1. Introduction: The Strategic Imperative of Generic Drug Launch Tracking

1.1. The Evolving Global Generic Pharmaceutical Landscape

The global generic drugs market is experiencing a period of significant expansion, fundamentally reshaping the pharmaceutical industry. Projections indicate robust growth, with the market anticipated to expand from approximately USD 491.35 billion in 2024 to USD 816.75 billion by 2034, demonstrating a Compound Annual Growth Rate (CAGR) of 5.3%.1 Other market analyses forecast growth from USD 468.08 billion in 2025 to USD 728.64 billion by 2034, with a CAGR of 5.04%.3 This substantial growth is primarily fueled by the impending expiration of patents on numerous high-revenue brand-name drugs, a phenomenon widely known as the “patent cliff”.4 This creates a critical window for generic manufacturers to enter established markets.

Generic medicines have become a cornerstone of healthcare systems worldwide, accounting for a substantial majority of prescriptions. In the United States, for instance, generics comprise approximately 90% of all dispensed prescriptions.9 This widespread adoption is not merely a matter of preference but a strategic imperative driven by the immense cost savings they deliver. Estimates suggest that generic medicines have saved the U.S. healthcare system over $1.67 trillion in a recent decade 10, with $338 billion in savings attributed to generics in 2020 alone.13 This pervasive growth and cost-saving impact underscore a fundamental and irreversible global shift towards healthcare sustainability and broader patient access. The consistent high percentages of generic prescriptions and the multi-trillion dollar savings demonstrate that generics are deeply embedded in healthcare systems, signifying their role as a core economic and public health pillar.

Governments and regulatory bodies globally actively support and promote the utilization of generic drugs. This is achieved through various policy levers, including centralized procurement and initiatives aimed at enhancing the accessibility and affordability of critical medications.1 The consistent market growth forecasts, coupled with proactive government support, indicate a sustained, policy-driven trend. This suggests that the generic market’s evolution is a critical factor for all pharmaceutical stakeholders, not just generic manufacturers, as it influences overall healthcare budgeting and patient access strategies. The “patent cliff” directly triggers generic market entry, which, in turn, leads to significant price erosion for originator products and substantial savings for consumers and healthcare systems.4 This clear cause-and-effect relationship between patent expiry, generic entry, and price reduction is paramount for forecasting market shifts and developing proactive business strategies. The increasing prominence of generics necessitates a strategic re-evaluation for both innovator companies, who must adapt to potential revenue loss and pivot towards new innovations, and generic manufacturers, who need to optimize their market entry and capture market share in an increasingly competitive environment.

1.2. Why Proactive Tracking is Essential for Innovator and Generic Companies

The introduction of generic versions of pharmaceutical products represents a pivotal shift in the market landscape, carrying substantial implications for various stakeholders. For innovator companies, the expiration of patent protection and subsequent generic entry often lead to significant price erosion and a decline in market share.5 Timely and precise information regarding generic drug launches allows these companies to proactively adjust their marketing strategies, explore authorized generic options, or focus on developing next-generation therapies.15 This proactive approach is crucial for mitigating the impact of the “patent cliff,” which can result in a sharp decline in revenue.6

Conversely, for generic manufacturers, the ability to accurately predict the timing of generic drug launches is of paramount strategic importance. This intelligence is crucial for optimizing production schedules, anticipating market demand, and strategically timing their product entries to capitalize on established drug markets with lower development costs.15 Missing “first to file” status or delaying launch can result in lost exclusivity periods worth millions in potential revenue.19 This highlights that proactive, data-driven competitive intelligence is no longer a luxury but a strategic imperative for all pharmaceutical stakeholders to navigate the complex and rapidly evolving generic drug market.

Payers and healthcare systems also rely heavily on launch forecasts. This information enables them to budget for drug expenditures and plan formulary updates, ultimately impacting patient access to more affordable treatment options.15 This collective need for foresight underscores the critical role of competitive intelligence (CI). CI is defined as the systematic collection, analysis, and application of data about competitors, market trends, and regulatory changes to inform strategic decision-making.21 It is indispensable for anticipating competitor strategies, ensuring regulatory awareness, analyzing market opportunities, and shaping pricing and market access strategies.21

Fragmented data and slow signal detection pose significant risks, directly leading to “intelligence gaps” and “missed timelines”.19 For generic companies, this translates into lost revenue and missed exclusivity opportunities 19, while for innovators, it hampers their ability to effectively mitigate losses.15 The observation that “slow signal detection can mean lost market share or missed opportunities altogether” 22 confirms a direct causal link between the quality and timeliness of intelligence and financial outcomes. This necessitates a fundamental shift towards integrated data platforms and advanced analytical methodologies. The adoption of tools, including artificial intelligence (AI), is essential to transform raw data into actionable strategic foresight. AI-powered CI, with its capabilities for “faster time-to-insight” and “always-on market monitoring” 22, directly addresses the challenges posed by fragmented data, making technological adoption critical for effective tracking and competitive advantage.

2. Generic Drug Approval Pathways: FDA and EMA

Navigating the regulatory landscape is a critical component of tracking generic drug launches. The two primary regulatory bodies governing pharmaceutical approvals in major global markets are the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Their distinct processes significantly influence the timing and feasibility of generic market entry.

2.1. The FDA Abbreviated New Drug Application (ANDA) Process

The Abbreviated New Drug Application (ANDA) is the cornerstone of generic drug approval in the United States, submitted to the U.S. Food and Drug Administration (FDA) for the review and potential approval of a generic drug product.23 The core objective of the ANDA process is to facilitate a streamlined and cost-effective path to market for generic drugs, thereby enhancing the accessibility and affordability of critical medications for consumers.23

A significant pattern observed in the FDA’s ANDA process is its sophisticated regulatory framework, designed to foster a competitive generic market while rigorously upholding public health standards. This framework balances innovation incentives with the imperative for affordability. Unlike New Drug Applications (NDAs) for new, innovative drugs, ANDAs do not require extensive preclinical (animal) or clinical (human) trial data to establish safety and effectiveness.23 This reliance on the safety and efficacy data of an already approved Reference Listed Drug (RLD) is a direct mechanism that reduces development costs and accelerates market entry for generics, which in turn drives down overall drug prices.23

To obtain FDA approval, generic applicants must scientifically demonstrate that their proposed product is therapeutically equivalent and bioequivalent to the RLD.23 This means the generic drug must deliver the same amount of active ingredients into a patient’s bloodstream in the same amount of time as the innovator drug.26 Key components of an ANDA submission include comprehensive data confirming identical active ingredients, dosage form, strength, route of administration, quality, performance characteristics, and labeling that is substantially the same as the RLD.23 Furthermore, strict compliance with Current Good Manufacturing Practices (cGMP) is essential to ensure product quality and consistency.24

The ANDA pathway was formally established under the Hatch-Waxman Act of 1984 (also known as the Drug Price Competition and Patent Term Restoration Act), a landmark legislation designed to encourage competition in the pharmaceutical industry and lower prescription drug costs.24 The submission process itself involves several critical steps:

- Pre-ANDA Preparation: This initial phase includes a thorough analysis of the RLD’s chemical composition, formulation, labeling, and regulatory history. It also necessitates conducting bioavailability and bioequivalence studies, reviewing manufacturing standards for cGMP compliance, and assessing all relevant FDA guidance documents and submission expectations.24

- Dossier Preparation: The comprehensive ANDA submission dossier must include detailed drug formulation and composition, manufacturing processes and quality control measures, labeling information, bioequivalence study results, analytical data, and stability testing reports.24 A complete and well-documented application is crucial for avoiding delays due to FDA requests for additional information.24

- Electronic Submission: Once compiled, the ANDA is submitted electronically to the FDA’s Center for Drug Evaluation and Research (CDER) via the FDA Electronic Submissions Gateway (ESG), ensuring secure and efficient processing.24

- FDA Review Process: Upon receipt, the FDA conducts a multi-phase review, assessing bioequivalence and safety data, labeling compliance, and performing manufacturing site inspections for quality assurance.24

- FDA Decision: Following the rigorous review, the FDA will either approve the ANDA, authorizing the generic drug for marketing, or issue a Complete Response Letter (CRL) if deficiencies are identified, requiring the applicant to address concerns before reapplying.24

The FDA’s review process typically takes around 30 months, though applications for priority generics, such as those addressing drug shortages or unmet medical needs, may be expedited.23 The total timeline for ANDA approval varies based on drug complexity, regulatory workload, and potential review cycles. However, early planning, thorough documentation, and strict adherence to FDA guidelines can significantly improve approval prospects.24 For pharmaceutical professionals, understanding the ANDA’s specific requirements, such as bioequivalence and cGMP, is paramount for successful generic development and approval. Precision in submission directly impacts a company’s ability to capitalize on market opportunities and achieve competitive advantage.

