Part I: The Exclusivity Landscape: Understanding the Terrain

The strategic management of a pharmaceutical company’s portfolio is fundamentally dictated by the lifecycle of its intellectual property and regulatory protections. The concept of a “patent cliff”—a term that signifies a dramatic and often perilous decline in revenue following the loss of market exclusivity—is a central feature of this landscape.1 However, viewing this phenomenon merely as an unavoidable threat is a strategic error. For the prepared executive, the patent expiration calendar is not a doomsday clock but a strategic map, revealing opportunities for value extension, competitive maneuvering, and long-range planning. This guide provides a comprehensive framework for transforming the patent cliff from a defensive liability into a proactive strategic opportunity. It begins by deconstructing the intricate and often misunderstood landscape of pharmaceutical exclusivity, moving beyond simplistic definitions to explore the complex interplay between patent law, regulatory frameworks, and market economics.

The Pharmaceutical Patent Lifecycle: Beyond the 20-Year Myth

The foundation of pharmaceutical innovation and profitability rests upon the patent system. However, the common understanding of a patent’s duration is a dangerously incomplete picture for strategic planning. The true commercial value of a patent is not its statutory length but its effective market life, a period significantly eroded by the realities of drug development and regulatory approval.

The Statutory Framework

The lifecycle of a drug patent formally begins with the preparation and filing of a patent application.3 This application must provide a detailed disclosure of the invention—be it a new composition of matter, a specific formulation, or a novel therapeutic use—sufficient to allow a “person skilled in the art” to replicate it without undue experimentation.3 Following an examination process that can take several years, a patent is granted if it meets the statutory criteria of novelty, non-obviousness, and utility.3

Under international agreements, most notably the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), the standard term for a pharmaceutical patent is 20 years from the date of the initial application filing.3 This 20-year period represents the “nominal” or “theoretical” lifespan of the patent, during which the patent holder has the right to exclude others from making, using, or selling the claimed invention.4

The Commercial Reality

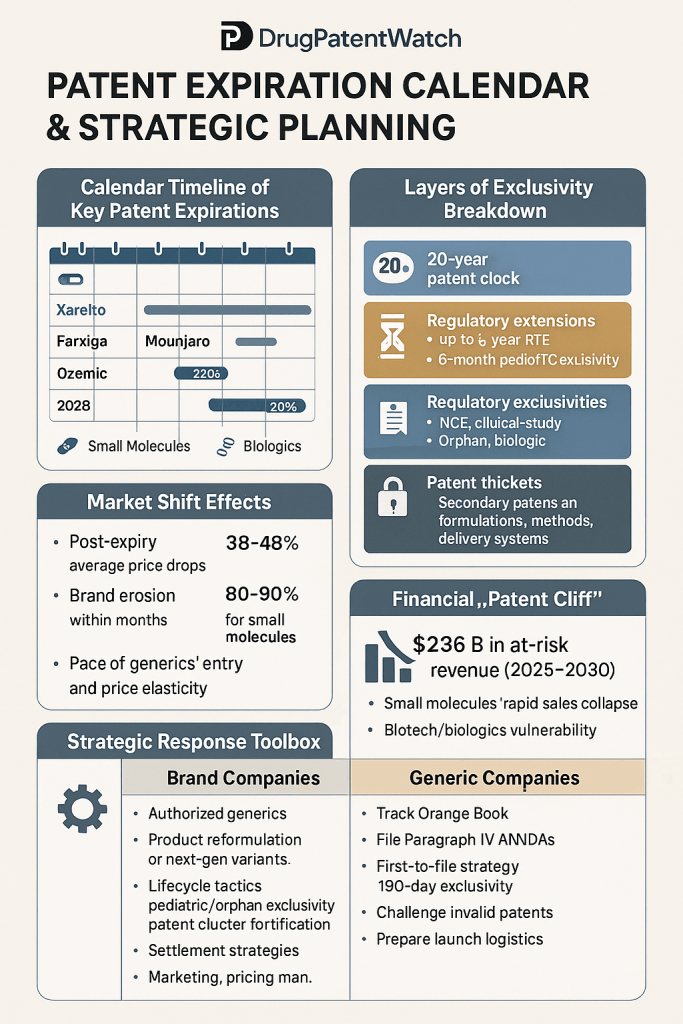

The critical strategic challenge lies in the disconnect between this 20-year nominal term and the actual period of commercial exclusivity. The patent’s clock starts ticking from the filing date, which typically occurs very early in the drug development process.3 A substantial portion of the patent term—often more than a decade—is consumed during the arduous and high-risk phases of preclinical research, clinical trials, and regulatory review before the drug ever reaches the market.3 This chasm between the nominal 20-year term and the effective market exclusivity period, which is often only 7 to 12 years at the time of launch, is not a mere footnote; it is the crucible in which nearly every high-stakes commercial strategy is forged.2

This immense pressure to recoup billions of dollars in R&D investment within a compressed timeframe is the primary driver behind the industry’s characteristic behaviors: aggressive launch pricing, massive marketing expenditures, and a relentless, forward-looking focus on lifecycle management.2 The “strategic gap” between the nominal patent term and the effective commercial life is the central economic pressure point that dictates nearly every major decision in the pharmaceutical industry. The journey from a multi-billion dollar R&D investment over a decade or more, protected by a patent whose clock has been running the entire time, to a market launch with a severely truncated window for recouping costs, explains the “why” behind the strategies detailed throughout this report.1

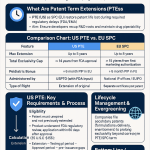

Restoring Lost Time: PTE and SPCs

Recognizing that regulatory delays unfairly erode the value of a patent, major jurisdictions have established mechanisms to restore a portion of the lost term.

In the United States, the Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act, created the Patent Term Extension (PTE) program.12 PTE is designed specifically to restore some of the patent term lost during the FDA’s pre-market review process.12 To be eligible, a patent must claim a product (or its use or method of manufacture) that underwent regulatory review, and the application must be filed within 60 days of the product’s first commercial marketing approval.12 The length of the extension is calculated based on a complex statutory formula that accounts for time spent in clinical trials (the “testing phase”) and during the FDA’s review of the marketing application (the “approval phase”).12 However, the extension is subject to two critical limitations: it cannot exceed five years, and the total remaining patent term after the extension cannot be more than 14 years from the FDA approval date.12

In the European Union, a similar mechanism exists in the form of Supplementary Protection Certificates (SPCs). Like PTEs, SPCs are designed to compensate for the long time it takes to get regulatory approval for a new medicine and can extend the effective patent life by up to five years.3 These extensions are not automatic; they must be applied for and are governed by a distinct set of regulations in each jurisdiction. They are a critical first line of defense in any lifecycle management strategy.

The Regulatory Moat: Patents vs. FDA-Granted Exclusivities

A comprehensive understanding of market protection requires looking beyond the patent system. The U.S. Food and Drug Administration (FDA) grants its own set of statutory marketing rights, known as exclusivities, which are entirely separate from patents. For an executive, it is critical to understand that patents are a form of intellectual property granted by the U.S. Patent and Trademark Office (USPTO), while market exclusivity is a statutory marketing right granted by the FDA to prevent generic competition.14 These two forms of protection can run concurrently or sequentially, creating a layered defense against competitors.

