Introduction: The Affordability Paradox and the New Competitive Frontier

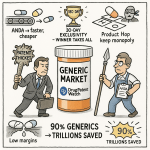

Welcome to the high-stakes world of generic pharmaceuticals. On the surface, it’s a story of immense societal good—a powerful deflationary engine in a healthcare landscape plagued by runaway costs. The numbers are, frankly, staggering. In 2023 alone, generic and biosimilar medicines saved the U.S. healthcare system a record $445 billion, contributing to a cumulative savings of an extraordinary $3.1 trillion over the past decade. This industry is the primary reason that over 90% of all prescriptions dispensed in the United States are for generic drugs, yet they account for a mere 13.1% of the nation’s total prescription drug spending. It is, by any measure, a triumph of public policy and market competition.

But for those of us competing within this arena, this triumph presents a profound and defining challenge: the affordability paradox. The very market forces that create this incredible value—intense competition, relentless price pressure, and stringent quality standards—are the same forces that have transformed much of the industry into a brutal, high-stakes gauntlet of commoditization. The traditional low-cost, high-volume business model that defined the generic sector for decades is proving increasingly unsustainable. The moment a blockbuster drug’s patent expires, triggering a multi-billion-dollar market opportunity, it also fires the starting gun on a race to the bottom, where margins are relentlessly squeezed and profitability can evaporate in a matter of quarters.4

This is the new reality. The game has changed. For years, the strategic questions were relatively simple: Which big drug is going off-patent next? Can we make a bioequivalent copy? Can we be first to market? Today, those questions are merely the entry fee. The strategic calculus has become exponentially more complex. How do you navigate a global regulatory maze where the rules for approval in the U.S., Europe, and Japan diverge in subtle but critical ways? How do you build a supply chain that is not only cost-effective but also resilient enough to withstand geopolitical shocks and pandemics? How do you win a legal war against innovator companies that have mastered the art of building “patent thickets” to extend their monopolies?

And most importantly, how do you escape the gravitational pull of commoditization?

This report is a playbook for answering those questions. It is designed for the strategic decision-makers tasked with navigating this new competitive frontier. We will move beyond the surface-level analysis to deconstruct the intricate interplay of patent law, regulatory science, commercial forecasting, and operational excellence that defines modern generic competition. We will explore how to turn patent data into a predictive weapon, how to transform regulatory complexity into a competitive moat, and how to innovate your portfolio to capture value beyond the simple pill.

In this new era, victory will not belong to the company that is merely the cheapest. It will belong to the company that is the smartest—the one that can master complexity, execute with precision, and turn intelligence into a decisive, sustainable competitive advantage. Let’s begin.

Section 1: The Global Generic Drug Arena: A Multi-Billion Dollar Battlefield

To formulate a winning strategy, we must first understand the scale and dynamics of the battlefield. The global generic drug market is not just a segment of the pharmaceutical industry; it is a massive economic force in its own right, shaped by powerful demographic trends, government policies, and the cyclical nature of pharmaceutical innovation. Understanding its size, its growth engines, and its profound economic impact is the foundational step in identifying and seizing competitive opportunities.

Market Size and Growth Trajectory: Deconstructing the Forecasts

The top-line numbers paint a picture of a robust and expanding market. According to a synthesized analysis of recent market reports, the global generic drug market was valued at approximately $491.35 billion in 2024. Looking ahead, the consensus points toward sustained growth, with projections estimating the market will surge to over $926 billion by 2034, expanding at a compound annual growth rate (CAGR) in the range of 5% to 8%.3 This growth rate confirms a healthy and enduring expansion that outpaces many other mature industries.

However, a savvy strategist knows that headline forecasts are just the beginning of the story. A closer look at the data reveals slight variations in projections from different research firms, with CAGRs ranging from 5.04% to 6.55% and even higher in some analyses.6 These are not errors; they are strategic signals. The discrepancies arise from different underlying assumptions about critical market variables: the inclusion or exclusion of biosimilars in the total market value, varying predictions about the rate of price erosion post-generic entry, and different timelines for the impact of major patent expiries. A winning strategy, therefore, cannot be built on a blindly accepted third-party number. It requires building an internal forecast based on a clear-eyed assessment of these variables, allowing your organization to develop a unique point of view on where the market is headed and why.

The primary engine powering this growth is the cyclical and predictable phenomenon known as the “patent cliff.” This is the period when blockbuster branded drugs lose their market exclusivity, representing a massive and recurring transfer of market value from innovator companies to generic competitors. The scale of the impending opportunity is monumental. Between 2025 and 2030, the industry is set to witness one of the largest waves of patent expiries in history. Branded drugs generating between $217 billion and $236 billion in annual sales are projected to lose their patent protection, opening the floodgates to generic competition.3 This predictable cascade of opportunity, fueled by an aging global population and the rising prevalence of chronic diseases that demand affordable, long-term treatment, forms the bedrock of the generic market’s sustained growth.

The Economic Juggernaut: Quantifying the Deflationary Power of Generics

The true significance of the generic drug market lies not just in its size, but in its profound economic impact. It is the single most effective cost-containment mechanism in the entire healthcare ecosystem. This is best illustrated by what we can call the “90/13 disparity”: generic medicines account for over 90% of all prescriptions filled in the United States, a testament to their deep integration into clinical practice. Yet, this overwhelming volume is responsible for a mere 13.1% of the nation’s total spending on prescription drugs. The remaining 10% of prescriptions—overwhelmingly on-patent, brand-name drugs—are responsible for the other 86.9% of the country’s pharmaceutical bill.

This stark contrast demonstrates that the United States does not have a generalized drug price problem; it has a specific brand-name drug price problem. The generic market functions as an efficient, deflationary engine that consistently delivers lower costs year after year.

The economic impact is staggering; over the past decade alone, the use of generic and biosimilar medicines has saved the U.S. healthcare system an estimated $3.1 trillion, with savings of $445 billion in 2023 alone.1

This value is distributed across the entire healthcare system, providing critical relief to every major payer:

- Medicare: As the largest single purchaser of prescription drugs, Medicare has realized enormous savings, benefiting both taxpayers and senior beneficiaries. In 2023, generics and biosimilars saved the Medicare program a staggering $137 billion. This translates to an average savings of $2,672 for every single beneficiary, a tangible benefit that directly impacts the financial well-being of millions of seniors.

- Commercial Health Plans: The commercial market, which covers the majority of working-age Americans and their families, represents the largest pool of absolute savings. In 2023, these plans saved $206 billion through the use of generics, helping to keep insurance premiums more affordable for employers and employees alike.

- Patients: The most direct and tangible benefit is felt at the pharmacy counter. The average out-of-pocket copayment for a generic prescription has remained remarkably low and stable, recorded at just $7.05 in 2023. This stands in sharp contrast to the average copay for a brand-name drug, which is nearly eight times higher at $56.12.1 In fact, an incredible 93% of all generic prescriptions are filled for a patient copay of $20 or less, making life-saving medications accessible and affordable.1

This deep understanding of the market’s economic fundamentals is crucial. It confirms the industry’s enduring value proposition and highlights the immense societal pressure to maintain and expand access to affordable medicines—a pressure that both fuels opportunity and intensifies the competitive challenges we will explore next.

Section 2: The Regulatory Gauntlet: A Global Playbook for Market Access

While the commercial opportunity in generics is vast, the path to market is a formidable gauntlet of scientific scrutiny and regulatory complexity. Mastering this landscape is not a downstream, box-checking exercise; it is a core strategic function that can dictate a product’s timeline, cost, and ultimate commercial viability. Each major global market has its own unique system, its own set of rules, and its own strategic nuances. A successful global player must be fluent in the language of each.

