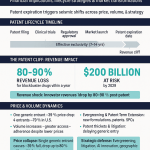

The countdown is relentless. For every blockbuster drug that reaches the market, a clock starts ticking, marking the finite years of patent-protected revenue. For decades, the pharmaceutical industry has viewed the end of this period with a sense of dread, coining the term “patent cliff” to describe the precipitous drop in sales that follows the loss of exclusivity (LOE). This is no small matter; by 2030, an estimated $300 billion in annual revenue is at risk from patent expirations, with 190 drugs, including 69 blockbusters, set to lose their market protection. The pressure is immense, and the stakes have never been higher.

However, the narrative of a sudden, catastrophic fall from grace is becoming dangerously outdated. In today’s complex and fast-moving market, the most forward-thinking companies are rewriting the script. They understand that the patent cliff is not an endpoint but a transition point—a strategic inflection that separates the proactive from the reactive. As Pfizer so masterfully demonstrated with Viagra, a well-executed strategy can transform a potential free-fall into a “controlled descent,” preserving significant value long after the primary patent has expired. This is the art of the second act.

This report provides a comprehensive, expert-level framework for mastering that second act. We will delve into the six critical steps of effective late-stage lifecycle management (LCM), a phase that typically begins 3-5 years before LOE and extends well into the period of generic or biosimilar competition.3 As pharmaceutical consultant Dr. Sarah Johnson aptly puts it, “Late-stage lifecycle management is about squeezing every ounce of value from a drug while ensuring it continues to meet patient needs. It’s a delicate balance of commercial strategy and medical responsibility”.

The six-step framework presented here is not a simple, linear checklist. It is a dynamic, interconnected system that demands the dismantling of traditional functional silos. True success in late-stage LCM requires the seamless integration of research and development (R&D), commercial, legal, and regulatory strategies from the very beginning of a product’s journey.5 Organizations that wait until the final years of a product’s patent life to consider their defensive strategy are not just late to the game; they are playing a different, far less profitable one, risking immense value left on the table.

This strategic imperative is amplified by a powerful market force: life cycle compression. According to analysis from McKinsey, the window for a new drug to achieve 50% of its lifetime sales has shrunk by a staggering 18 to 24 months since the year 2000.8 This compression is driven by fiercer competition, with rivals entering the same disease area in as little as two years, compared to 15 years two decades ago, and by significant policy pressures like the U.S. Inflation Reduction Act (IRA), which shortens the negotiation-free period for top-selling drugs. This new reality means that late-stage LCM is no longer just about

extending a drug’s commercial life; it’s about maximizing its value density within a shorter, more intense timeframe. The six steps that follow are a framework for achieving both longevity and profound value in an era of unprecedented challenge and opportunity.

Step 1: Building the Strategic Foundation—A 360-Degree Market and Competitive Analysis

Before you can chart a course for the future, you must have an unflinchingly honest and deeply detailed map of the present. The first step in any effective late-stage LCM plan is to conduct a comprehensive, 360-degree analysis of the market landscape. This is not a perfunctory, one-time exercise but a continuous process of intelligence gathering that forms the bedrock of every subsequent strategic decision. It’s about understanding the terrain, identifying the other players on the field, and knowing the rules of engagement better than anyone else.

Beyond the Basics: Advanced Competitive Intelligence

A thorough competitive analysis must go far beyond a simple list of existing products in your therapeutic area. It requires a deep, granular scrutiny of your competitors’ entire strategic posture. This means mapping their product portfolios, dissecting their pricing strategies, reverse-engineering their marketing approaches, and, most critically, monitoring their R&D pipelines for future threats. This intelligence net must be cast wide, capturing not only the established Big Pharma players but also the nimble, emerging biotech firms that could be tomorrow’s disruptive competitors or, perhaps, your next strategic partner.

Are your competitors investing in new formulations? Are they running trials in adjacent indications? Understanding these moves is fundamental to positioning your mature drug effectively and anticipating the competitive threats that lie just over the horizon.

Leveraging Patent Intelligence with Tools like DrugPatentWatch

In the high-stakes game of pharmaceuticals, one of the most powerful yet frequently underutilized sources of competitive intelligence is the patent database. Patent filings serve as a powerful early warning system, offering a glimpse into a competitor’s strategic intentions years before a product ever reaches the market. Because patent applications are typically published 18 months after their initial filing, they create a valuable intelligence window for those who know where and how to look.10

This is where specialized platforms like DrugPatentWatch become indispensable. These tools are not just databases; they are strategic intelligence engines. They allow your teams to systematically track competitor patent portfolios, identify “white space” opportunities in therapeutic areas with limited patent activity, and assess your own freedom-to-operate for potential lifecycle extension initiatives.10 By analyzing the

types of patents being filed—for instance, a flurry of formulation patents versus a new method-of-use patent—you can effectively decode a competitor’s LCM strategy long before it is announced in a press release. This intelligence allows you to move from a reactive posture to a proactive one, preparing your defenses or launching your own initiatives with a clear view of the competitive landscape.

The Voice of the Customer: Understanding Unmet Needs

While competitive intelligence tells you what other companies are doing, patient and physician insights tell you what you should be doing. A deep dive into patient demographics, preferences, and, most importantly, unmet needs is a critical component of this foundational analysis. This goes beyond the primary clinical endpoints of your original trials. It’s about understanding the real-world friction points. Is the dosing schedule inconvenient? Are there persistent, low-grade side effects that impact quality of life? Is the administration method difficult for elderly patients?

This shift toward patient-centricity is not just a trend; it’s a regulatory and commercial imperative. The U.S. Food and Drug Administration’s (FDA) Patient-Focused Drug Development (PFDD) initiative is a clear signal of this, as it aims to systematically gather patient input to inform regulatory decisions on a drug’s benefits and risks. Furthermore, Patient Advocacy Groups (PAGs) have evolved from simple support networks into sophisticated and influential stakeholders. They are often deeply knowledgeable about the drug development process, fund their own research, and can provide invaluable real-world data and patient perspectives that can strengthen regulatory filings and inform your LCM strategy. Engaging them early and treating them as true partners is no longer optional.

The convergence of patent intelligence and patient-centricity creates a remarkably powerful predictive tool. Imagine your market research reveals that patients find your daily oral tablet burdensome. Simultaneously, your competitive intelligence team, using a platform like DrugPatentWatch, flags a new patent filing from a key competitor for an extended-release, once-weekly formulation of a similar compound. The threat is no longer hypothetical; it is a clear and present danger. This synthesis of data allows you to anticipate your competitor’s “product hopping” strategy years in advance. It gives you the time to respond strategically—perhaps by accelerating the development of your own next-generation product, initiating RWE studies to highlight other unique benefits of your current formulation, or adjusting your marketing message to preemptively counter their future claims. This is how you turn a defensive reaction into a preemptive strategic masterstroke.

The Forward-Looking SWOT Analysis

Finally, all of this intelligence must be synthesized into a dynamic and forward-looking SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis. For a late-stage product, this is not a static corporate exercise. It is a living document that guides strategic prioritization.

- Strengths: What are your core, defensible assets? This could be decades of real-world safety data, deep-rooted physician loyalty, or a highly effective patient support program.

- Weaknesses: Where are you vulnerable? This might be an inconvenient dosing regimen, a side effect profile that newer competitors have improved upon, or a looming patent expiration on a key formulation.

- Opportunities: Where can you create new value? This could be an unexplored patient subgroup, a potential new indication suggested by emerging scientific literature, or the possibility of an Rx-to-OTC switch.

- Threats: What external forces could derail your strategy? This includes the obvious threat of generic entry, but also changes in clinical guidelines that might deprioritize your drug, or a competitor’s new product that offers a superior mechanism of action.

This rigorous, multi-faceted analysis in Step 1 doesn’t just inform your LCM plan; it is the plan’s foundation. Without it, you are navigating the most treacherous phase of your product’s life with an outdated map, or worse, no map at all.

