In the high-stakes world of pharmaceutical development and commercialization, few regulatory mechanisms have as profound an impact on market dynamics, revenue projections, and corporate strategy as Paragraph IV patent challenges. These specialized legal proceedings, born from a landmark legislative compromise, represent the critical battleground where brand manufacturers defend their hard-won intellectual property against generic competitors seeking early market entry. For pharmaceutical executives, understanding the nuances of this battlefield is not merely a legal necessity; it is a fundamental business imperative that can significantly influence corporate valuation, pipeline decisions, and long-term market positioning.

Filing an Abbreviated New Drug Application (ANDA) with a Paragraph IV certification is not a simple regulatory procedure. It is the first shot fired in a high-stakes commercial conflict, a strategic declaration of war on a brand’s market exclusivity. This is a chess game where the opening move can determine the outcome of a multi-million-dollar contest years down the line. It demands a masterful integration of regulatory precision, legal acumen, and, above all, strategic business intelligence. The central tension of the Hatch-Waxman Act—the delicate balance between incentivizing brand innovation through patent protection and promoting affordable access to medicines by fostering generic competition—provides the foundational context for this entire strategic landscape.1

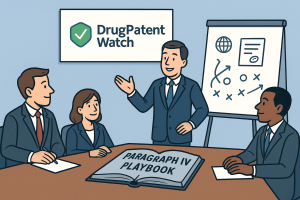

This report serves as your strategic playbook. We will dissect the intricate legal and regulatory frameworks that govern this process, transforming them into actionable competitive intelligence. We will move from the foundational principles of the Hatch-Waxman Act to the granular tactics of litigation, from the immense economic prize of 180-day exclusivity to the nuanced strategies required for both first-filers and subsequent challengers. Our journey will be illuminated by real-world case studies and grounded in the data that separates market leaders from the laggards. Welcome to the definitive guide for navigating multiple ANDA submissions and turning the Paragraph IV challenge into your company’s next major competitive advantage.

Foundations of the Battlefield: The Hatch-Waxman Act and the ANDA Pathway

To win any contest, you must first understand the rules of engagement. In the world of generic pharmaceuticals, that rulebook was written in 1984 and is known as the Hatch-Waxman Act. This legislation didn’t just create a process; it engineered a new commercial ecosystem, defining the relationships, conflicts, and opportunities that shape the industry to this day. Understanding its core tenets, from the structure of the ANDA to the central role of the Orange Book, is the non-negotiable first step in building a winning Paragraph IV strategy.

The Grand Compromise: Unpacking the Hatch-Waxman Act

The Drug Price Competition and Patent Term Restoration Act of 1984, informally known as the Hatch-Waxman Act, was a landmark piece of legislation that fundamentally reshaped the American pharmaceutical landscape.2 Before its passage, the generic drug industry was nascent, hamstrung by a regulatory system that required generic applicants to conduct their own costly and duplicative clinical trials to prove safety and effectiveness.2 The Act was, at its core, a grand compromise designed to balance two seemingly contradictory objectives: encouraging the immense investment required for pharmaceutical innovation while simultaneously promoting robust generic competition to make medications more affordable for consumers.1

The Act achieved this balance by creating a symbiotic system of benefits for both brand-name and generic manufacturers.

For generic companies, the benefits were transformative:

- The Abbreviated New Drug Application (ANDA) Pathway: This streamlined process allowed generics to rely on the FDA’s prior findings of safety and efficacy for the brand-name drug, eliminating the need for new clinical trials.2 This single provision made the development of low-cost generics economically viable.

- The “Safe Harbor” Provision: The Act created a statutory exemption from patent infringement for activities reasonably related to developing and submitting information for an ANDA.2 This allows generics to develop their products and conduct bioequivalence studies while the brand’s patents are still in force, without fear of being sued for these preparatory acts.

- The 180-Day Exclusivity Incentive: To encourage generics to challenge potentially weak patents, the Act created a powerful financial incentive: a 180-day period of market exclusivity for the first generic applicant to successfully file a Paragraph IV certification.5

For brand-name companies, the Act provided crucial new protections to compensate for the increased generic competition:

- Patent Term Extension: The Act allows brand companies to apply for an extension of their patent term to compensate for time lost during the lengthy FDA regulatory review process, ensuring that regulatory delays do not unduly consume a patent’s effective life.3 The extension is capped at a maximum of five years, with the total effective patent life post-approval not to exceed 14 years.

- Market Exclusivities: The Act established several periods of FDA-administered market exclusivity that operate independently of patents. These include a five-year exclusivity for New Chemical Entities (NCEs) and a three-year exclusivity for new clinical investigations on previously approved drugs.5

- The 30-Month Stay: When a brand company sues a Paragraph IV challenger for patent infringement within a 45-day window, the Act provides for an automatic 30-month stay of the generic’s FDA approval, giving the brand time to litigate the patent dispute in court.1

What is most remarkable about the Hatch-Waxman Act is that it does not just allow for conflict; it choreographs it. The sequence of events—the ANDA filing with a Paragraph IV certification, the mandatory notice to the brand, the 45-day window to initiate a lawsuit, and the resulting 30-month stay—is a legislated timeline for patent disputes.9 This structure provides a predictable framework for conflict. It allows both sides to plan their legal, commercial, and financial strategies with a degree of certainty about the process, even if the ultimate outcome remains uncertain. In doing so, the Act transforms what could be a chaotic and unpredictable legal battle into a more manageable, albeit still incredibly high-stakes, business process.

The Regulatory Gauntlet: The Abbreviated New Drug Application (ANDA)

At the heart of the generic approval process is the Abbreviated New Drug Application, or ANDA.12 The very name “abbreviated” speaks to its core purpose and its revolutionary impact on the pharmaceutical industry. Unlike a New Drug Application (NDA) for an innovator drug, which must contain extensive preclinical (animal) and clinical (human) data to establish safety and effectiveness from scratch, an ANDA is streamlined because it relies on the FDA’s previous finding that the brand-name drug it references—the Reference Listed Drug (RLD)—is safe and effective.10

This reliance on the RLD’s data is the cornerstone of the generic drug model. It allows a generic manufacturer to bypass the most time-consuming and expensive part of drug development, making it possible to offer the product at a significantly lower cost.14 However, this regulatory shortcut comes with a strict condition: the generic applicant must scientifically demonstrate that its product is, for all intents and purposes, a copy of the RLD.

The core scientific burden of an ANDA is to prove bioequivalence.10 In simple terms, bioequivalence means that the generic drug performs in the same manner as the innovator drug. To demonstrate this, a generic company typically conducts studies in a small group of healthy volunteers to measure the rate and extent to which the active ingredient is absorbed into the bloodstream.10 The generic version must deliver the same amount of active ingredient into a patient’s bloodstream in the same amount of time as the brand-name drug.

Beyond bioequivalence, an ANDA must prove that the generic product is a pharmaceutical mirror image of the RLD in several key aspects 6:

- Active Ingredient: It must contain the exact same active pharmaceutical ingredient (API).

- Strength and Dosage Form: It must be identical in strength (e.g., 20 mg) and dosage form (e.g., tablet, capsule).

- Route of Administration: The method of delivery (e.g., oral, topical) must be the same.

- Intended Use and Labeling: It must have the same conditions of use, and its labeling must, with very few exceptions, be identical to the RLD’s label.

- Quality and Manufacturing: The generic must be manufactured under the same strict standards of identity, strength, purity, and quality (Current Good Manufacturing Practices, or cGMP) as the brand.

This intense focus on sameness and equivalence reveals the strategic position of a generic company. The challenge is not one of novel R&D, but of mastery in replication, manufacturing consistency, and regulatory compliance. The “abbreviated” nature of the ANDA provides a massive economic advantage, but it also constrains the product. Therefore, a generic company’s competitive strength lies not in discovering new medicines, but in its operational excellence and, as we will see, its legal and strategic acumen in navigating the patent landscape.