The U.S. FDA and the Hatch-Waxman Chessboard

The modern generic drug industry in the United States was born from the Drug Price Competition and Patent Term Restoration Act of 1984, more commonly known as the Hatch-Waxman Act. To call it a piece of legislation is to understate its significance; it is the foundational rulebook for a high-stakes strategic game played between innovator and generic companies. Before 1984, the pathway for generics was arduous. Companies often had to conduct their own expensive and duplicative clinical trials to prove safety and effectiveness, even for molecules that had been on the market for years. Generic drugs were consequently rare, accounting for only 19% of U.S. prescriptions.1

Hatch-Waxman fundamentally changed this by striking what has been called a “grand compromise”. It created a streamlined pathway for generics while providing new incentives for innovators, balancing the societal need for affordable medicines with the commercial need for R&D investment.

At the heart of this framework is the Abbreviated New Drug Application (ANDA) pathway.1 The brilliance of the ANDA is that it allows a generic manufacturer to rely on the FDA’s previous finding of safety and effectiveness for the innovator’s drug (known as the Reference Listed Drug, or RLD).15 Instead of repeating massive clinical trials, the generic applicant’s entire scientific burden is to prove that its product is a pharmaceutical equivalent and, crucially,

bioequivalent to the RLD.14 Bioequivalence means the generic drug delivers the same amount of active ingredient into a patient’s bloodstream in the same amount of time as the brand-name drug, ensuring it has the same therapeutic effect.18

This streamlined scientific requirement dramatically lowers the cost and time of development. However, navigating the Hatch-Waxman framework is a strategic chess match, not a simple scientific submission. The Act establishes a predictable, turn-based game of legal and regulatory maneuvers:

- The Opening Move (Generic): The generic company files its ANDA, which includes a certification regarding the patents listed by the innovator in the FDA’s “Orange Book.” A Paragraph IV certification is the most aggressive move, asserting that the innovator’s patents are invalid, unenforceable, or will not be infringed by the generic product.20 This filing is considered an artificial act of infringement, deliberately initiating a legal confrontation.

- The Defensive Counter (Innovator): Upon receiving notification of a Paragraph IV filing, the innovator company has a 45-day window to file a patent infringement lawsuit.

- The Automatic Stay (Regulatory Shield): If the innovator files suit within that 45-day window, it triggers an automatic 30-month stay on the FDA’s ability to grant final approval to the generic’s ANDA.20 This gives the innovator a significant period of protection to resolve the patent dispute in court.

- The Grand Prize (Generic): To incentivize these risky and expensive patent challenges, the Act offers a powerful reward: the first generic applicant to file a substantially complete ANDA with a Paragraph IV certification is eligible for 180 days of market exclusivity.23 During this six-month period, the FDA cannot approve any subsequent generic versions of the same drug, allowing the “first-to-file” company to operate in a highly profitable duopoly with the brand before the market becomes fully commoditized.21

Understanding this sequence is fundamental to U.S. generic strategy. It allows a company to model timelines, anticipate competitor actions, and budget for the near-certainty of litigation.

Adding another layer of complexity are the Generic Drug User Fee Amendments (GDUFA). First enacted in 2012, GDUFA allows the FDA to collect user fees from the industry to hire more reviewers and modernize its processes, with the goal of making the review of generic applications more predictable and efficient.2 While GDUFA has improved review timelines, it has also created a significant financial barrier to entry. For Fiscal Year 2025, these non-refundable, upfront costs are substantial: an ANDA filing fee of $321,920, an annual program fee for large companies of $1,891,664, and various facility fees. This means that the decision to pursue a generic candidate is no longer just a scientific and legal one; it is a major capital allocation decision that requires a high degree of confidence in the product’s commercial potential.

The European EMA: Navigating a Unified but Fragmented Market

Competing in Europe requires mastering a different, though equally complex, regulatory system overseen by the European Medicines Agency (EMA) and national competent authorities. Unlike the single-gateway FDA system, Europe offers multiple pathways to market authorization, and choosing the right one is a critical strategic decision.

- Centralised Procedure (CP): This is the most direct route to the entire European Union market. A single Marketing Authorisation Application (MAA) is submitted to the EMA. If successful, it results in a single marketing authorization that is valid in all EU member states, plus Iceland, Liechtenstein, and Norway.26 This procedure is mandatory for certain innovative medicines, such as those derived from biotechnology, and is the automatic pathway for generics of centrally authorized products.25

- Decentralised Procedure (DCP): This pathway is used for medicines that have not yet been authorized in any EU country and are intended for marketing in more than one member state. The applicant chooses a Reference Member State (RMS) to lead the scientific assessment. Other chosen countries, the Concerned Member States (CMS), participate in the review. A successful procedure results in national authorizations in all involved states.

- Mutual Recognition Procedure (MRP): This procedure is used when a medicine has already received a national marketing authorization in one EU member state. That company can then apply for this authorization to be “mutually recognized” by other EU countries. The country that granted the initial authorization acts as the RMS.25

The strategic decision of which pathway to use depends on the company’s commercial goals. A CP offers the broadest market access but can be a high bar. For companies targeting only a specific cluster of countries, a DCP or MRP may be more efficient. The selection of the RMS in a DCP is a crucial strategic choice, as the expertise, workload, and regulatory philosophy of the chosen national agency can significantly influence the timeline and outcome of the assessment. For instance, securing a review slot with a preferred RMS can sometimes require planning up to two years in advance.

Japan’s Dual Guardians: Mastering the MHLW & PMDA

The Japanese market, the world’s third-largest, presents a unique regulatory structure that requires a nuanced approach. Success depends on satisfying two distinct but interconnected bodies:

- The Pharmaceuticals and Medical Devices Agency (PMDA): This is the scientific and technical arm, akin to the FDA’s review divisions. The PMDA conducts the rigorous, science-based evaluation of all applications, focusing on quality, efficacy, and safety. Their review of a generic application hinges on meticulous Chemistry, Manufacturing, and Controls (CMC) data and robust proof of bioequivalence.

- The Ministry of Health, Labour and Welfare (MHLW): This is the cabinet-level ministry with ultimate authority. The MHLW sets healthcare policy, grants the final marketing approval based on the PMDA’s recommendation, and, critically, determines the reimbursement price under the National Health Insurance (NHI) system.

This dual-guardian system means a successful strategy must speak two languages: the language of impeccable science for the PMDA and the language of public health value and economic partnership for the MHLW.

A key strategic challenge in Japan is its unique and opaque patent linkage system. Unlike the transparent, codified rules of Hatch-Waxman, Japan’s system operates through administrative notices and informal negotiations. The PMDA’s review considers certain patents (substance and use), but not others (formulation, manufacturing process), which are addressed in a separate negotiation phase before the drug is listed for reimbursement. This lack of a formal, transparent process creates significant uncertainty and elevates the risk of “at-risk” launches, where a generic is launched before all patent disputes are fully resolved.

India’s CDSCO: The “Pharmacy of the World”

No discussion of the global generic market is complete without acknowledging the central role of India. The country’s regulatory body, the Central Drugs Standard Control Organisation (CDSCO), oversees a massive manufacturing ecosystem that serves as the “pharmacy of the world”.30 India is one of the largest suppliers of generic medicines to the U.S. and other global markets, exporting billions of dollars worth of affordable drugs annually.32

The approval process in India is managed by the CDSCO, with applications now submitted through a digitized platform called the SUGAM portal.30 For global generic companies, India is not just a market but a critical node in the global supply chain. Many companies either operate their own manufacturing facilities in India or partner with Indian contract manufacturers to leverage the country’s scale and cost advantages. Therefore, a deep understanding of CDSCO’s requirements, particularly its GMP standards, is essential for ensuring a stable and compliant global supply of products.

The Harmonization Hurdle and the Advantage of Global Expertise

Navigating this patchwork of global regulations is a significant operational burden. While international bodies like the International Council for Harmonisation (ICH) work to align technical standards, true harmonization remains a distant goal. A primary obstacle is the common requirement for bioequivalence studies to be conducted using a reference product sourced from the local market (e.g., a U.S.-sourced RLD for an FDA submission, an EU-sourced one for an EMA submission). This can force companies to conduct expensive and duplicative clinical studies to enter different markets, increasing costs and delaying patient access.