The “Exclusivity Stack”

The various types of FDA-granted exclusivities form what can be termed an “exclusivity stack”—a series of overlapping or sequential protections that can significantly prolong a drug’s monopoly period.9 A company’s true Loss of Exclusivity (LOE) date is not merely its patent expiration date; it is the date on which the

last-to-expire protection—be it a patent, a PTE, or an FDA exclusivity—runs out. The key types of exclusivity include 14:

- New Chemical Entity (NCE) Exclusivity: A drug containing a new active moiety (an active ingredient never before approved by the FDA) is granted five years of market exclusivity from the date of its approval. During this period, the FDA cannot accept an Abbreviated New Drug Application (ANDA) from a generic manufacturer for the first four years (if it contains a Paragraph IV patent challenge).

- Orphan Drug Exclusivity (ODE): To incentivize the development of drugs for rare diseases (affecting fewer than 200,000 people in the U.S.), the FDA grants a seven-year period of market exclusivity for a drug approved with an orphan designation.

- New Clinical Investigation (NCI) Exclusivity: This three-year exclusivity is granted for the approval of a new application, or a supplement to an existing application, if that approval required the submission of new clinical studies (other than bioavailability studies). This is a powerful tool for lifecycle management, as it can be awarded for new indications, new dosage forms, or other significant changes to a previously approved drug.

- Pediatric Exclusivity: To encourage the study of drugs in children, the FDA can grant an additional six months of exclusivity. This valuable extension is added to all existing patent and exclusivity periods for all of the drug’s approved indications, not just the pediatric one.

- Generating Antibiotic Incentives Now (GAIN) Act Exclusivity: To combat antibiotic resistance, certain drugs designated as Qualified Infectious Disease Products (QIDPs) are eligible for an additional five-year exclusivity period, which is added to any other exclusivities.

- 180-Day Generic Drug Exclusivity: In a crucial provision of the Hatch-Waxman Act, the first generic applicant to submit a substantially complete ANDA containing a Paragraph IV patent challenge is rewarded with a 180-day period of marketing exclusivity. During this time, the FDA cannot approve any other generic versions of the same drug, giving the first-filer a significant first-mover advantage.2

The various FDA exclusivities are not mere footnotes to patent law; they constitute a parallel and independent system of monopoly protection. A savvy executive must strategize across both patent and regulatory frameworks simultaneously. A patent’s validity can be challenged and overturned in court, but an FDA-granted exclusivity, such as the seven-year ODE, is a statutory right not subject to the same legal vulnerabilities.15 This means a company’s “exclusivity stack” must be meticulously mapped, managed, and maximized as a core strategic asset, as a strong regulatory position can sometimes be more durable than a contested patent.

Anatomy of the Patent Cliff: Quantifying the Financial Precipice

The “patent cliff” is a colloquialism that aptly captures the phenomenon of a sharp, sudden, and often catastrophic decline in revenue that a company experiences when a blockbuster drug loses market exclusivity and is flooded with low-cost generic or biosimilar competition.1

Economic Impact

The financial consequences of falling off the patent cliff are staggering. It is not uncommon for a blockbuster drug’s revenue to plummet by 80-90% within the first year of generic entry.2 This is driven by the dramatically lower price of generic alternatives, which can be 80-85% cheaper than the original branded drug.1 For a company that is heavily reliant on a single product, this represents an existential threat.2 The effect is particularly pronounced for “blockbuster drugs” that generate billions in annual revenue. For example, when Pfizer’s Lipitor lost patent protection in 2011, its annual revenue dropped from approximately $13 billion to under $3 billion within a few years.10

The Looming Cliff (2025-2030)

The pharmaceutical industry is currently staring down a patent cliff of historic proportions. Industry analysts project that between 2025 and 2030, nearly 70 high-revenue products will face patent expiration, putting a colossal $236 billion in annual revenue at risk.2 Some estimates place the total revenue loss risk as high as

$400 billion.17 Analysis from William Blair estimates that from 2023 through the end of 2025 alone, nearly 50 products will lose patent protection, which is expected to erode the aggregate sales of these drugs from $162.8 billion in 2025 to just $67 billion in 2029.18 This looming wave of expirations is forcing companies to aggressively restock their pipelines by investing in R&D, in-licensing experimental therapies, or acquiring other drugmakers.2

Investor and Market Implications

This phenomenon is not merely an internal concern. It has profound implications for investors, who scrutinize a company’s pipeline and patent portfolio for signs of vulnerability.2 A looming, unaddressed patent cliff can erode investor confidence, depress stock prices, and severely limit a company’s access to the capital required for future innovation.2 This pressure has been a major driver of industry consolidation, as companies seek to merge or acquire to replace lost revenue streams.1 The abstract threat of the patent cliff becomes concrete when quantified. The table below provides an at-a-glance view of the specific drugs, companies, and revenue figures at risk, serving as a calendar of disruption. This visualization allows an executive to immediately assess their own company’s vulnerability relative to its peers, informing competitive intelligence and highlighting potential M&A targets or partners. It transforms an industry-wide problem into a specific, actionable set of data points for strategic planning.

Table 1: The Upcoming Patent Cliff (2025-2029)

| Blockbuster Drug (Brand Name) | Active Ingredient | Innovator Company(s) | Peak/Recent Annual Sales | Expected U.S. LOE Year(s) | Source(s) |

| Keytruda | Pembrolizumab | Merck | ~$29.5 Billion (2023) | 2028 | 2 |

| Eliquis | Apixaban | Bristol Myers Squibb / Pfizer | >$13 Billion (2024) | ~2026-2028 | 2 |

| Opdivo | Nivolumab | Bristol Myers Squibb | >$9 Billion (2023) | 2028 | 18 |

| Entresto | Sacubitril/Valsartan | Novartis | $7.8 Billion (2024) | 2025 | 18 |

| Januvia/Janumet | Sitagliptin | Merck | >$5 Billion (Combined) | 2026 | 18 |

| Ibrance | Palbociclib | Pfizer | >$4.7 Billion (2022) | 2027 | 18 |

| Xtandi | Enzalutamide | Pfizer / Astellas | >$4.5 Billion (Combined) | 2027 | 18 |

| Farxiga | Dapagliflozin | AstraZeneca | $7.7 Billion (2024) | 2025 | 18 |

| Yervoy | Ipilimumab | Bristol Myers Squibb | $2.5 Billion (2024) | 2025 | 18 |

Part II: The Originator’s Playbook: Strategies for Defending and Extending Value

Faced with the inevitability of patent expiration, originator companies have developed a sophisticated playbook of strategies designed to defend market share, mitigate revenue erosion, and extend the commercial value of their products. This is not a single strategy, but a multi-faceted approach that must be initiated years in advance and integrated across legal, R&D, and commercial functions.19 The following sections detail the core components of this strategic playbook.

