In the high-stakes world of pharmaceutical innovation, information is more than just power—it’s the bedrock of value, the shield against catastrophic risk, and the engine of competitive advantage. Every decision, from the initial funding of a research program to the strategic timing of a generic launch, is underpinned by an understanding of the intellectual property (IP) landscape. A single overlooked patent can invalidate years of research, trigger billion-dollar infringement lawsuits, and erase shareholder value in an instant. The choice of a patent search tool, therefore, is not a minor operational detail left to a junior analyst; it is a core strategic decision with profound implications for a company’s financial health and market position.

The pharmaceutical industry’s entire economic model is built upon the foundation of the patent system.1 Patents provide a crucial, albeit temporary, period of market exclusivity—typically 20 years from the filing date—that allows innovator companies to recoup the staggering costs of research and development.3 These investments are monumental, with studies showing the cost of bringing a single new drug to market ranging from $161 million to an eye-watering $4.5 billion.6 This exclusivity is the primary driver of revenue, funding the next wave of life-saving innovation and creating the value that attracts investors.1

The flip side of this value creation is the ever-present “patent cliff,” a term that describes the dramatic and often devastating loss of revenue when a blockbuster drug’s patent expires. Over the next five years alone, the industry faces an estimated $200 billion in revenue at risk from expiring patents. This financial precipice makes the precise management and understanding of patent timelines a matter of corporate survival.

Compounding this pressure is the constant threat of litigation. The pharmaceutical sector is a hotbed of patent disputes, where the stakes are measured in billions. Landmark cases like the $2.54 billion verdict in Idenix Pharmaceuticals v. Gilead Sciences serve as a stark reminder of the financial consequences of patent infringement.10 Even without such headline-grabbing awards, the average cost of patent litigation runs into the millions of dollars, creating a significant drain on resources.12

Into this high-pressure environment comes Google Patents, a tool that promises to democratize patent intelligence. It is free, globally accessible, and backed by the most powerful search technology company in the world. Its appeal is undeniable. Yet, this report will argue that for the specific, mission-critical needs of the pharmaceutical industry, this appeal is a dangerous siren’s call. While Google Patents can be a useful starting point for general discovery or academic research, its inherent limitations in data integrity, technical search capabilities, and legal reliability transform it from a helpful resource into a significant liability when used for high-stakes drug patent analysis. Relying on it for freedom-to-operate (FTO) assessments, patentability searches, or competitive intelligence is not just a shortcut; it is a gamble with the company’s future. This report will meticulously deconstruct those risks and illuminate the path toward a more professional, secure, and strategically sound approach to pharmaceutical patent intelligence.

The Siren’s Call: Deconstructing the Allure of Google Patents

Before dissecting the profound risks associated with using Google Patents for pharmaceutical research, it is essential to first understand its powerful appeal. To dismiss it as merely a flawed tool would be to underestimate why it has become the default starting point for so many, from individual inventors to researchers in large corporations. Its widespread adoption is no accident; it is the result of a deliberate combination of unparalleled access, massive data aggregation, and a user experience designed for mass appeal. By fairly assessing these strengths, we can better understand how they create a “usability mirage”—an illusion of professional-grade comprehensiveness that masks deep-seated and dangerous deficiencies.

A Universe of Information at Your Fingertips

The primary allure of Google Patents is the sheer scale of its database, offered at an unbeatable price: free. This combination has fundamentally changed the accessibility of patent information for a global audience.

First and foremost is its broad coverage. Google Patents indexes an astonishing volume of data, boasting over 120 million patent publications from more than 100 patent offices around the world.15 This includes major jurisdictions critical to the pharmaceutical industry, such as the United States Patent and Trademark Office (USPTO), the European Patent Office (EPO), and the national offices of China, Japan, and Canada.15 For any researcher, the ability to cast such a wide net across global patent literature from a single search bar is incredibly powerful. It provides an immediate, high-level overview of the global state of an art that was once the exclusive domain of highly trained specialists with expensive subscriptions.

A second, and perhaps more unique, advantage is its integration of non-patent literature (NPL). Recognizing that novel ideas are often published in academic journals or technical books before they appear in patent applications, Google has integrated its vast Google Scholar and Google Books repositories directly into the patent search function.15 A user can, with a single checkbox, expand their prior art search to include millions of technical documents. These NPL documents are even machine-classified using the Cooperative Patent Classification (CPC) system, the same system used to organize patents, theoretically making it easier to find relevant scientific papers alongside patent documents.15 For a preliminary patentability search, where the goal is to quickly find any potential “knockout” prior art, this integrated approach is a compelling feature.

Finally, the cost—or lack thereof—cannot be overstated. Professional patent databases often come with licensing fees that run into the tens of thousands of dollars per user, per year. This cost is prohibitive for individual inventors, academic labs, and early-stage startups. Google Patents removes this barrier entirely, democratizing access to a world of technical information that was previously locked away behind a steep paywall.18

An Interface Built for Humans

Beyond the data itself, Google’s success has always been rooted in its mastery of the user experience, and Google Patents is no exception. It was designed to feel familiar and intuitive, deliberately lowering the barrier to entry for users who are not trained patent search professionals.

The most obvious element is the user-friendly design. The search interface is clean, simple, and operates on the same principles as a standard Google web search.18 This stands in stark contrast to the often clunky, complex, and intimidating interfaces of legacy professional databases, which can require extensive training to use effectively.19 A user can simply type in a few keywords and immediately receive a list of relevant-looking documents, creating a frictionless and satisfying user experience.

The platform also includes a suite of genuinely useful features that enhance its usability. It provides on-the-fly machine translation of foreign-language patents, allowing an English-speaking user to get the gist of a document from Japan or Germany without needing a professional translator.15 The presentation of information is clean and logical, with a patent’s abstract, claims, and description often laid out in an easy-to-read, side-by-side format. Results can be easily saved to a user’s Google account or shared with colleagues via a simple link, facilitating collaboration. These features, while seemingly basic, contribute to an experience that feels modern, efficient, and powerful.

The danger, however, lies in this very simplicity. The Google brand is globally recognized as the authority on comprehensive information retrieval. Users instinctively transfer this trust to Google Patents, assuming the results are as complete and accurate as a standard web search. The tool’s effortless delivery of millions of documents creates a powerful illusion of thoroughness. This user experience gives no indication of the critical data that is missing, the lag in its updates, or its inability to perform the specialized searches essential for pharmaceutical IP. It is this gap between perceived and actual capability that transforms a convenient tool for casual exploration into a high-risk instrument for professional decision-making.

Cracks in the Foundation: The Data Integrity Minefield of Google Patents

While the vastness of the Google Patents database is its main attraction, the integrity of that data is its Achilles’ heel. For the pharmaceutical industry, where decisions are measured in millions of dollars and decades of research, the quality, timeliness, and accuracy of information are non-negotiable. It is in these fundamental areas that Google Patents reveals its most critical flaws. A strategy built upon the data within Google Patents is a strategy built on shifting sands, vulnerable to the hidden risks of data lags, jurisdictional gaps, and legally unreliable information. These are not minor inconveniences to be worked around; they are structural deficiencies that create a distorted and dangerously misleading picture of the patent landscape.

The Peril of Lag Time: When “Recent” Isn’t Recent Enough

In the hyper-competitive race to market, timing is everything. For a generic drug manufacturer, being the “first-to-file” an Abbreviated New Drug Application (ANDA) with a Paragraph IV certification can grant a lucrative 180-day period of market exclusivity.4 For an innovator company, knowing about a competitor’s newly published patent application can provide a crucial early warning, enabling a pivot in R&D strategy. In both scenarios, access to the most current patent information is paramount.

This is where Google Patents falters significantly. Multiple independent analyses and user reports confirm that the database is not updated in real-time. There is often a considerable lag, ranging from several weeks to even a couple of months, between when a patent document is officially published by a patent office and when it becomes discoverable on Google Patents.16 For example, a new patent application published by the USPTO on a Thursday might not appear in Google’s index for weeks. During that critical window, a researcher relying on Google Patents is operating with a blind spot, completely unaware of a potentially pivotal new piece of prior art.

This lag compounds the inherent 18-month publication delay built into the patent system itself. In the U.S. and many other jurisdictions, patent applications are kept confidential for the first 18 months after their earliest priority date.31 This period already creates a significant “black box” where competitors’ activities are invisible. The additional update delay from Google Patents extends this period of uncertainty, further increasing the risk that a company will invest heavily in a project only to be blindsided by a prior art reference that was publicly available but not yet indexed by their search tool of choice. Professional databases, in contrast, invest heavily in direct data feeds from patent offices to ensure their information is updated daily or, in some cases, within hours of official publication.

