The Patent Cliff Ecosystem: Strategic Maneuvers, Regulatory Realities, and the Economics of Loss of Exclusivity

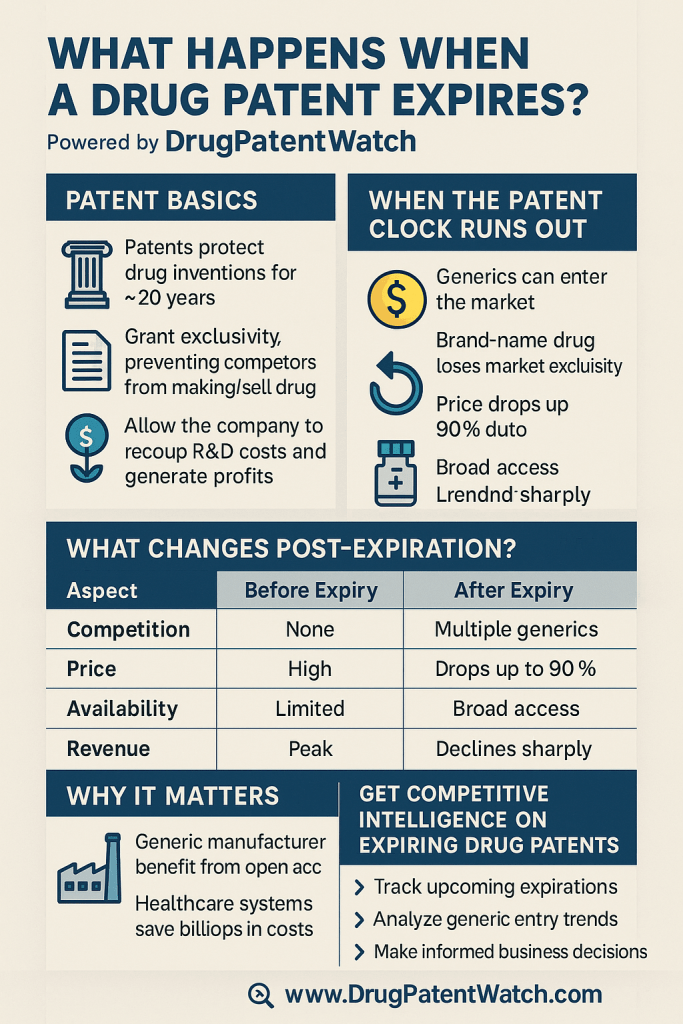

The pharmaceutical industry operates on a biological and economic clock unlike any other sector in the global economy. In technology, obsolescence is driven by innovation; a faster chip or a sharper screen renders the predecessor irrelevant. In pharmaceuticals, relevance is governed not by the diminishing utility of the molecule—Lipitor is as effective at lowering cholesterol today as it was in 2005—but by a rigid, statutory countdown: the patent term. When that clock runs out, the resulting event is rarely a gentle transition. It is a seismic shift known as the “patent cliff,” a moment where market exclusivity evaporates, and the mechanics of free-market competition, often suppressed for two decades by a lattice of intellectual property protections, come rushing in with devastating speed and efficiency.

For the uninitiated observer, a patent expiration appears to be a simple calendar date, a line in a spreadsheet marking the end of a monopoly. For the pharmaceutical executive, the intellectual property (IP) attorney, and the institutional investor, it is the fulcrum upon which billions of dollars in enterprise value pivot. It is a war of attrition fought in federal district courts, a regulatory labyrinth within the U.S. Food and Drug Administration (FDA), and a high-stakes negotiation with Pharmacy Benefit Managers (PBMs) who control the gateways to patient access.

The sheer magnitude of this transition cannot be overstated. Industry analysts are currently bracing for a patent cliff of “tectonic magnitude” between 2025 and 2030, a period that will see an estimated $200 billion to $300 billion in annual branded drug sales put at risk globally.1 This wave of expirations will impact approximately 190 drugs, including 69 “blockbusters”—products with over $1 billion in annual sales.1 This creates a dual reality in the marketplace: a crisis of revenue replacement for innovator companies who must desperately refill their pipelines, and a simultaneous gold rush for generic and biosimilar manufacturers poised to capture market share through price arbitrage.

However, the modern patent cliff is no longer a simple drop. It has evolved into a complex ecosystem of legal defenses, regulatory exclusivities, and market access barriers. The transition from monopoly to competition is now governed by “patent thickets,” “rebate walls,” and “at-risk” launches—nuanced mechanisms that can either delay the cliff or accelerate the fall. To navigate this landscape requires more than a calendar; it requires a deep understanding of the interplay between the Hatch-Waxman Act, the Biologics Price Competition and Innovation Act (BPCIA), and the emerging pressures of the Inflation Reduction Act (IRA).