Proactive Lifecycle Management: The Art of “Evergreening”

The most prominent set of strategies for extending a drug’s commercial life falls under the umbrella of “lifecycle management,” often referred to by critics as “evergreening”.19 This practice involves obtaining new, secondary patents on incremental innovations related to an existing drug, thereby layering new periods of exclusivity on top of the original protection.21 While these tactics are often controversial from a public policy perspective, with critics arguing they unduly extend monopolies without significant therapeutic advancement, they are established and legal practices, provided the new inventions meet the statutory requirements for patentability: novelty, non-obviousness, and utility.5

These are not merely defensive legal maneuvers but proactive market-shaping strategies designed to re-segment markets, re-engage prescribers, and create new value propositions for a branded product in the face of generic competition.19 The most durable and defensible evergreening strategies are not just clever legal filings; they are built upon a foundation of tangible, or at least marketable, patient benefit. Strategies that offer “added convenience,” “new routes of administration,” “improved side-effect profiles,” or “reduced dosing” are more likely to succeed in the market and withstand public and legal scrutiny than those perceived as purely anti-competitive.4 This “patient-benefit narrative” is a prerequisite for success, as it provides a compelling reason for physicians and patients to remain loyal to the brand even when a cheaper generic of the original formulation becomes available, creating “brand stickiness” and defending market share.26

Key Evergreening Tactics

The originator’s toolkit for lifecycle management is diverse. The following table provides a structured framework of the available legal strategies, linking them to their mechanisms and real-world examples. This serves as a menu of options, allowing an executive to see the different levers they can pull and understand the strategic rationale behind each.

Table 2: Lifecycle Management (“Evergreening”) Strategies and Examples

| Strategy Type | Mechanism/Description | Real-World Example(s) | Strategic Goal | Source(s) |

| New Formulations | Patenting modifications to the drug’s composition, such as creating an extended-release version, improving stability, or enhancing bioavailability. | Eli Lilly’s Prozac Weekly, a once-a-week formulation launched after the original daily Prozac patent expired. | Enhance patient compliance and convenience, creating a new value proposition to retain market share. | 4 |

| New Delivery Methods | Patenting novel ways to administer the drug, such as inhalers, transdermal patches, or subcutaneous injections for a previously intravenous drug. | GSK’s Imitrex intranasal spray; Merck’s development of a subcutaneous formulation for Keytruda. | Offer a less invasive or more convenient route of administration, shifting loyalty and capturing new patient segments. | 8 |

| New Indications (Repurposing) | Discovering and patenting new therapeutic uses for an existing drug through new clinical trials. R&D often begins years before the original patent expires. | Allergan’s Botox, originally approved for eye muscle disorders, was repurposed and patented for treating chronic migraines, excessive sweating, and cosmetic wrinkles. | Extend patent life and dramatically broaden the drug’s market into entirely new therapeutic areas, compensating for losses in the original indication. | 4 |

| Combination Products | Patenting a new product that combines the original drug with one or more other active ingredients in a single dosage form. | Combining a drug with another to improve efficacy or reduce side effects, creating a new, patent-protected fixed-dose combination. | Offer a superior therapeutic profile or simplified regimen compared to taking separate pills, thereby switching patients to the new combination product. | 4 |

| “Patent Thickets” | Filing a dense, overlapping web of dozens or even hundreds of secondary patents covering various aspects of a drug (formulation, dosage, manufacturing, etc.). | AbbVie’s Humira, which was shielded by a portfolio of at least 105 patents in the U.S., creating a formidable legal barrier for biosimilar competitors. | Make it prohibitively expensive and complex for competitors to litigate their way through the patent landscape, thereby delaying generic/biosimilar entry for years. | 9 |

| Other Secondary Patents | Obtaining patents on specific aspects like active metabolites, intermediates, polymorphs (different crystalline structures), or specific methods of manufacture. | Patents on a specific, more stable crystalline form of a drug (polymorph patent) or a more efficient manufacturing process (process patent). | Create additional layers of protection that a generic manufacturer must either design around or invalidate through litigation. | 4 |

Commercial and Market Access Strategies for Pre- and Post-LOE

Parallel to legal and R&D strategies, a sophisticated commercial and market access plan is essential for maximizing value before LOE and defending it afterward. This involves strategic pricing, dynamic rebate negotiations with payers, and targeted marketing efforts.

Pre-LOE Revenue Maximization

In the final 12 to 18 months of exclusivity, originator companies often shift their pricing strategy to maximize earnings before the revenue cliff. A common tactic is surge pricing, which involves implementing systematic, incremental increases to the drug’s Wholesale Acquisition Cost (WAC).26 For example, one major pharmaceutical company gradually increased the WAC of its nerve pain medication starting three years before LOE, while another raised the price of its multiple myeloma drug by over 50% in the years leading up to its 2022 patent expiration.26 This strategy must be carefully managed, as historical analysis shows that price increases greater than 9% can prove counterproductive and negatively impact revenues.26

Navigating Payers and Pharmacy Benefit Managers (PBMs)

As LOE approaches, the dynamic with payers and PBMs shifts dramatically. Payers, anticipating the availability of low-cost alternatives, begin to adopt a “Gx first” (generic first) attitude.26 This shift, however, creates a strategic opening for originators. The complex interplay of PBM business models, which are often reliant on rebates from high-list-price drugs, creates a dynamic that savvy originators can exploit. While PBMs publicly advocate for generic use, their financial incentives can create a reluctance to fully embrace low-cost alternatives, as was vividly demonstrated in the slow initial uptake of Humira biosimilars.30

The originator’s strategic counter-move is to shift the rebate battleground. They can afford to terminate or reduce rebate contracts on the expiring brand, as its formulary position will inevitably degrade.26 The freed-up capital can then be deployed to offer aggressive, market-shaping rebates on a

next-generation product or a line extension.26 This creates a powerful financial incentive for the PBM to actively help the originator switch patients from the old, soon-to-be-genericized brand to the new, patent-protected one. This sophisticated market access maneuver effectively uses the PBM’s own business model to help the originator bridge its revenue gap across the patent cliff.

Post-LOE Defensive Tactics

Once generic competition arrives, the originator’s focus shifts to defending the remaining brand value. Key tactics include:

- Authorized Generics (AGs): The originator can launch its own generic version of the drug, either directly or through a subsidiary.2 An AG can be launched during the 180-day exclusivity period of the first-filing generic, allowing the originator to compete on price immediately and capture a portion of the generic market. The threat of an AG launch can also be a powerful deterrent used in settlement negotiations with generic challengers.2

- Brand Loyalty and Patient Support: For brands with high patient affinity, investing in patient-centric programs can be highly effective.9 This includes co-pay assistance programs, direct-mail pharmacy options, and other support services that generics cannot easily match.20 Novartis, for example, successfully extended its co-pay assistance program for its multiple sclerosis drug Gilenya after its LOE to soften the impact of generic erosion.26

- Over-the-Counter (OTC) Switch: For suitable products, transitioning from prescription to OTC status can open up a new, high-volume market and extend the product’s commercial life, albeit at a lower margin.26

Pipeline Fortification and Strategic M&A

While lifecycle management and commercial tactics can soften the blow of a patent cliff, the only durable, long-term solution is a robust and innovative R&D pipeline capable of generating new products to replace lost revenue.2 The patent expiration calendar must be a primary driver of a company’s R&D and M&A prioritization.

