For decades, the generic business model was elegantly simple: wait for a blockbuster drug’s patent to expire, race to be the first to market with a bioequivalent copy, and capture a significant market share before the inevitable flood of competitors. Today, this “first-to-market” race has become a perilous “race to the bottom”.1 The once-steep and predictable “patent cliff” has eroded into a gradual, treacherous “patent slope,” with companies battling to survive on razor-thin or non-existent margins.1 This paradigm shift is the central problem that branded generics are designed to solve.

Enter the branded generic: a strategic lifeline for pharmaceutical companies grappling with the commoditization of off-patent molecules. This isn’t just about slapping a brand name on a drug; it’s about crafting a competitive edge in a market teeming with unbranded alternatives.4 Branded generics occupy a strategic middle ground, positioned between high-cost, innovator brands and low-cost, unbranded generics. This unique positioning allows them to capture a new revenue stream and sustain profitability long after the original brand’s monopoly has ended.4

This report is a comprehensive guide for business professionals looking to turn patent data into a competitive advantage. It provides a data-driven framework to help IP, R&D, and business development teams, as well as their legal and investment partners, make an informed decision on whether to brand a generic. We will move beyond marketing hype and aggressive sales tactics, focusing instead on hard data, real-world case studies, and clear ROI metrics.4 The decision to brand a generic is not an emotional one; it is a calculated, evidence-based choice that hinges on a deep understanding of market dynamics, regulatory pathways, intellectual property landscapes, and, most importantly, the psychology of patients and providers.5

The Unavoidable Choice: Navigating the Post-Patent Abyss

The Economic Reality of the Patent Cliff

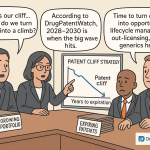

When a new medicine is released, it is patented and sold under a brand name. This patent grants the innovator company a period of exclusive rights, typically 20 years from the filing date, to recoup the substantial costs of research and development, which can run into the billions of dollars.8 However, the lengthy clinical trials and regulatory approval processes significantly erode this exclusivity, leaving an “effective patent life” of only 12-14 years on average.9 When this exclusivity expires, a “patent cliff” ensues, and sales of the original drug can drop by 80% or more as generic competitors enter the market.4 This dynamic creates a massive transfer of market value, with over $200 billion in annual sales from branded drugs set to lose exclusivity between 2025 and 2030 alone.3

The Pricing Death Spiral of Unbranded Generics

The moment an unbranded generic enters the market, it sets in motion a dramatic pricing death spiral. The value proposition of a traditional generic is its affordability, which is delivered through intense competition.1 With the entry of just a single generic competitor, the price of the original drug is slashed by 30% to 39%.1 This initial drop, while significant, is only the beginning. As more competitors enter, the price continues to plummet. According to industry data, with six or more generics on the market, the average manufacturer price can fall by a staggering 95%.1 This extreme level of price erosion can make continued production economically unsustainable for all but the most cost-efficient, large-scale manufacturers.1

This economic pressure is a global phenomenon. In Europe, for instance, generic prices have fallen by approximately 8% over the last decade, even as overall consumer prices rose by 30%.1 For portfolio managers, this brutal reality requires a re-evaluation of the entire business model. The old playbook, which relied on being the cheapest, is now pushing companies to the brink of insolvency.1

The New Generic Playbook: From Replication to Re-innovation

The traditional “race to the bottom” model is clearly no longer sustainable. The new generic playbook is not about replication; it is about sophisticated “re-innovation” and “incremental innovation” to create differentiated, higher-value products that can escape the commoditization trap.2 This strategic pivot requires a holistic mastery of scientific, legal, and regulatory tools.3 Branding, in this context, is a critical pillar of this new playbook, offering a way to create a competitive moat and sustain profitability where simple replication would fail. The stakes of getting this right are enormous, both economically and for public health, as generic medicines are the bedrock of modern healthcare systems, saving the U.S. healthcare system alone an estimated $445 billion in 2023.3

Defining the Battlefield: A Primer on Pharmaceutical Archetypes

To understand the strategic value of branding a generic, we must first clearly define the three key archetypes that dominate the post-patent pharmaceutical market. Each has a distinct regulatory pathway, financial model, and marketing posture.