Step 2: The Unvarnished Truth—A Rigorous Evaluation of Product Performance and Potential

With a clear understanding of the external market landscape, the focus must now turn inward. Step 2 is an unvarnished, data-driven audit of your drug’s performance and, more importantly, its remaining untapped potential. This is not about celebrating past successes; it’s about critically assessing the asset’s current standing and identifying every possible lever for future value creation. This evaluation must be comprehensive, triangulating data from commercial operations, post-market surveillance, and the rapidly expanding universe of real-world evidence.

A Deep Dive into Performance Metrics

The evaluation begins with a granular analysis of traditional performance metrics. This involves dissecting sales data not just by total revenue, but by geographic region, patient demographic, and prescriber specialty. Where are your strongholds of brand loyalty? Where are you seeing early signs of erosion? Is market share declining among general practitioners but holding steady with specialists? Answering these questions reveals the specific vulnerabilities that your LCM strategy must address.

Beyond sales, this analysis must incorporate softer but equally critical metrics like patient adherence rates and healthcare provider satisfaction. Low adherence can signal problems with dosing frequency, side effects, or cost, all of which are potential targets for a lifecycle-extending reformulation or a new patient support program.

Crucially, this phase must treat pharmacovigilance not as a mere regulatory compliance function, but as a strategic asset.17 A robust, long-term safety profile, meticulously documented through years of post-market surveillance, is one of the most powerful differentiators a mature brand possesses. In a world of new market entrants with less long-term data, a proven track record of safety is a cornerstone of late-stage marketing and a key message for reassuring physicians, payers, and patients.

Uncovering Hidden Value with Real-World Evidence (RWE)

Randomized controlled trials (RCTs) are the gold standard for regulatory approval, but they represent a “best-case scenario” conducted in a highly controlled environment with a carefully selected patient population. Payers and providers, however, make decisions in the messy, complex “real world.” This is where Real-World Evidence (RWE) becomes an indispensable tool for late-stage LCM.

RWE, derived from sources like electronic health records (EHRs), insurance claims data, and patient registries, provides a crucial understanding of how your drug performs in everyday clinical practice. It can bridge critical evidence gaps left by your initial RCTs, especially concerning:

- Long-Term Effectiveness and Safety: RWE can demonstrate your drug’s durable efficacy and safety profile over many years of use in diverse, co-morbid patient populations—something an 18-month RCT can never show.

- Comparative Effectiveness: RWE allows for head-to-head comparisons against competitors in a real-world setting, providing powerful data to support your drug’s value proposition.

- Healthcare Resource Utilization (HCRU): This is the holy grail for payers. RWE can demonstrate that while your branded drug may have a higher upfront cost than a generic, it leads to fewer hospitalizations, emergency room visits, or other costly interventions, resulting in a lower total cost of care.

As payers and health technology assessment (HTA) bodies increasingly demand proof of ongoing value, a proactive RWE generation plan is no longer a “nice to have”; it is essential for defending your price, securing favorable formulary placement, and negotiating innovative value-based contracts.21

Identifying Untapped Potential for Lifecycle Extension

The final component of this internal audit is a systematic and creative search for untapped potential. This involves looking at your existing asset with fresh eyes to identify opportunities for lifecycle extension. This systematic exploration should include:

- Screening for New Indications: Reviewing all existing preclinical and clinical data, as well as emerging scientific literature, for signals of efficacy in other diseases or conditions.

- Identifying Combination Therapy Opportunities: Assessing the scientific rationale and market need for combining your drug with other established or emerging therapies.

- Evaluating the Need for New Formulations: Using patient adherence data and physician feedback to identify needs for improved formulations (e.g., extended-release), new dosage forms (e.g., a liquid for pediatric patients), or novel delivery methods (e.g., a subcutaneous auto-injector to replace an intravenous infusion).

This process of rigorous self-assessment directly fuels the strategic choices you will make in Step 3. There is a direct and powerful causal link between the insights generated in this evaluation and the potential return on investment (ROI) of your subsequent LCM initiatives. For example, RWE that quantifies poor adherence rates in a specific patient population provides the concrete business case for investing in the development of a new extended-release formulation. Pharmacovigilance data that reveals an unexpected but consistently observed positive side effect could be the first clue to a multi-billion-dollar drug repurposing opportunity, as was famously the case when clinical trial subjects for an angina medication reported an unusual effect, leading to the birth of sildenafil (Viagra) as a treatment for erectile dysfunction.

Therefore, Step 2 is not merely a passive evaluation of past performance. It is the active target identification phase for high-impact, data-driven LCM investments. It transforms weaknesses into opportunities and transforms anecdotal observations into quantifiable business cases, providing the strategic clarity needed to build a powerful and profitable second act for your mature asset.

Step 3: The Strategic Playbook—Developing a Robust and Multi-Pronged Lifecycle Extension Strategy

Armed with a deep understanding of the market and a clear-eyed assessment of your product, it’s time to build the strategic playbook. Step 3 is where analysis translates into action. Effective late-stage LCM is not about finding a single “silver bullet” tactic; it’s about orchestrating a sophisticated, multi-pronged campaign that integrates R&D innovation, legal fortification, and commercial ingenuity. The goal is to build a resilient and overlapping defense that extends the value of your asset far beyond its initial patent horizon.

The Three Pillars of Modern LCM

The most successful lifecycle management programs are built on three interconnected pillars: R&D-driven value enhancement, legal and intellectual property (IP) defense, and commercially-driven market expansion.24 These are not sequential or siloed functions; they are a synergistic system. The teams responsible for each must work in lockstep, as the output of one pillar often becomes the critical input for another. The legendary LCM strategy for Pfizer’s Lipitor, for example, was not a single move but the culmination of over 50 different strategies developed across its legal, marketing, and R&D departments, starting a full six years before patent expiry.24 This level of foresight and integration is the benchmark for success.

The R&D Arsenal: Enhancing Value Beyond the Original Molecule

The R&D pillar is focused on a simple but powerful premise: making your drug better. This involves leveraging your deep knowledge of the molecule and its clinical effects to create tangible improvements that benefit patients, differentiate you from generics, and, critically, generate new intellectual property.

Indication Expansion (Drug Repurposing)

Finding new therapeutic uses for an existing drug is one of the most powerful and capital-efficient strategies in the LCM arsenal.3 By leveraging the drug’s already-established safety profile, you can bypass much of the costly and high-risk early-stage development process. The numbers are compelling: a drug repurposing program can cost an average of $300 million and take 3-12 years, a fraction of the estimated $2.6 billion and 10-15 years required to bring a new chemical entity to market.23

The regulatory pathway for this is well-established. In the United States, a new indication is typically sought via a Supplemental New Drug Application (sNDA), which contains the clinical data supporting the new use.29 In the European Union, the equivalent process might be a Type II variation or a line extension application, depending on the nature of the change. While overall drug development success rates from Phase I to approval hover between a sobering 10% and 20%, repurposing initiatives often enjoy a higher probability of success, especially once they enter Phase II, because the fundamental safety questions have already been answered.28

- Case Study: Viagra (Sildenafil). The story of Viagra is the canonical example of drug repurposing. Originally developed by Pfizer to treat angina, researchers in early clinical trials noted an unexpected and consistent side effect among male subjects. Rather than dismissing this as an anomaly, the company astutely recognized its potential. This pivot transformed a moderately promising cardiovascular drug into a cultural phenomenon and a multi-billion-dollar blockbuster for erectile dysfunction.23 While this initial discovery was serendipitous, today’s repurposing efforts are far more systematic, using computational biology and AI to screen existing molecules against new disease targets.

Reformulation and Delivery Innovation

Often, the greatest unmet need for a mature drug isn’t a new indication but a better way of taking it. Reformulation strategies focus on creating new versions of a drug that improve the patient experience, enhance compliance, and can generate valuable new formulation patents.3 This is a common and effective “evergreening” tactic that can provide real clinical benefits. Examples include:

- Developing extended-release (ER) versions that reduce dosing frequency from multiple times a day to once daily.

- Creating new dosage forms, such as switching from an oral tablet to a topical patch or a liquid formulation for patients with dysphagia.

