Share This Page

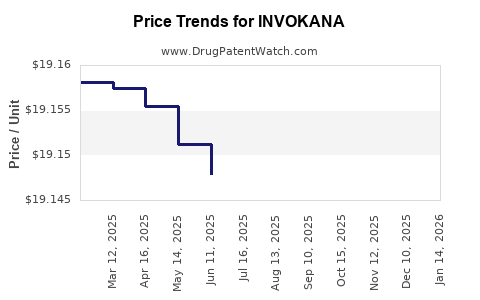

Drug Price Trends for INVOKANA

✉ Email this page to a colleague

Average Pharmacy Cost for INVOKANA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INVOKANA 100 MG TABLET | 50458-0140-30 | 19.13711 | EACH | 2025-12-17 |

| INVOKANA 100 MG TABLET | 50458-0140-90 | 19.13711 | EACH | 2025-12-17 |

| INVOKANA 300 MG TABLET | 50458-0141-90 | 19.15300 | EACH | 2025-12-17 |

| INVOKANA 300 MG TABLET | 50458-0141-30 | 19.15300 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Invokana (Canagliflozin)

Introduction

Invokana (canagliflozin) is a pioneering oral medication developed by Janssen Pharmaceuticals, classified as a sodium-glucose co-transporter 2 (SGLT2) inhibitor. Approved by the U.S. Food and Drug Administration (FDA) in 2013, Invokana is primarily prescribed for managing type 2 diabetes mellitus (T2DM). It functions by reducing renal glucose reabsorption, leading to increased glycosuria and improved blood sugar control. Given its innovative mechanism and evolving therapeutic landscape, analyzing Invokana’s market trajectory and pricing dynamics is vital for stakeholders.

Market Landscape Overview

Global Diabetes Epidemic and Therapeutic Shift

The global diabetes population surpassed 537 million in 2021, with projections exceeding 700 million by 2045 (IDF, 2021). As T2DM prevalence surges, demand for effective management options intensifies, positioning SGLT2 inhibitors like Invokana as key players. The paradigm shift toward medications offering cardiovascular and renal benefits further elevates their importance.

Competitive Positioning

Invokana faces competition from a suite of SGLT2 inhibitors, including Jardiance (empagliflozin), Farxiga (dapagliflozin), Steglatro (ertugliflozin), and others. Notably, Jardiance and Farxiga have gained significant market share, leveraging extensive clinical trial data demonstrating cardiovascular and renal benefits, which positioning some analysts as more favorable options.

Market Penetration and Adoption

Since launch, Invokana captured early market share, particularly within North America, driven by its first-mover advantage. However, concerns regarding adverse events—such as diabetic ketoacidosis, volume depletion, and amputations—have impacted physician prescribing patterns. Nonetheless, updated clinical guidelines and cardio-renal outcome data bolster its ongoing adoption.

Market Size and Revenue Trends

Current Market Valuation

The global SGLT2 inhibitor market was valued at approximately $8.4 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 15-20% through 2028 (MarketWatch, 2022). Invokana, among the earliest entrants, contributed a significant proportion to these revenues, estimated at $1.2 billion in 2022, with North America constituting the majority share.

Revenue Drivers

- Market expansion in emerging markets: China, India, and Latin America are experiencing rapid T2DM growth, opening new sales avenues.

- Cardio-renal indications: The inclusion of SGLT2 inhibitors in guidelines for heart failure and chronic kidney disease (CKD) management broadens their market footprint.

- Physician familiarity: Early dominance and extensive clinical data support continued prescriber confidence.

Market Challenges

- Pricing pressures: Competitive landscape and cost-effectiveness considerations exert downward pressure on pricing.

- Side effect concerns: Safety warnings have led to cautious prescribing, especially among vulnerable patient groups.

- Patent expiry potential: Although Invokana’s US patent protection extends into the late 2020s, biosimilar and generic options threaten future pricing.

Price Projections

Current Pricing Landscape

In the U.S., the retail list price for Invokana is approximately $500-$600 per month for a typical prescription, but actual out-of-pocket costs vary based on insurance coverage, discounts, and pharmacy benefit managers (PBMs). The average net price is estimated between $350-$450 per month after rebates and discounts.

Factors Influencing Future Pricing

- Patent Protection and Competition: The expiration of Invokana’s patents, anticipated between 2027-2028, is likely to lead to biosimilar entry, exerting substantial pricing pressure.

