1. Introduction: The Billion-Dollar Illusion of the Patent Cliff

In the lexicon of pharmaceutical finance, few terms are as evocative—or as misleading—as the “patent cliff.” The phrase suggests a definitive, binary event: a date on the calendar when the intellectual property protecting a blockbuster drug expires, the monopoly collapses, and the market is instantly flooded with low-cost generics. It conjures images of a sudden, vertical drop in revenue for the innovator and immediate relief for healthcare payers. For decades, this model served as a reasonable approximation of reality. In the era of simple small molecules, the expiration of the “composition of matter” patent often marked the end of the brand’s commercial dominance.

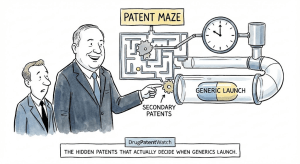

However, in the modern biopharmaceutical landscape, the patent cliff has largely been engineered out of existence. It has been replaced by a “patent thicket”—a dense, meticulously constructed web of overlapping exclusionary rights that can extend market dominance for years, and sometimes decades, beyond the expiration of the original active ingredient patent. For the seasoned industry strategist, the patent expiration date found in public databases is rarely the date that matters. The true “Loss of Exclusivity” (LOE) is a dynamic variable, determined by a complex interplay of secondary patents, regulatory exclusivities, litigation settlements, and strategic product shifts.

The stakes of this distinction are astronomical. Between 2025 and 2030, the global pharmaceutical industry faces a wave of patent expirations that places an estimated $236 billion in annual branded revenue at risk.1 Yet, the difference between a generic launch in January versus December of a single year for a drug like Keytruda or Eliquis can represent billions of dollars in preserved revenue for the innovator—or billions in lost savings for the healthcare system. A forecast error of a single quarter can alter stock valuations, force R&D restructuring, or trigger hostile takeovers.1

This report provides an exhaustive analysis of the “hidden” patents and strategic mechanisms that actually dictate market entry. We move beyond the surface-level analysis of primary patents to dissect the granular mechanics of lifecycle management. We explore how “product hopping” forces patients onto new formulations before generics arrive, how the legal doctrine of “skinny labeling” is being litigated into irrelevance, and how the divergent regulatory regimes for small molecules and biologics create distinct battlegrounds for exclusivity. Furthermore, we examine the seismic shifts occurring in 2024 and 2025, as the Inflation Reduction Act (IRA) and a newly aggressive Federal Trade Commission (FTC) attempt to dismantle these strategies.

For the business professional, the investor, or the legal strategist, understanding these hidden mechanisms is no longer optional; it is the prerequisite for accurately forecasting market entry, valuing pharmaceutical assets, and navigating the treacherous waters of modern intellectual property.

2. The Regulatory Bedrock: Hatch-Waxman, BPCIA, and the Tale of Two Books

To understand how generics are delayed, one must first master the divergent regulatory frameworks that govern them. The U.S. system is bifurcated: one path for small-molecule drugs (chemical pills) and another for biologics (large, complex proteins). This distinction dictates the rules of engagement for patent litigation and market entry.

2.1 The Hatch-Waxman Act: The Small Molecule Framework

Enacted in 1984, the Drug Price Competition and Patent Term Restoration Act—commonly known as Hatch-Waxman—established the modern generic industry. Its central compromise was simple: innovators got patent term extensions to account for FDA review time, and generics got an abbreviated approval pathway (the Abbreviated New Drug Application, or ANDA) that relied on the innovator’s safety and efficacy data.2

The cornerstone of this system is the Orange Book (Approved Drug Products with Therapeutic Equivalence Evaluations). Innovators must list patents that claim the drug substance (active ingredient), the drug product (formulation), or a method of use. Crucially, the FDA serves a purely ministerial role; it lists whatever patents the innovator submits, provided they meet statutory criteria.4

The 30-Month Stay: A Statutory Shield

The true strategic power of the Orange Book lies in the “Paragraph IV” (PIV) certification process. When a generic manufacturer files an ANDA, they must certify against the listed patents. A PIV certification asserts that the patent is invalid, unenforceable, or will not be infringed. This filing is technically an act of infringement, allowing the brand to sue immediately.

If the brand files suit within 45 days of receiving the PIV notice, an automatic 30-month stay of FDA approval is triggered. This stay prevents the FDA from approving the generic for 30 months or until a court rules in the generic’s favor.2

- Strategic Implication: This provision acts as a guaranteed “floor” for exclusivity. Even if the patent is weak, the mere act of listing it and suing triggers a 2.5-year freeze on competition. This gives the brand a guaranteed window to litigate, settle, or shift the market.