When internal pipelines are insufficient to fill the looming revenue gap, companies turn to M&A and in-licensing, using the substantial cash reserves generated by their blockbusters to acquire external innovation.2 The pharmaceutical industry’s M&A activity is not random; it operates in a cyclical, symbiotic relationship with the patent cliff calendar. The cash generated by today’s blockbusters directly funds the acquisitions needed to replace them tomorrow, while the threat of a patent cliff makes potential targets more amenable to acquisition.17 This dynamic creates a predictable market cycle: as a major wave of patent expirations approaches, such as the one from 2025-2030, M&A and licensing activity intensifies as large companies use their war chests to buy the next generation of patented products from smaller innovators.17

Strategic considerations in this area include:

- Timing and Valuation: Acquirers must conduct deep due diligence on a target’s patent portfolio, including its pending and granted patents, as this is a cornerstone of the company’s value.11 The strength, defensibility, and remaining life of a target’s IP are critical valuation inputs.

- Global Sourcing of Innovation: Companies are increasingly looking beyond traditional markets for innovation. In recent years, there has been a surge in licensing deals between Western pharma and Chinese biotechs, reflecting a strategic pivot to access promising new therapies and accelerate R&D globally.17

- Case Examples of Pipeline Strategy: The strategic responses of companies facing major cliffs illustrate the importance of the pipeline.

- AbbVie represents a success story, having effectively navigated the Humira cliff by aggressively developing and promoting its next-generation immunology drugs, Skyrizi and Rinvoq, which are now generating tens of billions in combined revenue and have offset the Humira decline.19

- Merck is preparing for its 2028 Keytruda cliff by advancing a more convenient subcutaneous formulation and banking on growth from newly approved therapies like Winrevair.18

- Bristol Myers Squibb, in contrast, has been viewed by analysts as less prepared for its impending cliffs for Eliquis and Opdivo, leading the company to implement sweeping cost-cutting measures and layoffs as a primary mitigation strategy.18

The Legal Battlefield: Litigation as a Strategic Tool

Patent litigation is an unavoidable and integral part of the LOE landscape. For originators, it is a key strategic tool for defending their intellectual property and delaying the entry of competitors.

Litigation as a Delay Tactic

The Hatch-Waxman Act itself builds in a litigation-based delay mechanism. When an originator files a patent infringement suit against a generic challenger that has filed a Paragraph IV certification, it triggers an automatic 30-month stay on the FDA’s ability to grant final approval to the generic’s ANDA.36 This gives the originator a significant window to prepare other defensive strategies or negotiate a settlement. Originators frequently use litigation to defend their patents, with some studies showing that up to 75% of generic challenges result in a lawsuit from the brand company.21

Emerging Litigation Trends

The nature of patent litigation is constantly evolving. Key current trends include:

- Biologics and the “Enablement” Challenge: Litigation in the biologics space is increasing, and a primary battleground is the legal requirement of “enablement”.15 A foundational biologics patent often makes broad claims covering a class of molecules (e.g., “an antibody that binds to target X”). While powerful, this breadth creates a vulnerability. A challenger can argue that the patent, while describing one such antibody, did not sufficiently teach a skilled person how to make and use the

full scope of the claimed invention without undue experimentation.3 This “enablement challenge” has become a central and often successful strategy for biosimilar companies, meaning that an originator’s broadest and most valuable biologic patents may also be their most fragile from a litigation perspective.15 - Settlement Strategies and Antitrust Scrutiny: Companies often choose to settle patent litigation to avoid the cost and uncertainty of a trial. However, certain types of settlements have drawn intense antitrust scrutiny. “Reverse payment” or “pay-for-delay” settlements, in which the brand-name patent holder pays the generic challenger to delay market entry, are viewed by the Federal Trade Commission (FTC) and courts as potentially anti-competitive agreements to divide the market.23

- Citizen Petitions: Another tactic involves filing a “citizen petition” with the FDA, raising questions about the safety, efficacy, or quality of a pending generic application. While a legitimate regulatory pathway, this tool has been used strategically to create delays. Data shows that 92% of these petitions are filed by brand manufacturers, often close to the patent expiration date, effectively seeking to stall generic competition.21

Part III: The Competitive Counter-Play: Generic and Biosimilar Strategies

To build a robust LOE strategy, originator executives must possess a deep understanding of the playbook used by their generic and biosimilar challengers. These companies are not passive entrants; they are sophisticated, economically motivated actors who leverage a specific statutory and strategic framework to dismantle monopolies and capture market share.

The Hatch-Waxman Blueprint for Generics

The modern generic industry was born from the Hatch-Waxman Act of 1984. This landmark legislation fundamentally rewired the economics of the pharmaceutical industry by creating an expedited pathway for generic drug approval and, crucially, by creating powerful incentives for generics to challenge originator patents.2

The ANDA Pathway and Paragraph IV Challenge

The Act established the Abbreviated New Drug Application (ANDA) pathway, which allows a generic manufacturer to gain FDA approval by simply demonstrating that its product is bioequivalent to the innovator’s drug.36 This relieves the generic company of the need to conduct its own expensive and time-consuming clinical trials for safety and efficacy, dramatically lowering the barrier to market entry.2

The most strategically significant component of the ANDA process is the “Paragraph IV” certification. When filing an ANDA, the generic company must certify the status of the originator’s patents listed in the Orange Book. A Paragraph IV certification is an aggressive assertion that the originator’s patent is invalid, unenforceable, or will not be infringed by the generic product.9 This is a direct legal challenge to the brand’s monopoly and the primary mechanism for initiating patent litigation.

The 180-Day Exclusivity Prize

The Hatch-Waxman Act was designed not just to permit generic entry, but to actively encourage generic firms to act as public watchdogs by challenging potentially weak or invalid patents. It accomplishes this by offering a deliberately crafted financial “bounty”: a 180-day period of marketing exclusivity granted to the first generic company to file a substantially complete ANDA with a Paragraph IV certification.9 During this lucrative six-month window, the FDA cannot approve any other generic versions of the drug, allowing the first-filer to capture significant market share at a price point higher than what would be possible in a fully competitive multi-generic market.36 This incentive transforms generic companies from passive market entrants into proactive litigants, effectively deputizing them to police the patent system and accelerate the arrival of competition. Originator executives must therefore view their generic challengers not merely as copycats, but as economically motivated litigants empowered by statute to dismantle their patent protections.

