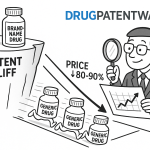

Welcome to the precipice of one of the largest transfers of market value in pharmaceutical history. Over the next five to ten years, we will witness a monumental patent cliff, a period where blockbuster drugs that have defined therapeutic landscapes and generated hundreds of billions in revenue will lose their market exclusivity. Between 2025 and 2030 alone, branded drugs with combined annual sales between $217 billion and $236 billion are set to face the unforgiving gravity of generic competition. For those of us in the generic and specialty pharmaceutical space, this isn’t a crisis; it’s a gold rush.

This is an unprecedented opportunity to bring affordable, life-saving medications to millions of patients while capturing significant market share. However, let’s be clear: this is not the generic industry of the 1990s. The days of simply being the first to file and coasting on a simple formulation are long gone. The modern generic landscape is defined by a central, governing paradox: the very event that creates the opportunity—patent expiration—is the same event that triggers a brutal, rapid, and inevitable commoditization of the market. Intense price competition, sophisticated brand defense strategies, and a complex global supply chain have raised the stakes immeasurably.

Success in this new era is no longer a matter of speed alone; it is a matter of strategy. It requires a deeply nuanced, data-driven framework for identifying not just any opportunity, but the right opportunity—one where your company’s legal prowess, commercial capabilities, and technical expertise align to create a defensible and profitable market position.

This report is your playbook. We will embark on a comprehensive journey, starting with a 30,000-foot view of the global market and then diving deep into the granular details that separate winning launches from costly failures. We will map the intricate regulatory maze of the Hatch-Waxman Act, decode the high-stakes game of patent litigation, and build a robust framework for commercial and financial evaluation. We will dissect the technical challenges of formulation and the geopolitical risks of the supply chain. Finally, we will look to the horizon, exploring the trends in biosimilars and technology that will define the next decade of this dynamic industry. My goal is to equip you, the business leader and strategist, with the insights and tools necessary to turn these impending patent cliffs into your company’s next profit peak. Let’s begin.

Section 1: Mapping the Terrain – The Global Generic Drug Market Landscape

Before we can identify a single promising drug candidate, we must first understand the terrain on which we’ll be competing. The global generic drug market is a vast and dynamic ecosystem, shaped by powerful economic, demographic, and regulatory forces. A clear grasp of its scale, key players, and strategic currents is the essential first step in building a winning portfolio strategy. This is not just background noise; it’s the foundational context that informs every subsequent decision you’ll make.

The Scale of the Opportunity: Market Size and Growth Projections

The sheer scale of the generic drug market is staggering, and its growth trajectory is both steady and resilient. In 2024, the global market was valued between approximately $445 billion and $491 billion.2 Looking ahead, forecasts project this figure to swell to well over $728 billion, with some estimates reaching as high as $926 billion, by 2034.2 This expansion represents a compound annual growth rate (CAGR) in the range of 5% to 8%, a remarkably robust figure for such a mature industry.1

What does this steady growth tell us? It reveals a market propelled by deep, structural tailwinds that are not subject to short-term economic cycles. The primary drivers are systemic and long-term. First, the aging global population is leading to a higher prevalence of chronic diseases like cardiovascular conditions, diabetes, and cancer, creating a sustained demand for medication.4 Second, governments and healthcare payers worldwide are under immense pressure to control spiraling healthcare costs. With generic drugs costing, on average, 85% less than their branded counterparts, their promotion is a fiscal and political imperative. Finally, the constant cycle of patent expirations on blockbuster drugs provides a reliable and recurring infusion of new opportunities into the market.2 These forces—demographic, economic, and regulatory—are not fleeting trends; they are the bedrock of the industry’s consistent growth.

Geographically, North America, and specifically the United States, remains the titan of the generic world, accounting for over a third of the entire global market.2 Its highly developed regulatory pathway and market-based pricing system create a fertile ground for generic competition. However, the most explosive growth is happening elsewhere. The Asia-Pacific region is poised to expand at the fastest rate, driven by a rising middle class, expanding healthcare infrastructure, and a growing demand for affordable medicines in countries like India and China.5 For companies with global ambitions, understanding these regional dynamics is critical for allocating resources and tailoring market entry strategies.

The Titans of the Trade: Profiling the Competitive Ecosystem

The generic drug market is a fiercely competitive arena dominated by a mix of global giants and nimble regional players. Understanding who these companies are, their scale, and their strategic priorities is essential for anyone looking to carve out a niche. At the top of the hierarchy are behemoths like Sandoz, Teva Pharmaceutical Industries, Sun Pharma, and Viatris, each commanding billions in annual revenue and wielding significant influence over the market.9

As the table below illustrates, the competitive landscape is diverse. Sandoz, now a standalone entity spun off from Novartis, has firmly established itself as the leader by revenue, with a clear strategic focus on high-value biosimilars and complex generics. Teva, long a dominant force, leverages its massive global manufacturing and commercial footprint to compete across a broad portfolio. Meanwhile, Indian powerhouses like Sun Pharma, Cipla, and Dr. Reddy’s have become formidable global competitors, leveraging their development and manufacturing prowess to challenge incumbents in key markets.

Table 1: Top 10 Global Generic Companies by 2023 Revenue

| Rank | Company | 2023 Generic Revenue ($B) | Y/Y Revenue Change (%) | Strategic Note |

| 1 | Sandoz | $9.64 | +6.37% | Focus on biosimilars and complex generics; strong European presence. |

| 2 | Teva Pharmaceuticals | $8.73 | +1.53% | Global leader with a massive portfolio and strong U.S. and European sales. |

| 3 | Sun Pharma | $5.70 | +11.27% | Indian powerhouse with a vast portfolio of over 2000 molecules. |

| 4 | Viatris | $5.58 | -11.70% | Formed from Mylan/Upjohn merger; focuses on branded and complex generics. |

| 5 | Fresenius Kabi | $4.63 | +6.98% | German company with strong growth driven by its biosimilar portfolio. |

| 6 | Cipla | $2.93 | +11.86% | Indian firm specializing in complex generics for respiratory and other diseases. |

| 7 | Dr. Reddy’s | $2.86 | +15.22% | Strong growth in global generics segment, active in new product launches. |

| 8 | Lupin | $2.34 | +20.36% | Significant market-driven growth; strong in formulations and APIs. |

| 9 | Aspen | $2.33 | +3.40% | South African company focusing on post-patent branded and sterile medicines. |

| 10 | Zydus | $2.04 | +91.00% | Massive revenue surge driven by increased product sales and new approvals. |

Data sourced from PharmaShots analysis of 2023 company revenues.

This table isn’t just a league ranking; it’s a strategic map. The revenue figures indicate scale, but the year-over-year changes and strategic notes reveal the underlying dynamics. The strong growth of companies like Dr. Reddy’s and Lupin points to successful recent launches, while the massive surge from Zydus suggests a particularly impactful new product hitting the market. Conversely, Viatris’s revenue decline may reflect portfolio divestitures or increased competition in its core areas. When you evaluate a potential target, you must ask: which of these titans will be my competitor? Do their strengths align with my target’s weaknesses? Could one of them be a potential partner or acquirer?

The Rise of Complex Generics and Biosimilars: A Strategic Shift

Perhaps the most significant strategic trend shaping the modern generic industry is the deliberate pivot away from simple oral solid dosage forms toward more technically demanding products. Why is this happening? It’s a direct response to the industry’s central paradox. For conventional generics—the straightforward tablets and capsules—the path from patent expiry to market entry is well-trodden. This leads to a flood of competitors, triggering a rapid and severe price war that crushes profitability, leaving companies with “razor-thin profit margins”.11 It is a race to the bottom, a game of pure commoditization.

To escape this margin-eroding vortex, savvy companies are moving up the value chain. They are increasingly focusing their R&D and manufacturing investments on two key areas: complex generics and biosimilars.6

- Complex Generics are products that are inherently difficult to develop and manufacture. This can include long-acting injectables, transdermal patches, drug-device combinations, or drugs with complex formulations.