2.2 The BPCIA: The Biologic Frontier

For biologics, the landscape is governed by the Biologics Price Competition and Innovation Act (BPCIA) of 2010. Unlike small molecules, biologics are grown in living cells, making them impossible to replicate perfectly. Competitors create “biosimilars”—highly similar, but not identical, versions.7

The Purple Book and the Patent Dance

The BPCIA created the Purple Book (Lists of Licensed Biological Products with Reference Product Exclusivity and Biosimilarity or Interchangeability Evaluations). Historically, the Purple Book lacked the patent transparency of the Orange Book. While recent legislation (the Biological Product Patent Transparency section of the Consolidated Appropriations Act of 2021) has improved this, the BPCIA process remains fundamentally opaque compared to Hatch-Waxman.9

Instead of an automatic stay, the BPCIA mandates a “Patent Dance”—a ritualized, multi-step exchange of information:

- Disclosure: The biosimilar applicant provides their dossier (aBLA) to the innovator within 20 days of FDA acceptance.

- Patent List: The innovator provides a list of potentially infringed patents.

- Negotiation: The parties negotiate which patents to litigate immediately and which to reserve for a second wave.11

Table 1: Regulatory Pathways Comparison

| Feature | Hatch-Waxman (Small Molecules) | BPCIA (Biologics) |

| Reference Book | Orange Book (Mandatory Patent Listing) | Purple Book (Listing Evolving/Patent Dance) |

| Approval Pathway | ANDA (Bioequivalence) | aBLA (Biosimilarity/Interchangeability) |

| Litigation Trigger | PIV Certification | The “Patent Dance” Information Exchange |

| Automatic Stay | Yes (30 Months) | No (Injunction must be sought) |

| Exclusivity | 5 years (NCE) + 3 years (Clinical) | 12 years (Reference Product Exclusivity) |

| Generic Incentive | 180-day Exclusivity for First Filer | Interchangeability Exclusivity (Complex) |

This regulatory bifurcation means that strategies for extending monopoly differ radically depending on the molecule type. For small molecules, the game is about listing patents to trigger the stay. For biologics, it is about creating a “thicket” so dense that the sheer cost of the “Patent Dance” forces a settlement.8

3. The Anatomy of a Patent Thicket: Building the Fortress

A “patent thicket” is not merely a collection of patents; it is a strategic architecture designed to make market entry prohibitively expensive and risky. It relies on the distinction between “primary” and “secondary” patents.

3.1 Primary Patents: The Vulnerable Core

The primary patent covers the active pharmaceutical ingredient (API)—the chemical structure itself. These are filed early in the drug discovery phase, often years before clinical trials confirm efficacy. By the time a drug reaches the market, the 20-year term of the primary patent may have eroded to just 7-10 years of effective commercial life.14 Relying solely on the primary patent is now considered a failure of corporate strategy.

3.2 Secondary Patents: The Evergreening Engine

To extend exclusivity, companies file secondary patents on incremental modifications. These patents are the building blocks of the thicket. Research indicates that for the top-selling drugs in the U.S., 72% of patent applications are filed after the drug has already received FDA approval.15

These secondary patents cover:

- Polymorphs: Alternative crystalline structures.

- Formulations: Specific combinations of excipients or release mechanisms.

- Methods of Use: New indications or dosing regimens.

- Manufacturing Processes: Methods of synthesis or purification.

- Delivery Devices: Inhalers, pens, and auto-injectors.

Industry Insight: “A patent thicket… occurs when a drug company constructs a complicated, overlapping system of patents on one drug… For example, Novo Nordisk’s Ozempic, Wegovy, and Rybelsus have 320 patent applications with the USPTO and 154 patents approved with an estimated 49 years of monopoly protection.” — Commonwealth Fund 16

The goal is to force a competitor to invalidate or design around not just one patent, but dozens. Even if each individual secondary patent is weak, the aggregate weight of the thicket creates a formidable barrier.

4. The Polymorph Paradox: Chemistry as a Legal Weapon

One of the most technically sophisticated layers of the patent thicket involves “polymorphs.” A polymorph is a specific 3D crystalline arrangement of a molecule. Just as carbon can exist as diamond or graphite, a drug molecule can exist in multiple crystal forms, each with distinct physical properties like solubility, stability, and melting point.17

4.1 The Science of Exclusion

During development, scientists screen for the most stable polymorph. Once identified, this specific form is patented separately from the molecule itself.

- The Trap: If the innovator patents the only stable, commercially viable polymorph, the generic is effectively blocked even if the primary API patent expires. The generic must find a different polymorph that is stable enough to sit on a pharmacy shelf but bioequivalent enough to pass FDA muster. This is often scientifically impossible.

4.2 Litigating the Crystal

Patent claims for polymorphs are defined by their X-ray Powder Diffraction (XRPD) patterns—a unique fingerprint of peaks produced when X-rays bounce off the crystal lattice.

- Strategic Claiming: Innovators use a “cascading” claim strategy. They file claims covering the polymorph characterized by:

- The full spectrum of 30+ peaks (narrow scope).

- The top 10 major peaks (medium scope).

