The pharmaceutical landscape is in the midst of a tectonic shift, and at its epicenter are biologic drugs and their disruptive counterparts, biosimilars. Biologics, the titans of modern medicine, have revolutionized the treatment of complex diseases like cancer, rheumatoid arthritis, and Crohn’s disease, generating unprecedented clinical outcomes and, in parallel, astronomical revenues. In 2021, these therapies accounted for a staggering 46% of all U.S. drug expenditures, despite being used by less than 2% of the population. This concentration of cost has placed immense pressure on healthcare systems, payers, and patients, creating an urgent need for more affordable alternatives.

Enter the biosimilar. Far more than a simple generic, a biosimilar represents a new paradigm in pharmaceutical competition—one born from the inherent complexity of its reference product. The arrival of biosimilars was heralded as the dawn of a new era of cost containment and expanded patient access. Projections from the Association for Accessible Medicines suggest biosimilars could save the U.S. healthcare system $133 billion by 2025. Yet, the reality has been far more complex. The journey from regulatory approval to widespread market adoption has been fraught with challenges, largely because biosimilars don’t just compete on price; they challenge the very architecture of biologic drug reimbursement.

This report provides an expert-level analysis of this ongoing revolution. We will dissect the intricate interplay between the science of biologics, the nuances of global regulatory pathways, and the powerful economic forces that govern reimbursement in the United States. We will explore how the traditional “buy-and-bill” model and the opaque world of Pharmacy Benefit Managers (PBMs) create both barriers and opportunities for biosimilar adoption. Through detailed case studies and a forward-looking analysis of market trends, we will equip you, the business and pharmaceutical professional, with the nuanced understanding required to navigate this disruption and turn the complex dynamics of biosimilar reimbursement into a powerful competitive advantage. The question is no longer if biosimilars will reshape the market, but how—and who will be positioned to win.

The Biologic Bedrock and the Biosimilar Dawn

To understand the seismic shifts biosimilars are causing, one must first appreciate the unique nature of the ground they are built upon: the biologic drug itself. The scientific and manufacturing complexity of biologics is not merely a technical detail; it is the foundational principle that dictates everything that follows—from regulatory pathways and development costs to market dynamics and reimbursement models.

Deconstructing Biologics: More Than Just a Large Molecule

Unlike conventional small-molecule drugs like aspirin, which are produced through predictable chemical synthesis, biologics are a different beast entirely. They are vast, intricate molecules derived from living organisms, such as animal or human cells, proteins, tissues, or nucleic acids.2 Think of a small-molecule drug as a bicycle, with a defined number of parts assembled in a repeatable process. A biologic, in contrast, is more like a complex, living ecosystem—a monoclonal antibody can contain thousands of amino acids folded into a precise three-dimensional structure.

This biological origin means their production requires cutting-edge and highly sensitive biotechnology. They are grown in living cell cultures, which are inherently sensitive to the slightest environmental changes in temperature, pH, or nutrients. This sensitivity leads to a phenomenon known as “inherent variability,” meaning that even between different batches of the exact same originator biologic, there will be minor, natural variations in the molecular structure.5 This is not a flaw but a fundamental characteristic of biological manufacturing.

This complexity is precisely why biologics have been so revolutionary and so expensive. They can be engineered to target specific cells or pathways in the body with incredible precision, offering groundbreaking treatments for diseases once considered intractable.3 They are the fastest-growing class of drugs in the United States and represent a colossal market, valued at over $461 billion in 2023 and projected to soar past $700 billion by 2030.6 However, their high cost and complex administration—typically via injection or infusion—have made them a primary focus for cost-containment efforts. The very science that makes them so effective also makes them a focal point of economic pressure, setting the stage for the arrival of biosimilars.

Enter the Biosimilar: “Highly Similar,” Critically Different

Because it is scientifically impossible to create an identical, carbon copy of a complex biologic, the concept of a “generic biologic” does not exist.8 Instead, the regulatory and scientific communities developed the concept of a “biosimilar.” According to the U.S. Food and Drug Administration (FDA), a biosimilar is a biologic product that is

“highly similar” to an already-approved reference biologic and has “no clinically meaningful differences” in terms of safety, purity, and potency (i.e., effectiveness).4

The goal of a biosimilar development program is not to independently prove the drug’s safety and efficacy from the ground up, as is required for a new drug. Instead, the objective is to demonstrate biosimilarity to the reference product through a comprehensive “totality of the evidence” approach.12 This allows biosimilar manufacturers to leverage the years of clinical data and real-world experience of the originator, enabling an abbreviated and less costly path to market.8

This “highly similar, not identical” paradigm is a deliberate and scientifically necessary distinction. However, it also creates a psychological and marketing hurdle that does not exist for chemically identical generic drugs. While the science confirms no meaningful difference in clinical outcomes, the very language introduces a sliver of perceived difference. This nuance can be exploited by originator manufacturers to sow doubt among physicians and patients, creating “prescriber inertia” and slowing the adoption of these cost-saving alternatives, particularly in the early years of a biosimilar’s launch.15 Overcoming this perception gap through education, robust data, and aligned financial incentives is one of the central challenges in the biosimilar marketplace.

Why Biosimilars Are Not Generics: A Strategic Distinction

Confusing biosimilars with generics is a common but critical strategic error. It leads to flawed assumptions about pricing, market entry, and adoption dynamics. The differences are not trivial; they are fundamental and rooted in the scientific nature of the products themselves. Understanding these distinctions is paramount for any stakeholder seeking to navigate this landscape effectively.

The development cost alone illustrates the chasm between the two. Bringing a generic to market typically costs between $1 million and $4 million and takes about two years. In stark contrast, developing a biosimilar is a far more arduous and expensive endeavor, taking seven to eight years and costing upwards of $100 million to $250 million.17 This massive investment is a direct consequence of the manufacturing complexity and the extensive analytical and clinical data required to prove biosimilarity to regulators.

This cost differential has a direct and profound impact on pricing strategy. Generic manufacturers, with their low development costs, can enter the market with steep discounts of 80-90%, leading to rapid price erosion and market capture. Biosimilar manufacturers, needing to recoup a much larger investment, must launch at more modest discounts, typically in the range of 15-50% of the originator’s price.19 This difference in pricing power fundamentally changes the competitive dynamics and the timeline for realizing system-wide cost savings. The following table provides a clear, at-a-glance summary of these critical distinctions.

| Characteristic | Small-Molecule Drug (Brand) | Generic | Biologic (Originator) | Biosimilar |

| Origin | Chemical Synthesis | Chemical Synthesis | Living Cells/Organisms | Living Cells/Organisms |

| Size & Structure | Small, Simple, Well-defined | Small, Simple, Identical | Large, Complex, Heterogeneous | Large, Complex, Highly Similar |

| Manufacturing | Controlled, Predictable | Controlled, Repeatable | Sensitive Biological Process | Sensitive Biological Process |

| Regulatory Standard for Follow-on | N/A | Bioequivalence (Identical Active Ingredient) | N/A | Biosimilarity (“Highly Similar,” No Clinically Meaningful Differences) |

| Development Cost (Follow-on) | N/A | $1–$4 Million | N/A | $100–$250 Million |

| Typical Price Discount at Launch | N/A | 80%+ | N/A | 15–50% 19 |

| Interchangeability | N/A | Automatic Substitution | N/A | Requires Separate Designation (U.S.) or is Scientific Default (E.U.) |

Navigating the Regulatory Maze: FDA and EMA Pathways

The commercial viability and market dynamics of biosimilars are inextricably linked to the regulatory frameworks that govern their approval. The world’s two most influential regulatory bodies, the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have established robust but distinct pathways. While built on similar scientific principles, subtle differences in their approaches—particularly concerning the concept of interchangeability—have created vastly different market environments and offer crucial lessons for global pharmaceutical strategy.

The U.S. 351(k) Pathway: A “Totality of the Evidence” Approach

The modern era of biosimilars in the United States began with the passage of the Biologics Price Competition and Innovation Act (BPCI) in 2009, which was signed into law in 2010.6 This landmark legislation created the 351(k) abbreviated licensure pathway, a scientific and regulatory framework designed specifically for biosimilars.12 The core philosophy of the 351(k) pathway is not to re-prove the safety and efficacy of a drug from scratch, but rather to demonstrate, through a “totality of the evidence,” that the proposed product is indeed biosimilar to an existing, FDA-approved reference product.12

This process is structured as a stepwise approach, designed to be both rigorous and efficient. It begins with an exhaustive foundation of analytical studies.22 Using state-of-the-art technology, developers conduct extensive structural and functional characterization, comparing their proposed biosimilar to the reference product at a molecular level. This analytical comparison is the bedrock of the application, providing the greatest contribution to clinical predictability.