The Traditional Generic: A Commodity Defined by Bioequivalence

The traditional generic is a bioequivalent copy of a brand-name drug.10 To gain regulatory approval, a manufacturer must submit an Abbreviated New Drug Application (ANDA) to the FDA.12 This streamlined process allows the generic company to rely on the FDA’s prior finding of safety and effectiveness for the original brand drug, which eliminates the need for redundant and costly clinical trials.13 The cornerstone of this approval is demonstrating “bioequivalence,” which means the generic drug delivers the same amount of active ingredient into a patient’s bloodstream in the same amount of time as the brand drug.11 While a traditional generic must have the same active ingredients, strength, and dosage form, it can have different inactive ingredients, such as different fillers, binders, dyes, or flavorings.6

Despite the rigorous review process and the FDA’s declaration that bioequivalence is clinically sufficient for most drugs, a fundamental contradiction persists in the market.7 For a traditional generic, the entire value proposition is rooted in its price.10 However, the public perception of these products is often skeptical. Many patients, and even some healthcare providers, remain uncertain about the safety and efficacy of generics, believing that a cheaper product must be of lesser quality.7 This is a natural human tendency to apply the “you get what you pay for” logic to medications.7 The physical differences in a generic drug—its different shape, color, or markings—can also cause patient anxiety and confusion, which can, in turn, lead to reduced adherence and potentially poorer clinical outcomes.16 This psychological gap between regulatory certainty and patient perception creates a significant market opening for a branded alternative that can offer a sense of trust and familiarity.

The Authorized Generic Anomaly

The authorized generic is a unique player in the generic landscape. It is an exact copy of a brand-name drug, manufactured by the brand company itself or by another company with the brand company’s permission.6 Crucially, authorized generics are identical in all aspects, including both active and inactive ingredients.6 They are sold under a generic name but are, for all intents and purposes, the brand drug without the brand name on the label.6 Authorized generics do not need to go through the ANDA approval process; instead, the manufacturer simply needs to notify the FDA of its launch.6 They are marketed under the brand drug’s New Drug Application (NDA) and are therefore not listed in the FDA’s Orange Book.12

This anomaly creates a powerful strategic threat to traditional generic competition.20 The innovator company can launch an authorized generic at any time, but it typically does so just before or during the 180-day exclusivity window awarded to the first generic filer to challenge a patent.6 This move immediately introduces a low-cost, identical alternative to the market, diluting the profitability of the first generic’s exclusivity period.20 While authorized generics may offer consumers lower costs in the short term, this strategic maneuver can potentially deter traditional generic manufacturers from challenging patents in the long run, thereby hindering generic competition and impacting long-term consumer savings.20

The Branded Generic: The Best of Both Worlds?

A branded generic is a traditional generic drug that has been approved via the ANDA process and has been given a proprietary, trademarked name.5 It has the same active ingredients as the brand but is not necessarily identical in its inactive ingredients.5 The strategic positioning of a branded generic is what makes it a compelling business model. These products occupy a unique middle ground, priced below the originator brand but above the low-cost, unbranded generics.4 This intermediate pricing strategy allows manufacturers to command higher margins than their unbranded counterparts while still offering significant cost savings to patients.5

The core value proposition of a branded generic is psychological and strategic. The brand name serves as a powerful signal of trust, reliability, and perceived quality to both physicians and patients.4 This trust helps to overcome the skepticism and confusion often associated with unbranded generics, enabling healthcare providers to prescribe the medication with confidence and allowing patients to request a specific product by name.5