- Improving taste or ease of administration, particularly for pediatric populations.

- Case Study: Suboxone (buprenorphine/naloxone). For years, Suboxone was available as a sublingual tablet for the treatment of opioid use disorder. Recognizing patient feedback about dissolution time and taste, the manufacturer, Indivior (formerly part of Reckitt Benckiser), developed a sublingual film version. This new formulation offered faster dissolution and, according to one study, was preferred by 80% of patients given a choice between the two.37 This seemingly minor change created a tangible patient benefit, helped defend the brand’s market share against generic tablets, and became the centerpiece of a controversial but commercially successful “product hopping” strategy.

Combination Products

Another powerful R&D strategy is to combine your drug with one or more other complementary medications into a single, fixed-dose combination (FDC) product. This can create a new, patentable entity that offers significant advantages, such as simplifying complex treatment regimens (improving adherence), potentially enhancing efficacy through synergistic mechanisms, and reducing the pill burden for patients.3

- Case Study: Symbicort (budesonide/formoterol). AstraZeneca’s Symbicort is a classic example of a successful FDC. It combines an inhaled corticosteroid (ICS), budesonide, with a long-acting beta-agonist (LABA), formoterol, in a single inhaler for the treatment of asthma and COPD. This combination simplified treatment by eliminating the need for patients to use two separate inhalers, which was shown in clinical trials to improve outcomes.39 The convenience and efficacy of Symbicort helped it become a cornerstone of respiratory care and a multi-billion-dollar product, demonstrating the immense value that can be created by combining two known entities into a superior therapeutic solution.

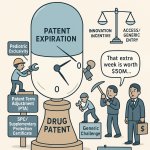

Pediatric Exclusivity

In the United States, the Best Pharmaceuticals for Children Act (BPCA) and the Pediatric Research Equity Act (PREA) provide a powerful incentive for manufacturers to study their drugs in children. By conducting specific pediatric studies requested by the FDA, a company can be granted an additional six months of market exclusivity. This extension applies to all existing patents and exclusivities for the drug, not just for the pediatric use. This is a win-win: it provides a significant financial reward for the company while helping to fill a critical data gap, as a vast number of drugs historically lacked adequate pediatric labeling.

The financial impact can be substantial. Eli Lilly’s blockbuster antidepressant Prozac, for example, gained an extra half-year of sales protection after the company completed pediatric trials, generating hundreds of millions in additional revenue before generics hit the market. Similarly, Pfizer strategically used pediatric studies for Revatio (sildenafil for pulmonary hypertension) to help extend the patent life of Viagra.

The Legal Fortress: Mastering Intellectual Property Strategy

While R&D creates new value, the legal and IP pillar is responsible for protecting it. An aggressive, forward-thinking IP strategy is the shield that defends your revenue stream from premature erosion. The initial composition-of-matter patent on the active molecule is merely the first brick in what should become a formidable fortress of protection.

The Multi-Layered Patent Strategy

A robust late-stage IP strategy involves securing multiple, overlapping patents that cover every conceivable aspect of your product. The goal is to create a “web of protection” or a “legal labyrinth” that makes it exceedingly difficult, time-consuming, and expensive for a generic or biosimilar competitor to successfully challenge your exclusivity.14 Beyond the core molecule, this strategy involves filing for:

- Formulation Patents: Protecting the specific excipients, coatings, or delivery mechanisms used in your product.

- Method-of-Use Patents: Covering each new indication for which the drug is approved.27

- Process Patents: Protecting the unique methods used to manufacture the drug, which is especially critical for complex biologics.

- Dosage Regimen Patents: In some jurisdictions, protecting specific dosing schedules or treatment protocols.

Patent Term Extension (PTE) and Adjustment (PTA)

The nominal 20-year life of a patent begins at the time of filing, not at market launch. Given that drug development and regulatory review can consume 10-15 years of that term, the effective patent life is often much shorter. To compensate for these delays, U.S. patent law provides two crucial mechanisms for extending this period. Patent Term Extension (PTE) can restore a portion of the patent term lost during the FDA’s regulatory review process, while Patent Term Adjustment (PTA) can add time to compensate for certain delays caused by the U.S. Patent and Trademark Office (USPTO) during the patent examination process.27 These extensions can add up to five years of invaluable market exclusivity, and similar provisions, known as Supplementary Protection Certificates (SPCs), exist in Europe.45 Securing these extensions is a critical and standard part of late-stage IP strategy.

The Controversial World of “Patent Thickets”

The multi-layered patent strategy, when taken to its extreme, leads to the creation of a “patent thicket”—a dense, overlapping, and often impenetrable web of secondary patents on a single drug.47 These patents are often filed many years after the drug’s initial approval and can cover seemingly minor modifications, such as a new manufacturing process, a different crystalline form of the active ingredient, or the design of an injector pen.

- Case Study: Humira (adalimumab). AbbVie’s strategy for its mega-blockbuster Humira is the quintessential—and most controversial—example of a patent thicket. The original patent on the adalimumab molecule was set to expire in 2016. However, AbbVie built a fortress of secondary patents around the product. According to a landmark report by the Initiative for Medicines, Access & Knowledge (I-MAK), AbbVie filed a staggering 247 patent applications on Humira in the U.S. alone, with an incredible 89% of them filed after the drug was first approved by the FDA. This dense thicket effectively extended Humira’s U.S. market monopoly for an additional seven years, delaying the entry of biosimilars until 2023—long after they had launched in Europe. The economic impact was monumental. I-MAK’s analysis estimates that this delay cost the U.S. healthcare system an excess of $14.4 billion, while allowing AbbVie to earn an additional $114 billion in U.S. revenue during that seven-year period of extended exclusivity.49

The practice of building patent thickets is at the heart of the ethical debate surrounding LCM. Critics vehemently label it as “evergreening”—a cynical manipulation of the patent system designed to stifle competition, block patient access to more affordable medicines, and prioritize profits over true innovation.35 The pharmaceutical industry and its defenders, however, argue that these secondary patents protect legitimate, incremental inventions that improve the product’s safety, efficacy, or convenience for patients. They maintain that strong and broad IP protection is the essential incentive required to justify the massive, high-risk R&D investments needed to bring new medicines to light in the first place.48

| Patent Category | Description/Purpose | Example from Humira Portfolio | Year of Filing Range | |

| New Indications | Patents covering the use of Humira for new autoimmune diseases beyond the original rheumatoid arthritis indication. | Use of adalimumab to treat Crohn’s disease, ulcerative colitis, psoriasis, etc. | 2005 – 2018 | |

| Formulation | Patents on new formulations of the drug, such as citrate-free versions designed to reduce injection site pain and improve patient experience. | High-concentration, low-volume, citrate-free formulations. | 2009 – 2016 | |

| Dosing Regimen | Patents on specific dosing schedules and frequencies for various indications. | Bi-weekly (every other week) subcutaneous injection schedule. | 2007 – 2015 | |

| Manufacturing Process | Patents protecting specific methods of producing the adalimumab monoclonal antibody, including cell culture and purification techniques. | Methods for producing and purifying recombinant human TNF-alpha antibodies. | 2003 – 2017 | |

| Delivery Device | Patents on the design and mechanics of the auto-injector pen used to administer the drug. | Design of the “Humira Pen” for patient self-administration. | 2005 – 2014 | |

| Source: Analysis based on data from I-MAK reports and patent databases.47 | ||||

Commercial Levers for Sustained Growth

The commercial pillar of LCM focuses on innovative market strategies that can extend a brand’s life and open up new revenue streams, often by reaching new customer segments or creating new channels for access.

The Rx-to-OTC Switch

For certain drugs with a well-established safety profile and for conditions that consumers can reliably self-diagnose, switching from prescription (Rx) to over-the-counter (OTC) status is a powerful LCM strategy.3 An OTC switch can breathe new life into a mature brand, opening it up to a massive new consumer market and leveraging years of brand equity built during its prescription life. The U.S. OTC market alone is valued at over $36 billion, representing a significant commercial opportunity.