- Biosimilars are the “generic” versions of large-molecule biologic drugs. Unlike small-molecule generics, they are not exact copies but are proven to be “highly similar” with no clinically meaningful differences from the original biologic.

The strategic logic is simple: complexity creates barriers to entry. Developing these products requires a different and more sophisticated skill set than that needed for simple tablets. It demands advanced R&D capabilities to reverse-engineer intricate formulations, deep regulatory expertise to navigate often unclear approval pathways, and significant capital investment in specialized manufacturing facilities.11 The result? Fewer competitors can enter the market, which in turn leads to more sustainable pricing and higher profit margins.

The market data confirms this strategic shift. The biosimilars segment is projected to be a primary growth engine for the entire industry, with some forecasts suggesting the market could reach $175 billion by 2034.1 In the U.S. alone, biosimilars generated $9.4 billion in savings in 2022, demonstrating their growing impact. This trend is fundamentally reshaping the competitive landscape. The generic industry is bifurcating. On one side are the high-volume, low-margin players who excel at the operational efficiency required for commodity products. On the other are the high-value, specialized players who thrive on scientific and regulatory prowess. As you build your company’s strategy, you must decide which game you are equipped to play, because the investment, talent, and risk profile for each are worlds apart.

Section 2: The Opportunity Engine – Decoding the Patent and Regulatory Maze

If the market landscape is the terrain, then the patent and regulatory systems are the rules of the game. In the generic drug industry, these rules don’t just govern the competition; they create the opportunities. A deep, strategic understanding of the legal frameworks in key markets like the United States and Europe is not a task to be delegated solely to your legal team. It is a core commercial competency. Mastering this maze is what allows you to identify opportunities before your rivals, navigate around obstacles, and time your market entry for maximum impact.

The U.S. Playbook: Mastering the Hatch-Waxman Act

In the United States, the entire generic drug industry as we know it is a product of a single, transformative piece of legislation: the Drug Price Competition and Patent Term Restoration Act of 1984, universally known as the Hatch-Waxman Act.16 As we approach its 40th anniversary, its impact remains profound.19 Before its passage, generics were a market afterthought, accounting for just 19% of all prescriptions. Today, they represent over 90%, a testament to the Act’s success in reshaping the pharmaceutical landscape.16

A Landmark Legislation

The genius of Hatch-Waxman lies in the elegant bargain it struck. It created a delicate but effective balance between two competing interests: incentivizing innovation for brand-name drug companies and promoting competition from low-cost generics to increase affordability and access.16 For brands, it offered patent term extensions to compensate for time lost during the lengthy FDA approval process. For generics, it created a revolutionary new pathway to market.

The ANDA Pathway

The cornerstone of the Act is the Abbreviated New Drug Application (ANDA) pathway.16 This provision is the engine of the generic industry. It allows a generic manufacturer to seek FDA approval without having to conduct its own costly and time-consuming preclinical and clinical trials to prove safety and efficacy. Instead, the ANDA filer can rely on the FDA’s previous finding that the original brand-name drug (known as the Reference Listed Drug, or RLD) is safe and effective. The generic company’s primary scientific burden is to prove that its product is bioequivalent to the RLD—that it gets the same amount of the active ingredient to the site of action in the body in the same amount of time. This dramatically lowers the cost and time of development, making generic competition economically feasible.

The FDA Orange Book: The Strategic Blueprint

To make this system work, Hatch-Waxman created a central repository of information, a document that has become the bible for generic drug strategists: the “Approved Drug Products with Therapeutic Equivalence Evaluations,” more commonly known as the Orange Book.

Purpose and Structure

The Orange Book is the official FDA publication that lists all approved drug products, along with their patents and regulatory exclusivity periods.24 It is the definitive source for identifying which patents a brand company claims protect its product and when those protections are set to expire. For strategists, it provides a comprehensive map of the market, allowing you to identify competitors, assess market saturation, and, most importantly, pinpoint future opportunities.

Strategic Patent Listing

The Orange Book is not a passive list; it’s an active competitive tool. Brand companies are required to submit to the FDA all patents that claim the approved drug or a method of using it. A savvy brand company will strategically build a “patent thicket” around its product by listing multiple patents covering not just the core active ingredient (the drug substance) but also specific formulations, crystalline forms, and approved methods of use.25 Each of these patents represents another potential hurdle that a generic competitor must overcome. The Orange Book even includes specific “patent use codes” (e.g., U-1234) that define the precise indication a method-of-use patent covers, allowing for surgical challenges and “skinny label” strategies where a generic might launch for only the non-patented uses of a drug.

Identifying Opportunities

For generic companies, the Orange Book is a treasure map. The entire process of opportunity identification begins with a meticulous analysis of this data. We scrutinize the listings to find attractive drug targets that have key patents nearing expiration. We look for patents that appear weak or overly broad, making them prime candidates for a legal challenge. We search for opportunities to design a new formulation that might circumvent, or “design around,” a brand’s existing product patents. This deep analysis of patent landscapes is a core function of specialized competitive intelligence platforms. For instance, a service like DrugPatentWatch provides sophisticated dashboards and analytics tools that aggregate and interpret Orange Book data, allowing companies to monitor patent expirations, track litigation, and receive alerts on competitor activities, thereby streamlining the process of identifying and prioritizing market entry opportunities.28

The High-Stakes Game: Paragraph IV Patent Challenges

While waiting for a patent to expire is the most straightforward path to market, it is often not the most profitable. The real high-stakes, high-reward game in the U.S. generic market involves challenging a brand’s patents head-on before they expire. This is done through a mechanism known as a Paragraph IV certification.

What is a Paragraph IV Certification?

When a generic company files an ANDA, it must make a certification for every patent listed in the Orange Book for the brand-name drug. A Paragraph IV (PIV) certification is a bold legal assertion: the generic company declares that, in its opinion, the brand’s patent is invalid, unenforceable, or will not be infringed by the generic product it intends to market.30 This is not just a paperwork exercise; under U.S. law, it is considered an “artificial” act of patent infringement, designed specifically to create a legal basis for a lawsuit to be filed and for the patent’s validity to be tested in court before the generic launches.

The Process and the 30-Month Stay

The PIV filing kicks off a highly choreographed legal dance. The generic applicant must send a detailed notice letter to the brand company and the patent holder, explaining the basis for its challenge. The brand then has a 45-day window to respond by filing a patent infringement lawsuit.33 If a suit is filed within that window, it triggers an automatic and critical provision of the Hatch-Waxman Act: a 30-month stay on the FDA’s ability to grant final approval to the generic’s ANDA.18

This 30-month stay was intended to provide a reasonable period for the courts to resolve the patent dispute. However, its strategic function has evolved. While it appears to be a major delay, the reality is more nuanced. Research has shown that in many cases, the 30-month stay period actually expires years before the generic drug ultimately launches. This tells us that the stay itself is often not the rate-limiting step. Instead, its primary role in the modern landscape is to act as a powerful forcing function. It brings both parties to the negotiating table under a defined timeline, making a settlement agreement—which will dictate the ultimate generic entry date—the most common outcome of PIV litigation. The stay creates the framework for negotiation, where the true barriers to entry, such as the strength of the patent portfolio or the potential for a costly legal defeat, are battled out.

The Grand Prize: 180-Day Exclusivity

Why would a generic company voluntarily invite a multimillion-dollar lawsuit from a pharmaceutical giant? The answer lies in the grand prize established by Hatch-Waxman to incentivize these challenges: 180 days of generic market exclusivity.

The Incentive

The law states that the first generic applicant to submit a “substantially complete” ANDA containing a PIV certification is eligible for a 180-day period of marketing exclusivity.22 During this six-month period, the FDA is blocked from approving any other generic ANDAs for the same drug.

The Economic Impact

This 180-day exclusivity is the lifeblood of the PIV strategy. It is an incredibly valuable and lucrative prize. For six months, the first-filer operates in a duopoly with the brand-name drug. This allows them to capture a massive portion of the market share, often at a price that is only moderately discounted from the brand price (perhaps 15-25% lower). The real price collapse—the one that drives prices down by 80-90% or more—only occurs after the 180-day period expires and multiple other generic competitors flood the market. The super-profits earned during this exclusivity period are what justify the immense cost and risk of undertaking PIV litigation in the first place.