- Just the 2-3 most distinct peaks (broad scope).17

This makes “designing around” the patent essentially impossible. A generic crystal that shares the major peaks but lacks the minor ones will still infringe the broad claim.

4.3 The Priority Date Nuance

A critical legal battleground is the priority date. If a polymorph patent is filed too late, it might be invalidated by the company’s own earlier disclosures (prior art). However, Amgen Inc. v. Sandoz Inc. showed that in rare cases, a polymorph patent can claim the priority date of an earlier provisional application even if that application didn’t explicitly disclose the polymorph, provided the method to obtain it was disclosed.17 This legal nuance allows companies to backdate their polymorph protection, tightening the thicket.

5. Formulation and Device Hopping: Shifting the Goalposts

When patent expirations are imminent, companies often employ “product hopping”—modifying the drug and moving the patient population to the new version before generics launch.

5.1 Hard Switch vs. Soft Switch

- Hard Switch: The company withdraws the original product from the market. Patients must switch.

- Example: Actavis withdrew Namenda IR (twice daily) to force Alzheimer’s patients onto Namenda XR (once daily) just before IR generics arrived.16

- Soft Switch: The old product remains, but marketing and rebates are shifted aggressively to the new one.

5.2 The Device Wall: Inhalers and Injectors

For drug-device combinations, the device itself becomes the fortress. The drug might be old, but the delivery mechanism is protected by a fresh layer of patents.

Case Study: Teva’s QVAR Redihaler

Teva’s QVAR (beclomethasone) is an asthma inhaler. As patents on the original CFC-free inhaler approached expiration, Teva introduced a “dose counter”—a mechanism that counts remaining puffs.

- The Strategy: Teva obtained new patents on the dose counter mechanism. They then discontinued the non-counter version (“hard switch”).

- The Consequence: When generics tried to launch, they faced infringement suits not on the drug, but on the dose counter. Plaintiffs in antitrust litigation allege this was a “sham” innovation designed solely to delay competition, noting that the FDA guidance on dose counters exempted existing products.18

- Outcome: Teva eventually settled for $35 million and agreed to delist certain patents, but only after years of delay.19

Case Study: Lantus SoloSTAR

Sanofi’s Lantus (insulin glargine) is a blockbuster biologic. Sanofi listed patents in the Orange Book covering the drive mechanism of the SoloSTAR pen injector.

- Legal Battle: In Sanofi-Aventis U.S. LLC v. Mylan, the First Circuit Court of Appeals scrutinized these listings. The court found that listing device patents that do not claim the drug product itself could be improper. The patent covered the mechanics of the pen, not the insulin.

- Implication: This case highlighted the practice of using “junk” device patents to trigger the 30-month stay on the drug itself. It paved the way for the FTC’s recent crackdown on improper listings.20

6. The Biologic Fortress: Humira and the $200 Billion Wall

If small molecule strategies are a thicket, biologic strategies are a fortress. The defense of Humira (adalimumab) by AbbVie stands as the defining case study of modern IP strategy.

6.1 The Scale of the Thicket

The primary patent for the adalimumab molecule expired in 2016. Yet, biosimilars did not enter the U.S. market until 2023. This seven-year extension was achieved through an unprecedented accumulation of secondary patents.

- The Numbers: AbbVie filed over 250 patent applications and obtained over 130 patents.7

- The Coverage: These patents covered every conceivable aspect of the product:

- Formulation: A switch to a citrate-free, high-concentration formulation that reduced injection pain.

- Manufacturing: Specific methods of fermentation, purification, and cell culture.

- Indications: Methods of treating specific diseases like Crohn’s or uveitis.

- Device: The specific firing mechanism of the auto-injector pen.24

6.2 The Settlement Strategy

Faced with the prospect of litigating 100+ patents—a process that would take years and cost hundreds of millions—every biosimilar competitor (Amgen, Samsung Bioepis, Sandoz) chose to settle.

- The Deal: AbbVie granted these competitors licenses to launch in Europe in 2018 but forced them to delay U.S. launch until 2023.25

- Economic Impact: This market segmentation strategy allowed AbbVie to harvest monopoly profits in the U.S. (where prices are higher) for an additional five years. The cost to the U.S. healthcare system of this delay is estimated at $7.6 billion.15

Key Insight: The Humira case demonstrates that in the biologic space, the goal of the patent thicket is not necessarily to win in court, but to make the process of litigation so burdensome that settlement becomes the only rational business decision for a competitor.

7. Settlement Dynamics: From “Pay-for-Delay” to “Volume-Limited” Entry

The legal resolution of these patent disputes has evolved. In the past, brand companies often paid generics to stay off the market—a practice known as “Pay-for-Delay” or “Reverse Payments.” The Supreme Court’s 2013 decision in FTC v. Actavis made these cash settlements legally perilous.26

7.1 The Evolution: Volume-Limited Licenses

To avoid antitrust scrutiny while still managing the “cliff,” companies have shifted to “volume-limited” settlements.

