INVOKAMET Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Invokamet, and when can generic versions of Invokamet launch?

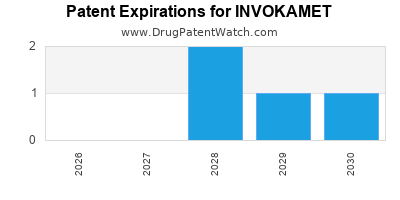

Invokamet is a drug marketed by Janssen Pharms and is included in two NDAs. There are five patents protecting this drug and one Paragraph IV challenge.

This drug has two hundred and seventy-one patent family members in forty-eight countries.

The generic ingredient in INVOKAMET is canagliflozin; metformin hydrochloride. There are twenty-one drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the canagliflozin; metformin hydrochloride profile page.

DrugPatentWatch® Generic Entry Outlook for Invokamet

Invokamet was eligible for patent challenges on March 29, 2017.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be August 26, 2029. This may change due to patent challenges or generic licensing.

There have been nineteen patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for INVOKAMET?

- What are the global sales for INVOKAMET?

- What is Average Wholesale Price for INVOKAMET?

Summary for INVOKAMET

| International Patents: | 271 |

| US Patents: | 5 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Patent Applications: | 56 |

| Drug Prices: | Drug price information for INVOKAMET |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for INVOKAMET |

| What excipients (inactive ingredients) are in INVOKAMET? | INVOKAMET excipients list |

| DailyMed Link: | INVOKAMET at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for INVOKAMET

Generic Entry Date for INVOKAMET*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Pharmacology for INVOKAMET

| Drug Class | Biguanide Sodium-Glucose Cotransporter 2 Inhibitor |

| Mechanism of Action | P-Glycoprotein Inhibitors Sodium-Glucose Transporter 2 Inhibitors |

Paragraph IV (Patent) Challenges for INVOKAMET

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| INVOKAMET | Tablets | canagliflozin; metformin hydrochloride | 50 mg/500 mg 50 mg/1000 mg 150 mg/500 mg 150 mg/1000 mg | 204353 | 6 | 2017-03-29 |

US Patents and Regulatory Information for INVOKAMET

INVOKAMET is protected by five US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of INVOKAMET is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Janssen Pharms | INVOKAMET XR | canagliflozin; metformin hydrochloride | TABLET, EXTENDED RELEASE;ORAL | 205879-004 | Sep 20, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Janssen Pharms | INVOKAMET XR | canagliflozin; metformin hydrochloride | TABLET, EXTENDED RELEASE;ORAL | 205879-002 | Sep 20, 2016 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Janssen Pharms | INVOKAMET XR | canagliflozin; metformin hydrochloride | TABLET, EXTENDED RELEASE;ORAL | 205879-003 | Sep 20, 2016 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Janssen Pharms | INVOKAMET XR | canagliflozin; metformin hydrochloride | TABLET, EXTENDED RELEASE;ORAL | 205879-004 | Sep 20, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for INVOKAMET

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Janssen Pharms | INVOKAMET | canagliflozin; metformin hydrochloride | TABLET;ORAL | 204353-002 | Aug 8, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| Janssen Pharms | INVOKAMET | canagliflozin; metformin hydrochloride | TABLET;ORAL | 204353-003 | Aug 8, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| Janssen Pharms | INVOKAMET | canagliflozin; metformin hydrochloride | TABLET;ORAL | 204353-004 | Aug 8, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| Janssen Pharms | INVOKAMET | canagliflozin; metformin hydrochloride | TABLET;ORAL | 204353-001 | Aug 8, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for INVOKAMET

When does loss-of-exclusivity occur for INVOKAMET?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 4099