The following table provides a clear, at-a-glance comparison of these three archetypes, highlighting their core differences in a structured format that helps to demystify this complex segment of the pharmaceutical market.

| Pharmaceutical Archetypes: A Strategic Comparison | |

| Attribute | Branded Generic |

| Regulatory Pathway | Abbreviated New Drug Application (ANDA) |

| Active Ingredients | Same as brand |

| Inactive Ingredients | Can be different |

| Pricing (Relative to brand) | 20-30% discount 4 |

| Marketing Strategy | Targeted, cost-efficient, builds brand recognition 5 |

| Market Position | Middle ground; quality assurance at an affordable price 4 |

The Business Case: Maximizing Return on Investment (ROI)

The decision to brand a generic is a strategic financial calculation aimed at maximizing return on investment. The business case is compelling, rooted in market data, sustainable margins, and an ability to extend a drug’s commercial lifecycle.

Financial Metrics and Profitability

The global branded generics market is a substantial and rapidly growing segment. It was valued at USD 240.75 billion in 2022 and is projected to reach USD 375.95 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.7%.5 This growth is consistent across regions, with mature markets showing moderate growth and emerging markets in Asia, Latin America, and Africa demonstrating more aggressive expansion.5

The profitability model for branded generics is fundamentally different from that of either innovator brands or unbranded generics. While patent-protected brands can achieve gross profit margins of approximately 80%, branded generics typically operate with margins of around 40%.5 This may seem lower, but it is far more sustainable and profitable than the “razor-thin or non-existent” margins that plague unbranded generics in crowded markets.1 The true ROI of a branded generic is not built on high unit margins but on the ability to achieve sustainable profitability through high-volume sales of established, low-cost molecules.5 The business model is built on leveraging reduced research and development costs and achieving economies of scale through optimized manufacturing processes.5 This focus on operational efficiency and strategic marketing enables a durable, profitable business that avoids the pricing death spiral of traditional generics.5

Beyond the Patent Cliff: Extending a Drug’s Lifecycle

For an innovator company, a branded generic can be a lifeline after patent expiration. It provides a means to extend the lifecycle of a drug, preserve market share, and keep revenue flowing.4 Patients and providers who developed loyalty and trust with the original brand are more likely to stick with a branded generic from the same reputable company.4 This continuity of trust is a powerful asset.

The successful launch of a branded generic is a tightrope walk between affordability and profitability.4 Branded generics are typically priced at a 20-30% discount off the original drug, but unbranded generics can undercut that price by another 50%.4 A study found that a branded generic priced 25% below the original drug captured 40% of the market share within a year, illustrating the potential for a well-executed strategy.4

The Strategic Playbook: From Data to Dominance

Launching a branded generic requires a sophisticated, multi-pronged strategy that goes far beyond simple manufacturing. It is a fusion of legal intelligence, targeted marketing, and operational excellence.

Intellectual Property as a Strategic Weapon

Innovator companies often build a “patent thicket”—a dense, overlapping web of secondary patents—around their core product to extend market exclusivity and deter competition.9 These patents can cover everything from specific formulations and methods of use to manufacturing processes and delivery systems.25

This is where sophisticated patent intelligence platforms, such as DrugPatentWatch, become a crucial competitive advantage.2 Rather than passively observing the landscape, a data-driven approach allows a company to systematically deconstruct the patent thicket. By analyzing data on key expiration dates, patent types, and litigation history, a company can identify the weakest patents that are “ripe for a challenge”.2 This process transforms patent analysis from a legal exercise into a core business strategy, enabling a proactive approach to market entry and risk management.2 The financial asymmetry of this landscape is stark: while a duplicative patent may cost as little as $25,000 to obtain, challenging it can cost a generic company nearly $800,000 in administrative proceedings and even more in district court litigation.2