Jurisdictional Blind Spots and the Myth of “Global” Coverage

Google Patents’ claim of indexing documents from over 100 patent offices creates a powerful impression of comprehensive global coverage. However, the fine print reveals a more complex and concerning reality. Google itself explicitly states that it “cannot guarantee complete coverage” of all documents from these offices. This is not just a standard legal disclaimer; it reflects a tangible gap in the data that can have severe consequences for pharmaceutical companies operating in a global market.

For a freedom-to-operate analysis to be meaningful, it must cover all key commercial markets. Critical analysis has shown that patent data from major pharmaceutical markets, including China, Japan, and India, may be incomplete or only partially indexed within Google Patents.23 A searcher might find some patents from these jurisdictions but miss the one critical document that could block market entry. This creates a false negative—the search returns nothing, leading to a dangerous assumption that freedom to operate exists when it does not.

Furthermore, the platform’s reliance on automated machine translation for non-English patents introduces another layer of risk. While useful for a cursory overview, these translations are notoriously unreliable for the highly technical and nuanced language of patent claims. A subtle distinction in chemical terminology or a specific legal phrase can be easily lost or mistranslated, leading a researcher to fundamentally misinterpret the scope of a patent’s claims.23 A decision to proceed with a billion-dollar drug development program could be based on a flawed understanding of a foreign patent, courtesy of a translation algorithm that cannot grasp the legal and scientific subtleties involved.

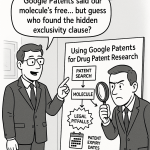

Legal Status Roulette: Relying on Data Google Itself Disclaims

Perhaps the single most dangerous deficiency of Google Patents for any serious legal or commercial analysis is the unreliability of its legal status information. Knowing whether a patent is active, expired, abandoned for non-payment of maintenance fees, or invalidated by a court is the most fundamental data point in any patent assessment.

On this critical point, Google offers a stark and unambiguous warning directly on its patent pages: “The legal status is an assumption and is not a legal conclusion. Google has not performed a legal analysis and makes no representation as to the accuracy of the status listed”. This disclaimer should be a major red flag for any professional user. It is an admission that the data point most crucial for determining freedom to operate is, at best, an educated guess.

In practice, this data is frequently outdated or simply incorrect. A patent may be listed as “Active” on Google long after its owner has failed to pay the required maintenance fees, causing it to lapse. Conversely, a patent that has been successfully challenged and invalidated in a court or a post-grant review proceeding may still appear as active. The system also struggles to accurately account for complex events like “terminal disclaimers,” where a patent’s term is deliberately shortened to expire on the same date as an earlier, related patent.

The gold standard for determining the legal status and history of a U.S. patent is the USPTO’s own Patent Center (which replaced the system known as PAIR). This official portal provides access to the complete “file wrapper”—a real-time, comprehensive record of the entire prosecution history of a patent, including all office actions, applicant responses, fee payments, and terminal disclaimers.36 Google Patents does not reliably integrate or display this detailed, authoritative information.

The consequences of relying on Google’s flawed legal status data are severe. A generic company could invest millions in preparing an ANDA, only to find that the patent they believed had expired was actually extended. An innovator company might abandon a promising new therapeutic area because of a competitor’s patent that appears active on Google but is, in fact, unenforceable. Using Google Patents for legal status assessment is akin to playing roulette with your IP strategy. The “free” tool’s hidden price is the immense cost of making critical business decisions based on what is little more than a guess.

A Blunted Instrument: Why Google Patents Fails at Specialized Pharma Searches

Beyond the foundational issues of data integrity, Google Patents suffers from a more profound, functional inadequacy: it is a generalist tool trying to operate in a specialist’s world. The language of modern pharmaceutical and biotechnological innovation is not primarily text-based; it is written in the complex grammars of chemical structures and biological sequences. A patent search tool that cannot fluently read and interpret this language is fundamentally handicapped. Google Patents, with its keyword-centric search paradigm, is largely illiterate in these critical domains. This is not a minor feature gap; it is a catastrophic failure that renders the tool unsuitable for the most essential types of patent analysis in the life sciences.

The Chemical Structure Chasm: Searching for Molecules, Not Just Words

In pharmaceutical R&D, the core invention is often a new chemical entity (NCE). While this molecule will have a name—or several names, including IUPAC nomenclature, company codes, and eventually a brand name—the patent protection is tied to its actual structure.38 Competitors will not be developing the exact same named drug; they will be exploring structurally similar compounds to achieve a similar therapeutic effect, a practice known as “designing around” a patent. Therefore, a truly comprehensive patent search must be able to search for the structure itself, not just the words used to describe it.

Here, Google Patents’ limitations become starkly apparent. Its keyword-based algorithm is a blunt instrument. A search for “atorvastatin” will find patents that explicitly use that word, but it will be completely blind to a patent that claims a novel, structurally related cholesterol-lowering agent that is never referred to by that name.39 This creates massive blind spots in any competitive intelligence or FTO analysis.

Google has attempted to address this with its “Chemistry Search,” but this feature is deeply misleading. It does not allow a user to draw a chemical structure and search for it. Instead, it is another form of text search that recognizes specific chemical identifiers like trade names, IUPAC names, and text-based structural representations such as SMILES (Simplified Molecular-Input Line-Entry System) or InChI (International Chemical Identifier) keys.41 This is only useful if the searcher

already knows the exact identifier for the molecule of interest. It offers no way to explore the landscape of structurally similar or related compounds, which is the entire point of a chemical patent search.

This stands in stark contrast to professional-grade chemical information platforms like CAS SciFinder or STN. These tools are built around powerful graphical search engines. A chemist can draw a molecule or a molecular fragment (a substructure) and execute searches to find:

- Exact Matches: Patents that disclose that precise molecule.

- Substructure Matches: Patents that disclose any molecule containing the drawn fragment as part of a larger structure.

- Similarity Matches: Patents that disclose molecules that are structurally similar based on complex algorithms.

This capability is the absolute bedrock of chemical patent searching.39 The inability of Google Patents to perform these fundamental search types means it cannot answer the most basic questions a pharmaceutical company needs to ask, such as, “Has anyone patented a compound with this core scaffold before?” A recent academic analysis confirmed this deficiency, finding that even manually curated professional databases like SciFinder significantly outperform Google Patents in retrieving molecules from patent documents.

The Markush Structure Black Hole: A Fatal Flaw for Pharma IP

If the lack of a graphical structure search is a chasm, the inability to handle Markush structures is a black hole—a void from which no relevant information can escape. Markush claims are a unique and powerful feature of chemical patent law, and they are the single greatest technical reason why Google Patents is a dangerous tool for pharmaceutical research.

A Markush structure is a way of claiming an entire family of related chemical compounds in a single claim. It uses a generic chemical scaffold with variable positions, where each variable (often denoted as R1, R2, etc.) can be selected from a list of specified chemical groups.48 For example, a claim might describe a core ring structure where “

R1 is selected from the group consisting of hydrogen, methyl, ethyl, or propyl.” This single claim does not cover one compound; it covers four. In reality, pharmaceutical patents use multiple variable groups with dozens of options each, allowing a single Markush claim to encompass millions, or even billions, of distinct, patent-protected compounds.7 This allows innovator companies to proactively protect not only the specific compound they have synthesized but also a wide range of functionally equivalent variations, making it much harder for competitors to “design around” the patent.

For a company developing a new drug, the most critical FTO question is: “Is our candidate molecule covered by a competitor’s existing Markush claim?” Answering this question with Google Patents is impossible. The platform has no mechanism to parse, interpret, or search the complex, graphical, and variable nature of a Markush claim.7 A keyword search is useless, as the specific compound of interest is almost never explicitly named in the text. It exists only as one of the countless potential combinations defined by the Markush formula.

This is a complete and total failure of the tool. Specialized professional databases, such as the MARPAT database from CAS (Chemical Abstracts Service), are designed for this exact purpose.48 They employ sophisticated algorithms that can take a specific query structure and determine if it falls within the scope of any of the billions of compounds covered by the Markush claims in their vast patent collection. Without access to such a tool, a pharmaceutical company is effectively flying blind, unable to perform the most fundamental type of freedom-to-operate search for any new small-molecule drug.

The Biologic Sequence Blindness: Irrelevant for Modern Biopharma

The pharmaceutical industry is increasingly dominated by biologics—large-molecule drugs like monoclonal antibodies, vaccines, and cell and gene therapies.55 For these revolutionary medicines, the invention is not defined by a small-molecule chemical structure, but by a specific biological sequence of amino acids (for proteins) or nucleotides (for DNA and RNA). Consequently, patent protection for biologics hinges on claims that recite these specific sequences or functionally similar variants.