However, this complexity can be transformed from a burden into a powerful competitive moat. Companies that treat regulatory affairs as a tactical, country-by-country compliance function will always be at a disadvantage. In contrast, a company that invests in building a world-class, globally integrated regulatory affairs team can create a durable competitive advantage. This team can design a single, efficient global development program that anticipates and satisfies the requirements of multiple agencies simultaneously. They can strategically sequence filings to gain first-mover advantages in key regions, leveraging data from one submission to accelerate the next. This level of sophistication and foresight is difficult for smaller or less experienced rivals to replicate, turning regulatory expertise into a core driver of commercial success.

To aid in this strategic planning, the following table provides a high-level comparison of the two largest and most influential generic drug markets: the United States and the European Union.

Table 1: Comparative Analysis of Key Regulatory Pathways (FDA vs. EMA)

| Feature | U.S. FDA | European EMA |

| Primary Application | Abbreviated New Drug Application (ANDA) | Marketing Authorisation Application (MAA) via Centralised, Decentralised, or Mutual Recognition Procedures |

| Key Scientific Hurdle | Proof of Bioequivalence (BE) to a single, FDA-designated Reference Listed Drug (RLD) 12 | Proof of Bioequivalence (BE) to a Reference Medicinal Product sourced from within the EEA 28 |

| Reference Product Sourcing | Must use the U.S.-approved RLD for BE studies | Must use a reference product sourced from an EEA member state |

| First-to-File Incentive | 180-day market exclusivity for the first successful Paragraph IV patent challenger; a highly valuable commercial prize 23 | No equivalent 180-day exclusivity period. Market entry is primarily dictated by patent and data exclusivity expiry |

| Data Exclusivity Periods | 5 years for New Chemical Entities (NCEs); 3 years for new clinical investigations | 8 years of data exclusivity + 2 years of market protection (the “8+2” rule) |

| User Fee Structure | Significant upfront GDUFA fees for applications, facilities, and program participation | Fees are charged for the scientific assessment of the MAA, but the structure is less front-loaded than GDUFA |

This comparative framework highlights the critical strategic trade-offs. The U.S. market offers the immense prize of 180-day exclusivity, creating a powerful incentive for aggressive patent litigation. The European system, while lacking this “winner-take-all” incentive, provides a longer period of data exclusivity for the innovator, creating a different timeline for generic entry. A successful global strategy must account for these fundamental differences from day one of product selection.

Section 3: The Art of the Start: Data-Driven Product Selection and Portfolio Strategy

In the generic drug industry, you can win or lose the game before it even begins. The most critical strategic decision any company makes is which products to pursue. A successful launch is not a matter of luck or intuition; it is the result of a rigorous, data-driven process of market analysis, competitive intelligence, and predictive financial modeling. Choosing the right target—and avoiding the wrong one—is the single most important determinant of profitability.

Decoding the Patent Cliff: Beyond the Primary Expiration Date

The starting point for any product selection analysis is the patent cliff. However, a naive approach that looks only at the expiration date of the primary composition of matter patent is a recipe for disaster. Innovator companies have become masters of lifecycle management, constructing formidable defenses to delay generic competition long after the core patent on the molecule has lapsed.

The most common defense is the creation of a “patent thicket”.9 This is a dense, overlapping web of secondary patents that cover not the drug molecule itself, but everything around it:

- Formulation Patents: Protecting the specific combination of active and inactive ingredients, or a novel delivery system like an extended-release tablet.39

- Method-of-Use Patents: Covering a specific indication or way of using the drug. A generic may have to launch with a “skinny label,” carving out the patented use, which can limit its market potential.

- Manufacturing Process Patents: Protecting a specific, proprietary method of synthesizing the drug.

- Polymorph Patents: Covering a specific crystalline form of the active ingredient.

A thorough analysis requires dissecting this entire patent estate to identify the last-to-expire relevant patent that could block a generic launch.

But the analysis doesn’t stop there. An entirely separate and independent barrier to entry is regulatory exclusivity. Granted by the FDA upon a drug’s approval, these exclusivities are not patents but are statutory prohibitions on the FDA approving a generic application for a set period.40 Key types include:

- New Chemical Entity (NCE) Exclusivity: 5 years from the approval of a drug containing a new active moiety.

- New Clinical Investigation Exclusivity: 3 years for changes to a previously approved drug that require new clinical studies (e.g., a new indication or dosage form).

- Orphan Drug Exclusivity (ODE): 7 years for drugs that treat rare diseases.

- Pediatric Exclusivity: Adds an extra 6 months to any existing patents and exclusivity periods.

A drug’s primary patent could expire, seemingly opening the door for generic entry, only for that door to be held shut by a remaining period of regulatory exclusivity. Therefore, the strategic planning for a generic launch is dictated by a simple but critical rule: the first legal opportunity for market entry is determined by whichever barrier—the last-to-expire relevant patent or the last-to-expire applicable exclusivity—falls last.

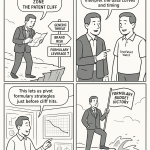

Weaponizing Competitive Intelligence with DrugPatentWatch

A comprehensive patent and exclusivity analysis is impossible without sophisticated competitive intelligence (CI) tools. In today’s market, CI is not a “nice to have”; it is the central nervous system of a successful generic strategy.43 It allows a company to move from reacting to the market to proactively shaping its own destiny.

Specialized patent intelligence platforms like DrugPatentWatch are indispensable in this process. They aggregate and analyze vast amounts of data from the FDA’s Orange Book, patent office records, and litigation databases, transforming raw information into actionable strategic intelligence.17 A robust CI program using such tools can:

- Map the Competitive Landscape: By tracking ANDA filings, a company can get a real-time picture of how crowded a particular product market is likely to be. Are you one of two companies targeting a drug, or one of twenty? This is the single most important variable for forecasting profitability.17

- Identify the Legal Battleground: These platforms reveal which specific patents are being challenged via Paragraph IV certifications. This intelligence helps you assess the strength of the innovator’s patent thicket and identify the most likely path to market entry.

- De-Risk Investment Decisions: By analyzing the outcomes of past Hatch-Waxman litigation cases involving a particular innovator or a specific type of patent, you can better assess the probability of success and the potential cost of your own legal challenge.

- Uncover Hidden Opportunities: “White space” analysis can identify drugs with expiring patents that have, for whatever reason, attracted little to no generic interest. These may represent overlooked niche opportunities with lower competition.

Leveraging this kind of deep intelligence allows a company to make smarter portfolio choices, allocating its R&D and legal resources to products with the highest probability of a successful and profitable launch.

The Price Erosion Curve and Commercial Forecasting

Simply picking a blockbuster drug with an expiring patent is a dangerously naive strategy. A sophisticated commercial assessment requires a predictive, risk-adjusted financial model that accounts for the brutal reality of price erosion. The moment a generic drug enters the market, its price begins a steep and predictable decline, with the rate of that decline being a direct function of the number of competitors.46

A successful product selection process, therefore, follows a disciplined, multi-step financial analysis:

- Quantify the Market Size: Determine the total annual sales of the brand-name drug you are targeting.

- Predict the Competition: Use competitive intelligence tools to forecast the likely number of generic competitors at the time of your potential launch.

- Apply the Price Erosion Curve: Use the data-backed model (detailed in Table 2 below) to forecast the likely generic price point based on the expected number of competitors.

- Factor in Costs: Subtract the significant, non-refundable GDUFA fees, the probability-weighted cost of litigation (which can average millions of dollars), and your own R&D and manufacturing costs.2

- Calculate Risk-Adjusted ROI: The result is a much more realistic, risk-adjusted return on investment. This rigorous process allows for a true apples-to-apples comparison of different portfolio candidates, ensuring that capital is deployed to the opportunities with the best real-world chance of generating a strong return.

The cornerstone of this analysis is understanding the price erosion curve. Based on extensive historical data, the relationship between competition and price is remarkably consistent.