The FDA’s review process for an ANDA is a multi-stage gauntlet. Upon submission, the application first undergoes a filing review by the Division of Filing Review to ensure it is sufficiently complete to be accepted. Once accepted, a formal review “clock” begins, and various scientific disciplines within the Office of Generic Drugs (OGD)—including chemistry, bioequivalence, and labeling—conduct a substantive review.20 During this process, the FDA may issue Information Requests (IRs) or Discipline Review Letters (DRLs) seeking clarification or additional data. If deficiencies remain after all reviews are complete, the agency will issue a Complete Response Letter (CRL), and the applicant must address all deficiencies before the application can be approved.

The Oracle of Pharma: The Role of the Orange Book

For any company venturing into the generic drug space, the first and most critical piece of intelligence is a publication from the FDA known as the “Approved Drug Products with Therapeutic Equivalence Evaluations,” more commonly referred to as the Orange Book. The Orange Book is far more than a simple database; it is the official document that defines the scope of the impending patent conflict. It is, in essence, the definitive map of the battlefield.

The Orange Book serves two primary functions. First, it lists all FDA-approved drug products and provides therapeutic equivalence ratings, which guide pharmacists and physicians on substitutability. But for our strategic purposes, its second function is paramount: the Orange Book lists the patents that a brand-name company asserts protect its drug.1 When an innovator company submits a New Drug Application (NDA), it is required to identify any patents that claim the drug substance (active ingredient), drug product (formulation), or an approved method of using the drug. The FDA publishes this information, creating a centralized, transparent repository of the patent landscape for every approved drug.

This listing is the lynchpin of the Hatch-Waxman system. It dictates the legal obligations of any generic company wishing to market a copy of that drug. An ANDA filer must review the Orange Book and, for every patent listed for its chosen RLD, make a certification addressing that patent.9 This requirement transforms the Orange Book from a passive list into an active strategic tool. It tells the generic company precisely which patents it must either wait for, design around, or challenge directly. An error in identifying or interpreting the patents listed in the Orange Book can be a fatal strategic misstep, leading to a rejected ANDA or a lost patent suit.

Making the Call: The Four Patent Certifications

As part of its ANDA, a generic applicant must provide a certification for each patent listed in the Orange Book for the RLD. This certification is a formal declaration to the FDA of the generic company’s position with respect to the brand’s intellectual property. There are four possible certifications, each with vastly different strategic implications.6

- Paragraph I Certification: This is a statement that the required patent information has not been filed by the brand-name company in the Orange Book. This is a relatively rare occurrence.

- Paragraph II Certification: This is a statement that the patent in question has already expired.

- Paragraph III Certification: This is a statement that the patent has not yet expired, and the generic applicant will wait to market its product until the patent expires on a specified date. FDA approval will be granted, but it will not become effective until the patent expiration date.

- Paragraph IV Certification: This is a statement that the patent is, in the generic applicant’s opinion and to the best of its knowledge, invalid, unenforceable, or will not be infringed by the manufacture, use, or sale of the proposed generic drug.

These four options can be neatly categorized by their strategic intent. Paragraphs I, II, and III represent paths of avoidance or delay. They are essentially ways of telling the FDA, “There is no patent conflict here” (Paragraphs I and II) or “We will wait until the patent conflict is over” (Paragraph III). These are passive, non-confrontational routes that accept the validity and applicability of the brand’s patents.

The Paragraph IV certification, in stark contrast, is the path of direct confrontation. It is the only certification that actively seeks to initiate and win a conflict to accelerate market entry. It is a bold declaration that the generic company believes the brand’s patent protection is either illegitimate or irrelevant to its product. This aggressive posture is precisely what the Hatch-Waxman Act was designed to incentivize, and it is the strategic decision that sets in motion the entire high-stakes process of patent litigation, 30-month stays, and the race for 180-day exclusivity.

The Paragraph IV Gambit: Declaring Commercial War

Choosing to file a Paragraph IV certification is the strategic equivalent of crossing the Rubicon. It is an irreversible decision that transforms a regulatory filing into a direct legal challenge against a well-entrenched and highly motivated incumbent. This section dissects the Paragraph IV gambit itself—what it is, how it is executed, and the immediate, game-changing consequences that ripple through the market the moment it is played.

What is a Paragraph IV Certification?

A Paragraph IV certification is a formal statement within an ANDA in which the generic applicant asserts that one or more patents listed in the Orange Book for the RLD are “invalid, unenforceable, or will not be infringed by the manufacture, use, or sale of the drug product for which the ANDA is submitted”.1 This is not a mere opinion; it is a legally significant act with a specific and powerful consequence.

Under U.S. patent law, specifically 35 U.S.C. § 271(e)(2), the very act of submitting an ANDA with a Paragraph IV certification is defined as an “artificial act of patent infringement”.1 This is a brilliant, if counterintuitive, legal fiction. It allows the brand-name company to sue the generic applicant for patent infringement

before the generic product is actually on the market and causing any commercial harm.

Without this provision, the system would be mired in uncertainty. A brand would have to wait for a generic to launch and begin eroding its market share before it could file a lawsuit. A generic company, in turn, would face the perilous decision of launching “at-risk,” potentially exposing itself to catastrophic damages if a court later found the patent to be valid and infringed. The “artificial infringement” mechanism elegantly solves this problem. It is the legal key that unlocks the courthouse doors early, forcing the patent dispute to be resolved in a structured and (somewhat) more predictable manner before the generic launch can occur. It is the core legal engine that drives the entire Hatch-Waxman litigation system.

The Critical First Salvo: The Paragraph IV Notice Letter

Once an ANDA containing a Paragraph IV certification has been submitted and the FDA has sent an acknowledgment letter confirming the application is sufficiently complete for review, the generic applicant must execute a critical next step: notifying the brand company. This is done via a Paragraph IV notice letter.1

This letter is far more than a simple courtesy. It is a statutory requirement with strict rules and profound strategic importance. The generic applicant must send the notice letter to the NDA holder (the brand company) and each patent owner within 20 days of receiving the FDA’s acknowledgment.1 Sending the letter before receiving this acknowledgment is premature and can have negative legal consequences, as courts have held that the proper sequence is essential to prevent unnecessary litigation based on incomplete ANDAs.

Crucially, the notice letter must include a “detailed statement of the factual and legal basis” for the generic company’s opinion that the patent is invalid, unenforceable, or not infringed.9 This requirement means the notice letter is not just a notification; it is the

opening argument in the litigation. It is the first time the generic company formally lays out its case, and it sets the tone for the entire dispute.

Crafting this detailed statement is a delicate strategic balancing act:

- Revealing Too Little: A vague or conclusory statement may be deemed statutorily insufficient by a court. More critically, a baseless or poorly supported position could be used later as evidence of willful infringement, potentially leading to enhanced damages (up to treble damages) if the generic company loses the lawsuit. The opinion must be based on a good-faith belief grounded in sound legal and scientific analysis.9

- Revealing Too Much: A highly detailed letter that lays out every piece of prior art and every nuance of a non-infringement argument can prematurely reveal the generic’s entire litigation strategy. It gives the brand company a comprehensive roadmap of the case against it, allowing it to prepare its defenses and counter-arguments well in advance.

Best practices for drafting the notice letter involve careful consideration of these factors. The arguments presented should be robust and well-vetted by both internal and external legal counsel. Furthermore, because these letters have been attached to public court filings in the past, generic companies should be extremely cautious about including confidential or trade secret information about their product formulation or manufacturing process directly in the letter.

To address the brand’s need to evaluate non-infringement claims, the Hatch-Waxman framework includes a mechanism called an Offer of Confidential Access (OCA).9 This is a separate offer from the generic company to allow the brand’s counsel confidential access to the relevant portions of the ANDA itself, under terms similar to a protective order in litigation. Providing an OCA is strategically important, as it allows the generic to file a declaratory judgment action for non-infringement if the brand does not sue within the 45-day window.9

The Brand’s Response and the 30-Month Stay

The receipt of the Paragraph IV notice letter starts a 45-day clock for the brand company.1 Within this critical window, the brand and its patent counsel must evaluate the generic’s arguments and decide whether to file a patent infringement lawsuit. Given the billions of dollars in revenue at stake, a lawsuit is almost always filed.