Litigation Trends and Outcomes

The PIV pathway has become the standard approach for any generic drug of significant commercial value.

- Prevalence: For top-selling drugs with over $250 million in annual sales, a staggering 93% face at least one PIV challenge. It’s no longer a question of if a blockbuster will be challenged, but when and by how many. The average blockbuster now faces between six and nine PIV challengers, all vying for a piece of the market.

- Predictive Factors: The decision to mount a PIV challenge is overwhelmingly an economic one. Market size is the single most powerful predictor. A cross-sectional study of new drugs found that once a drug’s market value in its fourth year crosses the ~$500 million threshold, the probability of it being challenged skyrockets to over 90%.

- Financial Stakes: The financial implications of these lawsuits are immense. For a generic firm, a win can cause its stock valuation to jump by an average of 3.1%, while a loss can trigger a 1.6% drop. For the brand company, the stakes are even higher, averaging an astounding $4.3 billion in market value per case. This is truly a high-stakes game where the outcome of a single court case can alter the fortunes of a company.

The European Perspective: Navigating the EMA

While the U.S. market is often the primary target, a truly global generic strategy requires mastering the regulatory landscape in Europe as well. The European Medicines Agency (EMA) oversees a system that shares some concepts with the FDA’s but has critical differences in its procedures and, most importantly, its exclusivity rules.

The primary route for approval is through a Marketing Authorisation Application (MAA). For generics of products that were originally approved via the EMA’s Centralised Procedure, access to this streamlined pathway is automatic.23 For generics of products approved at a national level within the E.U., applicants may need to justify use of the Centralised Procedure by demonstrating that their product offers a significant innovation or is in the interest of public health across the Union.

The most crucial difference from the U.S. system is Europe’s approach to data and market exclusivity, often referred to as the “8+2+1” rule. Here’s how it works:

- 8 Years of Data Exclusivity: For eight years following the approval of the original brand-name drug, no other company can file a generic application that references the brand’s data.

- +2 Years of Market Exclusivity: A generic application can be filed after the eight-year mark, but the generic product cannot be launched onto the market until a full 10 years have passed since the brand’s initial approval.

- +1 Additional Year: The brand company can earn one additional year of market protection (for a total of 11 years) if, during the initial eight years, it gets approval for a new therapeutic indication that brings significant clinical benefit.

This “8+2+1” framework provides a much more predictable timeline for generic entry than the litigation-driven system in the U.S. There is no direct equivalent to the PIV challenge or the 180-day exclusivity prize in Europe; market entry is dictated by this regulatory clock.

Table 2: Comparison of U.S. (FDA) vs. E.U. (EMA) Generic Approval Pathways

| Feature | United States (FDA) | European Union (EMA) |

| Governing Law | Hatch-Waxman Act of 1984 | Directive 2001/83/EC |

| Key Regulatory Body | Food and Drug Administration (FDA) | European Medicines Agency (EMA) |

| Application Type | Abbreviated New Drug Application (ANDA) | Marketing Authorisation Application (MAA) |

| Data Exclusivity | 5 years for New Chemical Entities (NCEs) | 8 years from brand approval |

| Market Exclusivity | Tied to patent life; no separate regulatory market exclusivity post-data exclusivity | 10 years total (+1 year possible for new indication) |

| Patent Challenge Mechanism | Paragraph IV Certification (pre-expiry) | Litigation in national patent courts (typically post-expiry) |

| First Generic Incentive | 180-day market exclusivity for first successful PIV filer | None |

Data sourced from.16

This table crystallizes the fundamental strategic differences between the two largest pharmaceutical markets. The U.S. system is a high-risk, high-reward environment centered on patent litigation. The European system is a more predictable, timeline-driven environment governed by regulatory clocks. A successful global launch strategy must be bilingual, capable of navigating both of these distinct paradigms.

Beyond Regulation: The Necessity of a Freedom-to-Operate (FTO) Analysis

Finally, it is critical to understand that regulatory approval and patent compliance are not the same thing. Securing an ANDA approval from the FDA does not grant you a license to infringe on patents. This is where a Freedom-to-Operate (FTO) analysis becomes an indispensable part of your due diligence.

An FTO is a proactive and comprehensive legal assessment conducted to determine whether a proposed product, process, or commercial activity is at risk of infringing on the valid, in-force patent rights of a third party.41 It is a critical risk-mitigation tool that should be employed

before committing significant capital to a development program.

Crucially, an FTO analysis must go far beyond the patents listed in the Orange Book. The Orange Book is notoriously incomplete, as it does not include patents related to manufacturing processes, intermediates, or certain polymorphs (different crystalline structures of the active ingredient).27 A competitor could hold a valid process patent that your manufacturing method infringes, which could lead to an injunction and block your launch, even if all the Orange Book-listed patents have expired or been invalidated.

A proper FTO analysis involves a three-step process 41:

- Define the Scope: Clearly define the product, its formulation, the manufacturing process, and the specific geographic markets where you intend to launch.

- Conduct a Comprehensive Search: Use professional patent databases to search for all potentially relevant patents—composition of matter, formulation, process, polymorph, and method-of-use.

- Assess the Risk: Work with experienced patent attorneys to analyze the claims of the identified patents and render a legal opinion on the risk of infringement.

This is not an insignificant undertaking. A preliminary FTO search might cost $10,000, while a comprehensive, in-depth analysis for a global launch can easily exceed $100,000. However, this is a small price to pay to avoid a multimillion-dollar infringement lawsuit or a catastrophic, last-minute derailment of your product launch.

Section 3: Sizing the Prize – A Framework for Commercial Evaluation

With a firm grasp of the market and regulatory landscapes, we can now transition to the core task of commercial evaluation. This is where we move from the general to the specific, from mapping the terrain to identifying the X on the treasure map. A successful generic launch is born from a rigorous and disciplined process of target selection, market forecasting, and competitive analysis. This framework will provide the structure to assess the commercial viability of any potential opportunity, ensuring that you invest your resources in products with the highest probability of success.

Target Selection: How to Spot a Winner

The first and most critical step is identifying the right branded drug to target. The universe of possibilities is vast, but a systematic approach can quickly narrow the field to the most promising candidates.

The process begins with an analysis of the branded drug’s commercial performance. What is the total size of the market? Is the drug’s sales trajectory growing, flat, or declining? Blockbuster drugs—those with annual sales exceeding $1 billion—are naturally the most alluring targets due to their massive revenue potential, but they also attract the most intense competition.45 It’s essential to look beyond the headline sales number. Analyze prescription volume trends, patient population size, and the growth prospects of the overall therapeutic area. Is the standard of care evolving? Are there new, more effective branded competitors on the horizon that could render your generic obsolete shortly after launch? A drug that is first-in-class may be a strong candidate, but if it’s about to be supplanted by a best-in-class newcomer, the opportunity window could be dangerously short.

This is where sophisticated competitive intelligence becomes invaluable. You cannot afford to operate with outdated or incomplete information. Modern pharmaceutical intelligence platforms, such as DrugPatentWatch, are designed specifically for this purpose. They provide integrated dashboards that allow you to monitor patent expirations, track ongoing Paragraph IV litigation, and keep tabs on competitor pipelines in real-time. By setting up alerts for specific drugs or therapeutic classes, you can “identify market entry opportunities and inform portfolio management decisions” proactively, rather than reactively.28 This allows you to spot potential winners early and begin your due diligence well before the opportunity becomes common knowledge.

Forecasting Market Dynamics and Price Erosion

Once a potential target is identified, the next step is to build a realistic forecast of its market potential as a generic. This requires a deep understanding of two key dynamics: the rate of price erosion and the potential for market share capture.

The Price Erosion Curve

The price erosion curve is one of the most fundamental and predictable phenomena in the generic drug industry. The moment a generic enters the market, prices begin to fall, and they fall faster as more competitors arrive. Understanding the slope of this curve is critical to accurately forecasting revenue.