- Case Studies: Claritin & Prilosec. The switches of the allergy medication Claritin (loratadine) and the heartburn treatment Prilosec (omeprazole) are landmark examples of this strategy’s success. The Claritin switch in 2002 was a game-changer, single-handedly rejuvenating the entire OTC allergy category and expanding its buyer base by an astonishing 45% in its first year.55 Similarly, Prilosec OTC, backed by a massive marketing campaign, quickly became a top-selling product, with initial annual sales approaching $400 million.

However, the path to an OTC switch is neither simple nor guaranteed. The process is complex, costly, and requires extensive clinical data—including label comprehension studies, self-selection studies, and actual use studies—to convince the FDA that consumers can use the product safely and effectively without the supervision of a healthcare professional.58 Not all switches succeed commercially, and those that do face intense and immediate competition from lower-priced private-label (store brand) versions.54

Authorized Generics (AGs)

An Authorized Generic (AG) is a generic version of a branded drug that is marketed by the brand manufacturer itself or by a subsidiary company. It is the exact same product as the brand—same formulation, same manufacturing process—just sold under a different label and at a lower price. This strategy allows the brand company to enter and compete directly in the generic market, thereby retaining a significant portion of the revenue that would otherwise be lost entirely to independent generic competitors.

The key strategic advantage of an AG lies in its timing. Because it is the same approved drug, an AG does not require an Abbreviated New Drug Application (ANDA) and can be launched immediately upon patent expiry, bypassing the regulatory hurdles that other generics face. This allows the brand manufacturer to launch its AG simultaneously with the first independent generic challenger. This move can be devastating to the first-filer, as it immediately introduces price competition during their crucial 180-day exclusivity period, with studies showing it can reduce the first-filer’s profits during this window by 40% to 52%. Pfizer used this strategy with great effect to manage the generic entry for Viagra, launching its own AG through its Greenstone subsidiary to control the market transition.

Strategic Alliances: Co-Promotion and Co-Marketing

No company can be an expert in everything. Strategic alliances, such as co-promotion or co-marketing agreements, can be a powerful way to maximize a drug’s late-stage potential by leveraging a partner’s strengths.63 A co-promotion deal can expand your sales force reach into a new physician audience, provide access to a partner’s deep expertise in a specific therapeutic area, and share the significant costs and risks of commercialization. This is a particularly valuable strategy for smaller biotech companies with a promising late-stage asset but without the commercial infrastructure to launch it globally, or for established companies looking to enter a new, highly competitive market.

- Case Study: Lynparza (AstraZeneca & Merck). The global strategic oncology collaboration between AstraZeneca and Merck for the PARP inhibitor Lynparza is a masterclass in late-stage value maximization through partnership. In 2017, Merck agreed to pay AstraZeneca up to $8.5 billion in a landmark deal to jointly develop and commercialize Lynparza. The collaboration was a perfect strategic fit: it combined AstraZeneca’s deep scientific leadership in DNA Damage Response (DDR) pathways with Merck’s formidable global oncology development and commercialization expertise, particularly with its blockbuster immuno-oncology agent, Keytruda. The alliance dramatically expanded and accelerated Lynparza’s development program, exploring its potential not only as a monotherapy across a wider range of cancers (including breast, prostate, and pancreatic) but also as a critical backbone therapy in combination with immuno-oncology agents.65 This partnership transformed Lynparza from a promising but niche drug into a franchise-level asset, demonstrating how a well-structured late-stage alliance can unlock exponential value for both partners.

Ultimately, the most effective LCM strategies are not just multi-pronged; they are deeply integrated. A successful indication expansion (R&D) is immediately protected by a new method-of-use patent (Legal). This new, patent-protected indication then becomes a key part of the value story used to justify a premium or value-based price to payers (Commercial/Market Access). This creates a virtuous cycle where each strategic action reinforces the others. Developing a novel extended-release formulation without a clear IP strategy to protect it or a compelling value proposition for payers is a recipe for a poor return on investment. The goal is to build a strategic “moat” around your brand that is constructed from scientific, legal, and commercial bricks, creating a barrier to competition that is far more formidable than any single patent.

| Strategy | Primary Goal | Typical Timeline (Years) | Estimated Cost | Potential ROI | Key Risks | Payer Perception | |

| Indication Expansion | Increase patient population, new revenue stream | 3 – 7 | High | High | Clinical failure, regulatory rejection | Favorable (if unmet need) | |

| Reformulation | Improve compliance, patient preference, new patent | 2 – 4 | Medium | Medium-High | Bioequivalence failure, low patient uptake | Neutral to Favorable | |

| Combination Product | Enhance efficacy, simplify regimen, new patent | 4 – 8 | High | High | Clinical failure, complex development | Favorable | |

| Pediatric Exclusivity | Gain 6 months of market exclusivity (US) | 2 – 4 | Medium | High | Negative trial results (but exclusivity still granted) | Favorable | |

| Patent Thicket | Delay generic/biosimilar entry, extend monopoly | Ongoing | Medium (Legal Fees) | Very High | Antitrust litigation, reputational damage | Very Negative | |

| PTE / SPC | Recoup time lost in regulatory review | 1 – 2 (Application) | Low | Very High | Eligibility failure, calculation disputes | Neutral | |

| Rx-to-OTC Switch | Access new consumer market, extend brand life | 3 – 5 | High | Variable | Regulatory rejection, low consumer sales | Favorable (cost savings) | |

| Authorized Generic | Retain market share, pressure generic competitors | < 1 | Low | Medium | Cannibalization of brand sales | Favorable (lower price) | |

| Co-Promotion | Expand sales reach, share costs, access expertise | 1 – 2 (Deal) | Low (Deal Dependant) | Medium-High | Alliance mismanagement, strategic misalignment | Neutral | |

| Source: Synthesized from multiple sources detailing strategy costs, timelines, and market dynamics.3 | |||||||

Navigating the Global Regulatory Maze: FDA vs. EMA

Executing a global lifecycle management strategy requires navigating the distinct regulatory landscapes of the world’s two largest markets: the United States, governed by the Food and Drug Administration (FDA), and the European Union, overseen by the European Medicines Agency (EMA). While both agencies are committed to ensuring the safety and efficacy of medicines, their processes, timelines, and requirements for post-approval changes can differ significantly. Understanding these differences is critical for planning and executing a seamless global LCM campaign.

The table below provides a high-level comparison of the regulatory pathways for major lifecycle-extending changes in the US and EU. These changes, such as adding a new indication or introducing a new dosage form, are fundamental to many of the R&D strategies discussed previously.

| Feature | FDA (United States) | EMA (European Union) | |

| Primary Submission Type | Supplemental New Drug Application (sNDA). This is an application to make changes to an already approved NDA. | Line Extension Application or Type II Variation. The pathway depends on the significance of the change. | |

| Governing Regulation | 21 CFR Parts 210/211, various FDA guidances on sNDAs. | Commission Regulation (EC) No 1234/2008 (the “Variations Regulation”). | |

| Typical Scope | New indication, new dosage form, new strength, significant labeling changes, major manufacturing changes. | Changes to the active substance, strength, pharmaceutical form, or route of administration typically require a Line Extension. A new indication is often a Type II Variation. | |

| Triggers | Any significant change to the approved product that has the potential to affect its identity, strength, quality, purity, or potency. | Changes are formally classified. Major changes that fundamentally alter the marketing authorization are defined as Line Extensions in Annex I of the Variations Regulation. | |

| Pre-Submission Notice | Recommended, often through formal meetings (e.g., Type C meetings), but not a mandatory waiting period. | A formal 6-month advance notice of intent to submit a Line Extension is requested by the EMA for planning purposes. | |

| Review Timeline | Varies by supplement type. A Prior Approval Supplement (PAS) for a major change typically has a 4-6 month review clock. | A Line Extension application typically follows a 210-day review timetable, similar to an initial Marketing Authorisation Application (MAA). | |

| Outcome | Approval of the supplement, allowing the change to be implemented. The original NDA number is maintained. | A Line Extension results in the granting of a new, separate marketing authorisation under the same invented name. A Type II Variation amends the existing MA. | |

| Source: Analysis of regulatory guidance documents from the FDA and EMA.29 | |||

The key takeaway from this comparison is that while the scientific data requirements are often similar, the procedural and administrative pathways are distinct. A global LCM plan must account for these differences from the outset. For instance, the EMA’s request for a 6-month pre-submission notice for a line extension requires earlier planning and engagement than is typical for an FDA sNDA. Similarly, the fact that a line extension in the EU results in a new marketing authorisation has different administrative and legal implications than an sNDA approval in the US. A successful global strategy requires a regulatory team that is fluent in both languages and can orchestrate submissions in a coordinated, rather than sequential, manner to ensure timely approvals across key markets.