The Regulatory Architecture: Rules of Engagement

To understand the commercial violence of a patent expiry, one must first dissect the rules of engagement established by the legislative frameworks that define the U.S. and global pharmaceutical markets. These laws created the “grand bargain” of the modern pharmaceutical economy: a period of guaranteed monopoly to incentivize the immense risk of R&D, followed by a mechanism for rapid, low-cost competition to benefit the public health.2

Small Molecules and the Hatch-Waxman Framework

For small-molecule drugs—synthesized chemicals like atorvastatin (Lipitor) or fluoxetine (Prozac)—the foundational statute is the Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act. Before 1984, generic manufacturers essentially had to repeat the safety and efficacy trials of the innovator, a cost-prohibitive barrier that left many off-patent drugs without generic competition. Hatch-Waxman established the Abbreviated New Drug Application (ANDA), a pathway that allows generic manufacturers to rely on the safety and efficacy findings of the Reference Listed Drug (RLD), provided they can demonstrate bioequivalence in the bloodstream.3

The genius—and the chaos—of Hatch-Waxman lies in the Paragraph IV certification. This is not merely a regulatory filing; it is a legal trigger mechanism. When a generic company files an ANDA with a Paragraph IV certification, they are asserting that the brand’s patents listed in the FDA’s “Orange Book” are either invalid, unenforceable, or will not be infringed by the generic product.5 This filing is effectively a declaration of commercial war. It allows the generic to challenge patents before they naturally expire, seeking to enter the market early.

The 30-Month Stay and the 180-Day Prize

The statute creates a unique litigation cadence. If the brand manufacturer sues the generic applicant within 45 days of receiving the Paragraph IV notice, the FDA is automatically barred from approving the generic ANDA for 30 months.5 This “30-month stay” buys the innovator precious time to litigate the patent validity without facing immediate competition. It is a statutory injunction that preserves the status quo while the courts deliberate.

However, the generic challenger is incentivized by a massive financial carrot: the 180-day exclusivity period. The first generic company to successfully file a Paragraph IV ANDA (the “first-to-file”) is granted six months of market exclusivity against other generics.7 During this window, the market is a duopoly consisting only of the brand and the first generic. This period is where the bulk of generic profits are made—often funding the company’s entire legal budget for years to come. The value of this exclusivity is so high that it creates a “race to the courthouse,” where generic firms constantly monitor patent listings to be the first to challenge.9

Biologics and the BPCIA: The “Patent Dance”

Biologics—large, complex molecules derived from living cells, such as monoclonal antibodies like Humira (adalimumab) or Keytruda (pembrolizumab)—are governed by a different set of rules: the Biologics Price Competition and Innovation Act (BPCIA) of 2010. Because these drugs are grown in living systems, they cannot be identically replicated, only “highly similar.” Thus, the follow-on products are termed “biosimilars,” not generics.3

The BPCIA introduced a distinct litigation protocol known as the “Patent Dance.” Unlike the public listing of patents in the Orange Book for small molecules, biologics utilize a private information exchange.5 The biosimilar applicant and the reference product sponsor (the innovator) exchange lists of patents and detailed contentions in a structured, pre-litigation ritual mandated by statute. This process is designed to streamline the identification of relevant patents, but in practice, it often serves as an early reconnaissance phase for the sprawling patent litigation that follows.

Industry Insight: “The differences in legal and regulatory structure arise because biosimilar manufacturers cannot make an identical copy of the innovator biologics. These differences have a substantial impact on biosimilar approval requirements, patent and regulatory exclusivity provisions, and market dynamics.” 3

Crucially, the BPCIA lacks the automatic 30-month stay found in Hatch-Waxman.5 If an innovator wants to stop a biosimilar launch, they must seek a preliminary injunction in federal court. This raises the evidentiary bar significantly; the innovator must prove they are likely to succeed on the merits and will suffer irreparable harm, a much harder standard than the automatic stay provided to small molecules.

Global Divergence: The European Perspective

While the U.S. relies on this adversarial litigation system, the European Union operates under a centralized procedure via the European Medicines Agency (EMA). The patent linkage in Europe is less direct; marketing authorization by the EMA generally does not depend on the patent status of the originator to the same degree as the FDA’s “approval stay” mechanism.10

A critical divergence in recent years has been the EU’s introduction of the Supplementary Protection Certificate (SPC) manufacturing waiver. In the EU, SPCs extend patent protection to compensate for regulatory delays, similar to Patent Term Extensions in the U.S. However, Regulation (EU) 2019/933 introduced a waiver allowing EU-based generic and biosimilar manufacturers to produce SPC-protected medicines during the exclusivity period, provided the production is for export to non-EU countries where protection has expired, or for stockpiling during the final six months of the SPC to ensure a “Day 1” launch in the EU.11 This regulation was designed to level the playing field for European manufacturers against competitors in countries without SPC regimes (like China or India), preventing the offshoring of pharmaceutical manufacturing.

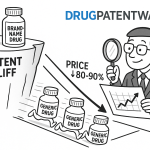

The Economics of Erosion: Cliffs vs. Slopes

The term “patent cliff” is most accurate for small-molecule drugs. The erosion curve following the Loss of Exclusivity (LOE) for a pill is precipitous, brutal, and algorithmic. For biologics, however, the erosion resembles a “slope”—a gradual decline tempered by manufacturing complexity and physician hesitation.

The Small Molecule Freefall

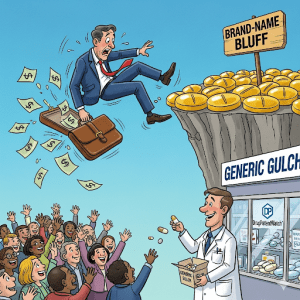

When a small-molecule blockbuster loses protection, the market reacts with ruthless efficiency. The mechanics of this erosion are driven by pharmacy economics and state substitution laws.