Only if “residual uncertainty” remains after this deep analytical dive does the FDA require progression to the next steps, which may include animal studies and, ultimately, targeted clinical studies.22 These clinical studies are not the large-scale Phase 3 efficacy trials required for a novel biologic. Instead, they are typically smaller, more focused studies designed to confirm similarity in pharmacokinetics (PK), which is what the body does to the drug, and pharmacodynamics (PD), what the drug does to the body. An assessment of immunogenicity—the potential for the drug to provoke an immune response—is also a critical component.

A key cost-saving and efficiency-driving feature of the 351(k) pathway is the concept of extrapolation. If a biosimilar demonstrates similarity to its reference product in one approved indication, the FDA can approve it for other indications of the reference product without requiring direct clinical studies in those additional populations.12 This is based on the scientific justification that if the mechanism of action is the same across indications, and the product is proven biosimilar, its performance can be scientifically extrapolated. This principle is crucial to the economic viability of biosimilar development, as it avoids the immense cost and time of repeating clinical trials for every single condition the originator biologic treats.

Europe’s Head Start: The EMA’s Centralized Framework

While the U.S. was establishing its pathway, Europe was already a decade into its biosimilar journey. The EMA, which oversees approvals for the European Union, has been a trailblazer, approving the first biosimilar back in 2006.13 This long head start has allowed the EU to build a mature and predictable regulatory environment, fostering a more robust and competitive biosimilar market.

The EMA utilizes a centralized procedure, meaning a single application and evaluation can lead to marketing authorization across all EU member states. Like the FDA, the EMA’s evaluation is based on comprehensive comparability studies demonstrating that the biosimilar is highly similar to the reference medicine with no clinically meaningful differences.

This extensive experience has generated a massive body of evidence supporting the safety and efficacy of biosimilars. With over a million patient-treatment years of data, European regulators and clinicians have developed a high level of confidence in these products. This confidence is now leading the EMA to push for even greater efficiency. A recent draft reflection paper proposes a “tailored clinical approach” that could further streamline the approval process by waiving the requirement for comparative efficacy studies in certain cases where analytical and PK/PD data provide a sufficiently strong foundation of evidence.26 This forward-thinking approach reflects a deep trust in the science of biosimilarity, built on nearly two decades of real-world experience.

The Interchangeability Conundrum: A U.S. Anomaly and Its Market Impact

Perhaps the most significant point of divergence between the U.S. and European regulatory frameworks lies in the concept of “interchangeability.” In the United States, interchangeability is a specific, higher regulatory designation that a biosimilar can seek.4 An interchangeable biosimilar is one that has met additional statutory requirements to demonstrate that it can be substituted for the reference product at the pharmacy level without the direct intervention of the prescribing physician, much like a generic drug.28 To achieve this designation, manufacturers have historically been required to conduct complex and costly “switching studies,” where patients are alternated between the reference product and the biosimilar to prove that doing so poses no additional risk or loss of efficacy.

The EMA and European national bodies have taken a fundamentally different approach. From a scientific standpoint, they consider all approved biosimilars to be interchangeable with their reference product.13 The scientific rationale is that if a product has been proven to be biosimilar, it can be used in place of the originator. The practical decision of whether to allow automatic pharmacy-level substitution is then left to the individual health authorities of each EU member state.

This U.S.-specific designation, while intended to build confidence and facilitate substitution, has had the unintended consequence of creating a perceived two-tiered system. It has fostered a misconception among some clinicians and patients that a “regular” biosimilar is somehow inferior or less safe for switching than one with the “interchangeable” seal of approval. This confusion has acted as a significant barrier to adoption, particularly for pharmacy-benefit drugs where substitution is most relevant. The perception, however, often spills over to the medical-benefit side, where providers directly choose the product and pharmacy substitution is not a factor.

Recognizing this challenge, the FDA is now signaling a major policy evolution. The agency’s thinking has matured, informed by years of accumulating global real-world evidence showing that the risks of switching are insignificant. In a significant move, the FDA has released draft guidance proposing to remove the requirement for switching studies to obtain an interchangeability designation. Even more fundamentally, other draft guidance suggests eliminating the distinction between “biosimilar” and “interchangeable” from the product labeling altogether, instead using a single, unified “biosimilarity statement”.23

This potential policy shift represents a tacit acknowledgment by the FDA that the original framework may have inadvertently created more confusion than clarity and erected an unnecessary barrier to competition. A move toward the European model—treating interchangeability as an inherent scientific property of biosimilarity—would streamline the path to market, reduce development costs for manufacturers, and, most importantly, eliminate a key source of confusion for stakeholders. This evolution is a critical trend to watch, as it could significantly accelerate biosimilar competition in the U.S. market in the coming years.

The Architecture of Reimbursement: Buy-and-Bill and PBMs

The impact of biosimilars cannot be understood in a vacuum. Their disruptive potential is realized only when they enter the complex machinery of U.S. healthcare reimbursement. Biologic drugs flow through two primary channels, each with its own gatekeepers, economic incentives, and operational complexities. Understanding the mechanics of these systems—the provider-centric “buy-and-bill” model for medically-administered drugs and the PBM-dominated model for pharmacy-dispensed drugs—is essential to grasping how and why biosimilars are forcing a fundamental re-evaluation of the status quo.

The Provider’s Gambit: Understanding the “Buy-and-Bill” Model

For many of the most impactful biologics—particularly those used in oncology and rheumatology—treatment is administered directly by a healthcare professional in a physician’s office, infusion center, or hospital outpatient department. These drugs are typically covered under the patient’s medical benefit (e.g., Medicare Part B), and the reimbursement process is governed by the “buy-and-bill” model.31

The process is exactly as the name implies:

- Buy: The healthcare provider (e.g., an oncology practice) purchases the specialty drug directly from a specialty distributor or wholesaler, taking on the upfront financial cost.33 The practice must then manage the inventory, ensuring proper storage (often requiring refrigeration) and handling to maintain the drug’s integrity.31

- Bill: After administering the drug to a patient, the provider submits a claim to the patient’s insurance payer (e.g., Medicare or a commercial plan) for reimbursement.33 This claim covers both the cost of the drug itself and a separate fee for its administration.

This model places the provider at the very center of the economic transaction. On one hand, it grants them significant control over the supply chain, ensuring they have the necessary medications on hand and can verify the product’s pedigree and integrity, which is crucial for patient safety.31 On the other hand, it exposes the practice to substantial financial risk. They must bear the upfront cost of incredibly expensive medications, manage the complexities of inventory and potential waste, and navigate the often-tortuous process of prior authorization and claims submission, all while facing the risk of delayed payment or claim denial.31 The financial viability of a specialty practice operating under this model depends heavily on the margin between their acquisition cost for the drug and the reimbursement they ultimately receive from the payer. This margin, as we will see, is the critical friction point where biosimilars create economic disruption.

The Middlemen Monarchs: How PBMs Shape Access Through Formularies and Rebates

When a biologic is self-administered by the patient (e.g., an injectable pen for psoriasis or rheumatoid arthritis), it is typically covered under the pharmacy benefit. This channel is dominated by a different set of powerful intermediaries: Pharmacy Benefit Managers (PBMs). PBMs are third-party administrators that manage prescription drug benefits on behalf of health plans, large employers, and government programs, covering over 275 million Americans.38

The PBM market is a highly concentrated oligopoly, with three behemoths—CVS Caremark, Express Scripts (owned by Cigna), and OptumRx (owned by UnitedHealth Group)—controlling approximately 80% of all prescription claims.40 Their primary mechanism of control is the

drug formulary, a curated list of medications that a health plan will cover.42

Formularies are typically structured in tiers, with each tier corresponding to a different level of patient cost-sharing:

- Tier 1: Usually reserved for low-cost generic drugs, with the lowest copayments.

- Tier 2: Includes “preferred” brand-name drugs, which have a higher copay but are more affordable than non-preferred options.

- Tier 3: Contains “non-preferred” brand-name drugs, which are covered but carry a significantly higher cost-sharing burden for the patient.