Estimated Expiration: ⤷ Get Started Free

Patent: 7510

Estimated Expiration: ⤷ Get Started Free

Patent: 8450

Estimated Expiration: ⤷ Get Started Free

Patent: 9907

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 07329895

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0718882

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 71357

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 07003487

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1573368

Estimated Expiration: ⤷ Get Started Free

Patent: 2675299

Estimated Expiration: ⤷ Get Started Free

Patent: 2675380

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 10719

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 861

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0140254

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 14969

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 02224

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 099489

Estimated Expiration: ⤷ Get Started Free

El Salvador

Patent: 09003285

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 7103

Estimated Expiration: ⤷ Get Started Free

Patent: 0970540

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 02224

Estimated Expiration: ⤷ Get Started Free

Guatemala

Patent: 0900151

Estimated Expiration: ⤷ Get Started Free

Honduras

Patent: 09001135

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 9032

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 59788

Estimated Expiration: ⤷ Get Started Free

Patent: 10511602

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 3702

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 09005857

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 829

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 7545

Estimated Expiration: ⤷ Get Started Free

Nicaragua

Patent: 0900113

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 4354

Estimated Expiration: ⤷ Get Started Free

Patent: 091778

Estimated Expiration: ⤷ Get Started Free

Panama

Patent: 59401

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 081201

Estimated Expiration: ⤷ Get Started Free

Patent: 110841

Estimated Expiration: ⤷ Get Started Free

Patent: 130591

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 02224

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 02224

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 274

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 02224

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0903941

Patent: Crystalline form of 1- (Beta-D-Glucopyranosyl)-4-methyl-3-[5-(4-fluorophenyl)-2-thienylmethyl] benzene hemihydrate

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1146095

Estimated Expiration: ⤷ Get Started Free

Patent: 090086282

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 56640

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 03325

Estimated Expiration: ⤷ Get Started Free

Patent: 0829259

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 135

Patent: КРИСТАЛІЧНА ФОРМА ГЕМІГІДРАТУ 1-(β-D-ГЛЮКОПІРАНОЗИЛ)-4-МЕТИЛ-3-[5-(4-ФТОРФЕНІЛ)-2-ТІЕНІЛМЕТИЛ]БЕНЗОЛУ[КРИСТАЛЛИЧЕСКАЯ ФОРМА ГЕМИГИДРАТА 1-(b-D-ГЛЮКОПИРАНОЗИЛ)-4-МЕТИЛ-3-[5-(4-ФТОРФЕНИЛ)-2-ТИЭНИЛМЕТИЛ]БЕНЗОЛА (CRYSTALLINE FORM OF 1-(в-D-GLUCOPYRANOSYL)-4-METHYL-3-[5-(4-FLUOROPHENYL)-2-THIENYLMETHYL] BENZENE HEMIHYDRATE)

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 730

Patent: FORMA CRISTALINA DEL HEMIHIDRATO DE 1-(B (BETA)-D-GLUCOPIRANOSIL) -4-METIL-3-[5-(4-FLUOROFENIL) -2-TIENILMETIL]BENCENO

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering INVOKAMET around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Costa Rica | 11263 | COMPUESTOS NOVEDOSOS QUE POSEEN ACTIVIDAD INNHIBITORIA CONTRA TRANSPORTADOR DE GLUCOSA DEPENDIENTE DE SODIO (Solicitud divisional) | ⤷ Get Started Free |

| European Patent Office | 2451482 | ⤷ Get Started Free | |

| Eurasian Patent Organization | 009768 | ЗАМЕЩЕННЫЕ КОНДЕНСИРОВАННЫЕ ГЕТЕРОЦИКЛИЧЕСКИЕ С-ГЛИКОЗИДЫ (SUBSTITUTED FUSED HETEROCYCLIC C-GLYCOSIDES) | ⤷ Get Started Free |

| Luxembourg | 92426 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for INVOKAMET

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1651658 | C 2014 017 | Romania | ⤷ Get Started Free | PRODUCT NAME: CANAGLIFLOZIN; NATIONAL AUTHORISATION NUMBER: EU/1/13/884; DATE OF NATIONAL AUTHORISATION: 20131115; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/13/884; DATE OF FIRST AUTHORISATION IN EEA: 20131115 |

| 1651658 | 637 | Finland | ⤷ Get Started Free | |

| 1651658 | 164 1-2014 | Slovakia | ⤷ Get Started Free | PRODUCT NAME: KANAGLIFLOZIN; REGISTRATION NO/DATE: EU/1/13/884/001 - EU/1/13/884/008 20131115 |

| 1651658 | PA2014008,C1651658 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: CANAGLIFOZINUM; REGISTRATION NO/DATE: EU/1/13/884/001 - EU/1/13/884/004, 2013- 11-15 EU/1/13/884/005 - EU/1/13/884/008 20131115 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

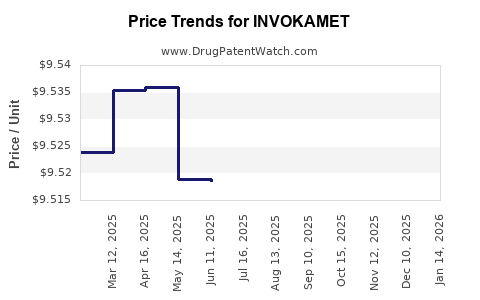

Market Dynamics and Financial Trajectory for INVOKAMET

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.