Table 2: The Price Erosion Curve: Forecasting Profitability

| Number of Generic Competitors | Approximate Price Reduction vs. Brand Price | Strategic Implication |

| 1 (First-to-File with Exclusivity) | 30% – 39% 2 | Highly profitable duopoly with the brand. The most valuable period for the generic. |

| 2-3 | 50% – 70% 2 | Prices fall rapidly as the market transitions from a duopoly to true competition. Profitability is still strong but declining. |

| 4-5 | 70% – 85% 47 | Significant price reductions are achieved. The market is becoming highly competitive. |

| 6-9 | ~85% | The market is approaching full commoditization. Margins are becoming thin. |

| 10+ | 70% – 95% 2 | Extreme price competition. Margins are razor-thin or non-existent. Only the most efficient, high-volume manufacturers can sustain profitability. |

This table is not just data; it is a strategic tool. It transforms one of the biggest uncertainties in a generic launch—the future price—into a quantifiable variable. For any business development or portfolio management professional, mastering this analysis is fundamental to making winning bets and avoiding costly failures.

Section 4: The Legal Battlefield: Winning Through Strategic Patent Challenges

In the U.S. generic market, the courtroom is as important as the laboratory. The Hatch-Waxman Act was designed to encourage legal challenges to innovator patents as a mechanism for bringing lower-cost drugs to market sooner. As a result, patent litigation is not an unfortunate side effect of the business; it is a core, expected, and often necessary component of a successful market entry strategy. Winning on this battlefield requires a deep understanding of the legal playbook, a calculated appetite for risk, and the financial discipline to manage a costly and complex process.

The Paragraph IV Playbook: A High-Stakes, Calculated Gambit

The primary weapon in the generic company’s legal arsenal is the Paragraph IV (PIV) certification. As discussed, this is a formal declaration within the ANDA submission that the generic company believes the innovator’s Orange Book-listed patents are either invalid, unenforceable, or will not be infringed by the proposed generic product.20 It is a direct and deliberate challenge—a calculated gambit to enter the market before the innovator’s patents are set to expire.

Executing a successful PIV strategy involves several critical steps and considerations:

- The “Detailed Statement”: Along with the PIV certification, the generic applicant must send a notice letter to the brand company and patent holder. This letter must include a “detailed statement” providing the factual and legal basis for the generic’s assertion of non-infringement or invalidity.20 Drafting this statement is a strategic art. Providing too little detail may fail to meet the statutory requirement, while providing too much may prematurely reveal your entire litigation strategy. The goal is to provide a rational, good-faith basis for your position without giving away your best arguments before the lawsuit even begins.

- The 45-Day Countdown: The clock starts ticking the moment the brand company receives the notice letter. Their decision to sue within the 45-day window is the single most important trigger in the Hatch-Waxman process. If they file suit, the 30-month stay on FDA approval is automatically initiated. If they fail to sue within 45 days, the stay is not triggered, and the FDA can approve the ANDA as soon as its scientific review is complete (assuming no other patents or exclusivities are blocking entry).

- Building the Case: The legal arguments in a PIV case typically revolve around two pillars:

- Invalidity: Arguing that the brand’s patent should never have been granted in the first place. This can be based on the existence of “prior art” that shows the invention was not new, or arguments that the invention was “obvious” to a person skilled in the field at the time.

- Non-Infringement: Arguing that the generic product has been “designed around” the brand’s patent claims. This involves demonstrating that the generic’s formulation, manufacturing process, or other characteristics fall outside the specific scope of what the patent legally protects.

The decision to file a PIV certification is one of the most significant a generic company can make. It requires a high-risk, high-reward mindset, backed by deep scientific expertise to identify patent vulnerabilities and world-class legal counsel to execute the challenge in court.

The 180-Day Exclusivity Prize: Securing and Maximizing the First-Mover Advantage

Why would a company willingly invite a multi-million-dollar lawsuit from a pharmaceutical giant? The answer lies in the immense commercial value of the 180-day market exclusivity period. This prize, awarded to the first applicant to file a successful PIV challenge, is the engine that drives the entire system of patent challenges.38

During this six-month window, the first-to-file (FTF) generic is the only generic on the market. This creates a temporary duopoly with the brand-name drug.21 The strategic implications are profound:

- Premium Pricing: Instead of facing the immediate price collapse seen in a multi-competitor market (as shown in Table 2), the FTF can price its product at a modest discount to the brand, often only 15-25% lower. This allows for substantially higher profit margins than are possible once the exclusivity period ends and the floodgates of competition open.

- Market Share Capture: With only one lower-cost alternative available, payers (insurers and PBMs) and pharmacies rapidly switch from the brand to the FTF generic. This allows the FTF to capture a dominant market share very quickly, often within the first few months of launch.20

The 180-day exclusivity period can be worth hundreds of millions, or even billions, of dollars for a blockbuster drug. It is this potential windfall that justifies the enormous risk and expense of PIV litigation. Securing this prize requires not only a strong legal case but also impeccable timing and execution in being the very first to submit a “substantially complete” ANDA to the FDA.

Managing the Financial Realities of Litigation

Engaging in Hatch-Waxman litigation is a significant financial commitment. The average cost of a pharmaceutical patent case in the U.S. is approximately $2.8 million, with complex cases easily exceeding this figure. For a generic company, whose business model is built on cost efficiency, managing these expenses is critical.

A disciplined approach to litigation finance includes:

- Rigorous Budgeting: Before initiating a PIV challenge, a comprehensive budget must be created that covers all anticipated expenses, including legal fees, discovery costs, expert witness fees, and court costs. This should be developed in close collaboration with legal counsel to ensure accuracy.

- Risk/Reward Analysis: The decision to litigate must be based on a clear-eyed analysis of the potential costs versus the expected benefits. This involves weighing the probability of winning the case against the forecasted value of the 180-day exclusivity period and the subsequent market opportunity.

- Leveraging Tax Advantages: A crucial and often overlooked aspect of managing litigation costs is understanding their tax treatment. For years, there was debate over whether these expenses had to be capitalized and amortized over many years. However, a series of recent court decisions, including the landmark Actavis Labs. FL v. United States case, have affirmed that patent infringement litigation fees related to ANDA filings are currently deductible as ordinary and necessary business expenses.48 This allows companies to deduct the full cost of litigation in the tax year it is incurred, rather than spreading it out over 15 years. The immediate deduction provides a significant tax shield and a substantial cash-flow advantage, making the financial burden of litigation more manageable.

While the legal battlefield is fraught with risk, it is also the primary gateway to the most lucrative opportunities in the U.S. generic market. A company that masters the strategic nuances of the PIV playbook and the financial discipline of litigation management can consistently outperform competitors who shy away from the fight.

Section 5: Operational Excellence: Building a Resilient and Profitable Engine

While legal strategy and regulatory acumen open the door to market entry, it is operational excellence that ensures long-term profitability and sustainability. In a low-margin, high-volume business, efficiency is paramount. The ability to source raw materials cost-effectively, manufacture products to the highest quality standards, and deliver them reliably through a resilient supply chain is what separates the market leaders from the rest of the pack.

Strategic API Sourcing: The Global Chessboard

The single largest cost component in manufacturing a generic drug is typically the Active Pharmaceutical Ingredient (API). Optimizing the procurement of APIs is therefore a critical lever for protecting margins. The central strategic decision revolves around where to source these materials, a choice that involves a complex trade-off between cost, risk, and control.

- Offshoring: For decades, the prevailing strategy has been to source APIs from regions with lower labor and manufacturing costs, primarily India and China.55 This approach can significantly reduce the total cost of ownership. However, it also introduces significant risks, including longer and more complex supply chains, potential quality control issues due to differing regulatory oversight, and vulnerability to geopolitical disruptions.2

- Nearshoring: An alternative strategy is nearshoring, which involves sourcing from countries geographically closer to the final manufacturing site (e.g., Mexico or Canada for U.S. companies). While the direct manufacturing cost may be higher than in Asia, nearshoring offers significant advantages in speed and agility. Shorter supply chains reduce lead times, simplify logistics, and allow for more flexible inventory management, such as just-in-time (JIT) delivery models that reduce capital tied up in stock.55

The COVID-19 pandemic and subsequent supply chain shocks have exposed the vulnerabilities of over-reliance on a single sourcing strategy or region. The modern imperative is diversification. A resilient sourcing strategy involves engaging with multiple qualified suppliers across different geographical locations. This multi-sourcing approach not only mitigates the risk of a single point of failure but also fosters competitive pricing and gives the manufacturer greater leverage in negotiations.55 Building strong, long-term partnerships with a portfolio of reliable suppliers is a cornerstone of operational excellence.

cGMP Compliance as a Competitive Weapon

Adherence to current Good Manufacturing Practices (cGMP) is a non-negotiable requirement for any pharmaceutical manufacturer. These are the regulations enforced by the FDA and other global agencies that provide for systems to assure the proper design, monitoring, and control of manufacturing processes and facilities. The core principles of cGMP can be summarized by the “Five Ps” :

- Primary Materials and Products: Ensuring all raw materials meet stringent quality standards and are sourced from qualified suppliers.