- Specialty Tier: A separate, higher tier often used for expensive biologics, which typically requires the patient to pay a percentage of the drug’s cost (coinsurance) rather than a flat copay.44

A PBM’s central function is to leverage its massive purchasing power to negotiate with pharmaceutical manufacturers. The primary tool in this negotiation is the rebate. Manufacturers provide substantial rebates—essentially, after-the-fact discounts—to PBMs in exchange for placing their drug on a favorable formulary tier (e.g., Tier 2 instead of Tier 3), which drives market share.41

This system, however, is rife with potential conflicts of interest. PBMs generate revenue not only from administrative fees paid by their clients but also by retaining a portion of the manufacturer rebates they negotiate or through “spread pricing,” where they charge the health plan more for a drug than they reimburse the pharmacy, pocketing the difference.42 This creates a dynamic where a PBM might be financially incentivized to favor a drug with a higher list price and a larger rebate over a drug with a lower list price and a smaller rebate, even if the latter’s net cost to the health plan is actually lower. This “rebate trap” is a central barrier to the adoption of many lower-list-price biosimilars, particularly those covered under the pharmacy benefit.

The Patient Perspective: Navigating Tiers, Coinsurance, and Out-of-Pocket Burdens

Ultimately, the structure of these reimbursement models translates directly into out-of-pocket costs for patients, which can be a significant barrier to accessing life-changing biologic therapies. For these high-cost drugs, payers have increasingly shifted away from predictable, flat-dollar copayments toward percentage-based coinsurance.47

This shift has profound implications for affordability. A $50 copay is the same regardless of whether the drug costs $2,000 or $5,000 per month. But a 30% coinsurance on a biologic that costs $20,000 per year means the patient is responsible for $6,000.47 In commercial plans, coinsurance rates for specialty drugs can range from 20% to 50%, and in Medicare Part D, they can be as high as 33% before the patient reaches the catastrophic coverage phase.47 Studies have shown that monthly out-of-pocket costs exceeding $100 are directly associated with higher rates of prescription abandonment—patients simply walk away from the pharmacy counter without their medication because they cannot afford it.

In theory, the introduction of a lower-priced biosimilar should be a boon for patients facing coinsurance. A 30% share of a $15,000 biosimilar is less than a 30% share of a $20,000 originator. However, the reality is often more complex. The intricate design of insurance benefits, including deductibles and the Medicare Part D “donut hole,” combined with aggressive copay assistance programs offered by originator manufacturers, can sometimes create a paradoxical situation where the out-of-pocket cost for a patient on a lower-list-price biosimilar is actually higher than for the originator. This misalignment at the patient level creates yet another powerful headwind against the swift adoption of biosimilars, demonstrating that simply introducing a lower-priced product is not enough to guarantee savings for all stakeholders in the current system.

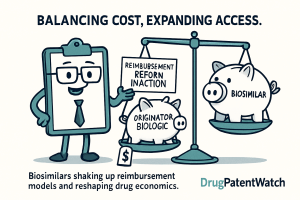

The Economic Shockwave: How Biosimilars Disrupt Reimbursement

The arrival of biosimilars does more than just introduce clinical alternatives; it sends an economic shockwave through the established reimbursement frameworks. By offering clinically equivalent therapies at a lower price point, biosimilars expose and often exploit the misaligned incentives embedded within the buy-and-bill and PBM-managed systems. This disruption creates a central economic conflict: while biosimilars promise significant savings for the healthcare system as a whole, their adoption can be financially disadvantageous for the very stakeholders—providers and PBMs—who control access.

The ASP Squeeze: Perverse Incentives in the Buy-and-Bill System

Nowhere is this conflict more apparent than in the buy-and-bill model for physician-administered drugs. Under Medicare Part B, the standard reimbursement formula for these drugs is based on their Average Sales Price (ASP). ASP is a manufacturer-reported figure that reflects the average price of a drug to all purchasers in the U.S., net of certain discounts and rebates.49 Providers are then reimbursed at

ASP plus a 6% add-on payment.32

This seemingly straightforward formula creates what is widely known as a “perverse incentive” when a lower-cost biosimilar enters the market. Because the 6% add-on is calculated based on the drug’s price, a provider receives a higher absolute dollar amount for administering a more expensive drug.

Let’s illustrate this with a simple model. Imagine a provider can choose between an originator biologic with an ASP of $1,000 per dose and a biosimilar with an ASP of $700 per dose.

- Originator Reimbursement: $1,000 (ASP) + (6% of $1,000) = $1,000 + $60 = $1,060

- Biosimilar Reimbursement: $700 (ASP) + (6% of $700) = $700 + $42 = $742

Assuming the provider’s acquisition cost is equal to the ASP, the margin on the originator is $60, while the margin on the biosimilar is only $42. A rational economic actor, faced with this choice, is financially incentivized to prescribe the more expensive originator drug, even though the biosimilar would save the Medicare system $300 per dose.1 This fundamental misalignment between what is best for the provider’s bottom line and what is best for the payer’s budget is the single greatest barrier to biosimilar adoption for drugs covered under the medical benefit.

Price Erosion in Action: The Competitive Effect on Reference and Biosimilar ASP

Despite the reimbursement hurdles, when biosimilars do gain a foothold in the market, their competitive effect is undeniable and powerful. The introduction of lower-priced alternatives forces a downward pressure on the prices of all products within a therapeutic class, including the originator biologic. This is a classic market response to competition, and the data bears it out.

A 2023 report from the Association for Accessible Medicines found that the average sales price for biosimilars is, on average, 50% lower than the reference brand biologic’s price was at the time of the biosimilar’s launch. This competition doesn’t just benefit patients who switch to the biosimilar; it compels the originator manufacturer to lower its own price to avoid losing its entire market share. This dynamic has been clearly observed in Medicare reimbursement data. One analysis found that over a five-year period following the launch of the first biosimilar in a class, the reimbursement rates for the reference biologics fell by an average of 32.7%, while the rates for the biosimilars themselves fell by a staggering 50.3%.

This price erosion translates into massive savings for the healthcare system. Biosimilar competition was estimated to have reduced Medicare Part B spending by about 62% in 2023 compared to what would have been spent without them. However, this very success creates a new challenge. The rapid decline in ASPs, or a “race to the bottom,” can compress the already thin margins for biosimilar manufacturers, potentially threatening the long-term financial viability of the market, especially for companies that are not the first or second to launch. If the potential return on a $100+ million investment becomes too uncertain due to rapid price decay, it could disincentivize future biosimilar development, ultimately stifling the very competition that generates savings.

Medicare’s Response: The Inflation Reduction Act’s ASP+8% Boost

Recognizing the powerful disincentive embedded in the ASP+6% formula, U.S. policymakers took direct legislative action. A key provision of the Inflation Reduction Act (IRA) of 2022 was designed specifically to level the playing field for biosimilars under Medicare Part B.

Effective from October 1, 2022, the IRA implemented a temporary, five-year increase in the add-on payment for “qualifying” biosimilars. A qualifying biosimilar is defined as one whose ASP is not higher than the ASP of its reference product.56 For these products, the reimbursement formula was changed to:

the biosimilar’s ASP plus 8% of the reference product’s ASP.

This is a subtle but crucial change. By unlinking the add-on from the biosimilar’s own low price and instead pegging a higher percentage (8%) to the originator’s higher price, the policy aims to make the biosimilar the more profitable option for the provider. Let’s revisit our earlier model with the new IRA formula:

| Metric | Originator Biologic | Biosimilar (Standard Reimbursement) | Biosimilar (IRA-Adjusted Reimbursement) |

| Example ASP | $1,000 | $700 | $700 |

| Add-on Calculation | 6% of Originator ASP ($60) | 6% of Biosimilar ASP ($42) | 8% of Originator ASP ($80) |

| Total Reimbursement | $1,060 | $742 | $780 |

| Provider Margin (Illustrative) | $60 | $42 | $80 |

As the table demonstrates, the IRA’s policy change successfully flips the economic incentive. The provider now stands to make a larger margin ($80) by choosing the lower-cost biosimilar, aligning their financial interest with the payer’s goal of cost savings.