- The Mechanism: The brand allows the generic to launch before the last patent expires, but restricts their market share to a specific percentage (e.g., 5-10%) for a set period.

Case Study: Revlimid (Lenalidomide)

Bristol Myers Squibb (BMS) executed this strategy perfectly with Revlimid, a cancer drug with over $12 billion in annual sales.

- The Settlements: BMS settled with Natco, Teva, and others. The generics were allowed to launch in March 2022, years before the full patent expiry.

- The Catch: The launch was volume-limited. In the first year, generics were restricted to a “mid-single-digit percentage” of the total market. This cap gradually increases until January 31, 2026, when full unrestricted entry is allowed.28

- The Result: Instead of a cliff, BMS engineered a “slope.” They retained the vast majority of market share and revenue even after “generic entry” technically occurred. This strategy effectively secured a soft landing for their blockbuster asset.30

7.2 Antitrust Implications

While these deals avoid direct cash payments, the FTC and private plaintiffs argue they are still anticompetitive. The “payment” is the transfer of value via the early (but restricted) entry license. However, courts have been hesitant to condemn these as per se illegal, viewing them as a compromise that brings some competition to the market earlier than a full trial might.31

8. The “Skinny Label” Crisis: GSK v. Teva and the Trap of Inducement

One of the few reliable tools generics had to bypass patent thickets was the “Skinny Label” (Section viii carve-out). If a brand drug has multiple indications (e.g., Heart Failure and Hypertension) and only one is patented (Heart Failure), the generic can seek approval only for Hypertension.

8.1 The Legal Earthquake

This strategy was severely compromised by the Federal Circuit’s decision in GlaxoSmithKline (GSK) v. Teva (2021).

- The Facts: Teva launched a generic version of Coreg (carvedilol) with a skinny label that carved out the patented heart failure indication. However, GSK sued for “induced infringement,” arguing that Teva’s marketing materials and press releases implied the drug could be used for heart failure.

- The Ruling: The court reinstated a $235 million jury verdict against Teva. It found that even though the label was skinny, Teva’s other communications—and the general knowledge that the drug was the same—amounted to inducement.33

8.2 The Strategic Chilling Effect

This ruling has created a massive chilling effect. Generics are now terrified that even with a skinny label, they could be liable for massive damages if they don’t perfectly police every press release and website summary.

- Consequence: Generics are less likely to use Section viii carve-outs, effectively extending the brand’s monopoly on all indications—even the unpatented ones—until the very last method-of-use patent expires.35 This reinforces the power of “method of use” patents as a key pillar of the thicket.

9. The New Legal Standard: Amgen v. Sanofi and the Death of Functional Claims

While GSK v. Teva strengthened brand protections, the Supreme Court’s May 2023 decision in Amgen v. Sanofi struck a major blow against biologic thickets.

9.1 The “Functional” Claim Strategy

For years, biotech companies attempted to patent antibodies based on what they did (function) rather than exactly what they were (structure). Amgen sought to patent “the entire genus of antibodies that bind to specific amino acids on the PCSK9 protein and block it from binding to LDL receptors.” This would have covered millions of potential antibodies, including those not yet discovered.37

9.2 The “Enablement” Smackdown

The Supreme Court unanimously ruled these claims invalid for lack of “enablement.” The Court held that if you claim a vast genus, you must explain how to make them all—not just give a few examples and tell scientists to engage in “trial and error.”

- Strategic Shift: This ruling forces innovators to narrow their patents to the specific antibodies they have characterized (structural claims). It destroys the “Type I” thicket strategy of claiming the entire therapeutic mechanism.

- Opportunity: This opens the door for biosimilar competitors to engineer “design-around” antibodies that bind to the same target but have different amino acid sequences, without infringing the structural patent.39

10. Economic Consequences: The Price of Delay

The economic impact of these strategies is not abstract. It is measured in billions of dollars of excess healthcare spending.

10.1 Direct Costs to the System

According to a 2023 report by the American Economic Liberties Project and I-MAK, antitrust violations and patent abuse by the pharmaceutical industry cost U.S. patients and payers an estimated $40.07 billion in 2019 alone.41

- Medicare Impact: Antitrust violations increased Medicare Part D gross spending by roughly 14.15% ($14.82 billion) for the top 100 drugs.41

- Per Capita Cost: This amounts to a “corruption tax” of approximately $120 per year for every American man, woman, and child.41

10.2 Asset-Level Impact

- Humira: Delayed biosimilar entry cost the U.S. system $7.6 billion.15

- Imbruvica: Patent thickets resulted in $3.1 billion in lost savings.15

- Revlimid: The volume-limited settlement and delayed entry effectively extended the monopoly, with prices remaining high despite the “launch” of generics.30

11. The Policy Counterstrike (2024-2025): A New Era of Enforcement

The unchecked expansion of patent thickets has triggered a coordinated response from the U.S. government. We are currently witnessing the most aggressive regulatory crackdown on pharmaceutical IP in decades.