If the brand company initiates a patent infringement suit against the generic applicant within this 45-day period, a powerful provision of the Hatch-Waxman Act is automatically triggered: the 30-month stay of FDA approval.1 This means the FDA is generally barred from granting final approval to the ANDA for a period of up to 30 months from the date the brand received the notice letter, or until the court case is resolved, whichever comes first.8

The 30-month stay is a strategic pause button, not a permanent stop. Its purpose is to provide a prescribed and predictable amount of time for the patent dispute to be litigated in court before a potentially infringing generic product can enter the market.28

From the brand’s perspective, the stay is an invaluable tool. It provides a guaranteed period of market protection without having to meet the high legal standard required for a preliminary injunction, which is considered an “extraordinary remedy” in patent law. This 30-month window gives the brand time to execute a range of defensive strategies, such as :

- Launching its own “authorized generic” to compete with the first-filer.

- Attempting to switch the market to a next-generation product with new patent protection (a practice known as “product hopping”).

- Negotiating a settlement agreement with the generic challenger.

From the generic’s perspective, the stay establishes a clear, albeit lengthy, timeline for the litigation phase. However, it is crucial to understand that the 30-month stay is often not the ultimate gatekeeper to generic entry. Research and case history show that complex patent litigation frequently takes longer than 30 months to resolve.1 This creates a critical strategic decision point for the generic company if the stay expires but the litigation is ongoing. At this point, if the FDA has completed its scientific review, the generic may receive final approval and can choose to launch its product “at-risk.” An at-risk launch is a high-stakes gamble: the generic can begin capturing market share, but it faces the risk of massive financial damages if the court ultimately sides with the brand.11

Therefore, the 30-month stay is less of a permanent barrier and more of a structured timeline that shapes the strategic options and risk calculations for both parties throughout the litigation process.

The Golden Ticket: The Economics and Strategy of 180-Day Exclusivity

In the complex and often unforgiving landscape of generic pharmaceuticals, there is one prize that stands above all others: the 180-day marketing exclusivity period. This is the “golden ticket” of the Hatch-Waxman Act, the single most powerful incentive designed to encourage generic companies to undertake the risk and expense of challenging brand-name patents. For the company that wins it, this six-month period can be a financial windfall, often accounting for the majority of a product’s lifetime profitability. Understanding the immense value of this prize and the fierce competition to secure it is essential to grasping the core economic drivers of Paragraph IV strategy.

Defining the Prize: What is 180-Day Exclusivity?

The 180-day exclusivity is a statutory reward granted to the “first applicant” to challenge a brand’s patents.8 Specifically, the first generic company (or companies) to submit a “substantially complete” ANDA containing a Paragraph IV certification to at least one patent listed in the Orange Book is generally eligible for this prize.1

Once this first applicant launches its generic product, the FDA is prohibited from approving any subsequent ANDAs for the same drug for 180 days. This effectively creates a temporary duopoly in the market, with only the brand-name drug and the single “first-filer” generic available to patients.

This exclusivity is not an accident; it is a deliberate and crucial piece of policy engineering. The law explicitly creates an incentive to reward the risk-taker.8 Patent litigation is expensive, time-consuming, and uncertain. Without a significant potential payoff, few generic companies would be willing to mount these challenges, and brand monopolies, even those based on weak patents, would go uncontested for longer. By granting the successful first challenger a six-month period of limited competition, the government is effectively subsidizing the very patent challenges that can bring lower-cost drugs to market sooner. This is the core policy rationale behind the golden ticket: using a temporary, government-granted period of exclusivity for one generic to break the brand’s long-term monopoly for the benefit of all consumers.

The Financial Windfall: Quantifying the Value of Exclusivity

The financial value of the 180-day exclusivity period is difficult to overstate. It represents the most profitable phase of a generic product’s lifecycle, a unique window of opportunity before the market becomes fully commoditized.

The economic dynamics are straightforward. In a market with only the brand and one generic, the first-filer does not need to engage in aggressive price competition. It can price its product at a moderate discount to the brand—typically 15-25% lower—and still rapidly capture a substantial portion of the market share.1 This allows the first-filer to earn significantly higher profit margins than are possible once multiple generics enter the market.

In stark contrast, the moment the 180-day exclusivity period ends, the floodgates open. Multiple subsequent generic filers, having already secured their FDA approvals, can launch their products immediately. The ensuing price competition is fierce and immediate. With multiple generics on the market, prices can plummet by 80-90% or more compared to the original brand price.1

“With a 76% success rate, the potential payoff of a first-to-file Paragraph IV challenge is worth the risk of litigation”.

The historic case of Barr Laboratories’ challenge to Eli Lilly’s blockbuster antidepressant, Prozac (fluoxetine), serves as a powerful illustration of this dynamic. After winning its patent litigation, Barr launched the first generic fluoxetine and enjoyed 180 days of exclusivity. The results were staggering :

- Market Share Capture: Within the first month, Prozac lost 46% of its total prescriptions. By the end of Barr’s six-month exclusivity, Prozac had lost 82% of its prescriptions to the generic.

- Revenue Impact: In the last quarter of 2001, during its monopoly on generic sales, Barr’s product sales reached $360 million.

- Profitability Surge: Barr’s gross profit margin, which stood at 16.8% before the launch, nearly doubled to 28.7% during the exclusivity period.

- Shareholder Value: When the favorable court decision was announced, Barr’s stock price surged by over 35% in a single month.

This case, and many others like it, demonstrate a critical strategic reality: the vast majority of the profit a generic company will ever make on a particular product may be earned during this initial six-month window. This explains the intense, “all-or-nothing” mentality that drives the race to be the first-to-file. The strategic goal is not simply to launch a generic; it is to win the 180-day exclusivity period. This singular focus justifies the significant upfront investment in legal, scientific, and regulatory resources required to be the first and to win the subsequent fight.

The Race to Be First: Shared Exclusivity and Same-Day Filings

The immense value of 180-day exclusivity has led to a fierce and sophisticated competition among generic manufacturers to be the “first applicant.” Initially, this was a straightforward race: the first company to get its ANDA through the FDA’s doors on the earliest possible day won the prize. However, the rules have evolved to accommodate the reality of multiple companies targeting the same product simultaneously.

Under current FDA regulations, if multiple generic companies submit substantially complete ANDAs with Paragraph IV certifications on the very same day, they are all considered “first applicants” and can share the 180-day exclusivity.5 This means that upon launch, they would compete against each other and the brand, but all other subsequent filers would still be blocked for 180 days.

This possibility of sharing exclusivity has transformed the competition. The “race to file” has evolved into a synchronized, strategic dash. It is no longer enough to be fast; companies must be precise. This requires an incredible level of preparation and competitive intelligence. Generic firms must:

- Accurately determine the earliest possible date an ANDA can be filed (often four years after the approval of a New Chemical Entity, a date known as “NCE-1”).

- Prepare a “substantially complete” application ready for submission on that exact date. Any deficiency that causes the FDA to reject the filing could mean losing first-filer status.

- Monitor the competitive landscape to anticipate how many other companies are likely to file on the same day.

To increase transparency, the FDA now publishes a “Paragraph IV Certifications List” which, for each drug product, includes the date of the first PIV submission and, crucially, the “Number of Potential First Applicant ANDAs Submitted” on that day.29 This data is invaluable for all subsequent filers, as it tells them exactly how many competitors have a head start in the race for the market.

Forfeiture Provisions: How the Golden Ticket Can Be Lost

Winning first-filer status is not the end of the story. The Hatch-Waxman Act includes several “forfeiture” provisions that can cause a first applicant to lose its eligibility for the 180-day exclusivity. These provisions act as a critical “use it or lose it” clause, preventing a first-filer from indefinitely blocking the market for other generics.

A first applicant can forfeit its exclusivity if it fails to meet certain milestones. One of the most significant forfeiture events occurs if the first applicant fails to obtain tentative approval from the FDA within 30 months of the date it submitted its ANDA.29 This can happen if the ANDA has significant scientific deficiencies that require multiple rounds of review with the FDA.