- Market Penetration of Generics: As biosimilars and generics gain market share, prices could decline by 30-50%, consistent with trends seen in other drug classes.

- Manufacturing and Distribution Optimization: Janssen’s capacity to reduce production costs might sustain margins even amid declining prices.

- Regulatory Approvals for New Indications: Growing approval for cardio-renal benefits could sustain or even elevate pricing before generics enter.

Projected Price Trajectory (2023-2030)

| Year | Estimated Price Range (USD/month) | Key Factors |

|---|---|---|

| 2023 | $450 - $550 | Continued demand with premiums for safety data; limited generic competition |

| 2025 | $400 - $500 | Increasing awareness of side effects; stabilization of prices |

| 2027 | $350 - $450 | Patent expiry approaches; biosimilar entry expected |

| 2028 | $200 - $300 | Biosimilar availability drives significant price reduction |

| 2030 | $150 - $250 | Mature market with widespread biosimilar adoption |

Geographical Market Dynamics

North America

Dominates revenue generation, driven by reimbursement structures, clinical guideline integration, and early adoption. Price reductions will be moderated by insurance negotiations and formulary placements.

Europe

Expected to follow North American trends but with more aggressive price negotiations and cost-containment measures, potentially leading to 20-30% lower prices compared to the U.S.

Emerging Markets

Prices tend to be significantly lower ($100-$200/month) due to affordability constraints, but the expanding diabetic population offers volume-based growth opportunities.

Future Opportunities and Risks

Opportunities

- Biosimilar Competition: Entry of biosimilars will significantly reduce prices, expanding access.

- Combination Therapies: Co-formulations with other antidiabetics (e.g., metformin, GLP-1 receptor agonists) offer premium pricing.

- Expanded Indications: Approval for heart failure and CKD will broaden market potential.

Risks

- Safety Concerns: Adverse events could lead to regulatory restrictions or declining utilization.

- Pricing Policies: Healthcare systems' emphasis on cost-containment may limit revenues.

- Generic/Biosimilar Entry: Forecasted patent expiration will trigger price erosion, affecting margins.

Key Takeaways

- Market growth for Invokana is robust, driven by the global rise in T2DM and expanding indications, but faces stiff competition and safety concerns.

- Revenue projections indicate a peak in pricing before patent expiration; post-2027, biosimilar entry could precipitate substantial price declines.

- Pricing strategies will need to adapt, balancing innovation, safety profiles, and competitive pressures to sustain profitability.

- Emerging markets present significant volume opportunities, albeit at lower price points.

- Regulatory developments and evolving clinical guidelines will be critical determinants of Invokana’s market trajectory.

FAQs

1. When will Invokana's patent protections expire, and how will this affect its pricing?

Patent protection in the U.S. is expected to expire around 2027-2028. The entry of biosimilars and generics post-expiration will likely cause a sharp decline in prices, potentially by 50% or more.

2. How does Invokana compare to other SGLT2 inhibitors in terms of pricing and market share?

While Invokana initially led the market, competitors like Jardiance and Farxiga have gained significant share, partly due to their broader cardiovascular benefits data. Pricing trends are similar across the class, with premium pricing in early years declining as generics emerge.

3. What factors could sustain Invokana's price premium beyond patent expiry?

Additional indications, such as its role in heart failure and CKD, combined with clinical evidence supporting superior safety profiles or patient outcomes, could justify premium pricing for specific formulations or markets.

4. How might healthcare policy changes impact Invokana’s future pricing?

Cost containment measures, especially in Europe and payor-driven markets, could pressure prices downward. Conversely, reimbursement policies highlighting cardiovascular and renal benefits may sustain higher prices in premium segments.

5. What is the outlook for Invokana in emerging markets?

In emerging markets, affordability constraints limit pricing, often leading to lower retail prices. Nevertheless, growing diabetes prevalence creates considerable volume opportunities, making these markets attractive despite lower margins.

References

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 9th edition.

[2] MarketWatch. (2022). Global SGLT2 Inhibitors Market Analysis.

[3] Janssen Pharmaceuticals. (2022). Invokana Prescribing Information.

[4] EvaluatePharma. (2022). 2022 World Market Intelligence.

[5] American Diabetes Association. (2022). Standards of Medical Care in Diabetes.

Note: All projections are estimates based on current market conditions, clinical data, and patent timelines. The actual market dynamics may vary based on regulatory, competitive, and economic factors.

More… ↓