11.1 The FTC’s Delisting Campaign

Under Chair Lina Khan, the FTC has declared war on “junk” Orange Book listings.

- The Action: In 2024, the FTC challenged over 100 patent listings held by major players like Teva, GSK, and Boehringer Ingelheim. The agency argued that patents on device components (caps, straps, counters) are not “drug products” and cannot be listed to trigger the 30-month stay.43

- The Result: Companies have capitulated. Teva, for example, agreed to delist patents for its asthma inhalers and pay $35 million in settlements. This removes the automatic stay barrier, potentially accelerating generic entry by years.44

11.2 The USPTO’s Terminal Disclaimer Proposal

The USPTO proposed a rule in 2024 that struck at the heart of the “continuation” patent strategy used to build thickets.

- The Proposal: The rule would require that if a patent is tied to another via a “terminal disclaimer” (common in thickets), and one is invalidated, they are all invalidated.

- Status: The proposal was withdrawn in December 2024 after massive industry pushback, but it signals the government’s intent to treat thickets as a single vulnerability rather than a hydra of independent rights.45

11.3 The Inflation Reduction Act (IRA): The Ultimate Override

The IRA is the most significant disruptor. By empowering Medicare to negotiate prices, it creates a “regulatory LOE” that overrides patent status.

- The Timelines:

- Small Molecules: Eligible for negotiation 9 years after approval.

- Biologics: Eligible 13 years after approval.47

- The “Pill Penalty”: This 4-year gap is driving a massive strategic shift. Venture capital is fleeing small molecule development (down 70%) in favor of biologics to capture the longer guaranteed exclusivity.47

- Negotiation as Expiry: If Medicare sets a “Maximum Fair Price” in year 9, the existence of a patent thicket that runs to year 20 becomes economically moot for the Medicare population. The negotiation date is the new patent cliff.49

12. Strategic Forecasting: The “Patent Cliff Protocol”

For the analyst or investor, relying on a simple patent expiry date is negligence. Accurate forecasting requires a probabilistic model—a “Patent Cliff Protocol.”

12.1 The Forecasting Checklist

- Identify the Thicket: Use tools like DrugPatentWatch to map the full “exclusivity stack.” Don’t just look at the API patent; map the formulation, device, and method patents.

- Monitor PIV Activity: Track the first PIV filing. This starts the clock on the 30-month stay.

- Analyze Litigation Venue: Is the case in Delaware (historically thorough/slow) or the Eastern District of Texas (fast/patent-friendly)? Who is the judge?

- Evaluate Settlement Incentives: Does the brand have a history of volume-limited deals (like BMS)? If so, forecast a “slope,” not a cliff.

- Factor in Regulatory Risk: Is the drug a small molecule approaching its 9th year? The IRA negotiation might hit before the generic does.

- Watch the Citizen Petitions: A late-stage Citizen Petition questioning generic safety is a leading indicator of a delay strategy.

12.2 The Erosion Curve

- Small Molecules: Post-180 days, expect a vertical cliff (90% revenue loss in 12 months).

- Biologics: Expect a gradual erosion. Biosimilars often discount only 30-50%, and uptake is slower due to interchangeability issues.

- Volume-Limited: Explicitly model the capped market share (e.g., 5% in Year 1, 10% in Year 2).

Expert Insight: “A forecast error of a single quarter for a blockbuster drug like Eliquis… represents a variance of hundreds of millions of dollars… The date is a Distribution, Not a Point.” 1

13. Future Outlook: The Hybrid Cliff

The future of pharmaceutical exclusivity is becoming a hybrid model. The “pure” patent cliff is dead. In its place is a landscape where:

- Biologics Dominance: The industry will continue to shift toward biologics to leverage the 13-year IRA window and the defensibility of manufacturing patents.

- Complex Generics: Generics companies will pivot from simple pills to “complex generics” (injectables, inhalers) where barriers to entry are higher, but price erosion is lower.49

- Litigation Velocity: With the FTC cracking down on listings, litigation will move faster. Brands will have to defend their patents on the merits rather than relying on procedural stays.

The “hidden” patents—on devices, crystals, and processes—will remain the primary tools of defense. But they are no longer invisible. Regulators, payers, and competitors have woken up to the game. The thickets will remain, but the machetes are getting sharper.

14. Key Takeaways

- The “Patent Cliff” is a Myth: For high-value assets, revenue erosion is a managed decline governed by settlements and regulatory structures, not a binary drop. The “Loss of Exclusivity” is a distribution of probabilities, not a calendar date.

- Secondary Patents are the Real Fortress: The primary API patent is merely the opening act. True exclusivity is maintained by post-approval patents on polymorphs, devices, and manufacturing processes, which constitute 72% of filings.