Other forfeiture events include failing to market the drug within a certain timeframe after final approval, withdrawing the application, or if the ANDA is changed so that it no longer contains a Paragraph IV certification.

These provisions are a crucial backstop in the Hatch-Waxman system. They ensure that a first filer who cannot or will not proceed to market—whether due to manufacturing problems, a weak legal case, or a potentially anticompetitive settlement with the brand—cannot permanently obstruct other generic companies that are ready to launch. If the first applicant (or all first applicants, in a shared exclusivity scenario) forfeits its exclusivity, the 180-day period is extinguished. At that point, the FDA can approve the ANDA of any subsequent filer that is otherwise ready for approval. This creates a powerful incentive for subsequent filers to continue with their own applications and litigation, as they may get an opportunity to enter the market sooner than expected if the first filer stumbles.

Navigating the Labyrinth: The ANDA Patent Litigation Lifecycle

The filing of a Paragraph IV certification is merely the opening move. What follows is a complex, multi-stage legal battle that can last for years and consume millions of dollars in resources. Navigating this labyrinth successfully requires more than just skilled lawyers; it demands a cohesive strategy that integrates legal tactics with commercial objectives at every stage of the process, from the crucial intelligence-gathering phase before a lawsuit is ever filed to the pivotal court hearings that can decide a product’s fate.

Pre-Litigation Intelligence: The Foundation of Success

In ANDA litigation, the outcome of the war is often determined in the planning room, long before the first legal complaint is ever filed. The most critical, highest-leverage activity a generic company can undertake is the rigorous intelligence-gathering and analysis that precedes the ANDA submission. Rushing to file without this essential groundwork is a recipe for a costly legal failure.

The foundation of a successful Paragraph IV challenge rests on two pillars of pre-litigation analysis:

1. Patent Landscape Analysis:

Before targeting a product, a generic company must conduct a comprehensive analysis of the entire patent landscape surrounding the RLD.22 This goes beyond simply looking at the patents listed in the Orange Book. It involves a deep dive into the prosecution history of each patent (the back-and-forth between the inventor and the patent office), analyzing the scope of the claims, and identifying potential vulnerabilities. The goal is to map the entire “patent thicket” and identify the weakest links—patents that may be vulnerable to challenges based on :

- Anticipation: The invention was not new because it was fully described in a single prior art reference.

- Obviousness: The invention would have been obvious to a person of ordinary skill in the art at the time it was made.

- Lack of Written Description or Enablement: The patent does not adequately describe the invention or teach how to make and use it.

This analysis forms the raw material for the invalidity arguments that will eventually populate the Paragraph IV notice letter and the subsequent litigation.

2. Freedom-to-Operate (FTO) Analysis:

An FTO analysis is a legal assessment that determines whether a proposed commercial product or process can be made, used, or sold without infringing the valid intellectual property rights of others.38 For a generic company, this means meticulously comparing its proposed product—including its formulation, excipients, and manufacturing process—against the claims of the brand’s patents.

The goal is to build a robust non-infringement position. Can the generic be “designed around” the patent claims? For example, if a patent claims a specific extended-release formulation, can the generic company develop a different formulation that achieves the same therapeutic effect but does not literally fall within the scope of the patent’s claims?

A thorough and well-documented FTO and patent landscape analysis provides two immense strategic benefits. First, it forms the bedrock of a strong legal case, providing the “detailed factual and legal basis” required for the Paragraph IV notice letter.26 Second, it serves as a powerful defense against a later charge of willful infringement. If a generic company can demonstrate that it conducted a competent and thorough analysis and formed a good-faith belief that the brand’s patents were invalid or not infringed, it can significantly mitigate the risk of a court awarding enhanced (treble) damages if it ultimately loses the case.26

The Crux of the Matter: Claim Construction and the Markman Hearing

At the heart of nearly every patent infringement lawsuit is a proceeding known as claim construction. This is the process by which a judge determines the legal meaning and scope of the words used in a patent’s claims. It is a pivotal stage of litigation because the construction of the claims often determines the outcome of the case. A broad construction may make it easier for the brand to prove infringement, while a narrow construction may allow the generic to escape infringement entirely.

This process typically culminates in a pre-trial hearing, known as a Markman hearing, where both sides present their arguments to the judge about how the claims should be interpreted. The judge’s resulting claim construction ruling sets the boundaries for the rest of the case.

For many years, the U.S. Court of Appeals for the Federal Circuit (the primary appellate court for patent cases) reviewed all aspects of a district court’s claim construction ruling de novo, meaning it gave no deference to the trial judge’s decision and could re-examine the issue from scratch. This practice was fundamentally altered by the Supreme Court’s 2015 decision in Teva Pharmaceuticals USA, Inc. v. Sandoz, Inc..42

In Teva, the Supreme Court established a new, hybrid standard of review for claim construction. The Court ruled that while the ultimate legal conclusion about a claim’s meaning is still a question of law to be reviewed de novo, any underlying factual findings made by the district court judge to arrive at that conclusion must be reviewed under the much more deferential “clear error” standard.42

This distinction is critical. Often, to understand what a technical term in a patent claim means, a judge must rely on “extrinsic evidence,” such as testimony from expert witnesses who explain what a person of ordinary skill in the art would have understood the term to mean at the time the patent was filed. The judge’s decision to credit one expert’s testimony over another’s is a finding of fact.

The Teva v. Sandoz decision has shifted the center of gravity in patent litigation decisively toward the district court. Before Teva, the Federal Circuit could essentially conduct a “do-over” of the entire claim construction analysis. Now, it must give significant deference to the trial judge’s fact-based determinations. This has several profound strategic implications for Hatch-Waxman litigation:

- The District Court is Paramount: The trial court proceeding, particularly the Markman hearing, is more critical than ever. It is much harder to reverse a fact-based claim construction ruling on appeal.

- The “Battle of the Experts” is Key: The credibility, clarity, and persuasiveness of expert witnesses have become even more important. Winning this battle at the district court level can effectively secure a favorable claim construction that will hold up on appeal.

- Increased Certainty: This standard may lead to greater predictability and finality in litigation, as there may be fewer reversals of claim construction rulings by the Federal Circuit.

The Litigation Lifecycle: From Discovery to Trial and Appeal

Following claim construction, the litigation proceeds through several familiar stages, each with its own strategic considerations.

Discovery: This is the phase where parties exchange information and evidence. In ANDA litigation, this is an intensive and expensive process that involves 37:

- Document Production: Exchanging millions of pages of documents, including the ANDA itself, lab notebooks, manufacturing records, and internal communications.

- Depositions: Oral examinations of key witnesses, including scientists, executives, and expert witnesses, under oath.

- Expert Discovery: Exchanging detailed reports from expert witnesses who will testify at trial on issues like infringement, validity, and damages.

Summary Judgment: After discovery, either party may file a motion for summary judgment, asking the court to rule on certain issues without a full trial. While few ANDA cases are resolved entirely at this stage, it can be a useful tool for narrowing the issues for trial.

Trial: Most ANDA cases are tried as bench trials, meaning they are decided by a judge rather than a jury. The trial involves presenting live testimony from fact and expert witnesses, cross-examination, and legal arguments. The generic company will present its evidence for invalidity and/or non-infringement, while the brand company will present its case for infringement and validity.

Decision and Appeal: After the trial, the judge will issue a decision. The losing party almost always appeals the decision to the U.S. Court of Appeals for the Federal Circuit. The appellate court will review the district court’s legal conclusions de novo and its factual findings for “clear error,” consistent with the Teva v. Sandoz standard. The Federal Circuit’s decision can affirm, reverse, or remand (send back) the case to the district court. In rare instances, a party may seek further review from the Supreme Court.

Throughout this entire lifecycle, the parties are constantly evaluating the strength of their case and the potential for settlement. Many ANDA cases settle before a final court decision is reached. A typical settlement involves the generic company agreeing to delay its market entry until a specified date before the patent’s natural expiration, in exchange for a license from the brand company. These settlements provide certainty for both sides, but they can also attract antitrust scrutiny from the Federal Trade Commission (FTC), particularly if they involve a “reverse payment” from the brand to the generic.