Step 4: Defending Value—Implementing Sophisticated Pricing and Market Access Strategies

As a drug enters the late stage of its lifecycle, the conversation with payers, providers, and health systems fundamentally changes. The focus shifts from the promise of innovation to the proof of sustained value. In an environment of increasing generic competition and intense budgetary pressure, simply having a well-known brand name is no longer enough to command a premium price. Step 4 is about proactively defending your product’s value through sophisticated pricing, reimbursement, and market access strategies that reframe the debate from the cost of the pill to the overall value it delivers to the healthcare system.

The Shift from Volume to Value: Embracing Value-Based Pricing

The traditional cost-plus or market-based pricing models are rapidly becoming obsolete, especially for mature drugs. Healthcare systems globally are pivoting towards Value-Based Pricing (VBP), a paradigm where the price of a drug is explicitly linked to the clinical and economic outcomes it delivers.70 For a late-stage product, this means being able to prove that its benefits—such as improved quality of life, reduced side effects, or better long-term outcomes—justify its price premium over a much cheaper generic alternative.

This concept is most powerfully operationalized through Value-Based Contracts (VBCs), also known as risk-sharing or outcomes-based agreements. These innovative arrangements directly tie reimbursement to the drug’s real-world performance. For example:

- An agreement could stipulate that a payer receives a larger rebate for patients taking a branded cholesterol-lowering drug if their LDL cholesterol does not fall below a certain threshold after six months.

- For an asthma medication, reimbursement could be linked to a reduction in exacerbations or hospital admissions within a patient population.

While these contracts are complex to design and implement—requiring robust data collection infrastructure and careful navigation of regulatory hurdles like the U.S. Medicaid Best Price rule—they represent the future of pharmaceutical reimbursement.72 They allow manufacturers to stand behind their product’s claims and share the risk with payers, building trust and defending market share based on performance.

Crafting the Value Story: Payer Engagement and HEOR

You cannot have a conversation about value without the evidence to back it up. This is the critical role of Health Economics and Outcomes Research (HEOR). HEOR is the discipline responsible for generating the data that demonstrates a drug’s economic value to the healthcare system.18 In the late stage, HEOR studies, often powered by the Real-World Evidence (RWE) discussed in Step 2, are the ammunition you need to make your case to payers.

This evidence must be packaged into a compelling and comprehensive value dossier and communicated through proactive and continuous engagement with payers and HTA bodies.3 The value story for a mature drug should highlight:

- Long-Term Clinical Benefits: Leveraging RWE to show sustained efficacy and safety over years of use.

- Superiority on Secondary Endpoints: Highlighting benefits in areas like patient-reported outcomes, quality of life, or convenience that generics cannot claim.

- Economic Advantages: Demonstrating through HEOR models and RWE that the use of your branded product leads to lower overall healthcare costs by reducing hospitalizations, avoiding costly adverse events, or improving patient productivity.

Navigating the Generic Onslaught: Strategic Pricing Dynamics

The entry of generics creates a new and intense pricing dynamic that must be managed strategically.

- Pre-LOE Strategy: In the 12-18 months leading up to patent expiry, some manufacturers have historically implemented significant price increases to maximize revenue before the cliff. However, this tactic can severely damage relationships with payers and is becoming less tenable in an era of increased price transparency and scrutiny. A more sustainable approach is to focus on demonstrating value to justify and maintain your premium price for as long as possible.

- Post-LOE Strategy: Once a generic enters the market, the brand manufacturer faces a critical strategic choice. Do you maintain a high price and focus on a smaller, brand-loyal segment of physicians and patients who are less price-sensitive? Or do you implement a significant price reduction to compete more directly with the generics? The decision to launch an Authorized Generic (as discussed in Step 3) is a key part of this calculus, as it allows the company to have it both ways: competing aggressively on price in the generic segment with the AG, while attempting to preserve a premium price for the original brand.

The strategic use of value-based contracts can fundamentally alter this dynamic. A VBC is not just a pricing tool; it is a powerful competitive defense mechanism against generics. A generic manufacturer competes on a single dimension: being bioequivalent and cheaper. A VBC allows the brand manufacturer to shift the competition to a completely different dimension: guaranteed outcomes.

Imagine a mature branded drug for a chronic condition that comes with a comprehensive patient support program, including nurse educators and an adherence monitoring app. The generic competitor offers only the pill. The brand manufacturer can approach a payer with a VBC that guarantees a certain level of patient adherence or a reduction in hospitalizations, with financial rebates if those targets are not met. This contract is built on the value of the entire “solution”—the drug plus the support services—which is demonstrated through RWE. The generic manufacturer, lacking the infrastructure to offer such a program, cannot make a similar guarantee.

This masterfully reframes the payer’s decision. It is no longer a simple choice between a high-priced pill and a low-priced pill. It becomes a choice between a low-priced pill with uncertain real-world outcomes and a premium-priced solution with a contractually guaranteed level of performance and a lower risk of high downstream costs. This is how you build a “value moat” that a simple generic cannot cross, transforming the conversation from the “price per pill” to the “total cost of care” and redefining value in a way that favors the incumbent brand long after the loss of exclusivity.

Step 5: Reinforcing the Brand—Optimizing Late-Stage Marketing and Communication

In the crowded and price-sensitive late-stage market, a drug’s brand is one of its most valuable and defensible assets. Years, often decades, of investment in building trust with physicians and familiarity with patients should not be abandoned at the first sign of generic competition. Step 5 is about evolving your marketing and communication strategy from one of growth and awareness to one of reinforcement, retention, and defense. The goal is to leverage your brand’s equity to create a “stickiness” that slows market share erosion and preserves a loyal base of prescribers and patients.

Evolving the Value Proposition for a Mature Product

The marketing narrative for a late-stage drug must pivot. The conversation is no longer about establishing novel efficacy; it’s about reinforcing the product’s enduring value and trusted place in the therapeutic landscape. The core message should shift to emphasize the unique strengths that only a mature, well-established brand can claim :

- A Proven Track Record: Highlight the millions of patient-years of experience and the extensive long-term safety data that new entrants lack.

- Real-World Effectiveness: Use the RWE generated in Step 2 to showcase the drug’s consistent performance across the diverse and complex patient populations seen in everyday clinical practice.

- Trust and Familiarity: Remind physicians of their years of positive experience with the product and its predictable outcomes.

This evolved value proposition should be deployed through highly targeted campaigns. The era of broad-based, “blockbuster” marketing is over. Instead, efforts should be focused on specific physician specialties, patient demographics, or clinical scenarios where the drug continues to offer a distinct advantage over alternatives.

The Power of Digital Engagement and Medical Education

In a mature market, maintaining mindshare is critical. A robust digital presence is essential for staying visible and relevant to both healthcare professionals (HCPs) and patients. This includes:

- Content Marketing and SEO: Developing valuable, educational content (e.g., articles on disease management, patient case studies) that is optimized for search engines ensures that HCPs and patients seeking information find your trusted brand first.

- Professional Social Media: Engaging with HCPs on professional platforms to share new data, highlight key publications, and participate in clinical discussions.

Beyond digital channels, investing in ongoing medical education is a powerful tool for reinforcing your drug’s role in established treatment guidelines. Sponsoring Continuing Medical Education (CME) courses, hosting webinars with key opinion leaders (KOLs), and providing detailed prescribing guides and decision support tools all serve to keep your product relevant and top-of-mind, even as newer competitors vie for attention.