The “At-Risk” Launch: A High-Stakes Gamble

A generic company that has received FDA approval for its product does not necessarily have to wait for all patent litigation to be fully resolved before entering the market. It has the option to launch “at risk”.36

Definition and Risk/Reward Calculus

An “at-risk” launch occurs when a generic firm begins selling its product while patent litigation is still ongoing, typically after an initial district court decision but while the case is on appeal.36

- The Risk: The gamble is substantial. If the generic company ultimately loses the appeal and its product is found to infringe a valid patent, it will be liable for damages based on the brand’s lost profits. In cases of willful infringement, these damages can be tripled.36

- The Reward: The potential benefit is equally significant. By launching immediately, the generic firm can begin generating revenue and capturing market share months or even years earlier than if it waited for the appeals process to conclude.36

The decision to launch at risk is a calculated one, based on the perceived probability of winning the litigation on appeal. Empirical data is telling: in one study of first-filer generics, those that received FDA approval before winning a favorable district court decision launched at risk 100% of the time.36 This indicates that once a generic has an initial court victory in hand, the expected profit from an immediate launch is generally seen as outweighing the risk of a reversal on appeal.

An at-risk launch is more than a financial calculation; it is a powerful strategic signal and a forcing function. The moment an at-risk generic hits pharmacy shelves, the market dynamics are irrevocably altered. The brand’s monopoly pricing structure collapses, and its market share begins to erode instantly.10 This massive transfer of value from the originator to consumers and the generic firm forces the brand to confront the reality of competition, regardless of the pending legal outcome. Even if the brand later wins on appeal and collects damages, it may never fully recover its pre-launch market position. The threat of an at-risk launch—and especially the launch itself—is often the event that forces the originator to accelerate its own LOE strategies, such as launching an authorized generic or offering deeper rebates on a next-generation product, and may push it toward a settlement to regain a measure of control over the market.

Part IV: The Executive’s Intelligence Toolkit

Strategic navigation of the patent cliff requires more than just a conceptual understanding of the landscape; it demands access to and mastery of specific data and intelligence tools. These resources allow executives to monitor threats, identify opportunities, and make informed decisions based on a clear view of the competitive and regulatory environment.

Mastering the Regulatory Databases

The FDA maintains two critical, publicly available databases that serve as the definitive sources for patent and exclusivity information in the U.S. These are not passive repositories but active competitive intelligence tools that must be used for both defensive and offensive strategic planning. Defensively, they allow a company to monitor threats to its own portfolio. Offensively, they provide a roadmap for identifying vulnerabilities in competitors’ portfolios.

The Orange Book (Small Molecules)

The publication Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book, is the authoritative resource for FDA-approved small-molecule drugs and their associated patents and exclusivities.38 Its key features for strategic intelligence include:

- Searchable Database: The online database can be searched by proprietary (brand) name, active ingredient, applicant, or patent number, allowing for targeted analysis of specific products or companies.38

- Patent and Exclusivity Listings: For each approved drug, the Orange Book lists all relevant patents that the innovator company has submitted to the FDA. It also details all applicable FDA-granted marketing exclusivities and their expiration dates.38

- Use Codes and Exclusivity Codes: The database includes specific codes that define the scope of a patent’s claims (e.g., a patent covering a specific method of use) and the type of FDA exclusivity (e.g., NCE, ODE).38

For a strategy executive, the Orange Book is an essential tool. A business development team can systematically scan the database to identify competitor products with near-term patent expirations or seemingly weak patent portfolios (e.g., a blockbuster protected by only a single patent). Analyzing a competitor’s “exclusivity stack” can reveal vulnerabilities; a drug relying on a single patent without multiple layers of regulatory exclusivity is a more attractive target for a generic development program.9

The Purple Book (Biologics)

For the more complex world of biological products, the FDA maintains the Purple Book.40 It serves a similar function to the Orange Book but is tailored to the unique aspects of biologics, biosimilars, and interchangeable products. Its critical features include:

- Database of Licensed Biologics: The Purple Book lists all FDA-licensed biological products, including reference products and their approved biosimilar and/or interchangeable biosimilar versions.40

- Interchangeability Status: A key piece of information is whether a biosimilar has been designated as “interchangeable.” An interchangeable product can be substituted for the reference product at the pharmacy level without the intervention of the prescribing physician, a status that significantly enhances its competitive potential.30

- Patent Information: Like the Orange Book, the Purple Book contains lists of patents provided by the reference product sponsor that are relevant to their biologic.40

The Purple Book is indispensable for strategizing in the biologics space. It allows companies to track the emergence of biosimilar competitors for their own products and to assess the competitive landscape for potential biosimilar development programs of their own.

Leveraging Commercial CI Platforms and Patent Data

While the FDA databases are foundational, commercial competitive intelligence (CI) platforms and advanced data analytics provide a crucial layer of strategic advantage.

Commercial Intelligence Platforms

Services like DrugPatentWatch and PatSnap aggregate vast amounts of data from global patent offices, regulatory agencies, litigation records, and clinical trial registries into integrated, user-friendly platforms.42 These tools allow for sophisticated analysis that goes beyond simple patent lookup, enabling users to:

- Identify market entry opportunities and track competitor activities.42

- Monitor patent litigation and Paragraph IV challenges.42

- Analyze global patent landscapes to inform international strategy.42

The Power of “Patent Pending” Data and AI

The most significant strategic edge comes from moving beyond published data, which is inherently a lagging indicator. Patent applications are typically not published until 18 months after they are filed, meaning that intelligence based solely on granted patents is always looking into the past.27 The real foresight comes from the analysis of

“patent pending” data—information derived from patent applications that are still under examination.33 This data provides early signals of:

- Competitors’ R&D directions and strategic priorities.

- Emerging technologies and potential new product launches years in advance.

- “White spaces” in the therapeutic landscape with limited patent activity and high innovation potential.33

The integration of patent pending data analysis with Artificial Intelligence (AI) represents a fundamental shift in competitive intelligence, moving the discipline from a reactive exercise of monitoring past events to a proactive one of predicting future market shifts.27 AI-powered platforms can analyze a competitor’s pending applications, connect them to recent licensing deals and clinical trial initiations, and predict that the competitor is developing a new product in a specific therapeutic area that will launch in five years. This predictive capability allows a company to make strategic adjustments—in its own R&D, M&A, or commercial strategy—to counter a competitive threat that is still years away. It transforms the patent calendar from a static list of expiration dates into a dynamic, predictive map of the entire competitive landscape.

The Global Chessboard: A Comparative Analysis of Key Jurisdictions

Pharmaceutical strategy is inherently global, but patent and regulatory systems are distinctly local. A strategy that is effective in the United States may be unworkable in the European Union or Japan. A nuanced understanding of these differences is critical for successful global lifecycle management. Applying a US-centric strategy to other markets is a common and costly error. The following table provides a concise, structured comparison of the most critical system features across the three major markets, allowing an executive to quickly grasp the fundamental differences that will shape their global LOE strategy. For example, it highlights that in the US, the strategy will be litigation-focused and transparent, while in Japan, it will be administrative-focused and opaque, which directly impacts resource allocation and risk assessment.