The Second Wave: Strategies for Subsequent ANDA Filers

While the spotlight often shines on the first-to-file generic, the reality of the modern pharmaceutical market is that for any valuable drug, there will be a second, third, and fourth wave of challengers. These subsequent filers operate in a completely different strategic environment. They face a unique set of challenges and must deploy a distinct playbook, as they are not competing for the golden ticket of exclusivity but for a share of the post-exclusivity market.

The Waiting Game: Challenges for the Non-First-Filer

The primary and most daunting challenge for a subsequent ANDA filer is being blocked from the market by the first filer’s 180-day exclusivity period.5 Even if a subsequent filer moves quickly through the FDA review process and wins its own patent litigation, it cannot receive final approval and launch its product until the first filer’s exclusivity has either expired or been forfeited.

This creates a cascade of disadvantages:

- Delayed Revenue: The subsequent filer must wait an additional six months after the first generic launch before it can begin generating revenue.

- Price Erosion: They do not enter a duopoly market with high margins. Instead, they launch directly into a hyper-competitive environment where the presence of multiple generics triggers immediate and dramatic price erosion—the “post-exclusivity bloodbath”.1 Prices can fall by over 50% with just a few competitors and by as much as 95% with six or more.

- Lower Return on Investment: Subsequent filers must bear the full, multi-million-dollar cost of developing their product and litigating the brand’s patents, but without the potential for the lucrative exclusivity period to recoup that investment.8

This reality means that the entire business case for a subsequent filer is fundamentally different from that of a first-filer. The first filer is engaged in a high-risk, high-reward venture to secure a temporary monopoly. The subsequent filer, by contrast, is making a more modest investment in gaining the right to compete in a commoditized market. Their strategic objective is not market dominance, but efficient market access. This distinction must inform every decision they make, from product selection to litigation posture.

Strategic Options for Subsequent Filers

Despite the challenges, subsequent filers are not powerless. They can and must pursue proactive strategies to optimize their position and accelerate their market entry. Their playbook should focus on monitoring, preparation, and opportunism.

1. Monitor and Prepare: The first filer’s litigation is the most important piece of competitive intelligence for all subsequent filers. By using data platforms and closely following court proceedings, subsequent filers can assess the strength of the first filer’s legal arguments, the likelihood of a settlement, and the overall probability of success. This intelligence allows them to refine their own case and prepare for launch, ensuring that all regulatory and manufacturing requirements are in place the moment the market opens.

2. Litigate in Parallel: A subsequent filer should not simply wait on the sidelines. They must proceed with their own litigation against the brand. A favorable outcome for any generic challenger can benefit all. For example, if a second-filer successfully gets a key patent invalidated in court, that ruling can have a powerful precedential effect (or even a binding effect through collateral estoppel) that helps clear the patent obstacle for everyone, including the first filer.

3. Target Forfeiture Events: Subsequent filers must be vigilant in monitoring the first filer for any action that could trigger a forfeiture of exclusivity. Is the first filer struggling to resolve deficiencies with the FDA? Are they approaching the 30-month deadline for tentative approval? Is there any indication they might withdraw their application? A forfeiture event can create a sudden opening for a well-prepared subsequent filer to leapfrog into the market.

4. Consider the “At-Risk” Launch: Like the first filer, a subsequent filer may also face the decision of whether to launch “at-risk” if the 30-month stay on its own application expires before the patent litigation is fully resolved.11 This is an extremely high-risk strategy, but it can be a viable option if the company has a very high degree of confidence in its invalidity or non-infringement case.

5. Collaborate in Multi-District Litigation (MDL): When multiple generics challenge the same drug, the resulting lawsuits are often consolidated into a Multi-District Litigation (MDL) for pre-trial proceedings. In this context, subsequent filers can find themselves in a complex dynamic of “co-opetition.” While they are ultimately competitors, they share a common enemy: the brand’s patents. Within the MDL, they can collaborate on key pre-trial activities like discovery, expert witness preparation, and claim construction arguments. This allows them to share the significant costs of litigation and present a more powerful, united front against the brand. This “wolf pack” approach, where the success of one can benefit all by weakening the brand’s patents, is a powerful strategy for subsequent filers.

The following table provides a clear, at-a-glance comparison of the strategic realities facing first-to-file and subsequent filers.

Table 1: First-to-File vs. Subsequent Filer: A Strategic Comparison

| Strategic Factor | First-to-File (FTF) Applicant | Subsequent Filer |

| Strategic Objective | Secure 180-day exclusivity and achieve temporary market dominance. | Gain efficient market access upon the expiration of the FTF’s exclusivity. |

| Primary Incentive | Super-normal profits from a temporary duopoly with the brand. | A share of a highly competitive, commoditized generic market. |

| Key Risks | High litigation costs for a single prize; failure to secure exclusivity; forfeiture of exclusivity. | Entering a hyper-competitive market with low margins; being indefinitely blocked if the FTF settles on unfavorable terms. |

| Litigation Posture | Aggressive and front-loaded; must establish a strong case from the outset to secure FTF status and win the litigation. | Often a “fast follower”; can learn from the FTF’s litigation, but must still mount a full legal challenge. |

| Settlement Goals | Secure an early, licensed entry date that preserves the value of the 180-day exclusivity period. | Settle for an entry date at or immediately after the 180-day period expires. |

| Post-Launch Market | Enters a duopoly market; prices are moderately discounted (15-25% off brand). | Enters a multi-player market; prices erode rapidly (80-90% off brand). |

Intelligence is Ammunition: Leveraging Data for Strategic Advantage

In the modern pharmaceutical landscape, strategy without data is merely guesswork. The complexity of patent thickets, the precision required for the race to file, and the high financial stakes of litigation demand a sophisticated, intelligence-driven approach. The days of relying on intuition or incomplete information are over. For today’s generic drug companies, comprehensive, real-time data is not just helpful; it is the cost of entry into the competitive arena.

Using Data Platforms like DrugPatentWatch

The sheer volume and complexity of the data involved in ANDA strategy—from patent filings and prosecution histories to court dockets and regulatory updates—make specialized business intelligence platforms an indispensable tool. Services like DrugPatentWatch are designed to aggregate this disparate information into a single, actionable resource for pharmaceutical companies.57

These platforms provide the critical intelligence needed to inform every stage of the Paragraph IV process 59:

- Opportunity Identification: By tracking patent expiration dates, regulatory exclusivities, and sales data for brand-name drugs, these platforms help companies identify the most promising targets for generic development. This allows for more strategic portfolio management, focusing resources on products with the highest potential return on investment.59

- Pre-Filing Due Diligence: A comprehensive database of global patents, including their legal status and litigation history, is the starting point for any robust patent landscape or FTO analysis. This data is essential for building the invalidity and non-infringement arguments required for a Paragraph IV challenge.59

- Litigation Strategy and Competitive Intelligence: Perhaps the most valuable function of these platforms is their ability to track ongoing ANDA litigation. By monitoring new Paragraph IV filings, lawsuits, court decisions, and settlements, companies can gain a real-time understanding of the competitive landscape. A subsequent filer can “study failed patent challenges to develop a better strategy” or “track litigation to anticipate early generic entry”. This allows companies to benchmark their strategies against competitors, predict litigation outcomes, and make more informed decisions about whether to litigate, settle, or abandon a project.

- Lifecycle Management: Intelligence on biosimilar activity, new formulations, and other “evergreening” strategies employed by brand companies helps generics anticipate future market shifts and identify new opportunities.

In today’s data-driven environment, attempting to navigate the Paragraph IV landscape without access to this level of intelligence is like trying to navigate a minefield blindfolded. Companies that leverage these tools effectively are able to make faster, smarter, and more profitable decisions, giving them a significant competitive advantage.

Decoding Litigation Statistics for Predictive Insights

Beyond tracking individual cases, analyzing aggregate litigation data can reveal powerful trends and provide predictive insights that can shape a company’s entire strategic posture. The statistics paint a clear and compelling picture of the ANDA litigation landscape.