Just as it is blind to Markush structures, Google Patents is blind to biological sequences. It has no integrated tool for performing a sequence similarity search. A researcher cannot input the amino acid sequence of their therapeutic antibody and use Google Patents to find patents that claim a similar or overlapping sequence.57 The platform can only search for text, and these sequences are typically included in patent documents in dedicated “sequence listing” sections, not as searchable text in the main body of the patent.

The biopharma industry relies on a completely different set of specialized tools for this purpose. Databases like GENESEQ, Aptean GenomeQuest, or those accessible via the STN platform are built specifically to house and search patent sequence data.59 They use powerful algorithms like BLAST (Basic Local Alignment Search Tool) to compare a query sequence against millions of patented sequences, identifying matches and calculating the percentage of identity. The National Center for Biotechnology Information (NCBI) also provides a public database for searching patent sequences, but it comes with the explicit warning that it is for research purposes only and “is not to be considered a definitive search for legal purposes”.

The inability to perform these specialized searches means that for the fastest-growing and most valuable sector of the pharmaceutical industry, Google Patents is not just a risky tool—it is an irrelevant one. It is fundamentally incapable of conducting the most basic forms of IP analysis required for biologic drug development. Relying on it is not a calculated risk; it is an admission of an incomplete and professionally inadequate search strategy.

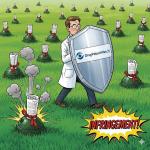

From Inconvenience to Catastrophe: Quantifying the Legal and Business Risks

The data integrity gaps and technical search failures of Google Patents are not merely academic shortcomings. In the unforgiving landscape of pharmaceutical IP, they translate directly into catastrophic legal and business risks. When a company bases its multi-million-dollar decisions on a foundation of incomplete and unreliable information, the consequences can range from costly litigation to the complete failure of an R&D program. Using Google Patents for mission-critical tasks moves beyond simple inconvenience and becomes an active liability, creating a discoverable record of flawed due diligence that can be weaponized by competitors in a court of law.

The Willful Infringement Trap: How Your Search History Becomes Exhibit A

One of the most severe penalties in U.S. patent law is a finding of “willful infringement.” If a court determines that a company knew about a valid patent and infringed upon it anyway—or was “willfully blind” to its existence—the judge has the discretion to award treble damages, meaning up to three times the amount of actual damages assessed by the jury. This can turn a costly judgment into a financially crippling one.

Herein lies the insidious legal trap of Google Patents. The act of performing a patent search, by its very nature, is an attempt to become aware of the prior art. When conducted on a public platform like Google, this activity creates a digital footprint. The URLs of patents viewed, and potentially the search queries themselves, can become discoverable evidence during the discovery phase of a lawsuit.

This creates a dangerous Catch-22 for researchers and IP professionals. A diligent but ultimately incomplete search on Google Patents might uncover a competitor’s patent. If the company proceeds with its product development and is later sued for infringement of that patent, the plaintiff’s lawyers can use the search history as Exhibit A to prove “actual notice.” This evidence makes it far easier to argue that the infringement was willful, dramatically increasing the company’s financial exposure.

The situation is even more perilous when considering the tool’s limitations. Imagine a scenario where a search on Google Patents uncovers Patent A, but due to the platform’s inability to perform a Markush structure search, it fails to find the closely related and much broader Patent B from the same competitor, which actually covers the company’s new drug. In court, the competitor’s counsel can argue that by finding Patent A, the company was put on notice of their activity in the field and had a duty to conduct a professional, thorough search. Their failure to do so, and their reliance on an inadequate free tool, could be framed as “willful blindness”—a reckless disregard for the patent owner’s rights. The very act of searching on an insufficient platform becomes a liability. This risk is so significant that some corporations have instituted strict internal policies forbidding their R&D and legal staff from using Google Patents for any sensitive research, fearing it creates more legal peril than it resolves.

The Illusion of Freedom-to-Operate (FTO): A Recipe for Disaster

A freedom-to-operate (FTO) analysis is one of the most critical due diligence activities a pharmaceutical company undertakes before launching a new product or acquiring a new asset. An FTO search and the resulting legal opinion aim to answer one crucial question: can we commercialize this product without getting sued for patent infringement? It is a comprehensive risk assessment that informs go/no-go decisions on projects worth hundreds of millions, if not billions, of dollars.

A credible FTO opinion demands the highest standard of rigor. It requires an exhaustive search of all active, in-force patents in every relevant commercial jurisdiction. It necessitates access to perfectly accurate, up-to-the-minute legal status information to ensure that only enforceable patents are considered. And, most importantly in pharma, it requires the technical capability to analyze complex chemical and biological claims, including Markush structures and sequences.64

As has been exhaustively detailed, Google Patents fails on every single one of these requirements. Its jurisdictional coverage is incomplete. Its legal status data is an unreliable “assumption”. It is functionally blind to Markush structures and biological sequences.24 Therefore, any FTO analysis based on Google Patents is not just incomplete; it is fundamentally invalid. It creates a dangerous illusion of safety.

No competent and ethically bound patent attorney would ever render a formal FTO opinion based solely on a Google Patents search; the risk of malpractice would be immense.18 The platform is a valuable tool for preliminary, “quick and dirty” landscape searches to get a feel for a technology area, but it is wholly unsuitable for the definitive, high-stakes analysis required to clear a product for launch. To do so is to invite a lawsuit that could have been easily foreseen with professional tools.

Building a Strategy on a House of Cards: The High Cost of Flawed Intelligence

The legal risks of infringement are stark, but the business risks of acting on flawed intelligence can be just as devastating. Corporate strategy in the pharmaceutical sector is a long-term game, and the quality of the IP data that informs that strategy is paramount.

A primary risk is misguided R&D investment. An incomplete prior art search can lead a company to pour years of effort and hundreds of millions of dollars into developing a promising drug candidate, only to discover late in the process that the molecule is already described in a prior art patent and is therefore unpatentable. This is a catastrophic waste of resources that could have been avoided with a proper, professional search at the outset.

The inverse risk is that of missed opportunities. The data lags and incomplete coverage of Google Patents can cause a company to completely miss a strategic opening. For example, a generic manufacturer might miss the expiration of a key patent, losing the race to be the first-to-file and forfeiting the 180-day exclusivity period to a more diligent competitor. An innovator company might fail to identify a “white space” in the patent landscape—a therapeutic area with high unmet need but low patent activity—where it could direct its R&D efforts for a higher probability of success.

Finally, relying on Google Patents for competitive intelligence provides a dangerously incomplete and outdated view of the market. A business development team might analyze a potential acquisition target’s portfolio on Google Patents and, due to the data lags and inaccurate legal status, fundamentally misjudge the strength and longevity of its IP assets. A strategic planning group might map out a competitor’s R&D pipeline based on their published applications on Google, without realizing that the most critical applications are still unpublished or that key patents have been invalidated. In every case, the strategy is being built on a house of cards, liable to collapse the moment it comes into contact with the reality of the complete, accurate IP landscape. The “free” tool exacts its price in the form of flawed decisions, wasted resources, and lost competitive advantage.

The Professional’s Toolkit: Investing in Certainty and Competitive Advantage

Having established the profound and multifaceted risks of relying on Google Patents for serious pharmaceutical IP work, the path forward becomes clear. The solution is not to abandon patent searching, but to adopt a professional toolkit designed for the unique rigors and high stakes of the life sciences industry. This means investing in specialized, purpose-built platforms that provide the certainty, depth, and strategic context that free tools inherently lack. This investment should not be viewed as a mere cost center, but as a fundamental driver of value—an essential expenditure for mitigating risk, enabling innovation, and securing a sustainable competitive advantage. The professional’s approach can be understood as a two-tiered strategy: deploying specialized technical databases for foundational analysis and leveraging integrated business intelligence platforms to translate that data into winning market strategies.

The Right Tool for the Technical Job: Specialized Search Databases

For the foundational tasks of patentability and freedom-to-operate analysis, there is no substitute for databases that are expertly curated and technically sophisticated. These platforms are the gold standard because they are designed to speak the native language of chemical and biological innovation.