However, while logically sound, the real-world impact of this policy change has so far been described as “modest”. This suggests that while the reimbursement formula is a critical piece of the puzzle, it is not the only one. Other powerful market forces can override this financial nudge. For example, commercial payers may still impose strict utilization management controls, like prior authorization, that dictate product choice regardless of the provider’s preference.59 Furthermore, hospitals participating in the 340B Drug Pricing Program have entirely different economic calculations. They acquire drugs at a deep statutory discount but are still reimbursed by Medicare at the same ASP-based rate, making the margin on high-cost originator drugs exceptionally large and creating a powerful disincentive to switch to a lower-cost biosimilar.49 The IRA’s provision is a step in the right direction, but its limited initial impact underscores the complexity of the reimbursement ecosystem and proves that a multi-pronged approach, addressing payer policies and site-of-care economics, is necessary to truly accelerate biosimilar adoption.

The Payer’s Playbook: Strategies to Accelerate Biosimilar Uptake

While providers in the buy-and-bill system grapple with the direct economics of ASP-based reimbursement, the ultimate arbiters of access—public and private payers—are deploying a sophisticated set of strategies to steer the market toward lower-cost biosimilars. This has created a high-stakes chess match between payers, who are determined to realize the promised cost savings, and originator manufacturers, who employ powerful defensive tactics to protect their blockbuster revenues. Understanding this strategic interplay is crucial to forecasting market share shifts and the future of biologic reimbursement.

Wielding the Formulary: Preferred Tiers, Step-Therapy, and Prior Authorization

For both medically- and pharmacy-administered biologics, payers wield a powerful set of utilization management (UM) tools to direct prescribing patterns and control costs. As biosimilars have entered the market, these tools have become the primary levers for driving their adoption.

- Aggressive Formulary Design: The most direct strategy is to manipulate the drug formulary to favor biosimilars. This can range from placing a biosimilar on a preferred tier with lower patient cost-sharing to create a financial incentive for patients, to more aggressive tactics. In a landmark shift, some of the largest PBMs have begun to completely exclude major originator biologics, such as AbbVie’s Humira, from their national commercial formularies, effectively forcing patients to use a preferred biosimilar alternative.62 This decisive action can rapidly shift prescribing patterns and capture nearly the entire market for a preferred biosimilar.

- Step Therapy: This strategy mandates a specific sequence of treatment. Payers can implement a policy requiring a patient to first try a more cost-effective biosimilar and demonstrate that it is not effective for them before they will approve coverage for the more expensive originator biologic.59 This “fail-first” approach is a common and effective tool for guiding new patients toward lower-cost options. Retrospective claims analyses have shown that payer policies incorporating step therapy have contributed to significant movements toward biosimilar adoption, particularly in the oncology space.

- Prior Authorization (PA): Payers can also use the administrative burden of prior authorization to their advantage. While a preferred biosimilar might be approved with minimal paperwork, a request for the originator biologic could trigger a rigorous PA process, requiring the provider to submit extensive clinical documentation justifying why the lower-cost alternative is not appropriate for the patient. This administrative friction can be a powerful deterrent, encouraging busy clinical practices to opt for the path of least resistance—the preferred biosimilar.

These strategies allow payers to override the perverse financial incentives that might exist for providers under the buy-and-bill model. By making it administratively difficult, or in some cases impossible, to get the originator reimbursed, they can force a market shift toward the more cost-effective biosimilar.

The “Rebate Wall”: How Originators Defend Their Turf

Originator manufacturers have not stood idly by. Their primary defensive strategy, particularly for blockbuster drugs with high market share, is the construction of a “rebate wall,” also known as a “rebate trap”.65 This is an exclusionary contracting practice that leverages the manufacturer’s market power to lock out competition.

Here is how it works: An originator manufacturer negotiates a contract with a large payer or PBM, offering a substantial rebate on its high-priced biologic. However, this rebate is contingent on the payer granting the drug exclusive or highly preferred status on its formulary, which means agreeing not to cover, or to severely restrict access to, any competing biosimilars.67

The “trap” is sprung if the payer decides to add a lower-priced biosimilar to its formulary. In doing so, the payer violates the terms of the agreement and risks losing the originator’s rebate not just on the prescriptions that switch to the biosimilar, but on its entire volume of the originator drug. Because many patients may remain on the originator due to prescriber inertia or clinical stability, the financial penalty of losing the rebate on this large, retained patient population can far outweigh the savings gained from the small population that switches to the biosimilar. This can make adding the cheaper biosimilar a financially irrational decision for the payer.

This strategy has been a particularly formidable barrier for biosimilars covered under the pharmacy benefit, where PBMs’ business models are often closely tied to maximizing rebate dollars. It creates a direct conflict of interest, as a PBM may be incentivized to maintain the high-rebate originator on formulary, even if a biosimilar offers a lower net cost to the health plan and its members. This dynamic has come under intense scrutiny from regulators, including the Federal Trade Commission (FTC), as a potentially anticompetitive practice that harms patients by limiting choice and keeping overall healthcare costs high.

Case Study: The Adalimumab (Humira) Battlefield and PBM Strategy Shifts

The 2023 launch of biosimilars for AbbVie’s Humira (adalimumab) serves as the ultimate real-world case study of this strategic battle. Humira, a self-injected treatment for autoimmune conditions, was the best-selling drug in the world, covered under the pharmacy benefit and thus subject to the full force of PBM formulary decisions and rebate walls.69

Despite multiple adalimumab biosimilars launching in the U.S. with staggering list price discounts of up to 85%, their initial market uptake was virtually nonexistent, capturing less than 2% of the market in the first year.71 The reason was clear: the major PBMs chose to keep the high-priced, high-rebate Humira on their formularies in a preferred position, effectively neutralizing the biosimilars’ price advantage.71 Payers still achieved significant savings because AbbVie was forced to dramatically increase its rebates on Humira to compete on net price, but the biosimilar manufacturers were locked out of the market.

However, the story did not end there. Facing immense pressure from employers, policymakers, and the public over the lack of transparency and misaligned incentives in the rebate system, a strategic pivot began in 2024. In a landmark move, CVS Caremark announced it would remove Humira from its major national commercial formularies, opting instead to cover its own co-branded adalimumab biosimilar. This single decision caused Humira’s dominant market share to plummet almost overnight.

The adalimumab saga reveals a critical evolution in PBM strategy. While initially clinging to the lucrative high-rebate model, the external pressure for cost savings and transparency is becoming too great to ignore. PBMs appear to be transitioning to a new value proposition, one where they demonstrate their worth not by negotiating opaque rebates, but by aggressively managing the transition to lower-cost biosimilars and passing those savings on to their clients. The emergence of PBM-affiliated or “private label” biosimilars is a key indicator of this shift.72 It marks a move from being a passive negotiator of discounts to an active manager of cost-effective therapy, a trend that will likely define the next phase of the biosimilar revolution.

Global Lessons in Adoption: U.S. vs. E.U. Market Dynamics

The global biosimilar landscape is not monolithic. The divergent experiences of the United States and the European Union provide a powerful natural experiment, illustrating how different regulatory approaches, reimbursement structures, and market environments can lead to dramatically different outcomes in biosimilar adoption and price erosion. By comparing these two major markets, U.S. stakeholders can glean valuable lessons and anticipate the future trajectory of their own evolving ecosystem.

A Tale of Two Markets: Contrasting Uptake for Key Biologics

The contrast in market penetration for some of the earliest and most significant biosimilars is stark. The data for key molecules like infliximab and adalimumab reveal two fundamentally different adoption curves.

- Infliximab (Remicade): As a physician-administered therapy for autoimmune diseases, infliximab was one of the first major biologics to face biosimilar competition in both markets. In Europe, adoption was swift and decisive. Driven by national health system policies and tenders, biosimilar market share in many countries soared past 70% within a few years of launch. This robust competition led to dramatic price reductions, with some European nations reporting discounts of up to 80%, which in turn expanded patient access to the therapy.77 The U.S. experience was a study in contrast. Four years after the first biosimilar launched, its market share languished at a mere 9%. The perverse incentives of the buy-and-bill system, combined with originator contracting strategies, created powerful headwinds that the European single-payer systems did not face.

- Adalimumab (Humira): The story of this pharmacy-benefit blockbuster is even more telling. Following the 2018 launch of biosimilars in Europe, the market shifted rapidly. Within just one year, biosimilars had captured nearly 35% of the European market, and Humira’s international revenues plummeted by over 30%. As discussed previously, the initial U.S. launch in 2023 was the polar opposite, with biosimilars gaining less than 2% of the market in their first year due to the formidable “rebate walls” erected by the originator with PBMs.