Table 1: Key Differences: NDA vs. ANDA

| Feature | New Drug Application (NDA) | Abbreviated New Drug Application (ANDA) |

| Purpose | Approval for new, innovative drugs | Approval for generic versions of approved drugs |

| Drug Type | New Chemical Entities (NCEs) or significant modifications | Bioequivalent to Reference Listed Drug (RLD) |

| Clinical Trials | Full preclinical and clinical trials required | Bioequivalence studies (no new clinical trials for safety/efficacy) |

| Basis for Approval | Demonstrated safety and efficacy through new data | Demonstrated bioequivalence to RLD |

| Development Time | Longer (typically 10+ years) | Shorter (typically 2.5-3 years for review) |

| Development Cost | High (billions of dollars) | Lower (millions of dollars) |

| Regulatory Act | Federal Food, Drug, and Cosmetic (FD&C) Act | Hatch-Waxman Act (Drug Price Competition and Patent Term Restoration Act of 1984) |

Value to Professionals: This table provides a clear, side-by-side comparison of the two fundamental drug approval pathways in the U.S., making complex regulatory distinctions immediately understandable. By highlighting the differences in requirements, timelines, and costs, it contextualizes the strategic decisions pharmaceutical companies make regarding innovation versus generic competition. For professionals needing a quick reference, it serves as an excellent educational tool, reinforcing why generics are more affordable and accessible.

2.2. The European Medicines Agency (EMA) Marketing Authorization for Generics

The European Medicines Agency (EMA) plays a central role in assessing applications for generic medicines within the European Union (EU).28 However, the EU’s regulatory framework for generics is notably more complex than the U.S. system, reflecting a balance between centralized harmonization and national regulatory autonomy. While new, innovative medicines often undergo a compulsory centralized procedure for authorization across all EU/EEA Member States 29, most generic medicines and non-prescription drugs are typically assessed and authorized at a national level.29 This multi-pathway system is a significant pattern observed in EMA’s approach to marketing authorization.

A generic medicinal product in the EU is precisely defined: it must have the same qualitative and quantitative composition in active substance(s), the same pharmaceutical form as the reference product, and its bioequivalence must be demonstrated by appropriate bioavailability studies.28 For generics, the EMA’s centralized procedure is generally optional, unless the product is considered a significant therapeutic, scientific, or technical innovation, or its authorization is deemed to be in the interest of public health at the EU level.29 An important exception is when a generic product references a centrally authorized product; in such cases, it gains automatic access to the centralized procedure.28

The EMA’s assessment process for centralized generic applications involves a structured timetable. Following submission, the application undergoes scientific evaluation by the Committee for Medicinal products for Human Use (CHMP), which then provides a recommendation. A final, legally binding decision is subsequently made by the European Commission, typically within 67 days of receiving EMA’s recommendation.28 The active assessment period for centralized generic applications can extend up to 210 days, with key milestones including preliminary assessment reports at Day 80, the CHMP opinion or list of questions at Day 120, and the final CHMP opinion by Day 180 or Day 210.28

For generic pharmaceutical companies targeting the European market, a deep understanding of these distinct pathways and the strategic considerations for choosing among them is crucial for efficient and timely market penetration. Given that most generic medicines are authorized at a national level 29, companies must strategically evaluate which pathway is optimal for their product and target markets, as this choice directly impacts their time-to-market and resource allocation.

For multi-country authorization of generics that do not fall under the compulsory centralized procedure, two main national authorization procedures are utilized:

- Mutual Recognition Procedure (MRP): This pathway is used when a marketing authorization has already been granted in one EU Member State, known as the Reference Member State (RMS). This authorization can then be recognized in other EU countries, referred to as Concerned Member States (CMS).29 The primary benefit of this procedure is to reduce duplication of assessments and expedite market entry across multiple territories.34 The typical review cycle for an MRP is 90 days, followed by an additional 30-day national phase for translation of product information into regional languages.36 The consequence of this streamlined approach is faster market access compared to individual national submissions.

- Decentralized Procedure (DCP): This procedure is applicable for a medicine that has not yet obtained marketing authorization in any EU Member State but is intended to be simultaneously authorized in several EU Member States.29 The applicant selects an RMS to lead the assessment and prepare a draft assessment report, which is then reviewed concurrently by the CMS.38 The CMS have 90 days to accept the draft assessment report from the RMS.38 The overall review cycle for a DCP is approximately 210 days, including a 30-day national phase for translations.40 This mechanism, by enabling simultaneous multi-state submissions, significantly streamlines generic market entry across the EU by reducing redundant evaluations and administrative burdens.

The Coordination Group for Mutual Recognition and Decentralised Procedures – Human (CMDh) plays a pivotal role in these processes. It develops guidelines and facilitates agreement among Member States for both MRP and DCP, ensuring a harmonized approach to regulatory standards across the EU.35

Table 2: EMA Marketing Authorization Pathways for Generics

| Pathway | Scope | Primary Use for Generics | Key Characteristics | Typical Timeline |

| Centralized Procedure | All EU/EEA Member States (single MA) | Optional (if significant innovation/EU interest, or if reference product is centrally authorized) | Scientific assessment by EMA (CHMP), decision by European Commission | ~210 active days (EMA review) + 67 days (EC decision) |

| National Procedure | Single EU Member State | Most generics and OTCs | Assessment by national competent authority | Varies by Member State |

| Mutual Recognition Procedure (MRP) | Multiple EU/EEA Member States (based on existing national MA) | Generics already authorized in one MS seeking broader EU access | RMS assesses, CMS recognizes existing MA | 90 days (recognition) + 30 days (national phase) |

| Decentralized Procedure (DCP) | Multiple EU/EEA Member States (simultaneous new MA) | Generics seeking simultaneous authorization in multiple MS without prior national MA | RMS assesses, CMS simultaneously assesses | ~210 days (assessment) + 30 days (national phase) |

Value to Professionals: This table simplifies the often-confusing array of EMA pathways relevant to generic drugs, providing a clear, comparative overview. It serves as strategic guidance for generic manufacturers on how to best approach market entry across the diverse European regulatory landscape, aiding in decision-making and resource allocation for efficient and timely market penetration.

3. Decoding Pharmaceutical Patents and Exclusivities

A comprehensive understanding of intellectual property (IP) is fundamental for any pharmaceutical professional involved in generic drug launches. This involves not only grasping the intricacies of patent law but also the distinct yet interconnected realm of regulatory exclusivities.

3.1. Understanding Drug Patents: Types and Lifecycle

A pharmaceutical patent is a legal instrument that grants the originating company exclusive rights to manufacture, use, and sell a drug. This protection typically lasts for a period of 20 years from the date the patent application was filed.4 The purpose of this exclusivity is to allow innovator companies to recoup the substantial investments made in research and development (R&D) and to generate profits before facing competition from lower-priced generic alternatives.16 This reliance on intellectual property protection forms the fundamental business model of the pharmaceutical industry, leading to a multi-layered patenting strategy designed to maximize market exclusivity.

However, the effective market life of a patent can be significantly shorter than the statutory 20 years. This is due to the lengthy drug development and regulatory approval processes, which consume a considerable portion of the patent term.4 For example, much of the initial 20 years may be spent in product development and regulatory review, leaving an effective remaining patent life of only 7 to 10 years at the time of approval.16 This erosion of effective patent life directly compels innovator companies to pursue secondary patents and extensions to prolong their market advantage.