Table 3: Comparative Analysis of US, EU, and Japanese Patent/Regulatory Systems

| Key Feature | United States | European Union | Japan |

| Primary Regulatory Authority | Food and Drug Administration (FDA) (Centralized) | European Medicines Agency (EMA) (Centralized for many drugs) & National Authorities | Ministry of Health, Labour and Welfare (MHLW) & Pharmaceuticals and Medical Devices Agency (PMDA) |

| Patent Term Restoration | Patent Term Extension (PTE): Up to 5 years, max 14 years post-approval. | Supplementary Protection Certificate (SPC): Up to 5 years. | Patent Term Extension (PTE): Up to 5 years. |

| Public Patent Listing | Orange Book (small molecules) & Purple Book (biologics). Mandatory and transparent. | No central, EU-wide equivalent to the Orange Book. | No public listing system. Innovators voluntarily submit patent info to MHLW; it is not public. |

| Generic/Biosimilar Pathway | Hatch-Waxman Act (ANDA for generics), BPCIA (351(k) for biosimilars). | Centralized, Decentralized, and Mutual Recognition Procedures. | Formal generic/biosimilar approval pathways exist. |

| Patent Linkage System | Formal & Judicial: P.IV certification triggers a 30-month stay and likely litigation in federal court. | No formal system. Patent disputes are handled separately from regulatory approval. | Informal & Administrative: Opaque system where MHLW facilitates private discussions between innovator and generic firm to resolve patent issues pre-approval. |

| Strategic Environment | Highly litigious, transparent, driven by statutory deadlines and judicial outcomes. | Fragmented, with additional hurdles from national pricing/reimbursement (HTA) bodies. | Opaque, relationship-based, driven by administrative guidance rather than public court battles. |

| Source(s) | 12 | 3 | 6 |

Part V: Case Studies in Strategic Execution

The principles and strategies for navigating the patent cliff are best understood through their real-world application. The contrasting stories of Pfizer’s Lipitor and AbbVie’s Humira provide two seminal case studies: the first illustrates the classic, brutal patent cliff for a small-molecule drug, while the second reveals the modern, more complex battleground for a blockbuster biologic.

The Classic Cliff: Pfizer’s Lipitor (Atorvastatin)

For over a decade, Pfizer’s cholesterol-lowering drug Lipitor (atorvastatin) was the best-selling drug in the world, a quintessential small-molecule blockbuster with peak annual sales of approximately $13 billion.10 Its patent expiration was a landmark event that serves as a stark illustration of the sheer force of a traditional patent cliff.

The Cliff and its Impact

When Lipitor’s basic U.S. patent expired on November 30, 2011, followed by its European patents in May 2012, the financial impact on Pfizer was immediate and severe.48 The entry of multiple low-cost generic competitors led to a precipitous drop in sales. Worldwide revenues for Lipitor plummeted by 59% in the first year after U.S. generic entry, falling from $9.5 billion in 2011 to $3.9 billion in 2012.2 Within a few years, annual revenue had fallen below $3 billion.10 The price of the drug fell dramatically, benefiting healthcare systems and patients but decimating the brand’s revenue stream.3

Pfizer’s Strategic Response

Pfizer was not idle in the face of this threat. The company deployed a multi-pronged defense aimed at delaying generic entry and preserving as much market share as possible.32 These strategies included:

- Legal Delay: Pfizer engaged in extensive legal battles in multiple jurisdictions to defend its patents and delay the launch of generic versions.48

- Commercial and Marketing Efforts: The company invested heavily in direct-to-consumer (DTC) marketing to build strong brand loyalty among patients.32 It also implemented sophisticated rebate strategies with payers to maintain formulary access.32

- Authorized Generic: Upon patent expiration, Pfizer launched its own authorized generic version of atorvastatin to compete directly with the first independent generic entrants.32

- Lifecycle Management: Pfizer explored several lifecycle management strategies, including the development of a potential “me-too” follow-on drug and an attempt to switch Lipitor to over-the-counter (OTC) status.32

Outcome and Lessons

Despite this comprehensive effort, the strategies were ultimately insufficient to prevent a massive loss of revenue. The Lipitor case demonstrates that for a small-molecule drug with a relatively simple chemical structure, once the primary composition-of-matter patent falls, it is exceedingly difficult to fend off generic competition. The low cost and rapid market penetration of multiple generic manufacturers create an overwhelming economic force. The primary lesson from Lipitor is that for such products, legal and commercial tactics can at best soften the landing, but they cannot prevent the fall. The only true defense would have been a robust pipeline with a new blockbuster ready to replace the lost revenue.

The Modern Fortress: AbbVie’s Humira (Adalimumab)

The case of AbbVie’s Humira (adalimumab) represents the modern patent cliff in the era of biologics. As the highest-grossing drug of all time, with peak global sales exceeding $21 billion, Humira’s loss of exclusivity (LOE) was a highly anticipated event that has redefined the strategic playbook.2 It demonstrates that for today’s complex biologics, the patent cliff is no longer a simple function of a single patent’s expiration. It is a complex, multi-year battle fought on three distinct fronts: legal, commercial, and R&D.

The Legal Front: Building the “Patent Thicket”

AbbVie’s primary defensive strategy was to construct a nearly impenetrable legal fortress around Humira. Instead of relying on a single patent, AbbVie built a “patent thicket”—a dense, overlapping web of at least 105 patents in the U.S. alone.28 These secondary patents covered not just the active ingredient but every conceivable aspect of the product, including specific formulations, methods of use for various autoimmune diseases, and manufacturing processes.28 This strategy was remarkably successful. While Humira’s primary patent expired in 2016, the patent thicket delayed the entry of any biosimilar competitors in the lucrative U.S. market until January 2023—years after they had launched in Europe.29

The Commercial Front: The PBM “Rebate Wall”

When biosimilars finally launched in the U.S. in 2023, the market did not behave like the Lipitor cliff. Despite the availability of up to 10 biosimilars, some priced at an 85% discount to Humira’s list price, their initial uptake was astonishingly slow.31 Through the first quarter of 2024, Humira retained 97% of the adalimumab market share.50 For all of 2023, biosimilars accounted for less than 2% of total prescriptions.30

The reason for this market inertia was not a lack of low-priced alternatives, but the powerful role of Pharmacy Benefit Managers (PBMs). AbbVie had successfully constructed a “rebate wall.” By offering substantial, confidential rebates on the high-list-price Humira, AbbVie made it more profitable for PBMs to keep the brand in a preferred formulary position than to switch to a low-list-price biosimilar.30 In a telling market inversion, data from Q4 2023 showed that Humira’s

net price (after rebates) was actually lower than the net prices of its biosimilar competitors.30

The market only began to shift significantly in 2024, when major PBMs like CVS Caremark and Express Scripts made the strategic decision to remove Humira from their major national formularies, often in favor of their own private-label or preferred biosimilars.31 This move finally broke the rebate wall and drove biosimilar market share up to approximately 22% by late 2024.52 The total savings to the US healthcare system from adalimumab biosimilar competition were estimated at nearly $11 billion after 18 months, though uptake remained slower than for small-molecule generics.53

The R&D Front: The Pipeline Pivot

Facing the eventual erosion of its biggest product, AbbVie executed a masterful pipeline pivot. For years, the company had been investing heavily in developing and commercializing its next-generation immunology drugs, Skyrizi and Rinvoq. This strategy paid off spectacularly.