- Regulatory Regimes Dictate Strategy: The divergence between Hatch-Waxman (Orange Book/Stay) and BPCIA (Patent Dance/No Stay) necessitates fundamentally different lifecycle strategies.

- “Skinny Labels” are Dangerous: Following GSK v. Teva, relying on Section viii carve-outs is legally perilous, reinforcing the power of method-of-use patents to block all indications.

- The IRA is the New LOE: Medicare price negotiation effectively caps the economic life of a drug at 9 years (small molecules) or 13 years (biologics), regardless of the patent estate.

- Enforcement is the Wild Card: The FTC’s delisting of device patents and the USPTO’s scrutiny of terminal disclaimers represent an existential threat to the traditional “thicket” business model.

- Data is the Competitive Advantage: In this complex environment, real-time intelligence on PIV filings, litigation status, and patent validity—provided by platforms like DrugPatentWatch—is the only way to accurately value assets.

15. FAQ: Navigating the Maze

Q1: How does the “30-month stay” differ from the “Patent Dance”?

A: The 30-month stay (Hatch-Waxman) is an automatic federal injunction that prevents the FDA from approving a small-molecule generic for 2.5 years once a lawsuit is filed. The Patent Dance (BPCIA) is a mandatory information exchange process for biologics that forces the parties to identify relevant patents. Crucially, the Patent Dance does not trigger an automatic stay; the innovator must convince a judge to issue a preliminary injunction to stop the launch, which is a much higher legal bar.

Q2: Why are “polymorph” patents so difficult for generics to invalidate?

A: Polymorph patents are scientifically tenacious. If the innovator patents the most thermodynamically stable crystal form, any other form the generic creates might naturally convert into the patented form over time (e.g., on the pharmacy shelf). If the generic’s product contains even a trace amount of the patented polymorph, it infringes. Proving that your crystal won’t convert requires massive amounts of stability data, making it a high-risk scientific endeavor.

Q3: What exactly is a “volume-limited” settlement, and why is it legal?

A: A volume-limited settlement allows a generic to launch before patents expire, but restricts them to a small market share (e.g., 5%). It is legal because it is viewed as a compromise: the generic gets early entry (pro-competitive), and the brand keeps most of its revenue (respecting the patent). Unlike “Pay-for-Delay” deals involving cash, courts have generally upheld these because they technically increase competition, albeit incrementally.

Q4: How does the “Pill Penalty” in the Inflation Reduction Act affect R&D?

A: The IRA allows Medicare to negotiate prices for small molecules 9 years after approval, but gives biologics 13 years. This 4-year gap creates a massive financial incentive to develop biologics over small molecules. Investors view the 9-year window as insufficient to recoup the investment for “pills,” leading to a 70% drop in funding for small molecule R&D since the law’s discussion began.47

Q5: What is the “Purple Book,” and how has it changed?

A: The Purple Book is the FDA’s registry for licensed biological products. Historically, it was just a list of products without patent data. However, recent legislation (the Biological Product Patent Transparency provisions) now requires innovators to list the patents they asserted during the “Patent Dance.” This is slowly transforming the Purple Book into something more like the Orange Book, giving biosimilar developers better visibility into the patent landscape earlier in the process.10

Works cited

- The Patent Cliff Protocol: Advanced Methodologies for Forecasting …, accessed December 14, 2025, https://www.drugpatentwatch.com/blog/the-patent-cliff-protocol-advanced-methodologies-for-forecasting-generic-drug-launches-and-market-erosion/

- The timing of 30‐month stay expirations and generic entry: A cohort study of first generics, 2013–2020 – NIH, accessed December 14, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8504843/

- Hatch-Waxman Overview | Axinn, Veltrop & Harkrider LLP, accessed December 14, 2025, https://www.axinn.com/en/insights/publications/hatch-waxman-overview

- Patent Listing in FDA’s Orange Book – Congress.gov, accessed December 14, 2025, https://www.congress.gov/crs-product/IF12644

- Drug Patent Research: Expert Tips for Using the FDA Orange and Purple Books, accessed December 14, 2025, https://www.drugpatentwatch.com/blog/drug-patent-research-expert-tips-for-using-the-fda-orange-and-purple-books/

- Patent Certifications and Suitability Petitions – FDA, accessed December 14, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/patent-certifications-and-suitability-petitions

- Humira’s $200B Fortress: When Biology Becomes Business Strategy – Sargam Gupta, accessed December 14, 2025, https://sgsargam.medium.com/humiras-200b-fortress-when-biology-becomes-business-strategy-6107ecec49c8

- Two Pathways, Two Playbooks: A Comparative Analysis of Biosimilar and Generic Drug Development and the Divergent Roles of the Purple and Orange Books – DrugPatentWatch, accessed December 14, 2025, https://www.drugpatentwatch.com/blog/two-pathways-two-playbooks-a-comparative-analysis-of-biosimilar-and-generic-drug-development-and-the-divergent-roles-of-the-purple-and-orange-books/