Pharmaceutical patents can cover a wide array of aspects related to a drug, demonstrating the comprehensive approach innovators take to protect their assets:

- Active Ingredient Patents: These protect the specific chemical compound that constitutes the active pharmaceutical ingredient (API) of a drug. They are often the most valuable patents as they cover the core innovation of the product, providing a significant competitive advantage by preventing others from producing generic versions during the patent term.45

- Formulation Patents: These cover the specific composition of a drug, including its inactive ingredients (excipients) and the way these ingredients are combined. Such patents can extend the exclusivity period by protecting improvements to the original drug, such as extended-release formulations or new delivery methods.45

- Method of Use Patents: These protect specific ways of using the drug to treat particular conditions. They are crucial for drugs that have multiple therapeutic applications, allowing companies to extend market exclusivity and fend off competition from generics that might seek approval for different uses.45

- Process Patents: These cover the proprietary methods and processes used to manufacture the drug. They are essential for protecting unique manufacturing techniques that can be critical to the drug’s efficacy and safety, providing an additional layer of protection and creating barriers to entry for competitors.45

For generic manufacturers, navigating this complex IP landscape requires a thorough understanding of all patent types and their expiration dates. This is essential to identify viable market entry opportunities and to avoid infringement.46 The “patent maze” necessitates significant investment in comprehensive patent searches and analyses to identify gaps and potential opportunities for new business ventures.46 This means that detailed patent analysis is a core competency for achieving competitive advantage in the generic pharmaceutical market.

3.2. Regulatory Exclusivity Periods: FDA and EMA Frameworks

Beyond patent protection, regulatory exclusivity periods provide an additional layer of market protection for brand-name drugs, distinct from patent rights.15 These exclusivities are a crucial policy lever, constantly adjusted to strike a balance between incentivizing pharmaceutical innovation and promoting timely access to affordable generic medicines.47

FDA Exclusivity Periods:

The U.S. FDA grants several types of regulatory exclusivities:

- New Chemical Entity (NCE) Exclusivity: Provides 5 years of protection for a drug containing an active moiety not previously approved by the FDA.47

- Orphan Drug Exclusivity: Grants 7 years of market exclusivity for drugs developed to treat rare diseases or conditions affecting fewer than 200,000 people in the U.S..47

- New Clinical Investigation Exclusivity: Offers 3 years of exclusivity for a drug product if new clinical studies, essential for the approval of a new use or formulation, are conducted by the applicant.47

- Pediatric Exclusivity: An additional 6 months of exclusivity can be added to existing patents or exclusivities if the drug sponsor conducts pediatric studies in response to a written request from the FDA.5 This incentivizes research into pediatric populations.

- Antibiotic Exclusivity: Certain new antibiotic drugs for specific infectious diseases may be eligible for a 5-year exclusivity period.47

- 180-Day Generic Exclusivity: This is a unique and powerful incentive awarded to the first generic drug applicant to submit a substantially complete Abbreviated New Drug Application (ANDA) containing a Paragraph IV certification.13 A Paragraph IV certification asserts that the brand-name drug’s patent is either invalid or will not be infringed by the proposed generic. This exclusivity grants the first generic a temporary market monopoly, precluding subsequent generics from obtaining final approval for 180 days after the first applicant commercially launches its product.13 This mechanism is a significant driver for generic companies to challenge patents, ultimately accelerating patient access to lower-cost medicines.13 The 180-day exclusivity has been described as the “only incentive” for generic companies to challenge brand patents and the “most significant driver of competition”.13 This directly leads to substantial cost savings for the healthcare system, with first generics reducing drug costs by 39% and saving nearly $20 billion in 2020 alone.13

Table 3: FDA Exclusivity Periods Overview

| Exclusivity Type | Duration | Trigger/Conditions | Purpose/Impact |

| New Chemical Entity (NCE) | 5 years | New active moiety | Incentivize NCE development |

| Orphan Drug | 7 years | Drug for rare disease (<200k U.S. patients) | Incentivize rare disease drug development |

| New Clinical Investigation | 3 years | New clinical studies for new use/formulation | Incentivize new uses/formulations |

| Pediatric | 6 months | Pediatric studies in response to FDA request | Incentivize pediatric research |

| Antibiotic | 5 years | Certain new antibiotic drugs | Incentivize new antibiotic development |

| 180-Day Generic | 180 days | First-to-file Paragraph IV ANDA | Incentivize patent challenges, provide first-mover advantage for generics |

Value to Professionals: This table centralizes critical, often complex, FDA exclusivity data into an easy-to-reference format. It allows pharmaceutical professionals to quickly ascertain the various layers of protection for brand-name drugs, which is vital for forecasting generic entry timelines and identifying precise windows of opportunity for market entry.

EMA Exclusivity Periods:

The European Union also employs a system of data and market exclusivities:

- Data Exclusivity: Typically 8 years, during which generic manufacturers are prohibited from referencing the innovator’s preclinical and clinical data to obtain regulatory approval.28

- Market Exclusivity: Follows data exclusivity for an additional 2 years, during which the generic cannot be marketed, even if it has received approval.28 This creates an “8+2” year period, providing a total of 10 years of market protection.

- An additional 1-year market exclusivity can be granted if, during the 8-year data exclusivity, the marketing authorization holder obtains an authorization for a new therapeutic indication that brings a significant clinical benefit.28 This results in an “8+2+1” year period.

- Orphan medicinal products in the EU receive a 10-year market exclusivity period, which can be reduced to 6 years or extended to 12 years under specific conditions.28

For pharmaceutical professionals, meticulously tracking both patent expiration dates and regulatory exclusivity periods is paramount. Regulatory exclusivities can independently delay generic entry, even after patents expire, creating a dual-layer protection that requires integrated intelligence for accurate market forecasting.15

3.3. The Hatch-Waxman Act: A Foundation for Generic Competition

The Drug Price Competition and Patent Term Restoration Act of 1984, universally known as the Hatch-Waxman Act, stands as a landmark piece of legislation that fundamentally transformed the U.S. pharmaceutical landscape.24 Its enactment established a foundational legislative framework that continues to govern the delicate balance between pharmaceutical innovation and affordable drug access.

The Act’s primary objectives were multifaceted: to encourage robust competition within the pharmaceutical industry, to significantly lower prescription drug costs by enabling faster approval of generic medicines, and to reduce redundant and costly clinical trials for generic versions.24

Key provisions of the Hatch-Waxman Act include:

- Abbreviated New Drug Application (ANDA) Pathway: This critical provision allowed generic manufacturers to seek FDA approval by demonstrating bioequivalence to a Reference Listed Drug (RLD), thereby eliminating the need to repeat expensive and time-consuming clinical trials for safety and efficacy.24 This streamlined pathway directly contributed to the dramatic increase in generic drug availability.

- 180-Day Generic Exclusivity: As discussed previously, this incentive was designed to encourage generic manufacturers to challenge brand drug patents. It grants the first generic company to successfully challenge a patent a temporary market monopoly, providing a crucial window for market penetration and profit generation.13

- Patent Term Extensions (PTEs): To balance the incentives for generic entry, the Act also granted brand-name companies the ability to obtain patent term extensions. These extensions compensate innovators for a portion of the time their patented product is under FDA review, ensuring that the effective patent life is not unduly shortened by regulatory delays.16

The impact of Hatch-Waxman has been profound and quantifiable. Since its enactment, generic medicines have surged from accounting for only 18% of all prescriptions in 1984 to approximately 90% today.9 This dramatic increase in generic utilization has contributed to trillions of dollars in healthcare savings for U.S. consumers and the healthcare system.13 The Act’s incentives directly stimulated generic competition, leading to a significant increase in generic drug availability and substantial reductions in drug spending.

Understanding the intricacies of the Hatch-Waxman Act is fundamental for any pharmaceutical professional operating in the U.S. market. Its provisions dictate the strategic pathways for both brand and generic products and are central to competitive intelligence efforts. The Act’s mechanisms, such as patent challenges and exclusivity, are deeply intertwined with market entry strategies, requiring legal and regulatory teams to have a profound understanding of this legislation to advise on competitive strategies effectively.