- Premises: Maintaining clean, controlled, and properly designed manufacturing facilities.

- People: Ensuring all personnel are properly trained, qualified, and follow procedures.

- Processes: Implementing robust, validated, and reproducible manufacturing processes.

- Procedures: Following detailed, written procedures (Standard Operating Procedures, or SOPs) for every critical activity and documenting every step.

Failure to comply with cGMP can have severe consequences, including warning letters, product seizures, production halts, and recalls. Any drug made in a non-compliant facility is considered “adulterated” under the law.

However, the most successful companies view cGMP not merely as a regulatory burden to be met, but as a strategic asset to be leveraged. In an industry frequently plagued by drug shortages and recalls—often stemming from manufacturing or quality problems at a single facility—a reputation for impeccable quality and reliability becomes a powerful market differentiator. Hospitals, pharmacies, and Group Purchasing Organizations (GPOs) are increasingly looking for stability and predictability in their suppliers. A company that invests in building a true culture of quality excellence, going beyond the minimum requirements of cGMP, can position itself as a “supplier of choice.” This can lead to more favorable long-term contracts, greater market stability, and a brand halo that transcends the commoditized nature of the product itself. In this context, quality is not a cost center; it is a competitive weapon.

Building the Unbreakable Supply Chain

The fragility of the global pharmaceutical supply chain is one of the most pressing challenges facing the industry today. The system has been optimized for one variable above all others: lowest possible cost. This has led to a dangerous level of geographic concentration, with the U.S. and other Western nations heavily dependent on China and India for both finished generic drugs and the critical APIs needed to make them. This concentration creates single points of failure that can have devastating consequences. In 2023, for example, the shutdown of a single manufacturing plant in India, which supplied 50% of the U.S. market for the critical chemotherapy drug cisplatin, led to nationwide shortages and delayed treatments for thousands of cancer patients.

The market is beginning to recognize that the lowest price is not always the best value if the product is not available when patients need it. This creates a strategic opening for forward-thinking generic companies. Supply chain resilience is evolving from an internal operational goal into an external strategic differentiator that can be actively marketed to customers.

Building a truly resilient supply chain requires a multi-faceted approach:

- End-to-End Transparency: You cannot manage what you cannot see. Companies must map their entire supply chain, from the suppliers of raw chemical inputs to the final distributors, to identify hidden vulnerabilities and concentration risks.61

- Strategic Redundancy: This involves moving beyond single-sourcing for critical materials. It means qualifying backup API suppliers, establishing redundant manufacturing capabilities, and even collaborating with industry peers to create shared supply networks for essential medicines.

- Intelligent Inventory Management: While JIT models are efficient, resilience requires maintaining strategic buffer stocks of critical APIs and finished products to absorb unexpected supply shocks.61

- Advanced Analytics: Using AI and predictive analytics to monitor the supply chain in real-time can provide early warnings of potential disruptions, allowing companies to react proactively rather than after a crisis has already hit.

Investing in these capabilities is not cheap. It may mean a slightly higher cost of goods than a competitor who is still chasing the absolute lowest price. However, a savvy generic company can turn this investment into a powerful value proposition. By marketing its reliability and the security of its supply chain to purchasers who have been repeatedly burned by shortages, it can justify a small price premium for the assurance of continuity of care. This reframes the supply chain from a simple cost center into a value-creation engine, building a sustainable competitive advantage based on trust and reliability.

Section 6: Escaping Commoditization: The High-Value Frontier

The relentless price erosion inherent in the traditional generic model is a powerful force, but it is not inescapable. The most forward-thinking companies are actively seeking strategies to move up the value chain, developing products that are more difficult to replicate and, therefore, more defensible against the pressures of commoditization. This high-value frontier—encompassing complex generics, value-added medicines, and biosimilars—represents the future of profitable growth in the industry.

Complex Generics: High Risk, High Reward

Not all generics are created equal. While the market for simple oral solid dosage forms (pills and capsules) is often hyper-competitive, a growing category of “complex generics” offers a pathway to more sustainable margins. The FDA defines these as products that are difficult to develop and manufacture due to 65:

- Complex Active Ingredients: Such as peptides, complex mixtures, or polymeric compounds.

- Complex Formulations: Including liposomes, emulsions, or long-acting injectable suspensions.

- Complex Routes of Delivery: Such as topical creams, ophthalmic solutions, or transdermal patches.

- Complex Drug-Device Combinations: Products like metered-dose inhalers, nasal sprays, or auto-injectors.

These products present significant scientific, manufacturing, and regulatory hurdles that act as natural barriers to entry.67 For example, proving bioequivalence for a locally acting topical cream, which isn’t absorbed into the bloodstream in a measurable way, is far more challenging than for a simple tablet.66 The manufacturing process for a long-acting injectable can involve dozens of highly controlled steps, compared to just a handful for a standard pill.66

Because of this complexity, these products face far less competition. It is not uncommon for a complex drug to have only one or two generic competitors, or even none at all, for years after the brand’s patent expiry.65 This less crowded market allows for more stable pricing and higher profitability.

Recognizing the need to encourage competition in this space, the FDA has taken a multifaceted approach through the GDUFA program to provide greater scientific and regulatory clarity for complex generic developers.65 This has led to a number of landmark approvals that serve as case studies for success:

- Generic Glucagon (December 2020): The approval of the first generic for this complex synthetic peptide, used to treat severe hypoglycemia, was made possible by FDA-led research into advanced analytical methods for peptides.

- Generic Parenteral Iron (January 2021): The first generic for a complex non-biological iron product was approved based on the FDA’s investment in advanced characterization and novel bioequivalence study designs.

- Generic Loteprednol Etabonate Ophthalmic Suspension (February 2021): This approval was a breakthrough, utilizing a new in vitro bioequivalence approach that avoided the need for a massive and costly clinical endpoint study in hundreds of cataract surgery patients.

These successes demonstrate that while the investment and risk are higher, companies with the requisite scientific expertise and manufacturing capabilities can carve out highly profitable niches in the complex generics space, escaping the “race to the bottom” that defines the simpler end of the market.

Value-Added Medicines: The 505(b)(2) Strategic Advantage

Perhaps the single most powerful strategy for a generic company to escape commoditization is to pivot from being a pure replicator to becoming an innovator. The 505(b)(2) regulatory pathway in the U.S. provides a unique and valuable mechanism to do just that.71

The 505(b)(2) pathway is a hybrid between a full New Drug Application (NDA) for a novel drug and an Abbreviated New Drug Application (ANDA) for a standard generic. It allows a developer to create a new, differentiated product but to rely, in part, on the FDA’s previous findings of safety and effectiveness for an already-approved drug.71 This streamlined approach is ideal for creating “value-added medicines” or “super generics”—products that offer a meaningful improvement over an existing therapy.

Ideal candidates for the 505(b)(2) pathway include :

- New Formulations: Changing an immediate-release drug to an extended-release version.

- New Dosage Forms: Developing an oral liquid version of a drug that was only available as a tablet.

- New Routes of Administration: Creating a transdermal patch for a drug that was previously only available as an injection.

- New Combination Products: Combining two existing drugs into a single fixed-dose pill to improve patient convenience and adherence.

- New Indications: Seeking approval for an existing drug to treat a new disease.