The ultimate legal maneuver for a generic developer is the Paragraph IV challenge. This high-stakes legal chess match, established by the Hatch-Waxman Act, allows a generic company to formally assert that an innovator’s patent is either invalid or will not be infringed upon by their product.13 The first company to successfully file a Paragraph IV challenge is rewarded with a 180-day period of market exclusivity, creating a de facto monopoly that can be worth hundreds of millions of dollars.26

Marketing the Promise of Quality

The marketing approach for branded generics is a stark contrast to that of both traditional brands and unbranded generics.5 Unlike innovator brands that invest heavily in physician detailing and costly direct-to-consumer advertising, branded generic companies employ more targeted, cost-efficient marketing strategies.5 These campaigns focus on building brand recognition among healthcare providers and pharmacists, who are key decision-makers in the prescribing and dispensing process.5

The core marketing value proposition for a branded generic is not novelty, but reliability and trustworthiness.5 By creating a recognizable brand identity, manufacturers enable healthcare providers to prescribe medications with confidence and reassure patients who might be skeptical of unbranded alternatives.4 As Dr. Sarah Lee, a pharma marketing consultant, wisely stated, “Branding isn’t just a logo; it’s a promise of quality. In branded generics, that promise drives adoption”.4

This strategic playbook is also evolving to incorporate innovative digital health solutions. The concept of going “beyond the pill” by pairing a branded generic with a digital companion tool—like an app for adherence, a wearable device, or a telemedicine platform—offers a holistic experience that enhances patient value and engagement.4 A 2024 survey found that 60% of patients are more likely to choose a branded generic with a digital companion tool, a powerful indicator of this emerging trend.4

Supply Chain and Distribution as a Competitive Advantage

The supply chain for generic drugs operates on fundamentally different market dynamics than that of brand-name products.28 For one, generic manufacturers rarely, if ever, negotiate rebates with Pharmacy Benefit Managers (PBMs) or health plans.28 While brand manufacturers can control their pricing more easily, a generic manufacturer competing in a crowded field has less control over pricing decisions.28

Therefore, optimizing distribution channels is critical for success. A well-oiled distribution network and strategic partnerships with retail pharmacies, hospitals, and online platforms are crucial for market penetration.4 A case example highlights the potential: one company boosted sales of its branded generic for asthma by 30% after partnering with a telehealth provider.4

Navigating the Regulatory Maze

While the ANDA process is called “abbreviated,” it is nonetheless a complex and meticulous undertaking.13 The process requires a generic manufacturer to demonstrate “pharmaceutical equivalence” and prove that their manufacturing facilities and processes meet the same strict standards as those for brand drugs.14 The science of bioequivalence is a central pillar, requiring rigorous pharmacokinetic studies that measure two key parameters: the maximum concentration (

Cmax) of the drug in the blood and the total exposure to the drug over time, known as the Area Under the Curve (AUC).11 The FDA requires that the 90% confidence interval for these values must fall within a range of 80% to 125% of the brand-name drug’s values.11 This is not a broad range; to achieve this confidence interval, the variance in performance is typically less than 5%.11

Real-World Triumphs and Cautionary Tales

The branded generic strategy is not without its risks and challenges, but a number of companies have proven its viability and profitability through real-world success.

The Blueprint for Success

Companies like Indian pharmaceutical giants Ranbaxy (which merged with Japan’s Daiichi Sankyo) and Dr. Reddy’s Laboratories have built highly successful business models centered on branded generics.5 Their ability to create a portfolio of these products enabled them to achieve significant global scale and profitability, demonstrating the viability of this strategic approach.5

An illustrative case study highlights the potential ROI. One company launched “LipNova,” a branded generic for the cholesterol drug Lipitor. The campaign emphasized the product’s heritage and quality, successfully capturing 35% of the market within 12 months and generating $600 million in revenue.4