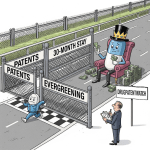

3.4. Strategic Maneuvers: Evergreening and Patent Thickets

In response to the competitive pressures introduced by generic drugs, innovator pharmaceutical companies often engage in sophisticated intellectual property strategies to extend their market monopolies beyond the life of their primary patents. These practices, while legal, are often contentious and significantly impact generic drug development and market access.

“Evergreening” is a common practice where pharmaceutical companies apply for new patents on secondary features of an existing drug as its initial patents near expiration.4 These secondary patents can cover various aspects, such as new formulations (e.g., extended-release versions), different delivery methods, or combinations with other drugs.4 The primary objective of this tactic is to effectively extend the period during which generic competition is blocked, thereby prolonging revenue streams for the innovator.4

A related and often more complex phenomenon is the creation of “patent thickets.” These are dense webs of overlapping patents amassed around a single drug, creating significant legal and financial barriers to market entry for potential generic competitors.46 A striking statistic highlights this strategy: for top-selling drugs, an average of 66% of patent applications are filed

after FDA approval.53 This pattern indicates that the primary goal is often market extension and revenue maximization rather than the protection of initial, groundbreaking innovation.

These strategies serve to extend monopolies, delay generic alternatives, and inflate drug prices, costing patients and healthcare systems billions annually.53 Notorious examples include AbbVie’s Humira, which was protected by over 250 patents, effectively delaying biosimilar entry until 2023 despite its initial launch in 2002.53 Similarly, Celgene’s Revlimid faced 18 years of litigation, which blocked generics even after its primary patents had expired.53 The financial burden on generic companies is immense, as challenging dozens of patents within a thicket can cost millions of dollars in legal fees.53

The aggressive use of “evergreening” and “patent thickets” by innovator companies represents a strategic shift from merely protecting core innovation to maximizing lifecycle revenue through intricate legal and intellectual property maneuvers. This directly creates substantial litigation barriers and costs for generic manufacturers, effectively delaying generic entry and artificially maintaining high brand-name drug prices. For generic manufacturers, navigating these complex IP landscapes requires significant legal and analytical resources to identify weak patents and strategically challenge them.46 This includes investing in comprehensive patent searches and analyses and employing skilled legal teams to “maneuver through the patent maze”.46 For policymakers, these practices raise critical questions about the balance between innovation incentives and public access, leading to ongoing debates and calls for regulatory reform.53

3.5. The Impact of Patent Litigation on Market Entry

Patent litigation plays a critical and often decisive role in shaping the pharmaceutical landscape, directly influencing when and how generic drugs reach the market.44 For pharmaceutical companies, protecting their intellectual property is paramount to securing market exclusivity and recovering the significant investment required for drug development.

Lawsuits initiated by brand-name companies against generic competitors can effectively block generic entry until the disputed patent expires or is ruled invalid or not infringed by a court.55 The Hatch-Waxman Act, while streamlining generic approvals, also provides mechanisms for generic drug companies to challenge patents in court prior to marketing their products.26 A successful patent challenge can significantly accelerate generic market entry, often years before the patent would naturally expire.13 This highlights that patent litigation in the pharmaceutical industry is not merely a legal process but a strategic battleground directly shaping market entry timelines and competitive dynamics.

A particularly contentious issue in pharmaceutical patent litigation is the practice of “reverse payment” or “pay-for-delay” settlements. In these arrangements, a brand-name drug company pays a generic firm not to market its product for a specified period of time.53 This phenomenon, where payment flows counter-intuitively from the patent holder to the alleged infringer, raises serious antitrust concerns. Such settlements are widely criticized for delaying generic competition and artificially keeping drug prices high, thereby undermining the pro-competitive intent of legislation like Hatch-Waxman.53 Congress has recognized these concerns and mandated that litigants notify federal antitrust authorities of such pharmaceutical patent settlements.55 The consequence of “pay-for-delay” settlements, by compensating generics to delay market entry, is a direct undermining of pro-competitive legislation, resulting in prolonged brand monopolies and higher drug costs for consumers.

For pharmaceutical professionals, tracking patent litigation status—including Paragraph IV challenges and the details of any settlement agreements—is as crucial as monitoring patent expiration dates. Legal outcomes can significantly alter generic launch timelines and market forecasts.20 This means that integrating legal intelligence into competitive intelligence frameworks is an indispensable part of strategic planning in the pharmaceutical sector.

4. Leveraging Patent Data for Competitive Advantage

The intricate web of patent expirations, regulatory exclusivities, and legal challenges creates both significant threats and lucrative opportunities within the pharmaceutical market. Transforming this complex patent data into actionable competitive advantage requires sophisticated analysis and strategic foresight.

4.1. Identifying Generic Entry Opportunities: The “Day 181” Phenomenon and Beyond

The “Day 181 generic drug launch” represents a pivotal strategic milestone in the generic pharmaceutical market. This critical juncture occurs immediately after the expiration of the 180-day exclusivity period granted to the first generic applicant.20 This period of initial exclusivity is highly valuable for the first generic, as it typically allows them to enter the market at a price point approximately 20-30% below the brand-name drug, securing healthy profit margins due to limited competition.20

The generic drug market operates on a highly predictable, albeit aggressive, pricing dynamic where competition intensifies rapidly after initial exclusivity, leading to a race for early market entry. When the 180-day exclusivity expires, the FDA is free to approve additional Abbreviated New Drug Applications (ANDAs) for the same reference product.20 This often results in multiple generic versions entering the market simultaneously, fundamentally transforming the drug’s economics.20 This expiration directly triggers a surge in generic competition, which in turn causes rapid and profound price declines, benefiting consumers and healthcare systems.

The entrance of additional generic competitors leads to substantial price reductions, illustrating the aggressive nature of generic price competition. Research indicates a clear relationship between the number of generic competitors and the average price reduction:

- With 2 generic competitors, the average price reduction compared to the brand is 54%.43

- With 3 to 5 competitors, prices decline by an additional 15-40% after the first generic has entered the market.17

- With 6 or more competitors, prices can drop by as much as 95% relative to the brand-name drug.17

- In markets with 10 or more competitors, prices decline by 70% to 80% relative to the pre-generic entry price after three years.17

Table 4: Impact of Generic Competitors on Price Reduction

| Number of Generic Competitors | Average Price Reduction Compared to Brand (%) |

| 1 (during 180-day exclusivity) | 20-30% |

| 2 | 54% |

| 3-5 | 15-40% (additional savings) |

| 6+ | 95% |

| 10+ | 70-80% (after 3 years) |

Value to Professionals: This table provides concrete, data-backed evidence of the financial impact of generic competition, which is invaluable for strategic planning and forecasting. It clearly illustrates the aggressive nature of generic price competition and the significant savings for healthcare systems as more competitors enter. For generic manufacturers, it underscores the importance of early entry, while for payers and healthcare providers, it aids in budgeting and formulary decisions by predicting future drug costs.

For generic companies that were not the first to file a Paragraph IV certification, Day 181 represents the earliest opportunity to enter the market.20 Companies that launch on or very near Day 181 typically capture a larger market share than later entrants.20 This means that optimizing the timing of market entry, particularly aiming for “first-to-file” status or launching precisely on Day 181, is critical for maximizing initial profitability and securing a significant market share before intense price erosion occurs. For payers, Day 181 signifies the point of maximum cost-saving opportunity due to the influx of multiple competitors.

4.2. Strategic Implications for Innovator Companies: Protecting Market Share

Innovator companies face substantial revenue contraction when their blockbuster drugs lose patent exclusivity, a phenomenon often referred to as the “patent cliff”.5 For example, nearly 50 products are estimated to lose patent protections from 2023 through the end of 2025, potentially eroding aggregate sales from $162.8 billion in 2025 to just $67 billion in 2029.7 This significant financial exposure necessitates proactive and diversified lifecycle management strategies to protect market share and sustain revenue.