- The Power of N: Decades of data reveal that the single most critical variable dictating price erosion is the number of generic competitors ($N$). With just two competitors, the price drops by roughly 50%. As the number of competitors grows to six or more, the price collapses to 95% below the brand price.13 In large markets, the entry of 10+ competitors drives prices down by 70-80% relative to the pre-entry price within just a few years.14

- Automatic Substitution: In the United States, state laws empower (and often mandate) pharmacists to automatically substitute an “AB-rated” generic for the brand-name drug.15 This substitution happens at the pharmacy counter, often without the patient or prescribing physician needing to intervene.

- The Pharmacy Incentive: Pharmacies make significantly higher profit margins on generic drugs than on branded drugs. While the revenue per script is lower, the margin is higher. A study indicated that gross generic margins for pharmacies averaged 42.7%, compared to a meager 3.5% for brand-name drugs.16 This creates a powerful financial incentive for the dispenser to switch the patient immediately upon LOE, driving the brand’s market share into single digits within weeks.

The Biologic Slope and the “Interchangeability” Hurdle

Biologics face a different commercial reality. The manufacturing barriers to entry are higher—building a biologic manufacturing facility costs hundreds of millions, compared to a fraction of that for small molecules—limiting the number of entrants.3 Consequently, the price erosion is less severe.

- Price Floor: Biosimilars typically bottom out at 50-70% of the brand price, rather than the 5-10% seen with generics.15

- Adoption Lag: Because biosimilars are not identical, they have historically not been automatically substitutable at the pharmacy level. They required a specific FDA designation of “interchangeability,” which until recently required costly “switching studies” to prove that a patient could alternate between the brand and the biosimilar without loss of efficacy.17 Without this designation, a biosimilar acts more like a branded competitor; it must be specifically prescribed, or the payer must intervene to force the switch.

- Market Share Dynamics: While small molecules lose 90% of their volume in months, biologics might retain significant share for years. However, this is changing. Recent data on Humira biosimilars shows that while uptake was initially slow (1% share in 2023), aggressive payer formulary changes drove share to over 14% in 2024, with projections to overtake the brand in 2025.18

Table 1: Market Dynamics Post-LOE: Small Molecule vs. Biologic

| Characteristic | Small Molecule (Generic) | Biologic (Biosimilar) |

| Erosion Shape | “Cliff” (Vertical Drop) | “Slope” (Gradual Decline) |

| Price Decay | Bottoms out at ~5-10% of brand price | Bottoms out at ~50-70% of brand price |

| Typical Competitor Count | High (often 10+) | Low to Moderate (2-5 typical) |

| Primary Driver of Uptake | Pharmacy Auto-Substitution | Payer Formulary Status / Rebates |

| Primary Innovator Defense | Authorized Generics | “Rebate Walls” / Patent Thickets |

| Time to 90% Volume Erosion | Weeks/Months | Years (historically) |

| Pharmacy Margin Incentive | High (over 40% margin) | Variable (driven by rebates/fees) |

Source: Adapted from DrugPatentWatch analysis and market data.14

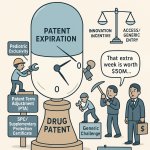

The Innovator’s Arsenal: Strategies to Extend Monopoly

Pharmaceutical companies do not go gently into that good night. Faced with the expiration of their primary assets, they employ sophisticated lifecycle management strategies—often termed “evergreening”—to extend exclusivity beyond the standard 20-year patent term. These strategies are legally complex, commercially aggressive, and increasingly the subject of antitrust scrutiny.

1. The Patent Thicket

This strategy involves filing dozens, sometimes hundreds, of patents on minor variations of the drug—formulations, manufacturing processes, dosing regimens, and delivery devices. This creates a dense web of IP that competitors must slash through, one patent at a time.

- The Humira Masterclass: AbbVie created the definitive “patent thicket” around Humira (adalimumab). While the primary composition of matter patent expired in 2016, AbbVie accumulated over 130 patents covering formulation and manufacturing.20 This thicket was so dense that it delayed biosimilar entry in the U.S. until 2023, seven years after the primary patent expiry. By settling with biosimilar challengers and granting them licenses to enter in 2023, AbbVie effectively bought itself seven additional years of monopoly revenue on the world’s best-selling drug—generating tens of billions in “excess” revenue.21

- Duplication: Research suggests that many of these thickets are built on “duplicative” patents—continuation patents that cover essentially the same subject matter as the parent patent but extend the timeline or tweak the claims just enough to create a new legal hurdle.23

2. Product Hopping

“Product hopping” occurs when an innovator reformulates a drug slightly—for example, moving from a twice-daily tablet to a once-daily extended-release capsule—and then aggressively switches patients to the new version before the old one goes generic. Ideally, they withdraw the old version from the market entirely.