- Initial Entry: The first generic to launch typically enters at a price point roughly 30% to 40% below the brand’s price.37

- Second Entrant: The arrival of a second generic competitor triggers a further significant drop, with prices often falling to around 50% of the original brand price.

- Multiple Competitors: Once four or more generic competitors are in the market, the price war intensifies dramatically. Prices can plummet to less than 20% of the brand price, effectively turning the product into a commodity.29

It’s also important to note that the pace of this erosion has accelerated over time. A decade ago, this process might have taken a couple of years. Today, for simple oral solid generics launched between 2011 and 2013, prices were observed to fall by an average of 79% within the first 12 months. Now, it is common for these products to ultimately cost 90% less than the brand they replace. Your financial models must account for this rapid and steep decline.

Modeling Market Share Capture

Forecasting revenue isn’t just about price; it’s about volume. How quickly will your generic product capture market share from the brand? This is influenced by several factors. In the U.S., state-level automatic substitution laws often empower or even mandate pharmacists to dispense a generic equivalent unless the prescriber explicitly writes “dispense as written.” This is a powerful driver of rapid uptake. Payer formularies also play a crucial role; pharmacy benefit managers (PBMs) will almost always place the generic in a preferred tier with a lower patient copay to steer volume away from the more expensive brand. A reasonable base-case assumption is that generics will capture the vast majority (80-90%) of the brand’s volume within the first year.

The Authorized Generic (AG) Wrench

Just when your forecast seems straightforward, you must account for one of the most disruptive tools in the brand defense playbook: the authorized generic (AG).

What is an AG?

An authorized generic is the brand-name drug, in its exact formulation, packaged and sold as a generic.49 It is typically marketed either by the brand company itself through a subsidiary or by a partner generic company that has struck a deal with the brand. Critically, because it is the identical product, an AG does not require a separate ANDA approval from the FDA and can be launched at the brand company’s discretion.

Strategic Impact

The strategic power of the AG is immense. A brand company can launch an AG at any time, including on day one of the first-filer’s 180-day exclusivity period.49 This move instantly shatters the lucrative duopoly that the first-filer was counting on. Instead of competing only with the high-priced brand, the first generic now faces a third competitor that is identical to the brand but priced like a generic. This can slash the first-filer’s projected revenue during the exclusivity period by 30% to 50%, dramatically diluting the value of the 180-day prize and weakening the economic incentive to challenge patents in the first place.

Pricing Impact

The presence of an AG not only splits the market share but also accelerates price erosion. Data shows that the on-invoice prices paid by pharmacies for new generics are 13% to 18% lower in markets where an AG is present compared to those without.

The threat of an AG launch must be treated as a “shadow competitor” in every commercial evaluation. When building a financial model for a Paragraph IV opportunity, you can no longer assume you will enjoy a clean 180-day duopoly. A prudent forecast must include a scenario—or perhaps even the base case—where an AG launches on day one and immediately captures a significant portion of the generic market. This reality has profound implications. It effectively raises the commercial viability threshold for a PIV challenge. Drugs with smaller or mid-sized markets, which might have been attractive targets a decade ago, may no longer generate a sufficient risk-adjusted return to justify millions in litigation costs once the dilutive effect of a potential AG is factored in. This strategic use of AGs by brand firms serves as an indirect filter, ensuring that only the largest blockbuster drugs with the most substantial revenue potential remain attractive targets for PIV litigation.

Competitive Landscaping: Know Your Enemy

A thorough commercial evaluation requires an honest and detailed assessment of the competition. Who else is targeting this product, and what are their capabilities?

The first place to look is the FDA’s Paragraph IV Certification List, which is publicly available and updated regularly. This list will tell you which companies have already filed an ANDA with a PIV certification for your target drug. Again, platforms like DrugPatentWatch are invaluable here, as they track and organize this data, making it easy to see the competitive landscape at a glance.

But simply counting the number of filers is not enough. You must perform due diligence on each potential competitor. What is their track record? Do they have a history of successful first-to-file launches? Are they known for being aggressive on price, or do they tend to follow the market? Do they have the manufacturing capacity and supply chain robustness to reliably supply the market, or are they prone to quality issues and shortages? A competitor with a weak manufacturing base may be less of a threat than one with a vertically integrated, global supply chain.

Finally, never underestimate the brand’s will to defend its franchise. Beyond authorized generics, brand companies deploy a host of strategies to slow the erosion of their market share. These can include aggressive direct-to-prescriber marketing campaigns that emphasize minor differences or patient support programs, the issuance of patient copay cards to reduce the out-of-pocket cost difference between the brand and the generic, and the strategic launch of a “next-generation” follow-on product (a practice sometimes called “product hopping”) designed to switch patients from the old drug to the new one just before the original’s patent expires.53 Your commercial forecast must account for the potential impact of these defensive maneuvers.

Section 4: From Lab to Launch – Navigating Technical and Supply Chain Hurdles

A brilliant commercial strategy is worthless if you cannot develop a compliant product and reliably supply it to the market. The technical and operational aspects of generic drug development are fraught with challenges that can derail even the most promising opportunities. This section delves into the scientific hurdles of proving “sameness,” the rising complexity of modern generics, and the profound vulnerabilities of the global pharmaceutical supply chain.

The Science of “Sameness”: Bioequivalence and Formulation

The scientific heart of any generic drug application is the concept of bioequivalence (BE). As we’ve discussed, generic developers get to bypass the massive cost of full clinical trials by relying on the brand’s original safety and efficacy data. The price of that shortcut is the requirement to scientifically prove that their product is effectively the same as the brand’s.

Bioequivalence means that the generic drug delivers the same amount of the active pharmaceutical ingredient (API) into a patient’s bloodstream over the same period as the reference listed drug (RLD).55 The FDA has established a precise statistical standard for this. In a BE study, a small group of healthy volunteers (typically 24-36) are given both the generic and the brand drug in a crossover design. Scientists then measure key pharmacokinetic (PK) parameters, primarily the total drug exposure (Area Under the Curve, or AUC) and the peak drug concentration (

Cmax). To be deemed bioequivalent, the 90% confidence interval for the geometric mean ratio of the generic’s AUC and Cmax to the brand’s must fall entirely within the range of 80.00% to 125.00%.56 While this window may seem wide, in practice, the average difference in absorption between generics and their brand counterparts is a mere 3.5%.

Achieving this statistical “sameness” is a significant formulation challenge. Generic developers are essentially tasked with reverse-engineering, or “de-formulating,” the brand product without access to its proprietary manufacturing process or exact recipe. While the API must be the same, the FDA allows for differences in the inactive ingredients, or excipients—the fillers, binders, and coatings that make up the bulk of a tablet or capsule. This is where the art and science of formulation come into play. The choice of excipients can have a profound impact on the drug’s stability, its dissolution profile in the gut, and ultimately, its ability to meet the strict 80-125 BE window. A poorly chosen excipient can lead to a failed BE study, sending formulators back to the drawing board and causing costly delays.

This is precisely why the cost to develop a generic drug, while a fraction of a new drug’s cost, is not trivial. The typical range of $2 million to $10 million largely reflects the investment in formulation science, analytical testing, and the execution of these pivotal bioequivalence studies. This is a far cry from the estimated $2.6 billion required to bring a novel drug to market, but it is a substantial investment that must be justified by a sound commercial case.

The Complexity Frontier: Tackling Difficult-to-Make Generics

As discussed, the intense price competition in the simple oral solid market is pushing the industry toward more complex products. These “complex generics” represent a higher barrier to entry and, consequently, a more attractive and sustainable commercial opportunity. The FDA defines a complex generic as a product that has one or more of the following: a complex active ingredient, formulation, dosage form, route of administration, or is a complex drug-device combination product.

Examples include:

- Long-Acting Injectables: These formulations are designed to release a drug slowly over weeks or months, requiring sophisticated polymer or microsphere technology.

- Transdermal Patches: These must adhere to the skin properly while delivering a consistent dose of the drug over a set period.