The strategic brilliance of the 505(b)(2) pathway lies in its commercial outcome. Unlike a standard generic approved via an ANDA, a product approved through a 505(b)(2) application is a new, branded drug. Crucially, it can qualify for its own period of market exclusivity—typically three years for a new clinical investigation, and potentially five or even seven years for a new chemical entity or orphan drug, respectively.71

This transforms the entire business model. Instead of launching into a hyper-competitive market and competing solely on price, a company can launch a unique, value-added product with a protected revenue stream. It allows a generic-focused company to leverage its formulation expertise and knowledge of existing molecules to build a pipeline of innovative, higher-margin products. It is the ultimate strategic pivot, offering a direct path to escape the commoditization trap and build a more sustainable and profitable business.

The Biosimilar Revolution: The Next Great Wave of Opportunity

The next great frontier for generic-minded companies is the world of biologics. These large, complex molecules, derived from living organisms, represent the cutting edge of medicine and are among the best-selling drugs in the world. As these blockbuster biologics begin to lose their patent protection, they are creating a massive new market for biosimilars—highly similar, lower-cost versions.

The global biosimilar market is already substantial and poised for explosive growth, projected to expand from around $35 billion in 2025 to over $72 billion by 2035.74 This growth is driven by the same forces that built the small-molecule generic market: patent expiries on major products, the immense pressure to control healthcare costs, and a growing number of regulatory approvals. As of March 2025, the FDA had already approved 73 biosimilars in the U.S..

Key therapeutic areas driving this opportunity include:

- Oncology: Cancer biologics are a primary target, with biosimilars for drugs like Herceptin, Avastin, and Rituxan already on the market, significantly lowering treatment costs.74

- Immunology: The 2023 launch of multiple biosimilars for Humira (adalimumab), one of the best-selling drugs of all time, marked a major inflection point for the U.S. market.

- Emerging Opportunities: The upcoming patent expiries for GLP-1 agonists, a class of blockbuster drugs used to treat diabetes and obesity, represent a massive future opportunity for biosimilar developers.

However, competing in the biosimilar space is an order of magnitude more complex and expensive than traditional generics. Development is a multi-year, multi-hundred-million-dollar endeavor. Because biologics are large and complex, it is impossible to create an identical copy. The regulatory standard is not “bioequivalence,” but a “totality of the evidence” approach to demonstrate that the product is “highly similar” to the reference biologic with no clinically meaningful differences in safety or efficacy.77

Winning in the biosimilar market requires a different set of strategies:

- Deep Biologic Expertise: Success requires world-class capabilities in cell line development, protein characterization, and biologics manufacturing—skills not typically found in a traditional small-molecule generic company.

- Innovative Formulation: Companies can differentiate their biosimilars through formulation strategies, such as developing higher-concentration or buffer-free versions that improve patient convenience and tolerability.

- Sophisticated Regulatory Engagement: The biosimilar approval pathway is less prescriptive than the ANDA pathway. Success requires proactive, strategic, and continuous dialogue with regulatory agencies like the FDA and EMA to align on the development program and data requirements.

For companies that can make the necessary investments and build the required capabilities, the biosimilar revolution represents the next great wave of opportunity to deliver value to the healthcare system and generate substantial, sustainable revenue.

Section 7: The Future of Generics: A Roadmap to 2030 and Beyond

The generic drug industry stands at a strategic inflection point. The foundational drivers that have fueled its growth for four decades—an aging population, the rising burden of chronic disease, and the relentless pressure for healthcare cost containment—remain as potent as ever. The upcoming patent cliff promises a massive infusion of new market opportunities. Yet, the traditional business model is under unprecedented strain from price erosion, supply chain fragility, and increasing development complexity.4

Surviving and thriving in the next decade will require a radical rethinking of strategy. The future will not be defined by simply being the cheapest alternative, but by a company’s ability to master complexity, innovate up the value chain, and build a resilient, technology-enabled operational backbone.3 Expert analyses suggest that successful companies will likely evolve toward one of three strategic archetypes.

As outlined in a 2023 KPMG report, these future-proof strategies are :

- Become Bigger and Better: This strategy focuses on achieving scale through consolidation and mergers and acquisitions (M&A). In a market dominated by powerful consolidated buyers (GPOs and PBMs), size matters. Larger companies have greater negotiating leverage, more efficient supply chains, and the financial resources to invest in a broad and diverse portfolio, including high-risk, high-reward areas like complex generics and biosimilars.

- Eliminate the Middlemen: This strategy involves vertical integration to gain greater control over the supply chain and capture more value. By moving into API manufacturing (backward integration) or even distribution and pharmacy services (forward integration), companies can reduce their dependence on third-party suppliers and distributors. This not only improves margins but also builds a more secure and resilient supply chain, a key differentiator in an era of frequent drug shortages.

- Develop Higher-Value Generics: This is the innovation-led strategy, focused on deliberately escaping the commoditization trap. As we explored in the previous section, this involves shifting the portfolio away from simple, hyper-competitive oral solids and toward more defensible, higher-margin products. This means investing in the specialized capabilities required for complex generics, leveraging the 505(b)(2) pathway to create value-added medicines with their own market exclusivity, and entering the capital-intensive but lucrative biosimilars market.

Underpinning all of these strategies will be the transformative impact of digital technologies. The pharmaceutical industry has historically been a laggard in digital adoption, but the pressures of the modern market are forcing a rapid acceleration.81 The digitalization of the generic industry, or “Pharma 4.0,” is no longer a futuristic concept but a present-day competitive necessity.

Key areas of digital transformation include:

- AI-Powered R&D and Portfolio Selection: Artificial intelligence and advanced analytics are revolutionizing how companies identify and prioritize development candidates. Algorithms can now analyze vast datasets of patent information, clinical trial outcomes, and real-world prescribing patterns to forecast market dynamics and predict the risk-adjusted ROI of potential products with far greater accuracy than traditional methods.83

- Manufacturing 4.0: The factory of the future will be a “smart factory.” This involves implementing technologies like continuous manufacturing, which replaces slow, sequential batch processing with a seamless, integrated flow, dramatically increasing efficiency and quality. Robotic process automation (RPA) can handle repetitive tasks like documentation and quality control checks, reducing errors and freeing up human capital for higher-value work. Digital twins—virtual models of a manufacturing line—can be used to simulate and optimize processes before they are ever implemented in the real world, reducing costs and accelerating scale-up.83

- Intelligent Supply Chains: The integration of IoT sensors, blockchain for traceability, and AI-driven predictive analytics will create transparent, agile, and self-correcting supply chains. These systems can provide real-time visibility from the API supplier to the pharmacy shelf, predict potential disruptions before they occur, and automatically optimize inventory and logistics to ensure resilience and efficiency.81

The road ahead for the generic drug industry is undeniably challenging. The simple, profitable days of copying blockbuster pills are over. The future belongs to those who embrace complexity, who see innovation not as a cost but as an investment, and who leverage the power of data and technology to build smarter, faster, and more resilient organizations. The companies that successfully navigate this transformation will not only survive; they will define the next era of affordable medicine.

Conclusion and Key Takeaways

The generic drug market is in the midst of a profound transformation. While its role in delivering affordable medicine and generating massive healthcare savings is more critical than ever, the legacy business model is being fundamentally challenged by the forces of global competition, price commoditization, and increasing complexity. Success in the coming decade will not be a matter of simply doing the same things better; it will require a fundamental shift in strategy, capability, and mindset.

The playbook for winning is no longer about being the cheapest—it’s about being the smartest. It demands a holistic approach that integrates sophisticated patent intelligence, deep regulatory expertise, operational excellence, and a commitment to innovation. Companies must move beyond the simple pill to build defensible portfolios of high-value products. They must transform their supply chains from cost-optimized liabilities into resilient strategic assets. And they must embrace digital transformation to unlock new levels of efficiency and insight across the entire organization.

The path forward is not easy, but it is clear. The companies that master this new, complex landscape will not only secure their own profitability but will also be the ones to deliver the next generation of accessible, affordable, and life-saving medicines to patients around the world.