To mitigate the impact of the patent cliff, innovator companies employ a range of strategic maneuvers:

- Developing Next-Generation Therapies: A primary long-term strategy involves proactively investing in research and development (R&D) for new drugs or new indications for existing drugs. This aims to create a pipeline of innovative products that can replace the revenue lost from off-patent blockbusters.7

- Authorized Generics: Some innovator companies choose to launch their own generic versions of their brand-name drugs, often through licensing agreements with generic manufacturers. This allows them to capture a portion of the generic market rather than ceding it entirely to independent generic competitors.5

- Evergreening: As discussed in Section 3.4, this involves applying for new patents on secondary features of a drug, such as new formulations, delivery methods, or combinations with other drugs, as initial patents near expiration.4 This tactic aims to extend market exclusivity and delay generic entry.

- Regulatory Strategies: Innovators leverage various regulatory provisions to extend market protection. This includes pursuing pediatric exclusivity, which can add an additional six months to existing patents or exclusivities if pediatric studies are conducted in response to an FDA request.5 They also utilize regulatory data protection periods, which prevent generic manufacturers from referencing the originator’s clinical data for specified durations.5

- Pricing Adjustments and Brand Loyalty Initiatives: Companies may implement strategic pricing adjustments and targeted marketing campaigns to maximize the value of products approaching patent expiration. This includes fostering brand loyalty and exploring options like transitioning to over-the-counter (OTC) sales or diversifying into generic production.5

- Operational Efficiency and Cost Reduction: Facing significant revenue headwinds, some companies, like Bristol Myers Squibb, implement sweeping realignment programs and cost-cutting measures to weather the storm.6 This focuses on optimizing internal operations to maintain profitability amidst declining sales.

The impact of the patent cliff is evident across the industry. For example, Merck’s blockbuster cancer therapy Keytruda faces patent expiration in 2028, representing a significant financial exposure.7 Similarly, Bristol Myers Squibb is set to lose key protections for Eliquis and Opdivo, which accounted for a significant share of its 2024 revenue.7 AstraZeneca’s Farxiga and Soliris, and Novartis’s Entresto, are also facing loss of exclusivity in the near future.7 These companies are actively banking on new pipeline catalysts and cost-cutting to navigate these challenges.7 This necessitates a strategic re-evaluation of business models, emphasizing agility and innovation to sustain growth in a post-exclusivity environment.

4.3. Strategic Implications for Generic Manufacturers: Capturing Market Share

For generic manufacturers, the expiration of brand-name drug patents and their associated exclusivities presents lucrative opportunities to enter established markets with lower development costs.15 However, success in this highly competitive landscape requires meticulous planning and strategic execution.

Key strategies for generic manufacturers to capture market share include:

- Thorough Market Research: Before any manufacturing begins, generic companies must conduct in-depth market research to identify high-demand therapeutic areas and pinpoint unmet needs or gaps in existing generic offerings.18 This involves analyzing existing medications for efficacy, safety, and market demand, as well as studying the molecular structure of the original drug to understand its active ingredients and therapeutic effects.58

- Leveraging Data Analytics for Precision: Data is a critical asset. Generic manufacturers must utilize advanced analytics to forecast demand, predict pricing pressures, and identify target physicians or patient demographics.57 Predictive modeling, by analyzing historical launch data, can estimate how a new generic will perform, with studies showing that companies using predictive analytics in drug launches achieve higher market penetration.57

- Navigating Regulatory Hurdles with Finesse: Mastering the approval process is paramount. For the U.S. market, this means navigating the FDA’s Abbreviated New Drug Application (ANDA) process, with timing being critical to secure first-to-market advantages.57 In Europe, understanding the EMA’s centralized, mutual recognition (MRP), or decentralized (DCP) procedures is essential.57 Early filing and adherence to regulatory guidelines can significantly improve approval prospects and avoid delays.24

- Crafting a Competitive Pricing Strategy: Pricing is not merely about undercutting the competition. It involves a delicate balance: pricing too low can signal poor quality, while pricing too high can negate the generic advantage. Analyzing competitor pricing and payer willingness to reimburse is crucial.57 The market dynamics show that prices fall significantly with increasing generic competition, making early entry vital for higher initial profit margins.17

- Building a Robust Supply Chain: A strong and resilient supply chain is fundamental for ensuring product availability and meeting market demand.57 This includes securing reliable Active Pharmaceutical Ingredient (API) suppliers and managing inventory effectively, both pre- and post-launch, to minimize excess brand-name product and adapt to price changes as more generics enter.59

- Promoting Rapid Uptake and Therapeutic Alternatives: Facilitating the rapid adoption of new generics involves managing NDC (National Drug Code) switches in pharmacy systems and conducting clinical reviews to identify opportunities for formulary adjustments or new therapeutic interchange programs.59

- Continuous Monitoring and Optimization Post-Launch: The launch is not the end of the strategic journey. Continuous monitoring of performance metrics, market dynamics, and competitor activities is essential for adapting strategies and optimizing product positioning.57 This includes tracking bioequivalence status, product appearance, and packaging changes to ensure quality and patient trust.25

The competitive landscape for generics is fierce, with pricing wars and regulatory hurdles being constant challenges.57 However, by blending market insights, regulatory expertise, and strategic execution, generic manufacturers can transform a generic product into a market dominator.57 For example, Teva’s successful launch of a urology drug generic, which captured 70% of the market within a year, was attributed to early filing, aggressive pricing, and data-driven targeting of specialists.57 This demonstrates that strategic execution, informed by comprehensive intelligence, is the secret to outpacing rivals and capturing market share.

5. Tools and Resources for Generic Drug Launch Tracking

Effective tracking of generic drug launches requires access to reliable, comprehensive, and timely data. Pharmaceutical professionals can leverage a variety of tools and resources to gather the necessary intelligence and convert it into competitive advantage.

5.1. Official Regulatory Databases and Publications

Official regulatory databases are indispensable primary sources for tracking patent and exclusivity information, as well as approval statuses.

- FDA Orange Book: The “Approved Drug Products with Therapeutic Equivalence Evaluations,” commonly known as the Orange Book, is a central and frequently updated source for drug products approved by the FDA based on safety and effectiveness.15 It directly links approved medications with their associated patent details and expiration dates, making it a key tool for tracking potential generic entry timelines.15 The Orange Book provides daily updates for new generic drug approvals and is updated monthly with cumulative supplements.61 Users can search by active ingredient, proprietary name, applicant, application number, dosage form, route of administration, or patent number.60 It also lists patent listing disputes and exclusivity codes and definitions.60

- FDA Purple Book: For biological products, the FDA provides the Purple Book, which lists licensed biological products, including biosimilar and interchangeable biological products.62 It helps track biosimilar market entry and related exclusivities.

- EMA Website and EudraLex: The European Medicines Agency (EMA) website provides detailed guidance on marketing authorization procedures for human medicines, including generic and hybrid applications.28 While most generics are authorized nationally, the EMA website offers information on the centralized procedure and refers to the Mutual Recognition Procedure (MRP) and Decentralized Procedure (DCP).29 EudraLex – Volume 2 provides comprehensive pharmaceutical legislation and guidance for marketing authorization applications in the EU.32 The CMDh (Coordination Group for Mutual Recognition and Decentralised Procedures – Human) website also publishes guidelines and best practice documents for MRP and DCP.35

- ClinicalTrials.gov and EU Clinical Trials Register: These databases allow monitoring of clinical trial progress for both innovator and generic drugs, providing insights into competitor drug development and potential future market shifts.21

5.2. Commercial Intelligence Platforms and Databases

Beyond official regulatory sources, specialized commercial intelligence platforms aggregate vast amounts of data, providing analytical tools and actionable insights for competitive advantage.