- Topical Creams and Ointments: These act locally, meaning blood levels of the drug may not be a relevant measure of efficacy, requiring different types of equivalence studies.

- Drug-Device Combinations: Products like metered-dose inhalers require not only a bioequivalent formulation but also a device that performs identically to the brand’s.

Developing these products presents a host of unique hurdles. How do you prove bioequivalence for a topical cream that is not absorbed systemically? You may need to conduct comparative clinical endpoint studies, which are far more complex and expensive than a standard PK study.13 How do you ensure an injectable product is not only sterile but also free of pyrogens (fever-inducing substances)? This requires specialized manufacturing facilities and stringent quality control. Furthermore, the regulatory pathways for these products are often less well-defined than for simple tablets, creating uncertainty and potentially leading to longer and more unpredictable review times with the FDA. This combination of scientific, manufacturing, and regulatory complexity is precisely what limits the number of competitors and preserves the profit margins for those companies with the expertise to succeed.

The Global Supply Chain: A Source of Risk and Resilience

The ability to reliably manufacture and supply your product is a fundamental requirement for a successful launch. However, the modern pharmaceutical supply chain is a global, interconnected, and often fragile system. Understanding its vulnerabilities is a critical component of risk management.

The most significant vulnerability is geographic concentration. Over the past few decades, in the relentless pursuit of lower costs, the manufacturing of APIs and their precursors, Key Starting Materials (KSMs), has become heavily concentrated in a few countries, primarily China and India.60 This has created what experts call “critical choke points” in the supply chain. A disruption in one of these regions—whether from a natural disaster like Hurricane Maria, which crippled manufacturing in Puerto Rico, a geopolitical trade dispute, or a localized quality control failure at a single large factory—can have cascading effects, leading to widespread drug shortages across the globe.62

This leads to what can be described as the “affordability paradox” of the generic industry. The very force that delivers immense value to the healthcare system—fierce price competition—is also the force that creates systemic fragility. The constant downward pressure on prices results in razor-thin profit margins for many essential generic drugs.63 These low margins, in turn, disincentivize manufacturers from making crucial investments. They may be unable or unwilling to afford to build redundant manufacturing sites, maintain a buffer inventory of API, or invest in upgrading older facilities to the latest quality standards. This economic reality forces production to the lowest-cost regions, exacerbating the geographic concentration problem. When a disruption inevitably occurs at one of the few remaining manufacturing sites, there is no slack or backup capacity in the system. The result is a drug shortage, which can delay patient care, lead to medication errors as hospitals scramble for alternatives, and ultimately harm public health.64 The public’s demand for the absolute lowest price inadvertently fuels a brittle system that is prone to failure.

What are the mitigation strategies? For an individual company, the key is to build resilience into your specific supply chain. This means moving away from a single-source strategy for critical APIs. Developing relationships with at least two geographically diverse suppliers, even if one is slightly more expensive, provides crucial redundancy.12 It also involves maintaining a strategic buffer inventory of key raw materials and finished products to weather short-term disruptions. From a policy perspective, there is a growing recognition that procurement models need to change. Instead of “winner-take-all” contracts awarded solely on the lowest price, payers and governments are beginning to explore models that value and reward supply chain reliability and manufacturing redundancy.64

Section 5: The Bottom Line – Financial Modeling and Risk Assessment

After navigating the market, regulatory, and technical landscapes, the ultimate decision to proceed with a generic launch comes down to a single question: does it make good financial sense? This requires translating all of your strategic analysis into a rigorous financial model that projects costs, forecasts revenues, and provides a clear-eyed assessment of the potential return on investment. It also demands a structured approach to identifying and mitigating the myriad risks that can threaten a successful launch.

Building the Business Case: Financial Modeling for Generic Launches

A robust financial model is the bedrock of any sound investment decision. For a generic drug launch, the most appropriate and widely used valuation methodology is a Discounted Cash Flow (DCF) analysis, which calculates the project’s Net Present Value (NPV).67

Key Valuation Models

The NPV model is foundational because it accounts for the two most important elements of a long-term investment: the total cash generated and the time value of money.69 It recognizes that a dollar earned ten years from now is worth less than a dollar in your pocket today. By discounting all future projected cash flows back to their present value, the NPV gives you a single, clear figure that represents the total value the project is expected to create for the company in today’s dollars. A positive NPV indicates a profitable venture that exceeds your required rate of return; a negative NPV signals that the project is likely to destroy value.

Assembling the Inputs

The accuracy of your NPV model is entirely dependent on the quality of your inputs. This is where all the preceding analysis comes together.

- Cash Outflows: These are the investments required to get the product to market. They must be timed correctly in your model.

- R&D and Formulation Costs: Typically in the range of $2 million to $10 million, spent in the years leading up to the ANDA filing.

- Legal Costs: For a Paragraph IV challenge, this is a significant expense, averaging between $2.7 million and $4.5 million, spread over the litigation period.

- Regulatory Fees: The FDA charges user fees under the Generic Drug User Fee Amendments (GDUFA) for reviewing an ANDA, which can be several hundred thousand dollars.

- Manufacturing Scale-Up (CAPEX): Capital expenditures for any new equipment or facility validation required for commercial production.

- Post-Launch Costs: These include the Cost of Goods Sold (COGS), which for generic injectables and orals is estimated at 42% and 36% of revenue, respectively, and Sales, General & Administrative (SG&A) expenses.

- Cash Inflows: This is the revenue forecast, built directly from your commercial evaluation in Section 3.

- Market Size: The annual sales of the branded drug at the time of your expected launch.

- Market Share Capture: Your projected share of the market volume over time.

- Price Erosion: Your forecast of the net price you will realize, accounting for the steep price erosion curve as more competitors enter.

- Discount Rate: This represents your company’s required rate of return, or its Weighted Average Cost of Capital (WACC). It reflects the riskiness of the investment. For the pharmaceutical industry, the cost of equity typically ranges from 7.7% to 9.4%. Your finance department can provide the appropriate rate for your company.

Calculating Net Present Value (NPV)

The NPV calculation itself is straightforward. For each year of the forecast period (typically 10-15 years), you calculate the project’s Free Cash Flow (FCF). Then, you discount each year’s FCF back to its present value using the formula:

PV=(1+r)nFCFn

where PV is the Present Value, FCFn is the Free Cash Flow in year n, r is the discount rate, and n is the year.

The Net Present Value is simply the sum of all the discounted free cash flows over the life of the project.

Table 3: Illustrative NPV Calculation for a Hypothetical Generic Launch ($ Millions)

| Year | -2 | -1 | 1 | 2 | 3 | 4 | 5 | … | 10 |

| Cash Outflows | |||||||||

| R&D Costs | ($2.0) | ($2.0) | |||||||

| Legal Costs | ($1.5) | ($1.5) | |||||||

| Cash Inflows | |||||||||

| Gross Revenue | $0 | $0 | $150.0 | $120.0 | $80.0 | $60.0 | $50.0 | … | $20.0 |

| COGS (@40%) | $0 | $0 | ($60.0) | ($48.0) | ($32.0) | ($24.0) | ($20.0) | … | ($8.0) |

| SG&A (@15%) | $0 | $0 | ($22.5) | ($18.0) | ($12.0) | ($9.0) | ($7.5) | … | ($3.0) |

| Profitability | |||||||||

| EBITDA | ($2.0) | ($3.5) | $66.0 | $54.0 | $36.0 | $27.0 | $22.5 | … | $9.0 |

| Taxes (@21%) | $0.4 | $0.7 | ($13.9) | ($11.3) | ($7.6) | ($5.7) | ($4.7) | … | ($1.9) |

| Free Cash Flow (FCF) | ($1.6) | ($2.8) | $52.1 | $42.7 | $28.4 | $21.3 | $17.8 | … | $7.1 |

| NPV Calculation | |||||||||

| Discount Rate (r) | 10% | ||||||||

| Discount Factor | 1.21 | 1.10 | 0.91 | 0.83 | 0.75 | 0.68 | 0.62 | … | 0.39 |

| Discounted FCF | ($1.3) | ($2.5) | $47.4 | $35.3 | $21.3 | $14.5 | $11.0 | … | $2.8 |

| Cumulative NPV | ($1.3) | ($3.8) | $43.6 | $78.9 | $100.2 | $114.7 | $125.7 | … | $145.2 |

This simplified model illustrates the process. The project requires an initial investment, leading to a negative NPV in the early years. Upon launch in Year 1, it begins generating significant positive cash flow. The final NPV of $145.2 million represents the total value this project is expected to create for the company, making it a financially attractive opportunity.