Building a Moat of Trust: Patient Support and Reputation Management

Perhaps the most potent differentiator in the late stage is the value delivered “beyond the pill.” Generic manufacturers compete on price; brand manufacturers can compete on service and support. Developing or enhancing patient support programs is a critical investment in brand loyalty.3 These programs can include:

- Adherence Support: Mobile apps with medication reminders, educational materials, and access to nurse hotlines can significantly improve patient adherence and, consequently, real-world outcomes.

- Financial Assistance: Robust co-pay assistance programs can help mitigate the cost difference between the brand and the generic for commercially insured patients, removing a key barrier to retention.

- Disease Management Resources: Providing tools and information that help patients manage their overall condition, not just their medication, builds a deeper relationship and reinforces the brand’s commitment to patient well-being.

This must be coupled with active reputation management. In the digital age, a brand’s reputation is constantly being shaped in online forums, social media, and patient review sites. It is essential to actively monitor these channels, share positive patient testimonials, and respond promptly and transparently to any safety concerns or negative feedback to maintain the trust you have spent years building.

The strategic purpose of these late-stage marketing efforts is fundamentally different from that of early-stage marketing. Early-stage marketing is about driving rapid adoption and growth. Late-stage marketing is about creating inertia and building a defensive moat. The investment in patient support programs, medical education, and digital engagement is not just a marketing expense; it’s a strategic investment in building brand equity that creates a powerful “stickiness” effect.

Consider the decision-making process of a physician who has been prescribing your drug for 15 years. They are comfortable with its efficacy, familiar with its side effect profile, and have seen their patients benefit from the comprehensive support programs you provide. When a generic alternative becomes available, the incentive to switch is based almost entirely on a lower price. However, the physician must weigh that lower price against the uncertainty of a new manufacturer, the loss of the support programs their patients rely on, and the simple friction of changing an established prescribing habit. The higher the “activation energy” required to make that switch, the slower your market share will erode. This brand equity, built and reinforced through strategic late-stage marketing, becomes a tangible competitive asset that directly counters the primary value proposition of the generic, preserving revenue and profitability long after the patent cliff.

Step 6: The Agile Mindset—Monitoring, Adapting, and Iterating for Sustained Success

The pharmaceutical market is not a static battlefield; it is a dynamic and constantly evolving ecosystem. The strategies you develop in Steps 1 through 5 are not meant to be carved in stone. They are a starting point—a well-informed hypothesis about how to maximize your product’s value. Step 6 is the crucial, ongoing process of testing that hypothesis against reality. It is about creating a continuous feedback loop of monitoring, adapting, and iterating to ensure your strategy remains relevant and effective in the face of new competitors, shifting clinical practices, and changing patient needs.

Establishing and Tracking Key Performance Indicators (KPIs)

“What gets measured gets managed.” This old business adage is the core principle of this final step. Effective late-stage management requires a relentless focus on data. You must establish a robust dashboard of Key Performance Indicators (KPIs) that provides a real-time view of your product’s health and the effectiveness of your LCM initiatives. This dashboard should include a mix of leading and lagging indicators, such as:

- Commercial KPIs: Sales volume, revenue, market share (national, regional, and by prescriber segment), and gross-to-net adjustments.

- Patient KPIs: New prescriptions, refill rates, patient adherence and persistence rates, and utilization of patient support programs.

- HCP KPIs: Prescriber base (breadth and depth), physician satisfaction surveys, and engagement with medical education programs.

- Safety KPIs: Adverse event reporting rates and analysis of post-marketing safety data.

This data provides the essential feedback needed to assess whether your strategies are achieving their intended goals. Is the new formulation actually improving adherence? Is the value-based contract leading to preferential formulary placement? The KPIs provide the answers.

The Role of Predictive Analytics and AI in Post-Market Surveillance

In today’s data-rich environment, monitoring should go beyond tracking historical performance. The most sophisticated companies are leveraging predictive analytics and Artificial Intelligence (AI) to anticipate the future. By analyzing vast datasets, machine learning models can identify emerging trends and predict market shifts before they become obvious. This can help you:

- Anticipate the impact of a new competitor’s launch on your market share.

- Identify patient subgroups that are at high risk of non-adherence, allowing for proactive intervention.

- Forecast changes in treatment guidelines based on emerging clinical evidence.

Furthermore, AI is revolutionizing the field of pharmacovigilance. AI-powered tools can now scan millions of EHRs, social media posts, and medical literature to detect potential adverse event signals far faster and more comprehensively than traditional methods. This not only enhances patient safety and ensures regulatory compliance but also allows you to proactively manage your drug’s safety narrative and strengthen its long-term value proposition.

Fostering a Culture of Agility

Data and analytics are useless without a culture that is empowered to act on them. Sustained success in the late stage requires organizational agility—the ability to make smart, data-driven decisions quickly. This means breaking down the very functional silos that this six-step framework is designed to bridge. Cross-functional teams comprising representatives from commercial, medical, legal, and regulatory affairs should meet regularly to review the KPI dashboard and competitive intelligence.

This culture must also embrace a willingness to pivot. The market will inevitably throw curveballs. A new competitor may launch with an unexpectedly aggressive price. A major clinical trial may change the standard of care. Your RWE study may reveal a surprising finding. An agile organization does not rigidly stick to its initial plan in the face of new information. It is prepared to adjust its strategies dynamically. This could involve :

- Adjusting pricing or market access approaches.

- Updating marketing messages or reallocating resources between channels.

- Investing in new clinical trials or RWE studies to address an evidence gap.

- Exploring new partnership opportunities that have emerged.

This final step is not the end of the process; it is the engine that drives its continuous evolution. It functions as the “central nervous system” of the entire LCM framework. The insights generated through monitoring—for example, a sudden dip in market share in a key demographic—should directly trigger a re-evaluation in Step 1 (Market Analysis) and Step 2 (Product Evaluation). This new analysis then informs a strategic adjustment in Step 3 (Lifecycle Extension), Step 4 (Pricing), or Step 5 (Marketing).

This creates a strategic OODA loop—Observe, Orient, Decide, Act. In the fast-paced late-stage environment, the company that can execute this loop fastest and most intelligently will win. The rise of AI and predictive analytics will only accelerate the speed and precision of this cycle, making a deeply ingrained data and analytics capability a core and non-negotiable competitive advantage for any company seeking to master the art of the second act.

Conclusion: The Lifecycle is a Circle, Not a Line

The journey through the six steps of late-stage lifecycle management reveals a fundamental truth: the lifecycle of a successful pharmaceutical product is not a linear path that ends abruptly at a patent cliff. It is a continuous, iterative circle of innovation, protection, and adaptation. The end of one phase of a drug’s life is simply the beginning of the next, demanding a new level of strategic foresight, cross-functional integration, and relentless execution.

Success in this challenging environment is not achieved through a single “silver bullet” strategy. It is the product of a masterfully integrated campaign that weaves together the disparate threads of R&D innovation, legal fortification, commercial execution, and agile, data-driven adaptation. It requires developing a new indication while simultaneously crafting the method-of-use patent to protect it. It means using real-world evidence to prove the value that underpins an outcomes-based contract. It involves building a fortress of brand loyalty through patient support that can withstand the siege of low-cost generics.

The future of lifecycle management belongs to those organizations that can build these resilient, future-proof capabilities. It means embracing data and analytics not as a support function, but as the central nervous system of the commercial organization. It requires fostering a culture of radical collaboration that demolishes the silos between the lab coat, the briefcase, and the law book. And above all, it demands a mindset that never stops searching for new ways to create value—for patients who rely on proven medicines, for payers who must manage finite resources, and for the company that invested billions to bring that medicine to the world.

The ultimate goal of mastering this second act is to ensure that a valuable medicine’s contribution to healthcare does not end when its primary patent does. It is to transform the finite timeline of a patent into the enduring legacy of a trusted therapeutic solution.