- Trastuzumab (Herceptin): Interestingly, the oncology space has been a relative success story in the U.S. For trastuzumab, a key therapy for HER2-positive breast cancer, biosimilars have achieved significant market penetration. Within three years of launch, biosimilars had captured a majority of the market, and the intense competition drove down the prices of all trastuzumab products, including the originator Herceptin.79 This success is likely due to a combination of factors, including a more concentrated and informed prescriber base in oncology and perhaps less effective defensive strategies from the originator compared to the adalimumab market.

The following table synthesizes these divergent experiences, providing a clear snapshot of the market dynamics three years after the first biosimilar launch for two key molecules.

| Metric | Infliximab (U.S.) | Infliximab (E.U. Average) | Adalimumab (U.S.)* | Adalimumab (E.U. Average) |

| Biosimilar Market Share (%) | <10% | >70% | <5% | >50% |

| Average Price Erosion vs. Pre-Launch Originator (%) | Moderate | 70-80% | Significant (net price) but low uptake | 50-70% |

| Key Adoption Driver(s) | Payer UM, Provider Economics | National Tenders, Government Mandates, Physician Incentives | PBM Formulary Exclusion | National Tenders, Physician Choice, Price Competition |

| *Note: U.S. Adalimumab data reflects the market approximately one year post-launch, as three years of data is not yet available. The trend is extrapolated based on early market dynamics. |

Policy and Practice: Why Europe’s Adoption Rates Have Historically Outpaced the U.S.

The dramatic differences in uptake are not accidental; they are the direct result of fundamental structural differences between the U.S. and European healthcare systems. Europe’s success in fostering rapid biosimilar adoption can be attributed to several key factors:

- Centralized Decision-Making: In many European countries, healthcare is managed by a single-payer national health system. This allows for centralized, top-down policy decisions. Governments can implement national tenders, where manufacturers bid for the exclusive right to supply the entire country, often resulting in massive price discounts.76

- Aligned Incentives: These systems often include direct incentives for physicians and hospitals to prescribe the most cost-effective option, such as prescribing quotas or shared savings models.82

- Scientific Consensus on Switching: As noted, the broad European consensus that all approved biosimilars are scientifically interchangeable has removed a major psychological barrier for prescribers, making them more comfortable switching stable patients.

The U.S. market, in contrast, is a highly fragmented patchwork of thousands of private commercial payers, government programs, and powerful intermediaries like PBMs.84 This fragmentation leads to a complex web of often-conflicting incentives. A strategy that saves money for a health plan might reduce revenue for a provider, while a rebate that benefits a PBM might increase out-of-pocket costs for a patient. It is this systemic misalignment that has historically slowed biosimilar adoption in the U.S.

Closing the Gap: Is the U.S. Market Finally Maturing?

Despite its slower start and structural hurdles, it would be a mistake to write off the U.S. biosimilar market. The landscape is evolving rapidly, and there are clear signs that the U.S. is entering a new, more aggressive phase of adoption. While the U.S. lagged Europe in initial approvals, it has since accelerated its regulatory process, approving more biosimilars in its first five years of the BPCI Act than the EMA did in its first five years.

More importantly, the market dynamics are beginning to shift. The initial period of provider hesitancy and successful originator defense is giving way to a new reality driven by powerful commercial payers. The dramatic PBM-led shift in the adalimumab market is a prime example. While Europe’s transition was largely orchestrated by government health authorities, the U.S. transition is being driven by the sheer market power of its largest commercial entities. This may lead to a more volatile and less predictable transformation, but the direction of travel is clear.

The savings are now becoming too substantial to ignore. In 2023 alone, biosimilars generated $12.4 billion in savings for the U.S. healthcare system, with total savings since 2015 reaching $36 billion.87 In some therapeutic areas, like oncology, U.S. biosimilar uptake is now on par with or even exceeding that of Europe. The U.S. market is undergoing a compressed and chaotic evolution, but it is undeniably maturing. The key takeaway for stakeholders is that the era of slow, tentative adoption is ending, and the era of aggressive, payer-driven market shifts is here.

The Strategic Horizon: From Patent Intelligence to Value-Based Care

As the biosimilar market matures and the competitive landscape intensifies, stakeholders must adopt more sophisticated strategies to navigate the complexities and capitalize on the opportunities. Success is no longer just about developing a scientifically sound product; it’s about mastering the interplay of intellectual property, reimbursement innovation, and long-term market trends. This final section provides a forward-looking analysis of the strategic tools and paradigms that will define the next chapter of the biosimilar revolution.

Leveraging Patent Data for Competitive Edge: The Role of DrugPatentWatch

In the world of biosimilars, timing is everything. The entire business model hinges on entering the market as soon as an originator biologic’s web of exclusivity protections expires. Patent expirations are the primary trigger for market entry, but the path is rarely straightforward.90 Originator manufacturers have become masters of creating “patent thickets”—dense, overlapping portfolios of secondary patents covering formulations, manufacturing processes, and methods of use—that can delay biosimilar competition for years beyond the expiration of the core composition-of-matter patent.90 AbbVie’s Humira, with its fortress of over 160 U.S. patents, is the canonical example of this strategy, successfully delaying U.S. biosimilar entry for nearly seven years after its primary patent expired.

Navigating this legal minefield requires more than just scientific expertise; it demands sophisticated competitive intelligence. This is where specialized services like DrugPatentWatch become indispensable strategic assets. By providing comprehensive, global business intelligence on biologic patents, exclusivity periods, ongoing litigation, and regulatory developments, such platforms transform patent data from a purely legal concern into a powerful tool for commercial strategy.96

- For Biosimilar Developers: Patent intelligence allows for a proactive, rather than reactive, approach. By analyzing the patent landscape early, developers can identify blockbuster biologics with less formidable patent defenses, assess the risk and potential cost of litigation, and more accurately forecast launch timelines.99 This data-driven risk assessment is critical for prioritizing R&D investments and building a viable business case.

- For Originator Companies: Monitoring the biosimilar pipeline and the patent challenge strategies of competitors is essential for effective lifecycle management. It informs decisions on when to deploy defensive strategies, when to pursue settlement agreements, and how to forecast the erosion curve of their own products.

- For Payers and Providers: Understanding the patent expiration pipeline allows for proactive financial and clinical planning. Payers can anticipate when lower-cost alternatives will become available and begin developing formulary strategies and negotiating contracts well in advance.95 This foresight enables a smoother and more rapid transition, maximizing cost savings from day one of biosimilar availability.

In this high-stakes environment, the ability to accurately predict patent cliffs and navigate the complexities of intellectual property is no longer a niche legal skill—it is a core determinant of commercial success for every stakeholder in the biosimilar ecosystem.

Beyond Fee-for-Service: The Emerging Role of Value-Based Contracts

While legislative fixes like the IRA’s ASP+8% provision attempt to patch the flaws of the fee-for-service (FFS) system, a more fundamental solution is emerging: the shift toward value-based care (VBC). VBC models represent a paradigm shift in reimbursement, moving away from paying for the volume of services provided (the FFS model) and toward paying for the quality and efficiency of the care delivered.103

Programs like the Centers for Medicare & Medicaid Services’ (CMS) Enhancing Oncology Model (EOM) are at the forefront of this transition. In these models, provider practices take on two-sided risk, meaning they are not only eligible for bonus payments if they meet quality targets and keep the total cost of care below a benchmark, but they are also financially penalized if costs exceed that benchmark.

This shift has the potential to be the ultimate catalyst for biosimilar adoption because it perfectly aligns the economic incentives of payers and providers. The perverse incentive of the buy-and-bill model, which rewards the use of higher-priced drugs, simply evaporates in a VBC framework. The provider’s new objective is to achieve the best possible patient outcome at the lowest possible total cost.

Consider the provider’s decision-making process under a VBC contract:

- The goal is to lower the total cost of a patient’s episode of care while maintaining or improving quality.

- A biosimilar is available that has been proven to have no clinically meaningful differences from the originator but has a significantly lower acquisition cost.

- By choosing the biosimilar, the provider directly reduces the total cost of care for that patient.

- This reduction in cost helps the practice meet its financial benchmark, making it eligible for a shared savings payment from the payer.

In this model, the biosimilar is transformed from a financial threat (a product with a lower FFS margin) into a powerful financial tool (an enabler of shared savings and value-based success). As the healthcare system continues its slow but inexorable march away from FFS and toward VBC, this alignment of incentives will become the most powerful structural driver of a sustainable and efficient biosimilar market. Biosimilars, in essence, become a bridge that helps providers successfully make the transition to value-based care.