- FAQs – FDA Purple Book, accessed December 14, 2025, https://purplebooksearch.fda.gov/faqs

- Drug to Biologic Transition: Is Purple The New Orange?, accessed December 14, 2025, https://ktslaw.com/en/Blog/MEMO/2021/2/Drug-to-Biologic-Transition—Is-Purple-The-New-Orange

- The Patent Dance | Articles | Finnegan | Leading IP+ Law Firm, accessed December 14, 2025, https://www.finnegan.com/en/insights/articles/the-patent-dance-article.html

- What Is the Patent Dance? | Winston & Strawn Law Glossary, accessed December 14, 2025, https://www.winston.com/en/legal-glossary/patent-dance

- Comparison of the Hatch-Waxman Act and the BPCIA – Fish & Richardson, accessed December 14, 2025, https://www.fr.com/wp-content/uploads/2019/03/Comparison-of-Hatch-Waxman-Act-and-BPCIA-Chart.pdf

- The End of Exclusivity: Navigating the Drug Patent Cliff for Competitive Advantage, accessed December 14, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- The Thicket Maze: A Strategic Guide to Navigating and Dismantling …, accessed December 14, 2025, https://www.drugpatentwatch.com/blog/the-thicket-maze-a-strategic-guide-to-navigating-and-dismantling-drug-patent-fortresses/

- How Drugmakers Use the Patent Process to Keep Prices High | Commonwealth Fund, accessed December 14, 2025, https://www.commonwealthfund.org/publications/explainer/2025/nov/how-drugmakers-use-patent-process-keep-prices-high

- Polymorph Patents – Sterne Kessler, accessed December 14, 2025, https://www.sternekessler.com/news-insights/insights/polymorph-patents-2025/

- -1- United States District Court District of Massachusetts Iron Workers District Council of New England Health and Welfare Fund – GovInfo, accessed December 14, 2025, https://www.govinfo.gov/content/pkg/USCOURTS-mad-1_23-cv-11131/pdf/USCOURTS-mad-1_23-cv-11131-0.pdf

- Teva agrees to pay $35 million to settle asthma inhaler antitrust lawsuit – Westlaw, accessed December 14, 2025, https://content.next.westlaw.com/Document/I4a57e6d0b34711f0a7d7f8a7b8a30bbc/View/FullText.html?transitionType=Default&contextData=(sc.Default)

- In re Lantus Direct Purchaser Antitrust Litig – United States Court of Appeals, accessed December 14, 2025, https://media.ca1.uscourts.gov/pdf.opinions/18-2086P-01A.pdf

- First Circuit Finds Device Patent Improperly Listed in the Orange Book – Fish & Richardson, accessed December 14, 2025, https://www.fr.com/insights/thought-leadership/blogs/first-circuit-device-patent-improperly-listed-orange-book/

- Patenting Strategies on Inhaler Delivery Devices – PMC – NIH, accessed December 14, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10475818/

- Humira: The First $20 Billion Drug – AJMC, accessed December 14, 2025, https://www.ajmc.com/view/humira-the-first-20-billion-drug

- Patent thickets and their impact on plan spend – Marsh McLennan Agency, accessed December 14, 2025, https://mmaeast.com/blog/patent-thickets-plan-spend/

- AbbVie’s Enforcement of its ‘Patent Thicket’ For Humira Under the BPCIA Does Not Provide Cognizable Basis for an Antitrust Violation | Mintz, accessed December 14, 2025, https://www.mintz.com/insights-center/viewpoints/2231/2020-06-18-abbvies-enforcement-its-patent-thicket-humira-under

- pay for delay – Federal Trade Commission, accessed December 14, 2025, https://www.ftc.gov/terms/pay-delay

- Pay for Delay | Federal Trade Commission, accessed December 14, 2025, https://www.ftc.gov/news-events/topics/competition-enforcement/pay-delay

- Bristol Myers Squibb Announces Settlement of U.S. Patent Litigation for REVLIMID® (lenalidomide) with Cipla, accessed December 14, 2025, https://news.bms.com/news/details/2020/Bristol-Myers-Squibb-Announces-Settlement-of-U.S.-Patent-Litigation-for-REVLIMID-lenalidomide-with-Cipla/default.aspx

- Lotus and Alvogen settled the US Revlimid® patent litigation with Celgene, accessed December 14, 2025, https://www.lotuspharm.com/newsroom/lotus-and-alvogen-settled-us-revlimid-patent-litigation

- How Celgene and Bristol Myers Squibb Used Volume Restrictions to Delay Revlimid Competition – I-MAK, accessed December 14, 2025, https://www.i-mak.org/2025/04/04/how-celgene-and-bristol-myers-squibb-used-volume-restrictions-to-delay-revlimid-competition/

- Revlimid Antitrust – Hagens Berman, accessed December 14, 2025, https://www.hbsslaw.com/cases/revlimid-antitrust