The Dangers of Patient Perception

Conversely, there are powerful cautionary tales that underscore the risks of ignoring patient perception. A prominent example is the Teva bupropion XL fiasco.17 After years of patient complaints about the ineffectiveness and adverse effects of Teva’s generic antidepressant, the FDA pulled it from the market in 2012.17 This product, while deemed bioequivalent by regulatory standards, failed in the real world due to a critical disconnect between the data and the patient experience. The failure serves as a powerful reminder that patient-reported outcomes can ultimately determine a product’s fate, regardless of its regulatory status.17 It also highlights why branding a generic is about more than a name; it is about earning and maintaining trust, especially for critical-dose drugs with narrow therapeutic indices where minor variations can lead to significant clinical consequences.11

The following table provides a clear illustration of the pricing death spiral, which serves as the core economic justification for seeking a branded alternative.

| The Economics of Generic Entry: Price Erosion vs. Competition | |

| Number of Generic Competitors | Approximate Price Reduction vs. Brand Price |

| 1 | 30% – 39% |

| 2 | 50% – 54% |

| 3-5 | 60% – 79% |

| 6-10+ | 80% – 95% |

Market Dynamics and M&A

The high rate of mergers and acquisitions (M&A) in the generic pharmaceutical market further underscores the strategic shift towards building value and scale. Most M&A activity in this sector involves generic small molecules, and the deals are often aimed at building larger, more diverse portfolios.30 The trend of large pharmaceutical companies, which typically manufacture brand-name drugs, acquiring generic firms is an implicit acknowledgment that sustained profitability in the generic space requires scale and a strategic portfolio of value-added products.12 Branded generics are a key component of this new, value-driven strategy.

Key Takeaways

- The traditional generic business model, once a lucrative race to market, is now a race to the bottom characterized by brutal price erosion and razor-thin margins.

- Branded generics are a sophisticated, strategic response to this challenge, offering a profitable middle ground between high-cost brands and low-cost, unbranded generics.

- The decision to brand a generic should be a calculated, evidence-based choice driven by a clear ROI model, not a marketing gimmick.

- The psychological value proposition of branding—the promise of quality and consistency—is a powerful tool for overcoming patient and provider skepticism and enhancing medication adherence.

- Intellectual property intelligence and platforms like DrugPatentWatch are no longer just legal tools; they are strategic weapons that enable companies to deconstruct patent thickets, identify high-value opportunities, and manage risk.

- Success hinges on a holistic playbook that combines legal acumen (e.g., Paragraph IV challenges), strategic marketing (e.g., targeted campaigns, digital companions), and operational excellence.

- While regulatory bodies certify a generic’s bioequivalence, real-world failures demonstrate the critical importance of patient experience and the trust that a strong brand can instill.

Frequently Asked Questions (FAQ)

Q1: How do branded generics differ from authorized generics, and which is a better investment?

Branded generics and authorized generics are distinct from both a regulatory and a strategic perspective. An authorized generic is an exact copy of a brand-name drug, including both active and inactive ingredients, and is marketed by the original manufacturer or its licensee. It is not listed in the Orange Book and is marketed under the brand’s NDA.6 In contrast, a branded generic is a traditional generic that has been given a proprietary name, is approved via the ANDA process, and may have different inactive ingredients.5 From an investment standpoint, the choice depends on your objective. Authorized generics are a defensive strategy for innovator companies to protect their market share and dilute the profitability of a first-to-market generic competitor.20 Branded generics, however, represent an offensive strategy for a generic manufacturer to capture a higher-margin, value-added niche in a crowded market.5

Q2: What is a “patent thicket,” and how can patent data help me navigate it?

A “patent thicket” is a dense, overlapping web of secondary patents that innovator companies create to extend market exclusivity beyond the original composition of matter patent.9 These patents can cover everything from new formulations and methods of use to specific crystalline structures.25 Navigating this maze is a major legal and financial challenge. Patent data and intelligence platforms like DrugPatentWatch are crucial for systematically deconstructing this landscape. They enable a company to identify key expiration dates, understand the specific claims of each patent, and pinpoint the weakest patents that are “ripe for a challenge,” thereby informing a proactive legal strategy and de-risking the development process.2

Q3: Are branded generics simply a marketing tactic, or do they offer real value to patients and providers?