Key Takeaways

- Embrace the Affordability Paradox: Acknowledge that the immense value generics provide through low prices creates a hyper-competitive market. Strategy must focus on escaping the resulting commoditization trap, not just competing within it.

- Weaponize Intelligence: Transform patent and regulatory data into a predictive weapon. Use platforms like DrugPatentWatch to analyze the competitive landscape, de-risk portfolio decisions, and model the financial impact of price erosion before committing R&D capital.

- Master the Regulatory Gauntlet: Treat global regulatory affairs as a strategic competitive advantage, not a compliance burden. Build integrated expertise to navigate the divergent pathways of the FDA, EMA, and other key agencies to accelerate global launches and create barriers to entry for less sophisticated rivals.

- Litigate to Win: In the U.S. market, view the Paragraph IV patent challenge not as a risk to be avoided but as a calculated, high-stakes strategy to secure the immensely valuable 180-day first-to-file exclusivity.

- Compete on Reliability, Not Just Price: In an era of chronic drug shortages, a resilient and reliable supply chain is a powerful market differentiator. Invest in operational excellence and market your company’s stability as a premium feature to secure long-term contracts.

- Innovate Up the Value Chain: Actively shift the portfolio away from simple, crowded markets. Prioritize investment in high-barrier-to-entry segments:

- Complex Generics: Target products with difficult formulations or delivery systems to face less competition.

- Value-Added Medicines (505(b)(2)): Use this pathway to innovate on existing molecules, creating new branded products with their own market exclusivity.

- Biosimilars: Invest in the capabilities to compete in the next great wave of off-patent opportunities.

- Lead the Digital Transformation: Embrace Pharma 4.0. Implement AI, advanced analytics, and automation across R&D, manufacturing, and the supply chain to drive efficiency, enhance quality, and build a smarter, more agile organization.

Frequently Asked Questions (FAQ)

1. Our portfolio is heavily weighted toward simple oral solids, and our margins are compressing. What is the most realistic first step to move toward higher-value products?

The most realistic and strategically sound first step is to explore the 505(b)(2) pathway for value-added medicines. Unlike a full pivot to complex generics or biosimilars, which requires entirely new and highly specialized scientific and manufacturing capabilities, the 505(b)(2) route leverages your existing expertise in small-molecule formulation. The initial investment is focused on creating a meaningful modification to a known drug—such as developing an extended-release version, a new dosage form like a liquid or film, or a fixed-dose combination. This approach is less capital-intensive and has a lower risk profile than developing a complex biologic from scratch, yet it offers the transformative benefit of creating a new, branded asset with its own market exclusivity (typically three years). This provides a crucial bridge out of the commoditized ANDA space and into a higher-margin, innovation-driven business model.

2. How should we balance the cost advantages of API sourcing from China and India with the growing geopolitical and supply chain risks?

The modern imperative is to shift from a “lowest cost” to a “best total value” sourcing strategy, which explicitly prices in the cost of risk. This requires a diversified, multi-pronged approach. First, do not abandon your low-cost country sourcing, but strengthen it through deeper partnerships and increased oversight with your primary suppliers in India and China. Second, actively qualify at least one backup supplier in a different geographical region for your most critical APIs, even if it comes at a 10-20% cost premium. This “insurance policy” mitigates the risk of a single point of failure. Third, for select, high-value products, explore nearshoring options in regions like Mexico or Canada to create a shorter, more agile supply chain for the North American market. The goal is not to onshore everything, but to build a blended portfolio of suppliers that balances cost, resilience, and speed.

3. We’ve been hesitant to pursue Paragraph IV litigation due to the high cost and risk. Is it still possible to be successful in the U.S. market without it?

While it is possible to build a business by waiting for all patents to expire (a Paragraph III filing), this strategy consigns you to entering a market that is already mature and likely crowded. By the time you launch, the lucrative early-entry pricing will be gone, and margins will already be thin. Pursuing Paragraph IV challenges is essential for capturing maximum value in the U.S. market. The 180-day exclusivity period is the single greatest wealth-creation opportunity in the generic industry. A better approach than avoidance is strategic risk management. This means investing heavily in upfront competitive and legal intelligence to pick your battles wisely. Target products where the innovator’s patent thicket appears vulnerable. Partner with top-tier legal counsel who have a proven track record. And importantly, factor the probability-weighted cost of litigation into your commercial models from day one. The recent tax court rulings allowing for the immediate deduction of these legal fees also significantly improve the financial calculus, making this strategic risk more manageable.

4. Our board sees “digital transformation” as an expensive buzzword. How can we make a compelling business case for investing in technologies like AI and advanced analytics?

Frame the investment not in terms of technology, but in terms of solving the two biggest financial problems in the generic business: poor portfolio choices and inefficient operations. The business case should be built on tangible, quantifiable returns. For example:

- Smarter Portfolio Selection: Demonstrate how an AI-powered analytics platform can more accurately predict the number of future competitors for a target drug. Then, using the price erosion curve, show how avoiding just one “bad bet”—a product that launches into an unexpectedly crowded market—could save millions in wasted R&D and legal fees, paying for the platform several times over.

- Improved Manufacturing Yield: Propose a pilot project using a “digital twin” or advanced process controls on a single manufacturing line. Show how a modest 2-3% improvement in yield, driven by data-led optimization, translates directly into millions of dollars in increased gross margin for a high-volume product.

By focusing on concrete ROI and starting with targeted, high-impact pilot projects, you can demonstrate the value of digital transformation in the language of finance, not technology.

5. With the rise of biosimilars, is the small-molecule generic market a dying business?

The small-molecule generic market is not dying; it is maturing and segmenting. The “easy money” era of simply copying blockbuster pills is certainly ending, and that segment of the market will continue to face intense margin pressure. However, the overall market is still projected to grow significantly, driven by hundreds of billions of dollars in upcoming patent expiries. The future of the small-molecule business lies in moving up the complexity ladder. The opportunities in complex generics (e.g., injectables, inhalers) and value-added medicines (505(b)(2)) are substantial and offer much more defensible and profitable niches than standard oral solids. The rise of biosimilars should not be seen as a replacement for the small-molecule business, but rather as an adjacent opportunity and a strategic lesson: the entire off-patent industry is moving toward higher science, greater complexity, and more significant barriers to entry. The companies that build these advanced capabilities, whether in complex small molecules or biologics, will be the ones that thrive.

References

- The Impact of Generic Drugs on Healthcare Costs – DrugPatentWatch, accessed August 3, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-generic-drugs-on-healthcare-costs/

- Top 10 Challenges in Generic Drug Development – DrugPatentWatch, accessed August 3, 2025, https://www.drugpatentwatch.com/blog/top-10-challenges-in-generic-drug-development/

- The Global Generic Drug Market: Trends, Opportunities, and Challenges – DrugPatentWatch, accessed August 3, 2025, https://www.drugpatentwatch.com/blog/the-global-generic-drug-market-trends-opportunities-and-challenges/

- Generics 2030: Three strategies to curb the downward spiral – KPMG International, accessed August 3, 2025, https://kpmg.com/us/en/articles/2023/generics-2030-curb-downward-spiral.html

- The Generic Industry Faces External Challenges – Lachman Consultants, accessed August 3, 2025, https://www.lachmanconsultants.com/2024/02/the-generic-industry-faces-external-challenges/

- Global Generic Drug Market Size, Share 2025 – 2034, accessed August 3, 2025, https://www.custommarketinsights.com/report/generic-drug-market/

- Generic Drugs Market Size to Hit USD 728.64 Billion by 2034 – Precedence Research, accessed August 3, 2025, https://www.precedenceresearch.com/generic-drugs-market

- Generic Drugs Market Size to Hit USD 775.61 Billion by 2033 – BioSpace, accessed August 3, 2025, https://www.biospace.com/press-releases/generic-drugs-market-size-to-hit-usd-775-61-billion-by-2033

- Next drug patent cliff to challenge Big Pharma strategy – European Pharmaceutical Review, accessed August 3, 2025, https://www.europeanpharmaceuticalreview.com/news/261834/next-drug-patent-cliff-to-challenge-big-pharma-strategy/