The Future Outlook: Projecting Market Growth and Overcoming Adoption Hurdles

The future of the biosimilar market is one of immense potential tempered by significant challenges. The economic imperative is undeniable. With dozens of major biologics set to lose exclusivity over the next decade, the market opportunity is vast.92 Market projections reflect this, with forecasts for the global biosimilar market reaching between $76 billion and $93 billion by 2030, and some more aggressive estimates projecting a surge to $1.3 trillion by 2032.106 This explosive growth will be fueled by the relentless pressure to contain healthcare costs, the rising prevalence of chronic diseases, and increasingly supportive regulatory environments worldwide.

However, realizing this potential is not a foregone conclusion. As this report has detailed, significant hurdles remain:

- Regulatory and Legal Barriers: The “patent thicket” remains a formidable obstacle, delaying competition and adding immense cost and risk to biosimilar development. While legislative solutions are being proposed, their passage and impact are uncertain.93

- Reimbursement Misalignment: While VBC offers a long-term solution, the FFS and buy-and-bill models will persist for the foreseeable future, requiring continued policy interventions to address their misaligned incentives.

- Payer and PBM Dynamics: The power of rebate walls, while being challenged, will continue to shape formulary access and market share for pharmacy-benefit biosimilars.

- Stakeholder Confidence: Despite overwhelming scientific evidence, residual hesitancy among some providers and patients remains a barrier that can only be overcome through continued education, transparency, and positive real-world experience.111

The trajectory of the biosimilar market will be defined by the ongoing struggle between these powerful growth drivers and persistent market barriers. Success will require a concerted effort from all stakeholders: regulators must continue to streamline pathways and promote fair competition; payers must design reimbursement models that reward value over volume; providers must embrace evidence-based adoption of cost-effective therapies; and biosimilar manufacturers must navigate the complex landscape with strategic foresight. The revolution is well underway, and the companies that master these complex dynamics will not only survive but thrive in the new era of biologic medicine.

Key Takeaways

- Biosimilars Are Fundamentally Different from Generics: Their biological origin and manufacturing complexity lead to higher development costs ($100M+), more modest price discounts (15-50%), and a unique “highly similar, not identical” regulatory standard. Misunderstanding this distinction leads to flawed market strategy.

- Reimbursement Models Create Perverse Incentives: The traditional “buy-and-bill” model, which reimburses providers at ASP plus a percentage, financially penalizes the use of lower-cost biosimilars. While policy fixes like the Inflation Reduction Act’s ASP+8% boost help, they are not a complete solution to this core economic conflict.

- PBMs and Payers Are the Primary Drivers of Adoption: Through aggressive formulary management, including preferred tiering, step-therapy, and originator exclusions, payers are the most powerful force in shifting market share to biosimilars, especially for pharmacy-benefit drugs.

- “Rebate Walls” Are the Main Defensive Strategy for Originators: Originator manufacturers leverage high-volume rebates contingent on formulary exclusivity to create a “rebate trap,” making it financially disadvantageous for payers to cover lower-cost biosimilars. The battle over adalimumab (Humira) is the definitive case study of this dynamic.

- The U.S. Market Is Maturing but Remains Structurally Different from the E.U.: While Europe’s single-payer systems and government tenders led to rapid, top-down biosimilar adoption, the fragmented U.S. market is undergoing a more chaotic, commercially-driven transition led by powerful payers and PBMs.

- Value-Based Care Is the Ultimate Solution: The long-term shift from fee-for-service to value-based reimbursement models will be the most powerful catalyst for biosimilar uptake, as it perfectly aligns the financial incentives of providers and payers around the goal of lowering the total cost of care.

- Patent Intelligence Is a Critical Strategic Tool: In the biosimilar landscape, accurately forecasting market entry timelines by navigating complex “patent thickets” is essential. Services like DrugPatentWatch provide the necessary competitive intelligence to move from a reactive to a proactive commercial strategy.

Frequently Asked Questions (FAQ)

1. How can a biosimilar manufacturer best position its product for favorable formulary placement with major PBMs?

Securing favorable formulary placement with the “Big Three” PBMs requires a multi-pronged strategy that goes beyond simply offering a low price. First, manufacturers must engage in sophisticated net price modeling to compete with the originator’s rebate offers. This may involve a dual-pricing strategy, offering both a low-WAC (Wholesale Acquisition Cost) version with minimal rebates and a high-WAC version with larger rebates to give PBMs flexibility. Second, achieving an “interchangeable” designation from the FDA, while not a guarantee of preferred status, can be a valuable negotiating tool, as it simplifies substitution logistics for the PBM’s pharmacy network. Third, manufacturers should generate and present compelling real-world evidence and health economic outcomes data that demonstrate the total cost-of-care savings their product can deliver to a health plan, moving the conversation beyond unit price to overall value. Finally, as seen with the adalimumab market, forming strategic partnerships, potentially including co-branding with a PBM’s own specialty pharmacy, is emerging as a powerful path to securing exclusive or preferred access.

2. For a provider practice, what are the key operational and financial steps to prepare for a market shift from an originator to its biosimilars?

Provider practices, especially those operating on a buy-and-bill model, must be proactive. Financially, they need to conduct a thorough analysis of their payer mix and the specific reimbursement policies for the new biosimilars. This includes understanding whether payers will adopt the IRA’s ASP+8% formula for Medicare patients and how commercial contracts will reimburse the new products. Practices should use this analysis to model the impact on their margins and identify which biosimilar, if any, is the most financially viable option. Operationally, they must update their electronic health record (EHR) and billing systems with the new HCPCS codes for each biosimilar.113 Staff training is critical to ensure billing teams understand the new codes and any payer-specific modifier requirements (e.g., JW modifier for discarded drug) to prevent claim denials. Clinically, the practice needs a clear protocol for patient communication and education to manage the transition smoothly, address patient concerns, and mitigate the nocebo effect.

3. As an investor, what are the key green and red flags to look for when evaluating the commercial potential of a biosimilar in the pipeline?

Investors should look beyond the size of the reference product’s market. A key green flag is a “first-mover” or early-launch advantage, as the first biosimilar to market often captures a dominant and sticky market share. Another is a clear legal and regulatory path, indicated by favorable outcomes in patent litigation or settlement agreements that specify a near-term launch date. A product seeking an interchangeability designation for a pharmacy-benefit drug is also a positive sign. The biggest red flag is a reference product protected by a dense and complex “patent thicket,” which signals a high probability of costly, protracted litigation and significant launch delays. Another red flag is entering a crowded market late; the third or fourth biosimilar to launch faces intense price competition and compressed margins. Finally, investors should scrutinize the manufacturer’s commercial capabilities and partnerships, as market access in the U.S. is as much about negotiating with payers as it is about science.

4. How is the Inflation Reduction Act’s drug price negotiation provision likely to interact with and impact the biosimilar market for selected drugs?

The IRA’s Medicare drug price negotiation provision introduces significant uncertainty into the biosimilar market. If an originator biologic is selected for negotiation before biosimilars have had a chance to launch and establish a competitive market, the “maximum fair price” (MFP) set by CMS could be substantially lower than the pre-negotiation price. This could severely diminish the potential savings a biosimilar can offer, thereby reducing the financial incentive for manufacturers to develop and launch biosimilars for that product. The market opportunity could effectively be preempted by government price setting. This creates a race against time for biosimilar developers, as their commercial viability may depend on launching before their reference product becomes subject to negotiation. This dynamic could lead manufacturers to deprioritize biosimilar development for biologics that are likely candidates for near-term negotiation.

5. If the FDA finalizes its proposal to effectively eliminate the “interchangeability” designation from a practical standpoint, what would be the most likely immediate impact on the U.S. biosimilar market?

Finalizing the FDA’s proposal to remove switching study requirements and the interchangeability distinction from labeling would likely have a net positive impact on the U.S. biosimilar market.23 The immediate effect would be to level the playing field, removing the perceived two-tiered system and clarifying for providers and patients that all approved biosimilars are equally safe and effective for switching. This would lower a significant barrier to entry, as manufacturers would no longer need to invest in costly and time-consuming switching studies, potentially encouraging more competition. While it might remove the marketing exclusivity period granted to the “first interchangeable,” the overall effect of increased competition and reduced stakeholder confusion would likely accelerate market penetration and lead to greater cost savings for the healthcare system. It would essentially move the U.S. closer to the more pragmatic and scientifically-grounded European model.