One of the most telling sets of statistics relates to the success rates of generic challengers. One comprehensive study found that the overall “success rate” for generics in Paragraph IV challenges was a remarkable 76%. However, this number comes with a critical caveat: the study defined “success” to include not only court victories but also settlements and cases that were dropped by the brand.1 When looking only at cases that were fully litigated to a trial decision, the generic win rate plummeted to just

48%. More recent data from 2024 suggests an even starker trend, with innovator companies prevailing in court decisions 20% of the time, compared to just 2% for generic companies.

This massive gap between the overall “success” rate and the actual trial win rate reveals a crucial strategic insight: generics are exceptionally good at forcing settlements, but brands remain formidable opponents in the courtroom. The primary strategic value of filing a Paragraph IV challenge is often not to achieve a complete knockout victory at trial, but rather to create a sufficient level of legal risk and commercial uncertainty for the brand company that it is compelled to offer a settlement with an early, licensed entry date.

This understanding should fundamentally shape a generic company’s goals and expectations. While preparing to win at trial is essential, the most likely and often most profitable outcome is a negotiated peace. This places a premium on building a strong enough case during the pre-litigation and discovery phases to create maximum leverage at the settlement table.

Other key statistical trends that should inform strategy include:

- Venue Matters: The vast majority of ANDA cases are filed in just a few federal districts, primarily the District of Delaware and the District of New Jersey.52 These courts have developed deep expertise in handling these complex cases. Statistics show that the trial win rate for generics in these popular districts is even lower, at around 36%. This data can inform venue selection strategies and help set realistic expectations based on where a case is being heard.

- The Rise of IPRs: The creation of the Inter Partes Review (IPR) process at the U.S. Patent and Trademark Office (USPTO) has provided an alternative venue for challenging patent validity. The institution rate for IPRs filed against Orange Book-listed patents is a healthy 62% , making it an attractive and often faster and less expensive option for generics to attack a brand’s patents, often in parallel with district court litigation.

By continuously monitoring and interpreting these statistical trends, pharmaceutical executives can move beyond reacting to individual events and begin to anticipate market shifts, predict legal outcomes, and allocate their resources with greater strategic precision.

Lessons from the Trenches: Illuminating Case Studies

Theory and statistics provide the map, but case studies show the terrain. To truly understand the strategic nuances of Paragraph IV litigation, we must examine the real-world battles that have shaped the industry. The following cases have been selected not just for their legal significance, but for the powerful, actionable lessons they offer to any company preparing to enter the ANDA arena. Each one illuminates a key strategic principle, from attacking patent thickets to the critical importance of settlement language.

Teva v. Pfizer (Celebrex): The Double Patenting and Best Mode Attack

The Battle: Teva Pharmaceuticals launched a Paragraph IV challenge against Pfizer’s blockbuster anti-inflammatory drug, Celebrex. Pfizer had constructed a “patent thicket” around the drug, including a primary patent on the celecoxib compound and later patents on methods of using the drug to treat inflammation. Teva’s attack focused on invalidating these patents.

The Outcome: The U.S. Court of Appeals for the Federal Circuit handed Teva a major victory. It invalidated one of Pfizer’s key method-of-use patents (U.S. Patent No. 5,760,068) on the grounds of obviousness-type double patenting.65 The court found that the earlier patent covering the celecoxib compound (‘165 patent) had already disclosed the compound’s use for treating inflammation in its specification. Therefore, Pfizer could not get a second, later-expiring patent for the same use of the same compound. The court ruled that this was an improper attempt to extend its patent monopoly. However, the court rejected Teva’s argument that other patents were invalid for failing to disclose the “best mode” of the invention, specifically the compound’s preference for inhibiting the COX-2 enzyme.65

The Strategic Lesson: This case is a quintessential example of how a generic company can successfully dismantle a patent thicket. It demonstrates that later-filed patents on new formulations or methods of use—common “evergreening” strategies for brand companies—are highly vulnerable to a double patenting challenge if that new use or formulation was already described or made obvious by the brand’s original patent. For generic strategists, this highlights a critical area for pre-litigation analysis: meticulously scrutinize the specifications of a brand’s early patents for disclosures that could invalidate their later ones.

Mylan/Sandoz v. Teva (Copaxone): Obviousness of Dosing and the Supreme Court’s Impact

The Battle: This was a complex, multi-front war involving multiple generic challengers, including Mylan and Sandoz, against Teva’s patents covering its blockbuster multiple sclerosis drug, Copaxone. A key part of the fight centered on Teva’s later-filed patents for a new, more convenient dosing regimen (40 mg, three times per week) designed to extend the product’s life cycle. The generics argued this new regimen was obvious over the prior art, which already disclosed various doses and frequencies. A separate but related issue involving Sandoz, concerning the indefiniteness of the term “molecular weight” in an earlier patent, escalated all the way to the Supreme Court.46

The Outcome: The generic challengers were largely successful. The Federal Circuit affirmed a lower court decision that the new dosing regimen was indeed obvious to a person of ordinary skill in the art, invalidating those key patents. The court found that the prior art contained a finite number of known, successful dose and frequency options, and there was a clear motivation for a skilled artisan to try a less frequent, higher-dose regimen to improve patient convenience. In the landmark Teva v. Sandoz portion of the dispute, the Supreme Court established the new, more deferential “clear error” standard of review for factual findings underlying claim construction, a decision with far-reaching implications for all patent litigation.

The Strategic Lesson: This case provides two powerful lessons. First, it shows that even clever evergreening strategies like new dosing regimens can be successfully defeated on obviousness grounds if the prior art provides a strong “obvious to try” rationale. It serves as a warning to brands that minor modifications may not be enough to secure a valid new patent. Second, it reinforces the monumental importance of the district court phase of litigation. As established in the Teva v. Sandoz decision, winning the “battle of the experts” and securing favorable factual findings from the trial judge is now more critical than ever, as those findings are much more difficult to overturn on appeal.

Dr. Reddy’s v. AstraZeneca (Nexium): When Settlements Lead to New Fights

The Battle: Dr. Reddy’s Laboratories and AstraZeneca had previously settled a patent infringement lawsuit over the blockbuster heartburn medication Nexium, with the agreement allowing Dr. Reddy’s to launch its generic on a specified date. When Dr. Reddy’s launched its product, it used a purple-colored capsule, similar to the iconic “purple pill” branding of Nexium. AstraZeneca promptly filed a new lawsuit, not for patent infringement, but for trademark and trade dress infringement over the color purple.70

The Outcome: An initial temporary restraining order was granted against Dr. Reddy’s, halting sales of its purple generic. Dr. Reddy’s immediately countersued, arguing that AstraZeneca’s new lawsuit was a breach of their original settlement agreement. Dr. Reddy’s claimed that the product it launched, including the purple capsule, was the same one disclosed to AstraZeneca during the original patent litigation, and that the settlement’s release from claims should have covered this issue.

The Strategic Lesson: This case is a critical cautionary tale about the scope and precision of settlement agreements. It demonstrates that resolving a patent dispute does not automatically resolve all potential intellectual property conflicts. Brand companies can and will use other forms of IP, such as trademarks and trade dress, as a secondary line of defense to harass or delay generic entry. The lesson for generic companies is to demand comprehensive settlement agreements that include broad releases from all potential claims—patent, trademark, or otherwise—related to the manufacture, marketing, and sale of the specific generic product described in the ANDA.

Sun Pharma v. Eli Lilly (Gemzar): The Classic Double Patenting Play

The Battle: Sun Pharmaceutical challenged an Eli Lilly patent covering a method of using its chemotherapy drug, Gemzar, to treat tumors. Sun did not dispute that its product would infringe the patent; instead, it argued that the patent itself was invalid.

The Outcome: Sun Pharma won a decisive victory at the district court level on summary judgment. The court agreed with Sun’s argument that Eli Lilly’s method-of-use patent (‘826 patent) was invalid for obviousness-type double patenting. The court found that the earlier patent covering the Gemzar compound itself (‘614 patent) had explicitly disclosed the compound’s anti-cancer utility in its specification. Therefore, Lilly had effectively claimed the same invention twice and was improperly trying to extend its monopoly.

