Last updated: July 30, 2025

Introduction

Alpharma Pharms, a notable name within the global pharmaceutical sector, has established a significant footprint through a diverse portfolio spanning opioid analgesics, generic pharmaceuticals, and specialty medicines. Its strategic positioning in various healthcare markets, along with its innovation-driven approach, underscores its importance in the competitive pharmaceutical landscape. This analysis evaluates Alpharma’s market position, core strengths, competitive differentiators, and strategic prospects, offering critical insights for stakeholders seeking to understand its trajectory and influence.

Market Position Overview

Historical Background and Market Presence

Founded in 1959, Alpharma has evolved from a regional player to a formidable global entity, particularly known for its generic drug portfolio and opioid products. Its acquisition by King Pharmaceuticals in 2009 and subsequent integration into Pfizer's generics division broadened its reach, positioning Alpharma as a critical component of Pfizer’s global generics strategy. Despite divestitures and corporate restructuring, Alpharma continues to influence the availability of affordable medicines, especially in pain management and specialty therapeutics.

Product Portfolio and Therapeutic Focus

Alpharma’s core offerings include opioid analgesics (e.g., morphine, hydromorphone), generic versions of branded drugs, and niche formulations in the orthopedic and dermatological spaces. Its significant footprint in pain management, especially in the opioid segment, positions it amid critical public health debates and regulatory scrutiny, impacting its market dynamics.

Competitive Market Dynamics

While the landscape features giants like Teva, Sandoz, and Mylan, Alpharma’s niche specialty and strategic focus areas offer competitive differentiation. Its ability to swiftly develop generics and maintain supply chain integrity underpins its competitive resilience. However, regulatory challenges, especially concerning opioid products, continually shape its market positioning and strategic alternatives.

Strengths of Alpharma Pharms

Robust Product Portfolio and R&D Capabilities

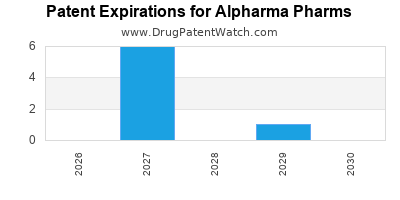

Alpharma boasts a comprehensive product pipeline with a proven track record of launching high-quality generics. Its R&D expertise enables rapid development, ensuring early market entry and capturing patent expiry opportunities. Its specialization in controlled substances, such as opioids, grants it a dominant position in pain therapeutics.

Strategic Alliances and Distribution Network

Leveraging its integration with Pfizer, Alpharma benefits from an extensive distribution network, regulatory expertise, and access to emerging markets. Strategic partnerships facilitate market penetration and streamline production, quality control, and compliance.

Operational Efficiency

Alpharma maintains lean manufacturing processes and rigorous quality standards. Its ability to produce cost-effective generics ensures competitive pricing, crucial amid increasing price pressures and healthcare cost containment policies.

Regulatory Acumen and Market Adaptation

Navigating complex regulatory environments, especially concerning controlled substances, underscores Alpharma’s expertise. Its compliance track record allows for smoother approvals and timely market access.

Strategic Challenges and Risks

Regulatory and Legal Risks

The opioid epidemic has prompted intensified regulatory scrutiny and litigation. Alpharma’s manufacturing of opioid products exposes it to legal liabilities, bans, or restrictions that could diminish its profitability and market share.

Market Saturation and Price Erosion

The generics sector faces substantial pricing pressures, driven by market saturation and competitive bidding. Alpharma must continuously innovate and optimize costs to sustain margins.

Public Perception and Ethical Considerations

Public and governmental scrutiny around opioid distribution and misuse impacts Alpharma’s reputation, potentially hindering future licensing, partnerships, and market access.

Strategic Insights and Future Outlook

Diversification and Niche Focus

To mitigate opioid-related risks, Alpharma could leverage its expertise to diversify into biosimilars, specialty drugs, or develop abuse-deterrent formulations, aligning with regulatory trends emphasizing safer pain management solutions.

Innovation and Digital Transformation

Investing in digital logistics, AI-driven R&D, and advanced formulation technologies will enhance responsiveness to market demands and reduce time-to-market for novel products.

Geographic Expansion

Emerging markets offer growth opportunities. Tailored strategies to navigate local regulations and forge partnerships can expand Alpharma’s footprint beyond mature markets.

Public-Private Collaborations and Resilience Building

Engaging in collaborations aimed at safe prescribing practices and abuse deterrence can restore public trust and create new revenue streams.

Conclusion

Alpharma Pharms maintains a strong niche within the pharmaceutical sector, predominantly driven by its generics and opioid portfolios. Its strategic alliances, operational efficiencies, and R&D capabilities position it well to capitalize on patent expirations and market demands. However, regulatory hurdles, market saturation, and public scrutiny, particularly surrounding opioids, remain significant challenges. Moving forward, diversification into higher-margin specialty areas and innovation in abuse-deterrent formulations can safeguard its competitive edge and foster sustainable growth.

Key Takeaways

- Market Position: Alpharma remains influential in pain management, leveraging its manufacturing expertise in opioids and generics, underpinned by strategic integration into Pfizer’s broader healthcare network.

- Core Strengths: Strong R&D capabilities, operational efficiency, robust compliance, and wide distribution channels sustain its competitive advantage.

- Challenges: Regulatory risks, legal liabilities linked to opioids, and pricing pressures necessitate strategic agility and diversification.

- Growth Strategies: Expanding into biosimilars, specialty therapeutics, and emerging markets, while investing in digital transformation, can bolster growth and mitigate risks.

- Public and Regulatory Engagement: Active collaboration on responsible prescribing and abuse prevention is vital to maintain market relevance and societal license to operate.

FAQs

1. How has Alpharma’s integration into Pfizer impacted its market reach?

The integration provided access to Pfizer’s expansive distribution networks, enhanced regulatory support, and increased resource availability, facilitating broader global reach and accelerated product launches.

2. What are the primary risks associated with Alpharma’s opioid portfolio?

Legal liabilities stemming from opioid litigation, regulatory restrictions, and public scrutiny pose significant risks that could impact product availability and revenue streams.

3. Is Alpharma well-positioned to compete in emerging markets?

Yes, with strategic localization, partnerships, and regulatory navigation, Alpharma can leverage its robust manufacturing and R&D expertise to expand into high-growth markets.

4. What strategic initiatives can help Alpharma reduce its dependence on opioids?

Diversifying into biosimilars, specialty medicines, and developing abuse-deterrent formulations can reduce reliance on opioids while aligning with evolving healthcare priorities.

5. How can Alpharma improve its reputation amid regulatory and public health challenges?

Active engagement in responsible prescribing practices, transparency, societal contributions toward addiction mitigation, and innovation in safer medication formulations are crucial strategies.

Sources:

[1] Deloitte. "Pharmaceutical Industry Outlook." 2022.

[2] IQVIA. "Global Pharmaceuticals Market Analysis." 2022.

[3] U.S. Food & Drug Administration. "Regulations on Opioid Manufacturing." 2023.

[4] Pfizer Inc. Annual Reports. 2021-2022.

[5] MarketWatch. "Generic Drugs Market Trends." 2023.