While branding is a marketing tactic, in the context of generics, it delivers tangible value. The brand name serves as a powerful signal of reliability and consistency, which helps to alleviate the confusion and anxiety that some patients feel when switching from a familiar brand-name drug to a new, unbranded generic with a different appearance.7 For providers, a branded generic offers confidence in the product’s quality, simplifying the prescribing and dispensing process.4 This psychological reassurance can lead to greater patient adherence, better health outcomes, and a more streamlined healthcare experience, which are all forms of real, quantifiable value.16

Q4: What specific metrics should I be tracking to assess the ROI of a branded generic launch?

A robust ROI model for a branded generic must track metrics beyond traditional sales figures. Key financial metrics include the projected market size and growth rate, the expected market share capture (e.g., based on a strategic pricing discount), and the potential for sustainable gross margins.4 However, the analysis must also include the cost of development and potential litigation (especially for a Paragraph IV challenge) and the projected impact of a price erosion curve.1 Metrics such as patient adherence rates, provider adoption, and the success of digital health integrations are also critical for measuring the holistic value proposition and justifying a higher price point than an unbranded competitor.4

Q5: In a market with multiple generic competitors, what are the most effective non-price-based strategies for capturing and retaining market share?

In a market defined by intense price competition, success hinges on non-price-based differentiation. The most effective strategies include developing a strong brand identity that signals quality and trust, leveraging targeted marketing to educate healthcare providers and pharmacists, and building a highly efficient distribution network.5 Another increasingly important strategy is to create a value-added proposition by pairing the branded generic with a digital companion tool, such as an adherence app or a telehealth service. This turns the product into a “holistic experience” and provides a competitive advantage that is difficult for a low-cost, unbranded competitor to replicate.4

Works cited

- From Chaos to Clarity: Streamlining Your Generic Drug Portfolio – DrugPatentWatch, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/from-chaos-to-clarity-streamlining-your-generic-drug-portfolio/

- The New Generic Playbook: Turning Patent Data into Competitive …, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/the-new-generic-playbook-turning-patent-data-into-competitive-advantage-with-value-added-drugs/

- Innovative Approaches to Generic Drug Development: Forging …, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/innovative-approaches-to-generic-drug-development-case-studies/

- Maximizing ROI with Branded Generics: A Comprehensive Guide – DrugPatentWatch, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/maximizing-roi-with-branded-generics-a-comprehensive-guide/

- Branded Generics: What They Are and Why They’re Profitable – DrugPatentWatch, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/branded-generics-what-they-are-and-why-theyre-profitable/

- Authorized Generics: What You Need to Know – GoodRx, accessed September 18, 2025, https://www.goodrx.com/drugs/medication-basics/what-are-authorized-generics

- Patient Perceptions of Generic Drugs: Dispelling Misconceptions – U.S. Pharmacist, accessed September 18, 2025, https://www.uspharmacist.com/article/patient-perceptions-of-generic-drugs-dispelling-misconceptions

- How to Protect Intellectual Property in Generic Drug Development – PatentPC, accessed September 18, 2025, https://patentpc.com/blog/how-to-protect-intellectual-property-generic-drug-development

- Optimizing Your Drug Patent Strategy: A Comprehensive Guide for Pharmaceutical Companies – DrugPatentWatch, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/optimizing-your-drug-patent-strategy-a-comprehensive-guide-for-pharmaceutical-companies/

- What’s the Difference Between Generics and Brand-Name Drugs?, accessed September 18, 2025, https://accessiblemeds.org/resources/blog/whats-difference-between-generics-and-brand-name-drugs/

- Similarities and Differences Between Brand Name and Generic Drugs | CDA-AMC, accessed September 18, 2025, https://www.cda-amc.ca/similarities-and-differences-between-brand-name-and-generic-drugs

