such as euglycemic ketoacidosis and genital infections monitored.

Market Performance

Sales Dynamics

Since its launch in 2014, INVOKAMET has achieved steady sales growth, driven by expanding indications and increased prescribing. In Q2 2022, Merck reported approximately $400 million in global sales of INVOKAMET and related formulations, reflecting a 15% year-over-year increase [6].

Pricing Strategies

Pricing varies by geography, influenced by reimbursement policies, competitive dynamics, and patent protections. In the US, the wholesale acquisition cost (WAC) for a 30-day supply ranges from $600 to $700. Generic versions are not yet widely available, but patent expirations are imminent, risking price erosion [7].

Price Projection Factors

Patent Expiry and Generic Competition

The primary patent for INVOKAMET is forecasted to expire around 2026–2027, opening the market to generic co-formulations. Historically, patent expiration precipitates substantial price declines of 50–80%, depending on market competition [8].

Market Penetration and Adoption

Increased adoption in emerging markets and expanding guidelines favoring combination therapies propel sales growth. However, the entrance of generics could significantly impact pricing strategies, especially in price-sensitive regions.

Regulatory and Clinical Trial Outcomes

Additional approvals for expanded indications (e.g., heart failure, chronic kidney disease) could sustain high pricing due to broader therapeutic utility. Conversely, regulatory setbacks or safety concerns could depress prices.

Reimbursement and Health Investment Trends

Hospitals and insurers increasingly favor cost-effective therapies. Value-based pricing models could pressure prices downward, though premium positioning may persist in countries with high per capita healthcare spending.

Future Price Estimate

Considering the upcoming patent cliff, competitive landscape, and growth projections, a conservative forecast suggests the US retail price may decline by approximately 35–50% by 2028, settling around $350–$400 per month per patient. In emerging markets, prices may decline more sharply or be negotiated based on local health budgets, potentially reducing the cost by up to 70%.

Market Outlook and Investment Implications

The combined effect of increased market penetration, expanded indications, and patent expiration presents both opportunities and risks. Strategic patent protections, lifecycle management (e.g., new formulations), and negotiations for value-based pricing will be pivotal for Merck’s sustained revenue streams.

Key Takeaways

- The global diabetes market’s rapid expansion underpins robust demand for INVOKAMET, especially given its cardiovascular benefits.

- Competition from monotherapies and other fixed-dose combinations constrains market share but also validates the therapeutic approach.

- Patent expirations around 2026–2027 will likely induce significant price declines, emphasizing the importance of early market penetration and lifecycle management strategies.

- Future pricing in developed countries may decrease by up to 50%, while in emerging markets, prices could decline more sharply due to high price sensitivity.

- Expanding indications could sustain higher price points; however, regulatory and safety considerations remain critical.

FAQs

1. When is INVOKAMET expected to lose patent protection?

Patent exclusivity is anticipated to expire around 2026–2027, depending on patent term extensions and market-specific regulatory decisions.

2. How does the upcoming patent expiration impact price projections?

Patent expiration typically leads to 50–80% price reductions due to generic competition, significantly affecting revenue streams.

3. What factors could influence potential price stabilization or increases?

Introduction of new indications, favorable regulatory decisions, and strategies to extend patent life (e.g., formulation patents) could uphold higher prices.

4. Are there generic equivalents currently available?

As of now, no generic co-formulations of empagliflozin/metformin extend-release are widely marketed; generics may enter around 2026–2027.

5. How do regional healthcare policies influence INVOKAMET pricing?

In developed markets, reimbursement policies support premium pricing, while in emerging markets, price sensitivity and procurement negotiations lower costs significantly.

References

[1] International Diabetes Federation. "IDF Diabetes Atlas," 2022.

[2] MarketsandMarkets. "Diabetes Drugs Market," 2022.

[3] American Diabetes Association. "Standards of Medical Care in Diabetes," 2022.

[4] Zinman B, et al. "Empagliflozin, cardiovascular outcomes, and mortality," NEJM, 2015.

[5] U.S. Food & Drug Administration. "INVOKAMET approval details," 2014.

[6] Merck & Co. Q2 2022 Earnings Report.

[7] GoodRx. "INVOKAMET pricing," 2022.

[8] IMS Health. "Pharmaceutical patent expiry trends," 2022.

This comprehensive market analysis supports strategic decision-making concerning Invokamet’s commercial prospects amid evolving competitive and regulatory landscapes.

More… ↓