- The Namenda Precedent: A classic example involved Allergan’s Alzheimer’s drug, Namenda. As the patent for the immediate-release (IR) version neared expiration, Allergan introduced Namenda XR (extended release) and attempted to withdraw the IR version from the market. The goal was to force patients onto the patent-protected XR version, so that when generic Namenda IR launched, there would be no market left for it to substitute against.24 This “forced switch” was challenged in New York ex rel. Schneiderman v. Actavis PLC, establishing that such hard switches could violate antitrust laws if they coerced consumer choice without clinical benefit.25

- Subtler Hops: More subtle versions involve changing dosage forms, such as moving from a capsule to a tablet, or a tablet to a film. Since state substitution laws often require the generic to be the exact same dosage form, this small change can effectively block automatic substitution at the pharmacy counter.24

3. The Authorized Generic (AG)

An Authorized Generic is a brand-name drug sold without the brand label, often by the innovator itself or a third-party licensee. It is chemically identical to the brand because it is the brand, manufactured on the same lines.

- Scorched Earth Tactics: Innovators often launch an AG at the exact moment the first true generic enters the market—specifically during the generic’s 180-day exclusivity period. By injecting a second “generic” (the AG) into this duopoly window, the innovator destroys the generic challenger’s pricing power. Data shows that the presence of an AG reduces the generic price by an additional 13% to 18%, significantly blunting the profit windfall for the generic company.26

- Strategic Deterrence: The goal is not just to capture some generic revenue, but to reduce the “bounty” for challenging patents. If generic companies know an AG will launch and ruin their exclusivity profits, they may be less likely to spend millions challenging patents in the first place.9 Statistics indicate that 70% of AGs are launched during this critical 180-day window.27

4. The “Volume-Limited” Settlement (Revlimid Case Study)

A sophisticated evolution of the “pay-for-delay” settlement is the volume-limited license. Instead of a complete block or a full entry, the brand allows the generic to enter early, but only for a tiny slice of the market.

- Bristol Myers Squibb & Revlimid: The primary patent for the cancer drug Revlimid expired in 2019. However, through a dense thicket of patents and aggressive litigation, BMS settled with generic makers like Natco and Teva. The settlement allowed them to launch in 2022, but with a catch: they were strictly limited to a low single-digit percentage of the total volume. This volume cap increases gradually until 2026, when full unlimited entry is permitted.28

- Economic Impact: This strategy allowed BMS to maintain high prices and the vast majority of market share for years after the primary patent expiry. It created an illusion of competition while preserving the monopoly economics. Critics argue this effectively extended the exclusivity by nearly seven years beyond the API patent expiration.28

The Challenger’s Gambit: Breaking the Monopoly

For generic and biosimilar companies, the patent cliff is an opportunity that must be seized aggressively, often at great financial risk. The strategies employed by challengers are the mirror image of the innovators’ defenses.

Paragraph IV and “At-Risk” Launches

Filing a Paragraph IV certification is standard operating procedure, but the decision to launch “at risk” is the nuclear option of pharmaceutical strategy. An at-risk launch occurs when a generic company receives FDA approval and launches its product while patent litigation is still ongoing in the courts.30

- The Risk: If the generic company ultimately loses the patent case after launching, they are not just liable for the innovator’s lost profits—they can be liable for treble damages (triple the damages) if the infringement is found to be willful. Given that blockbuster drugs generate billions, the potential damages can bankrupt a company.30

- The Protonix Cautionary Tale: The industry still shudders at the memory of Teva and Sun Pharma’s at-risk launch of generic Protonix (pantoprazole). After launching in 2007, they fought a protracted legal battle with Pfizer/Wyeth. Years later, a jury found the patent valid. The resulting settlement cost Teva and Sun $2.15 billion.31 This massive penalty chilled at-risk launches for a decade.

The 2024/2025 Resurgence: Amgen vs. Regeneron

Despite the Protonix scars, 2024 has seen a resurgence of aggressive launch tactics, particularly in biosimilars where the stakes—and the confidence in IP weakness—are high.

- Eylea (aflibercept) Showdown: Regeneron’s eye drug Eylea is a massive target. In 2024, Amgen received FDA approval for its biosimilar, Pavblu. Despite ongoing litigation regarding Regeneron’s secondary patents (covering formulation buffers), Amgen proceeded with an at-risk launch in late 2024 after a court denied Regeneron’s request for a preliminary injunction.32

- Strategic Calculus: Amgen’s move signals a shift. Biosimilar developers, having invested hundreds of millions in development (unlike the cheaper development of small molecule generics), are less willing to sit on the sidelines. They are betting that the “thickets” of secondary patents are weak and unenforceable. This aggression forces innovators to negotiate settlements more quickly or risk losing market share immediately.

The Gatekeepers: PBMs, Rebate Walls, and the FTC Crackdown

In the current U.S. market, a patent expiration does not guarantee generic uptake. The market is distorted by the intermediaries known as Pharmacy Benefit Managers (PBMs). These entities—CVS Caremark, Express Scripts (Cigna), and OptumRx (UnitedHealth)—control formulary access for nearly 80% of the U.S. market.34

The Mechanics of the Rebate Wall

Innovators use their high list prices to negotiate “rebate walls.” They offer PBMs massive rebates (payments back to the PBM) in exchange for exclusive or preferred placement on the formulary. Crucially, these rebates are often contingent on volume.

- The Trap: If a PBM allows a biosimilar onto the formulary, the innovator threatens to withdraw rebates not just for the volume lost, but for all the volume of the drug, and sometimes for other drugs in their portfolio (bundling). This creates a financial cliff for the PBM: switching to a cheaper biosimilar might save money on the drug cost, but the loss of the massive rebate check from the innovator creates a net loss for the plan.35

- The “Gladiator” Effect: This forces biosimilars to launch with deep discounts just to compete with the net price of the brand, often rendering the business model unsustainable.