A Structured Approach to Risk: The Risk Assessment Matrix

A financial model is only a forecast, and the future is inherently uncertain. A critical part of the evaluation process is to systematically identify, assess, and plan for the risks that could cause your forecast to go wrong. A Risk Management Plan (RMP) is not just a regulatory document; it’s a vital strategic tool.73 A risk assessment matrix provides a simple yet powerful framework for this process.

The matrix forces you to consider risks across several key domains:

- Patent & Legal Risk: The most obvious risk is losing a PIV lawsuit. This could result in being blocked from the market entirely or, in an “at-risk” launch scenario, facing massive damages for infringement.

- Regulatory Risk: The FDA could issue a Complete Response Letter rejecting your ANDA, demand additional time-consuming studies, or find significant issues during a pre-approval inspection of your manufacturing facility.

- Manufacturing & Supply Chain Risk: Your API supplier could face a shutdown, a commercial batch could fail quality control tests, or you could find you are unable to scale up production to meet market demand.

- Commercial & Market Risk: The market could evolve differently than you forecast. More competitors could enter than you anticipated, leading to faster price erosion. The brand could launch a highly effective defense strategy, including an authorized generic, that limits your market share. Or payers could refuse to add your product to their formularies.

For each identified risk, you assess its likelihood (low, medium, high) and its potential impact on the project if it were to occur. This allows you to prioritize the most critical risks—those in the top-right quadrant of the matrix—and focus on developing robust mitigation strategies.

Table 4: Sample Risk Assessment Matrix for a Generic Launch

| Risk Category | Specific Risk | Likelihood | Impact | Mitigation Strategy |

| Patent/Legal | Lose Paragraph IV patent infringement lawsuit. | Medium | High | Rigorous FTO analysis; select patents with strong invalidity arguments; retain experienced litigation counsel; model settlement scenarios. |

| Commercial | Brand launches an Authorized Generic (AG) on Day 1. | High | High | Build AG launch into base-case financial model; develop aggressive pricing and contracting strategy to compete for payer contracts. |

| Regulatory | FDA issues a Complete Response Letter due to BE study deficiencies. | Low | Medium | Conduct pilot BE studies; engage with FDA during pre-ANDA meetings; ensure study is conducted by a reputable CRO with a strong track record. |

| Supply Chain | Sole API supplier has a manufacturing shutdown due to quality issues. | Medium | High | Qualify a secondary, geographically diverse API supplier, even if at a higher cost; maintain a strategic safety stock of API. |

| Manufacturing | Commercial-scale batches fail stability testing. | Medium | Medium | Implement Quality by Design (QbD) principles during formulation; conduct robust process validation; perform accelerated stability testing early. |

Case Studies in Action: Learning from the Past

Theory and models are essential, but the richest lessons often come from studying how these dynamics have played out in the real world. The patent cliff launches of major blockbusters like Lipitor and Nexium provide invaluable case studies.

The Lipitor (Atorvastatin) Launch: A Lesson in Brand Defense

The loss of exclusivity for Pfizer’s Lipitor, once the best-selling drug in the world, was a landmark event.

- The Outcome: The launch of generic atorvastatin was a resounding success for the healthcare system. Total use of the molecule increased by 20% as prices fell, while overall spending on atorvastatin decreased by 23%, demonstrating the immense value of generic competition.

- Brand Strategy: Pfizer did not go quietly. It executed a masterful and aggressive defense strategy. It struck a deal with Watson Pharmaceuticals to launch an authorized generic, immediately cutting into the first-filer’s market. It also offered deep rebates and discounts directly to PBMs and health plans to keep branded Lipitor on formulary at a price competitive with the generic.

- Generic Strategy: The first-filer, Ranbaxy, secured the coveted 180-day exclusivity and generated approximately $600 million in sales during that period. However, the story of Teva, the world’s largest generic company at the time, is perhaps more instructive. Despite having an approved ANDA, Teva made the stunning decision not to launch its generic version.76 Their rationale? The market was already too crowded with Ranbaxy’s generic, Watson’s AG, and the deeply discounted brand. Furthermore, manufacturing the massive volumes required would have consumed a significant portion of their production capacity. This case proves that even for the biggest blockbusters, the launch decision is not automatic; it requires a cold, hard look at the competitive intensity and operational realities.

The Nexium (Esomeprazole) Launch: A Case Study in Litigation and Delay

The story of generic Nexium is less about commercial strategy and more about the complexities and risks of patent litigation.

- The Outcome: The launch of generic Nexium was delayed for years. The first-filer, Ranbaxy, entered into a settlement agreement with the brand company, AstraZeneca. This agreement was later challenged in court by direct purchasers and end-payers as an illegal “reverse payment” or “pay-for-delay” settlement, designed to keep the cheaper generic off the market in exchange for a share of the brand’s monopoly profits.79

- The Lesson: This case, which was one of the first to go to trial after the Supreme Court’s landmark FTC v. Actavis decision, highlights the immense legal and antitrust risks that now surround patent settlements. The litigation was complex and protracted. Ultimately, the jury delivered a split verdict: they found that the agreement was anticompetitive, but that the plaintiffs had failed to prove they were actually harmed by it, because Ranbaxy was facing significant manufacturing issues that would have delayed its launch anyway.79 This case serves as a stark reminder that the legal pathway to market can be fraught with peril, and the outcome of litigation can be unpredictable and hinge on complex technical details.

Section 6: The Next Frontier – Future Trends Shaping Generic Opportunities (2025-2035)

The generic drug industry is not static. It is a constantly evolving ecosystem, shaped by scientific breakthroughs, technological innovation, and shifting geopolitical currents. To build a sustainable and profitable portfolio, we must not only master the challenges of today but also anticipate the opportunities and threats of tomorrow. This final section looks to the horizon, exploring the key trends that will define the next decade of the generic landscape.

The Biosimilar Revolution Takes Center Stage

Without question, the most significant trend shaping the future of the off-patent market is the rise of biosimilars. As many of the world’s top-selling biologic drugs—complex proteins, antibodies, and other large molecules—lose their patent protection, the primary growth engine of the industry is shifting from small-molecule chemistry to large-molecule biotechnology.1 This is more than just a change in product type; it represents a fundamental paradigm shift in the R&D, manufacturing, and regulatory expertise required to compete.

A key catalyst for this revolution is the evolving regulatory landscape, particularly in the U.S. For years, a significant barrier to biosimilar adoption has been the concept of “interchangeability.” To earn this designation, which allows a pharmacist to substitute a biosimilar for the brand without consulting the prescriber, the FDA previously required developers to conduct costly and time-consuming “switching studies”. This created a perception of a two-tiered system, with interchangeable biosimilars seen as superior to non-interchangeable ones, which confused physicians and slowed uptake.

However, the ground is shifting. Citing a decade of real-world evidence showing that switching between biosimilars and their reference products is safe and effective, the FDA has recently issued draft guidance that proposes removing the requirement for switching studies.84 This is a game-changing development. By lowering this significant barrier to entry, the FDA is signaling a maturation of the biosimilar market. It effectively levels the playing field, reinforcing the message that “a biosimilar is a biosimilar.” The long-term implication is clear: the commoditization cycle that has long defined the small-molecule generic market is coming for biologics. As more competitors enter without the interchangeability hurdle, competition will intensify, price erosion will accelerate, and payers will become even more aggressive in steering patients to the lowest-cost biosimilar option. This will force biosimilar manufacturers to compete not just on science, but increasingly on price and supply chain reliability.

Technology as a Competitive Differentiator

The generic industry, often seen as a follower rather than an innovator, is on the cusp of a technological transformation. Companies that embrace and effectively integrate new technologies will gain a significant competitive advantage.