- The FDA, Generics and Differentiating Authorized from Branded Types, accessed September 18, 2025, https://www.pharmacytimes.com/view/the-fda-generics-and-differentiating-authorized-from-branded-types-

- The Regulatory Pathway for Generic Drugs: A Strategic Guide to Market Entry and Competitive Advantage – DrugPatentWatch, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/the-regulatory-pathway-for-generic-drugs-explained/

- What Is the Approval Process for Generic Drugs? – FDA, accessed September 18, 2025, https://www.fda.gov/drugs/generic-drugs/what-approval-process-generic-drugs

- Knowledge and perceptions of patients towards generic and local medications: The lebanese version – Pharmacia, accessed September 18, 2025, https://pharmacia.pensoft.net/article/98699/

- Potential Clinical and Economic Impact of Switching Branded Medications to Generics – PMC – PubMed Central, accessed September 18, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5417581/

- My Generic Medications Failed Me. I’m Not Alone – VICE, accessed September 18, 2025, https://www.vice.com/en/article/my-generic-medication-gave-me-constant-nosebleeds-im-not-alone/

- FDA List of Authorized Generic Drugs, accessed September 18, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/fda-list-authorized-generic-drugs

- en.wikipedia.org, accessed September 18, 2025, https://en.wikipedia.org/wiki/Authorized_generics

- Authorized Generics In The US: Prevalence, Characteristics, And Timing, 2010–19, accessed September 18, 2025, https://www.healthaffairs.org/doi/10.1377/hlthaff.2022.01677

- www.drugpatentwatch.com, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/branded-generics-what-they-are-and-why-theyre-profitable/#:~:text=Branded%20generics%20represent%20a%20distinct,been%20given%20proprietary%20brand%20names.

- Branded Generics Promise Profits for Drugmakers, Peace of Mind for Patients, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/branded-generics-promise-profits-for-drugmakers-peace-of-mind-for-patients/

- Branded Generics Market Size, Share, Growth Report, 2030, accessed September 18, 2025, https://www.grandviewresearch.com/industry-analysis/branded-generics-market

- The Pharmaceutical Patent Playbook: Forging Competitive Dominance from Discovery to Market and Beyond – DrugPatentWatch, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/developing-a-comprehensive-drug-patent-strategy/

- RAI Explainer: Generic Drugs, Property Rights, and the Orange Book | Perspectives on Innovation | CSIS, accessed September 18, 2025, https://www.csis.org/blogs/perspectives-innovation/rai-explainer-generic-drugs-property-rights-and-orange-book

- How America Built the World’s Most Successful Market for Generic Drugs, accessed September 18, 2025, https://marginalrevolution.com/marginalrevolution/2025/05/how-america-built-the-worlds-most-successful-market-for-generic-drugs.html

- The Generic Drug Supply Chain | Association for Accessible Medicines, accessed September 18, 2025, https://accessiblemeds.org/resources/blog/generic-drug-supply-chain/

- Mastering the Generic Gambit: A Comprehensive Playbook for a Winning Drug Launch Strategy – DrugPatentWatch – Transform Data into Market Domination, accessed September 18, 2025, https://www.drugpatentwatch.com/blog/how-to-implement-a-successful-generic-drug-launch-strategy/

- RESULTS – Mergers and Acquisitions (M&As) in Pharmaceutical Markets: Associations with Market Concentration, Prices, Drug Quantity Sold, and Shortages – NCBI, accessed September 18, 2025, https://www.ncbi.nlm.nih.gov/books/NBK611856/

- Mergers and Acquisitions (M&As) in Pharmaceutical Markets: Associations with Market Concentration, Prices, Drug Quantity, So – HHS ASPE, accessed September 18, 2025, https://aspe.hhs.gov/sites/default/files/documents/ec5de77c72cff3abf802b5e9c6cc8ae4/aspe-pharma-ma-report.pdf