- CAS SciFinder & STN: For anything involving small-molecule drugs, the services from the Chemical Abstracts Service (CAS), a division of the American Chemical Society, are indispensable. Platforms like CAS SciFinder and STN are not just patent databases; they are comprehensive scientific information solutions.46 Their key advantage lies in their human-curated content. Scientists at CAS meticulously index substances, reactions, and concepts from patents and journals worldwide, creating a database of unparalleled quality and accuracy. Most importantly, they are built around powerful graphical search engines that allow for the precise structure, substructure, and similarity searches that are impossible on Google Patents. For tackling the critical challenge of Markush claims, CAS offers the MARPAT database, the industry’s definitive tool for determining if a specific compound is covered by a broad generic claim.48

- Derwent World Patents Index (DWPI): Provided by Clarivate, DWPI is another cornerstone of professional patent searching. Its unique value proposition is the addition of human-written, value-added data. Each patent family is summarized in a clear, English-language abstract that highlights the novelty and utility of the invention, cutting through dense legal jargon. DWPI also excels at consolidating international patent filings into a single, unified “patent family,” making it far easier to track the global protection strategy for a particular invention and avoid missing crucial international counterparts to a known U.S. patent.

- Biologic-Specific Platforms: As the industry shifts towards biologics, a new class of hyper-specialized tools has emerged. Platforms like Aptean GenomeQuest and Clarivate’s GENESEQ are built from the ground up to handle the immense complexity of biological sequence searching.60 They contain curated databases of sequences extracted from patents and feature sophisticated algorithms, like BLAST and Smith-Waterman, to identify sequence similarities with high precision. For any company working on antibodies, CAR-T therapies, or CRISPR-based technologies, these tools are not optional; they are essential for navigating the IP landscape.

From Raw Data to Actionable Intelligence: The Role of Strategic Platforms

While technical databases like SciFinder provide the raw, foundational data needed for a legal opinion, winning in the pharmaceutical market requires more than just technical accuracy. It requires strategic context. This is where business intelligence platforms play a pivotal role. They synthesize raw patent data with a rich tapestry of regulatory, clinical, and commercial information to deliver actionable insights that drive business decisions.

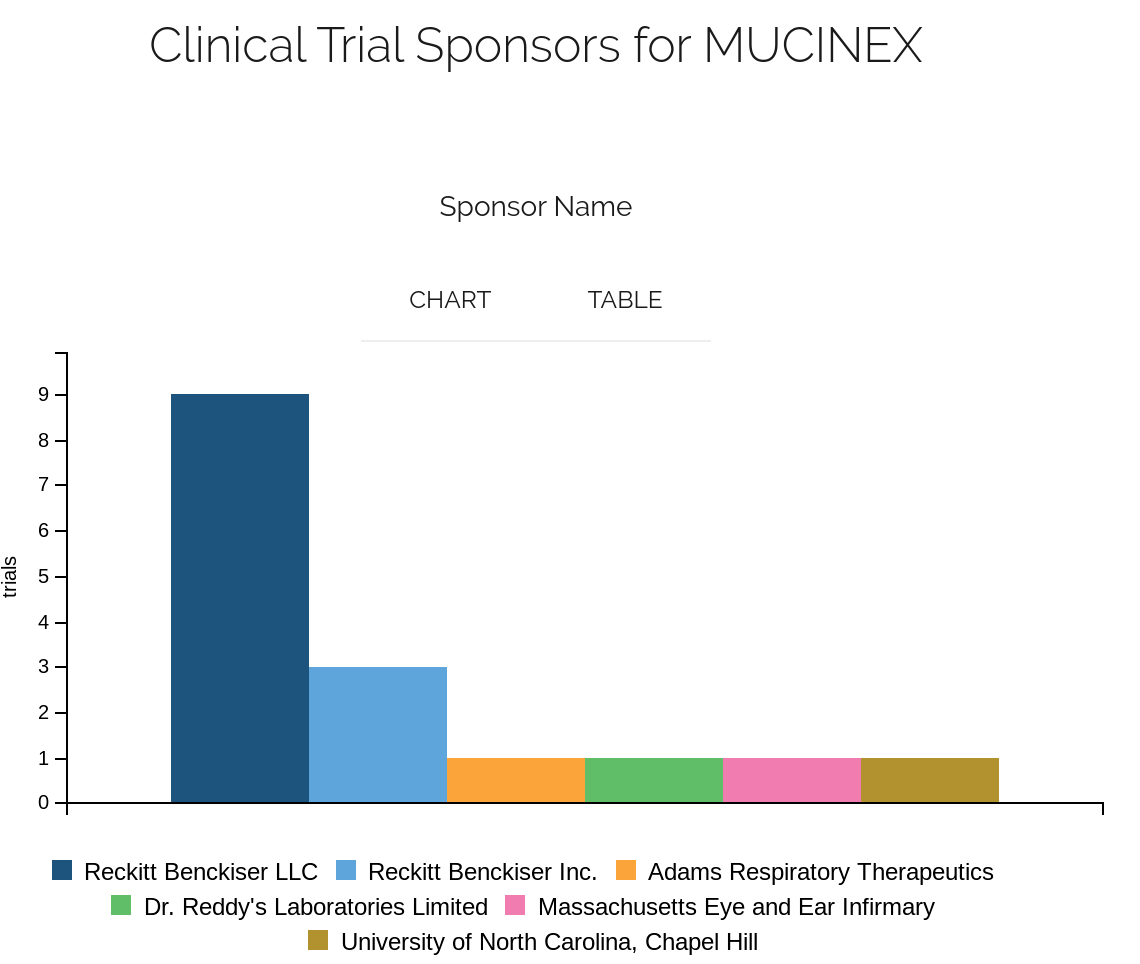

A prime example of such a platform is DrugPatentWatch. It is designed not just for patent attorneys, but for the business development executives, portfolio managers, and market analysts who need to understand the commercial implications of IP.33 The platform’s strategic value comes from its deep integration of disparate but critically linked datasets:

- Integrated Regulatory and Patent Data: DrugPatentWatch connects patent information directly with regulatory data from sources like the FDA’s Orange Book. This allows a user to see not just a patent’s expiration date, but also any regulatory exclusivities (like New Chemical Entity or Orphan Drug exclusivity) that might extend a drug’s monopoly period.33 This holistic view is essential for accurately predicting the loss of exclusivity (LOE).

- Litigation and Competitive Intelligence: The platform actively tracks patent litigation, including Paragraph IV challenges filed by generic companies. This serves as an early warning system for brand-name companies and helps generic players identify which patents are being challenged, by whom, and with what outcomes. This intelligence is crucial for developing litigation strategy and anticipating early generic entry.69

- Forecasting and Strategic Alerts: Users can set up alerts for upcoming patent expirations on key drugs or in specific therapeutic areas. This enables proactive planning, whether for a generic launch, an M&A opportunity, or an internal R&D pivot.33 For instance, a generic company using

DrugPatentWatch can monitor a blockbuster drug’s patent portfolio and litigation status for years, positioning themselves to be the first to file an ANDA the moment a window of opportunity appears. Securing this first-to-market position is a monumental advantage, often allowing the first generic to capture over 70% of the market.

By providing this rich, contextualized layer of intelligence, platforms like DrugPatentWatch bridge the gap between raw patent data and high-level business strategy. They transform patent information from a defensive, risk-mitigation tool into a proactive, opportunity-seeking weapon.

Feature Face-Off: Google Patents vs. Professional Pharmaceutical IP Platforms

The chasm in capability between a free, generalist tool and a professional, specialized platform is immense. The following table provides a direct, at-a-glance comparison, translating technical features into the tangible strategic implications that matter to business leaders in the pharmaceutical industry.

| Feature / Capability | Google Patents | Professional Tools (e.g., CAS SciFinder, DrugPatentWatch) | Strategic Implication for Pharmaceutical Companies |

| Data Update Frequency | Lag of weeks to months; not real-time 20 | Daily or near-real-time updates from official sources | Missing the narrow window for first-to-file generic opportunities; basing decisions on obsolete data. |

| Legal Status Accuracy | Disclaimed, often inaccurate or outdated 23 | Verified, real-time legal status linked to official registries and file wrappers | Wasting millions on challenging an already-expired patent or abandoning projects due to a seemingly active but invalid patent. |

| Chemical Structure Search | Text-based only (SMILES, IUPAC name) | Full graphical structure, substructure, and similarity searching 46 | Complete inability to find structurally relevant prior art that doesn’t share a common name; massive blind spot in patentability and FTO. |

| Markush Structure Search | Non-existent 7 | Dedicated Markush search engines (e.g., MARPAT) 48 | FATAL FLAW: Inability to assess freedom-to-operate for virtually any new small molecule drug, exposing the company to catastrophic infringement risk. |

| Biologic Sequence Search | Non-existent 57 | Integrated BLAST-like search against curated patent sequence databases 60 | Irrelevant for modern biopharma; complete blindness to the IP landscape for antibodies, gene therapies, etc. |

| Integrated Regulatory Data | Limited; integration with Scholar only | Deep integration with FDA Orange Book, litigation data, clinical trials 73 | Lack of context. A patent’s value is tied to its regulatory status; without this link, the data is incomplete. |

| Analytics & Forecasting | None | Tools for landscape analysis, competitor tracking, and patent expiration forecasting 1 | Inability to move from raw data to strategic insight; purely reactive decision-making. |

| Legal Risk (Willful Infringement) | High risk; creates a discoverable record of incomplete diligence | Lower risk; use of professional tools demonstrates a high standard of care and due diligence. Confidentiality is often guaranteed. | Using Google Patents can inadvertently strengthen an opponent’s case for treble damages in litigation. |

Conclusion: Investing in Certainty in a High-Stakes World

Google Patents is, without question, a remarkable technological achievement. It has placed a universe of public patent information into the hands of millions, fostering a level of access and transparency that was once unimaginable. For casual exploration, academic curiosity, or preliminary brainstorming, it is an invaluable resource. However, as this report has demonstrated, its application in the high-stakes, technically complex domain of pharmaceutical patent intelligence is fraught with unacceptable and potentially catastrophic risks.