The Strategic Lesson: This case provides another clear, textbook example of the power of the double patenting argument, reinforcing the lesson from the Celebrex case. It shows that a generic company doesn’t need a novel or complex legal theory to win; sometimes the most effective strategy is a straightforward application of established patent law principles. It underscores the importance for generic challengers to meticulously review the full text of a brand’s foundational compound patents. Often, in their effort to describe the utility of their new molecule, the brand’s scientists will disclose potential uses that the company later tries to patent separately. This creates a clear vulnerability that a sharp-eyed generic challenger can exploit to invalidate the later patent.

Conclusion: From Legal Hurdle to Strategic Weapon

The journey through the world of Paragraph IV certifications is a journey from regulatory complexity to strategic clarity. We have seen that the Hatch-Waxman Act is not merely a set of rules, but a carefully engineered ecosystem designed to foster a state of structured conflict. Within this system, the ANDA filing is not a passive submission but an active declaration of commercial intent, and the ensuing litigation is a high-stakes chess match where the opening moves, made years in advance through rigorous pre-filing intelligence, often decide the final outcome.

The 180-day exclusivity is the ultimate prize, a financial engine powerful enough to justify the immense risks of the challenge. This golden ticket has created an intense and sophisticated race among generic manufacturers, not just to be first, but to be perfectly timed. For those who are not first—the second wave of filers—the strategic calculus shifts entirely. Theirs is a game of patience, opportunism, and collaborative pressure, aiming not for market dominance but for efficient market access in the hyper-competitive world that follows exclusivity.

Throughout this process, one truth has become self-evident: intelligence is ammunition. In the modern ANDA landscape, data-driven strategy is no longer a luxury; it is the price of admission. Platforms that provide real-time insights into the patent and litigation landscape are foundational tools, and the ability to decode litigation statistics into predictive insights is a core competency of market leaders. The case studies from the legal trenches reinforce these principles, showing how well-executed strategies can dismantle even the most formidable patent thickets, while a lack of foresight can lead to new and unexpected battles.

Ultimately, navigating multiple ANDA submissions with Paragraph IV certifications requires a holistic and integrated approach. It demands that legal, regulatory, and commercial teams work in lockstep, guided by a singular strategic vision. It requires viewing the patent challenge not as a legal problem to be managed, but as a strategic weapon to be wielded. For the companies that master this complex art, the Paragraph IV pathway is more than just a route to market; it is a powerful engine for growth and a cornerstone of competitive advantage in the global pharmaceutical industry.

Key Takeaways

- The Paragraph IV Filing is a Strategic Act: View the filing of an ANDA with a Paragraph IV certification not as a regulatory task, but as a deliberate business decision to initiate a commercial conflict with predictable stages and high stakes.

- 180-Day Exclusivity is the Primary Economic Driver: The vast majority of a generic product’s lifetime profitability can be captured during the 180-day exclusivity period. This justifies the high upfront cost and risk of litigation and should be the central focus of any first-filer’s strategy.

- Pre-Filing Intelligence is Paramount: The outcome of ANDA litigation is often determined by the quality of the patent landscape and Freedom-to-Operate analysis conducted before the ANDA is ever filed. This is the highest-leverage investment a generic company can make.

- The District Court is the Key Battleground: Following the Supreme Court’s decision in Teva v. Sandoz, the factual findings of the district court judge in claim construction are harder to overturn. Winning the “battle of the experts” at the trial level is more critical than ever.

- Subsequent Filers Must Play a Different Game: Companies that are not first-to-file cannot simply copy the first-filer’s strategy. Their approach must be tailored to the realities of entering a post-exclusivity, commoditized market, focusing on opportunism, monitoring, and cost-sharing through mechanisms like MDLs.

- Litigation is Often a Means to a Settlement: Statistical analysis shows that while brands have a strong record in court, the high overall “success rate” for generics is driven by settlements. The primary goal of litigation is often to create enough leverage to negotiate a favorable, early market entry date.

- Data is Non-Negotiable: The complexity of the modern patent landscape and the precision required for timely filing make comprehensive business intelligence platforms, such as DrugPatentWatch, essential tools for strategic planning, competitive monitoring, and risk assessment.

Frequently Asked Questions (FAQ)

1. If multiple generic companies share 180-day exclusivity, how do they typically coordinate their launch and pricing strategies?

When multiple filers share exclusivity, there is no formal coordination, as that would raise significant antitrust concerns. Instead, what emerges is a competitive but still highly profitable market dynamic. Each company makes its own independent decision on launch timing and pricing. Typically, all sharing filers who are ready will launch on or around the same day to maximize their time in the limited-competition market. Pricing will be more competitive than a true duopoly (one generic vs. the brand) but still significantly higher than in a fully commoditized market. Prices might be 30-50% below the brand price, as opposed to 15-25% in a duopoly or 80-90% in a multi-generic market. The key takeaway is that while shared exclusivity is less lucrative than sole exclusivity, it is still vastly more profitable than entering the market after the 180-day period has expired.

2. What is the role of an “authorized generic” (AG), and how does its launch by the brand company impact the strategy of a first-to-file ANDA applicant?

An authorized generic is a drug product marketed by the brand company (or a partner) that is identical to the brand-name drug but sold under a generic label. Because it is marketed under the brand’s original NDA, it does not require an ANDA and is not blocked by the first-filer’s 180-day exclusivity. A brand company will often launch an AG simultaneously with the first generic challenger’s launch. This is a powerful defensive strategy. The AG immediately cuts into the first-filer’s sales and revenue, reducing the value of the 180-day exclusivity period by 40-52% on average. For a first-filer, the potential for an AG launch must be factored into the risk-reward analysis. It reduces the potential upside of a Paragraph IV challenge, but for blockbuster drugs, the remaining profit is often still substantial enough to incentivize the challenge.

3. How has the availability of Inter Partes Review (IPR) at the USPTO changed the strategic calculus for a Paragraph IV challenger?

The IPR process, established in 2011, has been a game-changer. It allows anyone to challenge the validity of a patent directly at the U.S. Patent and Trademark Office’s Patent Trial and Appeal Board (PTAB). For a Paragraph IV challenger, an IPR offers a parallel, often faster, and less expensive venue to attack a brand’s patents. The standard for proving invalidity at the PTAB is lower (“preponderance of the evidence”) than in district court (“clear and convincing evidence”). A generic company will often file IPR petitions against the brand’s key patents at the same time it is litigating in district court. A win at the PTAB can invalidate the patent, effectively ending the district court case. District court judges will sometimes even stay their own proceedings pending the outcome of an IPR. This two-front war significantly increases the pressure on the brand company and provides the generic with additional leverage for settlement.

4. What are the key considerations when deciding whether to accept a “pay-for-delay” or “reverse payment” settlement, and what are the antitrust risks?

A “pay-for-delay” or “reverse payment” settlement is one in which the brand company pays the generic challenger to settle the patent litigation and agree to delay its market entry until a certain date.27 The Supreme Court’s decision in

FTC v. Actavis held that these settlements can violate antitrust laws and are subject to a “rule of reason” analysis. The key consideration for a generic company is balancing the certainty of a guaranteed payment and a licensed entry date against the potential for an earlier, riskier launch and the threat of antitrust litigation from the Federal Trade Commission (FTC) or private parties. A settlement is risky if the payment from the brand is large and cannot be justified by legitimate business reasons (e.g., saved litigation costs). Companies must carefully structure any settlement to avoid the appearance of being paid to stay off the market, which is the core of the antitrust concern.

5. For a blockbuster drug with a dense “patent thicket,” how should a generic company prioritize which patents to challenge in its Paragraph IV certification?

Tackling a patent thicket requires a strategic, tiered approach. A generic company should prioritize its challenges based on a thorough pre-filing analysis:

- Identify the “Gatekeeper” Patents: First, identify the core patents that, if valid and infringed, would absolutely block market entry. These are typically the compound patent and key formulation patents. These must be challenged.