- DOJ and FTC Host “Listening Session” on Competition Issues in the Pharmaceutical Industry | Insights & Resources | Goodwin, accessed December 14, 2025, https://www.goodwinlaw.com/en/insights/publications/2025/07/alerts-practices-cldr-doj-and-ftc-host-listening-sessions

- Federal Circuit Vacates Judgment, Reinstates Jury’s Verdict of Induced Infringement, accessed December 14, 2025, https://www.jonesday.com/en/insights/2021/09/federal-circuit-vacates-judgment-reinstates-jurys-verdict-of-induced-infringement

- Generic Drugs and the Struggle to Compete: The Role of Skinny Labels – PMC – NIH, accessed December 14, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11963906/

- The Future of Healthcare: GlaxoSmithKline v. Teva’s Effect on Modern-Day Pharmaceuticals As We Know Them, accessed December 14, 2025, https://repository.law.uic.edu/cgi/viewcontent.cgi?article=1528&context=ripl

- GSK v. Teva1 Is a Big Win for Brand Pharma Companies; a Glimmer of Hope for Generics, accessed December 14, 2025, https://www.taftlaw.com/news-events/law-bulletins/gsk-v-teva1-is-a-big-win-for-brand-pharma-companies-a-glimmer-of-hope-for-generics/

- Impact Of Amgen Inc. v. Sanofi On Patenting Antibody Based Therapeutics – American Bar Association, accessed December 14, 2025, https://www.americanbar.org/content/dam/aba/publications/Jurimetrics/winter-2024/impact-of-amgen-inc-v-sanofi-on-patenting-antibody-based-therapeutics.pdf

- Amgen v. Sanofi: Supreme Court Holds Patents Claiming Antibody Genus Invalid as Not Enabled | Congress.gov, accessed December 14, 2025, https://www.congress.gov/crs-product/LSB10971

- The New Biologic Gold Rush: Patent Strategy in the Age of Amgen v. Sanofi, accessed December 14, 2025, https://www.drugpatentwatch.com/blog/the-new-biologic-gold-rush-patent-strategy-in-the-age-of-amgen-v-sanofi/

- AI and Enablement After Amgen v. Sanofi: Implications for Life Sciences Patents | Insights, accessed December 14, 2025, https://www.venable.com/insights/publications/2025/10/ai-and-enablement-after-amgen-v-sanofi

- The Costs of Pharma Cheating – I-MAK, accessed December 14, 2025, https://www.i-mak.org/wp-content/uploads/2023/06/AELP_052023_PharmaCheats_Report_FINAL.pdf

- The Costs of Pharma Cheating – American Economic Liberties Project, accessed December 14, 2025, https://www.economicliberties.us/our-work/the-costs-of-pharma-cheating/

- FTC Challenges More Than 100 Patents as Improperly Listed in the FDA’s Orange Book, accessed December 14, 2025, https://www.ftc.gov/news-events/news/press-releases/2023/11/ftc-challenges-more-100-patents-improperly-listed-fdas-orange-book

- Teva Removes Over 200 Improper Patent Listings Under Pressure from FTC, accessed December 14, 2025, https://www.ftc.gov/news-events/news/press-releases/2025/12/teva-removes-over-200-improper-patent-listings-under-pressure-ftc

- USPTO changes course on controversial proposed rule for terminal disclaimers, accessed December 14, 2025, https://www.nixonpeabody.com/insights/alerts/2024/12/16/uspto-changes-proposed-rule-for-terminal-disclaimers

- USPTO Drops Proposed Rules on Terminal Disclaimers – Foley & Lardner LLP, accessed December 14, 2025, https://www.foley.com/insights/publications/2024/12/uspto-drops-proposed-rules-terminal-disclaimers/

- Effect of the Inflation Reduction Act on Drug Innovation – ISPOR, accessed December 14, 2025, https://www.ispor.org/heor-resources/presentations-database/presentation-cti/ispor-europe-2025/poster-session-3-2/effect-of-the-inflation-reduction-act-on-drug-innovation

- The Inflation Reduction Act Is Negotiating the United States Out of Drug Innovation | ITIF, accessed December 14, 2025, https://itif.org/publications/2025/02/25/the-inflation-reduction-act-is-negotiating-the-united-states-out-of-drug-innovation/

- Mastering LOE: Expert Strategies to Predict Drug Patent Expiry and Seize Generic Market Share – DrugPatentWatch, accessed December 14, 2025, https://www.drugpatentwatch.com/blog/mastering-loe-expert-strategies-to-predict-drug-patent-expiry-and-seize-generic-market-share/

- Potential Implications of Inflation Reduction Act on Pharmaceutical Patent Litigation | Articles, accessed December 14, 2025, https://www.finnegan.com/en/insights/articles/potential-implications-of-inflation-reduction-act-on-pharmaceutical-patent-litigation.html