As Humira’s revenues declined, Skyrizi and Rinvoq’s sales soared. In AbbVie’s full-year 2024 financial report, global Humira net revenues were down 37.6%.35 However, global Skyrizi revenues grew by 50.9% to $11.7 billion, and global Rinvoq revenues grew by 50.4% to $6.0 billion.35 The staggering growth of these two assets more than compensated for Humira’s decline, leading to an overall

increase of 2.1% in AbbVie’s global immunology portfolio revenue for the year.35

Outcome and Lessons

The Humira case study has rewritten the rules for navigating a patent cliff in the biologics era. It shows that the “cliff” is now less of a sudden drop and more of a managed, multi-year slope whose gradient is determined by an originator’s skill across three strategic arenas. AbbVie demonstrated that a sophisticated legal strategy (the patent thicket) can buy precious years of additional exclusivity. It revealed that the commercial battleground has shifted to the complex economics of PBM rebates, where net price, not just list price, dictates market access. Most importantly, it proved that the ultimate defense against the loss of one blockbuster is the successful creation and launch of the next two.

Part VI: Conclusion: Strategic Imperatives for the C-Suite

The pharmaceutical patent cliff is not a static event but a dynamic and evolving feature of the industry landscape. The journey from the straightforward revenue collapse of Lipitor to the complex, multi-front war over Humira illustrates a clear trajectory: navigating the loss of exclusivity has become an increasingly sophisticated strategic challenge. For the C-suite, preparing for this challenge requires moving beyond siloed, reactive tactics to a holistic, proactive, and integrated approach. The following imperatives represent a synthesis of the key strategic takeaways for building a resilient and forward-looking patent expiration strategy.

- Embrace the Calendar as a Strategic Map, Not a Doomsday Clock: The patent expiration calendar should be the central organizing principle for long-range strategic planning. Impending LOE dates for key products must trigger a cascade of integrated activities across R&D, business development, legal, and commercial functions, starting not two, but five to ten years in advance. This proactive posture transforms the cliff from a looming threat into a predictable set of milestones around which to build a comprehensive corporate strategy.

- Integrate IP, Regulatory, and Commercial Strategy from Day One: The era of disconnected strategies is over. The decision to pursue a new formulation (an R&D choice) must be integrated with the strategy for patenting it (a legal choice) and the plan for marketing its convenience benefits to payers and physicians (a commercial choice). Similarly, the pursuit of regulatory exclusivities like orphan drug or pediatric extensions must be a core part of the initial development plan, not an afterthought. The “exclusivity stack”—the combined protection of patents, PTE/SPCs, and FDA exclusivities—is a single, integrated asset that must be managed as such.

- Master the New Commercial Landscape of Payer Economics: The Humira case has definitively shown that PBMs and payers are now kingmakers in the LOE process. A deep and nuanced understanding of their economic drivers is no longer optional. The strategic use of rebates—specifically, the pivot from defending an old brand to aggressively promoting a new one—is a critical tool for engineering a successful transition across the revenue cliff. Market access strategy must be as sophisticated and well-resourced as patent litigation strategy.

- Invest in Predictive Intelligence to Outmaneuver Competitors: Relying on published patents and public announcements is a recipe for being outmaneuvered. The strategic advantage lies in foresight. This requires investment in the tools (AI-powered platforms) and the expertise to analyze leading indicators like patent pending applications and early-stage clinical trial data. This shift from reactive monitoring to predictive intelligence allows a company to anticipate competitor moves and identify market “white spaces” years in advance, providing the time needed to build an effective counter-strategy.

- Recognize that the Pipeline is the Ultimate Defense: Legal tactics can build delays, and commercial strategies can soften the landing, but the only durable, long-term solution to the patent cliff is a robust, innovative R&D pipeline that consistently generates new sources of revenue. The looming revenue gap identified by the patent calendar must be the primary justification and driver for R&D funding and M&A prioritization. As demonstrated by AbbVie, the successful launch of next-generation products is the most powerful way to make the loss of a prior blockbuster a manageable transition rather than a corporate crisis.

- Prepare for a Global, Multi-Front War: The strategic environment for LOE is not monolithic. The highly litigious, transparent, and judicial-driven system in the United States is fundamentally different from the opaque, administrative, and relationship-based system in Japan, and different again from the fragmented, HTA-influenced landscape of the European Union. A successful global strategy requires a tailored, market-specific approach, demanding distinct expertise and resource allocation for each key region. A one-size-fits-all strategy is a blueprint for failure.

Ultimately, navigating the patent cliff successfully is a testament to an organization’s strategic foresight, cross-functional integration, and relentless focus on innovation. By mastering these imperatives, pharmaceutical leaders can transform the industry’s greatest challenge into a powerful catalyst for renewal and growth.

Works cited

- Patent Cliff: What It Means, How It Works – Investopedia, accessed August 5, 2025, https://www.investopedia.com/terms/p/patent-cliff.asp

- The End of Exclusivity: Navigating the Drug Patent Cliff for …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- When does a drug patent expire? – Patsnap Synapse, accessed August 5, 2025, https://synapse.patsnap.com/article/when-does-a-drug-patent-expire

- Strategies forExtending theLifeofPatents, accessed August 5, 2025, https://www.alston.com/-/media/files/insights/publications/2005/05/strategies-for-extending-the-life-of-patents/files/biopharm-spruill-may2005/fileattachment/biopharm-spruill-may2005.pdf

- Strategic Patenting by Pharmaceutical Companies – Should Competition Law Intervene? – PMC, accessed August 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7592140/

- New Ruling on Scope of Protection of Extended Patent Rights in …, accessed August 5, 2025, https://allegropat.com/extension-pharmaceutical-patent-japan/

- Overview of the Patent Term Extension in Japan – KAWAGUTI & PARTNERS, accessed August 5, 2025, https://www.kawaguti.gr.jp/aboutlaw/jp_practices/01_1.html

- Pharmaceutical Life Cycle Management | Torrey Pines Law Group®, accessed August 5, 2025, https://torreypineslaw.com/pharmaceutical-lifecycle-management.html

- How to own a Market you Don’t Own: Market Access Strategies Post-Patent Expiration, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/how-to-own-a-market-you-dont-own-market-access-strategies-post-patent-expiration/

- The Impact of Patent Expirations on the Pharmaceutical Industry – JOCPR, accessed August 5, 2025, https://www.jocpr.com/articles/the-impact-of-patent-expirations-on-the-pharmaceutical-industry-10233.html

- How Patent Laws Impact Competition and Merger Regulations in Pharma – PatentPC, accessed August 5, 2025, https://patentpc.com/blog/how-patent-laws-impact-competition-and-merger-regulations-in-pharma

- Introduction to Patent Term Extensions (PTE) – Fish & Richardson, accessed August 5, 2025, https://www.fr.com/insights/ip-law-essentials/intro-patent-term-extension/

- Patent Term Extension – Sterne Kessler, accessed August 5, 2025, https://www.sternekessler.com/news-insights/insights/patent-term-extension/