- Assess Vulnerability: Rank all listed patents based on their perceived weakness. Patents with clear vulnerabilities (e.g., strong prior art for an obviousness challenge, potential for a double patenting argument) should be prioritized for a Paragraph IV certification.

- Consider “Design-Arounds”: For some patents, particularly those related to specific formulations or manufacturing processes, the best strategy may not be a legal challenge but a scientific one. If the generic can develop a product that does not infringe the patent claims (a “design-around”), it can file a Paragraph IV certification on non-infringement grounds, which is often a stronger position than an invalidity challenge.

- Strategic Omission: It is not always necessary to challenge every single patent. For weaker, later-expiring method-of-use patents, a generic may choose to file a “Section viii statement” or “skinny label,” carving out the patented use from its product labeling and launching only for non-patented indications.6 This avoids litigation on that patent entirely. The goal is to find the most efficient path through the thicket, not to chop down every tree.

References

- What Every Pharma Executive Needs to Know About Paragraph IV Challenges, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- 40th Anniversary of the Generic Drug Approval Pathway – FDA, accessed August 6, 2025, https://www.fda.gov/drugs/cder-conversations/40th-anniversary-generic-drug-approval-pathway

- Drug Price Competition and Patent Term Restoration Act – Wikipedia, accessed August 6, 2025, https://en.wikipedia.org/wiki/Drug_Price_Competition_and_Patent_Term_Restoration_Act

- Hatch-Waxman Act – Practical Law, accessed August 6, 2025, https://uk.practicallaw.thomsonreuters.com/Glossary/PracticalLaw/I2e45aeaf642211e38578f7ccc38dcbee

- Hatch-Waxman 101 – Fish & Richardson, accessed August 6, 2025, https://www.fr.com/insights/thought-leadership/blogs/hatch-waxman-101-3/

- The Definitive Guide to Generic Drug Approval in the U.S.: From ANDA to Market Dominance – DrugPatentWatch, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/obtaining-generic-drug-approval-in-the-united-states/

- The Hatch-Waxman Act: A Primer – EveryCRSReport.com, accessed August 6, 2025, https://www.everycrsreport.com/reports/R44643.html

- Paragraph IV Explained – ParagraphFour.com, accessed August 6, 2025, https://paragraphfour.com/paragraph-iv-explained/

- Hatch-Waxman Litigation 101: The Orange Book and the Paragraph IV Notice Letter, accessed August 6, 2025, https://www.dlapiper.com/insights/publications/2020/06/ipt-news-q2-2020/hatch-waxman-litigation-101

- Abbreviated New Drug Application – Wikipedia, accessed August 6, 2025, https://en.wikipedia.org/wiki/Abbreviated_New_Drug_Application

- The timing of 30‐month stay expirations and generic entry: A cohort study of first generics, 2013–2020, accessed August 6, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8504843/

- www.fda.gov, accessed August 6, 2025, https://www.fda.gov/drugs/types-applications/abbreviated-new-drug-application-anda#:~:text=An%20abbreviated%20new%20drug%20application,brand%2Dname%20drug%20it%20references.

- Abbreviated New Drug Application (ANDA) – FDA, accessed August 6, 2025, https://www.fda.gov/drugs/types-applications/abbreviated-new-drug-application-anda

- What is ANDA? – UPM Pharmaceuticals, accessed August 6, 2025, https://www.upm-inc.com/what-is-anda

- Drugs@FDA Glossary of Terms, accessed August 6, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/drugsfda-glossary-terms

- What is Abbreviated New Drug Application (ANDA)? | Glossary – Proxima CRO, accessed August 6, 2025, https://www.proximacro.com/glossary/abbreviated-new-drug-application-anda

- The Generic Drug Approval Process – FDA, accessed August 6, 2025, https://www.fda.gov/drugs/cder-conversations/generic-drug-approval-process

- Abbreviated New Drug Application (ANDA) Approval Process – FDA, accessed August 6, 2025, https://www.fda.gov/media/166141/download

- Generic Drugs: Questions & Answers – FDA, accessed August 6, 2025, https://www.fda.gov/drugs/frequently-asked-questions-popular-topics/generic-drugs-questions-answers

- Essential ANDA Checklist: Key Steps to Streamline Your Filing Process, accessed August 6, 2025, https://vicihealthsciences.com/anda-checklist-for-filing-process/

- ANDA regulatory approval process | PPTX – SlideShare, accessed August 6, 2025, https://www.slideshare.net/slideshow/anda-regulatory-approval-process/170225208

- Inside the ANDA Approval Process: What Patent Data Can Tell You – DrugPatentWatch, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/inside-the-anda-approval-process-what-patent-data-can-tell-you/

- 21 CFR Part 314 Subpart C — Abbreviated Applications – eCFR, accessed August 6, 2025, https://www.ecfr.gov/current/title-21/chapter-I/subchapter-D/part-314/subpart-C

- An International Guide to Patent Case Management for Judges – WIPO, accessed August 6, 2025, https://www.wipo.int/patent-judicial-guide/en/full-guide/united-states/10.13.2

- Tips For Drafting Paragraph IV Notice Letters | Crowell & Moring LLP, accessed August 6, 2025, https://www.crowell.com/a/web/v44TR8jyG1KCHtJ5Xyv4CK/tips-for-drafting-paragraph-iv-notice-letters.pdf

- STRATEGIES FOR FILING SUCCESSFUL PARAGRAPH IV CERTIFICATIONS – St. Onge Steward Johnston & Reens LLC, accessed August 6, 2025, https://www.ssjr.com/wp-content/uploads/2018/05/presentations/lawyer_1/92706VA.pdf

- Hatch-Waxman ANDA procedure summary.rev2.docx – UH Law Center, accessed August 6, 2025, https://www.law.uh.edu/faculty/pjanicke/Pat.Rems.Defs.files/Hatch-Waxman%20ANDA%20procedure%20summary.rev2.docx

- Intricacies of the 30-Month Stay in Pharmaceutical Patent Cases …, accessed August 6, 2025, https://www.finnegan.com/en/insights/articles/intricacies-of-the-30-month-stay-in-pharmaceutical-patent-cases.html

- Patent Certifications and Suitability Petitions – FDA, accessed August 6, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/patent-certifications-and-suitability-petitions

- Hatch-Waxman 201 – Fish & Richardson, accessed August 6, 2025, https://www.fr.com/insights/thought-leadership/blogs/hatch-waxman-201-3/

- 30-Month Stay – Orange Book Blog, accessed August 6, 2025, https://www.orangebookblog.com/30-month-stay/

- The Role of Litigation Data in Predicting Generic Drug Launches – DrugPatentWatch, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/the-role-of-litigation-data-in-predicting-generic-drug-launches/

- Most-Favored Entry Clauses in Drug-Patent Litigation Settlements: A Reply to Drake and McGuire (2022) – American Bar Association, accessed August 6, 2025, https://www.americanbar.org/content/dam/aba/publications/antitrust/magazine/2023/december/most-favored-entry-clauses.pdf

- Guidance for Industry 180-Day Exclusivity When Multiple ANDAs Are Submitted on the Same Day – FDA, accessed August 6, 2025, https://www.fda.gov/files/drugs/published/180-Day-Exclusivity-When-Multiple-ANDAs-Are-Submitted-on-the-Same-Day.pdf

- Go for It! (Connect) Paragraph IV! FDA Revamps ANDA Paragraph IV Certifications List, accessed August 6, 2025, https://www.thefdalawblog.com/2019/06/go-for-it-connect-paragraph-iv/

- ANDA Filers Use Patent Landscaping and Paragraph IV Certifications to Overcome Branded Drug Patents – GeneOnline News, accessed August 6, 2025, https://www.geneonline.com/anda-filers-use-patent-landscaping-and-paragraph-iv-certifications-to-overcome-branded-drug-patents/

- ANDA Litigation: Strategies and Tactics for Pharmaceutical Patent Litigators, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/anda-litigation-strategies-and-tactics-for-pharmaceutical-patent-litigators/