“It is critical to plan from both a patent and regulatory perspective, while also embedding lifecycle management strategies early on in development. This integrated approach will help optimise long term value. The current patent cliff implications on pharma companies include loss of revenue and pricing pressures, however there are several opportunities for companies to focus on innovative therapies and re-defining their portfolio.”

**- Hannah Hans, Head of Pharma Strategic Intelligence at GlobalData **

Key Takeaways

- Start Early and Integrate: Effective late-stage LCM is not a last-minute defense. Planning should begin 3-5 years before patent expiry and must integrate R&D, commercial, legal, and regulatory strategies into a single, cohesive plan.

- Leverage Intelligence as a Weapon: Use advanced competitive intelligence, especially patent monitoring with tools like DrugPatentWatch, to anticipate competitor moves years in advance. Combine this with deep patient and physician insights to identify unmet needs and strategic opportunities.

- Build a Multi-Pillar Strategy: A robust LCM plan is built on three pillars: R&D (indication expansion, reformulation, combination products), Legal/IP (patent term extensions, multi-layered patenting, patent thickets), and Commercial (Rx-to-OTC switches, authorized generics, strategic alliances).

- Shift the Conversation to Value: In a market dominated by price pressure from generics, you must change the conversation from the cost of the pill to the total value of the solution. Use Real-World Evidence (RWE) and Health Economics and Outcomes Research (HEOR) to prove your mature brand’s long-term value and secure value-based contracts with payers.

- Invest in Brand Equity and “Stickiness”: Late-stage marketing should focus on retention and defense. Invest in “beyond the pill” services like patient support programs and ongoing medical education to build brand loyalty and create a “stickiness” that slows market share erosion.

- Embrace Agility and Data: The late-stage market is dynamic. Continuously monitor KPIs and use predictive analytics to anticipate changes. Foster an agile culture that can make data-driven decisions and pivot strategies quickly to respond to new threats and opportunities.

Frequently Asked Questions (FAQ)

1. How early is “too early” to start late-stage lifecycle management planning?

There is no such thing as “too early.” The most successful companies embed LCM thinking into their initial commercialization strategy, even before a drug is launched.4 Key decisions made during Phase III clinical trials—such as the endpoints chosen and the patient populations studied—have profound implications for future LCM options like indication expansion or demonstrating value to payers. Formal, dedicated late-stage planning should begin in earnest at least 3-5 years before the primary patent expires to allow enough time to execute complex, long-timeline strategies like developing a new formulation or conducting trials for a new indication.

2. What is the single biggest mistake companies make in managing the patent cliff?

The biggest mistake is a failure of integration, often manifesting as a “wait-and-see” approach. Many organizations still operate in functional silos, where the R&D team works on a new formulation, the legal team manages patents, and the commercial team prepares for generic entry, all as separate workstreams. This lack of a unified, cross-functional strategy leads to missed opportunities and suboptimal outcomes. For example, a new formulation might be developed without considering what patent claims are defensible or what evidence payers will require to grant it preferred status. The most successful LCM strategies are holistic, where every action is part of a single, integrated playbook.

3. How has the Inflation Reduction Act (IRA) changed the calculus for LCM strategies in the US?

The IRA has significantly changed the LCM landscape by introducing Medicare price negotiations after a set period of market exclusivity (9 years for small molecules, 13 years for biologics). This effectively shortens the “high-revenue” phase of a drug’s lifecycle, a phenomenon McKinsey calls “life cycle compression”. This has several major implications:

- Increased Urgency: The timeline to maximize ROI is now shorter, placing greater pressure on launching effectively and executing LCM strategies faster.

- Prioritization of Biologics: The longer exclusivity period for biologics may incentivize companies to prioritize their development over small molecules.

- Focus on High-Impact LCM: Strategies that can be executed within the pre-negotiation window (e.g., securing key new indications early) become more valuable. Long-term strategies that pay off after negotiations begin may be de-prioritized.

- Greater Need for Value Demonstration: The negotiation process will be heavily reliant on evidence of comparative effectiveness and value. This elevates the importance of generating robust RWE and HEOR data early and continuously.

4. For a smaller biotech company with one main asset, which LCM strategies offer the best ROI with limited capital?

Smaller biotechs must be highly strategic and capital-efficient. The highest ROI strategies for them often involve leveraging existing data and partnerships:

- Indication Expansion in Orphan Diseases: Targeting a new rare disease indication can be a powerful strategy. Development pathways can be faster, clinical trials smaller, and regulatory incentives like Orphan Drug Exclusivity (7 years in the US) can provide significant protection.

- Pediatric Exclusivity: If scientifically and ethically appropriate, conducting pediatric studies to gain an extra 6 months of exclusivity is a very high-ROI activity, as the financial return can be massive compared to the cost of the trials.

- Strategic Partnerships/Co-Promotion: Instead of building a large commercial infrastructure, partnering with a larger pharmaceutical company for co-promotion or out-licensing commercial rights can provide an immediate infusion of non-dilutive capital and access to a global sales force, maximizing the asset’s reach without massive upfront investment.

- Data-Driven Repurposing: Using computational and AI-driven methods to screen for new indications based on the drug’s mechanism of action can identify high-probability opportunities before committing to expensive clinical trials.

5. What is the role of the Patent Trial and Appeal Board (PTAB) in challenging the “patent thickets” used in LCM?

The Patent Trial and Appeal Board (PTAB) was created by the America Invents Act (AIA) in 2011 as a tribunal within the USPTO to provide a faster, less expensive alternative to federal court for challenging the validity of issued patents. Its primary proceedings are Inter Partes Review (IPR).

- Role in Challenging Thickets: Generic and biosimilar manufacturers can use the IPR process to challenge the validity of the secondary patents that make up a “patent thicket.” Because the PTAB uses a lower standard of proof (“preponderance of the evidence”) than federal courts (“clear and convincing evidence”) and is generally faster and cheaper, it has become a popular venue for challengers.

- Arguments For its Use: Proponents argue that the PTAB is a crucial tool for “improving patent quality” by weeding out weak or “obvious” secondary patents that should not have been granted. This helps clear the path for generic competition, which can lower drug prices for consumers.

- Arguments Against its Use (from Innovators): The innovative pharmaceutical industry has been critical of the PTAB, sometimes labeling it a “patent death squad”. They argue that it creates uncertainty for patent rights, discourages investment in innovation, and is unfair to patent holders who must defend their patents before the same agency that granted them. Some also point to instances where financial entities have used the PTAB process to challenge patents with the goal of shorting a company’s stock, rather than to bring a generic to market.

References

- The Patent Cliff: From Threat to Competitive Advantage – Esko, accessed July 27, 2025, https://www.esko.com/en/blog/patent-cliff-from-threat-to-competitive-advantage

- Viagra’s Generic Cliff: Why It Wasn’t a Free-for-All – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/viagra-a-complicated-case-study-of-generic-drug-market-entry-in-the-united-states/

- 6 Steps to Effective Late-Stage Lifecycle Drug Management – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/6-steps-to-effective-late-stage-lifecycle-drug-management/

- Ultimate Guide to Pharmaceutical Product Life Cycle Management (PLM) – TikaMobile, accessed July 27, 2025, https://www.tikamobile.com/resources/blog/ultimate-guide-to-pharmaceutical-product-life-cycle-management

- Winning Management Strategies For Early And Late-Stage Drug Development, accessed July 27, 2025, https://www.lifescienceleader.com/doc/winning-management-strategies-for-early-and-late-stage-drug-development-0001

- Managing Pharmaceutical Projects – Top 10 Best Practice Tips – Mission Control, accessed July 27, 2025, https://aprika.com/managing-pharmaceutical-projects-top-10-best-practice-tips/

- Understanding the Pharmaceutical Commercialization Lifecycle – TJP Agency, accessed July 27, 2025, https://tjpagency.com/blog/pharmaceutical-commercialization

- Simplification for success: Rewiring the biopharma operating model …, accessed July 27, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/simplification-for-success-rewiring-the-biopharma-operating-model

- Charting the path to patients: Optimizing drug pipelines | McKinsey, accessed July 27, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/charting-the-path-to-patients