- Artificial Intelligence (AI) in R&D: The use of AI and machine learning algorithms is set to revolutionize generic development. AI can be used to analyze vast datasets to predict which formulations are most likely to meet bioequivalence criteria, screen for potential impurities in API synthesis, and streamline the preparation of complex regulatory submissions. This can significantly reduce development timelines and increase the probability of first-cycle approvals.

- Advanced Manufacturing: The adoption of new manufacturing technologies, such as continuous manufacturing, offers a path to greater efficiency, lower costs, and enhanced product quality. Unlike traditional batch manufacturing, continuous processes can run 24/7, reduce the physical footprint of a facility, and allow for real-time quality monitoring, leading to more consistent and reliable production.

The Geopolitical Imperative: Reshoring and Supply Chain Security

The COVID-19 pandemic laid bare the profound vulnerabilities of a globalized pharmaceutical supply chain heavily reliant on a few key regions in Asia.60 This has triggered a major geopolitical and policy shift. Governments in the U.S. and Europe are now actively promoting the “onshoring” or “reshoring” of critical drug manufacturing to enhance national health security and reduce the risk of shortages. The EU’s Critical Medicines Act is a prime example of this new policy direction.

This trend presents both an opportunity and a challenge for the generic industry. While there may be government incentives and contracts available for companies that invest in domestic manufacturing, this shift inevitably comes with a trade-off between resilience and cost. Manufacturing in the U.S. or Europe is inherently more expensive due to higher labor, energy, and environmental compliance costs. This directly challenges the low-price business model that has defined the generic industry for decades. The future of pharmaceutical procurement will likely involve a new calculus, where buyers—both government and private—will need to balance the relentless pursuit of the lowest price with the strategic necessity of a secure and resilient supply chain. Contracts may evolve to reward suppliers who can guarantee supply, even if they are not the absolute cheapest option.

Quotes from the Top: CEO Perspectives on the Future

To understand where the industry is headed, it’s invaluable to listen to the leaders who are steering its largest companies. Their strategic priorities offer a clear window into the future competitive landscape.

- Richard Saynor, CEO of Sandoz: Saynor’s vision for Sandoz is firmly rooted in leading the high-value end of the market. He consistently emphasizes the strategic importance of biosimilars and is backing it up with major investments in European manufacturing capabilities, particularly in Austria and Slovenia.86 He is also a vocal critic of what he terms “patent abuses” and “evergreening” strategies by brand companies, arguing that they unfairly block generic and biosimilar competition. His perspective is that of a company betting its future on scientific and manufacturing excellence in complex products, while advocating for a regulatory environment that fosters faster competition.86 “We are choosing now to make the investment choices that we want to make that are right for the business, rather than as a compromise as a division to a parent,” he stated, highlighting Sandoz’s new independence.

- Richard Francis, CEO of Teva Pharmaceutical Industries: Francis is executing a “Pivot to Growth” strategy designed to stabilize and grow Teva’s massive generics business while simultaneously building a robust innovative drug portfolio.91 He views the generics division as a stable, cash-generating “powerhouse” that provides the financial foundation to invest in high-growth innovative assets like Austedo and Uzedy.92 His strategy acknowledges the pricing pressures in the generics market but sees it as an essential and enduring part of a diversified pharmaceutical company. “Today, Teva is a fundamentally different company – more focused, more innovative, and more robust,” Francis declared, signaling a move beyond pure generics into a hybrid biopharma model. He also notes the value generics bring, stating, “the generic prices in the US are some of the lowest in the world,” a point he believes policymakers should consider when contemplating tariffs or other measures.

- Scott A. Smith, CEO of Viatris: Viatris, born from the merger of Mylan and Upjohn, is also charting a course away from the commoditized end of the market. Their strategy explicitly focuses on complex generics and building deep expertise in specific specialty therapeutic areas like ophthalmology, dermatology, and gastroenterology.95 This is a clear move to escape the intense price erosion found in simple oral tablets. The company also sees a robust and competitive biosimilar market as “essential to the future of access to medicines,” aligning with the broader industry trend. The Viatris strategy is one of deliberate focus, moving away from being everything to everyone and toward becoming a leader in targeted, higher-margin segments of the market.

Key Takeaways

As we conclude this deep dive into the world of generic drug opportunities, several core strategic imperatives emerge for any company looking to succeed in this complex and competitive landscape.

- Strategy Over Speed: The modern generic market rewards thoughtful strategy more than pure speed. Success is no longer guaranteed to the first-to-file; it belongs to the company that selects the right targets, where a deep understanding of the patent landscape, a realistic commercial forecast, and a robust technical capability align to create a sustainable competitive advantage.

- The Market is Bifurcating: The generic industry is splitting into two distinct models. Companies must make a conscious strategic choice: either become a low-cost, high-volume operator excelling at the operational efficiency required for commodity generics, or invest in the scientific and regulatory prowess needed to compete in the higher-margin world of complex generics and biosimilars. Trying to be both is a recipe for failure.

- Risk is Multidimensional: A winning launch plan requires a holistic and proactive approach to risk management. Your framework must account for the full spectrum of potential threats: the high stakes of patent litigation, the unpredictability of the regulatory process, the inherent fragility of the global supply chain, and the brutal reality of market competition and price erosion.

- The Future is Complex and Biologic: The most significant growth and the most attractive profit pools for the next decade will be found in biosimilars and complex generics. This is an irreversible trend. Companies that fail to invest in the capabilities required to compete in these areas risk being left behind in an increasingly commoditized and low-margin segment of the market.

- Resilience is the New Efficiency: The paradigm of the pharmaceutical supply chain is shifting. The historical focus on achieving the absolute lowest manufacturing cost is now being balanced by the geopolitical and public health imperative of supply chain security. Building resilience—through dual sourcing, geographic diversification, and strategic inventory—is no longer a cost center; it is a source of competitive advantage and a key to long-term sustainability.

Frequently Asked Questions (FAQ)

1. What is the single biggest mistake companies make when selecting a generic target?

The most common and costly mistake is an incomplete or superficial assessment of the competitive landscape, particularly underestimating the brand’s defense strategy. Many companies focus heavily on the patent expiration date and the branded drug’s current sales, but they fail to adequately model the impact of an authorized generic (AG) launch, aggressive brand contracting with payers, or the potential for a “product hop” to a next-generation therapy. A financial model that assumes a simple duopoly during the 180-day exclusivity period is often dangerously optimistic. A robust evaluation must treat the brand’s defensive tactics not as a possibility, but as a near certainty, and build the business case accordingly.

2. How has the rise of “pay-for-delay” settlements affected the 180-day exclusivity incentive?

“Pay-for-delay” or “reverse payment” settlements, where a brand manufacturer pays a generic challenger to delay market entry, have come under intense antitrust scrutiny since the Supreme Court’s FTC v. Actavis decision. While these explicit payments are now riskier, the dynamic has shifted to more subtle forms of value transfer. For example, a common settlement term is a “no-AG agreement,” where the brand promises not to launch an authorized generic in exchange for the generic agreeing to a later entry date.49 This preserves the full value of the 180-day exclusivity for the first-filer, making a later, but more profitable, entry date attractive. This effectively dilutes the incentive for the

earliest possible generic entry, potentially costing the healthcare system billions by extending the brand’s monopoly.

3. For a smaller generic company, is it better to target a blockbuster drug with many competitors or a smaller niche drug with fewer?

This is a classic portfolio strategy question with no single right answer. Targeting a blockbuster (>$1B sales) offers immense revenue potential but guarantees a fight with multiple, well-funded competitors and the brand’s full defensive arsenal. Success requires impeccable execution and a strong stomach for risk. A smaller niche drug (<$250M sales) offers a quieter competitive landscape and a higher probability of being one of only a few generics. The revenue potential is lower, but the profit margins can be more stable and the path to market less contentious. For a smaller company, a portfolio of several well-chosen niche products can often be a more sustainable and less risky strategy than betting the entire company on a single blockbuster challenge.