The core argument is not that Google Patents is a “bad” tool, but that it is the wrong tool for the job. Its foundational data suffers from critical lags, gaps, and inaccuracies that create a distorted view of the IP landscape. Its search technology is fundamentally incapable of interpreting the structural and sequential language of modern pharmaceutical innovation, leaving vast and dangerous blind spots. These deficiencies culminate in severe legal and business risks, transforming a tool intended to provide clarity into a source of profound uncertainty and legal liability.

The allure of “free” is a powerful but deceptive force. The true cost of relying on Google Patents is not measured in subscription fees, but in the immense hidden costs of flawed strategic decisions. It is the cost of a multi-year, hundred-million-dollar R&D program invalidated by a piece of prior art a professional search would have found in hours. It is the cost of a billion-dollar infringement verdict that stemmed from a flawed freedom-to-operate analysis. It is the cost of a missed first-to-market generic opportunity that cedes hundreds of millions in revenue to a more diligent competitor. In the pharmaceutical industry, the cost of being wrong is simply too high to gamble on an inadequate tool.

The path forward for any serious player in the pharmaceutical and biotech space is to embrace a professional, two-pronged approach to IP intelligence. This is not a luxury, but a fundamental cost of doing business effectively and responsibly.

- Build on a Technical Foundation of Certainty: For all mission-critical legal assessments, such as patentability and freedom-to-operate, companies must use specialized, professional-grade databases. Tools like CAS SciFinder, STN, and GENESEQ provide the curated data and purpose-built search functionalities that are non-negotiable for conducting a rigorous, defensible analysis. This is the investment in getting the ground truth right.

- Drive Strategy with Integrated Intelligence: To translate that technical ground truth into a winning market strategy, companies must leverage business intelligence platforms. Services like DrugPatentWatch provide the essential strategic overlay, integrating raw patent data with the regulatory, litigation, and commercial context needed to make informed, forward-looking business decisions. This is the investment in turning data into a competitive weapon.

Ultimately, the most valuable asset in the pharmaceutical industry is not a single patent, but a deep and accurate understanding of the entire innovation and IP ecosystem. This level of understanding cannot be achieved by skimming the surface with a generalist tool. It requires a deliberate investment in professional resources designed for the unique complexities and monumental stakes of this industry. In a world of uncertainty, investing in the right intelligence tools is an investment in certainty itself—the certainty to innovate boldly, compete effectively, and mitigate the risks that can derail even the most promising scientific breakthroughs.

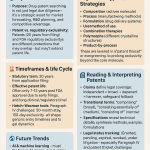

Key Takeaways

- High-Stakes Environment: Pharmaceutical IP is a multi-billion dollar arena where the choice of a patent search tool is a critical strategic decision, not a minor operational one. The costs of R&D, litigation, and patent expiration are immense.

- Google Patents is a Generalist Tool: While free, accessible, and user-friendly for preliminary searches, Google Patents is a generalist tool that is fundamentally unsuited for the specialized, high-stakes needs of pharmaceutical patent analysis.

- Critical Data Integrity Flaws: The platform suffers from significant data lags (not real-time), incomplete global coverage, and highly unreliable legal status information, which Google itself disclaims. Relying on this data for strategic decisions is extremely risky.

- Fatal Technical Deficiencies: Google Patents is functionally blind to the language of modern pharma innovation. It lacks the essential capabilities for graphical chemical structure searching, Markush structure analysis, and biologic sequence searching, creating massive and dangerous blind spots in any prior art or FTO search.

- Severe Legal and Business Risks: Using Google Patents for serious IP work creates a discoverable record of incomplete due diligence, which can be used to support claims of willful infringement (risking treble damages). It leads to flawed FTO analyses, misguided R&D investments, and missed market opportunities.

- Professional Tools are Essential: A professional approach requires a two-tiered investment. First, specialized technical databases (like CAS SciFinder, STN, GENESEQ) are necessary for accurate and defensible patentability and FTO searches. Second, business intelligence platforms like DrugPatentWatch are crucial for integrating this technical data with regulatory and commercial intelligence to drive winning business strategies.

- The “Cost of Free” is Too High: The apparent cost savings of using a free tool are an illusion. The hidden costs manifest as wasted R&D, catastrophic litigation exposure, and lost market share, far outweighing the subscription fees for professional platforms.

Frequently Asked Questions (FAQ)

1. Is it ever appropriate to use Google Patents in a professional pharmaceutical setting?

Yes, but with strict limitations and a clear understanding of its purpose. Google Patents can be a valuable tool for initial, non-critical discovery. For example, an R&D scientist might use it for a quick landscape search to see what is broadly being done in a new area of interest or to quickly pull up a known patent document by its number. However, it should never be used for any task that carries legal or significant financial weight, such as a formal patentability search, a freedom-to-operate (FTO) analysis, an invalidity search for litigation, or for making a final decision on R&D investment. The moment a search becomes mission-critical, professionals must transition to specialized, reliable databases.

2. My company can’t afford expensive database subscriptions. Isn’t using Google Patents better than doing no search at all?

This is a common and dangerous misconception. While it seems logical, using an inadequate tool like Google Patents for a critical search can be worse than doing no search at all. An incomplete search creates a false sense of security, potentially leading a company to invest heavily in a doomed project. More dangerously, it creates a discoverable legal record that you were aware of the technology space but failed to conduct a proper search, which can be used against you in court to argue for willful infringement. For startups and smaller entities, it is far more prudent to budget for a limited number of professional searches conducted by a specialized firm or patent attorney for their most critical inventions than to rely on a free tool that introduces such significant liability.

3. How does the FDA’s Orange Book relate to patent searching, and can I just rely on that instead of a full patent search?

The FDA’s Orange Book is a critical resource, but it is not a substitute for a comprehensive patent search.79 The Orange Book lists FDA-approved drugs and links them to specific patents covering the drug substance, formulation, or method of use that the brand-name manufacturer has submitted to the FDA. It is the cornerstone of the “patent linkage” system that governs generic drug approval. However, it is intentionally limited in scope. By law, it

excludes crucial patent types, such as those covering manufacturing processes, packaging, metabolites, or intermediates.79 A competitor could still infringe on these unlisted patents. Therefore, while checking the Orange Book is an essential step in analyzing a specific approved drug, a full FTO or patentability search must go much further, using professional databases to uncover all potentially relevant patents, not just those listed by the FDA.

4. What is a “Markush structure,” and why is it so important that Google Patents can’t search for it?

A Markush structure is a form of patent claim used in chemistry to define a whole family of related molecules with a single generic formula. It consists of a constant core structure (a scaffold) and one or more variable parts (e.g., “R1”), where the patent specifies a list of possible chemical groups that can be substituted at that variable position. This allows a patent to cover millions or even billions of potential compounds with a single claim, protecting against competitors who might make a minor tweak to the molecule to avoid infringement. This is a fatal flaw for Google Patents because these claims are graphical and variable, not text-based. Google’s keyword search cannot interpret them. A company could develop a new drug, and a Google Patents search would show no blocking patents. However, that new drug could be one of the billions of compounds covered by a competitor’s broad Markush claim, leading to direct and willful infringement. The inability to search Markush structures makes Google Patents functionally blind to the most common and powerful form of patent protection for small-molecule drugs.

5. How do specialized platforms like DrugPatentWatch provide a competitive advantage that a raw patent search database doesn’t?