- How to Track Competitor R&D Pipelines Through Drug Patent …, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/how-to-track-competitor-rd-pipelines-through-drug-patent-filings/

- Maximizing ROI on Drug Development by Monitoring Competitive Patent Portfolios, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/maximizing-roi-on-drug-development-by-monitoring-competitive-patent-portfolios/

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed July 27, 2025, https://crozdesk.com/software/drugpatentwatch

- DrugPatentWatch Highlights 5 Strategies for Generic Drug Manufacturers to Succeed Post-Patent Expiration – GeneOnline News, accessed July 27, 2025, https://www.geneonline.com/drugpatentwatch-highlights-5-strategies-for-generic-drug-manufacturers-to-succeed-post-patent-expiration/

- Filing Strategies for Maximizing Pharma Patents: A Comprehensive Guide for Business Professionals – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/filing-strategies-for-maximizing-pharma-patents/

- Why incorporating patients’ perspectives matters – PhRMA, accessed July 27, 2025, https://phrma.org/blog/why-incorporating-patients-perspectives-matters

- How rare disease drug developers can engage with patient advocacy groups – Parexel, accessed July 27, 2025, https://www.parexel.com/insights/new-medicines-novel-insights/advancing-rare-disease-drug-development/study-design-and-execution-rare-diseases/how-rare-disease-drug-developers-can-engage-patient-advocacy-groups

- The Complete Guide to Pharma Product Lifecycle: From Discovery to Market Success, accessed July 27, 2025, https://synergbiopharma.com/pharma-product-lifecycle/

- Late-stage clinical development – Voisin Consulting, accessed July 27, 2025, https://voisinconsulting.com/solutions/late-stage-solutions/

- The Importance of Real-World Evidence in Medical Research and Drug Development, accessed July 27, 2025, https://www.appliedclinicaltrialsonline.com/view/real-world-evidence-medical-research-drug-development

- Real-World Evidence: Bridging Gaps in Evidence to Guide Payer …, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7895868/

- Solving the Real-World Evidence Challenge for US Payers: A Call to Action for Pharma, accessed July 27, 2025, https://www.ispor.org/publications/journals/value-outcomes-spotlight/vos-archives/issue/view/growing-rates-of-obesity/solving-the-real-world-evidence-challenge-for-us-payers–a-call-to-action-for-pharma

- Real-world evidence: From activity to impact in healthcare decision making | McKinsey, accessed July 27, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/real-world-evidence-from-activity-to-impact-in-healthcare-decision-making

- Computational Drug Repurposing: Approaches and Case Studies – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/computational-drug-repurposing-approaches-and-case-studies/

- Pharmaceutical Lifecycle Extension Strategies – Content Delivery Network (CDN), accessed July 27, 2025, https://cpb-us-e1.wpmucdn.com/sites.psu.edu/dist/5/7386/files/2013/10/Kappe_11-Pharmaceutical-Lifecycle-Extension-Strategies.pdf

- Pharmaceutical Lifecycle Extension Strategies | Request PDF – ResearchGate, accessed July 27, 2025, https://www.researchgate.net/publication/278655296_Pharmaceutical_Lifecycle_Extension_Strategies

- Managing the challenges of pharmaceutical patent expiry: a case study of Lipitor, accessed July 27, 2025, https://www.researchgate.net/publication/309540780_Managing_the_challenges_of_pharmaceutical_patent_expiry_a_case_study_of_Lipitor

- Pharmaceutical Life Cycle Management | Torrey Pines Law Group®, accessed July 27, 2025, https://torreypineslaw.com/pharmaceutical-lifecycle-management.html

- Drug Repurposing Strategies, Challenges and Successes | Technology Networks, accessed July 27, 2025, https://www.technologynetworks.com/drug-discovery/articles/drug-repurposing-strategies-challenges-and-successes-384263

- What is Supplemental New Drug Application (sNDA)? – DDReg, accessed July 27, 2025, https://www.ddregpharma.com/what-is-supplemental-new-drug-application

- Supplemental New Drug Application (sNDA) – MMRF, accessed July 27, 2025, https://themmrf.org/glossary/supplemental-new-drug-application-snda/

- sNDA – All About Drugs, accessed July 27, 2025, https://www.allfordrugs.com/snda/

- Extensions of marketing authorisations: questions and answers | European Medicines Agency (EMA), accessed July 27, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/post-authorisation/variations-including-extensions-marketing-authorisations/extensions-marketing-authorisations-questions-answers

- Approval success rates of drug candidates based on target, action, modality, application, and their combinations – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8212735/

- What Viagra tells us about sustainability and repurposing – Maynooth University, accessed July 27, 2025, https://www.maynoothuniversity.ie/research/spotlight-research/what-viagra-tells-us-about-sustainability-and-repurposing

- What is the process of expanding a drug patent by changing the molecule (or formulation etc.) called again? – Patsnap Synapse, accessed July 27, 2025, https://synapse.patsnap.com/article/what-is-the-process-of-expanding-a-drug-patent-by-changing-the-molecule-or-formulation-etc-called-again

- Innovative Approaches to Extend the Life of Drug Patents – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/innovative-approaches-to-extend-the-life-of-drug-patents/

- Buprenorphine-Naloxone Film Versus Tablets for Opioid Use Disorder – NCBI Bookshelf, accessed July 27, 2025, https://www.ncbi.nlm.nih.gov/books/NBK599974/

- Suboxone Film Vs Tablet [2025 Guide] – TruLaw, accessed July 27, 2025, https://trulaw.com/suboxone-tooth-decay-lawsuit/suboxone-film-vs-tablet/

- Asthma Clinical Trial Data for SYMBICORT® (budesonide/formoterol fumarate dihydrate) Inhalation Aerosol, accessed July 27, 2025, https://www.symbicorttouchpoints.com/asthma-clinical-trials.html

- Real-Life Clinical Use of Symbicort® Maintenance and Reliever Therapy for Asthmatic Patients in Korea, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5705489/

- The Revolution in Pediatric Drug Development and Drug Use: Therapeutic Orphans No More – PubMed Central, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7541025/

- How Drug Life-Cycle Management Patent Strategies May Impact …, accessed July 27, 2025, https://www.ajmc.com/view/a636-article

- Drug Patent Life: The Complete Guide to Pharmaceutical Patent Duration and Market Exclusivity – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/how-long-do-drug-patents-last/

- Small Business Assistance: Frequently Asked Questions on the Patent Term Restoration Program | FDA, accessed July 27, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/small-business-assistance-frequently-asked-questions-patent-term-restoration-program

- EXTENDING THE LIFE OF A PATENT IN THE UNITED STATES, accessed July 27, 2025, https://www.oblon.com/A11960/assets/files/News/125.pdf

- How to Extend the Life of Biopharmaceutical Patents – PatentPC, accessed July 27, 2025, https://patentpc.com/blog/how-to-extend-the-life-of-biopharmaceutical-patents

- The Dark Reality of Drug Patent Thickets: Innovation or Exploitation? – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/the-dark-reality-of-drug-patent-thickets-innovation-or-exploitation/

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed July 27, 2025, https://www.congress.gov/crs-product/R46679

- Humira – I-MAK, accessed July 27, 2025, https://www.i-mak.org/wp-content/uploads/2021/09/i-mak.humira.report.3.final-REVISED-2021-09-22.pdf

- The Connection Between Patents and High Drug Prices – Politico, accessed July 27, 2025, https://www.politico.com/sponsored/2024/12/the-connection-between-patents-and-high-drug-prices/

- DOSE OF REALITY: I-MAK REPORT FINDS BIG PHARMA’S …, accessed July 27, 2025, https://www.csrxp.org/dose-of-reality-i-mak-report-finds-big-pharmas-patent-abuse-will-generate-billions-of-dollars-for-manufacturers-while-delaying-competition/

- Drug Patents: How Pharmaceutical IP Incentivizes Innovation and Affects Pricing, accessed July 27, 2025, https://www.als.net/news/drug-patents/