- DrugPatentWatch: Recognized as a leading global biopharmaceutical business intelligence platform, DrugPatentWatch provides accurate, actionable, and timely intelligence.65 Its key features include patent expiry dates, generic entry dates, patent litigation status, patent term extensions, and drug sales data.65 It offers a fully integrated database of drug patents and other critical information, incorporating data directly from the FDA, Patent and Trademark Office, and other international sources.67 The platform helps generic manufacturers evaluate market entry opportunities, API suppliers align production timelines, and legal teams track patent disputes.66 It also provides email alerts and custom dashboards for monitoring competitive activity.65

- Clarivate Cortellis Product Intelligence: This platform serves as a single source of global drug, market, API, and patent data.68 It helps users pinpoint when a drug will lose exclusivity, efficiently plan launches, and understand global biopharma pricing trends.68 Cortellis offers a “Constraint Date Forecast” tool that identifies the earliest time a drug can enter the generic market based on patents, exclusivities, and Supplementary Protection Certificates (SPCs).68 It also provides timely updates and customizable email alerts for US patent challenges, manufacturing intelligence, and market performance.68 Cortellis Product Intelligence is highly valued for its comprehensive, integrated data and its ability to save substantial time in competitive analysis.68

- IPD Analytics: This platform specializes in drug life-cycle insights, identifying, projecting, and quantifying the impact of competitive-landscape shifts in the pharmaceutical and biologic market.70 It offers industry-leading drug life-cycle analysis, loss-of-exclusivity timing, and innovative product-launch tracking.70 IPD Analytics provides insights on drug litigation updates, market-impact forecasts, clinical pipeline tracking, and drug-price and rebate monitoring tools.70

- AI-Powered Commercial Intelligence Platforms: The pharmaceutical industry is increasingly leveraging AI to overcome data fragmentation and enhance competitive intelligence.22 AI-powered platforms can provide adaptive market sensing, optimize pricing strategies, scale competitor analysis, and track regulatory landscapes.22 They offer faster time-to-insight, always-on market monitoring, deeper competitive intelligence, and greater forecast accuracy compared to traditional business intelligence tools.22 Examples include Spring Bio Solution’s NCE Grid, which centralizes critical data points for identifying first-to-file opportunities 19, and platforms like Okra Technologies’ ValueScope for HTA outcome prediction and Confity for competitor portfolio monitoring.22

5.3. Industry Reports and Publications

Industry reports, market analyses, and specialized publications provide aggregated data, trends, and expert commentary that complement raw data from databases.

- Market Research Reports: These reports offer insights into global market trends, patient demographics, therapeutic areas, and competitive product positioning.21 They provide forecasts for market size and growth, such as the global generic drugs market projected to reach USD 728.64 billion by 2034.3

- Financial and Investment Reports: Publications from financial analysts and investment firms often provide projections on the impact of patent expirations on innovator companies’ revenues and strategies.7

- Academic and Trade Journals: These sources publish research on market dynamics, regulatory challenges, and strategic approaches in the generic drug sector.11

6. Challenges in Tracking Generic Drug Launches

Despite the sophisticated tools and resources available, tracking generic drug launches is fraught with challenges that require continuous adaptation and strategic mitigation.

6.1. Data Fragmentation and Siloed Information

One of the most significant challenges is the pervasive data fragmentation across the biopharmaceutical industry.71 Critical information, including regulatory updates, market intelligence, and timelines, often remains scattered across various portals, siloed databases, and even basic spreadsheets within organizations.19 This fragmentation creates bottlenecks in operations by complicating access to critical information across departments, increasing operational expenses, and obstructing the integration of advanced technologies like artificial intelligence, which rely on unified and high-quality datasets.71 The consequence of fragmented insights and missed opportunities is directly observed in lost exclusivity periods worth millions in potential revenue for generic companies.19 This necessitates a strategic approach to data management and transformation, focusing on breaking down silos and fostering interoperability across platforms.71

6.2. Complexity of Global Patent Landscapes and Patent Thickets

The global patent landscape is a dense and confusing maze, often referred to as a “patent thicket”.46 Innovator companies frequently file numerous secondary patents on incremental changes, new formulations, or alternative methods of use to prolong market exclusivity, a practice known as “evergreening”.4 For top-selling drugs, an average of 66% of patent applications are filed

after FDA approval, indicating a strategy to extend monopolies rather than protect initial innovation.53

These layered sets of overlapping patents present significant barriers for generic manufacturers. Challenging dozens of patents within a thicket can cost generic companies millions of dollars and lead to prolonged litigation, delaying affordable alternatives by years.53 For example, the litigation surrounding Revlimid lasted 18 years, blocking generics despite expired primary patents.53 This creates a unique predicament for generic developers: they must replicate the performance of a Reference Listed Drug (RLD) without having full access to its proprietary formulation details or manufacturing blueprints.73 This transforms generic development from a simple copying exercise into a sophisticated scientific and engineering challenge, demanding deep analytical capabilities and innovative formulation expertise.73

6.3. Regulatory Divergence and Harmonization Challenges

Despite shared aims among global regulators to ensure quality, safety, and efficacy, a consistent approach to drug approval requirements is often lacking, leading to medicines being approved quicker in some countries than others.74 This regulatory divergence creates significant challenges for pharmaceutical companies with global ambitions. Developing a single drug that can be simultaneously submitted in all countries for approval is difficult due to varying regulatory requirements.74

The lack of international regulatory harmonization affects generic drug market access.11 While efforts towards harmonization, such as the International Council for Harmonisation (ICH) and initiatives between the FDA and EMA (e.g., the PSA pilot program for complex generics), are ongoing, significant differences remain, particularly in bioequivalence requirements for complex generics.74 This means that manufacturers must formulate a drug product that will have the same therapeutic efficacy, safety, and performance characteristics as its branded counterpart while adhering to the specific regulatory requirements of each target country.74 The complexity of navigating these varied regulatory frameworks can hinder companies from registering new drugs in developing markets.76

6.4. Timeliness and Anticipation of Launch Dates

Accurately predicting the exact launch date of a generic drug is critical but challenging. While the year, and often the quarter or month, can be estimated with reasonable accuracy as the anticipated launch nears, the precise date remains uncertain until very close to launch.59 This uncertainty is compounded by factors such as:

- Litigation Outcomes: Patent litigation can significantly alter launch timelines, as legal disputes can either block or accelerate market entry.44

- “Pay-for-Delay” Settlements: These agreements, where brand-name companies pay generic firms to delay market entry, directly impact timeliness and raise antitrust concerns.53

- Manufacturing and Supply Chain Readiness: Bottlenecks can occur at every stage of the generic development process, from characterization of the reference product to formulation development and manufacturing scale-up.72 Issues like ingredient shortages or manufacturing capacity constraints can impact timely delivery.77

- Regulatory Workload and Prioritization: Although regulatory bodies like the FDA may expedite reviews for priority generics (e.g., drugs addressing shortages), the overall review process can still take considerable time (e.g., 30 months for ANDA review).23

Slow signal detection in this dynamic environment can lead to lost market share or missed opportunities.22 For pharmaceutical companies, a significant challenge lies in ensuring that their launch strategies are agile enough to respond to these unpredictable elements.

7. Conclusions and Recommendations

The tracking of generic drug launches, underpinned by meticulous patent data analysis, is not merely a tactical exercise but a strategic imperative for all pharmaceutical professionals. The insights derived from this process directly translate into competitive advantage, influencing critical decisions for both innovator and generic manufacturers, as well as for payers and healthcare systems.

The pervasive growth and cost-saving impact of generic drugs underscore a fundamental, irreversible global shift towards healthcare sustainability and broader patient access. This necessitates that all stakeholders recognize generics as a core economic and public health pillar, demanding a strategic re-evaluation of business models. The “patent cliff” is a direct trigger for generic market entry, leading to significant price erosion. Innovator companies must therefore proactively adjust strategies, while generic manufacturers must optimize their market entry and capture share in this highly competitive environment.

The distinct regulatory pathways of the FDA (ANDA process) and EMA (centralized, national, MRP, DCP) highlight the need for tailored market entry strategies. Understanding the nuances of bioequivalence, GMP compliance, and the varying timelines across these jurisdictions is crucial for efficient and timely market penetration. The FDA’s 180-day exclusivity for first-to-file generics is a powerful incentive, directly stimulating patent challenges and accelerating patient access to affordable medicines, leading to substantial cost savings.