4. How is the FDA’s evolving view on biosimilar interchangeability likely to change the market dynamics for biologics?

The FDA’s recent draft guidance removing the requirement for switching studies to achieve an “interchangeable” designation is a watershed moment.84 It will dramatically accelerate the commoditization of the biologics market. Previously, the interchangeability hurdle created a high barrier and a perceived quality difference that slowed biosimilar adoption. By removing it, the FDA is leveling the playing field, which will likely lead to: 1) more biosimilar competitors entering the market faster, 2) more intense price competition sooner after the first biosimilar launch, and 3) payers (PBMs) becoming much more aggressive in forcing switches to the lowest-cost biosimilar on their formularies. The “biologic premium” will erode much faster than it has in the past.

5. With the political push for “onshoring,” will the cost advantage of generic drugs disappear?

No, the fundamental cost advantage will not disappear, but it may shrink. The primary cost advantage of generics comes from avoiding the multi-billion-dollar cost of novel drug discovery and clinical trials, and that remains unchanged.57 However, onshoring manufacturing from low-cost regions like India and China to higher-cost regions like the U.S. and Europe will undoubtedly increase the Cost of Goods Sold (COGS).86 This means that while generics will always be significantly cheaper than the brands they replace, the absolute lowest price points we see today for some commodity generics may become unsustainable. We are likely moving toward a new equilibrium where payers and governments may need to pay a slight premium for the security and reliability of a domestically produced medicine, shifting the procurement calculus from “lowest possible price” to “best value, including supply resilience.”

References

- The Global Generic Drug Market: Trends, Opportunities, and …, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/the-global-generic-drug-market-trends-opportunities-and-challenges/

- Generic Drugs Market Size to Hit USD 728.64 Billion by 2034, accessed July 29, 2025, https://www.precedenceresearch.com/generic-drugs-market

- Global Generic Drug Market Size, Share 2025 – 2034, accessed July 29, 2025, https://www.custommarketinsights.com/report/generic-drug-market/

- Generic Drugs Market Size to Hit USD 775.61 Billion by 2033 – BioSpace, accessed July 29, 2025, https://www.biospace.com/press-releases/generic-drugs-market-size-to-hit-usd-775-61-billion-by-2033

- Generic Drugs Market 2024-2035: Trends, Innovations, and Future Growth, accessed July 29, 2025, https://www.pharmiweb.com/press-release/2025-02-12/generic-drugs-market-2024-2035-trends-innovations-and-future-growth

- Generic Pharmaceuticals Market Size & Share Report, 2030, accessed July 29, 2025, https://www.grandviewresearch.com/industry-analysis/generic-pharmaceuticals-market-report

- Generic Drugs Market Size, Share And Trends Report, 2033 – Nova One Advisor, accessed July 29, 2025, https://www.novaoneadvisor.com/report/generic-drugs-market

- North America Generic Drugs Market Report and Forecast 2024-2032, accessed July 29, 2025, https://www.researchandmarkets.com/report/north-america-generics-market

- Top 20 Generic Pharma Companies of 2024 – PharmaShots, accessed July 29, 2025, https://pharmashots.com/15316/top-20-generic-pharma-companies-of-2024/

- Largest pharma companies by market cap, accessed July 29, 2025, https://companiesmarketcap.com/pharmaceuticals/largest-pharmaceutical-companies-by-market-cap/

- Overcoming Formulation Challenges in Generic Drug Development …, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/overcoming-formulation-challenges-in-generic-drug-development/

- Streamlining the Generic Drug Supply Chain: Best Practices – DrugPatentWatch, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/streamlining-the-generic-drug-supply-chain-best-practices/

- Complex Generics: Facts, Figures and Who They Benefit – Teva Pharmaceuticals, accessed July 29, 2025, https://www.tevapharm.com/news-and-media/feature-stories/what-are-complex-generics/

- Complex Generics News – FDA, accessed July 29, 2025, https://www.fda.gov/drugs/generic-drugs/complex-generics-news

- The impact of biosimilars on biologic drug distribution models …, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-biosimilars-on-biologic-drug-distribution-models/

- 40th Anniversary of the Generic Drug Approval Pathway | FDA, accessed July 29, 2025, https://www.fda.gov/drugs/cder-conversations/40th-anniversary-generic-drug-approval-pathway

- www.fda.gov, accessed July 29, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/hatch-waxman-letters#:~:text=The%20%22Drug%20Price%20Competition%20and,Drug%2C%20and%20Cosmetic%20Act%20(FD%26C

- Hatch-Waxman Act – Practical Law, accessed July 29, 2025, https://uk.practicallaw.thomsonreuters.com/Glossary/PracticalLaw/I2e45aeaf642211e38578f7ccc38dcbee

- Hatch-Waxman at 40 | Brookings, accessed July 29, 2025, https://www.brookings.edu/events/hatch-waxman-at-40/

- A Bipartisan Success: Celebrating 40 Years of the Hatch-Waxman Act, accessed July 29, 2025, https://www2.itif.org/2025-hatch-waxman-act-article.pdf

- The Hatch-Waxman Act Turns 40: The Law That Made Biosimilars Possible, accessed July 29, 2025, https://www.centerforbiosimilars.com/view/the-hatch-waxman-act-turns-40-the-law-that-made-biosimilars-possible

- The 180-Day Rule Supports Generic Competition. Here’s How., accessed July 29, 2025, https://accessiblemeds.org/resources/blog/180-day-rule-supports-generic-competition-heres-how/

- Navigating the Generic Drug Approval Process: A Comprehensive Guide, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/navigating-the-generic-drug-approval-process-a-comprehensive-guide/

- Approved Drug Products with Therapeutic Equivalence Evaluations | Orange Book – FDA, accessed July 29, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/approved-drug-products-therapeutic-equivalence-evaluations-orange-book

- Mastering Orange Book in Patent Law – Number Analytics, accessed July 29, 2025, https://www.numberanalytics.com/blog/mastering-orange-book-patent-law

- The Strategic Value of Orange Book Data in Pharmaceutical …, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/the-strategic-value-of-orange-book-data-in-pharmaceutical-competitive-intelligence/

- Drug Patent Research: Expert Tips for Using the FDA Orange and Purple Books, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/drug-patent-research-expert-tips-for-using-the-fda-orange-and-purple-books/

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed July 29, 2025, https://crozdesk.com/software/drugpatentwatch

- How to Identify Profitable Generic Drug Opportunities Using Patent …, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/how-to-identify-profitable-generic-drug-opportunities-using-patent-expiration-data/

- Full article: Continuing trends in U.S. brand-name and generic drug …, accessed July 29, 2025, https://www.tandfonline.com/doi/full/10.1080/13696998.2021.1952795

- Navigating the Complexities of Paragraph IV – Number Analytics, accessed July 29, 2025, https://www.numberanalytics.com/blog/navigating-paragraph-iv-complexities

- What Every Pharma Executive Needs to Know About Paragraph IV Challenges, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- Paragraph IV Explained – ParagraphFour.com, accessed July 29, 2025, https://paragraphfour.com/paragraph-iv-explained/

- The timing of 30‐month stay expirations and generic entry: A cohort study of first generics, 2013–2020 – PMC, accessed July 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8504843/

- Small Business Assistance | 180-Day Generic Drug Exclusivity | FDA, accessed July 29, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/small-business-assistance-180-day-generic-drug-exclusivity

- The Law of 180-Day Exclusivity (Open Access) – Food and Drug Law Institute (FDLI), accessed July 29, 2025, https://www.fdli.org/2016/09/law-180-day-exclusivity/

- GENERIC DRUGS IN THE UNITED STATES: POLICIES TO …, accessed July 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6355356/

- Predicting patent challenges for small-molecule drugs: A cross-sectional study – PMC, accessed July 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11867330/

- The Distribution of Surplus in the US Pharmaceutical Industry: Evidence from Paragraph iv Patent-Litigation Decisions, accessed July 29, 2025, https://jonwms.web.unc.edu/wp-content/uploads/sites/10989/2021/06/ParIVSettlements_JLE.pdf