Raw patent search databases like CAS SciFinder are essential for answering technical and legal questions: “Is this invention novel?” or “Does this product infringe this claim?” They provide the foundational data. However, business intelligence platforms like DrugPatentWatch answer a different set of questions: “When is the real-world market opportunity for a generic version of this drug?” or “Which competitors are most likely to challenge our patents?” They provide a competitive advantage by integrating the raw patent data with other critical business information.33 For example,

DrugPatentWatch combines patent expiration dates with FDA regulatory exclusivity data, ongoing litigation records, and clinical trial information. This synthesis provides a holistic view of a drug’s lifecycle, allowing companies to anticipate market events, identify licensing opportunities, track competitor strategies, and make proactive business decisions, rather than just reacting to technical patent data in a vacuum.1

References

- Best Practices for Drug Patent Portfolio Management: Leveraging Patent Data for Competitive Advantage – DrugPatentWatch, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/best-practices-for-drug-patent-portfolio-management-2/

- Patent Valuation in the Pharmaceutical Industry: Key Considerations – PatentPC, accessed July 28, 2025, https://patentpc.com/blog/patent-valuation-in-the-pharmaceutical-industry-key-considerations

- Drug Patents and Exclusivity – National CooperativeRx, accessed July 28, 2025, https://www.nationalcooperativerx.com/educational-materials/drug-patents-exclusivity/

- Patents and Exclusivity | FDA, accessed July 28, 2025, https://www.fda.gov/media/92548/download

- How Drug Patents Shape the Competitive Landscape in Pharma, accessed July 28, 2025, https://www.pharmafocuseurope.com/articles/drug-patents-shape-pharma-competition

- The Economics of Drug Discovery and the Impact of Patents – R Street Institute, accessed July 28, 2025, https://www.rstreet.org/commentary/the-economics-of-drug-discovery-and-the-impact-of-patents/

- How to do Chemical Markush Structure Search Patent? – GreyB, accessed July 28, 2025, https://www.greyb.com/blog/chemical-structure-search-patent/

- The Impact of Patent Expiry on Drug Prices: A Systematic Literature Review – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6132437/

- The Impact of Drug Patent Expiration: Financial Implications …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- The top 5 biggest cases of patent infringement globally – PatentRenewal.com, accessed July 28, 2025, https://www.patentrenewal.com/post/the-top-5-biggest-cases-of-patent-infringement-globally

- Gilead to pay Merck $2.54B in largest-ever patent infringement case – MedCity News, accessed July 28, 2025, https://medcitynews.com/2016/12/gilead-merck-2-54b-patent-infringement-case/

- Managing Drug Patent Litigation Costs – DrugPatentWatch …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/managing-drug-patent-litigation-costs/

- Patent Damages Statistics: What Innovators Should Know – PatentPC, accessed July 28, 2025, https://patentpc.com/blog/patent-damages-statistics-what-innovators-should-know

- Patent Litigation Statistics: An Overview of Recent Trends – PatentPC, accessed July 28, 2025, https://patentpc.com/blog/patent-litigation-statistics-an-overview-of-recent-trends

- Coverage – Google Help, accessed July 28, 2025, https://support.google.com/faqs/answer/7049585?hl=en

- Patent Research and Analysis Google Patents – Intellectual Property Owners Association, accessed July 28, 2025, https://ipo.org/wp-content/uploads/2019/11/2019-10-Patent-Searching-Google-Patents.pdf

- Google Patents – Wikipedia, accessed July 28, 2025, https://en.wikipedia.org/wiki/Google_Patents

- Google Patent Search – An Overview, accessed July 28, 2025, https://www.kaufholdpatentgroup.com/google-patent-search/

- Google Patents Search – A Definitive Guide by GreyB, accessed July 28, 2025, https://www.greyb.com/blog/google-patents-search-guide/

- Google Patents Search – Neustel Law Offices, accessed July 28, 2025, https://neustel.com/patents/google-patents-search/

- How to Use Google Patents for Effective Patent Searches, accessed July 28, 2025, https://patentpc.com/blog/how-to-use-google-patents-for-effective-patent-searches

- 6 Free and Possibly More Efficient Alternatives to Google Patents – PQAI, accessed July 28, 2025, https://projectpq.ai/5-free-and-possibly-more-efficient-alternatives-to-google-patents/

- Limitations of Google Patents Advanced Search for Invalidation …, accessed July 28, 2025, https://dev.to/patentscanai/limitations-of-google-patents-advanced-search-for-invalidation-what-ip-professionals-need-to-know-3ep2

- Using Google Patents to Find Drug Patents? Here’s 15 Reasons Why You Shouldn’t, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/using-google-patents-to-find-drug-patents-heres-15-reasons-why-you-shouldnt/

- How to Use the Google Patent Website: A Comprehensive Guide for New Inventors, accessed July 28, 2025, https://marketblast.com/patents_&_trademarks/how_to_use_the_google_patent_website:_a_comprehensive_guide_for_new_inventors/

- First Generic Launch has Significant First-Mover Advantage Over Later Generic Drug Entrants – DrugPatentWatch – Transform Data into Market Domination, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/first-generic-launch-has-significant-first-mover-advantage-over-later-generic-drug-entrants/

- How Often Is The Google Patents Search Database Updated? – SearchEnginesHub.com, accessed July 28, 2025, https://www.youtube.com/watch?v=kA41nLcPQp0

- Google Patents: Why It’s a Risky Tool for Finding Drug Patents – DrugPatentWatch, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/google-patents-why-its-a-risky-tool-for-finding-drug-patents/

- How often is Google Patents updated?, accessed July 28, 2025, https://patents.stackexchange.com/questions/10572/how-often-is-google-patents-updated

- Why Google Patents Is Not a Good Solution to Identify Drug Patents – DrugPatentWatch, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/why-google-patents-is-not-a-good-solution-to-identify-drug-patents/

- How long does it take from filing a patent to it surfacing on Google Patents? – Quora, accessed July 28, 2025, https://www.quora.com/How-long-does-it-take-from-filing-a-patent-to-it-surfacing-on-Google-Patents

- The Hidden Pitfalls of Searching Drug Patents on Google Patents – DrugPatentWatch, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/the-hidden-pitfalls-of-searching-drug-patents-on-google-patents/

- Find Your Next Blockbuster – Biotech & Pharmaceutical patents …, accessed July 28, 2025, https://www.drugpatentwatch.com/about.php

- US10107628B2 – Method and apparatus for navigating on artistic maps – Google Patents, accessed July 28, 2025, https://patents.google.com/patent/US10107628B2/it

- Terminal Disclaimer Rules, Filing Steps, and Legal Risks – UpCounsel, accessed July 28, 2025, https://www.upcounsel.com/terminal-disclaimer

- Does a Google patent document have all the details relevant to invention? What is the procedure of publishing and selling a US patent? – Quora, accessed July 28, 2025, https://www.quora.com/Does-a-Google-patent-document-have-all-the-details-relevant-to-invention-What-is-the-procedure-of-publishing-and-selling-a-US-patent

- Patent Center – USPTO, accessed July 28, 2025, https://www.uspto.gov/patents/apply/patent-center

- How to Conduct a Patent Search for Chemical Inventions – PatentPC, accessed July 28, 2025, https://patentpc.com/blog/how-to-conduct-a-patent-search-for-chemical-inventions

- Chemical Structure Searches Explained: Types, Tools and Tips for Getting the Most Accurate Patent Search Results, accessed July 28, 2025, https://www.tprinternational.com/chemical-structure-searches-explained-types-tools-and-tips-for-getting-the-most-accurate-patent-search-results/

- www.drugpatentwatch.com, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/using-google-patents-to-find-drug-patents-heres-15-reasons-why-you-shouldnt/#:~:text=Google%20Patents%20uses%20a%20keyword,technical%20specifications%20or%20chemical%20compositions.