The pharmaceutical industry’s reliance on intellectual property protection has led to complex, multi-layered patenting strategies, including “evergreening” and “patent thickets.” These maneuvers, while extending innovator monopolies, also create significant litigation barriers and costs for generic manufacturers, delaying market entry and maintaining high brand-name drug prices. Patent litigation, including “pay-for-delay” settlements, is a strategic battleground that can profoundly alter generic launch timelines. For generic manufacturers, navigating this complex IP landscape requires significant legal and analytical resources to identify weak patents and strategically challenge them.

Leveraging patent data effectively means understanding the predictable, aggressive pricing dynamics that characterize the generic market post-exclusivity. The “Day 181” phenomenon, where multiple generics enter, leads to rapid and profound price declines. For generics, optimizing market entry timing, particularly aiming for “first-to-file” status or launching precisely on Day 181, is critical for maximizing initial profitability and securing market share. Innovator companies, conversely, must deploy diversified lifecycle management strategies, from developing next-generation therapies and authorized generics to implementing cost-cutting measures, to mitigate the impact of the patent cliff.

Recommendations for Pharmaceutical Professionals:

- Integrate Comprehensive Competitive Intelligence: Establish cross-functional teams dedicated to competitive intelligence, ensuring seamless data flow and analysis across R&D, regulatory affairs, legal, business development, and commercial teams. This integration is vital to overcome data fragmentation and provide holistic market foresight.

- Invest in Advanced Analytical Tools: Adopt AI-powered commercial intelligence platforms and specialized databases (e.g., DrugPatentWatch, Clarivate Cortellis, IPD Analytics) to aggregate, analyze, and visualize complex patent, exclusivity, and market data. This investment enables faster time-to-insight, real-time market monitoring, and more accurate forecasting of generic entry opportunities and competitive dynamics.

- Develop Robust IP Strategy and Litigation Monitoring: For generic manufacturers, allocate significant resources to patent searches, analyses, and legal expertise to identify and strategically challenge weak patents within thickets. For innovators, continuously assess and strengthen patent portfolios while exploring authorized generic options and next-generation therapies. Both sides must actively monitor patent litigation status and settlement agreements, as legal outcomes can dramatically alter market timelines.

- Master Regulatory Pathways: Develop deep expertise in both FDA and EMA approval processes for generics, including the nuances of ANDA requirements, bioequivalence studies, and the various EU marketing authorization procedures (Centralized, MRP, DCP). Strategic selection of the optimal regulatory pathway is crucial for efficient and timely market access.

- Prioritize Timeliness and Agility: Recognize that market entry timing is paramount in the generic space. For generic manufacturers, this means striving for “first-to-file” status or precise “Day 181” launches. For all companies, it involves building agile launch strategies and supply chains capable of rapid adaptation to unforeseen regulatory, legal, or competitive shifts.

- Foster Cross-Functional Collaboration: Encourage continuous dialogue and collaboration between regulatory, legal, R&D, manufacturing, and commercial teams. This ensures that patent and exclusivity data are not just tracked but are actively translated into actionable insights that inform product development, market access, and commercialization strategies.

By embracing these recommendations, pharmaceutical professionals can transform the inherent complexities of generic drug launches and patent data into a powerful source of competitive advantage, driving market success and contributing to broader healthcare affordability and access.

Works cited

- Generic Drugs Market Size, Research, Trends and Forecast – Towards Healthcare, accessed July 27, 2025, https://www.towardshealthcare.com/insights/generic-drugs-market

- Global Generic Drug Market Size, Share 2025 – 2034, accessed July 27, 2025, https://www.custommarketinsights.com/report/generic-drug-market/

- Generic Drugs Market Size to Hit USD 728.64 Billion by 2034 – Precedence Research, accessed July 27, 2025, https://www.precedenceresearch.com/generic-drugs-market

- The Impact of Patent Expirations on Generic Drug Market Entry – PatentPC, accessed July 27, 2025, https://patentpc.com/blog/the-impact-of-patent-expirations-on-generic-drug-market-entry

- The Impact of Drug Patent Expiration: Financial Implications, Lifecycle Strategies, and Market Transformations – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- The Patent Cliff: From Threat to Competitive Advantage – Esko, accessed July 27, 2025, https://www.esko.com/en/blog/patent-cliff-from-threat-to-competitive-advantage

- 5 Pharma Powerhouses Facing Massive Patent Cliffs—And What They’re Doing About It, accessed July 27, 2025, https://www.biospace.com/business/5-pharma-powerhouses-facing-massive-patent-cliffs-and-what-theyre-doing-about-it

- Big Pharma Prepares for ‘Patent Cliff’ as Blockbuster Drug Revenue Losses Loom, accessed July 27, 2025, https://www.tradeandindustrydev.com/industry/bio-pharmaceuticals/big-pharma-prepares-patent-cliff-blockbuster-drug-34694

- Timeline: Generic medicines in the US – USP, accessed July 27, 2025, https://www.usp.org/our-impact/generics/timeline-of-generics-in-us

- Effects of Generic Entry on Market Shares and Prices of Originator Drugs – PubMed Central, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12209137/

- Comparing Generic Drug Markets in Europe and the United States: Prices, Volumes, and Spending, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5594322/

- Frequency of first generic drugs approved through “skinny labeling,” 2021 to 2023 – JMCP, accessed July 27, 2025, https://www.jmcp.org/doi/10.18553/jmcp.2025.31.4.343

- The Hatch-Waxman 180-Day Exclusivity Incentive Accelerates …, accessed July 27, 2025, https://accessiblemeds.org/resources/fact-sheets/the-hatch-waxman-180-day-exclusivity-incentive-accelerates-patient-access-to-first-generics/

- The Growing Importance of Generic Drug Development for Emerging Markets, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/the-growing-importance-of-generic-drug-development-for-emerging-markets/

- Tracking Generic Drug Launches: A Comprehensive Guide for Pharmaceutical Professionals – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/customer-success-will-a-generic-version-of-a-drug-launch-and-when/

- How Drug Life-Cycle Management Patent Strategies May Impact Formulary Management, accessed July 27, 2025, https://www.ajmc.com/view/a636-article

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices – HHS ASPE, accessed July 27, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- Analysis Recommends Market Understanding and Brand Building for Successful Generic Drug Launches – GeneOnline, accessed July 27, 2025, https://www.geneonline.com/analysis-recommends-market-understanding-and-brand-building-for-successful-generic-drug-launches/

- Spring Bio Solution launches intelligence platform to streamline generic drug development, accessed July 27, 2025, https://clinlabint.com/spring-bio-solution-launches-intelligence-platform-to-streamline-generic-drug-development/

- Day 181 Generic Drug Launch – A Fast and Cheap Way to Find Generic Entry Opportunities, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/day-181-generic-drug-launch-a-fast-and-cheap-way-to-find-generic-entry-opportunities/

- What is Competitive Intelligence in the pharmaceutical industry? – Lifescience Dynamics, accessed July 27, 2025, https://www.lifesciencedynamics.com/press/articles/what-is-competitive-intelligence-in-the-pharma-industry/

- AI-Powered Possibilities of Commercial Intelligence for Pharma – Edvantis, accessed July 27, 2025, https://www.edvantis.com/blog/commercial-intelligence-in-pharma/

- What is ANDA? – UPM Pharmaceuticals, accessed July 27, 2025, https://www.upm-inc.com/what-is-anda

- The ANDA Process: A Guide to FDA Submission & Approval – Excedr, accessed July 27, 2025, https://www.excedr.com/blog/what-is-abbreviated-new-drug-application

- INVESTIGATING GENERICS: America’s Overlooked Drug Crisis – MedShadow Foundation | Independent Health & Wellness Journalism, accessed July 27, 2025, https://medshadow.org/are-generic-drugs-safe/

- Abbreviated New Drug Application (ANDA) – FDA, accessed July 27, 2025, https://www.fda.gov/drugs/types-applications/abbreviated-new-drug-application-anda

- The Economics of the Pharmaceutical Sector: Innovation, Competition, and Patent Policy, accessed July 27, 2025, https://www.rstreet.org/commentary/the-economics-of-the-pharmaceutical-sector-innovation-competition-and-patent-policy/