- Exclusivity and Generic Drugs: What Does It Mean? | FDA, accessed August 5, 2025, https://www.fda.gov/files/drugs/published/Exclusivity-and-Generic-Drugs–What-Does-It-Mean-.pdf

- IP Litigation: A New Battleground for Patents Is Forecasted Based on …, accessed August 5, 2025, https://www.sidley.com/en/us/sidley-pages/trendspotting-2022/ip-litigation/

- Japanese patent law – Wikipedia, accessed August 5, 2025, https://en.wikipedia.org/wiki/Japanese_patent_law

- The $400 Billion Patent Cliff: Big Pharma’s Revenue Crisis, accessed August 5, 2025, https://americanbazaaronline.com/2025/08/04/the-400-billion-patent-cliff-big-pharmas-revenue-crisis-465788/

- 5 Pharma Powerhouses Facing Massive Patent Cliffs—And What …, accessed August 5, 2025, https://www.biospace.com/business/5-pharma-powerhouses-facing-massive-patent-cliffs-and-what-theyre-doing-about-it

- Navigating the Patent Cliff: Precision Print Campaigns for Pharma’s Evolving Landscape – RxJam, accessed August 5, 2025, https://rxjam.com/blog/navigating-the-patent-cliff-precision-print-campaigns-for-pharmas-evolving-landscape/

- Top Strategies for Pharma Profitability after Drug Patents Expire – DrugPatentWatch, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/top-strategies-for-pharma-profitability-after-drug-patents-expire/

- Evergreening – Wikipedia, accessed August 5, 2025, https://en.wikipedia.org/wiki/Evergreening

- What is patent evergreening? – Asia IP, accessed August 5, 2025, https://asiaiplaw.com/article/what-is-patent-evergreening

- Strategies that delay or prevent the timely availability of affordable …, accessed August 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4915805/

- EVERGREENING OF PATENTS IN THE PHARMACEUTICAL INDUSTRY – Intepat IP, accessed August 5, 2025, https://www.intepat.com/blog/evergreening-of-patents-in-the-pharmaceutical-industry

- Drug patents: the evergreening problem – PMC, accessed August 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3680578/

- Navigating pharma loss of exclusivity | EY – US, accessed August 5, 2025, https://www.ey.com/en_us/insights/life-sciences/navigating-pharma-loss-of-exclusivity

- Best Practices for Drug Patent Portfolio Management: Leveraging …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/best-practices-for-drug-patent-portfolio-management-2/

- Lessons From Humira on How to Tackle Unjust Extensions of Drug …, accessed August 5, 2025, https://www.biospace.com/policy/opinion-lessons-from-humira-on-how-to-tackle-unjust-extensions-of-drug-monopolies-with-policy

- Failure to Launch: Biosimilar Sales Continue to Fall Flat in the United States – PMC, accessed August 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7255927/

- How Biosimilar Competition Affected Adalimumab Usage, Pricing, accessed August 5, 2025, https://www.uspharmacist.com/article/how-biosimilar-competition-affected-adalimumab-usage-pricing

- Humira Biosimilars: Market Impact, Cost Savings, and Future Trends, accessed August 5, 2025, https://www.healthcarehuddle.com/p/humira-biosimilars-market-impact-cost-savings-and-future-trends

- Managing the challenges of pharmaceutical patent expiry: a case study of Lipitor, accessed August 5, 2025, https://www.researchgate.net/publication/309540780_Managing_the_challenges_of_pharmaceutical_patent_expiry_a_case_study_of_Lipitor

- Strategic Imperatives: Leveraging Patent Pending Data for …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/leveraging-patent-pending-data-for-pharmaceuticals/

- The State of Competitive Intelligence in Pharma: Key Trends for …, accessed August 5, 2025, https://northernlight.com/competitive-intelligence-in-pharma-key-trends/

- AbbVie Reports Full-Year and Fourth-Quarter 2024 Financial Results, accessed August 5, 2025, https://investors.abbvie.com/news-releases/news-release-details/abbvie-reports-full-year-and-fourth-quarter-2024-financial

- No Free Launch: At-Risk Entry by Generic Drug Firms, accessed August 5, 2025, https://www.nber.org/system/files/working_papers/w29131/w29131.pdf

- No Free Launch: At-Risk Entry by Generic Drug Firms – ResearchGate, accessed August 5, 2025, https://www.researchgate.net/publication/364503454_No_Free_Launch_At-Risk_Entry_by_Generic_Drug_Firms

- Approved Drug Products with Therapeutic Equivalence Evaluations …, accessed August 5, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/approved-drug-products-therapeutic-equivalence-evaluations-orange-book

- FDA Orange Book – PubChem Data Source, accessed August 5, 2025, https://pubchem.ncbi.nlm.nih.gov/source/11932

- Purple Book Info Sheet – FDA, accessed August 5, 2025, https://www.fda.gov/media/182175/download

- FDA Purple Book, accessed August 5, 2025, https://purplebooksearch.fda.gov/

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed August 5, 2025, https://crozdesk.com/software/drugpatentwatch

- Patsnap | AI-powered IP and R&D Intelligence, accessed August 5, 2025, https://www.patsnap.com/

- Drugs and Devices: Comparison of European and U.S. Approval …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/drugs-devices-comparison-european-u-s-approval-processes/

- Patent linkage in Japan: the present situation and challenges …, accessed August 5, 2025, https://www.managingip.com/article/2axkxcw96suati6wv2znk/sponsored-content/patent-linkage-in-japan-the-present-situation-and-challenges

- Pharmaceutical Intellectual Property And Competition – Nishimura & Asahi, accessed August 5, 2025, https://www.nishimura.com/sites/default/files/articles/file/451.pdf

- Japan’s patent linkage policy faces domestic debate and foreign pressure – MLex, accessed August 5, 2025, https://www.mlex.com/mlex/articles/2340428/japan-s-patent-linkage-policy-faces-domestic-debate-and-foreign-pressure

- When does the patent for Atorvastatin expire? – Patsnap Synapse, accessed August 5, 2025, https://synapse.patsnap.com/article/when-does-the-patent-for-atorvastatin-expire

- Humira Patent Expiration: What’s Next for its Biosimilars? – GreyB, accessed August 5, 2025, https://www.greyb.com/blog/humira-patent-expiration/

- Disruptor partnerships grow adalimumab biosimilar market share, accessed August 5, 2025, https://www.gabionline.net/reports/disruptor-partnerships-grow-adalimumab-biosimilar-market-share

- Sustaining competition for biosimilars on the pharmacy benefit: Use it or lose it – PMC, accessed August 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11144985/

- Samsung Bioepis Report Showcases Adalimumab Biosimilar …, accessed August 5, 2025, https://www.centerforbiosimilars.com/view/samsung-bioepis-report-showcases-adalimumab-biosimilar-growth-in-market-share

- Adalimumab BIosimilars Have Saved the US Health System $11 …, accessed August 5, 2025, https://biosimilarsrr.com/2024/08/12/18-months-of-us-adalimumab-biosimilar-competition-yields-11-billion-in-savings/