The 2024 FTC Offensive

In 2024 and 2025, the regulatory environment shifted dramatically. The Federal Trade Commission (FTC), led by Chair Lina Khan, launched a concerted attack on these PBM practices.

- The Insulin Lawsuit: In late 2024, the FTC sued the “Big 3” PBMs, alleging they artificially inflated insulin prices. The complaint details how PBMs systematically excluded lower-list-price insulins (and biosimilars) in favor of high-list-price, high-rebate versions to enrich themselves.37 The FTC argues this is an unfair method of competition that harms patients.

- Interim Report Findings: An FTC interim report highlighted how PBMs steer patients to their own affiliated pharmacies and use rebate contracts to “impair or block less expensive competing products,” explicitly naming biosimilars as victims of these tactics.39

The Wall Begins to Crumble

This regulatory pressure, combined with market maturity, is finally cracking the rebate wall. In a landmark move in April 2024, CVS Caremark removed branded Humira from its major commercial formularies, replacing it with biosimilars (including a co-branded version). The impact was immediate: Humira biosimilar market share, which had languished at 1% throughout 2023, surged to over 14% in 2024 and is projected to overtake the brand in 2025.18 This proves that the “slope” of biologic erosion can be turned into a “cliff” if the PBM gatekeepers decide to flip the switch.

The 2025-2030 Landscape: A New Era of Cliffs

As the industry moves through 2025, it faces a “Patent Cliff 2.0,” characterized not just by patent expiries, but by statutory price reductions introduced by the Inflation Reduction Act (IRA).

Key Expirations to Watch

The roster of drugs facing LOE includes some of the highest-grossing products in history.

Table 2: Major Impending Patent Cliffs (2025-2028)

| Brand Name | Innovator | Primary Indication | Approx. Sales (2023/24) | Est. LOE Impact Year |

| Stelara (ustekinumab) | J&J | Immunology | ~$10.9B | 2025 |

| Keytruda (pembrolizumab) | Merck | Oncology | >$29B | 2028 |

| Eliquis (apixaban) | BMS/Pfizer | Anticoagulant | >$13B | 2026-2028 |

| Trulicity (dulaglutide) | Eli Lilly | Diabetes | ~$7.0B | 2027 |

| Eylea (aflibercept) | Regeneron | Ophthalmology | ~$5.9B | 2024/2025 (At-Risk) |

| Entresto (sacubitril/valsartan) | Novartis | Heart Failure | ~$7.8B | 2025 |

Source: Aggregated data from DrugPatentWatch analysis and industry reports.41

- Keytruda’s $30 Billion Problem: Merck’s Keytruda is the elephant in the room. Generating nearly $30 billion annually, its LOE in 2028 represents perhaps the single largest revenue event in pharma history. Merck is preparing by aggressively diversifying through M&A (e.g., the $11B acquisition of Acceleron and $10B for Prometheus) and testing subcutaneous formulations to extend the franchise.43

- Stelara: J&J faces imminent biosimilar competition for Stelara in 2025. Following the Humira playbook, settlements have likely delayed entry to a specific date, but the erosion is expected to be rapid once the gates open.42

The IRA: The “Statutory Cliff”

The Inflation Reduction Act has fundamentally altered the calculus of LOE. By subjecting drugs to Medicare price negotiation 9 years after approval (for small molecules) or 13 years (for biologics), the IRA effectively creates a “statutory patent cliff.”

- The Distortion: This policy creates a government-mandated price ceiling that may arrive before the actual patents expire. Furthermore, the discrepancy between 9 and 13 years is driving R&D investment away from small molecules (pills) and toward biologics to capture the longer exemption period.45

- Impact on Generics: The “Maximum Fair Price” (MFP) set by Medicare negotiation acts as a floor. If the brand price is forcibly lowered by the government, the profit margin available for a generic challenger is compressed. This may paradoxically reduce the number of generic entrants, as the financial incentive to challenge patents is diminished.46

Strategic Intelligence and Forecasting

In this environment, static data is a liability. The “patent expiration date” listed on a label is rarely the day competition arrives. It might be years earlier (due to a lost lawsuit) or years later (due to a settlement or pediatric exclusivity).

Platforms like DrugPatentWatch have become essential infrastructure for investors and competitors. They engage in regulatory arbitrage intelligence: connecting the dots between a Paragraph IV filing in a district court, a tentative approval in the FDA database, and a manufacturing waiver in Europe.47

- Forecasting N: The holy grail of forecasting is predicting “N”—the number of competitors at launch. If a user can predict N, they can predict the price erosion curve using the established models (N=2 vs N=6). This requires monitoring not just the primary patent, but the manufacturing capacity and legal standing of every potential challenger.15

- Interchangeability Reform: A key variable to watch in 2025 is the FDA’s new guidance on interchangeability. By removing the need for switching studies, the FDA has lowered the barrier for biosimilars to be deemed “interchangeable”.49 This will likely accelerate the “pharmacy benefit” adoption of biosimilars, moving the erosion curve of biologics closer to the “cliff” model of small molecules.