References

- The impact of biosimilars on biologic drug reimbursement models – DrugPatentWatch – Transform Data into Market Domination, accessed July 31, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-biosimilars-on-biologic-drug-reimbursement-models/

- biotech-spain.com, accessed July 31, 2025, https://biotech-spain.com/en/articles/quality-control-in-biotechnology-ensuring-safety-in-the-biologics-manufacturing-process/#:~:text=Biopharmaceuticals%20are%20drugs%20derived%20from,edge%20biotechnologies%20to%20be%20obtained.

- What Are Biologic and Small Molecule Drugs Used For? – GoodRx, accessed July 31, 2025, https://www.goodrx.com/drugs/biologics/vs-small-molecule-drugs

- Understanding Biosimilars – FrameworkLTC, accessed July 31, 2025, https://frameworkltc.com/blog-posts/understanding-biosimilars

- Quality Control in Biotechnology: Ensuring Safety in the Biologics Manufacturing Process, accessed July 31, 2025, https://biotech-spain.com/en/articles/quality-control-in-biotechnology-ensuring-safety-in-the-biologics-manufacturing-process/

- Drafting Drug Patent Applications for Biologic Drugs – DrugPatentWatch – Transform Data into Market Domination, accessed July 31, 2025, https://www.drugpatentwatch.com/blog/drafting-drug-patent-applications-for-biologic-drugs/

- Foundational Concepts Generics and Biosimilars – FDA, accessed July 31, 2025, https://www.fda.gov/media/154912/download

- What are biosimilars? – Cardinal Health Newsroom, accessed July 31, 2025, https://newsroom.cardinalhealth.com/2021-11-3-An-introduction-to-biosimilars-Medications-that-drive-competition,-lower-costs-and-increase-accessibility

- What are Biosimilars and Biologics? | Pfizer Biosimilars, accessed July 31, 2025, https://www.pfizerbiosimilars.com/characteristics-of-biosimilars

- Biosimilars – CVS Specialty, accessed July 31, 2025, https://www.cvsspecialty.com/resource-center/biosimilars.html

- www.pfizerbiosimilars.com, accessed July 31, 2025, https://www.pfizerbiosimilars.com/characteristics-of-biosimilars#:~:text=What%20is%20a%20biosimilar%3F,effectiveness%20from%20the%20reference%20product.

- A Systematic Review of U.S. Biosimilar Approvals: What Evidence Does the FDA Require and How Are Manufacturers Responding?, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10398206/

- An Overview of Biosimilar Regulatory Approvals by the EMA and …, accessed July 31, 2025, https://www.drugpatentwatch.com/blog/the-biosimilar-landscape-an-overview-of-regulatory-approvals-by-the-ema-and-fda/

- Biosimilar Regulatory Approval Pathway – FDA, accessed July 31, 2025, https://www.fda.gov/media/154914/download

- Why Are Biosimilars Not Living up to Their Promise in the US …, accessed July 31, 2025, https://journalofethics.ama-assn.org/article/why-are-biosimilars-not-living-their-promise-us/2019-08

- Failure to Launch: Biosimilar Sales Continue to Fall Flat in the …, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7255927/

- Biosimilar vs Generic Drugs: Key Differences in Healthcare – Medical Packaging Inc, accessed July 31, 2025, https://medpak.com/biosimilar-vs-generic-drugs/

- The Economics of Biosimilars – PMC, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4031732/

- Op-Ed: Expand Patient Choice to Lower Medication Costs – Articularis – Healthcare Group, accessed July 31, 2025, https://articularishealthcare.com/news/op-ed-expand-patient-choice-to-lower-medication-costs/

- Biosimilars Often Reduce Prices by 50 Percent or More – Pacific Research Institute, accessed July 31, 2025, https://www.pacificresearch.org/biosimilars-often-reduce-prices-by-50-percent-or-more/

- What are 351(a) & 351(k)? – DDReg Pharma, accessed July 31, 2025, https://www.ddregpharma.com/what-are-351a-351k-in-biologics

- Overview of the Regulatory Framework and FDA’s Guidance for the …, accessed July 31, 2025, https://www.fda.gov/media/113820/download

- FDA further blurs the line between biosimilars and interchangeables, accessed July 31, 2025, https://www.agencyiq.com/blog/fda-further-blurs-the-line-between-biosimilars-and-interchangeables/

- Biosimilar medicines: Overview | European Medicines Agency (EMA), accessed July 31, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/biosimilar-medicines-overview

- Biosimilar medicines: marketing authorisation | European Medicines Agency (EMA), accessed July 31, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/marketing-authorisation/biosimilar-medicines-marketing-authorisation

- The European Medicines Agency Proposes Streamlined Pathway for the Approval of Biosimilar Medicinal Products in the EU | BioSlice Blog, accessed July 31, 2025, https://www.biosliceblog.com/2025/06/the-european-medicines-agency-proposes-streamlined-pathway-for-the-approval-of-biosimilar-medicinal-products-in-the-eu/

- A Complete Guide to Regulatory Pathways for Biosimilars in the EU and US, accessed July 31, 2025, https://resource.ddregpharma.com/blogs/a-complete-guide-to-regulatory-pathways-for-biosimilars-in-the-eu-and-us/

- How Similar Are Biosimilars? What Do Clinicians Need to Know About Biosimilar and Follow-On Insulins?, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5669137/

- 9 Things to Know About Biosimilars and Interchangeable Biosimilars – FDA, accessed July 31, 2025, https://www.fda.gov/drugs/things-know-about/9-things-know-about-biosimilars-and-interchangeable-biosimilars

- Biosimilar Interchangeability: FDA Designation, Marketing …, accessed July 31, 2025, https://www.ipdanalytics.com/post/biosimilar-interchangeability-fda-designation-marketing-exclusivity-guidance-and-future-trends

- What is Buy and Bill? Everything You Need To Know, accessed July 31, 2025, https://www.priorauthtraining.org/what-is-buy-and-bill-everything-you-need-to-know/

- Originator Biologics and Biosimilars: Payment Policy Solutions to Increase Price Competition While Maintaining Market Sustainabi, accessed July 31, 2025, https://healthpolicy.duke.edu/sites/default/files/2021-11/Realizing%20the%20Benefits%20of%20Biosimilars%20Part%20B.pdf

- Buy-and-bill 101 – AmerisourceBergen, accessed July 31, 2025, https://www.amerisourcebergen.com/-/media/assets/amerisourcebergen/buy-and-bill-101.pdf

- Understanding the buy-and-bill model – IntrinsiQ Specialty Solutions, accessed July 31, 2025, https://www.intrinsiq.com/insights/understanding-the-buy-and-bill-model

- Understanding Buy And Bill Model | AdvancedMD, accessed July 31, 2025, https://www.advancedmd.com/blog/using-the-buy-and-bill-model-for-drug-acquisitions-and-understanding-how-it-works/

- The pros and cons of the “buy and bill” model of pharmaceutical distribution: What’s appropriate for your practice? – McKesson Medical-Surgical, accessed July 31, 2025, https://mms.mckesson.com/content/insights/the-pros-cons-of-the-buy-and-bill-model-of-pharmaceutical-distribution-whats-appropriate-for-your-practice/

- Navigating buy-and-bill: What every practice should monitor and how data analytics can help – AmerisourceBergen, accessed July 31, 2025, https://www.amerisourcebergen.com/insights/physician-practices/navigating-buy-and-bill

- Pharmacy Benefit Managers (PBMs) – AMCP.org, accessed July 31, 2025, https://www.amcp.org/legislative-regulatory-position/pharmacy-benefit-managers

- The Role of PBMs in the US Healthcare System – Avalere Health Advisory, accessed July 31, 2025, https://advisory.avalerehealth.com/wp-content/uploads/2025/06/The-Role-of-PBMs-in-the-US-Healthcare-System_White-Paper.pdf

- Impact of Pharmacy Benefit Managers on Oncology Practices and Patients – PMC, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7351331/

- PBMs, Formularies, and Rebates: What Investors Should Know …, accessed July 31, 2025, https://www.drugpatentwatch.com/blog/pbms-formularies-and-rebates-what-investors-should-know/

- PBM Regulations on Drug Spending | Commonwealth Fund, accessed July 31, 2025, https://www.commonwealthfund.org/publications/explainer/2025/mar/what-pharmacy-benefit-managers-do-how-they-contribute-drug-spending