- Generic and hybrid applications | European Medicines Agency (EMA), accessed July 27, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/marketing-authorisation/generic-hybrid-medicines/generic-hybrid-applications

- Authorisation of medicines – EMA – European Union, accessed July 27, 2025, https://www.ema.europa.eu/en/about-us/what-we-do/authorisation-medicines

- What is a generic drug, and how does it get approved? – Patsnap Synapse, accessed July 27, 2025, https://synapse.patsnap.com/article/what-is-a-generic-drug-and-how-does-it-get-approved

- Key steps and considerations of the EU centralised procedure – TOPRA, accessed July 27, 2025, https://www.topra.org/TOPRA/TOPRA_MEMBER/PDFs/TOPRA-RR-CPD-JULAUG2019.PDF

- Marketing authorisation | European Medicines Agency (EMA), accessed July 27, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/marketing-authorisation

- Marketing Authorization (MA) for a New Drug – Alhena Consult, accessed July 27, 2025, https://alhena-consult.com/marketing-authorization-ma-for-a-new-drug/

- Leveraging Mutual Recognition Agreements MRA to Fast-Track Generic Drug Approvals, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/leveraging-mutual-recognition-agreements-mra-to-fast-track-generic-drug-approvals/

- MUTUAL RECOGNITION PROCEDURE/DECENTRALISED PROCEDURE – JAZMP, accessed July 27, 2025, https://www.jazmp.si/en/human-medicines/regulatory-information/marketing-authorisation/mutual-recognition-procedure-decentralised-procedure/

- Mutual Recognition Procedure (MRP) – Medicinal products – Freyr., accessed July 27, 2025, https://www.freyrsolutions.com/medicinal-products/mutual-recognition-procedure-mrp

- Decentralised procedure | European Medicines Agency (EMA), accessed July 27, 2025, https://www.ema.europa.eu/en/glossary-terms/decentralised-procedure

- Decentralised Procedure (DCP) – Mutual Recognition … – BfArM, accessed July 27, 2025, https://www.bfarm.de/EN/Medicinal-products/Licensing/Licensing-procedures/DCP-MRP/_node.html

- Understanding the Decentralized Procedure (DCP) – Registrar Corp, accessed July 27, 2025, https://www.registrarcorp.com/compliance-training/drugs/pharma-the-decentralized-procedure-dcp/

- Decentralized Procedure, Decentralized Procedure EMA – Freyr., accessed July 27, 2025, https://www.freyrsolutions.com/medicinal-products/decentralized-procedure

- Application for Marketing Authorisation ( MA – Heads of Medicines Agencies, accessed July 27, 2025, https://www.hma.eu/human-medicines/cmdh/procedural-guidance/application-for-ma.html

- DCP – Heads of Medicines Agencies, accessed July 27, 2025, https://www.hma.eu/human-medicines/cmdh/procedural-guidance/application-for-ma/dcp.html

- Generic Drug Entry Timeline: Predicting Market Dynamics After Patent Loss, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/generic-drug-entry-timeline-predicting-market-dynamics-after-patent-loss/

- How Patent Litigation Influences Drug Approvals and Market Entry, accessed July 27, 2025, https://patentpc.com/blog/how-patent-litigation-influences-drug-approvals-and-market-entry

- Patent Litigation in the Pharmaceutical Industry: Key Considerations, accessed July 27, 2025, https://patentpc.com/blog/patent-litigation-in-the-pharmaceutical-industry-key-considerations

- How to Protect Intellectual Property in Generic Drug Development – PatentPC, accessed July 27, 2025, https://patentpc.com/blog/how-to-protect-intellectual-property-generic-drug-development

- Exclusivity and Generic Drugs: What Does It Mean? | FDA, accessed July 27, 2025, https://www.fda.gov/files/drugs/published/Exclusivity-and-Generic-Drugs–What-Does-It-Mean-.pdf

- Data Exclusivity: Is there a happy medium? – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/data-exclusivity-is-there-a-happy-medium/

- The Benefits From Giving Makers Of Conventional `Small Molecule’ Drugs Longer Exclusivity Over Clinical Trial Data, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3804334/

- A new history and discussion of 180-day exclusivity – PubMed, accessed July 27, 2025, https://pubmed.ncbi.nlm.nih.gov/19999288/

- Exploring Biosimilars as a Drug Patent Strategy: Navigating the Complexities of Biologic Innovation and Market Access – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/exploring-biosimilars-as-a-drug-patent-strategy-navigating-the-complexities-of-biologic-innovation-and-market-access/

- What is a patent challenge, and why is it common in generics?, accessed July 27, 2025, https://synapse.patsnap.com/article/what-is-a-patent-challenge-and-why-is-it-common-in-generics

- The Dark Reality of Drug Patent Thickets: Innovation or Exploitation? – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/the-dark-reality-of-drug-patent-thickets-innovation-or-exploitation/

- Addressing Patent Thickets To Improve Competition and Lower Prescription Drug Prices – I-MAK, accessed July 27, 2025, https://www.i-mak.org/wp-content/uploads/2023/12/Addressing-Patent-Thickets-Blueprint_2023.pdf

- Pharmaceutical Patent Litigation Settlements: Implications for Competition and Innovation, accessed July 27, 2025, https://scholarship.law.georgetown.edu/facpub/574/

- Strategies that delay or prevent the timely availability of affordable generic drugs in the United States, accessed July 27, 2025, https://ashpublications.org/blood/article/127/11/1398/34989/Strategies-that-delay-or-prevent-the-timely

- How to Implement a Successful Generic Drug Launch Strategy – DrugPatentWatch – Transform Data into Market Domination, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/how-to-implement-a-successful-generic-drug-launch-strategy/

- Generic Product Development Process – Phases and Stages – Medkart, accessed July 27, 2025, https://www.medkart.in/blog/generic-product-development-process

- Preparing for New Generic Launches – Pharmacy Purchasing & Products Magazine, accessed July 27, 2025, https://www.pppmag.com/article/758

- Approved Drug Products with Therapeutic Equivalence Evaluations | Orange Book – FDA, accessed July 27, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/approved-drug-products-therapeutic-equivalence-evaluations-orange-book

- Frequently Asked Questions on The Orange Book – FDA, accessed July 27, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/frequently-asked-questions-orange-book

- FDA Update: Improving Access to Biosimilar Drug Products – U.S. Pharmacist, accessed July 27, 2025, https://www.uspharmacist.com/article/fda-update-improving-access-to-biosimilar-drug-products

- Purple Book: FAQs – FDA Purplebook, accessed July 27, 2025, https://purplebooksearch.fda.gov/faqs

- FDA Purplebook, accessed July 27, 2025, https://purplebooksearch.fda.gov/

- DrugPatentWatch Pricing, Features, and Reviews (Jul 2025) – Software Suggest, accessed July 27, 2025, https://www.softwaresuggest.com/drugpatentwatch

- DrugPatentWatch Ranked Best Biopharmaceuticals Commercial Business Intelligence Platform, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/drugpatentwatch-ranked-best-biopharmaceuticals-commercial-business-intelligence-platform/

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed July 27, 2025, https://crozdesk.com/software/drugpatentwatch

- Cortellis Generics & Products Intelligence – Clarivate, accessed July 27, 2025, https://clarivate.com/life-sciences-healthcare/manufacturing-supply-chain-intelligence/product-intelligence-analytics/

- Cortellis Product Intelligence – Clarivate, accessed July 27, 2025, https://apps.clarivate.com/marketing/generics/

- IPD Analytics | The Industry Leader in Drug Life-Cycle Insights, accessed July 27, 2025, https://www.ipdanalytics.com/

- Biopharma Industry Identifies Five Lessons to Overcome Data Fragmentation and Enhance AI Integration – GeneOnline, accessed July 27, 2025, https://www.geneonline.com/biopharma-industry-identifies-five-lessons-to-overcome-data-fragmentation-and-enhance-ai-integration/

- FDA Critical Path Initiatives: Opportunities for Generic Drug Development – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC2751455/