Conclusion: The Lifecycle Paradox

The expiration of a drug patent is a paradox. For the innovator, it is a “death” of revenue that must be stalled using every tool in the legal arsenal—thickets, hops, and settlements. For the generic maker, it is a “birth” of opportunity that must be seized, often by betting the company’s future on an at-risk launch. For the PBM, it is a leverage point to extract rebates. And for the patient, it is—finally—the promise of affordability.

The data indicates we are moving from an era of “simple cliffs” to “complex ecosystems.” The battles of the next decade will not just be about patent validity; they will be about formulary access, interchangeability designations, and navigating the artificial price floors set by government policy. Success in this arena requires more than legal expertise; it requires a synthesis of regulatory, commercial, and litigation intelligence. As the patent clock ticks down on the industry’s biggest assets, the only currency that matters is time—and the foresight to know exactly when it runs out.

Key Takeaways

- The “Cliff” vs. “Slope” Dichotomy: Small molecules face a 90% revenue drop within months (cliff) driven by pharmacy automation. Biologics face a protracted erosion (slope) due to rebate walls and interchangeability barriers, though this is accelerating.

- PBMs as Gatekeepers: Patent expiration no longer guarantees generic uptake. PBM rebate structures can block cheaper generics/biosimilars for years. The 2024 FTC lawsuits against the “Big 3” PBMs mark a turning point in dismantling these barriers.

- IRA as the New Cliff: The Inflation Reduction Act creates a “statutory cliff” at 9 or 13 years post-approval. This policy is reshaping R&D incentives, pushing capital toward biologics and potentially reducing the profitability of future generic launches.

- Defensive Evolution: Innovators have evolved from simple patent protection to complex strategies like “patent thickets” (Humira), “product hopping” (Namenda), and “volume-limited settlements” (Revlimid).

- At-Risk Aggression: Emboldened by recent trends, biosimilar companies (e.g., Amgen with Pavblu) are increasingly willing to launch “at risk” before litigation concludes, signaling a new phase of commercial aggression.

FAQ

Q1: What is the difference between “Patent Expiration” and “Loss of Exclusivity (LOE)”?

A: Patent expiration refers to the statutory end of the 20-year patent term. LOE is the actual date competitors can enter the market. LOE can be later than patent expiration due to “pediatric exclusivity” (adding 6 months) or patent term extensions. Conversely, LOE can be earlier if a patent is successfully challenged (Paragraph IV) or settled. It can also be effectively extended beyond the primary patent if “patent thickets” on formulation or manufacturing block entry.1

Q2: Why do drug prices sometimes increase right before a patent expires?

A: Innovators often raise prices in the final years of exclusivity to maximize revenue from the remaining “inelastic” patient base before cheap generics flood the market. Additionally, as alleged in the recent FTC insulin lawsuits, high list prices are often maintained or increased to offer larger rebates to PBMs, securing formulary position against emerging competitors.38

Q3: How does the 2024 FDA guidance on “Interchangeability” change the biosimilar market?

A: Previously, biosimilars needed expensive “switching studies” to be deemed “interchangeable” (allowable for automatic pharmacy substitution). The 2024 guidance removes this requirement for most cases, stating that standard biosimilarity data is sufficient. This lowers development costs and will likely accelerate the transition of biosimilars from “medical benefit” to “pharmacy benefit,” increasing market penetration rates.49

Q4: What is an “Authorized Generic” and why do brand companies launch them?

A: An Authorized Generic is the brand company’s own version of the drug, sold without the brand label. They launch it to compete directly with the first generic entrant during the 180-day exclusivity period. This “scorched earth” tactic preserves some revenue for the brand and significantly lowers the profits for the generic challenger (by ~13-18%), discouraging future patent challenges.26

Q5: How can investors predict which drugs are most vulnerable to early generic entry?

A: Investors should monitor Paragraph IV certifications, which signal a legal challenge to patents. High volumes of litigation or a history of losing patent suits (e.g., invalidation of method-of-use patents) suggest vulnerability. Tools like DrugPatentWatch provide alerts on these filings and litigation outcomes, allowing investors to model “at-risk” scenarios before they become public headlines.47

Works cited

- The Paragraph IV Playbook: Turning Patent Challenges into Market Dominance, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/the-paragraph-iv-playbook-turning-patent-challenges-into-market-dominance/

- Advanced Models for Predicting Pharma Stock Performance in the Face of Patent Expiration, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/advanced-models-for-predicting-pharma-stock-performance-in-the-face-of-patent-expiration/

- The Patent Cliff and Beyond: A Definitive Guide to Generic and Biosimilar Market Entry, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/generic-drug-entry-timeline-predicting-market-dynamics-after-patent-loss/

- BPCIA: Beyond the Hatch-Waxman Act – Pharmaceutical Law Group, accessed November 18, 2025, https://www.pharmalawgrp.com/bpcia/

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed November 18, 2025, https://www.congress.gov/crs-product/R46679

- What Are the Patent Litigation Differences Between the BPCIA and Hatch-Waxman Act? | Winston & Strawn Law Glossary, accessed November 18, 2025, https://www.winston.com/en/legal-glossary/BPCIA-Hatch-Waxman-Act-differences