- 5 Things To Know About Pharmacy Benefit Managers – Center for American Progress, accessed July 31, 2025, https://www.americanprogress.org/article/5-things-to-know-about-pharmacy-benefit-managers/

- Drug Lists and Formularies – CarelonRx, accessed July 31, 2025, https://www.carelonrx.com/drug-lists

- Section 9: Prescription Drug Benefits – 10240 | KFF, accessed July 31, 2025, https://www.kff.org/report-section/ehbs-2023-section-9-prescription-drug-benefits/

- Pharmaceutical Manufacturer Rebates | AMCP.org, accessed July 31, 2025, https://www.amcp.org/legislative-regulatory-position/pharmaceutical-manufacturer-rebates

- Excessive Cost Sharing as a Barrier to Health for People With Arthritis – Pharmacy Times, accessed July 31, 2025, https://www.pharmacytimes.com/view/excessive-cost-sharing-as-a-barrier-to-health-for-people-with-arthritis

- Coverage For High Cost Specialty Drugs for Rheumatoid Arthritis in …, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4464809/

- Medicare Part B Enrollee Use and Spending on Biosimilars, 2018-2023 – HHS ASPE, accessed July 31, 2025, https://aspe.hhs.gov/sites/default/files/documents/be065dbbd1f866c65cf627995bd2ea56/biosimilars-medicare-part-b.pdf

- Where Will Biosimilars Fit in Federal Drug Pricing Programs? – Morgan Lewis, accessed July 31, 2025, https://www.morganlewis.com/-/media/files/publication/outside-publication/article/bna_biosimilarsindrugpricingprograms.pdf

- Part B Drug Payment Limits Overview | CMS, accessed July 31, 2025, https://www.cms.gov/files/document/part-b-drug-payment-limits-overview.pdf-0

- Increasing Provider Reimbursement for Biosimilars Will Lead to Greater Adoption, accessed July 31, 2025, https://biosimilarscouncil.org/resource/increasing-provider-reimbursement-for-biosimilars-will-lead-to-greater-adoption/

- Report: 2023 U.S. Generic and Biosimilar Medicines Savings Report …, accessed July 31, 2025, https://accessiblemeds.org/resources/reports/2023-savings-report-2/

- Medicare reimbursement trends of biological reference agents and their biosimilars., accessed July 31, 2025, https://ascopubs.org/doi/10.1200/JCO.2024.42.16_suppl.11155

- IQVIA: Rebates put Biosimilar Manufacturers at a Disadvantage, accessed July 31, 2025, https://www.managedhealthcareexecutive.com/view/iqvia-rebates-put-biosimilar-manufacturers-at-a-disadvantage

- Frequently Asked Questions – CMS, accessed July 31, 2025, https://www.cms.gov/files/document/biosimilar-faqs.pdf

- Higher Medicare Add-On Payment for Biosimilars Effective October 1, accessed July 31, 2025, https://www.asrs.org/advocacy/updates/9272/higher-medicare-add-on-payment-for-biosimilars-effective-october-1

- How has the Inflation Reduction Act Impacted the Biosimilars Market? – Certara, accessed July 31, 2025, https://www.certara.com/blog/how-has-the-inflation-reduction-act-impacted-the-biosimilars-market/

- Strategies to Encourage the Adoption of Biosimilars – Evernorth Health Services, accessed July 31, 2025, https://www.evernorth.com/articles/specialty-biosimilar-adoption-strategies

- Factors Associated with Biosimilar Exclusions and Step Therapy Restrictions Among US Commercial Health Plans, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10287773/

- How the Biosimilar Boom Boosts Drug Wholesalers’ Profits – Drug Channels, accessed July 31, 2025, https://www.drugchannels.net/2022/10/how-biosimilar-boom-boosts-drug.html

- Biosimilars impact to PBM’s formulary & rebate language – Marsh McLennan Agency, accessed July 31, 2025, https://mmaeast.com/blog/biosimilars-impact-to-pbms-formulary-rebate-language/

- The Biosimilar Shift: How PBMs Are Reshaping Formularies, accessed July 31, 2025, https://www.ajmc.com/view/the-biosimilar-shift-how-pbms-are-reshaping-formularies

- Study: Step Therapy Contributes to Biosimilar Utilization, accessed July 31, 2025, https://www.centerforbiosimilars.com/view/study-step-therapy-contributes-to-biosimilar-utilization

- Realizing the Benefits of Biosimilars: Overcoming Rebate Walls …, accessed July 31, 2025, https://healthpolicy.duke.edu/sites/default/files/2022-03/Biosimilars%20-%20Overcoming%20Rebate%20Walls.pdf

- Realizing the Benefits of Biosimilars: Overcoming Rebate Walls, accessed July 31, 2025, https://healthpolicy.duke.edu/publications/realizing-benefits-biosimilars-overcoming-rebate-walls

- Federal Trade Commission Report on Rebate Walls, accessed July 31, 2025, https://www.ftc.gov/system/files/documents/reports/federal-trade-commission-report-rebate-walls/federal_trade_commission_report_on_rebate_walls_.pdf

- Scaling the “Rebate Wall” – Antitrust – American Bar Association, accessed July 31, 2025, https://www.americanbar.org/content/dam/aba/publications/antitrust/magazine/2024/vol-38-issue-2/scaling-the-rebate-wall.pdf

- Rising Tide Lifts US Biosimilars Market | BCG – Boston Consulting Group, accessed July 31, 2025, https://www.bcg.com/publications/2024/rising-tide-lifts-us-biosimilars-market

- Overview of Humira® biosimilars: current European landscape and …, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8014989/

- Sustaining competition for biosimilars on the pharmacy benefit: Use …, accessed July 31, 2025, https://www.jmcp.org/doi/10.18553/jmcp.2024.30.6.600

- Adalimumab Biosimilar Tracking – Biosimilars Council, accessed July 31, 2025, https://biosimilarscouncil.org/wp-content/uploads/2024/04/04022024_IQVIA-Humira-Tracking-Executive-Summary.pdf

- EU Leads in Biosimilar Market Access While US Lags Behind, Faces Challenges in Adoption – Pharmacy Times, accessed July 31, 2025, https://www.pharmacytimes.com/view/eu-leads-in-biosimilar-market-access-while-us-lags-behind-faces-challenges-in-adoption

- Four Challenges Impacting Biosimilar Savings – Innovative Rx Strategies, accessed July 31, 2025, https://innovativerxstrategies.com/4-challenges-biosimilar-savings/

- The Big Three PBMs’ 2025 Formulary Exclusions: Humira, Stelara, Private Labels, and the Shaky Future for Pharmacy Biosimilars – Drug Channels, accessed July 31, 2025, https://www.drugchannels.net/2025/01/the-big-three-pbms-2025-formulary.html

- Role of Biosimilars in US vs Europe – Pharmacy Times, accessed July 31, 2025, https://www.pharmacytimes.com/view/role-of-biosimilars-in-us-vs-europe

- Biosimilar competition in European markets of TNF-alpha inhibitors: a comparative analysis of pricing, market share and utilization trends – PubMed Central, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10160635/

- Biosimilars Have Driven Down Cost of Infliximab | MDedge, accessed July 31, 2025, https://www.mdedge.com/gihepnews/article/267771/ibd-intestinal-disorders/biosimilars-have-driven-down-cost-infliximab

- Biosimilars Drug Market Isn’t Broken After All, USC Schaeffer Study Finds – June 6, 2023, accessed July 31, 2025, https://schaeffer.usc.edu/research/biosimilars-drug-market-isnt-broken-after-all/

- Study: Biosimilars ‘Fulfilling Their Promise’ of Lowering Biologic Prices – BioSpace, accessed July 31, 2025, https://www.biospace.com/study-biosimilars-fulfilling-their-promise-of-lowering-biologic-prices

- Increased Competition Is Lowering Trastuzumab Prices, accessed July 31, 2025, https://www.centerforbiosimilars.com/view/increased-competition-is-lowering-trastuzumab-prices

- What are the pricing considerations when launching different types of biosimilars?, accessed July 31, 2025, https://remapconsulting.com/biosimilars/what-are-the-pricing-considerations-when-launching-different-types-of-biosimilars/

- Do pricing and usage-enhancing policies differ between biosimilars …, accessed July 31, 2025, https://gabi-journal.net/do-pricing-and-usage-enhancing-policies-differ-between-biosimilars-and-generics-findings-from-an-international-survey.html