- Google Patents, accessed July 28, 2025, https://patents.google.com/

- Google Patents Advanced Search, accessed July 28, 2025, https://www.google.com/advanced_patent_search

- Searching – Google Help, accessed July 28, 2025, https://support.google.com/faqs/answer/7049475?hl=en

- US5577239A – Chemical structure storage, searching and retrieval system – Google Patents, accessed July 28, 2025, https://patents.google.com/patent/US5577239A/en

- Chemical Structure Search – Effectual Services, accessed July 28, 2025, https://www.effectualservices.com/patent-services/patent-searches/chemical-structure-search/

- SciFinder – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6148602/

- PatCID: an open-access dataset of chemical structures in patent documents – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11297020/

- Find Patent Markush Structures – CAS SciFinder – Zendesk, accessed July 28, 2025, https://cas-product-help.zendesk.com/hc/en-us/articles/9838526793613-Find-Patent-Markush-Structures

- What is Markush search? – Patsnap Synapse, accessed July 28, 2025, https://synapse.patsnap.com/article/what-is-markush-search

- Navigating Markush Claims in Patent Ethics – Number Analytics, accessed July 28, 2025, https://www.numberanalytics.com/blog/ultimate-guide-markush-claims-patent-ethics

- The Role of Markush Structure Searches in Patent Protection and Analysis – Sagacious IP, accessed July 28, 2025, https://sagaciousresearch.com/blog/markush-structure-patent-search-analysis/

- US20050010603A1 – Display for Markush chemical structures – Google Patents, accessed July 28, 2025, https://patents.google.com/patent/US20050010603A1/en

- Markush searches simplified | CAS, accessed July 28, 2025, https://www.cas.org/resources/gated-content/markush-searches-simplified

- MARPAT User Guide – CAS, accessed July 28, 2025, https://www.cas.org/sites/default/files/documents/marpatug.pdf

- Biological Sequence Search – Effectual Services, accessed July 28, 2025, https://www.effectualservices.com/patent-services/patent-searches/bio-sequence-search/

- Pharmaceutical Patents: A Comprehensive Guide – Number Analytics, accessed July 28, 2025, https://www.numberanalytics.com/blog/ultimate-guide-pharmaceutical-patents-patent-eligibility

- US10658069B2 – Biological sequence variant characterization – Google Patents, accessed July 28, 2025, https://patents.google.com/patent/US10658069B2/en

- EP1429259A1 – Biological sequence information reading method and storing method – Google Patents, accessed July 28, 2025, https://patents.google.com/patent/EP1429259A1/en

- Sequence Search – Nordic Patent Institute, accessed July 28, 2025, https://npi.int/services/sequence-search/

- Comprehensive IP Search Tools At Your Fingertips – Aptean.com, accessed July 28, 2025, https://www.aptean.com/en-US/solutions/ip-search/products/aptean-genomequest

- GENESEQ Biological Gene Sequence Database – Clarivate, accessed July 28, 2025, https://clarivate.com/intellectual-property/patent-intelligence/geneseq/

- A Guide to Bio Sequence Patent Searching – Questel, accessed July 28, 2025, https://www.questel.com/resourcehub/a-guide-to-bio-sequence-patent-searching/

- FAQ Pertaining to Patent and Other Intellectual Property Information at NCBI, accessed July 28, 2025, https://www.ncbi.nlm.nih.gov/education/patent_and_ip_faqs/

- Avoid FTO Pitfalls: Best Practices for Patent Searches | TTC – TT Consultants, accessed July 28, 2025, https://ttconsultants.com/the-road-to-freedom-to-operate-fto-search-best-practices/

- When Is a “Freedom to Operate” Opinion Cost-Effective? | Articles …, accessed July 28, 2025, https://www.finnegan.com/en/insights/articles/when-is-a-freedom-to-operate-opinion-cost-effective.html

- Is patent search reserved to agents or attorneys? Is searcher accountable? – Ask Patents, accessed July 28, 2025, https://patents.stackexchange.com/questions/11975/is-patent-search-reserved-to-agents-or-attorneys-is-searcher-accountable

- Freedom to operate worries : r/patentlaw – Reddit, accessed July 28, 2025, https://www.reddit.com/r/patentlaw/comments/1ffn7dz/freedom_to_operate_worries/

- Inherent Anticipation in the Pharmaceutical and Biotechnology Industries – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4526724/

- Strategic Imperatives: Leveraging Patent Pending Data for Competitive Advantage in the Pharmaceutical Industry – DrugPatentWatch, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/leveraging-patent-pending-data-for-pharmaceuticals/

- Advanced patent searching techniques | CAS, accessed July 28, 2025, https://www.cas.org/resources/cas-insights/patent-searching-going-beyond-basics-increase

- CAS SciFinder Discovery Platform, accessed July 28, 2025, https://www.cas.org/solutions/cas-scifinder-discovery-platform

- Ensure freedom to operate around a biological sequence – Clarivate, accessed July 28, 2025, https://clarivate.com/intellectual-property/training-support/derwent/research-guides/ensure-freedom-to-operate-around-a-biological-sequence/

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed July 28, 2025, https://crozdesk.com/software/drugpatentwatch

- Using DrugPatentWatch to Support Out-Licensing and Partnering Decisions, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/using-drugpatentwatch-to-support-out-licensing-and-partnering-decisions/

- DrugPatentWatch not only saved us valuable time in tracking patent expirations but also streamlined our processes, accessed July 28, 2025, https://www.drugpatentwatch.com/

- Generic Drug Makers Rely on Patent Analysis, Data, and Partnerships for Competitive Edge., accessed July 28, 2025, https://www.geneonline.com/generic-drug-makers-rely-on-patent-analysis-data-and-partnerships-for-competitive-edge/

- DrugPatentWatch Analysis: Identifying Low-Competition Targets Key to Generic Drug Market Success – GeneOnline News, accessed July 28, 2025, https://www.geneonline.com/drugpatentwatch-analysis-identifying-low-competition-targets-key-to-generic-drug-market-success/

- DrugPatentWatch Highlights 5 Strategies for Generic Drug Manufacturers to Succeed Post-Patent Expiration – GeneOnline News, accessed July 28, 2025, https://www.geneonline.com/drugpatentwatch-highlights-5-strategies-for-generic-drug-manufacturers-to-succeed-post-patent-expiration/

- Patent Listing in FDA’s Orange Book – Congress.gov, accessed July 28, 2025, https://www.congress.gov/crs-product/IF12644

- Generic Drugs: Stakeholder Views on Improving FDA’s Information on Patents | U.S. GAO, accessed July 28, 2025, https://www.gao.gov/products/gao-23-105477

- The Listing of Patent Information in the Orange Book – FDA, accessed July 28, 2025, https://www.fda.gov/media/155200/download

- Orange Book 101 | The FDA’s Official Register of Drugs, accessed July 28, 2025, https://www.fr.com/insights/ip-law-essentials/orange-book-101/

- The basics of drug patent searching – DrugPatentWatch – Transform …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/the-basics-of-drug-patent-searching/

- Exploring current patent trends in the pharmaceutical industry, accessed July 28, 2025, https://www.einfolge.com/blog/Exploring-current-patent-trends-in-the-pharmaceutical-industry

- Patents Site – Google, accessed July 28, 2025, https://www.google.com/patents/licensing/

- How often does Google update their search indexes? – Quora, accessed July 28, 2025, https://www.quora.com/How-often-does-Google-update-their-search-indexes

- What is the difference between a negative limitation and a disclaimer in patent claims?, accessed July 28, 2025, https://blueironip.com/ufaqs/what-is-the-difference-between-a-negative-limitation-and-a-disclaimer-in-patent-claims/

- Advanced Guide to Google Patent Search – Bold Patents, accessed July 28, 2025, https://boldip.com/blog/google-patent-search-bp/

- Overview – Google Help, accessed July 28, 2025, https://support.google.com/faqs/answer/6390996?hl=en

- Patent, accessed July 28, 2025, https://en.wikipedia.org/wiki/Patent

- What does Google Patents do? – Quora, accessed July 28, 2025, https://www.quora.com/What-does-Google-Patents-do

- US20180011899A1 – Complex chemical substructure search query building and execution – Google Patents, accessed July 28, 2025, https://patents.google.com/patent/US20180011899A1/en

- Gene Sequence Search – Wissen Research, accessed July 28, 2025, https://www.wissenresearch.com/gene-sequence-search/

- PATENTSCOPE – WIPO, accessed July 28, 2025, https://www.wipo.int/en/web/patentscope

- Patent Prosecution | LexisNexis Intellectual Property Solutions, accessed July 28, 2025, https://www.lexisnexisip.com/solutions/patent-prosecution/

- Understanding USPTO Patent Searches: Uncover the World of Intellectual Property, accessed July 28, 2025, https://edisonlawgroup.com/understanding-uspto-patent-searches/

- Predicting patent challenges for small-molecule drugs: A cross-sectional study – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11867330/

- Unique Challenges for Patents in the Pharmaceutical Industry | Gearhart Law, LLC, accessed July 28, 2025, https://gearhartlaw.com/unique-challenges-for-patents-in-the-pharmaceutical-industry/

- FTC Expands Patent Listing Challenges, Targeting More Than 300 Junk Listings for Diabetes, Weight Loss, Asthma and COPD Drugs, accessed July 28, 2025, https://www.ftc.gov/news-events/news/press-releases/2024/04/ftc-expands-patent-listing-challenges-targeting-more-300-junk-listings-diabetes-weight-loss-asthma

- FTC Renews Challenge of More Than 200 Improper Patent Listings, accessed July 28, 2025, https://www.ftc.gov/news-events/news/press-releases/2025/05/ftc-renews-challenge-more-200-improper-patent-listings