- What Every Pharma Executive Needs to Know About Paragraph IV Challenges, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- Comparison of the Hatch-Waxman Act and the BPCIA – Fish & Richardson, accessed November 18, 2025, https://www.fr.com/wp-content/uploads/2019/03/Comparison-of-Hatch-Waxman-Act-and-BPCIA-Chart.pdf

- Patents and Exclusivity | FDA, accessed November 18, 2025, https://www.fda.gov/media/92548/download

- Authorized Generic Drugs: Short-Term Effects and Long-Term Impact | Federal Trade Commission, accessed November 18, 2025, https://www.ftc.gov/sites/default/files/documents/reports/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission.pdf

- In-Depth Look at the Differences Between EMA and FDA – Mabion, accessed November 18, 2025, https://www.mabion.eu/science-hub/articles/similar-but-not-the-same-an-in-depth-look-at-the-differences-between-ema-and-fda/

- The SPC Manufacturing & Stockpiling Waiver – IPOI, accessed November 18, 2025, https://www.ipoi.gov.ie/en/types-of-ip/supplementary-protection-certificates/the-spc-waiver/

- Supplementary protection certificates for pharmaceutical and plant protection products – Internal Market, Industry, Entrepreneurship and SMEs, accessed November 18, 2025, https://single-market-economy.ec.europa.eu/industry/strategy/intellectual-property/patent-protection-eu/supplementary-protection-certificates-pharmaceutical-and-plant-protection-products_en

- The Tipping Point: Navigating the Financial and Strategic Impact of Drug Patent Expiry, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-patent-expiry-on-drug-prices-a-systematic-literature-review/

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices – https: // aspe . hhs . gov., accessed November 18, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- Mastering the Inevitable: A Strategic Guide to Drug Market Share Erosion Forecasting, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/mastering-the-inevitable-a-strategic-guide-to-drug-market-share-erosion-forecasting/

- Competition, Consolidation, and Evolution in the Pharmacy Market | Commonwealth Fund, accessed November 18, 2025, https://www.commonwealthfund.org/publications/issue-briefs/2021/aug/competition-consolidation-evolution-pharmacy-market

- Breaking Down Biosimilar Barriers: Interchangeability, accessed November 18, 2025, https://www.centerforbiosimilars.com/view/breaking-down-biosimilar-barriers-interchangeability

- Q1 2025 Trends Focus: Biosimilars – Segal, accessed November 18, 2025, https://www.segalco.com/consulting-insights/q1-2025-trends-focus-biosimilars

- PSG Report: Humira Biosimilars Ease Specialty Drug Claim Costs, accessed November 18, 2025, https://www.managedhealthcareexecutive.com/view/psg-report-humira-biosimilars-ease-specialty-drug-claim-costs

- Patent Settlements Are Necessary To Help Combat Patent Thickets, accessed November 18, 2025, https://accessiblemeds.org/resources/blog/patent-settlements-are-necessary-to-help-combat-patent-thickets/

- Why Pharmaceutical Patent Thickets Are Unique – Rutgers University, accessed November 18, 2025, https://scholarship.libraries.rutgers.edu/esploro/fulltext/journalArticle/Why-Pharmaceutical-Patent-Thickets-Are-Unique/991032166117504646?repId=12778612660004646&mId=13778612650004646&institution=01RUT_INST

- AbbVie’s Enforcement of its ‘Patent Thicket’ For Humira Under the BPCIA Does Not Provide Cognizable Basis for an Antitrust Violation | Mintz, accessed November 18, 2025, https://www.mintz.com/insights-center/viewpoints/2231/2020-06-18-abbvies-enforcement-its-patent-thicket-humira-under

- Biological patent thickets and delayed access to biosimilars, an American problem – PMC, accessed November 18, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9439849/

- What is Drug Product Hopping: A Deep Dive into Drug Product Hopping and Its Impact on the Pharmaceutical Industry – DrugPatentWatch, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/what-is-drug-product-hopping-a-deep-dive-into-drug-product-hopping-and-its-impact-on-the-pharmaceutical-industry/

- PRODUCT HOPPING: A NEW FRAMEWORK – Notre Dame Law Review, accessed November 18, 2025, https://ndlawreview.org/wp-content/uploads/2017/01/Carrier-Shadowen_Final-with-PDF_2.pdf

- Understanding the Impact of Authorized Generics on Drug Pricing: A Strategic Imperative for Market Domination – DrugPatentWatch, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/understanding-the-impact-of-authorized-generics-on-drug-pricing-the-entacapone-case-study/

- Authorized Generics In The US: Prevalence, Characteristics, And Timing, 2010–19, accessed November 18, 2025, https://www.healthaffairs.org/doi/10.1377/hlthaff.2022.01677

- How Celgene and Bristol Myers Squibb Used Volume Restrictions to Delay Revlimid Competition – I-MAK, accessed November 18, 2025, https://www.i-mak.org/2025/04/04/how-celgene-and-bristol-myers-squibb-used-volume-restrictions-to-delay-revlimid-competition/

- Congressional Investigation of RevAssist-Linked and General Pricing Strategies for Lenalidomide – ASCO Publications, accessed November 18, 2025, https://ascopubs.org/doi/pdf/10.1200/OP.23.00579

- Launch-at-Risk Analysis | Secretariat, accessed November 18, 2025, https://secretariat-intl.com/wp-content/uploads/2023/11/CaseStudy-Launch-at-Risk-Analysis-Draft.pdf