- Report: 2022 U.S. Generic and Biosimilar Medicines Savings Report, accessed August 3, 2025, https://accessiblemeds.org/resources/reports/2022-savings-report/

- 10 Takeaways from the Savings Report | Association for Accessible Medicines, accessed August 3, 2025, https://accessiblemeds.org/resources/blog/10-takeaways-savings-report/

- 40th Anniversary of the Generic Drug Approval Pathway | FDA, accessed August 3, 2025, https://www.fda.gov/drugs/cder-conversations/40th-anniversary-generic-drug-approval-pathway

- Hatch-Waxman 101 – Fish & Richardson, accessed August 3, 2025, https://www.fr.com/insights/thought-leadership/blogs/hatch-waxman-101-3/

- What is ANDA? – UPM Pharmaceuticals, accessed August 3, 2025, https://www.upm-inc.com/what-is-anda

- The ANDA Process: A Guide to FDA Submission & Approval – Excedr, accessed August 3, 2025, https://www.excedr.com/blog/what-is-abbreviated-new-drug-application

- Abbreviated New Drug Application – Wikipedia, accessed August 3, 2025, https://en.wikipedia.org/wiki/Abbreviated_New_Drug_Application

- The Regulatory Pathway for Generic Drugs: A Strategic Guide to Market Entry and Competitive Advantage – DrugPatentWatch, accessed August 3, 2025, https://www.drugpatentwatch.com/blog/the-regulatory-pathway-for-generic-drugs-explained/

- Generic drug – Wikipedia, accessed August 3, 2025, https://en.wikipedia.org/wiki/Generic_drug

- Generic Drugs: Questions & Answers – FDA, accessed August 3, 2025, https://www.fda.gov/drugs/frequently-asked-questions-popular-topics/generic-drugs-questions-answers

- Paragraph IV Explained – ParagraphFour.com, accessed August 3, 2025, https://paragraphfour.com/paragraph-iv-explained/

- What Every Pharma Executive Needs to Know About Paragraph IV Challenges, accessed August 3, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- STRATEGIES FOR FILING SUCCESSFUL PARAGRAPH IV CERTIFICATIONS, accessed August 3, 2025, https://www.ssjr.com/wp-content/uploads/2018/05/presentations/lawyer_1/92706VA.pdf

- The Hatch-Waxman 180-Day Exclusivity Incentive Accelerates Patient Access to First Generics, accessed August 3, 2025, https://accessiblemeds.org/resources/fact-sheets/the-hatch-waxman-180-day-exclusivity-incentive-accelerates-patient-access-to-first-generics/

- Earning Exclusivity: Generic Drug Incentives and the Hatch-‐Waxman Act1 C. Scott – Stanford Law School, accessed August 3, 2025, https://law.stanford.edu/index.php?webauth-document=publication/259458/doc/slspublic/ssrn-id1736822.pdf

- Regulatory pathways in the European Union – PMC – PubMed Central, accessed August 3, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3149704/

- Authorisation of medicines – EMA – European Union, accessed August 3, 2025, https://www.ema.europa.eu/en/about-us/what-we-do/authorisation-medicines

- Obtaining an EU marketing authorisation, step-by-step | European Medicines Agency (EMA), accessed August 3, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/marketing-authorisation/obtaining-eu-marketing-authorisation-step-step

- Generic and hybrid applications | European Medicines Agency (EMA), accessed August 3, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/marketing-authorisation/generic-hybrid-medicines/generic-hybrid-applications

- Understanding the Regulatory Environment in Japan for Generic …, accessed August 3, 2025, https://www.drugpatentwatch.com/blog/understanding-the-regulatory-environment-in-japan-for-generic-drug-development/

- Drug Approval in India | Essential Steps to Get Drug Registered, accessed August 3, 2025, https://medicaldeviceregistration.com/blog/how-to-get-drug-approval-in-india/

- CDSCO, accessed August 3, 2025, https://cdsco.gov.in/opencms/opencms/en/Home/

- Domestic pharma industry may face setback if US imposes tariffs, accessed August 3, 2025, https://timesofindia.indiatimes.com/business/india-business/domestic-pharma-industry-may-face-setback-if-us-imposes-tariffs/articleshow/123002989.cms

- Trump tariffs to push up US drug prices, won’t change India’s pharma growth playbook: Pharmexcil, accessed August 3, 2025, https://economictimes.indiatimes.com/small-biz/trade/exports/insights/trump-tariffs-to-push-up-us-drug-prices-wont-change-indias-pharma-growth-playbook-pharmexcil/articleshow/123041531.cms

- Drug Approval Process in India – Chemxpert Database, accessed August 3, 2025, https://chemxpert.com/blog/drug-approval-process-in-india?

- Consumers are now actively seeking generic substitutes for branded medicines: Sujit Paul, Zota Healthcare, accessed August 3, 2025, https://economictimes.indiatimes.com/small-biz/entrepreneurship/consumers-are-now-actively-seeking-generic-substitutes-for-branded-medicines-sujit-paul-zota-healthcare/articleshow/122987675.cms

- Generic and hybrid medicines – EMA – European Union, accessed August 3, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/marketing-authorisation/generic-hybrid-medicines

- EMA and International Engagement for Generics Development – FDA, accessed August 3, 2025, https://www.fda.gov/media/177936/download

- The Law of 180-Day Exclusivity (Open Access) – Food and Drug Law Institute (FDLI), accessed August 3, 2025, https://www.fdli.org/2016/09/law-180-day-exclusivity/

- The Multi-Billion Dollar Countdown: Decoding the Patent Cliff and Seizing the Generic Opportunity – DrugPatentWatch, accessed August 3, 2025, https://www.drugpatentwatch.com/blog/patent-expirations-seizing-opportunities-in-the-generic-drug-market/

- Understanding the Lifecycle of Generic Drugs: From Patent Cliffs to Pharmacy Shelves, accessed August 3, 2025, https://www.drugpatentwatch.com/blog/understanding-the-lifecycle-of-generic-drugs-from-development-to-market-impact/

- “Skinny Labels” for Generic Drugs Under Hatch-Waxman | Congress.gov, accessed August 3, 2025, https://www.congress.gov/crs-product/IF12700

- The Hatch-Waxman Act: A Primer – EveryCRSReport.com, accessed August 3, 2025, https://www.everycrsreport.com/reports/R44643.html

- Role of Competitive Intelligence in Pharma and Healthcare Sector – DelveInsight, accessed August 3, 2025, https://www.delveinsight.com/blog/competitive-intelligence-in-healthcare-sector

- What is Competitive Intelligence in the pharmaceutical industry? – Lifescience Dynamics, accessed August 3, 2025, https://www.lifesciencedynamics.com/press/articles/what-is-competitive-intelligence-in-the-pharma-industry/

- Strategies for Effective Biosimilar Regulatory Agency Interactions – Drug Patent Watch, accessed August 3, 2025, https://www.drugpatentwatch.com/blog/strategies-for-effective-biosimilar-regulatory-agency-interactions/

- Generic pharmaceutical price decay – Wikipedia, accessed August 3, 2025, https://en.wikipedia.org/wiki/Generic_pharmaceutical_price_decay

- GENERIC DRUGS IN THE UNITED STATES: POLICIES TO ADDRESS PRICING AND COMPETITION, accessed August 3, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6355356/

- Managing Drug Patent Litigation Costs – DrugPatentWatch, accessed August 3, 2025, https://www.drugpatentwatch.com/blog/managing-drug-patent-litigation-costs/

- Generic Drug Facts | FDA, accessed August 3, 2025, https://www.fda.gov/drugs/generic-drugs/generic-drug-facts

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices – HHS ASPE, accessed August 3, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- “The Law of 180-Day Exclusivity” by Erika Lietzan and Julia Post, accessed August 3, 2025, https://scholarship.law.missouri.edu/facpubs/644/

- Predicting patent challenges for small-molecule drugs: A cross-sectional study – PMC, accessed August 3, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11867330/