- FTC Challenges Drug Patents Hindering Generic Competition, accessed July 28, 2025, https://www.presidentialprayerteam.org/2025/06/02/ftc-challenges-drug-patents-hindering-generic-competition/

- DrugPatentWatch Pricing, Features, and Reviews (Jul 2025) – Software Suggest, accessed July 28, 2025, https://www.softwaresuggest.com/drugpatentwatch

- Pharmaceutical patents: reconciling the human right to health with the incentive to invent, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7169928/

- New Guide Helps Pharmaceutical Professionals Navigate Drug Patents, Highlights Google Patents and PatentScope as Key Search Resources – GeneOnline, accessed July 28, 2025, https://www.geneonline.com/new-guide-helps-pharmaceutical-professionals-navigate-drug-patents-highlights-google-patents-and-patentscope-as-key-search-resources/

- Why Patent Prior Art Search is Crucial in Pharmaceutical Literature for Effective IP Strategy, accessed July 28, 2025, https://sagaciousresearch.com/blog/how-to-do-prior-art-searching-in-pharmaceutical-literature/

- [2503.16096] MarkushGrapher: Joint Visual and Textual Recognition of Markush Structures – arXiv, accessed July 28, 2025, https://arxiv.org/abs/2503.16096

- The Private Costs of Patent Litigation | Scholarly Commons at Boston University School of Law, accessed July 28, 2025, https://scholarship.law.bu.edu/context/faculty_scholarship/article/2389/viewcontent/The_Private_Costs_of_Patent_Litigation_pub.pdf

- Then, now, and down the road: Trends in pharmaceutical patent settlements after FTC v. Actavis, accessed July 28, 2025, https://www.ftc.gov/enforcement/competition-matters/2019/05/then-now-down-road-trends-pharmaceutical-patent-settlements-after-ftc-v-actavis

- Frequently Asked Questions on Patents and Exclusivity – FDA, accessed July 28, 2025, https://www.fda.gov/drugs/development-approval-process-drugs/frequently-asked-questions-patents-and-exclusivity

- Case Study 52 – Infringement of a pharmaceutical patent in Vietnam, accessed July 28, 2025, https://intellectual-property-helpdesk.ec.europa.eu/regional-helpdesks/south-east-asia-ip-sme-helpdesk/case-studies/case-study-52-infringement-pharmaceutical-patent-vietnam_en

- Pharmaceutical Patent Litigation Settlements: Implications for Competition and Innovation, accessed July 28, 2025, https://scholarship.law.georgetown.edu/facpub/574/

- Drug company takes 10 others to court for patent infringement – PMC – PubMed Central, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC1172859/

- Approved Drug Products with Therapeutic Equivalence Evaluations | Orange Book – FDA, accessed July 28, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/approved-drug-products-therapeutic-equivalence-evaluations-orange-book

- Frequently Asked Questions on The Orange Book – FDA, accessed July 28, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/frequently-asked-questions-orange-book

- Patent Linkage Explained: Navigating the Complexities – Number Analytics, accessed July 28, 2025, https://www.numberanalytics.com/blog/patent-linkage-explained

- Bio Sequence Searches | Dexpatent, accessed July 28, 2025, https://www.dexpatent.com/biosequence-search/

- Markush Structure Searches – DexPatent, accessed July 28, 2025, https://www.dexpatent.com/markush-structure-search/

- Markush Editor and MarkushTools – Chemaxon, accessed July 28, 2025, https://chemaxon.com/markush-editor-and-markushtools

- Patent search databases comparison – Baker Library – Harvard Business School, accessed July 28, 2025, https://www.library.hbs.edu/services/help-center/patent-search-databases-comparison

- Do As I Say, Not As I Do: Google’s Patent Transparency Hypocrisy, accessed July 28, 2025, https://cip2.gmu.edu/2016/06/30/do-as-i-say-not-as-i-do-googles-patent-transparency-hypocrisy/

- Pharmaceutical Patent Analyst – Journals – Journals & Congresses – PubsHub, accessed July 28, 2025, https://journalsandcongresses.pubshub.com/ph/journals/28252/details-pharmaceutical-patent-analyst

- Patent Analytics – IPApproach, accessed July 28, 2025, https://ipapproach.com/patent-analytics/

- IPD Analytics | The Industry Leader in Drug Life-Cycle Insights, accessed July 28, 2025, https://www.ipdanalytics.com/

- Decode a Drug Patent Like a Wall Street Analyst – DrugPatentWatch, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/how-to-check-if-a-drug-is-patented/

- Pat-INFORMED – The Gateway to Medicine Patent Information – WIPO, accessed July 28, 2025, https://www.wipo.int/pat-informed/en/

- Learn about Pharmaceutical Patent Analyst – Taylor & Francis Online, accessed July 28, 2025, https://www.tandfonline.com/journals/ippa20/about-this-journal

- Strategic Patenting by Pharmaceutical Companies – Should Competition Law Intervene? – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7592140/

- 2117-Markush Claims – USPTO, accessed July 28, 2025, https://www.uspto.gov/web/offices/pac/mpep/s2117.html

- Understanding The Reach And Limits Of Markush Claims | LexOrbis, accessed July 28, 2025, https://www.lexorbis.com/understanding-the-reach-and-limits-of-markush-claims/

- Improper Markush Grouping | Articles | Finnegan | Leading IP+ Law Firm, accessed July 28, 2025, https://www.finnegan.com/en/insights/articles/improper-markush-grouping.html

- Guide on Patent and Sequence Searches and Submissions Related to Genetic Resources and Genetic Resource Data in the Life Science – WIPO, accessed July 28, 2025, https://www.wipo.int/export/sites/www/tk/en/docs/ip-gr-tool-2.pdf

- Patome: a database server for biological sequence annotation and analysis in issued patents and published patent applications – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC1781150/

- Using Google Patents for Drug Patent Research: A Comprehensive Guide, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/using-google-patents-for-drug-patent-research-a-comprehensive-guide/

- Other patent web tech besides Google Patents? : r/patentlaw – Reddit, accessed July 28, 2025, https://www.reddit.com/r/patentlaw/comments/12rqdlc/other_patent_web_tech_besides_google_patents/

- Drug Patent Watch – GreyB, accessed July 28, 2025, https://www.greyb.com/services/patent-search/drug-patent-watch/

- Freshly Squeezed: Orange Book History and Key Updates at 45, accessed July 28, 2025, https://www.fdli.org/2025/05/freshly-squeezed-orange-book-history-and-key-updates-at-45/

- Orange Book: What it is and how it Works – Investopedia, accessed July 28, 2025, https://www.investopedia.com/terms/o/orange-book.asp

- When patent applications are incomplete or missing information – USPTO, accessed July 28, 2025, https://www.uspto.gov/patents/apply/when-patent-applications-are-incomplete-or-missing-information

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed July 28, 2025, https://www.congress.gov/crs-product/R46679

- Does Pharma Need Patents? – The Yale Law Journal, accessed July 28, 2025, https://www.yalelawjournal.org/feature/does-pharma-need-patents

- 4.2 Consequences of a declaration of no search or an incomplete search in subsequent European procedure, accessed July 28, 2025, https://www.epo.org/en/legal/guidelines-pct/2024/c_iv_4_2.html

- How Prior Art & Novelty Affect Your Patentability? – XLSCOUT, accessed July 28, 2025, https://xlscout.ai/understanding-patentability-how-prior-art-and-novelty-affect-your-patent-application/

- Key Strategies for Successfully Challenging a Drug Patent – DrugPatentWatch, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/key-strategies-for-successfully-challenging-a-drug-patent/

- Understanding Prior Art Search in 2025 – Lumenci, accessed July 28, 2025, https://lumenci.com/blogs/prior-art-search-guide-patent-non-patent-literature/

- Prior Art Search: What Every Innovator Needs to Know – Sagacious IP, accessed July 28, 2025, https://sagaciousresearch.com/blog/why-is-prior-art-search-important-for-innovators/

- Structure searching in Google patents – Bio <-> Chem, accessed July 28, 2025, https://cdsouthan.blogspot.com/2019/08/structure-searching-in-google-patents.html

- 4 Interesting Facts About the Orange Book – Pharmacy Times, accessed July 28, 2025, https://www.pharmacytimes.com/view/4-interesting-facts-about-the-orange-book

- 2164-The Enablement Requirement – USPTO, accessed July 28, 2025, https://www.uspto.gov/web/offices/pac/mpep/s2164.html

- Obstacles to prior art searching by the trilateral patent offices: empirical evidence from International Search Reports – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4833823/