- Pfizer Obtains $2.15 Billion Settlement From Teva And Sun For Infringement Of Protonix® Patent, accessed November 18, 2025, https://www.pfizer.com/news/press-release/press-release-detail/pfizer_obtains_2_15_billion_settlement_from_teva_and_sun_for_infringement_of_protonix_patent

- Amgen Fires Back with Counterclaims in Aflibercept BPCIA Litigation – Big Molecule Watch, accessed November 18, 2025, https://www.bigmoleculewatch.com/2025/09/24/amgen-fires-back-with-counterclaims-in-aflibercept-bpcia-litigation/

- Amgen pledges to launch Eylea biosim after legal win—but Regeneron stresses the fight’s not over yet | Fierce Pharma, accessed November 18, 2025, https://www.fiercepharma.com/pharma/amgen-pledges-launch-eylea-biosim-after-legal-win-regeneron-stresses-fights-not-over-yet

- PBMs Are Inflating the Cost of Generic Drugs. They Must Be Reined In – July 5, 2022, accessed November 18, 2025, https://schaeffer.usc.edu/research/pbms-are-inflating-the-cost-of-generic-drugs-they-must-be-reined-in/

- The Biosimilar Reimbursement Revolution: Navigating Disruption and Seizing Competitive Advantage – DrugPatentWatch – Transform Data into Market Domination, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-biosimilars-on-biologic-drug-reimbursement-models/

- Scaling the “Rebate Wall”: Growing Scrutiny of Rebate Contracting in Pharma and Potential Responses – American Bar Association, accessed November 18, 2025, https://www.americanbar.org/groups/antitrust_law/resources/magazine/2024-spring/scaling-the-rebate-wall/

- Part 3 Administrative Complaint – Revised Public Redacted Version – Federal Trade Commission, accessed November 18, 2025, https://www.ftc.gov/system/files/ftc_gov/pdf/612314.2024.11.26_part_3_administrative_complaint_-_revised_public_redacted_version.pdf

- FTC Sues Prescription Drug Middlemen for Artificially Inflating Insulin Drug Prices, accessed November 18, 2025, https://www.ftc.gov/news-events/news/press-releases/2024/09/ftc-sues-prescription-drug-middlemen-artificially-inflating-insulin-drug-prices

- FTC Report Critical of PBMs Highlights Middlemen Profits Over Patient Savings, accessed November 18, 2025, https://accessiblemeds.org/resources/press-releases/ftc-report-critical-pbms-highlights-middlemen-profits-over-patient-savings/

- FTC Releases Controversial Interim Staff Report on PBMs’ Purported Impact on Drug Prices, accessed November 18, 2025, https://www.ebglaw.com/insights/publications/ftc-releases-controversial-interim-staff-report-on-pbms-purported-impact-on-drug-prices

- The Multi-Billion Dollar Countdown: Decoding the Patent Cliff and Seizing the Generic Opportunity – DrugPatentWatch, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/patent-expirations-seizing-opportunities-in-the-generic-drug-market/

- A Strategic Investor’s Guide to Pharmaceutical Patent Expiration – DrugPatentWatch, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/a-strategic-investors-guide-to-pharmaceutical-patent-expiration/

- Keytruda’s Patent Wall – I-MAK, accessed November 18, 2025, https://www.i-mak.org/wp-content/uploads/2021/05/i-mak.keytruda.report-2021-05-06F.pdf

- Merck keeps deal focus with Keytruda patent cliff on horizon | BioPharma Dive, accessed November 18, 2025, https://www.biopharmadive.com/news/merck-dealmaking-15-billion-keytruda-cliff-davis/706309/

- Revenue Differences Between Top-Selling Small-Molecule Drugs and Biologics in Medicare, accessed November 18, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12534848/

- Impact of Medicare Price “Negotiation” Program on small and large molecule medicines – Charles River Associates, accessed November 18, 2025, https://media.crai.com/wp-content/uploads/2024/05/02104611/Gilead-CRA-Report-Impact-of-Medicare-Price-Negotiation-Program-on-small-and-large-molecule-medicines-31-May.pdf

- Implementing Patent-Expiry Forecasting: A 12-Step Checklist for Competitive Advantage, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/implementing-patent-expiry-forecasting-a-12-step-checklist-for-competitive-advantage/

- Unlocking Alpha: A Strategic Guide to Using Drug Patent Data for …, accessed November 18, 2025, https://www.drugpatentwatch.com/blog/unlocking-alpha-a-strategic-guide-to-using-drug-patent-data-for-financial-investment-positioning/

- FDA Issues Draft Guidance on Demonstrating Biosimilar Interchangeability – Goodwin, accessed November 18, 2025, https://www.goodwinlaw.com/en/insights/blogs/2024/07/fda-issues-draft-guidance-on-demonstrating-biosimilar-interchangeability

- Biologics and Biosimilars Landscape 2024: IP, Policy, and Market Developments, accessed November 18, 2025, https://www.fr.com/insights/thought-leadership/blogs/biologics-and-biosimilars-landscape-2024-ip-policy-and-market-developments/

- Rising Tide Lifts US Biosimilars Market | BCG, accessed November 18, 2025, https://www.bcg.com/publications/2024/rising-tide-lifts-us-biosimilars-market